Strategic partnerships in accelerating PHEV market growth

AUG 14, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

PHEV Market Evolution

The evolution of the Plug-in Hybrid Electric Vehicle (PHEV) market has been characterized by rapid technological advancements, shifting consumer preferences, and evolving regulatory landscapes. Initially, PHEVs emerged as a bridge technology between conventional internal combustion engine vehicles and fully electric vehicles, offering consumers the benefits of both worlds.

In the early stages of PHEV market development, adoption was primarily driven by early adopters and environmentally conscious consumers. However, as technology improved and awareness increased, the market began to expand. Government incentives, such as tax credits and rebates, played a crucial role in stimulating demand and encouraging manufacturers to invest in PHEV technology.

The PHEV market has experienced significant growth over the past decade, with sales volumes increasing steadily in many regions. This growth has been particularly pronounced in countries with stringent emissions regulations and well-developed charging infrastructure. As battery technology has advanced, PHEVs have seen improvements in electric range and overall efficiency, making them more attractive to a broader range of consumers.

Strategic partnerships have emerged as a key driver in accelerating PHEV market growth. Collaborations between automakers, battery manufacturers, and technology companies have led to faster innovation cycles and more cost-effective production methods. These partnerships have enabled the sharing of research and development costs, as well as the pooling of expertise across different domains.

One notable trend in the PHEV market evolution has been the expansion of model offerings across various vehicle segments. Initially focused on compact and mid-size cars, PHEVs are now available in SUVs, crossovers, and even luxury vehicles, catering to diverse consumer preferences and needs.

The integration of smart charging technologies and vehicle-to-grid (V2G) capabilities has further enhanced the appeal of PHEVs. These advancements not only improve the user experience but also position PHEVs as potential assets in grid stabilization and energy management systems.

As the PHEV market continues to mature, challenges such as range anxiety and charging infrastructure limitations are being addressed through ongoing technological improvements and strategic investments. The market is also witnessing increased competition from fully electric vehicles, prompting PHEV manufacturers to focus on enhancing electric range and overall performance to maintain their market position.

Looking ahead, the PHEV market is expected to continue evolving, with a focus on increased electrification, improved battery technology, and enhanced connectivity features. Strategic partnerships will likely play an even more critical role in driving innovation and market growth, as the automotive industry navigates the transition towards a more sustainable transportation ecosystem.

In the early stages of PHEV market development, adoption was primarily driven by early adopters and environmentally conscious consumers. However, as technology improved and awareness increased, the market began to expand. Government incentives, such as tax credits and rebates, played a crucial role in stimulating demand and encouraging manufacturers to invest in PHEV technology.

The PHEV market has experienced significant growth over the past decade, with sales volumes increasing steadily in many regions. This growth has been particularly pronounced in countries with stringent emissions regulations and well-developed charging infrastructure. As battery technology has advanced, PHEVs have seen improvements in electric range and overall efficiency, making them more attractive to a broader range of consumers.

Strategic partnerships have emerged as a key driver in accelerating PHEV market growth. Collaborations between automakers, battery manufacturers, and technology companies have led to faster innovation cycles and more cost-effective production methods. These partnerships have enabled the sharing of research and development costs, as well as the pooling of expertise across different domains.

One notable trend in the PHEV market evolution has been the expansion of model offerings across various vehicle segments. Initially focused on compact and mid-size cars, PHEVs are now available in SUVs, crossovers, and even luxury vehicles, catering to diverse consumer preferences and needs.

The integration of smart charging technologies and vehicle-to-grid (V2G) capabilities has further enhanced the appeal of PHEVs. These advancements not only improve the user experience but also position PHEVs as potential assets in grid stabilization and energy management systems.

As the PHEV market continues to mature, challenges such as range anxiety and charging infrastructure limitations are being addressed through ongoing technological improvements and strategic investments. The market is also witnessing increased competition from fully electric vehicles, prompting PHEV manufacturers to focus on enhancing electric range and overall performance to maintain their market position.

Looking ahead, the PHEV market is expected to continue evolving, with a focus on increased electrification, improved battery technology, and enhanced connectivity features. Strategic partnerships will likely play an even more critical role in driving innovation and market growth, as the automotive industry navigates the transition towards a more sustainable transportation ecosystem.

PHEV Demand Analysis

The demand for Plug-in Hybrid Electric Vehicles (PHEVs) has been steadily increasing in recent years, driven by a combination of environmental concerns, government incentives, and technological advancements. This growth trend is expected to continue as consumers become more environmentally conscious and seek alternatives to traditional internal combustion engine vehicles.

