How to Pursue Robust Designs in Cellophane Formulations?

JUL 9, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Cellophane Evolution

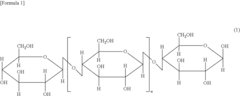

Cellophane, a transparent film made from regenerated cellulose, has undergone significant evolution since its invention in the early 20th century. The journey of cellophane formulations began with Jacques E. Brandenberger's discovery in 1908, initially aimed at creating a waterproof tablecloth. This accidental invention laid the foundation for a material that would revolutionize packaging and various industrial applications.

The early stages of cellophane development focused on improving its moisture resistance and clarity. In the 1920s and 1930s, researchers at DuPont made significant strides in enhancing cellophane's properties, particularly its barrier characteristics against moisture and gases. These advancements expanded cellophane's use in food packaging, extending the shelf life of products and improving their visual appeal to consumers.

The 1940s and 1950s saw a surge in cellophane production and application diversity. During this period, manufacturers explored various additives and coatings to tailor cellophane's properties for specific uses. The introduction of heat-sealable coatings in the 1950s marked a significant milestone, enabling more efficient packaging processes and broadening cellophane's market reach.

As environmental concerns gained prominence in the latter half of the 20th century, cellophane formulations began to evolve towards more sustainable solutions. Researchers focused on developing biodegradable variants and exploring renewable sources for cellulose. This shift aligned with growing consumer demand for eco-friendly packaging materials.

The turn of the millennium brought new challenges and opportunities for cellophane formulations. Advancements in nanotechnology opened avenues for enhancing cellophane's barrier properties and mechanical strength at the molecular level. Researchers began incorporating nanoparticles and exploring novel cellulose sources, such as bacterial cellulose, to create high-performance cellophane variants.

Recent years have seen a renewed interest in cellophane as a potential alternative to petroleum-based plastics. Efforts to improve cellophane's moisture resistance while maintaining its biodegradability have intensified. Innovations in cross-linking techniques and the incorporation of natural additives have led to more robust cellophane formulations capable of competing with synthetic polymers in various applications.

The pursuit of robust designs in cellophane formulations continues to evolve, driven by the need for sustainable, high-performance materials. Current research focuses on optimizing cellophane's mechanical properties, enhancing its barrier characteristics, and improving its processability. The integration of smart technologies, such as indicators for food freshness or antimicrobial properties, represents the cutting edge of cellophane evolution, promising to expand its functionality and market potential in the coming years.

The early stages of cellophane development focused on improving its moisture resistance and clarity. In the 1920s and 1930s, researchers at DuPont made significant strides in enhancing cellophane's properties, particularly its barrier characteristics against moisture and gases. These advancements expanded cellophane's use in food packaging, extending the shelf life of products and improving their visual appeal to consumers.

The 1940s and 1950s saw a surge in cellophane production and application diversity. During this period, manufacturers explored various additives and coatings to tailor cellophane's properties for specific uses. The introduction of heat-sealable coatings in the 1950s marked a significant milestone, enabling more efficient packaging processes and broadening cellophane's market reach.

As environmental concerns gained prominence in the latter half of the 20th century, cellophane formulations began to evolve towards more sustainable solutions. Researchers focused on developing biodegradable variants and exploring renewable sources for cellulose. This shift aligned with growing consumer demand for eco-friendly packaging materials.

The turn of the millennium brought new challenges and opportunities for cellophane formulations. Advancements in nanotechnology opened avenues for enhancing cellophane's barrier properties and mechanical strength at the molecular level. Researchers began incorporating nanoparticles and exploring novel cellulose sources, such as bacterial cellulose, to create high-performance cellophane variants.

Recent years have seen a renewed interest in cellophane as a potential alternative to petroleum-based plastics. Efforts to improve cellophane's moisture resistance while maintaining its biodegradability have intensified. Innovations in cross-linking techniques and the incorporation of natural additives have led to more robust cellophane formulations capable of competing with synthetic polymers in various applications.

