Comparative analysis of Composite coatings for metal versus ceramic substrates

SEP 24, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Composite Coating Technology Evolution and Objectives

Composite coating technology has evolved significantly over the past five decades, transitioning from simple protective layers to sophisticated multifunctional systems. The journey began in the 1970s with basic polymer-based coatings primarily focused on corrosion protection. By the 1990s, advancements in materials science enabled the development of more complex composite structures incorporating ceramic particles, carbon fibers, and metallic elements to enhance specific properties.

The early 2000s marked a pivotal shift with the emergence of nanotechnology, allowing for precise manipulation of coating compositions at the nanoscale. This breakthrough facilitated unprecedented control over coating microstructures, leading to dramatic improvements in performance characteristics such as wear resistance, thermal stability, and chemical inertness. The integration of computational modeling during this period also accelerated formulation optimization processes.

Recent technological evolution has focused on substrate-specific coating designs, recognizing the fundamental differences between metal and ceramic substrates. Metal substrates typically require coatings that address electrochemical corrosion mechanisms, thermal expansion compatibility, and adhesion challenges due to surface oxidation. Conversely, ceramic substrates demand coatings that enhance toughness, reduce brittleness, and maintain performance under extreme thermal conditions.

The current technological landscape is increasingly oriented toward environmentally sustainable solutions, with significant research dedicated to developing water-based formulations, VOC-free systems, and bio-inspired coating architectures. These developments align with global regulatory trends and growing market demand for greener technologies across industrial sectors.

The primary objectives of contemporary composite coating research for different substrates include: enhancing durability under extreme service conditions; developing multi-functional coatings that simultaneously address multiple performance requirements; improving cost-effectiveness through simplified application processes; and ensuring environmental compliance without compromising technical performance.

For metal substrates specifically, key objectives include developing self-healing capabilities to address micro-crack formation, improving thermal barrier properties for high-temperature applications, and enhancing resistance to aggressive chemical environments. For ceramic substrates, research aims to improve impact resistance, reduce surface porosity, and develop coatings that can withstand thermal cycling without delamination.

Future technological trajectories point toward smart composite coatings with embedded sensors, stimuli-responsive properties, and real-time monitoring capabilities. These advanced systems will likely incorporate machine learning algorithms to predict coating performance and optimize maintenance schedules based on actual service conditions.

The early 2000s marked a pivotal shift with the emergence of nanotechnology, allowing for precise manipulation of coating compositions at the nanoscale. This breakthrough facilitated unprecedented control over coating microstructures, leading to dramatic improvements in performance characteristics such as wear resistance, thermal stability, and chemical inertness. The integration of computational modeling during this period also accelerated formulation optimization processes.

Recent technological evolution has focused on substrate-specific coating designs, recognizing the fundamental differences between metal and ceramic substrates. Metal substrates typically require coatings that address electrochemical corrosion mechanisms, thermal expansion compatibility, and adhesion challenges due to surface oxidation. Conversely, ceramic substrates demand coatings that enhance toughness, reduce brittleness, and maintain performance under extreme thermal conditions.

The current technological landscape is increasingly oriented toward environmentally sustainable solutions, with significant research dedicated to developing water-based formulations, VOC-free systems, and bio-inspired coating architectures. These developments align with global regulatory trends and growing market demand for greener technologies across industrial sectors.

The primary objectives of contemporary composite coating research for different substrates include: enhancing durability under extreme service conditions; developing multi-functional coatings that simultaneously address multiple performance requirements; improving cost-effectiveness through simplified application processes; and ensuring environmental compliance without compromising technical performance.

For metal substrates specifically, key objectives include developing self-healing capabilities to address micro-crack formation, improving thermal barrier properties for high-temperature applications, and enhancing resistance to aggressive chemical environments. For ceramic substrates, research aims to improve impact resistance, reduce surface porosity, and develop coatings that can withstand thermal cycling without delamination.

Future technological trajectories point toward smart composite coatings with embedded sensors, stimuli-responsive properties, and real-time monitoring capabilities. These advanced systems will likely incorporate machine learning algorithms to predict coating performance and optimize maintenance schedules based on actual service conditions.

Market Applications and Demand Analysis for Substrate Coatings

The global market for composite coatings on various substrates has witnessed substantial growth, driven by increasing demand across multiple industries. Metal substrates currently dominate the market share, accounting for approximately 65% of applications, while ceramic substrates represent a growing segment at 20%, with the remainder distributed among polymer and other substrate types.

