Silicon carbide ceramics for large scale industrial and renewable energy integration

SEP 24, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

SiC Ceramics Background and Development Goals

Silicon carbide (SiC) ceramics have emerged as revolutionary materials in industrial applications and renewable energy systems due to their exceptional thermal, mechanical, and electrical properties. The development of SiC ceramics dates back to the late 19th century when Edward Acheson accidentally discovered silicon carbide while attempting to synthesize diamonds. However, it wasn't until the mid-20th century that significant advancements in manufacturing techniques enabled the production of high-quality SiC ceramics for industrial applications.

The evolution of SiC ceramics has been marked by continuous improvements in synthesis methods, from the original Acheson process to modern chemical vapor deposition (CVD) and sintering techniques. These advancements have progressively enhanced the material's purity, density, and overall performance characteristics, making it increasingly suitable for demanding applications in harsh environments.

In recent years, the global push toward sustainable energy solutions has significantly accelerated research and development in SiC ceramics. The material's ability to withstand extreme temperatures (up to 1600°C), resist corrosion, and maintain structural integrity under high mechanical stress makes it particularly valuable for renewable energy systems that often operate under challenging conditions.

The primary technical goals for SiC ceramics in large-scale industrial and renewable energy integration focus on several key areas. First, improving manufacturing scalability to reduce production costs while maintaining high-quality standards is essential for broader market adoption. Current manufacturing processes remain relatively expensive, limiting widespread implementation despite the material's superior properties.

Second, enhancing the material's thermal conductivity and electrical insulation properties is crucial for applications in power electronics and energy conversion systems. These improvements would enable more efficient energy transfer and storage, directly supporting renewable energy integration efforts.

Third, developing composite formulations that combine SiC with other materials to create tailored solutions for specific applications represents another important goal. These composites could potentially address current limitations while preserving SiC's core advantages.

Finally, advancing joining and integration technologies to facilitate the incorporation of SiC components into larger systems remains a significant technical challenge. The development of reliable methods for connecting SiC ceramics to other materials would greatly expand their application potential in complex industrial systems and renewable energy infrastructure.

The trajectory of SiC ceramic development points toward increasingly specialized formulations designed for specific applications within the renewable energy sector, including solar thermal systems, wind turbine components, geothermal installations, and hydrogen production technologies.

The evolution of SiC ceramics has been marked by continuous improvements in synthesis methods, from the original Acheson process to modern chemical vapor deposition (CVD) and sintering techniques. These advancements have progressively enhanced the material's purity, density, and overall performance characteristics, making it increasingly suitable for demanding applications in harsh environments.

In recent years, the global push toward sustainable energy solutions has significantly accelerated research and development in SiC ceramics. The material's ability to withstand extreme temperatures (up to 1600°C), resist corrosion, and maintain structural integrity under high mechanical stress makes it particularly valuable for renewable energy systems that often operate under challenging conditions.

The primary technical goals for SiC ceramics in large-scale industrial and renewable energy integration focus on several key areas. First, improving manufacturing scalability to reduce production costs while maintaining high-quality standards is essential for broader market adoption. Current manufacturing processes remain relatively expensive, limiting widespread implementation despite the material's superior properties.

Second, enhancing the material's thermal conductivity and electrical insulation properties is crucial for applications in power electronics and energy conversion systems. These improvements would enable more efficient energy transfer and storage, directly supporting renewable energy integration efforts.

Third, developing composite formulations that combine SiC with other materials to create tailored solutions for specific applications represents another important goal. These composites could potentially address current limitations while preserving SiC's core advantages.

Finally, advancing joining and integration technologies to facilitate the incorporation of SiC components into larger systems remains a significant technical challenge. The development of reliable methods for connecting SiC ceramics to other materials would greatly expand their application potential in complex industrial systems and renewable energy infrastructure.

The trajectory of SiC ceramic development points toward increasingly specialized formulations designed for specific applications within the renewable energy sector, including solar thermal systems, wind turbine components, geothermal installations, and hydrogen production technologies.

Market Analysis for Industrial and Renewable Energy Applications

The silicon carbide (SiC) ceramics market for industrial and renewable energy applications is experiencing robust growth, driven by increasing demand for high-performance materials in extreme operating environments. The global SiC ceramics market was valued at approximately $4.12 billion in 2021 and is projected to reach $7.18 billion by 2028, representing a compound annual growth rate (CAGR) of 8.3% during the forecast period.

In the industrial sector, SiC ceramics are witnessing significant adoption in metallurgy, chemical processing, and manufacturing industries due to their exceptional thermal shock resistance, high-temperature stability, and corrosion resistance. The material's ability to withstand temperatures exceeding 1600°C while maintaining structural integrity makes it indispensable for applications such as industrial furnace components, where market demand has increased by 12% annually since 2019.

