Comparative study of Composite coatings formulations for corrosion resistance

SEP 24, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Composite Coating Technology Evolution and Objectives

Composite coatings have emerged as a significant technological advancement in the field of corrosion protection over the past several decades. The evolution of these protective systems began in the mid-20th century with simple polymer-based coatings, gradually progressing to more sophisticated multi-component systems incorporating various functional additives. This technological progression has been driven by increasing demands for durability in aggressive environments across industries such as aerospace, automotive, marine, and infrastructure.

The fundamental concept behind composite coatings involves combining multiple materials to achieve synergistic properties that exceed those of individual components. Early developments focused primarily on polymer matrices with basic fillers, while contemporary formulations incorporate nanomaterials, smart additives, and environmentally responsive components that provide enhanced protection mechanisms against corrosive elements.

A significant milestone in this evolution occurred in the 1980s with the introduction of epoxy-based composite coatings containing metallic particles, which demonstrated superior barrier properties. The 1990s witnessed the integration of ceramic particles and inhibitor compounds, further enhancing protection capabilities. The early 2000s marked the beginning of the nanotechnology era in coating formulations, with nanoscale additives dramatically improving coating performance while reducing thickness and weight.

Recent technological advancements have focused on self-healing capabilities, stimuli-responsive mechanisms, and environmentally friendly formulations that eliminate toxic components like chromates and heavy metals. These developments align with global sustainability initiatives while maintaining or improving corrosion resistance performance. The integration of computational modeling and high-throughput experimentation has accelerated formulation optimization, allowing for more rapid development cycles.

The primary objectives of current composite coating research include extending service life under extreme conditions, reducing maintenance requirements, and developing more sustainable formulations. Specific technical goals encompass achieving uniform dispersion of nanoadditives, optimizing interfacial interactions between coating components, enhancing adhesion to various substrates, and developing multi-functional coatings that combine corrosion resistance with additional properties such as wear resistance, anti-fouling capabilities, or electrical conductivity.

Another critical objective is the development of standardized testing protocols that accurately predict long-term performance in real-world environments, addressing the gap between laboratory testing and actual service conditions. This includes accelerated testing methodologies that correlate with field performance data, enabling more reliable product development and qualification processes.

The fundamental concept behind composite coatings involves combining multiple materials to achieve synergistic properties that exceed those of individual components. Early developments focused primarily on polymer matrices with basic fillers, while contemporary formulations incorporate nanomaterials, smart additives, and environmentally responsive components that provide enhanced protection mechanisms against corrosive elements.

A significant milestone in this evolution occurred in the 1980s with the introduction of epoxy-based composite coatings containing metallic particles, which demonstrated superior barrier properties. The 1990s witnessed the integration of ceramic particles and inhibitor compounds, further enhancing protection capabilities. The early 2000s marked the beginning of the nanotechnology era in coating formulations, with nanoscale additives dramatically improving coating performance while reducing thickness and weight.

Recent technological advancements have focused on self-healing capabilities, stimuli-responsive mechanisms, and environmentally friendly formulations that eliminate toxic components like chromates and heavy metals. These developments align with global sustainability initiatives while maintaining or improving corrosion resistance performance. The integration of computational modeling and high-throughput experimentation has accelerated formulation optimization, allowing for more rapid development cycles.

The primary objectives of current composite coating research include extending service life under extreme conditions, reducing maintenance requirements, and developing more sustainable formulations. Specific technical goals encompass achieving uniform dispersion of nanoadditives, optimizing interfacial interactions between coating components, enhancing adhesion to various substrates, and developing multi-functional coatings that combine corrosion resistance with additional properties such as wear resistance, anti-fouling capabilities, or electrical conductivity.

Another critical objective is the development of standardized testing protocols that accurately predict long-term performance in real-world environments, addressing the gap between laboratory testing and actual service conditions. This includes accelerated testing methodologies that correlate with field performance data, enabling more reliable product development and qualification processes.

Market Analysis for Corrosion-Resistant Coating Solutions

The global market for corrosion-resistant coatings continues to expand significantly, driven by increasing industrial activities and infrastructure development across various sectors. Currently valued at approximately 7.5 billion USD, this market is projected to grow at a compound annual growth rate of 5.2% through 2028, reflecting the essential nature of these protective solutions across multiple industries.

