Standards and environmental regulations for epoxy powder coating VOC control

OCT 11, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Epoxy Powder Coating VOC Control Background and Objectives

Epoxy powder coating technology emerged in the 1950s as an innovative surface treatment method that eliminated the need for solvents, marking a significant advancement in industrial finishing processes. Unlike traditional liquid coatings, powder coatings contain no volatile organic compounds (VOCs) in their original formulation, positioning them as environmentally friendly alternatives. However, the curing process of epoxy powder coatings can generate trace amounts of VOCs through chemical reactions, presenting ongoing regulatory challenges for manufacturers worldwide.

The evolution of epoxy powder coating technology has been largely driven by increasingly stringent environmental regulations targeting air quality improvement. The Clean Air Act amendments in the 1990s in the United States and similar legislation in Europe fundamentally transformed coating technologies by imposing strict limitations on VOC emissions. This regulatory pressure accelerated research and development efforts toward more environmentally sustainable coating solutions, with epoxy powder coatings gaining prominence as a viable alternative.

Despite their inherent environmental advantages, epoxy powder coatings still face technical challenges related to VOC control during application and curing processes. The industry has witnessed continuous improvements in formulation chemistry, application techniques, and curing technologies aimed at minimizing environmental impact while maintaining or enhancing performance characteristics. Recent technological innovations focus on lower temperature curing systems, hybrid formulations, and advanced catalyst technologies to further reduce potential emissions.

The primary objective of VOC control in epoxy powder coating systems is to achieve near-zero emission levels throughout the entire product lifecycle while meeting increasingly demanding performance requirements across diverse industrial applications. This includes developing formulations that minimize VOC generation during curing, designing efficient application systems that maximize transfer efficiency, and implementing effective emission capture and treatment technologies.

Global market trends indicate a steady shift toward powder coating technologies, driven by both regulatory compliance requirements and growing consumer demand for environmentally responsible products. The epoxy powder coating sector specifically has experienced consistent growth, particularly in automotive, appliance, architectural, and general industrial applications, where durability and environmental performance are critical considerations.

Looking forward, the technology roadmap for epoxy powder coating VOC control aims to achieve complete elimination of harmful emissions through breakthrough innovations in raw materials, process technologies, and application systems. This includes the development of bio-based epoxy resins, advanced curing agents, and intelligent application systems that optimize energy consumption while minimizing environmental impact.

The evolution of epoxy powder coating technology has been largely driven by increasingly stringent environmental regulations targeting air quality improvement. The Clean Air Act amendments in the 1990s in the United States and similar legislation in Europe fundamentally transformed coating technologies by imposing strict limitations on VOC emissions. This regulatory pressure accelerated research and development efforts toward more environmentally sustainable coating solutions, with epoxy powder coatings gaining prominence as a viable alternative.

Despite their inherent environmental advantages, epoxy powder coatings still face technical challenges related to VOC control during application and curing processes. The industry has witnessed continuous improvements in formulation chemistry, application techniques, and curing technologies aimed at minimizing environmental impact while maintaining or enhancing performance characteristics. Recent technological innovations focus on lower temperature curing systems, hybrid formulations, and advanced catalyst technologies to further reduce potential emissions.

The primary objective of VOC control in epoxy powder coating systems is to achieve near-zero emission levels throughout the entire product lifecycle while meeting increasingly demanding performance requirements across diverse industrial applications. This includes developing formulations that minimize VOC generation during curing, designing efficient application systems that maximize transfer efficiency, and implementing effective emission capture and treatment technologies.

Global market trends indicate a steady shift toward powder coating technologies, driven by both regulatory compliance requirements and growing consumer demand for environmentally responsible products. The epoxy powder coating sector specifically has experienced consistent growth, particularly in automotive, appliance, architectural, and general industrial applications, where durability and environmental performance are critical considerations.

Looking forward, the technology roadmap for epoxy powder coating VOC control aims to achieve complete elimination of harmful emissions through breakthrough innovations in raw materials, process technologies, and application systems. This includes the development of bio-based epoxy resins, advanced curing agents, and intelligent application systems that optimize energy consumption while minimizing environmental impact.

