Research on Silicon carbide ceramics for high voltage and high temperature industrial use

SEP 24, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

SiC Ceramics Evolution and Research Objectives

Silicon carbide (SiC) ceramics have evolved significantly since their initial discovery by Edward G. Acheson in 1891. The journey from abrasive material to advanced engineering ceramic spans over a century, with transformative developments occurring particularly in the last three decades. Early applications were limited to grinding wheels and refractory materials due to manufacturing constraints and limited understanding of SiC's full potential.

The 1970s marked a turning point with the development of sintering techniques that enabled the production of dense SiC ceramics with improved mechanical properties. By the 1990s, advancements in powder synthesis and processing technologies facilitated the creation of high-purity SiC ceramics with controlled microstructures, setting the foundation for their application in demanding industrial environments.

Recent technological breakthroughs have propelled SiC ceramics into high-voltage and high-temperature applications. The development of liquid-phase sintering methods and hot isostatic pressing has significantly enhanced the density and uniformity of SiC components, while reducing manufacturing costs. Additionally, innovations in joining techniques have enabled the fabrication of complex SiC structures suitable for industrial systems operating under extreme conditions.

The current research landscape focuses on enhancing the electrical insulation properties of SiC ceramics while maintaining their exceptional thermal conductivity and mechanical strength at elevated temperatures. This balance is crucial for high-voltage applications where electrical breakdown must be prevented while efficiently dissipating heat generated during operation.

Our technical objectives center on developing next-generation SiC ceramic materials capable of withstanding voltages exceeding 20kV and temperatures above 800°C simultaneously. This represents a significant advancement over current commercial offerings that typically operate at either high voltage or high temperature, but rarely both concurrently with the required reliability.

Specific research goals include optimizing the microstructure of SiC ceramics to minimize electrical conductivity at elevated temperatures, developing novel dopant strategies to enhance dielectric strength without compromising thermal performance, and creating innovative surface treatments to prevent electrical tracking and erosion under extreme conditions.

Additionally, we aim to establish scalable manufacturing processes that can consistently produce these advanced SiC ceramics with the required properties while maintaining economic viability for industrial applications. This includes investigating alternative sintering aids and processing routes that reduce energy consumption and raw material costs without sacrificing performance.

The ultimate objective is to enable transformative industrial applications in power electronics, energy conversion systems, and high-temperature sensing technologies that are currently limited by material constraints. Success in this endeavor would significantly impact sectors ranging from renewable energy and electric grid infrastructure to aerospace propulsion and industrial processing equipment.

The 1970s marked a turning point with the development of sintering techniques that enabled the production of dense SiC ceramics with improved mechanical properties. By the 1990s, advancements in powder synthesis and processing technologies facilitated the creation of high-purity SiC ceramics with controlled microstructures, setting the foundation for their application in demanding industrial environments.

Recent technological breakthroughs have propelled SiC ceramics into high-voltage and high-temperature applications. The development of liquid-phase sintering methods and hot isostatic pressing has significantly enhanced the density and uniformity of SiC components, while reducing manufacturing costs. Additionally, innovations in joining techniques have enabled the fabrication of complex SiC structures suitable for industrial systems operating under extreme conditions.

The current research landscape focuses on enhancing the electrical insulation properties of SiC ceramics while maintaining their exceptional thermal conductivity and mechanical strength at elevated temperatures. This balance is crucial for high-voltage applications where electrical breakdown must be prevented while efficiently dissipating heat generated during operation.

Our technical objectives center on developing next-generation SiC ceramic materials capable of withstanding voltages exceeding 20kV and temperatures above 800°C simultaneously. This represents a significant advancement over current commercial offerings that typically operate at either high voltage or high temperature, but rarely both concurrently with the required reliability.

Specific research goals include optimizing the microstructure of SiC ceramics to minimize electrical conductivity at elevated temperatures, developing novel dopant strategies to enhance dielectric strength without compromising thermal performance, and creating innovative surface treatments to prevent electrical tracking and erosion under extreme conditions.