The oil and gas sector remains the largest consumer of corrosion-resistant composite coatings, accounting for nearly 28% of the total market share. This dominance stems from the harsh operating environments encountered in extraction, processing, and transportation activities, where equipment faces constant exposure to corrosive substances and extreme conditions. The marine industry follows closely, representing about 22% of market demand, with applications spanning shipbuilding, offshore platforms, and port infrastructure.

Infrastructure development, particularly in rapidly industrializing economies across Asia-Pacific, has emerged as a significant growth driver. China and India collectively contribute approximately 30% to the global market growth, with their extensive manufacturing bases and ambitious infrastructure projects creating substantial demand for advanced coating solutions. North America and Europe maintain significant market shares of 24% and 22% respectively, primarily driven by replacement and maintenance activities in mature industrial sectors.

Customer preferences are increasingly shifting toward environmentally friendly coating formulations with reduced volatile organic compound (VOC) emissions. This trend has accelerated following stricter environmental regulations in key markets, particularly the European Union's REACH regulations and similar frameworks in North America. Consequently, water-based and powder coating technologies have gained substantial market traction, growing at rates exceeding the overall market average.

Price sensitivity varies significantly across application segments. While high-performance sectors such as aerospace and specialized industrial applications prioritize performance over cost, mass-market applications in construction and general manufacturing demonstrate greater price elasticity. This dichotomy has led to market stratification, with premium composite coating solutions commanding price premiums of 30-45% over conventional alternatives.

The competitive landscape features both established multinational corporations and specialized regional players. Major chemical companies have strengthened their market positions through strategic acquisitions and R&D investments, while specialized coating manufacturers have carved out niches through technical expertise in specific application areas. This dynamic has intensified competition, driving innovation in formulation technologies and application methods.

The oil and gas sector remains the largest consumer of corrosion-resistant composite coatings, accounting for nearly 28% of the total market share. This dominance stems from the harsh operating environments encountered in extraction, processing, and transportation activities, where equipment faces constant exposure to corrosive substances and extreme conditions. The marine industry follows closely, representing about 22% of market demand, with applications spanning shipbuilding, offshore platforms, and port infrastructure.

Infrastructure development, particularly in rapidly industrializing economies across Asia-Pacific, has emerged as a significant growth driver. China and India collectively contribute approximately 30% to the global market growth, with their extensive manufacturing bases and ambitious infrastructure projects creating substantial demand for advanced coating solutions. North America and Europe maintain significant market shares of 24% and 22% respectively, primarily driven by replacement and maintenance activities in mature industrial sectors.

Customer preferences are increasingly shifting toward environmentally friendly coating formulations with reduced volatile organic compound (VOC) emissions. This trend has accelerated following stricter environmental regulations in key markets, particularly the European Union's REACH regulations and similar frameworks in North America. Consequently, water-based and powder coating technologies have gained substantial market traction, growing at rates exceeding the overall market average.

Price sensitivity varies significantly across application segments. While high-performance sectors such as aerospace and specialized industrial applications prioritize performance over cost, mass-market applications in construction and general manufacturing demonstrate greater price elasticity. This dichotomy has led to market stratification, with premium composite coating solutions commanding price premiums of 30-45% over conventional alternatives.

The competitive landscape features both established multinational corporations and specialized regional players. Major chemical companies have strengthened their market positions through strategic acquisitions and R&D investments, while specialized coating manufacturers have carved out niches through technical expertise in specific application areas. This dynamic has intensified competition, driving innovation in formulation technologies and application methods.

Current Challenges in Composite Coating Development

Despite significant advancements in composite coating technologies, several critical challenges continue to impede the development of optimal corrosion-resistant formulations. The primary obstacle remains achieving the perfect balance between corrosion protection, mechanical properties, and cost-effectiveness. Many current formulations that excel in corrosion resistance often compromise on adhesion strength, flexibility, or impact resistance, creating a persistent trade-off scenario for manufacturers and end-users.

The complexity of corrosion mechanisms across diverse environmental conditions presents another substantial challenge. Composite coatings that perform exceptionally in marine environments may fail prematurely when exposed to industrial atmospheres with high concentrations of sulfur compounds or when subjected to elevated temperatures. This environmental variability necessitates either highly specialized formulations for specific applications or versatile systems capable of withstanding multiple corrosive conditions, both approaches carrying significant technical difficulties.

