Applications In Remote Sensors: Design Requirements And Use Cases

AUG 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Remote Sensing Technology Background and Objectives

Remote sensing technology has evolved significantly over the past several decades, transforming from simple aerial photography to sophisticated multi-spectral and hyperspectral imaging systems. The journey began in the 1960s with the launch of the first Earth observation satellites, which provided basic visual imagery. Today's remote sensing capabilities encompass a vast array of technologies including radar, lidar, thermal imaging, and advanced optical systems that can detect electromagnetic radiation across multiple wavelengths.

The current technological landscape is characterized by miniaturization, increased resolution, and enhanced data processing capabilities. Satellite-based platforms like NASA's Landsat series and ESA's Sentinel program have continuously improved spatial, spectral, and temporal resolution. Meanwhile, unmanned aerial vehicles (UAVs) have democratized access to remote sensing technology, enabling cost-effective data collection for smaller-scale applications.

The primary objective of modern remote sensor applications is to provide accurate, timely, and actionable information across diverse use cases. These include environmental monitoring, agricultural management, urban planning, disaster response, and security surveillance. Each application domain presents unique requirements for sensor design, data collection protocols, and information processing algorithms.

Technical goals in remote sensing development focus on several key areas. First is the enhancement of sensor capabilities, including improved spatial resolution to detect smaller objects, better spectral resolution to distinguish between similar materials, and increased temporal resolution for more frequent observations. Second is the optimization of power consumption and size constraints, particularly critical for deployments on small satellites or UAVs. Third is the development of robust data transmission systems that can efficiently relay large volumes of information from remote locations.

The evolution of remote sensing is increasingly driven by integration with complementary technologies. Machine learning algorithms now enable automated feature extraction and pattern recognition from complex sensor data. Edge computing allows for preliminary data processing directly on sensing platforms, reducing transmission requirements. Cloud computing infrastructures support the storage and analysis of massive remote sensing datasets.

Looking forward, the field is moving toward multi-sensor fusion approaches that combine data from different sensing modalities to overcome the limitations of individual sensors. This trend, coupled with advances in artificial intelligence for data interpretation, promises to unlock new applications and improve the accuracy and utility of remote sensing information across all use cases.

The current technological landscape is characterized by miniaturization, increased resolution, and enhanced data processing capabilities. Satellite-based platforms like NASA's Landsat series and ESA's Sentinel program have continuously improved spatial, spectral, and temporal resolution. Meanwhile, unmanned aerial vehicles (UAVs) have democratized access to remote sensing technology, enabling cost-effective data collection for smaller-scale applications.

The primary objective of modern remote sensor applications is to provide accurate, timely, and actionable information across diverse use cases. These include environmental monitoring, agricultural management, urban planning, disaster response, and security surveillance. Each application domain presents unique requirements for sensor design, data collection protocols, and information processing algorithms.

Technical goals in remote sensing development focus on several key areas. First is the enhancement of sensor capabilities, including improved spatial resolution to detect smaller objects, better spectral resolution to distinguish between similar materials, and increased temporal resolution for more frequent observations. Second is the optimization of power consumption and size constraints, particularly critical for deployments on small satellites or UAVs. Third is the development of robust data transmission systems that can efficiently relay large volumes of information from remote locations.

The evolution of remote sensing is increasingly driven by integration with complementary technologies. Machine learning algorithms now enable automated feature extraction and pattern recognition from complex sensor data. Edge computing allows for preliminary data processing directly on sensing platforms, reducing transmission requirements. Cloud computing infrastructures support the storage and analysis of massive remote sensing datasets.

Looking forward, the field is moving toward multi-sensor fusion approaches that combine data from different sensing modalities to overcome the limitations of individual sensors. This trend, coupled with advances in artificial intelligence for data interpretation, promises to unlock new applications and improve the accuracy and utility of remote sensing information across all use cases.

Market Analysis for Remote Sensing Applications

The remote sensing market has experienced substantial growth over the past decade, driven by technological advancements and expanding applications across various industries. Currently valued at approximately $15.8 billion, the market is projected to reach $29.4 billion by 2027, representing a compound annual growth rate (CAGR) of 13.2%. This growth trajectory is supported by increasing demand for Earth observation data in environmental monitoring, agriculture, defense, and urban planning sectors.

