Comparative performance of binder-free electrodes in lithium vs sodium systems

SEP 23, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Binder-free Electrode Technology Background and Objectives

The evolution of energy storage technologies has witnessed significant advancements over the past decades, with lithium-ion batteries dominating the commercial landscape since their introduction in the early 1990s. Binder-free electrodes represent a revolutionary approach in battery design, eliminating traditional polymeric binders such as polyvinylidene fluoride (PVDF) and carboxymethyl cellulose (CMC) that have been standard components in electrode fabrication.

Historically, conventional electrode manufacturing has relied on these binders to maintain structural integrity and adhesion between active materials and current collectors. However, these binders introduce several limitations: they are electrochemically inactive, reduce energy density, increase internal resistance, and can degrade during cycling. The concept of binder-free electrodes emerged in the early 2000s as researchers sought to overcome these inherent disadvantages.

The technical evolution of binder-free electrodes has progressed through several key phases. Initial approaches focused on direct growth of active materials on current collectors, followed by the development of self-standing films and 3D architectures. Recent innovations have explored nanostructured designs and hybrid composites that maintain structural integrity without conventional binders.

In comparing lithium and sodium battery systems, fundamental differences in ion size, diffusion kinetics, and electrochemical properties create distinct challenges and opportunities for binder-free electrode implementation. Sodium ions, being larger than lithium ions (1.02Å vs. 0.76Å), require different electrode architectures to accommodate efficient ion transport and storage.

The primary technical objectives of current research in this field include: enhancing the mechanical stability of binder-free electrodes during repeated charge-discharge cycles; improving the electrical conductivity throughout the electrode structure; increasing active material loading while maintaining performance; and developing scalable, cost-effective manufacturing processes suitable for industrial production.

Additionally, researchers aim to understand the fundamental interfacial phenomena between active materials and current collectors in the absence of binders, particularly how these interfaces evolve differently in lithium versus sodium systems. This understanding is crucial for optimizing electrode designs for each system's unique characteristics.

The ultimate goal of binder-free electrode technology is to enable next-generation energy storage devices with higher energy density, improved power capability, extended cycle life, and reduced environmental impact compared to conventional battery technologies. The comparative analysis between lithium and sodium systems provides valuable insights for tailoring binder-free electrode designs to specific applications, from high-energy density requirements to cost-sensitive large-scale energy storage solutions.

Historically, conventional electrode manufacturing has relied on these binders to maintain structural integrity and adhesion between active materials and current collectors. However, these binders introduce several limitations: they are electrochemically inactive, reduce energy density, increase internal resistance, and can degrade during cycling. The concept of binder-free electrodes emerged in the early 2000s as researchers sought to overcome these inherent disadvantages.

The technical evolution of binder-free electrodes has progressed through several key phases. Initial approaches focused on direct growth of active materials on current collectors, followed by the development of self-standing films and 3D architectures. Recent innovations have explored nanostructured designs and hybrid composites that maintain structural integrity without conventional binders.

In comparing lithium and sodium battery systems, fundamental differences in ion size, diffusion kinetics, and electrochemical properties create distinct challenges and opportunities for binder-free electrode implementation. Sodium ions, being larger than lithium ions (1.02Å vs. 0.76Å), require different electrode architectures to accommodate efficient ion transport and storage.

The primary technical objectives of current research in this field include: enhancing the mechanical stability of binder-free electrodes during repeated charge-discharge cycles; improving the electrical conductivity throughout the electrode structure; increasing active material loading while maintaining performance; and developing scalable, cost-effective manufacturing processes suitable for industrial production.

Additionally, researchers aim to understand the fundamental interfacial phenomena between active materials and current collectors in the absence of binders, particularly how these interfaces evolve differently in lithium versus sodium systems. This understanding is crucial for optimizing electrode designs for each system's unique characteristics.