The pursuit of robust designs in cellophane formulations continues to evolve, driven by the need for sustainable, high-performance materials. Current research focuses on optimizing cellophane's mechanical properties, enhancing its barrier characteristics, and improving its processability. The integration of smart technologies, such as indicators for food freshness or antimicrobial properties, represents the cutting edge of cellophane evolution, promising to expand its functionality and market potential in the coming years.

Market Demand Analysis

The market demand for robust cellophane formulations has been steadily increasing across various industries. This growth is primarily driven by the rising consumer preference for sustainable and biodegradable packaging materials. Cellophane, being a renewable and compostable material, aligns well with the global shift towards eco-friendly alternatives to traditional plastics.

In the food packaging sector, there is a significant demand for cellophane due to its excellent barrier properties against moisture and gases. This characteristic makes it ideal for preserving food quality and extending shelf life. The food industry's focus on reducing food waste and improving packaging sustainability has further boosted the demand for advanced cellophane formulations.

The personal care and cosmetics industry has also shown increased interest in cellophane-based packaging solutions. Consumers in this sector are increasingly conscious of the environmental impact of their purchases, leading to a growing demand for biodegradable packaging options. Robust cellophane formulations that can withstand the rigors of transportation and storage while maintaining product integrity are highly sought after.

In the pharmaceutical sector, there is a growing need for cellophane-based blister packs and sachets. The industry requires packaging materials that offer excellent barrier properties against moisture and oxygen while being environmentally friendly. This has created a niche market for specialized cellophane formulations that meet stringent pharmaceutical packaging standards.

The e-commerce boom has further fueled the demand for robust cellophane formulations. As online shopping continues to grow, there is an increased need for protective packaging materials that can withstand the challenges of shipping and handling. Cellophane's flexibility and strength make it an attractive option for protective wrapping and void fill applications in this sector.

Market research indicates that the global cellophane market is expected to grow at a compound annual growth rate (CAGR) of over 4% in the coming years. This growth is attributed to the material's versatility, biodegradability, and potential for customization through advanced formulations. The Asia-Pacific region is anticipated to be the fastest-growing market for cellophane, driven by rapid industrialization and increasing environmental awareness in countries like China and India.

However, the market also faces challenges. The cost of producing robust cellophane formulations remains higher compared to some synthetic alternatives. This price sensitivity is particularly evident in developing markets where cost often takes precedence over environmental considerations. Additionally, the performance limitations of current cellophane formulations in certain high-stress applications present opportunities for innovation and market expansion.

To capitalize on the growing market demand, manufacturers are investing in research and development to create more robust cellophane formulations. These efforts focus on improving tensile strength, barrier properties, and heat resistance while maintaining the material's biodegradability. The development of such advanced formulations is expected to open up new application areas and further drive market growth in the coming years.

In the food packaging sector, there is a significant demand for cellophane due to its excellent barrier properties against moisture and gases. This characteristic makes it ideal for preserving food quality and extending shelf life. The food industry's focus on reducing food waste and improving packaging sustainability has further boosted the demand for advanced cellophane formulations.

The personal care and cosmetics industry has also shown increased interest in cellophane-based packaging solutions. Consumers in this sector are increasingly conscious of the environmental impact of their purchases, leading to a growing demand for biodegradable packaging options. Robust cellophane formulations that can withstand the rigors of transportation and storage while maintaining product integrity are highly sought after.

In the pharmaceutical sector, there is a growing need for cellophane-based blister packs and sachets. The industry requires packaging materials that offer excellent barrier properties against moisture and oxygen while being environmentally friendly. This has created a niche market for specialized cellophane formulations that meet stringent pharmaceutical packaging standards.

The e-commerce boom has further fueled the demand for robust cellophane formulations. As online shopping continues to grow, there is an increased need for protective packaging materials that can withstand the challenges of shipping and handling. Cellophane's flexibility and strength make it an attractive option for protective wrapping and void fill applications in this sector.