The agriculture segment represents the largest market share at 28%, where remote sensing technologies enable precision farming, crop health monitoring, and yield prediction. Government and defense applications follow closely at 24%, utilizing remote sensing for border surveillance, terrain mapping, and strategic intelligence gathering. Environmental monitoring constitutes 18% of the market, with applications in climate change research, disaster management, and natural resource conservation.

Regionally, North America dominates the market with 38% share, attributed to substantial government investments and the presence of major technology providers. Asia-Pacific represents the fastest-growing region with a 16.8% CAGR, driven by rapid industrialization, agricultural modernization, and increasing government initiatives in countries like China, India, and Japan.

Customer segmentation reveals three primary user groups: government agencies (42%), commercial enterprises (35%), and research institutions (23%). Government agencies primarily utilize remote sensing for national security, resource management, and public infrastructure planning. Commercial users focus on applications that provide competitive advantages in agriculture, energy, insurance, and urban development. Research institutions employ remote sensing technologies for scientific studies related to climate change, biodiversity, and geological phenomena.

Market trends indicate a shift toward miniaturized sensor technologies, with the small satellite segment growing at 22% annually. Cloud-based processing solutions are gaining traction, expected to grow by 28% over the next five years as organizations seek scalable data management capabilities. Integration of artificial intelligence with remote sensing is emerging as a transformative trend, enabling automated feature extraction and predictive analytics.

Key market drivers include decreasing sensor costs (30% reduction over five years), increasing spatial and spectral resolution capabilities, and growing demand for real-time monitoring solutions. However, market challenges persist, including data privacy concerns, regulatory hurdles across international boundaries, and the technical complexity of integrating remote sensing data with existing enterprise systems.

The agriculture segment represents the largest market share at 28%, where remote sensing technologies enable precision farming, crop health monitoring, and yield prediction. Government and defense applications follow closely at 24%, utilizing remote sensing for border surveillance, terrain mapping, and strategic intelligence gathering. Environmental monitoring constitutes 18% of the market, with applications in climate change research, disaster management, and natural resource conservation.

Regionally, North America dominates the market with 38% share, attributed to substantial government investments and the presence of major technology providers. Asia-Pacific represents the fastest-growing region with a 16.8% CAGR, driven by rapid industrialization, agricultural modernization, and increasing government initiatives in countries like China, India, and Japan.

Customer segmentation reveals three primary user groups: government agencies (42%), commercial enterprises (35%), and research institutions (23%). Government agencies primarily utilize remote sensing for national security, resource management, and public infrastructure planning. Commercial users focus on applications that provide competitive advantages in agriculture, energy, insurance, and urban development. Research institutions employ remote sensing technologies for scientific studies related to climate change, biodiversity, and geological phenomena.

Market trends indicate a shift toward miniaturized sensor technologies, with the small satellite segment growing at 22% annually. Cloud-based processing solutions are gaining traction, expected to grow by 28% over the next five years as organizations seek scalable data management capabilities. Integration of artificial intelligence with remote sensing is emerging as a transformative trend, enabling automated feature extraction and predictive analytics.

Key market drivers include decreasing sensor costs (30% reduction over five years), increasing spatial and spectral resolution capabilities, and growing demand for real-time monitoring solutions. However, market challenges persist, including data privacy concerns, regulatory hurdles across international boundaries, and the technical complexity of integrating remote sensing data with existing enterprise systems.

Current Technical Challenges in Remote Sensor Design

Remote sensor technology faces several significant challenges that impede its broader adoption and effectiveness across various applications. Power consumption remains a primary concern, particularly for sensors deployed in remote or inaccessible locations where regular battery replacement is impractical. Current battery technologies struggle to provide the longevity required for extended deployment periods, often necessitating compromises between functionality and operational lifespan.

Miniaturization presents another substantial challenge, as designers must balance size reduction with maintaining or improving sensor capabilities. This becomes especially critical in applications such as wearable health monitors, environmental tracking devices, and space-constrained industrial settings where physical footprint directly impacts usability and deployment options.

Environmental resilience constitutes a major technical hurdle, with sensors needing to withstand extreme temperatures, humidity, vibration, and other harsh conditions while maintaining accuracy and reliability. Current enclosure and protection technologies often add significant bulk or cost, creating design trade-offs that limit application versatility.