Long-term stability and degradation mechanisms of composite coatings remain inadequately understood. Accelerated testing protocols often fail to accurately predict real-world performance, creating a disconnect between laboratory results and practical applications. The synergistic effects between different components in composite formulations can lead to unexpected degradation pathways that only manifest after extended exposure periods, complicating both development and qualification processes.

Manufacturing scalability presents significant hurdles, particularly for advanced nanocomposite coatings. Laboratory-scale successes frequently encounter dispersion problems, agglomeration issues, and processing complications when scaled to industrial production volumes. The incorporation of nanoparticles, while beneficial for corrosion resistance, introduces challenges in achieving uniform distribution throughout the coating matrix, directly impacting performance consistency across production batches.

Regulatory constraints and environmental considerations increasingly restrict the use of certain effective corrosion inhibitors and matrix materials. The phase-out of hexavalent chromium compounds, historically excellent corrosion inhibitors, has created a significant gap in performance that alternative systems struggle to fill completely. Similarly, restrictions on volatile organic compounds (VOCs) have pushed formulators toward water-based systems that typically offer reduced corrosion protection compared to their solvent-based counterparts.

The interface between the substrate and coating remains a critical weak point in many composite systems. Surface preparation techniques, while well-established, still fail to consistently create optimal conditions for coating adhesion across different substrate materials and geometries. This interfacial weakness often becomes the initiation point for coating failure, regardless of the inherent corrosion resistance of the composite formulation itself.

The complexity of corrosion mechanisms across diverse environmental conditions presents another substantial challenge. Composite coatings that perform exceptionally in marine environments may fail prematurely when exposed to industrial atmospheres with high concentrations of sulfur compounds or when subjected to elevated temperatures. This environmental variability necessitates either highly specialized formulations for specific applications or versatile systems capable of withstanding multiple corrosive conditions, both approaches carrying significant technical difficulties.

Long-term stability and degradation mechanisms of composite coatings remain inadequately understood. Accelerated testing protocols often fail to accurately predict real-world performance, creating a disconnect between laboratory results and practical applications. The synergistic effects between different components in composite formulations can lead to unexpected degradation pathways that only manifest after extended exposure periods, complicating both development and qualification processes.

Manufacturing scalability presents significant hurdles, particularly for advanced nanocomposite coatings. Laboratory-scale successes frequently encounter dispersion problems, agglomeration issues, and processing complications when scaled to industrial production volumes. The incorporation of nanoparticles, while beneficial for corrosion resistance, introduces challenges in achieving uniform distribution throughout the coating matrix, directly impacting performance consistency across production batches.

Regulatory constraints and environmental considerations increasingly restrict the use of certain effective corrosion inhibitors and matrix materials. The phase-out of hexavalent chromium compounds, historically excellent corrosion inhibitors, has created a significant gap in performance that alternative systems struggle to fill completely. Similarly, restrictions on volatile organic compounds (VOCs) have pushed formulators toward water-based systems that typically offer reduced corrosion protection compared to their solvent-based counterparts.

The interface between the substrate and coating remains a critical weak point in many composite systems. Surface preparation techniques, while well-established, still fail to consistently create optimal conditions for coating adhesion across different substrate materials and geometries. This interfacial weakness often becomes the initiation point for coating failure, regardless of the inherent corrosion resistance of the composite formulation itself.

Existing Composite Coating Formulation Methodologies

01 Metal-based composite coatings for corrosion resistance

Metal-based composite coatings provide excellent corrosion resistance through the formation of protective layers on substrate surfaces. These coatings typically incorporate metals such as zinc, aluminum, or nickel, often combined with other elements to enhance their protective properties. The metal components can form sacrificial protection or passive films that prevent corrosive media from reaching the substrate. These coatings are particularly effective in harsh environments where traditional protective measures may fail.- Metal-based composite coatings for corrosion resistance: Metal-based composite coatings provide excellent corrosion resistance through the formation of protective layers on substrate surfaces. These coatings typically incorporate metals such as zinc, aluminum, or nickel, often combined with other elements to enhance their protective properties. The metal components can form sacrificial protection or passive films that prevent corrosive media from reaching the substrate. These coatings are particularly effective in harsh environments where traditional coatings might fail.