Market research indicates that the global cellophane market is expected to grow at a compound annual growth rate (CAGR) of over 4% in the coming years. This growth is attributed to the material's versatility, biodegradability, and potential for customization through advanced formulations. The Asia-Pacific region is anticipated to be the fastest-growing market for cellophane, driven by rapid industrialization and increasing environmental awareness in countries like China and India.

However, the market also faces challenges. The cost of producing robust cellophane formulations remains higher compared to some synthetic alternatives. This price sensitivity is particularly evident in developing markets where cost often takes precedence over environmental considerations. Additionally, the performance limitations of current cellophane formulations in certain high-stress applications present opportunities for innovation and market expansion.

To capitalize on the growing market demand, manufacturers are investing in research and development to create more robust cellophane formulations. These efforts focus on improving tensile strength, barrier properties, and heat resistance while maintaining the material's biodegradability. The development of such advanced formulations is expected to open up new application areas and further drive market growth in the coming years.

Technical Challenges

The development of robust cellophane formulations faces several significant technical challenges that require innovative solutions. One of the primary obstacles is achieving consistent mechanical properties across different production batches. Cellophane, being a biopolymer derived from cellulose, exhibits inherent variability in its molecular structure, which can lead to fluctuations in tensile strength, elongation, and barrier properties. This variability poses difficulties in maintaining product quality and meeting stringent industry standards.

Another critical challenge lies in enhancing the moisture resistance of cellophane without compromising its biodegradability. Traditional cellophane is highly sensitive to humidity, which can cause dimensional instability and affect its barrier properties. While various coating technologies have been developed to address this issue, finding a balance between improved moisture resistance and maintaining the material's eco-friendly characteristics remains a complex task.

The pursuit of improved heat-sealing properties in cellophane formulations presents yet another technical hurdle. Cellophane's relatively high melting point and narrow sealing temperature range make it challenging to achieve reliable and consistent seals, especially in high-speed packaging applications. Developing formulations that offer a wider sealing window without sacrificing other desirable properties is crucial for expanding cellophane's applicability in various packaging scenarios.

Furthermore, enhancing the gas barrier properties of cellophane, particularly against oxygen and carbon dioxide, continues to be a significant challenge. While cellophane naturally possesses good barrier properties against water vapor, its performance against gases is often insufficient for many food packaging applications. Improving gas barrier properties without resorting to non-biodegradable additives or coatings requires innovative approaches in polymer science and material engineering.

The integration of active and intelligent packaging features into cellophane formulations presents additional technical complexities. Incorporating antimicrobial agents, oxygen scavengers, or color-changing indicators while maintaining the film's structural integrity and biodegradability demands sophisticated formulation strategies and advanced processing techniques.

Lastly, scaling up laboratory-developed formulations to industrial production levels poses significant challenges. Ensuring that the desired properties and performance characteristics are maintained when transitioning from small-scale to large-scale production requires careful process optimization and quality control measures. This challenge is particularly pronounced given the sensitivity of cellophane properties to processing conditions such as temperature, humidity, and tension during film formation.

Another critical challenge lies in enhancing the moisture resistance of cellophane without compromising its biodegradability. Traditional cellophane is highly sensitive to humidity, which can cause dimensional instability and affect its barrier properties. While various coating technologies have been developed to address this issue, finding a balance between improved moisture resistance and maintaining the material's eco-friendly characteristics remains a complex task.

The pursuit of improved heat-sealing properties in cellophane formulations presents yet another technical hurdle. Cellophane's relatively high melting point and narrow sealing temperature range make it challenging to achieve reliable and consistent seals, especially in high-speed packaging applications. Developing formulations that offer a wider sealing window without sacrificing other desirable properties is crucial for expanding cellophane's applicability in various packaging scenarios.

