Comparative analysis of Silicon carbide ceramics versus alumina and zirconia ceramics

SEP 24, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

SiC vs Alumina/Zirconia: Background & Objectives

Silicon carbide (SiC) ceramics have emerged as a significant advancement in the field of technical ceramics, representing a notable evolution from traditional ceramic materials such as alumina (Al₂O₃) and zirconia (ZrO₂). The development of SiC ceramics can be traced back to the late 19th century, with Edward Acheson's accidental discovery during attempts to synthesize diamonds. However, it wasn't until the mid-20th century that significant progress was made in refining SiC for industrial applications.

The technological evolution of advanced ceramics has been driven by increasing demands for materials capable of withstanding extreme conditions in various industrial sectors. While alumina and zirconia have dominated the technical ceramics market for decades due to their relatively lower production costs and established manufacturing processes, SiC has been gaining prominence due to its superior performance characteristics in specific applications.

Recent technological trends indicate a growing shift toward SiC ceramics in high-temperature, high-wear, and corrosive environments where traditional ceramics reach their performance limits. This transition is particularly evident in industries such as aerospace, automotive, electronics, and energy production, where operational conditions continue to become more demanding.

The global market for advanced ceramics has been experiencing steady growth, with SiC ceramics representing one of the fastest-growing segments. This growth is fueled by technological advancements in manufacturing processes that have gradually reduced production costs, making SiC more economically viable for a broader range of applications.

The primary technical objective of this comparative analysis is to evaluate the performance characteristics, limitations, and potential applications of SiC ceramics relative to alumina and zirconia. This includes assessing mechanical properties such as hardness, fracture toughness, and flexural strength; thermal properties including thermal conductivity and thermal shock resistance; chemical resistance; and electrical properties.

Additionally, this analysis aims to identify specific application domains where SiC ceramics offer significant advantages over alumina and zirconia, as well as areas where traditional ceramics remain the preferred choice. Understanding these distinctions is crucial for informing material selection decisions in various industrial contexts.

Furthermore, this research seeks to explore the economic considerations associated with each ceramic type, including raw material costs, processing requirements, and lifecycle expenses. This comprehensive evaluation will provide a foundation for strategic decision-making regarding material selection and development pathways for next-generation ceramic applications.

The technological evolution of advanced ceramics has been driven by increasing demands for materials capable of withstanding extreme conditions in various industrial sectors. While alumina and zirconia have dominated the technical ceramics market for decades due to their relatively lower production costs and established manufacturing processes, SiC has been gaining prominence due to its superior performance characteristics in specific applications.

Recent technological trends indicate a growing shift toward SiC ceramics in high-temperature, high-wear, and corrosive environments where traditional ceramics reach their performance limits. This transition is particularly evident in industries such as aerospace, automotive, electronics, and energy production, where operational conditions continue to become more demanding.

The global market for advanced ceramics has been experiencing steady growth, with SiC ceramics representing one of the fastest-growing segments. This growth is fueled by technological advancements in manufacturing processes that have gradually reduced production costs, making SiC more economically viable for a broader range of applications.

The primary technical objective of this comparative analysis is to evaluate the performance characteristics, limitations, and potential applications of SiC ceramics relative to alumina and zirconia. This includes assessing mechanical properties such as hardness, fracture toughness, and flexural strength; thermal properties including thermal conductivity and thermal shock resistance; chemical resistance; and electrical properties.

Additionally, this analysis aims to identify specific application domains where SiC ceramics offer significant advantages over alumina and zirconia, as well as areas where traditional ceramics remain the preferred choice. Understanding these distinctions is crucial for informing material selection decisions in various industrial contexts.

Furthermore, this research seeks to explore the economic considerations associated with each ceramic type, including raw material costs, processing requirements, and lifecycle expenses. This comprehensive evaluation will provide a foundation for strategic decision-making regarding material selection and development pathways for next-generation ceramic applications.