Additionally, we aim to establish scalable manufacturing processes that can consistently produce these advanced SiC ceramics with the required properties while maintaining economic viability for industrial applications. This includes investigating alternative sintering aids and processing routes that reduce energy consumption and raw material costs without sacrificing performance.

The ultimate objective is to enable transformative industrial applications in power electronics, energy conversion systems, and high-temperature sensing technologies that are currently limited by material constraints. Success in this endeavor would significantly impact sectors ranging from renewable energy and electric grid infrastructure to aerospace propulsion and industrial processing equipment.

Market Analysis for High-Temperature Industrial Applications

The global market for high-temperature industrial applications is experiencing significant growth, driven by increasing demands in power electronics, automotive, aerospace, and energy sectors. Silicon carbide (SiC) ceramics have emerged as a critical material in these applications due to their exceptional thermal stability, electrical insulation properties, and mechanical strength at elevated temperatures.

The power electronics segment represents the largest market share for SiC ceramics, valued at approximately $1.2 billion in 2022, with projections indicating a compound annual growth rate (CAGR) of 11.3% through 2028. This growth is primarily fueled by the rapid expansion of electric vehicle production, which requires high-temperature resistant components for power modules and inverters.

In the energy sector, particularly in renewable energy systems and smart grid infrastructure, the demand for SiC ceramics is growing at 13.7% annually. This acceleration stems from the material's ability to operate efficiently at high voltages and temperatures, reducing energy losses in power transmission and conversion systems.

The aerospace and defense industries constitute another significant market segment, currently valued at $890 million and expected to reach $1.5 billion by 2027. Here, SiC ceramics are increasingly utilized in jet engine components, missile systems, and satellite technology where extreme temperature resistance is paramount.

Regionally, Asia-Pacific dominates the market with a 42% share, led by China and Japan's robust manufacturing bases in electronics and automotive sectors. North America follows with 28% market share, driven by aerospace and defense applications, while Europe accounts for 24%, primarily in automotive and industrial equipment manufacturing.

Customer requirements are evolving toward higher performance specifications, with industrial users now demanding SiC ceramics capable of withstanding temperatures exceeding 1600°C while maintaining electrical insulation properties at voltages above 10kV. This represents a significant increase from the previous industry standard of 1200°C and 6.5kV.

Market barriers include high production costs, with SiC ceramics typically commanding a 3-4x price premium over traditional materials, and technical challenges in achieving consistent quality at scale. However, recent manufacturing innovations are gradually reducing these barriers, with production costs decreasing by approximately 8% annually.

The competitive landscape features established materials science corporations alongside specialized ceramic manufacturers and emerging startups focused on novel production techniques. This diversification is expected to accelerate innovation while putting downward pressure on prices, potentially expanding market accessibility across more industrial applications.

The power electronics segment represents the largest market share for SiC ceramics, valued at approximately $1.2 billion in 2022, with projections indicating a compound annual growth rate (CAGR) of 11.3% through 2028. This growth is primarily fueled by the rapid expansion of electric vehicle production, which requires high-temperature resistant components for power modules and inverters.

In the energy sector, particularly in renewable energy systems and smart grid infrastructure, the demand for SiC ceramics is growing at 13.7% annually. This acceleration stems from the material's ability to operate efficiently at high voltages and temperatures, reducing energy losses in power transmission and conversion systems.

The aerospace and defense industries constitute another significant market segment, currently valued at $890 million and expected to reach $1.5 billion by 2027. Here, SiC ceramics are increasingly utilized in jet engine components, missile systems, and satellite technology where extreme temperature resistance is paramount.

Regionally, Asia-Pacific dominates the market with a 42% share, led by China and Japan's robust manufacturing bases in electronics and automotive sectors. North America follows with 28% market share, driven by aerospace and defense applications, while Europe accounts for 24%, primarily in automotive and industrial equipment manufacturing.