Market research indicates that the global PHEV market is poised for significant expansion. Consumers are attracted to PHEVs due to their ability to offer both electric-only driving for short trips and the flexibility of a gasoline engine for longer journeys. This dual-mode capability addresses range anxiety concerns often associated with fully electric vehicles, making PHEVs an attractive option for a wider range of consumers.

Several factors are contributing to the growing demand for PHEVs. Stricter emissions regulations in many countries are pushing automakers to produce more fuel-efficient and environmentally friendly vehicles. Government incentives, such as tax credits and rebates, are making PHEVs more financially accessible to consumers. Additionally, improvements in battery technology are extending electric-only driving ranges, further enhancing the appeal of PHEVs.

The corporate and fleet sectors are also showing increased interest in PHEVs. Many companies are adopting these vehicles as part of their sustainability initiatives and to reduce their carbon footprint. Fleet managers are recognizing the potential cost savings in fuel and maintenance that PHEVs can offer over traditional vehicles.

However, challenges remain in the PHEV market. The higher upfront cost of PHEVs compared to conventional vehicles is still a barrier for some consumers. There is also a need for more extensive charging infrastructure to support the growing number of PHEVs on the road. Education and awareness campaigns are crucial to help consumers understand the benefits and operational aspects of PHEVs.

Strategic partnerships play a vital role in accelerating PHEV market growth. Collaborations between automakers, battery manufacturers, and charging infrastructure providers are essential to overcome technological hurdles and reduce production costs. Partnerships with utility companies are also important to ensure the power grid can support increased electricity demand from PHEVs.

In conclusion, the demand for PHEVs is on an upward trajectory, driven by environmental concerns, technological advancements, and supportive policies. As the market continues to evolve, strategic partnerships will be crucial in addressing challenges and capitalizing on opportunities to further accelerate PHEV adoption and market growth.

Market research indicates that the global PHEV market is poised for significant expansion. Consumers are attracted to PHEVs due to their ability to offer both electric-only driving for short trips and the flexibility of a gasoline engine for longer journeys. This dual-mode capability addresses range anxiety concerns often associated with fully electric vehicles, making PHEVs an attractive option for a wider range of consumers.

Several factors are contributing to the growing demand for PHEVs. Stricter emissions regulations in many countries are pushing automakers to produce more fuel-efficient and environmentally friendly vehicles. Government incentives, such as tax credits and rebates, are making PHEVs more financially accessible to consumers. Additionally, improvements in battery technology are extending electric-only driving ranges, further enhancing the appeal of PHEVs.

The corporate and fleet sectors are also showing increased interest in PHEVs. Many companies are adopting these vehicles as part of their sustainability initiatives and to reduce their carbon footprint. Fleet managers are recognizing the potential cost savings in fuel and maintenance that PHEVs can offer over traditional vehicles.

However, challenges remain in the PHEV market. The higher upfront cost of PHEVs compared to conventional vehicles is still a barrier for some consumers. There is also a need for more extensive charging infrastructure to support the growing number of PHEVs on the road. Education and awareness campaigns are crucial to help consumers understand the benefits and operational aspects of PHEVs.

Strategic partnerships play a vital role in accelerating PHEV market growth. Collaborations between automakers, battery manufacturers, and charging infrastructure providers are essential to overcome technological hurdles and reduce production costs. Partnerships with utility companies are also important to ensure the power grid can support increased electricity demand from PHEVs.

In conclusion, the demand for PHEVs is on an upward trajectory, driven by environmental concerns, technological advancements, and supportive policies. As the market continues to evolve, strategic partnerships will be crucial in addressing challenges and capitalizing on opportunities to further accelerate PHEV adoption and market growth.

PHEV Tech Challenges

Plug-in Hybrid Electric Vehicles (PHEVs) face several significant technical challenges that hinder their widespread adoption and market growth. One of the primary issues is battery technology limitations. Current PHEV batteries struggle to provide sufficient all-electric range while maintaining a compact size and reasonable cost. This constraint affects the overall vehicle design and consumer appeal.

Another major challenge is the complexity of the dual powertrain system. Integrating and optimizing the performance of both electric and internal combustion engines requires sophisticated control systems and engineering solutions. This complexity not only increases production costs but also poses maintenance challenges for service technicians.

Charging infrastructure remains a significant hurdle for PHEV adoption. While PHEVs can operate without frequent charging, the lack of widespread, convenient charging stations limits the full potential of these vehicles. This issue is particularly pronounced in urban areas where many potential PHEV owners lack access to home charging options.

Weight management is another critical challenge for PHEV manufacturers. The addition of electric components, particularly the battery pack, increases the overall vehicle weight. This extra mass can negatively impact fuel efficiency and vehicle dynamics, requiring innovative lightweight materials and design solutions to mitigate these effects.