The renewable energy sector presents particularly promising growth opportunities for SiC ceramics. In solar energy applications, SiC components are increasingly utilized in photovoltaic inverters and power electronics, improving energy conversion efficiency by up to 15% compared to traditional materials. The concentrated solar power (CSP) segment is expected to grow at 10.2% CAGR through 2028, with SiC ceramics playing a crucial role in receiver tubes and thermal storage systems.

Wind energy represents another significant market, with SiC ceramics being incorporated into next-generation turbine designs. The material's lightweight yet durable properties contribute to larger, more efficient turbine blades, potentially increasing energy output by 7-9% while extending operational lifespan by up to 40% compared to conventional materials.

Geographically, Asia-Pacific dominates the market with 42% share, led by China's aggressive renewable energy expansion and industrial modernization initiatives. North America and Europe follow with 28% and 23% market shares respectively, with Europe showing the fastest growth rate due to stringent environmental regulations and renewable energy targets.

Key market challenges include high production costs, with SiC ceramics typically costing 3-5 times more than traditional alternatives, and technical complexities in large-scale manufacturing. However, recent manufacturing innovations have reduced production costs by approximately 18% over the past three years, suggesting improving economic viability.

The market is also influenced by regulatory factors, with carbon pricing mechanisms and renewable energy incentives in over 45 countries directly benefiting SiC ceramic adoption. Industry analysts predict that as production scales and technologies mature, the price premium for SiC ceramics could decrease by 30-35% by 2030, significantly expanding market penetration across both industrial and renewable energy sectors.

In the industrial sector, SiC ceramics are witnessing significant adoption in metallurgy, chemical processing, and manufacturing industries due to their exceptional thermal shock resistance, high-temperature stability, and corrosion resistance. The material's ability to withstand temperatures exceeding 1600°C while maintaining structural integrity makes it indispensable for applications such as industrial furnace components, where market demand has increased by 12% annually since 2019.

The renewable energy sector presents particularly promising growth opportunities for SiC ceramics. In solar energy applications, SiC components are increasingly utilized in photovoltaic inverters and power electronics, improving energy conversion efficiency by up to 15% compared to traditional materials. The concentrated solar power (CSP) segment is expected to grow at 10.2% CAGR through 2028, with SiC ceramics playing a crucial role in receiver tubes and thermal storage systems.

Wind energy represents another significant market, with SiC ceramics being incorporated into next-generation turbine designs. The material's lightweight yet durable properties contribute to larger, more efficient turbine blades, potentially increasing energy output by 7-9% while extending operational lifespan by up to 40% compared to conventional materials.

Geographically, Asia-Pacific dominates the market with 42% share, led by China's aggressive renewable energy expansion and industrial modernization initiatives. North America and Europe follow with 28% and 23% market shares respectively, with Europe showing the fastest growth rate due to stringent environmental regulations and renewable energy targets.

Key market challenges include high production costs, with SiC ceramics typically costing 3-5 times more than traditional alternatives, and technical complexities in large-scale manufacturing. However, recent manufacturing innovations have reduced production costs by approximately 18% over the past three years, suggesting improving economic viability.

The market is also influenced by regulatory factors, with carbon pricing mechanisms and renewable energy incentives in over 45 countries directly benefiting SiC ceramic adoption. Industry analysts predict that as production scales and technologies mature, the price premium for SiC ceramics could decrease by 30-35% by 2030, significantly expanding market penetration across both industrial and renewable energy sectors.

Current State and Technical Barriers of SiC Ceramics

Silicon carbide (SiC) ceramics have emerged as critical materials for high-temperature, high-stress, and corrosive environments in industrial and renewable energy applications. Currently, SiC ceramics are commercially produced through several methods including sintering, reaction bonding, chemical vapor deposition, and liquid phase sintering. The global market for SiC ceramics is experiencing steady growth, with an estimated market value of approximately $4.5 billion in 2022, projected to reach $7.2 billion by 2027.

In industrial applications, SiC ceramics have achieved significant penetration in sectors requiring extreme wear resistance and thermal stability. Notable implementations include heat exchangers, mechanical seals, bearings, and components for chemical processing equipment. Within renewable energy systems, SiC ceramics are increasingly utilized in concentrated solar power plants, geothermal energy systems, and as components in fuel cells and hydrogen production technologies.