Data transmission efficiency remains problematic, particularly in remote deployment scenarios with limited bandwidth or intermittent connectivity. The need to transmit large volumes of sensor data while minimizing power consumption creates significant engineering challenges, with current compression and transmission protocols often proving inadequate for optimal performance.

Signal interference and noise rejection capabilities continue to limit sensor accuracy in complex environments. As deployment environments become more crowded with electronic devices and varying electromagnetic conditions, maintaining signal integrity becomes increasingly difficult without sophisticated and power-hungry filtering systems.

Calibration drift represents a persistent challenge, with many remote sensors experiencing accuracy degradation over time due to environmental factors and component aging. Current self-calibration technologies remain limited in their effectiveness, often requiring periodic manual recalibration that undermines the "deploy and forget" ideal of remote sensing.

Cost constraints significantly impact widespread adoption, with advanced sensor technologies often proving prohibitively expensive for mass deployment scenarios. The integration of multiple sensing modalities into unified platforms while maintaining reasonable price points presents ongoing challenges for manufacturers and system integrators.

Standardization issues further complicate the landscape, with competing protocols and interfaces limiting interoperability between different sensor systems and data platforms. This fragmentation increases integration complexity and total deployment costs while reducing the potential for creating comprehensive sensing networks.

Miniaturization presents another substantial challenge, as designers must balance size reduction with maintaining or improving sensor capabilities. This becomes especially critical in applications such as wearable health monitors, environmental tracking devices, and space-constrained industrial settings where physical footprint directly impacts usability and deployment options.

Environmental resilience constitutes a major technical hurdle, with sensors needing to withstand extreme temperatures, humidity, vibration, and other harsh conditions while maintaining accuracy and reliability. Current enclosure and protection technologies often add significant bulk or cost, creating design trade-offs that limit application versatility.

Data transmission efficiency remains problematic, particularly in remote deployment scenarios with limited bandwidth or intermittent connectivity. The need to transmit large volumes of sensor data while minimizing power consumption creates significant engineering challenges, with current compression and transmission protocols often proving inadequate for optimal performance.

Signal interference and noise rejection capabilities continue to limit sensor accuracy in complex environments. As deployment environments become more crowded with electronic devices and varying electromagnetic conditions, maintaining signal integrity becomes increasingly difficult without sophisticated and power-hungry filtering systems.

Calibration drift represents a persistent challenge, with many remote sensors experiencing accuracy degradation over time due to environmental factors and component aging. Current self-calibration technologies remain limited in their effectiveness, often requiring periodic manual recalibration that undermines the "deploy and forget" ideal of remote sensing.

Cost constraints significantly impact widespread adoption, with advanced sensor technologies often proving prohibitively expensive for mass deployment scenarios. The integration of multiple sensing modalities into unified platforms while maintaining reasonable price points presents ongoing challenges for manufacturers and system integrators.

Standardization issues further complicate the landscape, with competing protocols and interfaces limiting interoperability between different sensor systems and data platforms. This fragmentation increases integration complexity and total deployment costs while reducing the potential for creating comprehensive sensing networks.

Current Design Solutions for Remote Sensors

01 Environmental monitoring and data collection systems

Remote sensor systems designed for environmental monitoring collect data on various parameters such as temperature, humidity, air quality, and other environmental conditions. These systems typically employ wireless communication technologies to transmit collected data to central processing units for analysis. The sensors can be deployed in diverse environments, from urban settings to remote wilderness areas, providing real-time or periodic monitoring capabilities for environmental management and research purposes.- Environmental monitoring systems using remote sensors: Remote sensors are utilized in environmental monitoring systems to collect data about various environmental parameters. These systems can track changes in temperature, humidity, air quality, and other environmental factors from a distance. The data collected by these sensors can be used for environmental research, climate monitoring, and early warning systems for natural disasters.

- Remote sensing technologies for industrial applications: Remote sensors are implemented in industrial settings to monitor equipment performance, detect anomalies, and ensure operational efficiency. These sensors can measure parameters such as temperature, pressure, vibration, and flow rates without direct physical contact. The data collected helps in predictive maintenance, reducing downtime, and optimizing industrial processes.

- Wireless communication networks for remote sensors: Wireless communication technologies enable remote sensors to transmit data efficiently over long distances. These networks facilitate real-time data collection and analysis from sensors deployed in remote or hazardous locations. The communication systems can include cellular networks, satellite communications, or dedicated wireless protocols designed specifically for sensor networks.