Thermal management of the battery and powertrain components presents another technical hurdle. Ensuring optimal operating temperatures for both the electric and combustion systems across various driving conditions is crucial for performance, efficiency, and longevity. Developing effective cooling systems that don't compromise vehicle packaging or add excessive weight is an ongoing challenge.

Cost reduction remains a persistent issue in PHEV development. The dual powertrain and advanced battery technology contribute to higher production costs compared to conventional vehicles. Achieving price parity or near-parity with traditional internal combustion engine vehicles is essential for broader market acceptance.

Lastly, software integration and cybersecurity pose emerging challenges. As PHEVs become more connected and reliant on complex software systems, ensuring robust cybersecurity measures and seamless integration of various software components becomes increasingly important. This includes managing over-the-air updates, protecting against potential hacks, and maintaining system reliability.

Addressing these technical challenges requires ongoing research and development efforts, as well as strategic partnerships between automakers, suppliers, and technology companies. Overcoming these hurdles is crucial for accelerating PHEV market growth and realizing the full potential of this transitional technology in the shift towards more sustainable transportation solutions.

Another major challenge is the complexity of the dual powertrain system. Integrating and optimizing the performance of both electric and internal combustion engines requires sophisticated control systems and engineering solutions. This complexity not only increases production costs but also poses maintenance challenges for service technicians.

Charging infrastructure remains a significant hurdle for PHEV adoption. While PHEVs can operate without frequent charging, the lack of widespread, convenient charging stations limits the full potential of these vehicles. This issue is particularly pronounced in urban areas where many potential PHEV owners lack access to home charging options.

Weight management is another critical challenge for PHEV manufacturers. The addition of electric components, particularly the battery pack, increases the overall vehicle weight. This extra mass can negatively impact fuel efficiency and vehicle dynamics, requiring innovative lightweight materials and design solutions to mitigate these effects.

Thermal management of the battery and powertrain components presents another technical hurdle. Ensuring optimal operating temperatures for both the electric and combustion systems across various driving conditions is crucial for performance, efficiency, and longevity. Developing effective cooling systems that don't compromise vehicle packaging or add excessive weight is an ongoing challenge.

Cost reduction remains a persistent issue in PHEV development. The dual powertrain and advanced battery technology contribute to higher production costs compared to conventional vehicles. Achieving price parity or near-parity with traditional internal combustion engine vehicles is essential for broader market acceptance.

Lastly, software integration and cybersecurity pose emerging challenges. As PHEVs become more connected and reliant on complex software systems, ensuring robust cybersecurity measures and seamless integration of various software components becomes increasingly important. This includes managing over-the-air updates, protecting against potential hacks, and maintaining system reliability.

Addressing these technical challenges requires ongoing research and development efforts, as well as strategic partnerships between automakers, suppliers, and technology companies. Overcoming these hurdles is crucial for accelerating PHEV market growth and realizing the full potential of this transitional technology in the shift towards more sustainable transportation solutions.

Current PHEV Solutions

01 Collaborative business models

Strategic partnerships involve developing collaborative business models that leverage the strengths of multiple organizations. These partnerships can enhance market reach, share resources, and create synergies to achieve mutual goals. Such collaborations often involve joint ventures, alliances, or co-development projects to drive innovation and competitive advantage.- Collaborative business models: Strategic partnerships involve developing collaborative business models that leverage the strengths of multiple organizations. These partnerships can enhance market reach, share resources, and create innovative solutions. By combining expertise and assets, companies can achieve mutual benefits and competitive advantages in their respective industries.

- Technology integration and data sharing: Partnerships often focus on integrating technologies and sharing data between organizations. This collaboration can lead to improved product offerings, enhanced customer experiences, and more efficient operations. By combining technological capabilities, partners can create synergies and develop cutting-edge solutions that address complex market challenges.

- Risk and resource management: Strategic partnerships allow for better risk and resource management. By sharing financial burdens, pooling resources, and distributing risks, companies can undertake larger projects or enter new markets with reduced individual exposure. This approach enables partners to optimize their resource allocation and mitigate potential losses.

- Supply chain optimization: Partnerships can significantly improve supply chain efficiency and effectiveness. By collaborating with suppliers, distributors, and logistics providers, companies can streamline operations, reduce costs, and enhance product quality. These partnerships often involve joint planning, forecasting, and inventory management to create a more responsive and agile supply chain.

- Cross-industry innovation: Strategic partnerships facilitate cross-industry innovation by bringing together expertise from diverse sectors. This collaboration can lead to the development of novel products, services, or business models that address emerging market needs. By combining knowledge and capabilities from different industries, partners can create unique value propositions and explore new growth opportunities.