Furthermore, enhancing the gas barrier properties of cellophane, particularly against oxygen and carbon dioxide, continues to be a significant challenge. While cellophane naturally possesses good barrier properties against water vapor, its performance against gases is often insufficient for many food packaging applications. Improving gas barrier properties without resorting to non-biodegradable additives or coatings requires innovative approaches in polymer science and material engineering.

The integration of active and intelligent packaging features into cellophane formulations presents additional technical complexities. Incorporating antimicrobial agents, oxygen scavengers, or color-changing indicators while maintaining the film's structural integrity and biodegradability demands sophisticated formulation strategies and advanced processing techniques.

Lastly, scaling up laboratory-developed formulations to industrial production levels poses significant challenges. Ensuring that the desired properties and performance characteristics are maintained when transitioning from small-scale to large-scale production requires careful process optimization and quality control measures. This challenge is particularly pronounced given the sensitivity of cellophane properties to processing conditions such as temperature, humidity, and tension during film formation.

Current Solutions

01 Chemical modification of cellophane

Chemical treatments can be applied to cellophane to enhance its robustness. These modifications may include cross-linking, grafting, or the addition of specific compounds to improve properties such as strength, flexibility, and resistance to environmental factors. Such treatments can significantly increase the durability and performance of cellophane in various applications.- Chemical modification of cellophane: Chemical treatments can be applied to cellophane to enhance its robustness. These modifications may include cross-linking, grafting, or the addition of specific compounds to improve properties such as strength, flexibility, and resistance to environmental factors. Such treatments can significantly increase the durability and performance of cellophane in various applications.

- Composite materials incorporating cellophane: Combining cellophane with other materials to create composite structures can enhance its robustness. This may involve layering cellophane with other films, incorporating it into laminates, or using it as a component in multi-layer packaging. These composite materials can offer improved strength, barrier properties, and overall durability compared to cellophane alone.

- Surface treatments for cellophane: Various surface treatments can be applied to cellophane to improve its robustness. These may include coating processes, plasma treatments, or the application of specialized films. Such treatments can enhance properties like scratch resistance, water repellency, and adhesion to other materials, thereby increasing the overall durability of cellophane products.

- Nanocomposite cellophane materials: Incorporating nanoparticles or nanostructures into cellophane can significantly enhance its robustness. These nanocomposites can improve mechanical strength, thermal stability, and barrier properties. The use of nanomaterials in cellophane production can lead to more durable and high-performance products for various industries.

- Manufacturing processes for robust cellophane: Optimizing the manufacturing process of cellophane can lead to more robust products. This may involve adjustments in extrusion techniques, drying methods, or the introduction of new production technologies. Improved manufacturing processes can result in cellophane with enhanced physical properties, uniformity, and overall durability.

02 Composite materials incorporating cellophane

Combining cellophane with other materials to create composite structures can enhance its robustness. This may involve layering cellophane with other films, incorporating it into polymer blends, or using it as a component in multi-layer packaging. These composites can offer improved mechanical properties, barrier characteristics, and overall durability compared to cellophane alone.Expand Specific Solutions03 Surface treatments for cellophane

Various surface treatments can be applied to cellophane to improve its robustness. These may include plasma treatments, coating applications, or surface functionalization techniques. Such treatments can enhance properties like adhesion, printability, and resistance to moisture or chemicals, thereby increasing the overall durability and versatility of cellophane products.Expand Specific Solutions04 Nanocomposite cellophane materials

Incorporating nanoparticles or nanostructures into cellophane can significantly enhance its robustness. These nanocomposites may exhibit improved mechanical strength, barrier properties, and thermal stability. The use of nanomaterials in cellophane can lead to the development of high-performance, durable products for various industries.Expand Specific Solutions05 Biodegradable and eco-friendly robust cellophane

Development of robust cellophane materials that maintain biodegradability and eco-friendliness. This involves the use of sustainable raw materials, environmentally friendly additives, and processing techniques that enhance the material's strength and durability while ensuring it remains biodegradable at the end of its life cycle. Such innovations address the growing demand for environmentally responsible packaging solutions.Expand Specific Solutions