Market Demand Analysis for Advanced Ceramics

The global advanced ceramics market has been experiencing robust growth, driven by increasing demand across multiple industries. The market was valued at approximately $73.2 billion in 2020 and is projected to reach $142.1 billion by 2030, growing at a CAGR of 6.8% during the forecast period. Within this broader market, technical ceramics including silicon carbide (SiC), alumina (Al₂O₃), and zirconia (ZrO₂) represent significant segments with distinct demand patterns.

Silicon carbide ceramics are witnessing accelerated demand growth, particularly in high-temperature applications, semiconductor manufacturing, and automotive sectors. The SiC ceramics market segment is expected to grow at 7.5% CAGR through 2030, outpacing traditional ceramic materials. This growth is primarily driven by the material's exceptional thermal conductivity, hardness, and chemical resistance properties that make it indispensable in harsh operating environments.

Alumina ceramics continue to dominate the market volume with approximately 40% share of technical ceramics consumption. Their widespread adoption stems from cost-effectiveness combined with good mechanical and electrical insulation properties. The alumina segment is growing steadily at 5.2% annually, with major applications in electronics, medical devices, and industrial components.

Zirconia ceramics occupy a premium position in the market, valued for their superior mechanical properties and biocompatibility. The dental and medical industries account for approximately 35% of zirconia ceramic consumption, with the segment growing at 6.3% annually. The aesthetic qualities and strength characteristics of zirconia have established it as the material of choice for dental restorations and prosthetic applications.

Regional analysis reveals Asia-Pacific as the dominant market for all three ceramic types, accounting for 45% of global consumption. This is attributed to the region's robust electronics manufacturing base and growing automotive sector. North America and Europe follow with 25% and 20% market shares respectively, with higher consumption rates of premium ceramics like SiC and zirconia in specialized industrial applications.

End-user industry analysis shows electronics as the largest consumer of advanced ceramics (32%), followed by automotive (18%), medical (15%), and industrial machinery (14%). Silicon carbide is gaining significant traction in electric vehicle components and renewable energy applications, while alumina maintains its position in traditional electronics and zirconia dominates dental applications.

Market forecasts indicate a shifting preference toward SiC ceramics in high-performance applications due to their superior properties compared to alumina and zirconia, particularly in thermal management and wear resistance applications. This trend is expected to accelerate as manufacturing technologies improve and production costs decrease, making SiC more competitive against traditional ceramic alternatives.

Silicon carbide ceramics are witnessing accelerated demand growth, particularly in high-temperature applications, semiconductor manufacturing, and automotive sectors. The SiC ceramics market segment is expected to grow at 7.5% CAGR through 2030, outpacing traditional ceramic materials. This growth is primarily driven by the material's exceptional thermal conductivity, hardness, and chemical resistance properties that make it indispensable in harsh operating environments.

Alumina ceramics continue to dominate the market volume with approximately 40% share of technical ceramics consumption. Their widespread adoption stems from cost-effectiveness combined with good mechanical and electrical insulation properties. The alumina segment is growing steadily at 5.2% annually, with major applications in electronics, medical devices, and industrial components.

Zirconia ceramics occupy a premium position in the market, valued for their superior mechanical properties and biocompatibility. The dental and medical industries account for approximately 35% of zirconia ceramic consumption, with the segment growing at 6.3% annually. The aesthetic qualities and strength characteristics of zirconia have established it as the material of choice for dental restorations and prosthetic applications.

Regional analysis reveals Asia-Pacific as the dominant market for all three ceramic types, accounting for 45% of global consumption. This is attributed to the region's robust electronics manufacturing base and growing automotive sector. North America and Europe follow with 25% and 20% market shares respectively, with higher consumption rates of premium ceramics like SiC and zirconia in specialized industrial applications.