02 Technology integration and data sharing

Partnerships often focus on integrating technologies and sharing data between organizations. This can involve developing common platforms, APIs, or data exchange protocols to facilitate seamless collaboration. Such integration enables partners to leverage each other's technological capabilities, enhance product offerings, and improve overall efficiency in their operations.Expand Specific Solutions03 Risk and resource sharing

Strategic partnerships allow for the sharing of risks and resources among participating entities. This can include financial investments, intellectual property, human resources, or market access. By distributing risks and pooling resources, partners can undertake larger projects, enter new markets, or develop innovative products that would be challenging for a single organization to accomplish alone.Expand Specific Solutions04 Supply chain optimization

Partnerships can be formed to optimize supply chain operations, improving efficiency and reducing costs. This may involve collaborating with suppliers, distributors, or logistics providers to streamline processes, enhance quality control, or implement just-in-time inventory systems. Such partnerships can lead to improved product availability, reduced lead times, and better overall supply chain performance.Expand Specific Solutions05 Cross-industry innovation

Strategic partnerships can facilitate cross-industry innovation by bringing together expertise from different sectors. This approach allows for the application of technologies or methodologies from one industry to solve challenges in another, leading to breakthrough innovations. Such collaborations can result in the development of new products, services, or business models that disrupt traditional markets or create entirely new ones.Expand Specific Solutions

Key PHEV Players

The strategic partnership landscape for accelerating PHEV market growth is characterized by a dynamic and evolving competitive environment. The industry is in a growth phase, with increasing market size driven by environmental concerns and government incentives. Technological maturity varies among players, with established automakers like Ford, Toyota, and Honda leading in PHEV development. Chinese manufacturers such as Guangzhou Automobile Group, Geely, and Chery are rapidly advancing their PHEV capabilities. Collaborations between automakers and technology companies, exemplified by partnerships like Chongqing Jinkang with Huawei, are becoming increasingly common to leverage complementary expertise in vehicle electrification and smart technologies.

Ford Global Technologies LLC

Technical Solution: Ford has been actively pursuing strategic partnerships to accelerate PHEV market growth. The company has formed alliances with various stakeholders, including battery suppliers, charging infrastructure providers, and technology companies. Ford's approach includes joint ventures with SK Innovation to produce EV batteries[1], partnerships with Electrify America for charging solutions[2], and collaborations with tech giants like Google for connected vehicle services[3]. Ford's PowerSplit architecture, used in their PHEVs, allows for efficient power distribution between the electric motor and internal combustion engine, optimizing fuel economy and performance[4]. The company is also investing in solid-state battery technology through a partnership with Solid Power, aiming to improve energy density and charging speeds for future PHEVs[5].

Strengths: Strong brand recognition, extensive dealership network, and diverse PHEV lineup. Weaknesses: Late entry into the EV market compared to some competitors, potential challenges in scaling battery production.

Zhejiang Geely Holding Group Co., Ltd.

Technical Solution: Geely has been actively pursuing strategic partnerships to accelerate PHEV market growth. The company has formed alliances with various stakeholders, including Volvo Cars (which it owns) for shared technology platforms[1], and partnerships with CATL and LG Chem for battery supply[2]. Geely's PHEV strategy includes the development of the Compact Modular Architecture (CMA) platform, which supports both hybrid and fully electric powertrains[3]. The company has also invested in flying car startup Terrafugia and is exploring PHEV technology for future urban air mobility solutions[4]. Geely's partnership with Daimler AG has led to the joint development of next-generation hybrid powertrains for premium compact vehicles[5]. Additionally, Geely has established a joint venture with Foxconn to provide contract manufacturing and consulting services for other automakers, potentially accelerating PHEV production capabilities industry-wide[6].

Strengths: Strong presence in the Chinese market, diverse brand portfolio, and advanced manufacturing capabilities. Weaknesses: Limited global brand recognition outside of China, potential challenges in meeting stringent emissions regulations in some markets.