Customer requirements are evolving toward higher performance specifications, with industrial users now demanding SiC ceramics capable of withstanding temperatures exceeding 1600°C while maintaining electrical insulation properties at voltages above 10kV. This represents a significant increase from the previous industry standard of 1200°C and 6.5kV.

Market barriers include high production costs, with SiC ceramics typically commanding a 3-4x price premium over traditional materials, and technical challenges in achieving consistent quality at scale. However, recent manufacturing innovations are gradually reducing these barriers, with production costs decreasing by approximately 8% annually.

The competitive landscape features established materials science corporations alongside specialized ceramic manufacturers and emerging startups focused on novel production techniques. This diversification is expected to accelerate innovation while putting downward pressure on prices, potentially expanding market accessibility across more industrial applications.

Global SiC Ceramics Development Status and Barriers

Silicon carbide (SiC) ceramics have emerged as critical materials for high-voltage and high-temperature industrial applications globally. Currently, the development of SiC ceramics exhibits significant regional disparities, with Japan, the United States, and Germany leading in research and commercialization. These countries have established comprehensive industrial chains and possess advanced manufacturing capabilities for high-performance SiC ceramic components.

In Japan, companies like Kyocera and NGK Insulators have achieved remarkable breakthroughs in SiC ceramic production technologies, particularly for power electronics and semiconductor manufacturing equipment. The Japanese approach emphasizes precision manufacturing and quality control, resulting in highly reliable SiC products for extreme operating conditions.

The United States maintains technological leadership through substantial investments from both government agencies and private corporations. Organizations such as NASA, Department of Energy, and corporations like Cree and GE have developed specialized SiC ceramics for aerospace, defense, and energy applications. American innovation focuses on pushing performance boundaries for ultra-high temperature and voltage environments.

European development, particularly in Germany, centers around engineering applications in automotive and industrial sectors. Companies like Bosch and Siemens leverage SiC ceramics for next-generation power electronics and industrial systems requiring exceptional thermal and electrical performance.

Despite these advancements, significant barriers impede broader adoption of SiC ceramics. The foremost challenge remains the high manufacturing cost, with complex production processes requiring specialized equipment and expertise. Current production methods struggle with scalability while maintaining consistent quality, limiting mass-market penetration.

Technical barriers include difficulties in achieving uniform microstructures in large or complex-shaped components, which directly impacts performance reliability. The sintering process for SiC ceramics demands precise control of temperature, pressure, and atmosphere, presenting substantial engineering challenges for manufacturers.

Material property limitations also persist. While SiC ceramics offer exceptional thermal and electrical properties, their inherent brittleness restricts application in scenarios with mechanical shock or vibration. Researchers continue to explore composite formulations and structural designs to overcome these limitations.

Standardization represents another significant barrier, as the lack of unified global standards for SiC ceramic materials hampers interoperability and complicates qualification processes across different industries and regions. This fragmentation slows adoption in regulated sectors like aerospace and medical devices.

Emerging economies, particularly China, are rapidly advancing their SiC ceramic capabilities through strategic investments in research infrastructure and manufacturing facilities, potentially reshaping the global competitive landscape in the coming decade.

In Japan, companies like Kyocera and NGK Insulators have achieved remarkable breakthroughs in SiC ceramic production technologies, particularly for power electronics and semiconductor manufacturing equipment. The Japanese approach emphasizes precision manufacturing and quality control, resulting in highly reliable SiC products for extreme operating conditions.

The United States maintains technological leadership through substantial investments from both government agencies and private corporations. Organizations such as NASA, Department of Energy, and corporations like Cree and GE have developed specialized SiC ceramics for aerospace, defense, and energy applications. American innovation focuses on pushing performance boundaries for ultra-high temperature and voltage environments.