Industry Leaders

The cellophane formulation industry is in a mature stage, with a global market size estimated to be in the billions of dollars. The technology for cellophane production is well-established, but there is ongoing research to improve its properties and sustainability. Companies like FUJIFILM Corp., Nippon Paper Industries, and Mitsubishi Gas Chemical are leading players in this field, leveraging their expertise in materials science and chemical engineering to develop robust cellophane designs. The focus is on enhancing biodegradability, barrier properties, and overall performance while reducing environmental impact. Collaboration between industry leaders and research institutions, such as the National Research Council of Canada, is driving innovation in this sector.

Nippon Paper Industries Co., Ltd.

Technical Solution: Nippon Paper Industries has developed a robust cellophane formulation approach that focuses on enhancing the material's barrier properties and structural integrity. Their method involves the use of specialized cellulose derivatives and the incorporation of nanoscale reinforcing agents to improve the cellophane's mechanical strength and flexibility[10]. The company has also implemented a unique drying and annealing process that optimizes the material's crystalline structure, resulting in improved dimensional stability and moisture resistance[11]. Nippon Paper's robust design strategy includes the careful control of cellulose chain length and the incorporation of bio-based plasticizers to achieve a balance between performance and environmental sustainability[12].

Strengths: Enhanced barrier properties, improved mechanical strength, and focus on sustainability. Weaknesses: Potential challenges in scaling up production and maintaining consistent quality.

BASF SE

Technical Solution: BASF has focused on developing robust cellophane formulations through the integration of advanced polymer science and sustainable chemistry. Their approach involves the use of bio-based raw materials and the incorporation of specially designed stabilizers to enhance the cellophane's durability and performance[7]. BASF has also developed a proprietary cross-linking technology that improves the material's resistance to heat and chemicals while maintaining its biodegradability[8]. The company's robust design strategy emphasizes the optimization of the cellophane's molecular structure and the careful selection of additives to achieve a balance between performance and environmental sustainability[9].

Strengths: Improved durability, enhanced chemical resistance, and focus on sustainability. Weaknesses: Potential trade-offs between performance and biodegradability.

Key Innovations

Resin composition and method for producing resin composition

PatentPendingUS20250092250A1

Innovation

- A resin composition is developed using cellulose fibers obtained from low basis weight paper that has been subjected to a drying step, combined with a thermoplastic resin, to enhance mechanical strength, impact resistance, and linear expansion coefficient.

Cellulose derivative and use thereof

PatentActiveUS20180291117A1

Innovation

- A cellulose derivative is synthesized with specific substitution degrees of short-chain (acetyl), medium-chain (3-5 carbon atoms), and long-chain (6-30 carbon atoms) organic groups, ranging from 0.7 to 1.5, 0.5 to 2.0, and 0.1 to 0.5 respectively, to ensure even introduction and optimal properties.

Environmental Impact

The environmental impact of cellophane formulations is a critical consideration in the pursuit of robust designs. As the demand for sustainable packaging solutions continues to grow, manufacturers must carefully evaluate the ecological footprint of cellophane throughout its lifecycle. The production process of cellophane, which involves the use of chemicals and energy-intensive steps, can contribute to air and water pollution if not properly managed.

One of the primary environmental concerns associated with cellophane is its biodegradability. While traditional cellophane is derived from renewable resources such as wood pulp, the addition of certain coatings and additives can significantly impact its ability to decompose naturally. Researchers are actively exploring ways to enhance the biodegradability of cellophane without compromising its performance characteristics, such as moisture resistance and tensile strength.

Water consumption is another crucial factor in cellophane production. The manufacturing process requires substantial amounts of water for various stages, including pulp preparation and film formation. Implementing water recycling systems and optimizing production processes can help reduce the overall water footprint of cellophane formulations. Additionally, the use of more efficient filtration technologies can minimize the release of pollutants into water bodies.