- Smart surveillance and security systems using remote sensors: Remote sensors are integrated into surveillance and security systems to detect unauthorized access, monitor secure areas, and identify potential threats. These sensors can include motion detectors, infrared cameras, and acoustic sensors that operate continuously without human intervention. The data from these sensors can trigger automated responses or alert security personnel to potential security breaches.

- AI and machine learning integration with remote sensors: Artificial intelligence and machine learning algorithms are being integrated with remote sensor systems to enhance data analysis capabilities. These technologies enable pattern recognition, anomaly detection, and predictive analytics based on sensor data. The combination of AI with remote sensors allows for more intelligent decision-making and automated responses to changing conditions.

02 Industrial automation and process control

Remote sensors are integral to industrial automation systems, enabling monitoring and control of manufacturing processes, equipment performance, and operational parameters. These sensors can detect variables such as pressure, flow, temperature, and machine status, transmitting this information to control systems. Advanced implementations incorporate predictive maintenance capabilities by analyzing sensor data to identify potential equipment failures before they occur, thereby reducing downtime and optimizing production efficiency.Expand Specific Solutions03 Network-connected sensor systems

Modern remote sensor architectures leverage network connectivity to create integrated monitoring systems. These systems utilize Internet of Things (IoT) frameworks to connect multiple sensors across distributed locations, enabling comprehensive data collection and analysis. The network infrastructure supports secure data transmission protocols and may incorporate edge computing capabilities to process data closer to the source before transmission to cloud-based platforms for further analysis and storage.Expand Specific Solutions04 Imaging and surveillance applications

Remote sensor technology for imaging and surveillance applications encompasses various types of cameras and detection systems designed to monitor areas from a distance. These systems may incorporate visible light cameras, infrared sensors, motion detectors, and other imaging technologies to provide comprehensive surveillance capabilities. Advanced implementations feature automated image analysis algorithms that can identify specific events or anomalies, triggering alerts when predefined conditions are detected.Expand Specific Solutions05 AI and machine learning integration

The integration of artificial intelligence and machine learning with remote sensor systems enables advanced data analysis and pattern recognition capabilities. These intelligent systems can process large volumes of sensor data to identify trends, anomalies, and correlations that might not be apparent through conventional analysis methods. The AI components can adapt to changing conditions, improving detection accuracy over time through continuous learning algorithms, and can make autonomous decisions based on predefined parameters and historical data patterns.Expand Specific Solutions

Key Industry Players and Competitive Landscape

The remote sensor technology landscape is currently in a growth phase, characterized by increasing market adoption across aerospace, defense, industrial, and consumer sectors. The market is projected to expand significantly due to rising demand for IoT applications and smart infrastructure. Leading aerospace and defense players like Boeing, Lockheed Martin, Raytheon, and BAE Systems are driving innovation in high-performance remote sensing applications, while technology giants including Samsung, Huawei, and Siemens are focusing on commercial implementations. The technology shows varying maturity levels across sectors, with aerospace and defense applications being more advanced than emerging consumer applications. Companies like Sensera Systems and Magik Eye represent specialized innovators developing niche solutions, while established industrial players such as Bosch and Honeywell are integrating remote sensing into broader product ecosystems.

Honeywell International Technologies Ltd.

Technical Solution: Honeywell has developed an integrated approach to remote sensing through their Smart Sensors platform, which combines multiple sensing modalities with edge processing capabilities. Their sensors feature self-calibration algorithms that maintain accuracy over extended deployment periods without manual intervention. Honeywell's industrial remote sensors incorporate redundant measurement channels with automated cross-checking to achieve 99.999% reliability in critical applications. The company's wireless sensor networks utilize mesh protocols with dynamic channel hopping to overcome interference in industrial environments, maintaining connectivity even with up to 30% of nodes experiencing signal degradation. For energy efficiency, Honeywell employs adaptive sampling rates that adjust based on detected activity levels, reducing power consumption by up to 75% during periods of low activity while maintaining rapid response to critical events. Their sensors are designed with modular architectures allowing field upgrades of both hardware and firmware without replacing entire systems.