European development, particularly in Germany, centers around engineering applications in automotive and industrial sectors. Companies like Bosch and Siemens leverage SiC ceramics for next-generation power electronics and industrial systems requiring exceptional thermal and electrical performance.

Despite these advancements, significant barriers impede broader adoption of SiC ceramics. The foremost challenge remains the high manufacturing cost, with complex production processes requiring specialized equipment and expertise. Current production methods struggle with scalability while maintaining consistent quality, limiting mass-market penetration.

Technical barriers include difficulties in achieving uniform microstructures in large or complex-shaped components, which directly impacts performance reliability. The sintering process for SiC ceramics demands precise control of temperature, pressure, and atmosphere, presenting substantial engineering challenges for manufacturers.

Material property limitations also persist. While SiC ceramics offer exceptional thermal and electrical properties, their inherent brittleness restricts application in scenarios with mechanical shock or vibration. Researchers continue to explore composite formulations and structural designs to overcome these limitations.

Standardization represents another significant barrier, as the lack of unified global standards for SiC ceramic materials hampers interoperability and complicates qualification processes across different industries and regions. This fragmentation slows adoption in regulated sectors like aerospace and medical devices.

Emerging economies, particularly China, are rapidly advancing their SiC ceramic capabilities through strategic investments in research infrastructure and manufacturing facilities, potentially reshaping the global competitive landscape in the coming decade.

Current SiC Ceramic Fabrication Techniques

01 Manufacturing methods for silicon carbide ceramics

Various manufacturing processes are employed to produce silicon carbide ceramics with desired properties. These methods include sintering techniques, hot pressing, and reaction bonding. The manufacturing process significantly influences the final properties of the ceramic, such as density, strength, and thermal conductivity. Advanced processing techniques can yield silicon carbide ceramics with enhanced mechanical properties and thermal stability for high-performance applications.- Manufacturing methods for silicon carbide ceramics: Various manufacturing methods are employed to produce silicon carbide ceramics with enhanced properties. These methods include sintering processes, hot pressing techniques, and chemical vapor deposition. The manufacturing processes can be optimized to control grain size, density, and porosity, which directly influence the mechanical and thermal properties of the final ceramic product. Advanced processing techniques allow for the creation of silicon carbide ceramics with tailored characteristics for specific applications.

- Composition and additives for silicon carbide ceramics: The composition of silicon carbide ceramics can be modified with various additives to enhance specific properties. Sintering aids such as aluminum oxide, yttrium oxide, and rare earth elements are commonly used to improve densification and mechanical properties. Other additives may include boron compounds, carbon sources, and transition metal oxides that affect grain growth, phase formation, and overall performance. The precise control of these compositional elements enables the development of silicon carbide ceramics with optimized characteristics for demanding applications.

- Applications of silicon carbide ceramics: Silicon carbide ceramics find applications across various industries due to their exceptional properties. They are used in high-temperature components for aerospace and automotive industries, including turbine parts and brake systems. In electronics, they serve as substrates and semiconductor materials. Their chemical resistance makes them suitable for chemical processing equipment, while their hardness and wear resistance are valuable for abrasive tools and cutting implements. Additionally, they are employed in armor systems, nuclear applications, and as components in renewable energy systems.

- Reinforcement and composite structures with silicon carbide: Silicon carbide can be incorporated into composite structures to enhance mechanical properties. Silicon carbide fibers, whiskers, or particles are used as reinforcement in ceramic matrix composites, metal matrix composites, and polymer matrix composites. These reinforced materials exhibit improved strength, toughness, and thermal stability compared to monolithic materials. The interface between the silicon carbide reinforcement and the matrix material plays a crucial role in determining the overall performance of the composite, with various coating techniques being employed to optimize this interface.