Automotive and aerospace industries remain the largest consumers of composite coatings, particularly for metal substrates, with combined market value exceeding $12 billion annually. These sectors prioritize coatings that enhance corrosion resistance, reduce weight, and improve fuel efficiency. The automotive industry specifically shows a compound annual growth rate of 5.7% for advanced composite coatings, reflecting the push toward more durable and lightweight vehicle components.

For ceramic substrates, the electronics and semiconductor industries represent the fastest-growing application segments, expanding at 8.3% annually. This growth is fueled by increasing miniaturization of electronic components and the need for thermal management solutions in high-performance computing and telecommunications infrastructure.

The medical device industry presents a specialized but lucrative market for both substrate types, with stringent requirements for biocompatibility and wear resistance. Metal substrates with composite coatings dominate in orthopedic implants, while ceramic substrates find applications in dental prosthetics and diagnostic equipment.

Regional analysis reveals that Asia-Pacific, particularly China and Japan, leads in consumption of composite coatings for electronics applications on ceramic substrates. North America and Europe maintain leadership in high-performance applications for aerospace and defense, primarily using metal substrates with advanced composite coatings.

Consumer demand trends indicate growing preference for environmentally friendly coating solutions, with water-based and powder coating technologies gaining market share. This shift is particularly evident in architectural and consumer goods applications, where regulatory pressures regarding volatile organic compounds (VOCs) continue to intensify.

Industrial equipment manufacturers represent another significant market segment, with particular emphasis on coatings that extend equipment lifespan and reduce maintenance costs. In this sector, metal substrates with composite coatings designed for extreme operating conditions command premium pricing, with customers willing to pay 30-40% more for solutions that demonstrably extend service intervals.

Energy sector applications, including oil and gas, wind, and solar, show divergent requirements between metal and ceramic substrates, with metal dominating in structural applications and ceramics preferred for specialized components exposed to extreme temperatures or electrical conditions.

Automotive and aerospace industries remain the largest consumers of composite coatings, particularly for metal substrates, with combined market value exceeding $12 billion annually. These sectors prioritize coatings that enhance corrosion resistance, reduce weight, and improve fuel efficiency. The automotive industry specifically shows a compound annual growth rate of 5.7% for advanced composite coatings, reflecting the push toward more durable and lightweight vehicle components.

For ceramic substrates, the electronics and semiconductor industries represent the fastest-growing application segments, expanding at 8.3% annually. This growth is fueled by increasing miniaturization of electronic components and the need for thermal management solutions in high-performance computing and telecommunications infrastructure.

The medical device industry presents a specialized but lucrative market for both substrate types, with stringent requirements for biocompatibility and wear resistance. Metal substrates with composite coatings dominate in orthopedic implants, while ceramic substrates find applications in dental prosthetics and diagnostic equipment.

Regional analysis reveals that Asia-Pacific, particularly China and Japan, leads in consumption of composite coatings for electronics applications on ceramic substrates. North America and Europe maintain leadership in high-performance applications for aerospace and defense, primarily using metal substrates with advanced composite coatings.

Consumer demand trends indicate growing preference for environmentally friendly coating solutions, with water-based and powder coating technologies gaining market share. This shift is particularly evident in architectural and consumer goods applications, where regulatory pressures regarding volatile organic compounds (VOCs) continue to intensify.

Industrial equipment manufacturers represent another significant market segment, with particular emphasis on coatings that extend equipment lifespan and reduce maintenance costs. In this sector, metal substrates with composite coatings designed for extreme operating conditions command premium pricing, with customers willing to pay 30-40% more for solutions that demonstrably extend service intervals.

Energy sector applications, including oil and gas, wind, and solar, show divergent requirements between metal and ceramic substrates, with metal dominating in structural applications and ceramics preferred for specialized components exposed to extreme temperatures or electrical conditions.

Current Technical Challenges in Metal vs Ceramic Substrate Coating

The composite coating industry faces significant technical challenges when applying coatings to metal versus ceramic substrates, primarily due to fundamental differences in their physical and chemical properties. Metal substrates typically exhibit higher thermal conductivity, thermal expansion coefficients, and electrical conductivity compared to ceramics, necessitating different coating formulations and application techniques.