Despite these advancements, several technical barriers impede the wider adoption of SiC ceramics. The manufacturing process remains energy-intensive and costly, with sintering temperatures typically exceeding 2000°C. This high-temperature requirement contributes significantly to production expenses and carbon footprint, contradicting sustainability goals of renewable energy applications.

Material brittleness presents another substantial challenge, with fracture toughness values typically ranging from 3-5 MPa·m^(1/2), considerably lower than metals. This inherent brittleness limits application in components subject to mechanical shock or vibration, necessitating complex design considerations or hybrid material approaches.

Scalability issues persist in manufacturing large-format SiC ceramic components needed for industrial-scale applications. Current production capabilities generally limit component sizes to under 500mm in any dimension, whereas many industrial applications require significantly larger components. This limitation stems from challenges in maintaining uniform properties throughout larger pieces during sintering processes.

Joining and integration difficulties represent another significant barrier. Traditional welding methods are ineffective with ceramics, requiring specialized techniques such as active metal brazing or mechanical fastening, which often introduce weak points in the overall system. These joining challenges complicate the integration of SiC components into larger systems.

Quality control and non-destructive testing methods remain underdeveloped compared to metallic materials. The opacity and high hardness of SiC ceramics complicate conventional inspection techniques, leading to higher rejection rates and increased production costs. Advanced techniques such as terahertz imaging and acoustic microscopy show promise but require further development for industrial implementation.

In industrial applications, SiC ceramics have achieved significant penetration in sectors requiring extreme wear resistance and thermal stability. Notable implementations include heat exchangers, mechanical seals, bearings, and components for chemical processing equipment. Within renewable energy systems, SiC ceramics are increasingly utilized in concentrated solar power plants, geothermal energy systems, and as components in fuel cells and hydrogen production technologies.

Despite these advancements, several technical barriers impede the wider adoption of SiC ceramics. The manufacturing process remains energy-intensive and costly, with sintering temperatures typically exceeding 2000°C. This high-temperature requirement contributes significantly to production expenses and carbon footprint, contradicting sustainability goals of renewable energy applications.

Material brittleness presents another substantial challenge, with fracture toughness values typically ranging from 3-5 MPa·m^(1/2), considerably lower than metals. This inherent brittleness limits application in components subject to mechanical shock or vibration, necessitating complex design considerations or hybrid material approaches.

Scalability issues persist in manufacturing large-format SiC ceramic components needed for industrial-scale applications. Current production capabilities generally limit component sizes to under 500mm in any dimension, whereas many industrial applications require significantly larger components. This limitation stems from challenges in maintaining uniform properties throughout larger pieces during sintering processes.

Joining and integration difficulties represent another significant barrier. Traditional welding methods are ineffective with ceramics, requiring specialized techniques such as active metal brazing or mechanical fastening, which often introduce weak points in the overall system. These joining challenges complicate the integration of SiC components into larger systems.

Quality control and non-destructive testing methods remain underdeveloped compared to metallic materials. The opacity and high hardness of SiC ceramics complicate conventional inspection techniques, leading to higher rejection rates and increased production costs. Advanced techniques such as terahertz imaging and acoustic microscopy show promise but require further development for industrial implementation.

Current SiC Ceramic Manufacturing Solutions

01 Manufacturing methods for silicon carbide ceramics

Various manufacturing methods are employed to produce silicon carbide ceramics with enhanced properties. These methods include sintering processes, hot pressing, and reaction bonding techniques that can yield dense, high-strength ceramic materials. The manufacturing processes often involve specific temperature controls, pressure applications, and the use of sintering aids to achieve desired microstructures and mechanical properties.- Manufacturing methods for silicon carbide ceramics: Various manufacturing methods are employed to produce silicon carbide ceramics with enhanced properties. These methods include sintering processes, hot pressing techniques, and reaction bonding approaches. The manufacturing processes can be optimized to control grain size, density, and microstructure, which directly influence the mechanical and thermal properties of the final ceramic product. Advanced processing techniques help to minimize defects and improve the overall quality of silicon carbide ceramics.

- Composition and additives for silicon carbide ceramics: The composition of silicon carbide ceramics can be modified with various additives to enhance specific properties. Sintering aids such as aluminum oxide, yttrium oxide, and rare earth elements are commonly used to promote densification at lower temperatures. Other additives may include boron compounds, carbon sources, and metal oxides that influence grain growth, phase formation, and microstructural development. The careful selection and proportion of these additives significantly impact the final ceramic properties.

- High-temperature applications of silicon carbide ceramics: Silicon carbide ceramics exhibit exceptional thermal stability and mechanical strength at elevated temperatures, making them ideal for high-temperature applications. These ceramics maintain their structural integrity in extreme environments, including furnace components, gas turbine parts, and heat exchangers. Their resistance to thermal shock, oxidation, and creep at high temperatures enables their use in aerospace, energy generation, and industrial processing sectors where conventional materials would fail.