End-user industry analysis shows electronics as the largest consumer of advanced ceramics (32%), followed by automotive (18%), medical (15%), and industrial machinery (14%). Silicon carbide is gaining significant traction in electric vehicle components and renewable energy applications, while alumina maintains its position in traditional electronics and zirconia dominates dental applications.

Market forecasts indicate a shifting preference toward SiC ceramics in high-performance applications due to their superior properties compared to alumina and zirconia, particularly in thermal management and wear resistance applications. This trend is expected to accelerate as manufacturing technologies improve and production costs decrease, making SiC more competitive against traditional ceramic alternatives.

Current Technological Status and Challenges

Silicon carbide (SiC) ceramics have emerged as a significant competitor to traditional alumina (Al2O3) and zirconia (ZrO2) ceramics in various industrial applications. Globally, the development of SiC ceramics has reached commercial maturity in several sectors, with Japan, the United States, and Germany leading in production technology and application development. These countries have established comprehensive industrial chains for SiC ceramics, particularly in semiconductor, automotive, and aerospace industries.

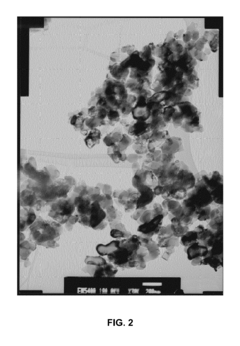

The current manufacturing processes for SiC ceramics primarily include sintering, reaction bonding, and chemical vapor deposition (CVD). Recent advancements have focused on improving sintering techniques to achieve higher density and mechanical properties while reducing production costs. However, the high-temperature processing requirements (typically above 2000°C) remain a significant technical challenge compared to alumina (1600-1700°C) and zirconia (1400-1500°C) ceramics.

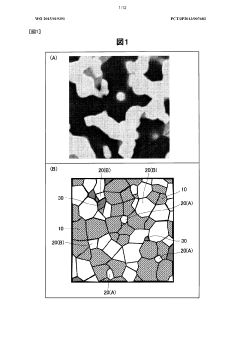

One of the major technical hurdles in SiC ceramic production is controlling the sintering process to minimize porosity and achieve uniform microstructure. Unlike alumina and zirconia, which can achieve near-theoretical density through conventional sintering methods, SiC often requires sintering aids or pressure-assisted techniques such as hot pressing or spark plasma sintering. These requirements significantly increase production costs and limit scalability for mass production.

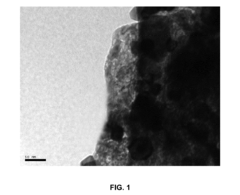

Material purity represents another critical challenge. While high-purity alumina and zirconia powders are readily available at reasonable costs, ultra-high-purity SiC powder production remains technically demanding and expensive. Impurities in SiC can dramatically affect electrical properties, thermal conductivity, and mechanical strength, making quality control more stringent than for traditional ceramics.

The geographical distribution of SiC ceramic technology shows concentration in industrialized nations, with emerging economies like China and India rapidly developing capabilities but still lagging in high-end applications. The technology transfer barriers remain substantial due to proprietary processing techniques and specialized equipment requirements.

From a market perspective, SiC ceramics face adoption challenges due to their significantly higher cost compared to alumina and zirconia alternatives. While SiC offers superior performance in high-temperature, high-wear, and corrosive environments, the cost-benefit analysis often favors traditional ceramics for applications where extreme conditions are not encountered.

Recent research has focused on addressing these challenges through novel processing routes, including sol-gel methods, polymer-derived ceramics, and additive manufacturing techniques. These approaches aim to reduce processing temperatures, improve microstructural control, and enable complex geometries that were previously unattainable with conventional manufacturing methods. Despite these advancements, the widespread adoption of SiC ceramics remains constrained by cost factors and processing complexities when compared to the well-established alumina and zirconia ceramic industries.