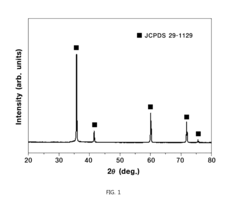

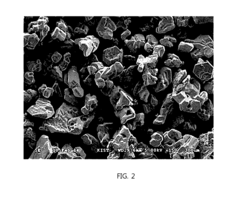

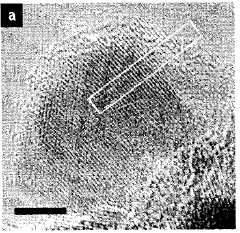

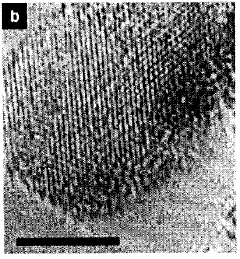

- Properties and characterization of silicon carbide ceramics: Silicon carbide ceramics possess exceptional properties that make them valuable for various applications. These include high hardness, excellent thermal conductivity, low thermal expansion, outstanding chemical stability, and good mechanical strength at elevated temperatures. The properties can vary depending on the polytype (alpha or beta), grain size, porosity, and purity of the silicon carbide. Various characterization techniques such as X-ray diffraction, electron microscopy, and thermal analysis are employed to evaluate these properties and ensure quality control in the production of silicon carbide ceramics.

02 Composition and additives for silicon carbide ceramics

The composition of silicon carbide ceramics can be modified with various additives to enhance specific properties. Sintering aids such as aluminum oxide, yttrium oxide, and rare earth elements are commonly used to promote densification. Other additives may include carbon, boron, and nitrogen compounds that affect grain growth and phase development. The precise formulation of these compositions determines the microstructure and performance characteristics of the resulting ceramic materials.Expand Specific Solutions03 High-temperature applications of silicon carbide ceramics

Silicon carbide ceramics exhibit exceptional thermal stability and mechanical strength at elevated temperatures, making them ideal for high-temperature applications. These materials maintain their structural integrity in extreme environments, including furnaces, combustion chambers, and heat exchangers. Their resistance to thermal shock, oxidation, and creep at high temperatures enables their use in aerospace components, gas turbines, and other demanding thermal applications where conventional materials would fail.Expand Specific Solutions04 Structural and mechanical properties of silicon carbide ceramics

Silicon carbide ceramics possess remarkable mechanical properties, including high hardness, wear resistance, and compressive strength. The microstructure of these ceramics, including grain size, porosity, and phase composition, significantly influences their mechanical behavior. Advanced processing techniques can produce silicon carbide ceramics with tailored mechanical properties for specific applications, such as cutting tools, armor systems, and structural components in harsh environments.Expand Specific Solutions05 Novel silicon carbide ceramic composites

Innovative composite materials incorporating silicon carbide have been developed to overcome limitations of monolithic ceramics. These composites may combine silicon carbide with other ceramics, metals, or carbon-based materials to achieve synergistic properties. Fiber-reinforced silicon carbide composites offer improved fracture toughness and damage tolerance. Other novel developments include functionally graded materials, nanostructured composites, and silicon carbide-based ceramic matrix composites with enhanced thermal and mechanical performance.Expand Specific Solutions

Leading Manufacturers and Research Institutions

Silicon carbide ceramics for high voltage and high temperature industrial applications are in a growth phase, with the market expanding due to increasing demand in power electronics, automotive, and renewable energy sectors. The global market size is projected to reach significant value by 2030, driven by the material's superior thermal conductivity, mechanical strength, and electrical properties. In terms of technical maturity, leading companies like Wolfspeed, Shin-Etsu Chemical, and Corning have achieved commercial-scale production capabilities, while academic institutions such as North Carolina State University and Kyoto University continue to advance fundamental research. Companies including Toshiba, Hitachi, and Saint-Gobain Ceramics & Plastics are developing specialized applications, with emerging players from China like Suntech Advanced Ceramics gaining market share through cost-competitive manufacturing processes.

Wolfspeed, Inc.