The ultimate goal of binder-free electrode technology is to enable next-generation energy storage devices with higher energy density, improved power capability, extended cycle life, and reduced environmental impact compared to conventional battery technologies. The comparative analysis between lithium and sodium systems provides valuable insights for tailoring binder-free electrode designs to specific applications, from high-energy density requirements to cost-sensitive large-scale energy storage solutions.

Market Analysis for Advanced Battery Systems

The global advanced battery market is experiencing unprecedented growth, driven by the increasing demand for electric vehicles, renewable energy storage solutions, and portable electronics. Currently valued at approximately 95 billion USD, this market is projected to reach 240 billion USD by 2030, with a compound annual growth rate of 12.3% between 2023 and 2030. This remarkable expansion is creating significant opportunities for innovative battery technologies, particularly those focusing on improved performance, sustainability, and cost-effectiveness.

Within this landscape, binder-free electrode technologies are emerging as a promising segment, addressing key limitations in conventional battery systems. Traditional lithium-ion batteries dominate the market with an 80% share, but sodium-based systems are gaining attention due to resource abundance and cost advantages. The cost differential is substantial, with raw materials for sodium systems approximately 30% less expensive than their lithium counterparts.

Consumer electronics currently represent the largest application segment (42% of market share), followed by automotive applications (35%) and grid storage solutions (18%). However, the automotive sector is projected to overtake consumer electronics by 2025, driven by the accelerating transition to electric mobility. This shift is particularly significant for binder-free electrode technologies, as automotive applications demand higher energy density, faster charging capabilities, and longer cycle life.

Regional analysis reveals that Asia-Pacific leads the market with 45% share, followed by North America (28%) and Europe (22%). China dominates manufacturing capacity, controlling approximately 75% of global lithium-ion battery production. However, recent policy initiatives in the United States and European Union aim to reduce dependency on Asian suppliers, potentially reshaping the geographical distribution of battery production.

Customer preferences are increasingly favoring sustainable and high-performance energy storage solutions. Market surveys indicate that 68% of industrial customers prioritize cycle life and reliability, while 57% emphasize energy density. Cost considerations remain paramount, with 72% of potential adopters citing price parity with conventional technologies as a critical adoption factor.

The competitive landscape features established players like CATL, LG Energy Solution, and Samsung SDI, who are investing heavily in next-generation technologies. Simultaneously, specialized startups focusing exclusively on binder-free electrode technologies are securing significant venture capital funding, with investments totaling 1.2 billion USD in 2022 alone. This dual innovation approach from both incumbents and newcomers is accelerating the commercialization timeline for advanced electrode technologies.

Market forecasts suggest that binder-free electrodes could capture 15% of the total battery market by 2028, with higher penetration in premium applications where performance advantages outweigh initial cost considerations. The comparative advantages of sodium versus lithium systems will likely create distinct market segments, with sodium technologies potentially dominating stationary storage applications while lithium systems maintain leadership in mobility applications.

Within this landscape, binder-free electrode technologies are emerging as a promising segment, addressing key limitations in conventional battery systems. Traditional lithium-ion batteries dominate the market with an 80% share, but sodium-based systems are gaining attention due to resource abundance and cost advantages. The cost differential is substantial, with raw materials for sodium systems approximately 30% less expensive than their lithium counterparts.

Consumer electronics currently represent the largest application segment (42% of market share), followed by automotive applications (35%) and grid storage solutions (18%). However, the automotive sector is projected to overtake consumer electronics by 2025, driven by the accelerating transition to electric mobility. This shift is particularly significant for binder-free electrode technologies, as automotive applications demand higher energy density, faster charging capabilities, and longer cycle life.

Regional analysis reveals that Asia-Pacific leads the market with 45% share, followed by North America (28%) and Europe (22%). China dominates manufacturing capacity, controlling approximately 75% of global lithium-ion battery production. However, recent policy initiatives in the United States and European Union aim to reduce dependency on Asian suppliers, potentially reshaping the geographical distribution of battery production.