Strengths: Exceptional energy efficiency through intelligent power management extends deployment lifetimes in remote locations. Robust industrial design withstands harsh environments including chemical exposure and extreme temperatures. Weaknesses: Higher initial cost compared to consumer-grade alternatives, and proprietary communication protocols can create integration challenges with existing infrastructure.

BAE Systems Information & Electronic Sys Integration, Inc.

Technical Solution: BAE Systems has developed advanced remote sensing technologies focused on persistent surveillance and intelligence gathering. Their SPECTRAL sensor platform integrates electro-optical, infrared, and radio frequency sensing capabilities into compact packages suitable for deployment on unmanned aerial vehicles and ground stations. BAE's sensors feature adaptive processing algorithms that automatically adjust sensitivity and filtering parameters based on environmental conditions, maintaining detection performance across diverse operating scenarios. Their systems employ distributed processing architectures where initial data analysis occurs at the sensor node, reducing bandwidth requirements for backhaul communications by up to 90% while preserving critical information. For maritime applications, BAE has developed specialized sensors that compensate for platform motion and atmospheric effects, achieving target classification at ranges exceeding 20km even in challenging weather conditions. Their latest generation of remote sensors incorporates machine learning capabilities that improve target recognition accuracy by continuously updating classification models based on operational feedback.

Strengths: Exceptional performance in adverse environmental conditions including fog, rain, and dust storms. Sophisticated counter-countermeasure capabilities resist jamming and deception attempts. Weaknesses: High power requirements for full-capability operation can limit deployment duration in remote locations, and complex integration requirements can extend implementation timelines for new installations.

Core Patents and Technical Literature Analysis

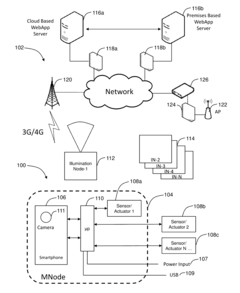

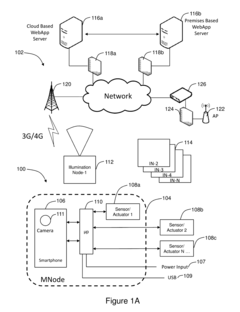

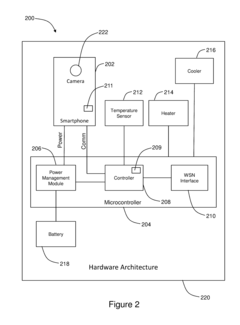

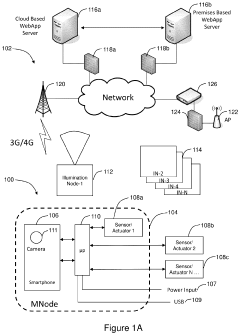

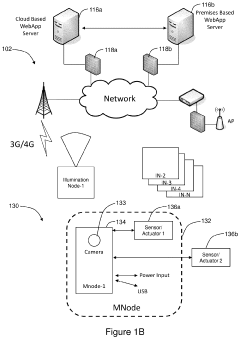

Remote sensing device, system and method utilizing smartphone hardware components

PatentActiveUS20160323431A1

Innovation

- A remote sensing device and system utilizing a smartphone housed in an enclosure with a microcontroller, leveraging low power consumption and wireless communication to detect motion and provide illumination over a wide area, reducing the number of cameras needed and simplifying installation and maintenance.

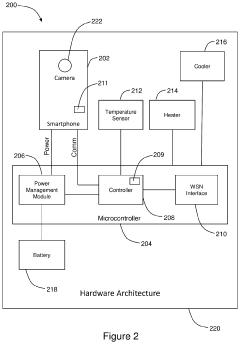

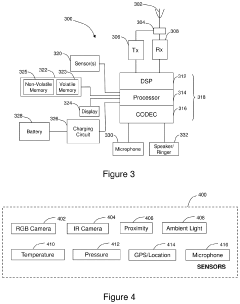

Portable remote sensing device and system

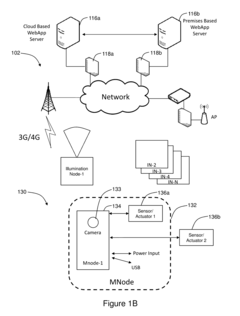

PatentActiveUS20240130024A1

Innovation

- A remote sensing device with a smartphone processor, microcontroller, and wireless communication module, powered by a battery charged via solar panels, that encodes low-resolution video streams for cellular communication and high-resolution streams for storage, and includes a camera for motion detection and illumination, enabling efficient data management and reduced power consumption.