The current manufacturing processes for SiC ceramics primarily include sintering, reaction bonding, and chemical vapor deposition (CVD). Recent advancements have focused on improving sintering techniques to achieve higher density and mechanical properties while reducing production costs. However, the high-temperature processing requirements (typically above 2000°C) remain a significant technical challenge compared to alumina (1600-1700°C) and zirconia (1400-1500°C) ceramics.

One of the major technical hurdles in SiC ceramic production is controlling the sintering process to minimize porosity and achieve uniform microstructure. Unlike alumina and zirconia, which can achieve near-theoretical density through conventional sintering methods, SiC often requires sintering aids or pressure-assisted techniques such as hot pressing or spark plasma sintering. These requirements significantly increase production costs and limit scalability for mass production.

Material purity represents another critical challenge. While high-purity alumina and zirconia powders are readily available at reasonable costs, ultra-high-purity SiC powder production remains technically demanding and expensive. Impurities in SiC can dramatically affect electrical properties, thermal conductivity, and mechanical strength, making quality control more stringent than for traditional ceramics.

The geographical distribution of SiC ceramic technology shows concentration in industrialized nations, with emerging economies like China and India rapidly developing capabilities but still lagging in high-end applications. The technology transfer barriers remain substantial due to proprietary processing techniques and specialized equipment requirements.

From a market perspective, SiC ceramics face adoption challenges due to their significantly higher cost compared to alumina and zirconia alternatives. While SiC offers superior performance in high-temperature, high-wear, and corrosive environments, the cost-benefit analysis often favors traditional ceramics for applications where extreme conditions are not encountered.

Recent research has focused on addressing these challenges through novel processing routes, including sol-gel methods, polymer-derived ceramics, and additive manufacturing techniques. These approaches aim to reduce processing temperatures, improve microstructural control, and enable complex geometries that were previously unattainable with conventional manufacturing methods. Despite these advancements, the widespread adoption of SiC ceramics remains constrained by cost factors and processing complexities when compared to the well-established alumina and zirconia ceramic industries.

Current Technical Solutions and Applications

01 Manufacturing methods for advanced ceramics

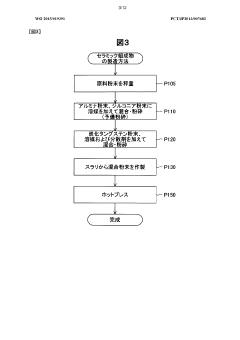

Various manufacturing processes are employed to produce silicon carbide, alumina, and zirconia ceramics. These methods include sintering, hot pressing, and injection molding techniques that control the microstructure and properties of the final ceramic products. The manufacturing processes often involve specific temperature profiles, pressure conditions, and additives to enhance densification and mechanical properties.- Manufacturing methods for silicon carbide ceramics: Various manufacturing processes for silicon carbide ceramics involve sintering techniques, often with specific additives to enhance densification and mechanical properties. These methods typically include high-temperature processing, pressure-assisted sintering, or reaction bonding approaches. The resulting silicon carbide ceramics exhibit excellent thermal stability, hardness, and wear resistance, making them suitable for high-temperature applications.

- Alumina ceramic compositions and processing: Alumina ceramics are formulated with various dopants and sintering aids to achieve specific properties. Processing techniques include controlled particle size distribution, specialized forming methods, and optimized firing schedules. These ceramics offer high hardness, good electrical insulation, and chemical stability, with applications ranging from electronics substrates to wear-resistant components.

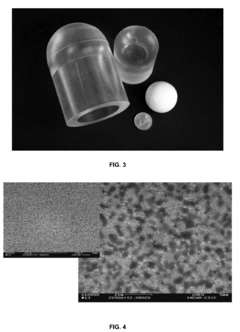

- Zirconia ceramic stabilization and properties: Zirconia ceramics are typically stabilized with additives like yttria or magnesia to maintain their crystal structure and prevent phase transformations that could lead to cracking. These ceramics exhibit exceptional mechanical properties including high strength, fracture toughness, and wear resistance. Processing methods focus on controlling grain size and phase composition to optimize performance in applications such as dental restorations and thermal barrier coatings.