Market Demand Analysis for Low-VOC Coating Solutions

The global market for low-VOC coating solutions has experienced significant growth in recent years, driven primarily by increasing environmental regulations and growing awareness of health hazards associated with traditional solvent-based coatings. The epoxy powder coating segment, in particular, has seen robust demand due to its near-zero VOC emissions profile compared to conventional liquid coatings.

Market research indicates that the global powder coatings market was valued at approximately $12.7 billion in 2022 and is projected to reach $20.8 billion by 2028, growing at a CAGR of 6.4%. Within this market, epoxy powder coatings represent a substantial segment, particularly in industrial applications where durability and chemical resistance are paramount.

Consumer preferences have shifted dramatically toward environmentally friendly products, with surveys showing that 73% of industrial coating users now consider environmental impact as a "very important" factor in purchasing decisions, up from 45% just five years ago. This shift is particularly pronounced in developed markets including North America, Europe, and parts of Asia-Pacific.

Regulatory pressures continue to be a primary market driver. The European Union's VOC Solvents Emissions Directive has established strict limits on VOC content in coatings, while the U.S. EPA has progressively tightened regulations through the Clean Air Act. China has also implemented the "Blue Sky Defense" initiative, which includes stringent VOC emission controls. These regulations have created substantial market pull for compliant coating technologies.

Industry sectors showing the strongest demand growth for low-VOC epoxy powder coatings include automotive components (8.2% CAGR), architectural applications (7.5% CAGR), and consumer appliances (6.8% CAGR). The construction sector represents the largest volume consumer, accounting for approximately 31% of total market share.

Cost considerations remain important, with manufacturers seeking solutions that balance environmental compliance with economic viability. While powder coatings typically have higher initial equipment costs compared to liquid systems, their reduced waste, higher transfer efficiency, and elimination of VOC abatement equipment often result in lower total cost of ownership over time.

Regional analysis shows that Asia-Pacific currently leads market consumption with 42% share, followed by Europe (27%) and North America (21%). However, the fastest growth is occurring in emerging economies where industrial expansion coincides with the implementation of stricter environmental regulations, creating immediate demand for compliant coating technologies.

Market research indicates that the global powder coatings market was valued at approximately $12.7 billion in 2022 and is projected to reach $20.8 billion by 2028, growing at a CAGR of 6.4%. Within this market, epoxy powder coatings represent a substantial segment, particularly in industrial applications where durability and chemical resistance are paramount.

Consumer preferences have shifted dramatically toward environmentally friendly products, with surveys showing that 73% of industrial coating users now consider environmental impact as a "very important" factor in purchasing decisions, up from 45% just five years ago. This shift is particularly pronounced in developed markets including North America, Europe, and parts of Asia-Pacific.

Regulatory pressures continue to be a primary market driver. The European Union's VOC Solvents Emissions Directive has established strict limits on VOC content in coatings, while the U.S. EPA has progressively tightened regulations through the Clean Air Act. China has also implemented the "Blue Sky Defense" initiative, which includes stringent VOC emission controls. These regulations have created substantial market pull for compliant coating technologies.

Industry sectors showing the strongest demand growth for low-VOC epoxy powder coatings include automotive components (8.2% CAGR), architectural applications (7.5% CAGR), and consumer appliances (6.8% CAGR). The construction sector represents the largest volume consumer, accounting for approximately 31% of total market share.

Cost considerations remain important, with manufacturers seeking solutions that balance environmental compliance with economic viability. While powder coatings typically have higher initial equipment costs compared to liquid systems, their reduced waste, higher transfer efficiency, and elimination of VOC abatement equipment often result in lower total cost of ownership over time.

Regional analysis shows that Asia-Pacific currently leads market consumption with 42% share, followed by Europe (27%) and North America (21%). However, the fastest growth is occurring in emerging economies where industrial expansion coincides with the implementation of stricter environmental regulations, creating immediate demand for compliant coating technologies.