Environmental Impact and Sustainability Considerations

The environmental footprint of remote sensing technologies has become increasingly significant as deployment scales expand globally. Remote sensors, while essential for monitoring environmental conditions, paradoxically contribute to environmental degradation through their lifecycle. Manufacturing processes for sensor components often involve rare earth elements and specialized materials that require energy-intensive extraction and processing methods. The production phase alone can generate substantial carbon emissions, particularly for advanced sensor arrays with complex semiconductor components.

Operational sustainability presents another critical dimension, as remote sensors deployed in field conditions require reliable power sources. Traditional battery-powered systems create significant waste streams, with replacement cycles generating hazardous materials that often end up in landfills. Solar-powered alternatives reduce operational emissions but introduce manufacturing complexity and end-of-life recycling challenges for photovoltaic components.

Deployment strategies must increasingly consider habitat disruption, particularly in sensitive ecosystems. Physical installation of sensor networks can damage local environments, while electromagnetic emissions from wireless transmission systems may potentially impact wildlife behavior patterns. Recent studies indicate that certain frequency ranges used in remote sensing communications overlap with biological signaling mechanisms in various species, necessitating careful frequency selection and transmission power management.

End-of-life considerations represent perhaps the most overlooked aspect of remote sensing sustainability. The average operational lifespan of field-deployed sensors ranges from 3-7 years, creating substantial electronic waste streams. Recovery logistics from remote deployment locations often prove prohibitively expensive, resulting in abandoned equipment. Modular design approaches that facilitate component replacement rather than complete system disposal show promise in extending operational lifespans by up to 300%.

Emerging sustainable design practices focus on biodegradable housings, energy harvesting technologies, and materials selection optimization. Bioplastic enclosures derived from agricultural waste streams demonstrate comparable durability to conventional plastics while decomposing naturally when exposed to soil microorganisms. Multi-source energy harvesting systems combining solar, vibration, and thermal gradient technologies can eliminate battery dependencies in many deployment scenarios.

Regulatory frameworks increasingly mandate lifecycle assessments for large-scale sensor deployments, particularly in protected areas. Carbon footprint calculations must now incorporate manufacturing, deployment, operational, and decommissioning phases. Organizations implementing remote sensing networks face growing pressure to demonstrate sustainability credentials through transparent reporting on material sourcing, energy consumption, and end-of-life management strategies.

Operational sustainability presents another critical dimension, as remote sensors deployed in field conditions require reliable power sources. Traditional battery-powered systems create significant waste streams, with replacement cycles generating hazardous materials that often end up in landfills. Solar-powered alternatives reduce operational emissions but introduce manufacturing complexity and end-of-life recycling challenges for photovoltaic components.

Deployment strategies must increasingly consider habitat disruption, particularly in sensitive ecosystems. Physical installation of sensor networks can damage local environments, while electromagnetic emissions from wireless transmission systems may potentially impact wildlife behavior patterns. Recent studies indicate that certain frequency ranges used in remote sensing communications overlap with biological signaling mechanisms in various species, necessitating careful frequency selection and transmission power management.

End-of-life considerations represent perhaps the most overlooked aspect of remote sensing sustainability. The average operational lifespan of field-deployed sensors ranges from 3-7 years, creating substantial electronic waste streams. Recovery logistics from remote deployment locations often prove prohibitively expensive, resulting in abandoned equipment. Modular design approaches that facilitate component replacement rather than complete system disposal show promise in extending operational lifespans by up to 300%.

Emerging sustainable design practices focus on biodegradable housings, energy harvesting technologies, and materials selection optimization. Bioplastic enclosures derived from agricultural waste streams demonstrate comparable durability to conventional plastics while decomposing naturally when exposed to soil microorganisms. Multi-source energy harvesting systems combining solar, vibration, and thermal gradient technologies can eliminate battery dependencies in many deployment scenarios.

Regulatory frameworks increasingly mandate lifecycle assessments for large-scale sensor deployments, particularly in protected areas. Carbon footprint calculations must now incorporate manufacturing, deployment, operational, and decommissioning phases. Organizations implementing remote sensing networks face growing pressure to demonstrate sustainability credentials through transparent reporting on material sourcing, energy consumption, and end-of-life management strategies.