Technical Solution: Wolfspeed has pioneered silicon carbide (SiC) ceramic technology for high voltage and high temperature applications through their advanced manufacturing processes. Their proprietary high-purity SiC substrate production enables the creation of ceramics with exceptional thermal conductivity (>350 W/mK) and breakdown field strength exceeding 2.8 MV/cm. Wolfspeed's technical approach involves controlled chemical vapor deposition (CVD) to produce ultra-pure SiC crystals with minimal defects, followed by precision machining and sintering processes that maintain structural integrity at temperatures above 1600°C. Their SiC ceramics feature specialized dopant profiles that enable stable electrical performance at junction temperatures up to 600°C, significantly outperforming traditional ceramic materials in power electronics applications. The company has developed proprietary surface passivation techniques that enhance long-term reliability under extreme voltage conditions, with demonstrated stability under 20kV/mm electric fields in industrial testing environments.

Strengths: Industry-leading purity levels in SiC production resulting in superior electrical performance; established manufacturing infrastructure allowing for scale; proprietary processing techniques that reduce defect density. Weaknesses: Higher production costs compared to conventional ceramics; longer manufacturing cycle times; requires specialized equipment for implementation in end applications.

Shin-Etsu Chemical Co., Ltd.

Technical Solution: Shin-Etsu Chemical has developed an innovative approach to silicon carbide ceramics focusing on high-voltage insulation properties through their proprietary sintering technology. Their technical solution involves a two-phase SiC ceramic system that incorporates carefully controlled secondary phases at grain boundaries to enhance dielectric strength while maintaining thermal conductivity. The company's manufacturing process utilizes ultra-fine SiC powder (average particle size <0.5μm) combined with rare-earth oxide sintering aids that promote densification at lower temperatures (1750-1850°C), resulting in ceramics with relative density exceeding 99.5%. Their SiC ceramics demonstrate stable electrical resistivity (>10^12 Ω·cm) at temperatures up to 800°C and can withstand voltage gradients of 15-18 kV/mm without breakdown. Shin-Etsu has further enhanced their SiC ceramics through surface treatment technologies that reduce partial discharge activity under high-voltage AC conditions, making them particularly suitable for high-voltage transformer and switchgear applications in harsh industrial environments.

Strengths: Exceptional high-temperature electrical insulation properties; superior resistance to thermal cycling; established quality control systems ensuring consistent performance. Weaknesses: Higher raw material costs compared to traditional ceramics; limited flexibility in complex geometries; requires specialized bonding techniques for system integration.

Critical Patents and Breakthroughs in SiC Materials

Porous silicon dioxide-carbon composite and method for preparing high-purity granular beta-phase silicon carbide powder with using the same

PatentActiveUS20170081197A1

Innovation

- A method involving the preparation of porous silicon dioxide-carbon composites through a sol-gel process, followed by a two-step heat treatment with metallic silicon, allowing for direct reaction and carbothermal reduction to produce high-purity β-phase silicon carbide granular powders with controlled particle size and impurity levels at lower temperatures.

Method for preparing size-controlled silicon carbide nanocrystals

PatentInactiveCA2646850A1

Innovation

- A method involving the reductive thermal processing of compositionally-controlled phenylsiloxane polymers, where the molar ratio of phenyl trichlorosilane to silicon tetrachloride controls the size of SiC nanocrystals, and a liberation procedure using oxidation and chemical etching is employed to produce both oxide-embedded and freestanding SiC nanocrystals with tunable diameters.

Regulatory Standards for Industrial Ceramic Materials

The regulatory landscape for silicon carbide (SiC) ceramics in high voltage and high temperature industrial applications is complex and multifaceted, requiring adherence to numerous international and regional standards. Organizations such as the International Electrotechnical Commission (IEC), ASTM International, and IEEE have established comprehensive frameworks governing the certification and deployment of these advanced ceramic materials.