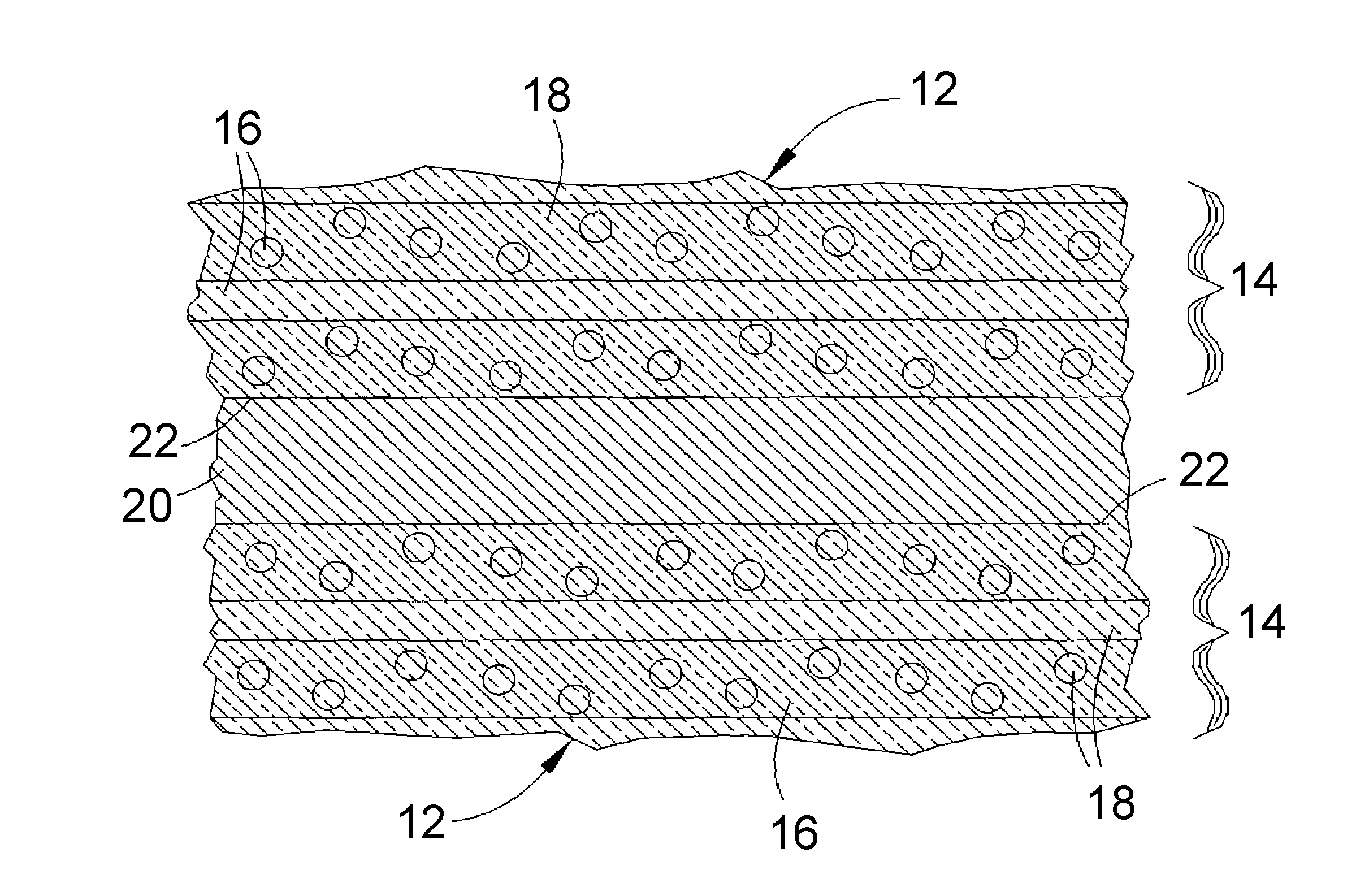

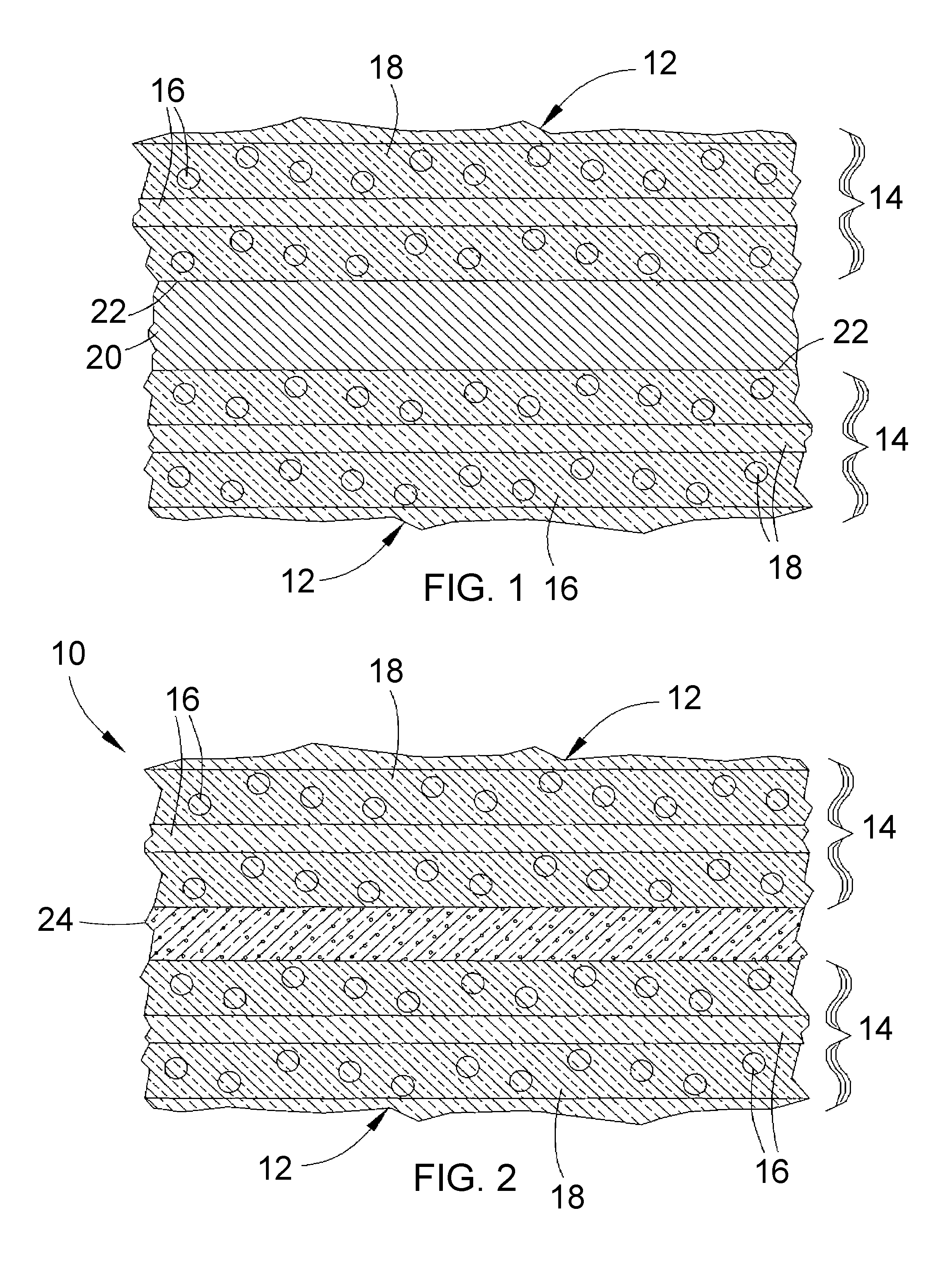

- Advanced silicon carbide ceramic composites: Advanced silicon carbide ceramic composites incorporate reinforcing phases such as fibers, whiskers, or particles to enhance mechanical properties. These composites may combine silicon carbide with other ceramic materials, metals, or carbon to create hybrid structures with tailored characteristics. Fiber-reinforced silicon carbide composites offer improved fracture toughness and damage tolerance compared to monolithic ceramics. These advanced materials find applications in cutting tools, armor systems, and components requiring exceptional wear resistance.

- Novel applications and emerging technologies for silicon carbide ceramics: Silicon carbide ceramics are finding novel applications in emerging technologies due to their unique combination of properties. These include semiconductor applications, biomedical implants, nuclear fuel cladding, and environmental remediation systems. Recent innovations focus on nanoscale silicon carbide structures, porous ceramics with controlled porosity, and functionally graded materials. The development of cost-effective processing techniques is expanding the commercial viability of silicon carbide ceramics in these new application areas.