PHEV Tech Innovations

Quick DP control method applied to PHEV

PatentInactiveCN101602364A

Innovation

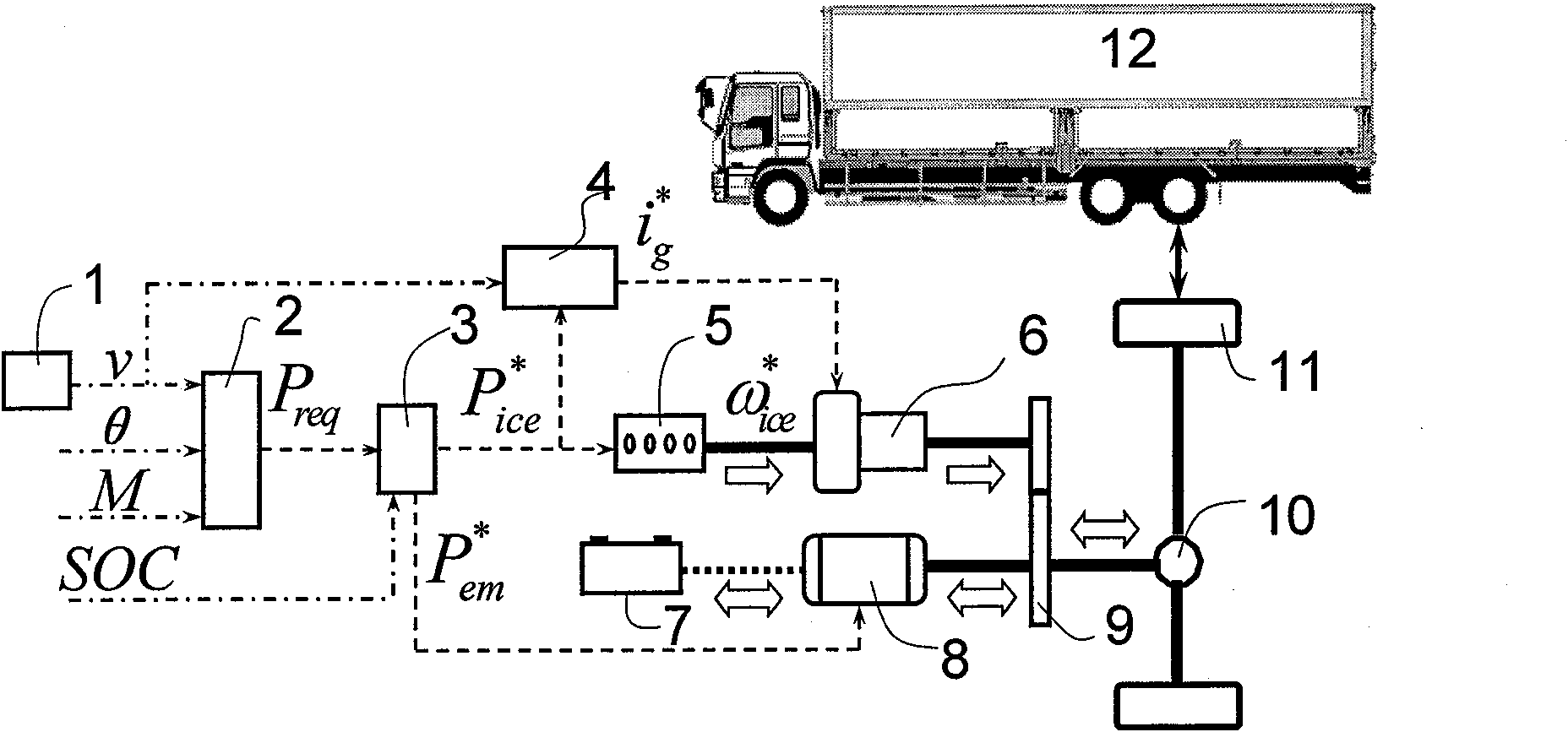

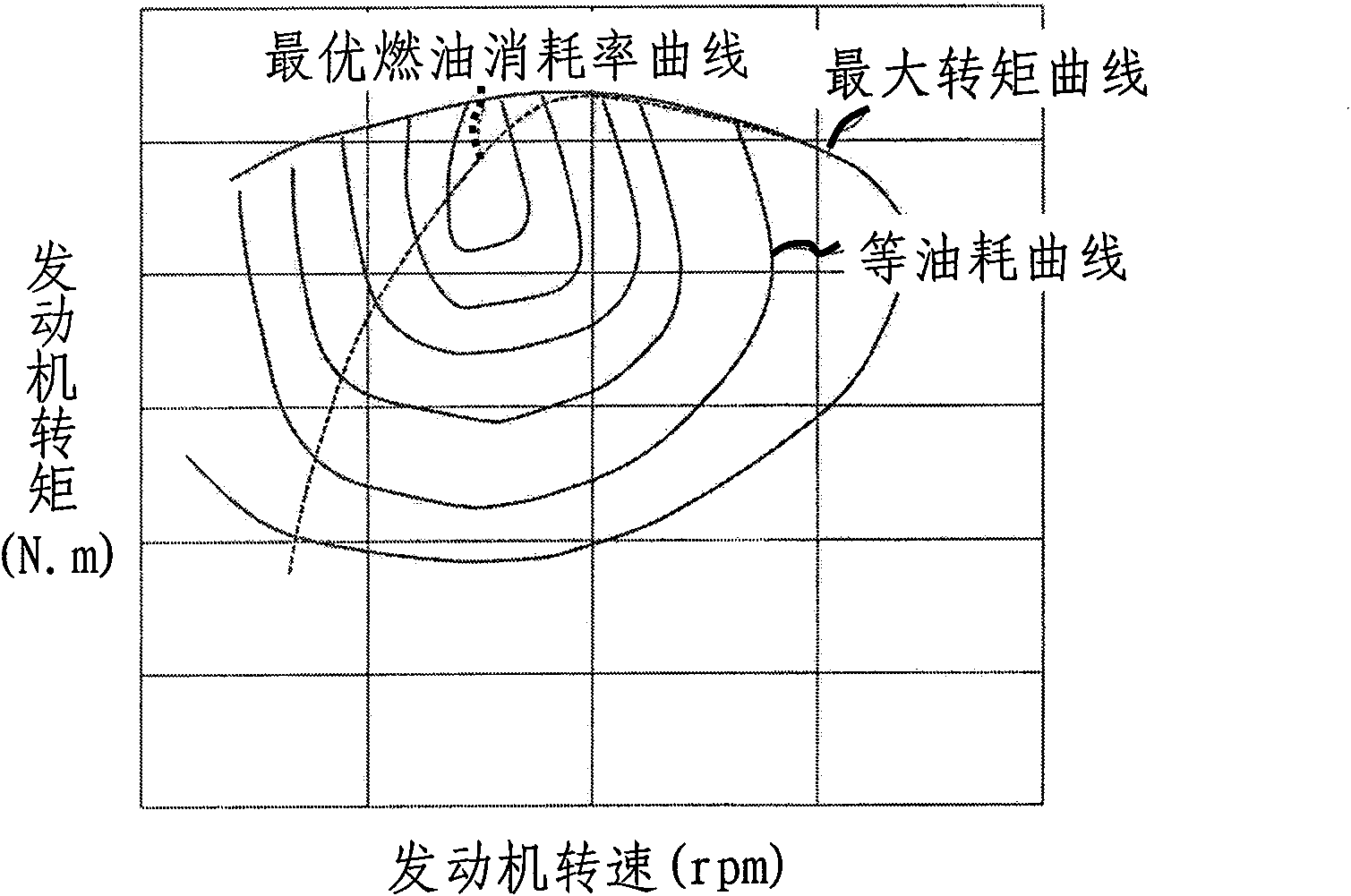

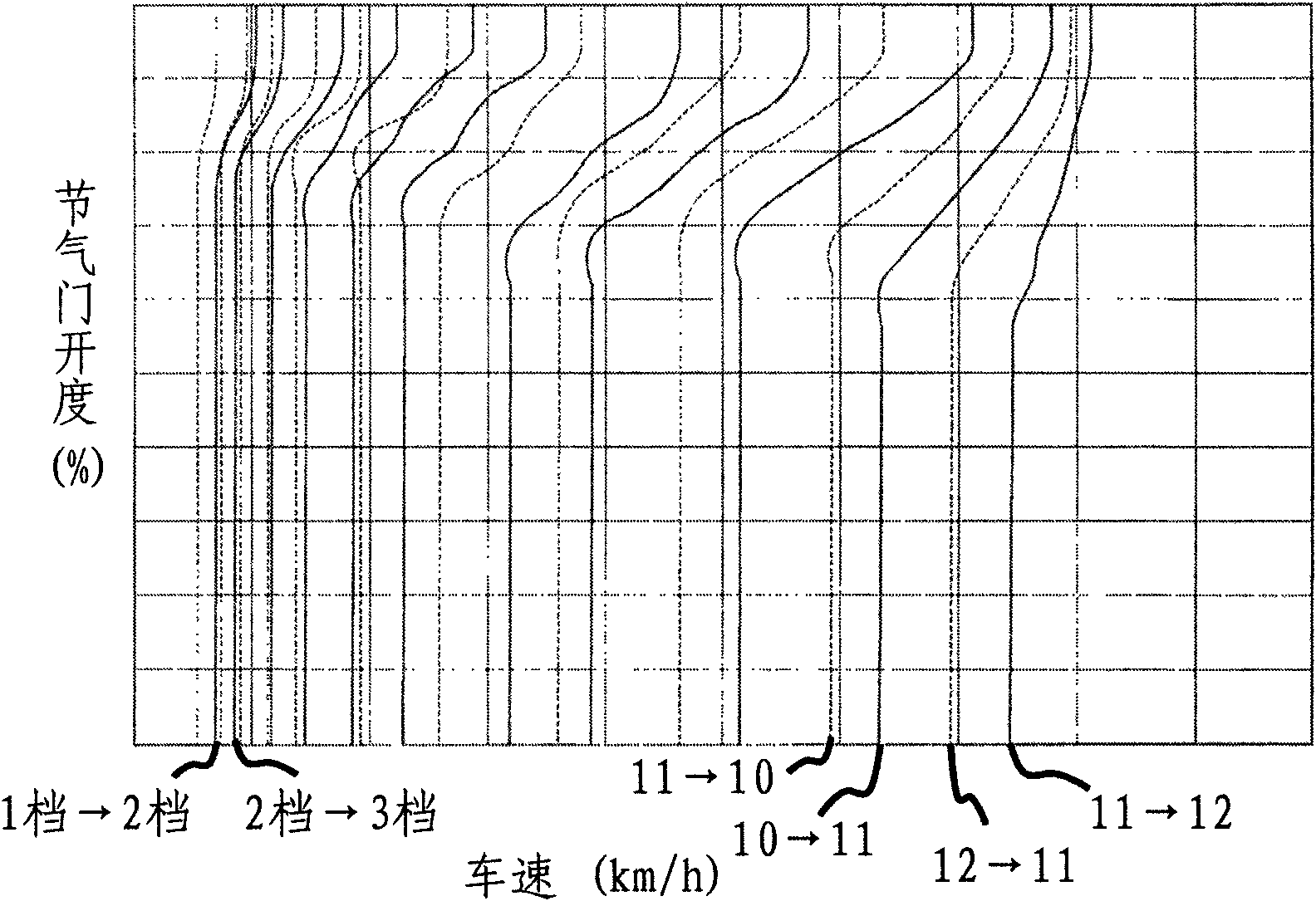

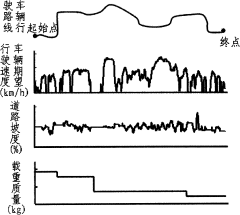

- The energy-based SOC definition method of the vehicle battery is used to derive the linear analytic function iterative form of the engine/motor power distribution ratio, and the optimal fuel consumption rate map of the engine is used to obtain the optimal speed ratio of the transmission gear, reducing the computational complexity. .

PHEV Policy Landscape

The PHEV policy landscape plays a crucial role in shaping the market growth and adoption of plug-in hybrid electric vehicles. Governments worldwide have implemented various policies and incentives to promote PHEV adoption, recognizing their potential to reduce greenhouse gas emissions and dependence on fossil fuels.

At the national level, many countries have established ambitious targets for PHEV market penetration. These targets are often accompanied by financial incentives, such as purchase subsidies, tax credits, and reduced registration fees. For instance, China, the world's largest automotive market, has implemented a dual-credit policy that encourages automakers to produce more PHEVs and other new energy vehicles.