Adhesion remains one of the most critical challenges, with metal substrates often requiring specific surface treatments like phosphating, blasting, or chemical etching to create mechanical interlocking points. Conversely, ceramic substrates present challenges due to their inherently smooth surfaces and chemical inertness, often demanding specialized coupling agents or primer layers to achieve adequate bonding.

Thermal mismatch between coating and substrate creates substantial technical hurdles. When metal substrates with high thermal expansion coefficients are coated with materials having different expansion properties, thermal cycling can lead to coating delamination, cracking, or spallation. Ceramic substrates, while more thermally stable, present challenges in achieving sufficient interfacial strength under thermal stress.

Corrosion protection mechanisms differ significantly between these substrate types. Metal substrates require coatings that provide effective barrier properties and often incorporate active corrosion inhibitors, while ceramic substrates primarily need protection against chemical attack and moisture penetration rather than electrochemical corrosion.

Processing temperature compatibility presents another major challenge. Many high-performance coatings require curing or sintering at elevated temperatures, which can alter the microstructure or properties of metal substrates through annealing, recrystallization, or oxidation. Ceramic substrates generally withstand higher processing temperatures but may experience phase transformations or dimensional changes.

Thickness control and uniformity are particularly challenging on complex geometries for both substrate types, though metals often present additional difficulties due to edge effects and the Faraday cage effect during electrostatic application processes.

Recent research has highlighted emerging challenges in developing multifunctional coatings that can simultaneously provide wear resistance, corrosion protection, and specialized properties like antimicrobial activity or self-healing capabilities. The integration of nanomaterials into composite coatings introduces additional complexities in dispersion stability and interfacial engineering specific to each substrate type.

Environmental and regulatory pressures further complicate coating development, with increasing restrictions on volatile organic compounds (VOCs), heavy metals, and other hazardous substances traditionally used in coating formulations, particularly for metal substrates where corrosion protection is paramount.

Adhesion remains one of the most critical challenges, with metal substrates often requiring specific surface treatments like phosphating, blasting, or chemical etching to create mechanical interlocking points. Conversely, ceramic substrates present challenges due to their inherently smooth surfaces and chemical inertness, often demanding specialized coupling agents or primer layers to achieve adequate bonding.

Thermal mismatch between coating and substrate creates substantial technical hurdles. When metal substrates with high thermal expansion coefficients are coated with materials having different expansion properties, thermal cycling can lead to coating delamination, cracking, or spallation. Ceramic substrates, while more thermally stable, present challenges in achieving sufficient interfacial strength under thermal stress.

Corrosion protection mechanisms differ significantly between these substrate types. Metal substrates require coatings that provide effective barrier properties and often incorporate active corrosion inhibitors, while ceramic substrates primarily need protection against chemical attack and moisture penetration rather than electrochemical corrosion.

Processing temperature compatibility presents another major challenge. Many high-performance coatings require curing or sintering at elevated temperatures, which can alter the microstructure or properties of metal substrates through annealing, recrystallization, or oxidation. Ceramic substrates generally withstand higher processing temperatures but may experience phase transformations or dimensional changes.

Thickness control and uniformity are particularly challenging on complex geometries for both substrate types, though metals often present additional difficulties due to edge effects and the Faraday cage effect during electrostatic application processes.

Recent research has highlighted emerging challenges in developing multifunctional coatings that can simultaneously provide wear resistance, corrosion protection, and specialized properties like antimicrobial activity or self-healing capabilities. The integration of nanomaterials into composite coatings introduces additional complexities in dispersion stability and interfacial engineering specific to each substrate type.

Environmental and regulatory pressures further complicate coating development, with increasing restrictions on volatile organic compounds (VOCs), heavy metals, and other hazardous substances traditionally used in coating formulations, particularly for metal substrates where corrosion protection is paramount.

Existing Composite Coating Methodologies for Different Substrates

01 Surface treatment techniques for enhanced adhesion

Various surface treatment methods can be employed to improve the adhesion of composite coatings to substrates. These techniques include chemical etching, plasma treatment, and application of coupling agents that create strong chemical bonds between the coating and substrate. Proper surface preparation ensures better mechanical interlocking and chemical bonding, significantly enhancing the overall adhesion performance and longevity of composite coatings.- Surface treatment techniques for enhanced adhesion: Various surface treatment methods can be employed to improve the adhesion of composite coatings to substrates. These techniques include chemical etching, plasma treatment, and application of coupling agents that create strong chemical bonds between the coating and substrate. Proper surface preparation ensures better wetting and mechanical interlocking, resulting in superior adhesion properties and longer coating lifespans.