The carbon footprint of cellophane production is also a significant concern. The energy required for processing and drying cellophane films contributes to greenhouse gas emissions. Manufacturers are increasingly exploring renewable energy sources and more energy-efficient equipment to mitigate these impacts. Furthermore, the transportation of raw materials and finished products adds to the overall carbon emissions associated with cellophane.

Waste management is an essential aspect of cellophane's environmental impact. While cellophane itself is recyclable, the presence of coatings and additives can complicate the recycling process. Developing easily separable multi-layer structures or using compatible additives can enhance the recyclability of cellophane products. Moreover, implementing closed-loop recycling systems within production facilities can help minimize waste and reduce the demand for virgin materials.

The choice of raw materials plays a crucial role in the environmental profile of cellophane formulations. Sourcing wood pulp from sustainably managed forests and exploring alternative bio-based materials can help reduce the ecological impact of cellophane production. Additionally, the use of non-toxic, biodegradable additives and coatings can further improve the overall environmental performance of cellophane products.

As regulations and consumer preferences continue to evolve, cellophane manufacturers must prioritize eco-friendly innovations in their formulations. This includes developing bio-based alternatives, improving energy efficiency, and enhancing end-of-life management strategies. By addressing these environmental concerns, the industry can work towards more sustainable and robust cellophane designs that meet both performance requirements and ecological standards.

One of the primary environmental concerns associated with cellophane is its biodegradability. While traditional cellophane is derived from renewable resources such as wood pulp, the addition of certain coatings and additives can significantly impact its ability to decompose naturally. Researchers are actively exploring ways to enhance the biodegradability of cellophane without compromising its performance characteristics, such as moisture resistance and tensile strength.

Water consumption is another crucial factor in cellophane production. The manufacturing process requires substantial amounts of water for various stages, including pulp preparation and film formation. Implementing water recycling systems and optimizing production processes can help reduce the overall water footprint of cellophane formulations. Additionally, the use of more efficient filtration technologies can minimize the release of pollutants into water bodies.

The carbon footprint of cellophane production is also a significant concern. The energy required for processing and drying cellophane films contributes to greenhouse gas emissions. Manufacturers are increasingly exploring renewable energy sources and more energy-efficient equipment to mitigate these impacts. Furthermore, the transportation of raw materials and finished products adds to the overall carbon emissions associated with cellophane.

Waste management is an essential aspect of cellophane's environmental impact. While cellophane itself is recyclable, the presence of coatings and additives can complicate the recycling process. Developing easily separable multi-layer structures or using compatible additives can enhance the recyclability of cellophane products. Moreover, implementing closed-loop recycling systems within production facilities can help minimize waste and reduce the demand for virgin materials.

The choice of raw materials plays a crucial role in the environmental profile of cellophane formulations. Sourcing wood pulp from sustainably managed forests and exploring alternative bio-based materials can help reduce the ecological impact of cellophane production. Additionally, the use of non-toxic, biodegradable additives and coatings can further improve the overall environmental performance of cellophane products.

As regulations and consumer preferences continue to evolve, cellophane manufacturers must prioritize eco-friendly innovations in their formulations. This includes developing bio-based alternatives, improving energy efficiency, and enhancing end-of-life management strategies. By addressing these environmental concerns, the industry can work towards more sustainable and robust cellophane designs that meet both performance requirements and ecological standards.

Regulatory Compliance

Regulatory compliance is a critical aspect of pursuing robust designs in cellophane formulations. The cellophane industry is subject to various regulations and standards that govern the production, quality, and safety of cellophane products. These regulations are designed to ensure consumer safety, environmental protection, and product quality consistency.

In the United States, the Food and Drug Administration (FDA) plays a crucial role in regulating cellophane used in food packaging. The FDA's Code of Federal Regulations (CFR) Title 21, Part 177, Subpart B, Section 177.1200 specifically addresses cellophane. This regulation outlines the permitted raw materials, production processes, and specifications for cellophane intended for food contact applications. Manufacturers must ensure their cellophane formulations comply with these regulations to obtain FDA approval for food packaging use.