IEC 61462 and IEC 62772 specifically address the requirements for ceramic and glass-ceramic insulators for high-voltage applications, detailing the mechanical, electrical, and thermal properties that SiC ceramics must demonstrate. These standards establish minimum performance thresholds for dielectric strength, typically requiring SiC ceramics to withstand field strengths exceeding 10 kV/mm and leakage currents below 1 mA/cm² at operating temperatures.

Temperature resistance standards are particularly stringent, with ASTM C1368 outlining testing methodologies for evaluating ceramic performance under extreme thermal conditions. For high-temperature industrial applications, SiC ceramics must maintain structural integrity and electrical properties at temperatures ranging from 600°C to 1600°C, with thermal cycling resistance requirements specified in ISO 20507.

Safety certification processes present significant regulatory hurdles, with UL 746A and UL 746B establishing protocols for evaluating the flammability, arc resistance, and comparative tracking index (CTI) of ceramic insulators. The European Union's Low Voltage Directive (2014/35/EU) and Machinery Directive (2006/42/EC) further impose CE marking requirements for SiC components used in industrial equipment.

Environmental compliance has become increasingly important, with RoHS (Restriction of Hazardous Substances) and REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) regulations limiting the use of certain additives in ceramic manufacturing processes. While pure SiC is generally compliant, sintering aids and dopants must be carefully selected to maintain regulatory compliance.

Industry-specific standards add another layer of complexity, with IEEE C37.100 series addressing requirements for high-voltage switchgear where SiC ceramics are increasingly utilized. The semiconductor industry has developed SEMI standards that govern the purity and performance characteristics of SiC materials used in power electronics applications, with SEMI M55 specifically addressing SiC wafer specifications.

Harmonization efforts between different regulatory frameworks remain ongoing, with organizations like the International Organization for Standardization (ISO) working to develop unified testing methodologies and performance criteria through standards such as ISO 20507 and ISO 15490, which specifically address technical ceramics for electrical applications.

IEC 61462 and IEC 62772 specifically address the requirements for ceramic and glass-ceramic insulators for high-voltage applications, detailing the mechanical, electrical, and thermal properties that SiC ceramics must demonstrate. These standards establish minimum performance thresholds for dielectric strength, typically requiring SiC ceramics to withstand field strengths exceeding 10 kV/mm and leakage currents below 1 mA/cm² at operating temperatures.

Temperature resistance standards are particularly stringent, with ASTM C1368 outlining testing methodologies for evaluating ceramic performance under extreme thermal conditions. For high-temperature industrial applications, SiC ceramics must maintain structural integrity and electrical properties at temperatures ranging from 600°C to 1600°C, with thermal cycling resistance requirements specified in ISO 20507.

Safety certification processes present significant regulatory hurdles, with UL 746A and UL 746B establishing protocols for evaluating the flammability, arc resistance, and comparative tracking index (CTI) of ceramic insulators. The European Union's Low Voltage Directive (2014/35/EU) and Machinery Directive (2006/42/EC) further impose CE marking requirements for SiC components used in industrial equipment.

Environmental compliance has become increasingly important, with RoHS (Restriction of Hazardous Substances) and REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) regulations limiting the use of certain additives in ceramic manufacturing processes. While pure SiC is generally compliant, sintering aids and dopants must be carefully selected to maintain regulatory compliance.

Industry-specific standards add another layer of complexity, with IEEE C37.100 series addressing requirements for high-voltage switchgear where SiC ceramics are increasingly utilized. The semiconductor industry has developed SEMI standards that govern the purity and performance characteristics of SiC materials used in power electronics applications, with SEMI M55 specifically addressing SiC wafer specifications.

Harmonization efforts between different regulatory frameworks remain ongoing, with organizations like the International Organization for Standardization (ISO) working to develop unified testing methodologies and performance criteria through standards such as ISO 20507 and ISO 15490, which specifically address technical ceramics for electrical applications.