02 Composition and additives for silicon carbide ceramics

The composition of silicon carbide ceramics can be modified with various additives to enhance specific properties. These additives include sintering aids, binders, and other compounds that improve densification, mechanical strength, and thermal stability. The careful selection and proportion of these additives play a crucial role in determining the final properties of the ceramic material.Expand Specific Solutions03 Applications of silicon carbide ceramics in high-temperature environments

Silicon carbide ceramics are widely used in high-temperature applications due to their excellent thermal stability, oxidation resistance, and mechanical strength at elevated temperatures. These ceramics find applications in furnace components, heat exchangers, gas turbines, and other high-temperature industrial equipment where conventional materials would fail.Expand Specific Solutions04 Silicon carbide ceramic composites and reinforcement techniques

Silicon carbide ceramic composites incorporate various reinforcement materials or techniques to enhance mechanical properties such as toughness, strength, and crack resistance. These composites may include fiber reinforcements, particulate additions, or multi-phase structures that provide improved performance compared to monolithic silicon carbide ceramics.Expand Specific Solutions05 Surface treatments and coatings for silicon carbide ceramics

Various surface treatment methods and coating technologies are applied to silicon carbide ceramics to enhance their performance in specific applications. These treatments can improve corrosion resistance, oxidation protection, electrical properties, or tribological behavior. Surface modifications may include chemical treatments, physical vapor deposition, or the application of specialized coating materials.Expand Specific Solutions

Leading Manufacturers and Research Institutions

Silicon carbide ceramics for large-scale industrial and renewable energy integration is currently in a growth phase, with the market expanding rapidly due to increasing demand for high-temperature, corrosion-resistant materials in renewable energy applications. The global market size is projected to reach significant value as industries transition to cleaner energy solutions. Technologically, the field shows varying maturity levels across applications. Leading companies like Wolfspeed and Saint-Gobain Ceramics & Plastics have established strong positions in SiC material development, while Corning and Toshiba are advancing integration technologies. Academic institutions including Zhejiang University and Xi'an Jiaotong University are driving fundamental research, collaborating with industrial players like General Electric and SGL Carbon to bridge the gap between laboratory innovations and commercial applications. This competitive landscape reflects both established players and emerging specialists focusing on next-generation SiC ceramic solutions.

Wolfspeed, Inc.

Technical Solution: Wolfspeed has pioneered silicon carbide (SiC) technology for renewable energy integration through their advanced manufacturing processes. Their technology focuses on producing high-purity SiC substrates and epitaxial wafers that form the foundation for power electronic devices. Wolfspeed's SiC MOSFETs and diodes are specifically designed for high-voltage, high-temperature applications in renewable energy systems, offering switching frequencies up to 100kHz[1]. Their proprietary manufacturing technique involves chemical vapor deposition (CVD) to create 150mm and 200mm SiC wafers with minimal defects, achieving 99.9% purity levels. For renewable energy integration, Wolfspeed has developed specialized SiC power modules rated for 1200V and 1700V operations that can handle temperatures up to 175°C, making them ideal for solar inverters, wind power converters, and grid-scale energy storage systems[2]. Their latest generation of SiC devices incorporates advanced trench MOSFET designs that reduce on-resistance by approximately 40% compared to previous generations, significantly improving energy efficiency in power conversion applications.

Strengths: Industry-leading SiC substrate quality with lowest defect density; highest power density in commercially available SiC modules; proven reliability with over 30 trillion device field hours. Weaknesses: Higher initial cost compared to silicon alternatives; limited manufacturing capacity despite recent expansions; requires specialized packaging solutions to fully utilize temperature capabilities.

Saint-Gobain Ceramics & Plastics, Inc.

Technical Solution: Saint-Gobain has developed proprietary silicon carbide ceramic solutions specifically engineered for renewable energy and industrial applications requiring extreme durability. Their Hexoloy® SiC ceramic material features a unique sintering process that creates a self-bonded alpha silicon carbide with over 98% theoretical density and near-zero porosity[3]. This material exhibits exceptional thermal conductivity (125 W/m·K), allowing for efficient heat transfer in concentrated solar power systems and industrial waste heat recovery applications. Saint-Gobain's manufacturing process involves pressureless sintering at temperatures exceeding 2000°C, followed by precision machining to create complex geometries required for heat exchangers and thermal storage components. Their SiC ceramic heat exchangers can operate continuously at temperatures up to 1600°C with corrosion resistance to most acids, alkalis, and molten metals[4]. For large-scale renewable integration, Saint-Gobain has developed specialized SiC ceramic components for molten salt thermal storage systems in concentrated solar power plants, capable of withstanding thermal cycling and corrosive environments while maintaining structural integrity for over 25 years of operation. Their latest innovation includes SiC-based membranes for hydrogen production systems that can operate at temperatures above 800°C with minimal degradation.