- Polymer-based composite coatings with corrosion inhibitors: Polymer-based composite coatings incorporate corrosion inhibitors to provide long-term protection against corrosive environments. These coatings typically consist of a polymer matrix (such as epoxy, polyurethane, or acrylic) with embedded corrosion inhibitors that can be released in a controlled manner when corrosion begins. The polymer matrix provides a physical barrier while the inhibitors actively suppress the corrosion process through various mechanisms including anodic or cathodic inhibition, or by forming protective films on metal surfaces.

- Ceramic and inorganic composite coatings for high-temperature corrosion resistance: Ceramic and inorganic composite coatings provide exceptional corrosion resistance at elevated temperatures where organic coatings would degrade. These coatings typically incorporate materials such as silica, alumina, zirconia, or various metal oxides that form stable protective layers even under extreme conditions. The ceramic components create a dense, impermeable barrier against corrosive species while maintaining structural integrity at high temperatures. These coatings are particularly valuable in industrial applications involving thermal cycling and exposure to aggressive chemicals.

- Nanocomposite coatings with enhanced corrosion resistance: Nanocomposite coatings utilize nanoscale materials to significantly enhance corrosion resistance properties. These coatings incorporate nanoparticles such as carbon nanotubes, graphene, nano-silica, or nano-metal oxides dispersed within a matrix material. The nanomaterials create tortuous pathways that impede the diffusion of corrosive species, while also improving adhesion, mechanical properties, and self-healing capabilities. The high surface area of nanoparticles allows for more effective interaction with corrosive media, providing superior protection compared to conventional coatings.

- Self-healing composite coatings for long-term corrosion protection: Self-healing composite coatings contain active components that can repair damage automatically, providing long-term corrosion protection. These innovative coatings incorporate encapsulated healing agents, shape memory materials, or stimuli-responsive polymers that are activated when the coating is damaged. When cracks or scratches occur, the healing agents are released to fill the damaged area and restore the protective barrier. This autonomous repair mechanism significantly extends the service life of the coating and reduces maintenance requirements, particularly in hard-to-access locations or critical infrastructure applications.

02 Polymer-based composite coatings for corrosion protection

Polymer-based composite coatings provide corrosion resistance through the formation of impermeable barriers that prevent corrosive agents from reaching the substrate. These coatings typically incorporate various polymers such as epoxy, polyurethane, or fluoropolymers, often enhanced with functional additives. The polymer matrix creates a physical barrier while additives can provide additional protection mechanisms. These coatings offer advantages including flexibility, adhesion to various substrates, and the ability to be formulated for specific environmental conditions.Expand Specific Solutions03 Ceramic and inorganic composite coatings for corrosion resistance

Ceramic and inorganic composite coatings provide superior corrosion resistance in extreme environments through the formation of dense, chemically stable protective layers. These coatings typically incorporate materials such as silicon carbide, aluminum oxide, or various silicates, often combined with binding agents to improve adhesion. The ceramic components create barriers that are resistant to chemical attack, high temperatures, and mechanical wear. These coatings are particularly valuable in aggressive industrial environments where organic coatings would degrade.Expand Specific Solutions04 Nanocomposite coatings for enhanced corrosion protection

Nanocomposite coatings provide enhanced corrosion resistance through the incorporation of nanoscale materials that significantly improve barrier properties and active protection mechanisms. These coatings typically incorporate nanoparticles such as nano-silica, carbon nanotubes, or nano-zinc oxide dispersed in various matrices. The nanomaterials can fill microscopic pores, enhance mechanical properties, and provide active corrosion inhibition. These advanced coatings offer superior performance compared to conventional systems while often requiring thinner application layers.Expand Specific Solutions05 Self-healing composite coatings for long-term corrosion resistance

Self-healing composite coatings provide sustained corrosion protection through mechanisms that automatically repair damage to the protective layer. These innovative coatings incorporate encapsulated healing agents, shape-memory materials, or stimuli-responsive components that activate when the coating integrity is compromised. When cracks or scratches occur, the healing components are released or activated to restore the protective barrier. This autonomous repair capability significantly extends coating service life and reduces maintenance requirements in corrosive environments.Expand Specific Solutions

Leading Manufacturers and Research Institutions

The composite coatings market for corrosion resistance is currently in a growth phase, characterized by increasing industrial demand and technological innovation. The market size is expanding significantly due to rising applications in automotive, aerospace, oil & gas, and marine industries. Leading players include PPG Industries, with their advanced dragonhide polyurea combinations, and Sherwin-Williams, who are focusing on environmentally friendly solutions. Technical maturity varies across formulations, with companies like Saudi Aramco, Tata Steel, and Southwest Research Institute investing heavily in R&D to develop next-generation coatings. Academic-industrial collaborations involving institutions like Commonwealth Scientific & Industrial Research Organisation and Northeastern University are accelerating innovation in this space, particularly in nano-composite and self-healing coating technologies.