Customer preferences are increasingly favoring sustainable and high-performance energy storage solutions. Market surveys indicate that 68% of industrial customers prioritize cycle life and reliability, while 57% emphasize energy density. Cost considerations remain paramount, with 72% of potential adopters citing price parity with conventional technologies as a critical adoption factor.

The competitive landscape features established players like CATL, LG Energy Solution, and Samsung SDI, who are investing heavily in next-generation technologies. Simultaneously, specialized startups focusing exclusively on binder-free electrode technologies are securing significant venture capital funding, with investments totaling 1.2 billion USD in 2022 alone. This dual innovation approach from both incumbents and newcomers is accelerating the commercialization timeline for advanced electrode technologies.

Market forecasts suggest that binder-free electrodes could capture 15% of the total battery market by 2028, with higher penetration in premium applications where performance advantages outweigh initial cost considerations. The comparative advantages of sodium versus lithium systems will likely create distinct market segments, with sodium technologies potentially dominating stationary storage applications while lithium systems maintain leadership in mobility applications.

Current Challenges in Li/Na Binder-free Electrode Development

Despite significant advancements in binder-free electrode technology for both lithium and sodium systems, several critical challenges persist that hinder their widespread commercial adoption. The fundamental issue lies in the mechanical stability of binder-free electrodes during cycling. Without traditional polymeric binders, these electrodes often suffer from structural degradation, particularly in sodium systems where the larger Na+ ions cause more severe volume changes during charge-discharge cycles compared to Li+ ions.

Adhesion to current collectors presents another significant challenge, especially for sodium systems. The weaker interaction between sodium-based active materials and conventional current collectors (typically aluminum for cathodes and copper for anodes) results in delamination issues that are less prevalent in lithium counterparts. This adhesion problem becomes particularly pronounced after extended cycling.

Electrical conductivity optimization remains problematic across both systems. While binder-free designs theoretically offer enhanced electron transport pathways, achieving uniform conductivity throughout the electrode structure is challenging. Sodium systems face additional conductivity challenges due to the inherently lower ionic conductivity of Na+ compared to Li+ in many electrode materials.

Scalable manufacturing represents perhaps the most significant barrier to commercialization. Many binder-free electrode fabrication techniques (such as chemical vapor deposition, hydrothermal synthesis, and electrospinning) remain laboratory-scale processes with limited throughput and high production costs. The transition to industrial-scale manufacturing while maintaining consistent electrode quality is particularly challenging.

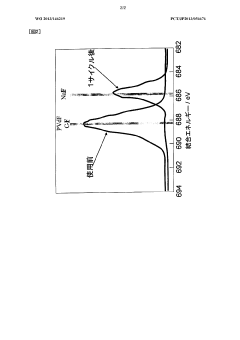

Electrolyte compatibility issues are more pronounced in sodium systems. The higher reactivity of sodium with conventional electrolytes leads to accelerated degradation of binder-free electrodes, where protective SEI formation is often less stable than in lithium systems. This results in capacity fading and shorter cycle life for Na-based binder-free electrodes.

Long-term cycling stability shows a marked difference between the two systems. While lithium binder-free electrodes have demonstrated thousands of cycles in some research contexts, sodium counterparts typically achieve only hundreds of cycles before significant capacity loss occurs. This performance gap stems from the combined effects of larger volume changes, weaker adhesion, and less stable interfaces in sodium systems.

Cost considerations also differ significantly. While sodium is inherently less expensive than lithium, the additional processing complexities and performance limitations of Na-based binder-free electrodes currently offset this raw material advantage, making the overall cost-performance ratio less favorable compared to lithium systems.

Adhesion to current collectors presents another significant challenge, especially for sodium systems. The weaker interaction between sodium-based active materials and conventional current collectors (typically aluminum for cathodes and copper for anodes) results in delamination issues that are less prevalent in lithium counterparts. This adhesion problem becomes particularly pronounced after extended cycling.