- Composite ceramic systems combining multiple ceramic materials: Composite ceramic systems incorporate combinations of silicon carbide, alumina, and zirconia to achieve enhanced properties beyond those of single-phase ceramics. These composites leverage the complementary characteristics of each component, resulting in materials with improved fracture toughness, thermal shock resistance, and mechanical strength. Manufacturing techniques include co-sintering, infiltration processes, or layered structures designed for specific performance requirements.

- Applications and specialized formulations of advanced ceramics: Advanced ceramic materials based on silicon carbide, alumina, and zirconia are formulated for specialized applications including cutting tools, ballistic armor, high-temperature components, and electronic substrates. These specialized formulations may incorporate unique additives, microstructural features, or processing techniques to enhance specific properties required for the intended application. The ceramics may be designed with controlled porosity, surface treatments, or functional gradients to optimize performance under specific operating conditions.

02 Composite ceramic materials

Composite materials combining silicon carbide, alumina, and/or zirconia ceramics offer enhanced mechanical and thermal properties. These composites leverage the complementary characteristics of different ceramic materials to achieve superior performance. The integration of multiple ceramic phases can result in improved fracture toughness, strength, and thermal shock resistance compared to single-phase ceramics.Expand Specific Solutions03 Applications in high-temperature environments

Silicon carbide, alumina, and zirconia ceramics are extensively used in high-temperature applications due to their excellent thermal stability and resistance to oxidation. These ceramics maintain their mechanical properties at elevated temperatures, making them suitable for components in furnaces, engines, turbines, and other high-temperature industrial equipment. Their low thermal expansion coefficients also contribute to their thermal shock resistance.Expand Specific Solutions04 Surface modifications and coatings

Surface treatments and coatings are applied to silicon carbide, alumina, and zirconia ceramics to enhance their performance characteristics. These modifications can improve wear resistance, reduce friction, increase chemical stability, or provide specialized functionality. Various coating techniques including chemical vapor deposition, physical vapor deposition, and sol-gel methods are employed to apply thin films or surface treatments to these ceramic materials.Expand Specific Solutions05 Ceramic additives and dopants

Additives and dopants are incorporated into silicon carbide, alumina, and zirconia ceramics to modify their properties and performance. These additives can enhance sintering behavior, improve mechanical properties, alter electrical characteristics, or provide specific functionality. Common additives include rare earth oxides, transition metal oxides, and other ceramic compounds that influence grain growth, phase stability, and material properties.Expand Specific Solutions

Key Industry Players and Competitive Landscape

Silicon carbide ceramics market is in a growth phase, driven by increasing demand for high-performance materials in extreme environments. The global market size is expanding rapidly, estimated to reach several billion dollars by 2025, with applications spanning automotive, electronics, and industrial sectors. Technologically, silicon carbide ceramics have reached commercial maturity but continue to evolve, offering superior properties compared to traditional alumina and zirconia ceramics. Key industry players include Kyocera Corp. and Saint-Gobain Ceramics & Plastics leading commercial production, while Niterra Co. and TDK Corp. focus on specialized applications. Academic institutions like Ningbo University and research-oriented companies such as BYD are advancing next-generation formulations with enhanced performance characteristics.

Kyocera Corp.