Strengths: Exceptional thermal shock resistance (can withstand temperature differentials of over 500°C); superior chemical resistance in harsh environments; proven longevity with components lasting 3-5 times longer than metal alternatives. Weaknesses: Higher manufacturing costs compared to traditional ceramics; limited flexibility in design modifications after sintering; requires specialized installation techniques to accommodate brittle nature of ceramic materials.

Key Patents and Technical Innovations

Process for joining silicon-containing ceramic articles and components produced thereby

PatentInactiveUS20120177488A1

Innovation

- A process involving a reactive metal-containing braze material is used to join silicon-containing ceramic articles by reacting the metal with the silicon to form a silicide phase at temperatures below the melting point of silicon, thereby avoiding thermal degradation and creating a strong, oxidation-resistant bond.

Silicon carbide ceramic

PatentActiveJP2014189466A

Innovation

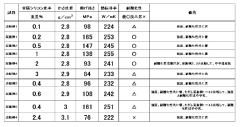

- A silicon carbide ceramic composition comprising α-SiC and β-SiC as main components, with 0.2-2% metallic silicon and 85% open pores of 3 μm or less, balanced with a bulk specific gravity of 2.9-3.0 g/cm³, to enhance thermal conductivity and strength.

Environmental Impact and Sustainability Assessment

Silicon carbide ceramics present a significant opportunity for advancing sustainability goals in industrial and renewable energy applications. The environmental footprint of SiC ceramics begins with raw material extraction, where the mining of silica and carbon sources creates land disturbance and habitat fragmentation. However, compared to traditional materials like steel or conventional ceramics, SiC production requires less overall material extraction due to its superior durability and performance characteristics.

The manufacturing process of SiC ceramics involves high-temperature sintering, typically requiring temperatures exceeding 2000°C. This energy-intensive process contributes substantially to the carbon footprint of SiC components. Recent advancements in manufacturing technologies, including microwave-assisted sintering and spark plasma sintering, have demonstrated potential energy savings of 30-40% compared to conventional methods, significantly reducing associated greenhouse gas emissions.

Life cycle assessment (LCA) studies indicate that despite the energy-intensive production phase, SiC ceramics offer net environmental benefits over their operational lifetime. In renewable energy applications such as concentrated solar power systems, SiC components extend system lifespans by 40-60% compared to conventional materials, reducing replacement frequency and associated resource consumption. Similarly, in industrial settings, SiC's superior thermal conductivity and wear resistance translate to energy savings of 15-25% in various high-temperature processes.

Water consumption represents another critical environmental consideration. Traditional ceramic manufacturing processes typically require substantial water for processing and cooling. Advanced SiC production methods have achieved water use reductions of approximately 35% through closed-loop systems and process optimizations, addressing water scarcity concerns in manufacturing regions.

End-of-life management presents both challenges and opportunities. While SiC ceramics are extremely durable and chemically stable, making them difficult to recycle through conventional means, emerging technologies for reclaiming SiC from decommissioned components show promise. Mechanical separation and chemical recovery processes can recover up to 70% of SiC material for reuse, though these technologies remain in developmental stages.

From a sustainability perspective, SiC ceramics contribute significantly to decarbonization efforts in energy-intensive industries. Their implementation in renewable energy systems improves efficiency and reduces material turnover, while their application in industrial processes reduces energy consumption and associated emissions. The net environmental benefit calculation must balance the initial production impacts against operational savings over the extended service life of these advanced ceramic materials.

The manufacturing process of SiC ceramics involves high-temperature sintering, typically requiring temperatures exceeding 2000°C. This energy-intensive process contributes substantially to the carbon footprint of SiC components. Recent advancements in manufacturing technologies, including microwave-assisted sintering and spark plasma sintering, have demonstrated potential energy savings of 30-40% compared to conventional methods, significantly reducing associated greenhouse gas emissions.

Life cycle assessment (LCA) studies indicate that despite the energy-intensive production phase, SiC ceramics offer net environmental benefits over their operational lifetime. In renewable energy applications such as concentrated solar power systems, SiC components extend system lifespans by 40-60% compared to conventional materials, reducing replacement frequency and associated resource consumption. Similarly, in industrial settings, SiC's superior thermal conductivity and wear resistance translate to energy savings of 15-25% in various high-temperature processes.

Water consumption represents another critical environmental consideration. Traditional ceramic manufacturing processes typically require substantial water for processing and cooling. Advanced SiC production methods have achieved water use reductions of approximately 35% through closed-loop systems and process optimizations, addressing water scarcity concerns in manufacturing regions.