In the European Union, stringent CO2 emission standards for new vehicles have indirectly boosted PHEV adoption. Automakers are incentivized to sell more PHEVs to meet these standards and avoid hefty fines. Additionally, many EU member states offer tax benefits and purchase incentives for PHEV buyers.

The United States has implemented a federal tax credit system for PHEVs, with credits varying based on battery capacity. However, these credits phase out once a manufacturer sells a certain number of eligible vehicles, creating a dynamic market environment.

Local and regional policies also significantly impact PHEV adoption. Cities and municipalities often offer additional incentives, such as free parking, access to high-occupancy vehicle lanes, and exemptions from congestion charges. These localized policies can create "hot spots" of PHEV adoption in urban areas.

Infrastructure development policies are another critical aspect of the PHEV landscape. Governments and utilities are investing in charging infrastructure to alleviate range anxiety and make PHEVs more practical for everyday use. Some jurisdictions have mandated that new buildings include EV charging capabilities, further supporting PHEV adoption.

Corporate fleet policies are increasingly favoring PHEVs, driven by both government incentives and corporate sustainability goals. Many countries offer enhanced tax deductions for businesses that incorporate PHEVs into their fleets, accelerating adoption in the commercial sector.

The policy landscape for PHEVs is dynamic and evolving. As technology improves and costs decrease, some governments are beginning to shift focus towards fully electric vehicles. This shift is creating new challenges and opportunities for PHEV manufacturers and requires adaptive strategies to maintain market growth.

At the national level, many countries have established ambitious targets for PHEV market penetration. These targets are often accompanied by financial incentives, such as purchase subsidies, tax credits, and reduced registration fees. For instance, China, the world's largest automotive market, has implemented a dual-credit policy that encourages automakers to produce more PHEVs and other new energy vehicles.

In the European Union, stringent CO2 emission standards for new vehicles have indirectly boosted PHEV adoption. Automakers are incentivized to sell more PHEVs to meet these standards and avoid hefty fines. Additionally, many EU member states offer tax benefits and purchase incentives for PHEV buyers.

The United States has implemented a federal tax credit system for PHEVs, with credits varying based on battery capacity. However, these credits phase out once a manufacturer sells a certain number of eligible vehicles, creating a dynamic market environment.