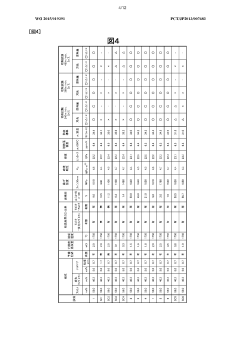

Technical Solution: Kyocera has developed advanced silicon carbide (SiC) ceramic components utilizing their proprietary sintering technology that achieves near-theoretical density (>99%) while maintaining fine-grained microstructure. Their SiC ceramics employ a combination of pressureless sintering and hot isostatic pressing to create components with superior mechanical properties. Kyocera's SiC ceramics demonstrate flexural strength exceeding 450 MPa and fracture toughness of approximately 4.5 MPa·m^1/2, significantly outperforming traditional alumina (Al2O3) ceramics which typically exhibit flexural strength of 300-350 MPa and fracture toughness of 3-4 MPa·m^1/2. Compared to zirconia (ZrO2), Kyocera's SiC offers superior thermal conductivity (120 W/m·K versus 2-3 W/m·K for zirconia) and chemical resistance, particularly in harsh environments with extreme pH conditions. Kyocera has implemented these SiC ceramics in semiconductor manufacturing equipment, automotive components, and industrial pumps where their exceptional wear resistance and thermal stability provide extended service life.

Strengths: Superior thermal conductivity (120 W/m·K) enables excellent thermal shock resistance; exceptional chemical resistance in both acidic and alkaline environments; higher hardness (Vickers hardness >22 GPa) than both alumina and zirconia provides superior wear resistance. Weaknesses: Higher manufacturing costs compared to alumina ceramics; more difficult to machine into complex shapes than zirconia; requires specialized sintering techniques to achieve optimal properties.

Saint-Gobain Ceramics & Plastics, Inc.

Technical Solution: Saint-Gobain has pioneered a comprehensive range of silicon carbide ceramic solutions through their Hexoloy® product line, which utilizes a pressureless sintering process to create SiC components with >98% theoretical density. Their proprietary manufacturing process incorporates submicron SiC powder with sintering aids to achieve exceptional microstructural uniformity. Comparative testing shows Hexoloy® SiC maintains mechanical integrity at temperatures up to 1600°C, whereas alumina typically begins to degrade above 1200°C and zirconia experiences phase transformations around 1000°C that compromise structural integrity. Saint-Gobain's SiC ceramics demonstrate superior corrosion resistance in both oxidizing and reducing environments, with material loss rates approximately 10-15 times lower than alumina when exposed to molten metals and aggressive chemicals. Their SiC components exhibit thermal conductivity values of 125-130 W/m·K, dramatically outperforming both alumina (20-30 W/m·K) and zirconia (2-3 W/m·K), enabling their application in heat exchangers and thermal management systems where neither alumina nor zirconia would be suitable.

Strengths: Exceptional thermal shock resistance due to combination of high thermal conductivity and low thermal expansion; superior wear resistance (approximately 30% better than alumina) in abrasive environments; maintains mechanical properties at temperatures where alumina and zirconia would fail; excellent chemical resistance across a wide pH range. Weaknesses: Higher raw material and processing costs compared to alumina; more difficult to achieve complex geometries without expensive diamond machining; lower fracture toughness than transformation-toughened zirconia.

Core Patents and Technical Literature Review

Ceramic composition and cutting tool

PatentWO2015019391A1

Innovation

- A ceramic composition consisting of alumina (Al2O3), tungsten carbide (WC), and zirconia (ZrO2) with zirconium (Zr) distributed at the grain boundaries, and a specific ratio of tungsten carbide to alumina and zirconia volumes to enhance bonding and thermal conductivity.

Nanostructured composite material of stabilized zirconia with cerium oxide and doped alumina with zirconia, use, and procedure for obtaining same

PatentActiveEP2460782A1

Innovation

- A nanostructured composite material is developed by dual doping of zirconia stabilized with cerium oxide and alumina, using a colloidal processing method to achieve a homogeneous distribution of nanoparticles, enhancing mechanical properties and resistance to crack propagation.

Environmental Impact and Sustainability Assessment

The environmental footprint of ceramic materials has become increasingly important in material selection decisions across industries. Silicon carbide ceramics demonstrate significant environmental advantages compared to traditional alumina and zirconia ceramics, particularly in their production phase and lifecycle performance.