End-of-life management presents both challenges and opportunities. While SiC ceramics are extremely durable and chemically stable, making them difficult to recycle through conventional means, emerging technologies for reclaiming SiC from decommissioned components show promise. Mechanical separation and chemical recovery processes can recover up to 70% of SiC material for reuse, though these technologies remain in developmental stages.

From a sustainability perspective, SiC ceramics contribute significantly to decarbonization efforts in energy-intensive industries. Their implementation in renewable energy systems improves efficiency and reduces material turnover, while their application in industrial processes reduces energy consumption and associated emissions. The net environmental benefit calculation must balance the initial production impacts against operational savings over the extended service life of these advanced ceramic materials.

Supply Chain Resilience and Raw Material Considerations

The supply chain for silicon carbide (SiC) ceramics presents unique challenges and strategic considerations for large-scale industrial and renewable energy applications. Raw silicon carbide production relies heavily on high-purity silica sand and petroleum coke, with China currently dominating global production at approximately 80% of world supply. This geographic concentration creates inherent vulnerabilities in the supply chain, particularly as demand increases for renewable energy applications and industrial processes requiring high-temperature ceramics.

Recent global disruptions, including the COVID-19 pandemic and geopolitical tensions, have exposed critical weaknesses in the SiC ceramic supply chain. Lead times for specialized SiC components have extended from typical 8-12 weeks to 20-30 weeks in some cases, significantly impacting project timelines for renewable energy installations. Price volatility has also emerged as a concern, with raw SiC material costs increasing by 30-45% between 2020 and 2023, driven by both supply constraints and surging demand.

Material quality consistency represents another significant challenge. The production of high-performance SiC ceramics for renewable energy applications requires exceptionally pure raw materials with minimal impurities. Variations in raw material quality can lead to inconsistent performance in final components, particularly problematic for applications like concentrated solar power receivers or high-temperature heat exchangers where thermal shock resistance is critical.

Diversification strategies are emerging as essential for supply chain resilience. Several European and North American manufacturers are developing alternative sourcing networks, including investments in SiC production facilities in Vietnam, Malaysia, and Mexico. Additionally, recycling initiatives are gaining traction, with technical advances enabling the recovery of up to 60% of SiC from end-of-life components, potentially reducing raw material dependencies.

Vertical integration is becoming increasingly common among major players in the renewable energy sector. Companies like Cree/Wolfspeed and STMicroelectronics have made significant investments to control larger portions of their SiC supply chains, from raw material processing to final component manufacturing. This approach helps mitigate supply disruptions while ensuring quality control throughout the production process.

Looking forward, synthetic alternatives and material substitution research offer promising pathways for reducing supply chain vulnerabilities. Laboratory-scale processes for synthesizing SiC from alternative silicon sources, including agricultural waste products, demonstrate potential for diversifying raw material inputs, though commercial viability remains several years away from widespread implementation in industrial applications.

Recent global disruptions, including the COVID-19 pandemic and geopolitical tensions, have exposed critical weaknesses in the SiC ceramic supply chain. Lead times for specialized SiC components have extended from typical 8-12 weeks to 20-30 weeks in some cases, significantly impacting project timelines for renewable energy installations. Price volatility has also emerged as a concern, with raw SiC material costs increasing by 30-45% between 2020 and 2023, driven by both supply constraints and surging demand.

Material quality consistency represents another significant challenge. The production of high-performance SiC ceramics for renewable energy applications requires exceptionally pure raw materials with minimal impurities. Variations in raw material quality can lead to inconsistent performance in final components, particularly problematic for applications like concentrated solar power receivers or high-temperature heat exchangers where thermal shock resistance is critical.

Diversification strategies are emerging as essential for supply chain resilience. Several European and North American manufacturers are developing alternative sourcing networks, including investments in SiC production facilities in Vietnam, Malaysia, and Mexico. Additionally, recycling initiatives are gaining traction, with technical advances enabling the recovery of up to 60% of SiC from end-of-life components, potentially reducing raw material dependencies.

Vertical integration is becoming increasingly common among major players in the renewable energy sector. Companies like Cree/Wolfspeed and STMicroelectronics have made significant investments to control larger portions of their SiC supply chains, from raw material processing to final component manufacturing. This approach helps mitigate supply disruptions while ensuring quality control throughout the production process.

Looking forward, synthetic alternatives and material substitution research offer promising pathways for reducing supply chain vulnerabilities. Laboratory-scale processes for synthesizing SiC from alternative silicon sources, including agricultural waste products, demonstrate potential for diversifying raw material inputs, though commercial viability remains several years away from widespread implementation in industrial applications.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!