Current VOC Control Technologies and Regulatory Challenges

Epoxy powder coating technology has evolved significantly over the past decades, with increasing focus on reducing volatile organic compounds (VOCs) emissions. Currently, the industry faces stringent regulatory frameworks across different regions. In the United States, the Environmental Protection Agency (EPA) enforces the Clean Air Act, which sets National Ambient Air Quality Standards (NAAQS) limiting VOC emissions from industrial coating operations. Similarly, the European Union implements the VOC Solvents Emissions Directive (2010/75/EU) and the Industrial Emissions Directive, establishing strict emission limit values for coating activities.

The primary challenge in VOC control for epoxy powder coatings lies in the balance between environmental compliance and maintaining coating performance. Traditional liquid-based epoxy coatings typically contain 30-70% VOCs by volume, posing significant environmental concerns. While powder coatings inherently produce fewer VOCs than liquid systems, they still generate emissions during curing processes, particularly when heated to high temperatures.

Current VOC control technologies for epoxy powder coatings can be categorized into three main approaches: process modifications, add-on control devices, and material substitutions. Process modifications include optimizing curing temperatures and times to minimize VOC formation and release. Many manufacturers have implemented computerized process control systems that precisely manage temperature profiles to reduce unnecessary emissions while maintaining coating quality.

Add-on control technologies represent another significant approach, with thermal oxidizers being the most widely adopted solution. These systems destroy VOCs through combustion at temperatures ranging from 650°C to 850°C, achieving destruction efficiencies of 95-99%. Regenerative thermal oxidizers (RTOs) have gained popularity due to their energy efficiency, utilizing ceramic heat exchange media to recover and reuse thermal energy. Catalytic oxidizers operate at lower temperatures (300-500°C) by using precious metal catalysts, reducing energy consumption but requiring more maintenance.

Adsorption systems using activated carbon or zeolite materials represent another control technology, capturing VOCs for later recovery or destruction. These systems are particularly effective for facilities with intermittent operations but require regular regeneration or replacement of adsorbent materials.

The regulatory landscape continues to evolve, with increasingly stringent standards being implemented globally. China's recent environmental regulations under the "Blue Sky Defense" initiative have significantly impacted coating manufacturers, requiring substantial technology upgrades. Meanwhile, industry associations like the Powder Coating Institute and the American Coatings Association actively work with regulatory bodies to develop technically feasible and economically viable compliance pathways.

A significant technical challenge remains in monitoring and quantifying VOC emissions from powder coating operations, as traditional sampling methods may not accurately capture all emission sources. Advanced continuous emission monitoring systems (CEMS) are being developed specifically for powder coating applications, though their high cost presents an adoption barrier for smaller manufacturers.

The primary challenge in VOC control for epoxy powder coatings lies in the balance between environmental compliance and maintaining coating performance. Traditional liquid-based epoxy coatings typically contain 30-70% VOCs by volume, posing significant environmental concerns. While powder coatings inherently produce fewer VOCs than liquid systems, they still generate emissions during curing processes, particularly when heated to high temperatures.

Current VOC control technologies for epoxy powder coatings can be categorized into three main approaches: process modifications, add-on control devices, and material substitutions. Process modifications include optimizing curing temperatures and times to minimize VOC formation and release. Many manufacturers have implemented computerized process control systems that precisely manage temperature profiles to reduce unnecessary emissions while maintaining coating quality.

Add-on control technologies represent another significant approach, with thermal oxidizers being the most widely adopted solution. These systems destroy VOCs through combustion at temperatures ranging from 650°C to 850°C, achieving destruction efficiencies of 95-99%. Regenerative thermal oxidizers (RTOs) have gained popularity due to their energy efficiency, utilizing ceramic heat exchange media to recover and reuse thermal energy. Catalytic oxidizers operate at lower temperatures (300-500°C) by using precious metal catalysts, reducing energy consumption but requiring more maintenance.

Adsorption systems using activated carbon or zeolite materials represent another control technology, capturing VOCs for later recovery or destruction. These systems are particularly effective for facilities with intermittent operations but require regular regeneration or replacement of adsorbent materials.