PPG Industries Ohio, Inc.

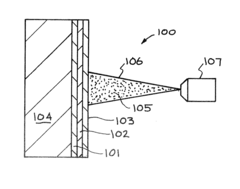

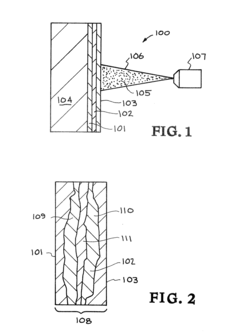

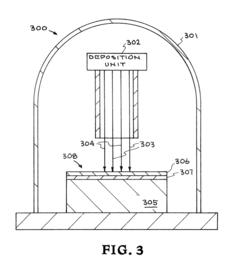

Technical Solution: PPG Industries has developed advanced multi-layer composite coating systems specifically designed for corrosion resistance in harsh environments. Their technology incorporates zinc-rich primers as the base layer, providing cathodic protection through sacrificial corrosion of zinc particles. This is followed by an epoxy-based intermediate layer with barrier properties enhanced by lamellar fillers (micaceous iron oxide or aluminum flakes) that create a tortuous path for corrosive species. The topcoat typically consists of polyurethane or polysiloxane formulations with hydrophobic properties, UV resistance, and self-healing capabilities. PPG's electrodeposition coating technology (E-coat) creates uniform films even on complex geometries, while their powder coating formulations eliminate VOCs and provide excellent edge coverage. Recent innovations include the incorporation of nano-scale corrosion inhibitors that release on-demand when pH changes occur in corrosion sites, and self-stratifying coatings that form multiple functional layers from a single application.

Strengths: Comprehensive multi-layer protection system addressing multiple corrosion mechanisms; advanced self-healing capabilities; environmentally friendly formulations with reduced VOCs. Weaknesses: Higher initial cost compared to conventional coatings; some formulations require specialized application equipment; performance highly dependent on proper surface preparation and application procedures.

Chugoku Marine Paints, Ltd.

Technical Solution: Chugoku Marine Paints has pioneered composite coating systems specifically engineered for marine environments where corrosion resistance is critical. Their flagship technology employs a copper-free self-polishing copolymer (SPC) matrix incorporating biocide packages that gradually hydrolyze in seawater, creating a controlled release mechanism. This is complemented by their patented "NMPI" (Nano Matrix Polymer Integration) technology that incorporates silyl acrylate polymers with nano-scale zinc oxide and cerium oxide particles, forming a dense cross-linked network that significantly enhances barrier properties. For underwater hull protection, Chugoku has developed a three-layer system consisting of an anticorrosive primer containing zinc phosphate and micaceous iron oxide, an intermediate tie-coat with enhanced adhesion properties, and a self-polishing topcoat that continuously exposes fresh biocide as the outer layer erodes. Their recent innovations include hydrophobic silicone-based foul-release coatings that prevent organism attachment without biocides, and hybrid epoxy-siloxane formulations that combine the toughness of epoxy with the weather resistance of silicone.

Strengths: Exceptional performance in aggressive marine environments; self-polishing technology provides extended service life; reduced environmental impact through copper-free formulations. Weaknesses: Higher application complexity requiring specialized training; performance can be affected by vessel operational profile (speed, idle time); initial cost premium compared to conventional antifouling systems.

Critical Patents and Innovations in Coating Technology

Amorphous metal formulations and structured coatings for corrosion and wear resistance

PatentInactiveUS8778460B2

Innovation

- Development of advanced amorphous metal formulations with over 11 elements, including iron or nickel-based alloys, combined with ceramic components, forming graded coatings that transition from metallic to ceramic layers for enhanced corrosion and wear resistance, utilizing techniques like thermal and cold spray processing.