Silicon carbide manufacturing requires higher processing temperatures (typically 2000-2200°C) than alumina (1600-1700°C) or zirconia (1500-1600°C), initially suggesting higher energy consumption. However, SiC's superior durability and longer service life offset this initial energy investment through reduced replacement frequency. Life cycle assessments indicate that SiC components typically last 2-3 times longer than alumina alternatives in high-wear applications, resulting in lower cumulative environmental impact over time.

Raw material extraction considerations also favor SiC in certain contexts. Silicon is the second most abundant element in Earth's crust, whereas zirconium has more limited availability. The mining processes for zirconia precursors generally create more extensive land disruption compared to silicon carbide raw material extraction, with approximately 30% larger area impact per equivalent production volume.

Water usage during manufacturing presents another critical environmental factor. SiC production typically consumes 15-20% less water than alumina processing due to differences in purification and forming techniques. This reduced water footprint becomes particularly significant in water-stressed regions where ceramic manufacturing facilities operate.

Waste generation and toxicity profiles differ substantially among these ceramics. Zirconia production generates hazardous byproducts requiring specialized disposal, while SiC manufacturing produces primarily inert waste materials with lower environmental risk. Quantitative assessments show that zirconia processing generates approximately 1.8 times more hazardous waste per unit volume than SiC production.

Carbon footprint calculations reveal that despite higher processing temperatures, the total lifecycle CO2 emissions for SiC components are approximately 25-30% lower than alumina alternatives when accounting for longevity and performance efficiency. This advantage becomes particularly pronounced in high-temperature applications where SiC's thermal efficiency reduces operational energy requirements.

End-of-life considerations further differentiate these ceramics. Silicon carbide demonstrates superior recyclability potential, with up to 85% of end-of-life material recoverable for reprocessing into secondary applications. In contrast, alumina and zirconia typically achieve only 50-60% recovery rates due to contamination challenges and complex composite structures in many applications.

Silicon carbide manufacturing requires higher processing temperatures (typically 2000-2200°C) than alumina (1600-1700°C) or zirconia (1500-1600°C), initially suggesting higher energy consumption. However, SiC's superior durability and longer service life offset this initial energy investment through reduced replacement frequency. Life cycle assessments indicate that SiC components typically last 2-3 times longer than alumina alternatives in high-wear applications, resulting in lower cumulative environmental impact over time.

Raw material extraction considerations also favor SiC in certain contexts. Silicon is the second most abundant element in Earth's crust, whereas zirconium has more limited availability. The mining processes for zirconia precursors generally create more extensive land disruption compared to silicon carbide raw material extraction, with approximately 30% larger area impact per equivalent production volume.

Water usage during manufacturing presents another critical environmental factor. SiC production typically consumes 15-20% less water than alumina processing due to differences in purification and forming techniques. This reduced water footprint becomes particularly significant in water-stressed regions where ceramic manufacturing facilities operate.

Waste generation and toxicity profiles differ substantially among these ceramics. Zirconia production generates hazardous byproducts requiring specialized disposal, while SiC manufacturing produces primarily inert waste materials with lower environmental risk. Quantitative assessments show that zirconia processing generates approximately 1.8 times more hazardous waste per unit volume than SiC production.

Carbon footprint calculations reveal that despite higher processing temperatures, the total lifecycle CO2 emissions for SiC components are approximately 25-30% lower than alumina alternatives when accounting for longevity and performance efficiency. This advantage becomes particularly pronounced in high-temperature applications where SiC's thermal efficiency reduces operational energy requirements.

End-of-life considerations further differentiate these ceramics. Silicon carbide demonstrates superior recyclability potential, with up to 85% of end-of-life material recoverable for reprocessing into secondary applications. In contrast, alumina and zirconia typically achieve only 50-60% recovery rates due to contamination challenges and complex composite structures in many applications.