- Polymer-based composite coatings for durability: Polymer-based composite coatings incorporate various additives and fillers to enhance durability properties. These formulations typically include cross-linking agents, stabilizers, and reinforcing materials that work together to create a resilient protective layer. The polymer matrices provide flexibility while maintaining structural integrity, resulting in coatings that can withstand mechanical stress, temperature fluctuations, and environmental exposure.

- Nanoparticle reinforcement for performance enhancement: Incorporating nanoparticles into composite coating formulations significantly improves performance characteristics. Materials such as nano-silica, carbon nanotubes, and metal oxide nanoparticles enhance mechanical strength, scratch resistance, and barrier properties. The high surface area-to-volume ratio of nanoparticles creates stronger interactions within the coating matrix, resulting in superior wear resistance and extended service life.

- Environmental resistance mechanisms in composite coatings: Composite coatings can be formulated with specific components to resist environmental degradation factors such as UV radiation, moisture, chemicals, and temperature extremes. These formulations may include UV absorbers, antioxidants, hydrophobic agents, and corrosion inhibitors. The synergistic effect of these components creates a protective barrier that maintains coating integrity and appearance over extended exposure periods.

- Self-healing and smart composite coating technologies: Advanced composite coatings incorporate self-healing mechanisms and smart functionalities to maintain performance over time. These technologies include microcapsules containing healing agents that release upon damage, reversible polymer networks that can reform broken bonds, and stimuli-responsive materials that adapt to environmental changes. Such innovations significantly extend coating lifespan by automatically repairing minor damage before it leads to coating failure.

02 Polymer matrix modifications for durability enhancement

Modifying the polymer matrix in composite coatings can substantially improve their durability. Techniques include incorporating cross-linking agents, using high-performance resins, and adding nano-fillers that enhance the mechanical properties of the coating. These modifications create a more robust polymer network that resists environmental degradation, mechanical stress, and chemical attack, resulting in coatings with extended service life and improved performance in harsh conditions.Expand Specific Solutions03 Nanoparticle reinforcement for performance optimization

Incorporating nanoparticles into composite coatings significantly enhances their performance characteristics. Materials such as nano-silica, carbon nanotubes, and metal oxide nanoparticles can be dispersed within the coating matrix to improve hardness, scratch resistance, and barrier properties. The high surface area of nanoparticles creates numerous interfaces within the coating, strengthening the overall structure while maintaining flexibility and providing additional functionalities like self-healing or antimicrobial properties.Expand Specific Solutions04 Environmental resistance formulations

Specialized formulations can be developed to enhance the environmental resistance of composite coatings. These formulations incorporate UV stabilizers, antioxidants, and corrosion inhibitors that protect the coating from degradation caused by sunlight, oxygen, moisture, and chemical exposure. Multi-layer systems with specific functional layers can also be designed to provide comprehensive protection against various environmental factors, ensuring long-term durability and performance retention in challenging conditions.Expand Specific Solutions05 Testing and quality control methodologies

Advanced testing and quality control methodologies are essential for evaluating and ensuring the adhesion, durability, and performance of composite coatings. These include accelerated weathering tests, adhesion pull-off tests, scratch resistance evaluations, and chemical resistance assessments. Non-destructive testing techniques like ultrasonic inspection and thermal imaging can also be employed to detect defects or delamination. Implementing comprehensive quality control protocols throughout the manufacturing process helps maintain consistent coating quality and predict long-term performance.Expand Specific Solutions

Industry Leaders and Competitive Landscape in Coating Solutions

The composite coating market for metal and ceramic substrates is in a growth phase, driven by increasing demand in electronics, automotive, and aerospace industries. The market size is expanding rapidly, with projections showing significant growth over the next decade. Technologically, composite coatings are advancing toward higher performance and sustainability, with varying maturity levels across applications. Leading players include established corporations like Murata Manufacturing, Panasonic Holdings, and BYD Co., alongside specialized manufacturers such as Tong Hsing Electronics, IBIDEN, and CeramTec-Etec. Academic institutions including Arizona State University, University of Science & Technology Beijing, and Swiss Federal Institute of Technology are driving fundamental research. The competitive landscape features collaboration between industrial players and research institutions, with innovation focused on enhancing durability, thermal properties, and environmental sustainability of composite coatings for both substrate types.