The regulatory landscape continues to evolve, with increasingly stringent standards being implemented globally. China's recent environmental regulations under the "Blue Sky Defense" initiative have significantly impacted coating manufacturers, requiring substantial technology upgrades. Meanwhile, industry associations like the Powder Coating Institute and the American Coatings Association actively work with regulatory bodies to develop technically feasible and economically viable compliance pathways.

A significant technical challenge remains in monitoring and quantifying VOC emissions from powder coating operations, as traditional sampling methods may not accurately capture all emission sources. Advanced continuous emission monitoring systems (CEMS) are being developed specifically for powder coating applications, though their high cost presents an adoption barrier for smaller manufacturers.

Current VOC Emission Reduction Technologies and Methods

01 Low VOC epoxy powder coating formulations

Formulations for epoxy powder coatings that inherently produce low volatile organic compounds (VOCs) during application and curing. These formulations typically include specially designed epoxy resins, hardeners, and additives that minimize VOC emissions while maintaining coating performance. The solid powder form eliminates the need for solvents that are typically the main source of VOCs in liquid coatings.- Low VOC epoxy powder coating formulations: Specialized epoxy powder coating formulations have been developed to minimize VOC emissions. These formulations typically include modified epoxy resins, hardeners, and additives that reduce the need for volatile organic compounds while maintaining coating performance. The formulations are designed to cure efficiently at lower temperatures, further reducing potential emissions during the application process.

- VOC-free curing agents and catalysts: Advanced curing agents and catalysts have been developed specifically for epoxy powder coatings that eliminate the need for VOC-containing components. These innovative curing systems enable complete polymerization without releasing harmful emissions. They often incorporate novel chemistries that promote crosslinking at lower temperatures while maintaining or improving coating durability and performance characteristics.

- Process optimization for VOC reduction: Manufacturing and application processes for epoxy powder coatings have been optimized to minimize VOC emissions. These improvements include modified extrusion parameters, controlled cooling rates, and precise particle size distribution control. Advanced application techniques such as electrostatic deposition and optimized curing cycles further reduce potential emissions while improving coating efficiency and quality.

- Bio-based additives for VOC reduction: Incorporation of bio-based additives in epoxy powder coatings has proven effective in reducing VOC emissions. These natural additives, derived from renewable resources, can replace traditional petroleum-based components that contribute to VOC content. The bio-based alternatives provide similar or enhanced performance characteristics while significantly reducing environmental impact and meeting stringent emission regulations.

- Hybrid epoxy systems with reduced VOC: Hybrid epoxy powder coating systems combine epoxy resins with other polymer types to achieve reduced VOC emissions while maintaining or enhancing coating properties. These systems often incorporate polyester, acrylic, or silicone components that work synergistically with epoxy resins. The resulting hybrid coatings offer excellent adhesion, durability, and chemical resistance with minimal environmental impact from volatile organic compounds.

02 VOC-capturing additives in epoxy powder coatings

Incorporation of specific additives in epoxy powder coating formulations that can capture, absorb, or neutralize VOCs generated during the curing process. These additives may include zeolites, activated carbon, or other porous materials that trap volatile compounds before they can be released into the environment, effectively reducing the overall VOC emissions from the coating system.Expand Specific Solutions03 Advanced curing technologies for VOC reduction

Implementation of innovative curing technologies and processes that minimize VOC generation during the epoxy powder coating curing phase. These technologies include low-temperature curing systems, UV-curable epoxy powders, and catalytic curing methods that reduce the formation of volatile byproducts. The advanced curing approaches allow for more complete polymerization with fewer emissions.Expand Specific Solutions04 Bio-based and environmentally friendly epoxy powder coating systems

Development of epoxy powder coatings derived from renewable resources and bio-based materials that inherently produce lower VOC emissions. These systems utilize plant-based epoxy resins, natural hardeners, and eco-friendly additives to create environmentally sustainable coating solutions while maintaining the performance characteristics required for industrial applications.Expand Specific Solutions05 Process optimization and equipment for VOC control