The European Union has its own set of regulations for cellophane and food contact materials. The EU Regulation No. 10/2011 on plastic materials and articles intended to come into contact with food, known as the Plastic Food Contact Materials Regulation, sets specific migration limits for substances used in cellophane production. Compliance with these regulations is essential for cellophane manufacturers seeking to enter the European market.

Environmental regulations also play a significant role in cellophane formulation design. Many countries have implemented restrictions on certain chemicals and materials used in packaging to reduce environmental impact. For instance, the EU's REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulation affects the use of certain substances in cellophane production. Manufacturers must carefully consider these environmental regulations when developing robust cellophane formulations.

Quality management systems and standards, such as ISO 9001 and ISO 22000, are crucial for ensuring consistent product quality and regulatory compliance. These standards provide frameworks for implementing and maintaining quality control processes throughout the cellophane production lifecycle. Adherence to these standards not only helps in meeting regulatory requirements but also enhances the overall robustness of cellophane formulations.

To pursue robust designs in cellophane formulations while ensuring regulatory compliance, manufacturers must implement comprehensive testing and documentation procedures. This includes regular testing of raw materials, in-process controls, and finished product testing to verify compliance with applicable regulations. Maintaining detailed records of formulation components, production processes, and test results is essential for demonstrating regulatory compliance during audits and inspections.

Staying informed about evolving regulations and emerging safety concerns is crucial for maintaining compliance and developing robust cellophane formulations. Manufacturers should actively participate in industry associations, attend regulatory workshops, and engage with regulatory bodies to stay ahead of potential changes in compliance requirements. This proactive approach allows for timely adjustments to formulations and production processes, ensuring continued compliance and product robustness.

In the United States, the Food and Drug Administration (FDA) plays a crucial role in regulating cellophane used in food packaging. The FDA's Code of Federal Regulations (CFR) Title 21, Part 177, Subpart B, Section 177.1200 specifically addresses cellophane. This regulation outlines the permitted raw materials, production processes, and specifications for cellophane intended for food contact applications. Manufacturers must ensure their cellophane formulations comply with these regulations to obtain FDA approval for food packaging use.

The European Union has its own set of regulations for cellophane and food contact materials. The EU Regulation No. 10/2011 on plastic materials and articles intended to come into contact with food, known as the Plastic Food Contact Materials Regulation, sets specific migration limits for substances used in cellophane production. Compliance with these regulations is essential for cellophane manufacturers seeking to enter the European market.

Environmental regulations also play a significant role in cellophane formulation design. Many countries have implemented restrictions on certain chemicals and materials used in packaging to reduce environmental impact. For instance, the EU's REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulation affects the use of certain substances in cellophane production. Manufacturers must carefully consider these environmental regulations when developing robust cellophane formulations.

Quality management systems and standards, such as ISO 9001 and ISO 22000, are crucial for ensuring consistent product quality and regulatory compliance. These standards provide frameworks for implementing and maintaining quality control processes throughout the cellophane production lifecycle. Adherence to these standards not only helps in meeting regulatory requirements but also enhances the overall robustness of cellophane formulations.

To pursue robust designs in cellophane formulations while ensuring regulatory compliance, manufacturers must implement comprehensive testing and documentation procedures. This includes regular testing of raw materials, in-process controls, and finished product testing to verify compliance with applicable regulations. Maintaining detailed records of formulation components, production processes, and test results is essential for demonstrating regulatory compliance during audits and inspections.

Staying informed about evolving regulations and emerging safety concerns is crucial for maintaining compliance and developing robust cellophane formulations. Manufacturers should actively participate in industry associations, attend regulatory workshops, and engage with regulatory bodies to stay ahead of potential changes in compliance requirements. This proactive approach allows for timely adjustments to formulations and production processes, ensuring continued compliance and product robustness.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!