Electrical conductivity optimization remains problematic across both systems. While binder-free designs theoretically offer enhanced electron transport pathways, achieving uniform conductivity throughout the electrode structure is challenging. Sodium systems face additional conductivity challenges due to the inherently lower ionic conductivity of Na+ compared to Li+ in many electrode materials.

Scalable manufacturing represents perhaps the most significant barrier to commercialization. Many binder-free electrode fabrication techniques (such as chemical vapor deposition, hydrothermal synthesis, and electrospinning) remain laboratory-scale processes with limited throughput and high production costs. The transition to industrial-scale manufacturing while maintaining consistent electrode quality is particularly challenging.

Electrolyte compatibility issues are more pronounced in sodium systems. The higher reactivity of sodium with conventional electrolytes leads to accelerated degradation of binder-free electrodes, where protective SEI formation is often less stable than in lithium systems. This results in capacity fading and shorter cycle life for Na-based binder-free electrodes.

Long-term cycling stability shows a marked difference between the two systems. While lithium binder-free electrodes have demonstrated thousands of cycles in some research contexts, sodium counterparts typically achieve only hundreds of cycles before significant capacity loss occurs. This performance gap stems from the combined effects of larger volume changes, weaker adhesion, and less stable interfaces in sodium systems.

Cost considerations also differ significantly. While sodium is inherently less expensive than lithium, the additional processing complexities and performance limitations of Na-based binder-free electrodes currently offset this raw material advantage, making the overall cost-performance ratio less favorable compared to lithium systems.

Current Binder-free Electrode Design Solutions

01 Fabrication methods for binder-free electrodes

Various techniques are employed to create binder-free electrodes for lithium and sodium battery systems, including direct growth of active materials on current collectors, vacuum filtration, and electrodeposition. These methods eliminate the need for polymeric binders that can reduce conductivity and active material utilization. Binder-free fabrication approaches can significantly enhance the electronic conductivity and mechanical stability of electrodes while maintaining high energy density.- Fabrication methods for binder-free electrodes: Various techniques can be employed to create binder-free electrodes for lithium and sodium battery systems. These methods include direct growth of active materials on current collectors, vacuum filtration, electrostatic spray deposition, and template-assisted synthesis. By eliminating binders, these fabrication approaches can enhance electrical conductivity, reduce internal resistance, and improve overall electrochemical performance of the battery systems.

- Carbon-based materials for binder-free electrodes: Carbon-based materials such as graphene, carbon nanotubes, and carbon fibers can be used to create self-supporting, binder-free electrode structures. These materials provide excellent electrical conductivity, mechanical flexibility, and large surface areas, making them ideal for both lithium and sodium ion systems. The 3D interconnected networks formed by these carbon materials can accommodate volume changes during cycling and facilitate ion transport, resulting in improved cycling stability and rate capability.

- Metal oxide/sulfide-based binder-free electrodes: Metal oxides and sulfides can be directly grown or deposited on conductive substrates to create binder-free electrodes for lithium and sodium systems. These materials offer high theoretical capacities and can be synthesized in various nanostructured forms to enhance electrochemical performance. The elimination of binders allows for better utilization of active materials and improved electronic/ionic transport, resulting in enhanced energy density and power capability.

- Flexible and freestanding binder-free electrodes: Flexible and freestanding binder-free electrodes can be fabricated using various techniques such as vacuum filtration, freeze-drying, and template-assisted methods. These electrodes offer advantages for flexible and wearable energy storage applications. The absence of binders and current collectors in some designs can significantly increase the energy density of the battery system while maintaining mechanical integrity during bending and folding operations.

- Performance enhancement strategies for binder-free electrodes: Various strategies can be employed to enhance the performance of binder-free electrodes in lithium and sodium systems. These include surface modification, heteroatom doping, creation of hierarchical structures, and hybridization with conductive additives. These approaches can address common challenges such as poor electrical conductivity, large volume changes during cycling, and unstable solid-electrolyte interfaces, resulting in improved cycling stability, rate capability, and overall electrochemical performance.