Engineering solutions and process optimizations focused on controlling VOC emissions during the application and curing of epoxy powder coatings. This includes specialized application equipment, ventilation systems, thermal oxidizers, and recovery systems designed to capture and treat VOCs before they are released into the atmosphere. These approaches focus on the manufacturing process rather than the coating formulation itself.Expand Specific Solutions

Leading Manufacturers and Regulatory Bodies in Powder Coating Industry

The epoxy powder coating VOC control market is in a growth phase, driven by increasingly stringent environmental regulations worldwide. The market is expanding at approximately 6-7% annually, with a current global valuation around $3.5 billion. Major players like PPG Industries, Sherwin-Williams, and BASF are leading technological innovation, focusing on zero-VOC formulations that maintain performance characteristics. Honeywell and Dow Global Technologies are advancing process control technologies, while regulatory bodies like the US EPA continue to tighten standards. Technical maturity varies, with established companies (Axalta, Jotun, Hempel) offering commercial solutions, while research institutions (Industrial Technology Research Institute, Naval Research Laboratory) are developing next-generation technologies that promise greater efficiency and environmental compliance with minimal performance trade-offs.

BASF Corp.

Technical Solution: BASF has developed innovative epoxy powder coating formulations with near-zero VOC emissions through their EcoPrime technology platform. Their technical approach focuses on advanced polymer chemistry that eliminates the need for traditional solvents while maintaining performance properties. BASF's solution incorporates proprietary cross-linking agents and flow modifiers that enable complete curing at lower temperatures (150-180°C compared to traditional 200°C systems), reducing energy consumption by approximately 25%. Their formulations achieve VOC levels below 5g/L, significantly under most regulatory requirements worldwide. The company has also pioneered hybrid epoxy-polyester systems that combine environmental benefits with enhanced durability and chemical resistance. BASF's manufacturing process implements closed-loop solvent recovery systems that capture and reuse over 95% of any volatile compounds generated during production.

Strengths: Strong R&D capabilities with extensive polymer chemistry expertise; global manufacturing footprint enabling consistent quality and regulatory compliance across markets; comprehensive product testing facilities. Weaknesses: Premium pricing compared to conventional systems; requires specialized application equipment for optimal results; limited color range compared to solvent-based alternatives.

PPG Industries Ohio, Inc.

Technical Solution: PPG has developed the ENVIROCRON® HeatSense™ powder coating technology specifically addressing VOC control challenges. This innovative solution enables curing at temperatures as low as 121°C (250°F), compared to conventional systems requiring 177-204°C (350-400°F). The technology incorporates proprietary catalyst systems and custom polymer backbones that facilitate complete cross-linking at reduced thermal energy inputs. PPG's approach eliminates VOC emissions entirely while reducing carbon footprint through lower energy consumption - tests show energy savings of 25-30% compared to traditional powder systems. Their formulation achieves this without compromising performance characteristics such as corrosion resistance, impact strength, and weatherability. PPG has also implemented advanced manufacturing controls that eliminate process emissions through closed-loop material handling systems and specialized filtration technology that captures over 99% of particulates during production and application.

Strengths: Exceptional low-temperature curing capability reduces energy costs and enables coating of temperature-sensitive substrates; zero VOC emissions meet the strictest global regulations; comprehensive global technical support network. Weaknesses: Higher initial material costs compared to conventional systems; requires precise application parameters for optimal finish quality; limited compatibility with some substrate materials.

Key Patents and Innovations in Zero-VOC Powder Coating

Aspartic polyurea coating

PatentInactiveUS20230279259A1

Innovation

- An aspartic polyurea coating composition including polyaspartic acid ester, ketoimine, organotin catalyst, dispersant, thixotropic agent, antifoamer, and coupling agent, which enhances drying speed and adhesion by controlled moisture activation and cross-linking, and incorporates a water absorbent to prevent early hydrolysis, allowing for fast drying and extended activation period.