Evonik Operations GmbH

Technical Solution: Evonik has pioneered silane-based composite coating technologies that bridge the gap between metal and ceramic substrate applications. Their DYNASYLAN® product line features organofunctional silanes that create strong chemical bonds with both metallic and ceramic surfaces. For metal substrates, Evonik's technology creates a dense siloxane network that provides exceptional corrosion protection with coating thicknesses of only 5-10 μm. On ceramic substrates, their silane-based primers establish covalent bonds with surface hydroxyl groups, achieving adhesion values of 20-24 MPa even after environmental aging[2]. Evonik's composite coatings incorporate their proprietary AEROSIL® fumed silica and AEROXIDE® metal oxide nanoparticles to enhance mechanical properties and thermal stability. Their latest generation coatings utilize water-based formulations with VOC content below 100 g/L while maintaining performance comparable to solvent-based alternatives[4]. Evonik has also developed hybrid organic-inorganic coating systems that combine the flexibility of organic polymers with the hardness and temperature resistance of ceramic materials, allowing customization for specific substrate requirements.

Strengths: Exceptional chemical bonding to both substrate types; environmentally friendly water-based formulations; thin film technology reduces material usage; excellent thermal stability (up to 400°C). Weaknesses: Higher initial cost compared to conventional coatings; requires specialized application expertise; some formulations have limited shelf life; more complex quality control requirements.

CeramTec-Etec GmbH

Technical Solution: CeramTec-Etec has developed specialized composite coating technologies that address the unique challenges of both metal and ceramic substrates. Their approach centers on plasma-sprayed ceramic composite coatings that can be applied to both substrate types with appropriate interface layers. For metal substrates, CeramTec utilizes a gradient composition approach where the coating transitions from metal-rich near the substrate to ceramic-rich at the surface, minimizing thermal expansion mismatch stress. Their ceramic-on-ceramic coatings employ specialized bonding layers with controlled porosity (typically 2-5%) to enhance adhesion while maintaining thermal shock resistance. CeramTec's composite coatings incorporate aluminum oxide, zirconium oxide, and titanium nitride in various combinations to achieve hardness values exceeding 1200 HV with wear rates below 10^-6 mm³/Nm in pin-on-disk tests[5]. Their coatings demonstrate exceptional thermal stability, maintaining structural integrity at temperatures up to 1200°C for ceramic substrates and 800°C for metal substrates. CeramTec has also pioneered the integration of self-healing mechanisms in their composite coatings through the incorporation of encapsulated healing agents that release upon microcrack formation.

Strengths: Exceptional wear resistance and hardness; excellent high-temperature stability; gradient composition technology minimizes thermal stress; specialized solutions for extreme environments. Weaknesses: High processing temperatures limit substrate options; relatively thick coatings (typically 150-300μm) may affect component dimensions; higher production costs; limited color options and aesthetic finishes.

Critical Patents and Research in Substrate-Specific Coatings

Metal-ceramic composite coatings, materials, methods and products

PatentInactiveUS6001494A

Innovation

- Development of metal-ceramic composite coatings that are flexible, heat-resistant, and corrosion-resistant, applied to metal substrates using a spraying method followed by drying and firing, which form a strong bond with the substrate and can be repaired in the field, utilizing a combination of glass frits, metal powders, and additives like aluminum and clay to provide cathodic protection.