Corrosion-Resistant Epoxy Nanocomposite Coatings containing Submicron Emeraldine-Base Polyaniline and Organomodified Montmorrilonite

PatentInactiveUS20100010119A1

Innovation

- A two-component nanocomposite coating composition is developed, comprising a base component with a curable binder and organomodified layered silicates, and a curing agent containing Emeraldine Base form of polyaniline dissolved in specific organic amines, which forms a stable dispersion and cross-linked coating on steel surfaces, enhancing corrosion resistance.

Environmental Impact and Sustainability Considerations

The environmental impact of composite coating formulations for corrosion resistance has become increasingly significant as industries face stricter regulations and growing sustainability concerns. Traditional anti-corrosion coatings often contain heavy metals and volatile organic compounds (VOCs) that pose substantial environmental and health risks. Chromium-based coatings, particularly those containing hexavalent chromium (Cr(VI)), have been widely used for their excellent corrosion resistance but are now recognized as carcinogenic and environmentally persistent pollutants.

Recent developments in composite coating technology have focused on creating environmentally friendly alternatives that maintain or exceed the performance of conventional coatings. Water-based composite formulations have emerged as promising substitutes for solvent-based systems, significantly reducing VOC emissions during application and curing processes. These formulations typically achieve 70-90% reduction in harmful emissions compared to traditional solvent-based counterparts.

Bio-based components derived from renewable resources are increasingly incorporated into composite coatings. Plant oils, lignin derivatives, and cellulose nanocrystals have demonstrated potential as sustainable ingredients that can enhance coating properties while reducing environmental footprint. Life cycle assessments indicate that coatings incorporating 30-50% bio-based materials can reduce carbon footprint by up to 45% compared to petroleum-based formulations.

The end-of-life considerations for composite coatings present both challenges and opportunities. Advanced coating systems are being designed with biodegradability and recyclability in mind. Some innovative formulations incorporate trigger mechanisms that facilitate coating removal and substrate recovery at the end of service life, enabling more efficient material reclamation and reducing waste.

Energy consumption during coating production and application represents another critical environmental factor. Newer composite coating technologies often employ room-temperature curing or UV-curing systems that require significantly less energy than traditional thermal curing processes. Studies indicate energy savings of 40-60% are achievable with these advanced curing technologies.

Regulatory frameworks worldwide are increasingly influencing coating formulation choices. The European Union's REACH regulation, the United States EPA regulations, and similar frameworks in Asia have accelerated the transition toward more sustainable coating options. Companies developing composite coatings must now consider these regulatory requirements as fundamental design parameters rather than secondary considerations.

The economic implications of environmentally sustainable coatings extend beyond compliance costs. Market analyses suggest that sustainable coating solutions can command premium pricing while simultaneously reducing lifetime costs through improved durability and reduced maintenance requirements. This creates a compelling business case for continued investment in environmentally responsible composite coating technologies.

Recent developments in composite coating technology have focused on creating environmentally friendly alternatives that maintain or exceed the performance of conventional coatings. Water-based composite formulations have emerged as promising substitutes for solvent-based systems, significantly reducing VOC emissions during application and curing processes. These formulations typically achieve 70-90% reduction in harmful emissions compared to traditional solvent-based counterparts.

Bio-based components derived from renewable resources are increasingly incorporated into composite coatings. Plant oils, lignin derivatives, and cellulose nanocrystals have demonstrated potential as sustainable ingredients that can enhance coating properties while reducing environmental footprint. Life cycle assessments indicate that coatings incorporating 30-50% bio-based materials can reduce carbon footprint by up to 45% compared to petroleum-based formulations.

The end-of-life considerations for composite coatings present both challenges and opportunities. Advanced coating systems are being designed with biodegradability and recyclability in mind. Some innovative formulations incorporate trigger mechanisms that facilitate coating removal and substrate recovery at the end of service life, enabling more efficient material reclamation and reducing waste.

Energy consumption during coating production and application represents another critical environmental factor. Newer composite coating technologies often employ room-temperature curing or UV-curing systems that require significantly less energy than traditional thermal curing processes. Studies indicate energy savings of 40-60% are achievable with these advanced curing technologies.

Regulatory frameworks worldwide are increasingly influencing coating formulation choices. The European Union's REACH regulation, the United States EPA regulations, and similar frameworks in Asia have accelerated the transition toward more sustainable coating options. Companies developing composite coatings must now consider these regulatory requirements as fundamental design parameters rather than secondary considerations.