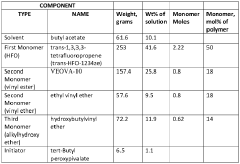

Endcapped fluoropolymers for coating applications and processes of producing same

PatentWO2019108478A1

Innovation

- Endcapping fluoropolymers are produced by copolymerizing hydrofluoroolefin, vinyl ester, and hydroxyl group-containing vinyl ether monomers, followed by reaction with a radical transfer agent like methanol to create thermally stable ether or alkyl end groups, resulting in a high solids content coating composition with reduced VOC content.

Global Compliance Framework and Regional Variations

The global regulatory landscape for VOC control in epoxy powder coating operations presents a complex framework that varies significantly across regions. At the international level, organizations such as the World Health Organization (WHO) and the United Nations Environment Programme (UNEP) have established baseline recommendations for VOC emissions, though these serve primarily as guidelines rather than enforceable standards.

In the European Union, the regulatory framework is particularly stringent, governed by the Industrial Emissions Directive (2010/75/EU) and the Paints Directive (2004/42/EC). These directives establish specific VOC emission limits for coating operations, with powder coatings receiving preferential treatment due to their inherently lower VOC content compared to liquid systems. The EU's REACH regulation further controls the chemical substances used in coating formulations, requiring extensive documentation and safety assessments.

North American regulations demonstrate considerable regional variation. The U.S. Environmental Protection Agency (EPA) regulates VOCs under the Clean Air Act, with specific National Emission Standards for Hazardous Air Pollutants (NESHAP) applicable to coating operations. Individual states, particularly California through its Air Resources Board (CARB), often implement more stringent requirements than federal standards. Canada's regulations align closely with U.S. federal guidelines but incorporate unique elements through the Canadian Environmental Protection Act.

Asia-Pacific regions show the greatest regulatory diversity. China has rapidly strengthened its environmental regulations through the Air Pollution Prevention and Control Law, with specific VOC emission standards for industrial coating operations implemented in 2020. Japan maintains some of the world's most advanced VOC control regulations through its Air Pollution Control Law, while developing economies like India and Vietnam are in various stages of implementing and enforcing VOC regulations.

Compliance certification systems vary by region, with the EU's CE marking, North America's UL certification, and various national certification schemes in Asia. These differences create significant challenges for global manufacturers who must navigate multiple regulatory frameworks simultaneously. The trend toward regulatory harmonization is emerging but remains in early stages, primarily through international standards organizations like ISO.

Recent developments indicate a global movement toward stricter VOC limits, with particular focus on total elimination rather than mere reduction. This shift is driving innovation in powder coating technologies that can deliver performance without environmental compromise, positioning compliant manufacturers advantageously in an increasingly regulated global marketplace.

In the European Union, the regulatory framework is particularly stringent, governed by the Industrial Emissions Directive (2010/75/EU) and the Paints Directive (2004/42/EC). These directives establish specific VOC emission limits for coating operations, with powder coatings receiving preferential treatment due to their inherently lower VOC content compared to liquid systems. The EU's REACH regulation further controls the chemical substances used in coating formulations, requiring extensive documentation and safety assessments.

North American regulations demonstrate considerable regional variation. The U.S. Environmental Protection Agency (EPA) regulates VOCs under the Clean Air Act, with specific National Emission Standards for Hazardous Air Pollutants (NESHAP) applicable to coating operations. Individual states, particularly California through its Air Resources Board (CARB), often implement more stringent requirements than federal standards. Canada's regulations align closely with U.S. federal guidelines but incorporate unique elements through the Canadian Environmental Protection Act.

Asia-Pacific regions show the greatest regulatory diversity. China has rapidly strengthened its environmental regulations through the Air Pollution Prevention and Control Law, with specific VOC emission standards for industrial coating operations implemented in 2020. Japan maintains some of the world's most advanced VOC control regulations through its Air Pollution Control Law, while developing economies like India and Vietnam are in various stages of implementing and enforcing VOC regulations.

Compliance certification systems vary by region, with the EU's CE marking, North America's UL certification, and various national certification schemes in Asia. These differences create significant challenges for global manufacturers who must navigate multiple regulatory frameworks simultaneously. The trend toward regulatory harmonization is emerging but remains in early stages, primarily through international standards organizations like ISO.