Regulatory Framework for Remote Sensing Applications

The regulatory landscape for remote sensing applications has evolved significantly over the past decades, reflecting both technological advancements and growing concerns about privacy, security, and environmental protection. At the international level, the United Nations Committee on the Peaceful Uses of Outer Space (COPUOS) provides foundational principles governing remote sensing activities, emphasizing cooperation and data sharing while respecting territorial sovereignty. These principles have been incorporated into various national regulatory frameworks with varying degrees of stringency.

In the United States, remote sensing operations are primarily regulated under the Land Remote Sensing Policy Act and subsequent amendments, with licensing authority vested in NOAA for commercial satellite operations. The European Union has established the Copernicus program regulatory framework, which emphasizes open data access while maintaining security protocols for sensitive information. Meanwhile, emerging economies like India and China have developed their own regulatory approaches, often balancing national security concerns with commercial development objectives.

Data privacy regulations significantly impact remote sensing applications, particularly with high-resolution imaging capabilities. The EU's General Data Protection Regulation (GDPR) imposes strict requirements on personal data captured through remote sensing, including facial recognition in aerial imagery. Similar regulations are emerging globally, creating a complex compliance landscape for cross-border remote sensing operations.

Frequency allocation and electromagnetic spectrum management represent another critical regulatory domain. The International Telecommunication Union (ITU) coordinates global spectrum allocation, while national bodies like the FCC in the United States manage domestic frequency assignments. Remote sensing system designers must navigate these regulations during early development phases to ensure operational compliance and avoid costly redesigns.

Export control regulations present significant challenges for international collaboration in remote sensing technologies. The Wassenaar Arrangement and country-specific regulations like ITAR in the United States restrict the transfer of certain sensing technologies deemed to have dual-use potential. These restrictions can impact supply chains, research partnerships, and market access for remote sensing products.

Emerging applications like drone-based sensing face rapidly evolving regulatory frameworks. Aviation authorities worldwide are developing rules for unmanned aerial systems, addressing airspace integration, operational limitations, and certification requirements. These regulations vary significantly by jurisdiction, creating compliance challenges for global deployment of mobile sensing platforms.

Environmental and conservation regulations increasingly incorporate remote sensing requirements, particularly for monitoring protected areas, emissions compliance, and environmental impact assessments. These regulations often specify minimum sensing capabilities, data retention periods, and reporting formats that directly influence system design requirements.

In the United States, remote sensing operations are primarily regulated under the Land Remote Sensing Policy Act and subsequent amendments, with licensing authority vested in NOAA for commercial satellite operations. The European Union has established the Copernicus program regulatory framework, which emphasizes open data access while maintaining security protocols for sensitive information. Meanwhile, emerging economies like India and China have developed their own regulatory approaches, often balancing national security concerns with commercial development objectives.

Data privacy regulations significantly impact remote sensing applications, particularly with high-resolution imaging capabilities. The EU's General Data Protection Regulation (GDPR) imposes strict requirements on personal data captured through remote sensing, including facial recognition in aerial imagery. Similar regulations are emerging globally, creating a complex compliance landscape for cross-border remote sensing operations.

Frequency allocation and electromagnetic spectrum management represent another critical regulatory domain. The International Telecommunication Union (ITU) coordinates global spectrum allocation, while national bodies like the FCC in the United States manage domestic frequency assignments. Remote sensing system designers must navigate these regulations during early development phases to ensure operational compliance and avoid costly redesigns.

Export control regulations present significant challenges for international collaboration in remote sensing technologies. The Wassenaar Arrangement and country-specific regulations like ITAR in the United States restrict the transfer of certain sensing technologies deemed to have dual-use potential. These restrictions can impact supply chains, research partnerships, and market access for remote sensing products.

Emerging applications like drone-based sensing face rapidly evolving regulatory frameworks. Aviation authorities worldwide are developing rules for unmanned aerial systems, addressing airspace integration, operational limitations, and certification requirements. These regulations vary significantly by jurisdiction, creating compliance challenges for global deployment of mobile sensing platforms.

Environmental and conservation regulations increasingly incorporate remote sensing requirements, particularly for monitoring protected areas, emissions compliance, and environmental impact assessments. These regulations often specify minimum sensing capabilities, data retention periods, and reporting formats that directly influence system design requirements.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!