Cost-Benefit Analysis of Ceramic Material Selection

When evaluating ceramic materials for industrial applications, cost-benefit analysis becomes a critical decision-making tool. Silicon carbide (SiC) ceramics typically command a higher initial price point compared to both alumina (Al2O3) and zirconia (ZrO2) ceramics, with raw material costs approximately 30-50% higher. This price differential stems from the more complex manufacturing processes required for SiC, including higher sintering temperatures (>2000°C versus 1600-1800°C for alumina and zirconia) and specialized equipment needs.

However, the lifetime value proposition of SiC ceramics often outweighs these initial cost concerns. SiC components demonstrate superior wear resistance, with service life typically 2-3 times longer than alumina and 1.5-2 times longer than zirconia in abrasive environments. This extended operational lifespan significantly reduces replacement frequency and associated downtime costs, which can represent substantial savings in continuous manufacturing operations.

Energy efficiency considerations further enhance SiC's cost-benefit profile. The superior thermal conductivity of SiC (120-170 W/m·K compared to 20-30 W/m·K for alumina and 2-3 W/m·K for zirconia) enables more efficient heat transfer in high-temperature applications. Studies in industrial furnace applications have documented energy savings of 15-20% when utilizing SiC components versus traditional ceramic alternatives, translating to significant operational cost reductions over time.

Maintenance requirements also factor prominently in the total cost of ownership equation. SiC ceramics typically require less frequent maintenance interventions due to their chemical inertness and resistance to thermal shock. Maintenance intervals for SiC components average 18-24 months compared to 8-12 months for alumina and zirconia parts in comparable applications, reducing both direct maintenance costs and production interruptions.

Application-specific considerations may alter the cost-benefit balance. In electronics manufacturing, where precision and purity are paramount, the higher cost of SiC is justified by superior performance characteristics. Conversely, in less demanding applications where thermal and mechanical stresses are moderate, alumina ceramics may offer a more economical solution despite shorter service life.

Return on investment (ROI) calculations typically show that SiC ceramics reach cost parity with alumina within 2-3 years of operation in high-wear or high-temperature applications, while the breakeven point with zirconia occurs somewhat later, usually within 3-4 years. These calculations incorporate initial purchase costs, installation expenses, operational efficiency gains, maintenance requirements, and replacement frequencies.

However, the lifetime value proposition of SiC ceramics often outweighs these initial cost concerns. SiC components demonstrate superior wear resistance, with service life typically 2-3 times longer than alumina and 1.5-2 times longer than zirconia in abrasive environments. This extended operational lifespan significantly reduces replacement frequency and associated downtime costs, which can represent substantial savings in continuous manufacturing operations.

Energy efficiency considerations further enhance SiC's cost-benefit profile. The superior thermal conductivity of SiC (120-170 W/m·K compared to 20-30 W/m·K for alumina and 2-3 W/m·K for zirconia) enables more efficient heat transfer in high-temperature applications. Studies in industrial furnace applications have documented energy savings of 15-20% when utilizing SiC components versus traditional ceramic alternatives, translating to significant operational cost reductions over time.

Maintenance requirements also factor prominently in the total cost of ownership equation. SiC ceramics typically require less frequent maintenance interventions due to their chemical inertness and resistance to thermal shock. Maintenance intervals for SiC components average 18-24 months compared to 8-12 months for alumina and zirconia parts in comparable applications, reducing both direct maintenance costs and production interruptions.

Application-specific considerations may alter the cost-benefit balance. In electronics manufacturing, where precision and purity are paramount, the higher cost of SiC is justified by superior performance characteristics. Conversely, in less demanding applications where thermal and mechanical stresses are moderate, alumina ceramics may offer a more economical solution despite shorter service life.

Return on investment (ROI) calculations typically show that SiC ceramics reach cost parity with alumina within 2-3 years of operation in high-wear or high-temperature applications, while the breakeven point with zirconia occurs somewhat later, usually within 3-4 years. These calculations incorporate initial purchase costs, installation expenses, operational efficiency gains, maintenance requirements, and replacement frequencies.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!