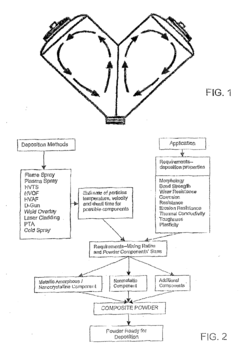

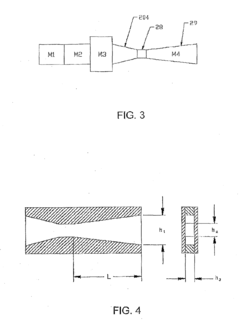

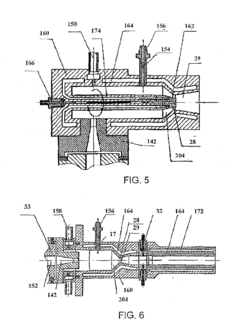

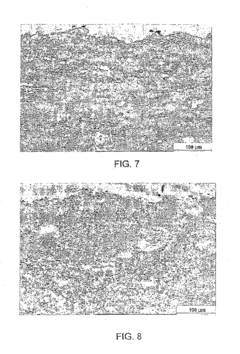

Deposition System, Method And Materials For Composite Coatings

PatentInactiveUS20130098267A1

Innovation

- Development of composite metal-ceramic powders with amorphous or nanocrystalline metallic components, combined with nonmetallic components, to form coatings that exhibit high corrosion resistance and structural properties, using thermal spraying processes that control particle temperature and velocity to prevent splashing and enhance bonding.

Environmental Impact and Sustainability of Coating Materials

The environmental impact of coating materials has become a critical consideration in industrial applications, particularly when comparing composite coatings for metal versus ceramic substrates. Traditional coating processes often involve volatile organic compounds (VOCs), heavy metals, and energy-intensive manufacturing methods that contribute significantly to environmental degradation. Metal substrate coatings typically require more aggressive surface preparation techniques, including acid etching and sandblasting, which generate hazardous waste and airborne particulates.

Ceramic substrate coatings generally demonstrate superior environmental performance due to their inherent thermal stability, which often allows for water-based formulations rather than solvent-based alternatives. This reduces VOC emissions by up to 80% compared to conventional metal coating systems. Additionally, ceramic-compatible coatings frequently require lower curing temperatures, resulting in reduced energy consumption during the application process—approximately 30-40% less energy than comparable metal substrate coating operations.

Life cycle assessment (LCA) studies reveal that composite coatings for metal substrates typically have a higher environmental footprint during production but may offer sustainability advantages through extended service life and reduced maintenance requirements. Metal substrate coatings containing chromium, cadmium, and lead are being phased out globally due to their toxicity, driving innovation toward more sustainable alternatives such as sol-gel technologies and nano-composite formulations.

Waste management presents distinct challenges for both substrate types. Metal coating processes generate more hazardous waste during surface preparation and stripping operations, while ceramic coating waste often contains fewer regulated materials but may present disposal challenges due to its inert nature and limited recycling infrastructure. Recent innovations in coating recovery systems have improved reclamation rates by approximately 25% for overspray materials in both applications.

Water consumption patterns differ significantly between the two substrate coating systems. Metal substrate coating operations typically require 2-3 times more water for surface preparation and rinsing processes than ceramic alternatives. However, advanced closed-loop water recycling systems are increasingly being implemented in metal coating facilities, reducing freshwater consumption by up to 70%.

Emerging sustainable technologies for both substrate types include bio-based composite coatings derived from renewable resources, powder coating systems with near-zero waste generation, and photocatalytic coatings that actively reduce air pollutants. These innovations represent promising pathways toward minimizing the environmental impact of coating materials while maintaining or enhancing performance characteristics for specific substrate applications.

Ceramic substrate coatings generally demonstrate superior environmental performance due to their inherent thermal stability, which often allows for water-based formulations rather than solvent-based alternatives. This reduces VOC emissions by up to 80% compared to conventional metal coating systems. Additionally, ceramic-compatible coatings frequently require lower curing temperatures, resulting in reduced energy consumption during the application process—approximately 30-40% less energy than comparable metal substrate coating operations.

Life cycle assessment (LCA) studies reveal that composite coatings for metal substrates typically have a higher environmental footprint during production but may offer sustainability advantages through extended service life and reduced maintenance requirements. Metal substrate coatings containing chromium, cadmium, and lead are being phased out globally due to their toxicity, driving innovation toward more sustainable alternatives such as sol-gel technologies and nano-composite formulations.

Waste management presents distinct challenges for both substrate types. Metal coating processes generate more hazardous waste during surface preparation and stripping operations, while ceramic coating waste often contains fewer regulated materials but may present disposal challenges due to its inert nature and limited recycling infrastructure. Recent innovations in coating recovery systems have improved reclamation rates by approximately 25% for overspray materials in both applications.

Water consumption patterns differ significantly between the two substrate coating systems. Metal substrate coating operations typically require 2-3 times more water for surface preparation and rinsing processes than ceramic alternatives. However, advanced closed-loop water recycling systems are increasingly being implemented in metal coating facilities, reducing freshwater consumption by up to 70%.