The economic implications of environmentally sustainable coatings extend beyond compliance costs. Market analyses suggest that sustainable coating solutions can command premium pricing while simultaneously reducing lifetime costs through improved durability and reduced maintenance requirements. This creates a compelling business case for continued investment in environmentally responsible composite coating technologies.

Testing Standards and Performance Evaluation Methods

The evaluation of composite coating formulations for corrosion resistance requires standardized testing methods to ensure reliable and comparable results across different studies and applications. International standards organizations such as ASTM International, ISO, and NACE International have developed comprehensive testing protocols specifically designed for assessing corrosion resistance properties of protective coatings.

Electrochemical testing methods represent a cornerstone of corrosion resistance evaluation. Electrochemical Impedance Spectroscopy (EIS) provides detailed information about coating barrier properties and degradation mechanisms by measuring the impedance response over a range of frequencies. Potentiodynamic polarization tests offer insights into corrosion kinetics and mechanisms by analyzing the current-potential relationship. These techniques enable quantitative assessment of corrosion rates and protective efficiency of different coating formulations.

Accelerated environmental exposure tests simulate harsh conditions to predict long-term performance within shortened timeframes. Salt spray testing (ASTM B117) remains one of the most widely used methods, exposing coated specimens to continuous salt fog environments. Cyclic corrosion testing combines multiple environmental stressors such as salt spray, humidity, and temperature fluctuations to better replicate real-world conditions. Immersion tests in various corrosive media provide valuable data on coating stability and degradation patterns in specific environments.

Physical and mechanical property evaluations complement corrosion testing by assessing coating durability and adhesion characteristics. Adhesion testing methods such as pull-off tests (ASTM D4541) and cross-cut tests (ASTM D3359) evaluate the bonding strength between coating and substrate. Impact resistance, flexibility, and hardness tests determine the coating's ability to withstand mechanical stresses without compromising corrosion protection.

Performance evaluation metrics must be clearly defined to enable objective comparison between different coating formulations. Key parameters include corrosion rate calculations, time to failure, impedance values at specific frequencies, and visual assessment scales for coating degradation. Statistical analysis methods such as Weibull distribution analysis help interpret reliability data and predict service life expectations for different coating systems.

Advanced characterization techniques provide deeper insights into coating performance mechanisms. Surface analysis methods including SEM-EDS, XPS, and FTIR spectroscopy reveal chemical composition changes and degradation pathways during corrosion processes. These techniques help establish correlations between coating formulation characteristics and observed corrosion resistance properties, guiding future formulation improvements.

Electrochemical testing methods represent a cornerstone of corrosion resistance evaluation. Electrochemical Impedance Spectroscopy (EIS) provides detailed information about coating barrier properties and degradation mechanisms by measuring the impedance response over a range of frequencies. Potentiodynamic polarization tests offer insights into corrosion kinetics and mechanisms by analyzing the current-potential relationship. These techniques enable quantitative assessment of corrosion rates and protective efficiency of different coating formulations.

Accelerated environmental exposure tests simulate harsh conditions to predict long-term performance within shortened timeframes. Salt spray testing (ASTM B117) remains one of the most widely used methods, exposing coated specimens to continuous salt fog environments. Cyclic corrosion testing combines multiple environmental stressors such as salt spray, humidity, and temperature fluctuations to better replicate real-world conditions. Immersion tests in various corrosive media provide valuable data on coating stability and degradation patterns in specific environments.

Physical and mechanical property evaluations complement corrosion testing by assessing coating durability and adhesion characteristics. Adhesion testing methods such as pull-off tests (ASTM D4541) and cross-cut tests (ASTM D3359) evaluate the bonding strength between coating and substrate. Impact resistance, flexibility, and hardness tests determine the coating's ability to withstand mechanical stresses without compromising corrosion protection.

Performance evaluation metrics must be clearly defined to enable objective comparison between different coating formulations. Key parameters include corrosion rate calculations, time to failure, impedance values at specific frequencies, and visual assessment scales for coating degradation. Statistical analysis methods such as Weibull distribution analysis help interpret reliability data and predict service life expectations for different coating systems.

Advanced characterization techniques provide deeper insights into coating performance mechanisms. Surface analysis methods including SEM-EDS, XPS, and FTIR spectroscopy reveal chemical composition changes and degradation pathways during corrosion processes. These techniques help establish correlations between coating formulation characteristics and observed corrosion resistance properties, guiding future formulation improvements.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!