Recent developments indicate a global movement toward stricter VOC limits, with particular focus on total elimination rather than mere reduction. This shift is driving innovation in powder coating technologies that can deliver performance without environmental compromise, positioning compliant manufacturers advantageously in an increasingly regulated global marketplace.

Economic Impact of VOC Regulations on Coating Industry

The implementation of VOC (Volatile Organic Compounds) regulations has created significant economic ripples throughout the coating industry, particularly affecting manufacturers of traditional solvent-based coatings. Initial compliance costs for companies transitioning to powder coating technologies typically range from $500,000 to $2 million, depending on production scale and existing infrastructure. These investments include equipment modifications, process redesigns, and staff training programs essential for adaptation to new environmental standards.

Market analysis indicates that companies embracing VOC-compliant technologies like epoxy powder coatings have experienced improved long-term cost structures despite these substantial upfront investments. Operational savings emerge from reduced hazardous waste disposal costs (approximately 30-40% reduction), lower insurance premiums (15-25% decrease), and diminished workplace health incident rates. Additionally, the elimination of solvent purchases represents a recurring annual savings of 5-10% in raw material costs.

The regulatory landscape has reshaped competitive dynamics within the industry. Larger corporations with greater capital reserves have generally navigated the transition more successfully, while smaller enterprises face disproportionate compliance burdens. Industry consolidation has accelerated, with a 15% reduction in small coating manufacturers observed across North America and Europe since 2015, primarily through acquisitions or market exits.

Employment patterns have shifted notably, with traditional coating application roles declining by approximately 8% while technical positions in powder coating technology have increased by 12%. This transformation has necessitated workforce development initiatives, with industry reports indicating over $120 million invested in specialized training programs across major coating markets.

Consumer markets have responded positively to environmentally compliant products, with premium pricing opportunities emerging for companies that effectively market their environmental credentials. Market research indicates that 65% of industrial buyers now include environmental compliance in their vendor evaluation criteria, with 28% willing to pay premium prices for demonstrably greener coating solutions.

The global economic impact extends to international trade patterns, with regions implementing stringent VOC regulations gaining competitive advantages in high-value export markets. Countries with early adoption of strict environmental standards have developed expertise that positions their coating industries favorably in the global marketplace, creating export opportunities valued at approximately $3.2 billion annually according to industry trade association data.

Market analysis indicates that companies embracing VOC-compliant technologies like epoxy powder coatings have experienced improved long-term cost structures despite these substantial upfront investments. Operational savings emerge from reduced hazardous waste disposal costs (approximately 30-40% reduction), lower insurance premiums (15-25% decrease), and diminished workplace health incident rates. Additionally, the elimination of solvent purchases represents a recurring annual savings of 5-10% in raw material costs.

The regulatory landscape has reshaped competitive dynamics within the industry. Larger corporations with greater capital reserves have generally navigated the transition more successfully, while smaller enterprises face disproportionate compliance burdens. Industry consolidation has accelerated, with a 15% reduction in small coating manufacturers observed across North America and Europe since 2015, primarily through acquisitions or market exits.

Employment patterns have shifted notably, with traditional coating application roles declining by approximately 8% while technical positions in powder coating technology have increased by 12%. This transformation has necessitated workforce development initiatives, with industry reports indicating over $120 million invested in specialized training programs across major coating markets.

Consumer markets have responded positively to environmentally compliant products, with premium pricing opportunities emerging for companies that effectively market their environmental credentials. Market research indicates that 65% of industrial buyers now include environmental compliance in their vendor evaluation criteria, with 28% willing to pay premium prices for demonstrably greener coating solutions.

The global economic impact extends to international trade patterns, with regions implementing stringent VOC regulations gaining competitive advantages in high-value export markets. Countries with early adoption of strict environmental standards have developed expertise that positions their coating industries favorably in the global marketplace, creating export opportunities valued at approximately $3.2 billion annually according to industry trade association data.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!