Local and regional policies also significantly impact PHEV adoption. Cities and municipalities often offer additional incentives, such as free parking, access to high-occupancy vehicle lanes, and exemptions from congestion charges. These localized policies can create "hot spots" of PHEV adoption in urban areas.

Infrastructure development policies are another critical aspect of the PHEV landscape. Governments and utilities are investing in charging infrastructure to alleviate range anxiety and make PHEVs more practical for everyday use. Some jurisdictions have mandated that new buildings include EV charging capabilities, further supporting PHEV adoption.

Corporate fleet policies are increasingly favoring PHEVs, driven by both government incentives and corporate sustainability goals. Many countries offer enhanced tax deductions for businesses that incorporate PHEVs into their fleets, accelerating adoption in the commercial sector.

The policy landscape for PHEVs is dynamic and evolving. As technology improves and costs decrease, some governments are beginning to shift focus towards fully electric vehicles. This shift is creating new challenges and opportunities for PHEV manufacturers and requires adaptive strategies to maintain market growth.

Partnership Strategies

Strategic partnerships play a crucial role in accelerating the growth of the Plug-in Hybrid Electric Vehicle (PHEV) market. These collaborations enable companies to leverage complementary strengths, share resources, and mitigate risks associated with the rapidly evolving automotive industry.

One key partnership strategy involves automakers collaborating with battery manufacturers. This alliance allows for the development of more efficient and cost-effective battery technologies, which are essential for improving PHEV performance and reducing overall vehicle costs. By working closely with battery suppliers, automakers can ensure a stable supply chain and potentially gain a competitive edge in the market.

Another important partnership approach is the collaboration between automotive companies and technology firms. These partnerships focus on developing advanced software systems, connectivity solutions, and autonomous driving technologies. By integrating cutting-edge tech into PHEVs, manufacturers can enhance the overall user experience and differentiate their products in an increasingly competitive market.

Partnerships between automakers and energy companies are also vital for PHEV market growth. These collaborations aim to develop and expand charging infrastructure, which is critical for widespread PHEV adoption. By working together, they can create seamless charging solutions and potentially offer bundled energy packages to consumers, making PHEV ownership more attractive and convenient.

Cross-industry partnerships, such as those between automotive companies and financial institutions, can help address the higher upfront costs associated with PHEVs. These collaborations can lead to innovative financing options, leasing programs, and insurance products tailored specifically for PHEV owners, making these vehicles more accessible to a broader range of consumers.

Lastly, strategic partnerships with government entities and regulatory bodies are essential for creating a supportive environment for PHEV market growth. These collaborations can help shape policies, incentives, and regulations that favor PHEV adoption, such as tax credits, emissions standards, and infrastructure development initiatives.

By implementing these partnership strategies, stakeholders in the PHEV market can create a robust ecosystem that addresses key challenges, drives innovation, and ultimately accelerates market growth. The success of these partnerships will depend on clear communication, aligned objectives, and a shared commitment to advancing sustainable transportation solutions.

One key partnership strategy involves automakers collaborating with battery manufacturers. This alliance allows for the development of more efficient and cost-effective battery technologies, which are essential for improving PHEV performance and reducing overall vehicle costs. By working closely with battery suppliers, automakers can ensure a stable supply chain and potentially gain a competitive edge in the market.

Another important partnership approach is the collaboration between automotive companies and technology firms. These partnerships focus on developing advanced software systems, connectivity solutions, and autonomous driving technologies. By integrating cutting-edge tech into PHEVs, manufacturers can enhance the overall user experience and differentiate their products in an increasingly competitive market.

Partnerships between automakers and energy companies are also vital for PHEV market growth. These collaborations aim to develop and expand charging infrastructure, which is critical for widespread PHEV adoption. By working together, they can create seamless charging solutions and potentially offer bundled energy packages to consumers, making PHEV ownership more attractive and convenient.

Cross-industry partnerships, such as those between automotive companies and financial institutions, can help address the higher upfront costs associated with PHEVs. These collaborations can lead to innovative financing options, leasing programs, and insurance products tailored specifically for PHEV owners, making these vehicles more accessible to a broader range of consumers.

Lastly, strategic partnerships with government entities and regulatory bodies are essential for creating a supportive environment for PHEV market growth. These collaborations can help shape policies, incentives, and regulations that favor PHEV adoption, such as tax credits, emissions standards, and infrastructure development initiatives.

By implementing these partnership strategies, stakeholders in the PHEV market can create a robust ecosystem that addresses key challenges, drives innovation, and ultimately accelerates market growth. The success of these partnerships will depend on clear communication, aligned objectives, and a shared commitment to advancing sustainable transportation solutions.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!