Environmental Impact and Sustainability Considerations

Silicon carbide ceramics in high voltage and high temperature industrial applications present significant environmental and sustainability advantages compared to traditional materials. The production process of SiC ceramics has been evolving toward more energy-efficient methods, reducing the carbon footprint associated with manufacturing. Modern sintering techniques have decreased energy consumption by approximately 30% over the past decade, while advanced powder synthesis methods have reduced harmful emissions by utilizing closed-loop systems.

The exceptional durability of SiC ceramics contributes substantially to sustainability through extended product lifecycles. Industrial components made from silicon carbide typically last 3-5 times longer than conventional alternatives, significantly reducing replacement frequency and associated resource consumption. This longevity translates directly to reduced waste generation and diminished environmental impact throughout the product lifecycle.

In energy applications, SiC ceramics enable more efficient power transmission and conversion systems. High-temperature SiC components in power electronics can improve energy efficiency by 15-20% compared to traditional materials, resulting in substantial energy savings across industrial sectors. This efficiency gain represents a significant contribution to global carbon reduction efforts when implemented at scale.

The raw material considerations for SiC production present both challenges and opportunities. Silicon and carbon are abundant elements, but their extraction and processing can have environmental consequences. Recent innovations in sourcing include utilizing agricultural waste as carbon sources and implementing silicon recovery systems that reduce mining impacts. Several manufacturers have achieved up to 40% recycled content in their SiC formulations without compromising performance characteristics.

End-of-life management for SiC ceramics demonstrates favorable sustainability metrics. Unlike many industrial materials, SiC is chemically stable and non-toxic, posing minimal environmental hazards during disposal. Emerging recycling technologies can recover up to 75% of silicon carbide from end-of-life components, creating potential for circular economy applications. Mechanical and chemical recovery processes are becoming increasingly viable as the installed base of SiC components grows.

Regulatory frameworks worldwide are increasingly recognizing the environmental benefits of SiC ceramics. The European Union's Sustainable Products Initiative and similar programs in North America and Asia have begun to incentivize the adoption of longer-lasting, energy-efficient materials like silicon carbide. These policy developments are expected to accelerate industry transition toward more sustainable material choices in high-performance industrial applications.

The exceptional durability of SiC ceramics contributes substantially to sustainability through extended product lifecycles. Industrial components made from silicon carbide typically last 3-5 times longer than conventional alternatives, significantly reducing replacement frequency and associated resource consumption. This longevity translates directly to reduced waste generation and diminished environmental impact throughout the product lifecycle.

In energy applications, SiC ceramics enable more efficient power transmission and conversion systems. High-temperature SiC components in power electronics can improve energy efficiency by 15-20% compared to traditional materials, resulting in substantial energy savings across industrial sectors. This efficiency gain represents a significant contribution to global carbon reduction efforts when implemented at scale.

The raw material considerations for SiC production present both challenges and opportunities. Silicon and carbon are abundant elements, but their extraction and processing can have environmental consequences. Recent innovations in sourcing include utilizing agricultural waste as carbon sources and implementing silicon recovery systems that reduce mining impacts. Several manufacturers have achieved up to 40% recycled content in their SiC formulations without compromising performance characteristics.

End-of-life management for SiC ceramics demonstrates favorable sustainability metrics. Unlike many industrial materials, SiC is chemically stable and non-toxic, posing minimal environmental hazards during disposal. Emerging recycling technologies can recover up to 75% of silicon carbide from end-of-life components, creating potential for circular economy applications. Mechanical and chemical recovery processes are becoming increasingly viable as the installed base of SiC components grows.

Regulatory frameworks worldwide are increasingly recognizing the environmental benefits of SiC ceramics. The European Union's Sustainable Products Initiative and similar programs in North America and Asia have begun to incentivize the adoption of longer-lasting, energy-efficient materials like silicon carbide. These policy developments are expected to accelerate industry transition toward more sustainable material choices in high-performance industrial applications.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!