Emerging sustainable technologies for both substrate types include bio-based composite coatings derived from renewable resources, powder coating systems with near-zero waste generation, and photocatalytic coatings that actively reduce air pollutants. These innovations represent promising pathways toward minimizing the environmental impact of coating materials while maintaining or enhancing performance characteristics for specific substrate applications.

Cost-Benefit Analysis of Coating Solutions Across Substrate Types

When evaluating composite coating solutions for different substrate materials, cost-benefit analysis becomes a critical decision-making tool for manufacturers and engineers. Metal and ceramic substrates present distinct economic considerations that significantly impact the overall value proposition of coating applications.

Initial investment costs vary substantially between metal and ceramic substrate coating processes. Metal substrates typically require less expensive surface preparation techniques, with mechanical abrasion and chemical cleaning being cost-effective options. In contrast, ceramic substrates often demand specialized preparation methods such as plasma treatment or chemical vapor deposition primers, increasing upfront costs by approximately 15-30% compared to metal counterparts.

Application efficiency represents another significant cost factor. Coating metal substrates generally achieves higher first-pass success rates (85-95%) versus ceramic substrates (70-85%), resulting in reduced material waste and rework expenses. This efficiency differential translates to approximately 10-20% higher labor and material costs when working with ceramic substrates.

Lifecycle performance metrics reveal interesting economic trade-offs. While initial coating costs for ceramic substrates are higher, these systems typically demonstrate 30-40% longer service lifespans under equivalent operating conditions. This extended durability significantly reduces maintenance frequency and associated downtime costs, particularly in high-temperature or corrosive environments where ceramic substrates excel.

Energy consumption during coating application presents another notable difference. Metal substrate coating processes generally require 15-25% less energy input due to better thermal conductivity and lower processing temperatures. This energy efficiency translates to measurable operational cost savings, especially in large-scale production environments.

Regulatory compliance costs also differ between substrate types. Metal substrate coatings often face stricter environmental regulations regarding VOC emissions and heavy metal content, potentially increasing compliance costs by 5-15%. Ceramic substrate coating solutions typically utilize more environmentally benign formulations, reducing long-term regulatory burden and associated expenses.

Return on investment calculations indicate that while ceramic substrate coating solutions demand higher initial investment, they frequently deliver superior long-term value in applications experiencing severe thermal cycling, chemical exposure, or mechanical stress. Conversely, metal substrate coatings offer more attractive short-term economics for applications with moderate environmental demands or shorter expected service lifespans.

Initial investment costs vary substantially between metal and ceramic substrate coating processes. Metal substrates typically require less expensive surface preparation techniques, with mechanical abrasion and chemical cleaning being cost-effective options. In contrast, ceramic substrates often demand specialized preparation methods such as plasma treatment or chemical vapor deposition primers, increasing upfront costs by approximately 15-30% compared to metal counterparts.

Application efficiency represents another significant cost factor. Coating metal substrates generally achieves higher first-pass success rates (85-95%) versus ceramic substrates (70-85%), resulting in reduced material waste and rework expenses. This efficiency differential translates to approximately 10-20% higher labor and material costs when working with ceramic substrates.

Lifecycle performance metrics reveal interesting economic trade-offs. While initial coating costs for ceramic substrates are higher, these systems typically demonstrate 30-40% longer service lifespans under equivalent operating conditions. This extended durability significantly reduces maintenance frequency and associated downtime costs, particularly in high-temperature or corrosive environments where ceramic substrates excel.

Energy consumption during coating application presents another notable difference. Metal substrate coating processes generally require 15-25% less energy input due to better thermal conductivity and lower processing temperatures. This energy efficiency translates to measurable operational cost savings, especially in large-scale production environments.

Regulatory compliance costs also differ between substrate types. Metal substrate coatings often face stricter environmental regulations regarding VOC emissions and heavy metal content, potentially increasing compliance costs by 5-15%. Ceramic substrate coating solutions typically utilize more environmentally benign formulations, reducing long-term regulatory burden and associated expenses.

Return on investment calculations indicate that while ceramic substrate coating solutions demand higher initial investment, they frequently deliver superior long-term value in applications experiencing severe thermal cycling, chemical exposure, or mechanical stress. Conversely, metal substrate coatings offer more attractive short-term economics for applications with moderate environmental demands or shorter expected service lifespans.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!