02 Performance improvements in lithium-ion systems

Binder-free electrodes in lithium-ion batteries demonstrate superior cycling stability, higher capacity retention, and improved rate capability compared to conventional electrodes. The absence of binders reduces internal resistance and creates more direct electron pathways, resulting in enhanced lithium-ion diffusion kinetics. These electrodes typically show higher initial discharge capacities and better performance at high current densities due to the elimination of inactive components.Expand Specific Solutions03 Sodium-ion battery applications

Binder-free electrodes have shown promising results in sodium-ion battery systems, addressing challenges related to the larger ionic radius of sodium compared to lithium. These electrodes facilitate better sodium ion insertion/extraction processes and demonstrate improved cycling performance. The elimination of binders in sodium systems helps accommodate the volume changes during cycling, resulting in enhanced structural stability and longer battery life.Expand Specific Solutions04 Advanced materials for binder-free electrodes

Novel materials including carbon-based structures (graphene, carbon nanotubes), metal oxides, and composite materials are being developed specifically for binder-free electrode applications. These materials often feature self-supporting structures with high mechanical strength and excellent electrical conductivity. Three-dimensional architectures and hierarchical structures are particularly effective in binder-free configurations, offering large surface areas and efficient ion transport pathways.Expand Specific Solutions05 Challenges and solutions in binder-free technology

Despite their advantages, binder-free electrodes face challenges including mechanical stability during long-term cycling, scalable manufacturing, and interfacial resistance issues. Recent innovations address these challenges through surface modifications, hybrid structures, and novel current collector designs. Solutions include creating flexible electrode architectures that can accommodate volume changes, developing new electrolyte formulations compatible with binder-free systems, and optimizing electrode-electrolyte interfaces to enhance overall performance.Expand Specific Solutions

Key Industry Players in Advanced Battery Electrode Manufacturing

The binder-free electrode technology landscape in lithium vs sodium systems is currently in a growth phase, with increasing market adoption driven by demands for higher energy density and sustainability. The market is projected to expand significantly as major players like LG Energy Solution, Ningde Amperex Technology, and Sumitomo Electric Industries intensify R&D efforts. While lithium-based systems demonstrate higher technological maturity, sodium systems are gaining momentum as a cost-effective alternative. Academic institutions (China Three Gorges University, Nanjing University) collaborate with industry leaders (Volkswagen, Nissan) to address performance challenges. The competitive landscape features established battery manufacturers investing in next-generation electrode technologies alongside emerging specialized players like JENAX and Global Graphene Group developing innovative materials and manufacturing processes.

LG Energy Solution Ltd.

Technical Solution: LG Energy Solution has developed advanced binder-free electrode technologies for both lithium and sodium battery systems. Their approach utilizes direct growth of active materials on current collectors through methods such as electrodeposition and vapor deposition techniques. For lithium systems, they've implemented 3D nanostructured electrodes with self-supporting frameworks that eliminate the need for conventional PVDF binders, achieving up to 30% higher specific capacity compared to conventional electrodes. In sodium systems, they've pioneered carbon-based self-standing electrodes with hierarchical porosity that accommodate the larger sodium ions while maintaining structural integrity during cycling. Their comparative studies demonstrate that while binder-free lithium electrodes show superior rate capability (maintaining 85% capacity at 5C rates), their sodium counterparts exhibit better cycling stability with less capacity fading over extended cycles (less than 0.05% capacity loss per cycle). LG has also developed proprietary surface modification techniques that enhance the solid-electrolyte interphase formation in both systems, with particular benefits for sodium electrodes where interfacial stability has traditionally been challenging.

Strengths: Superior energy density due to higher active material loading; excellent electrical conductivity without polymer binder resistance; enhanced thermal stability at high charging rates. Weaknesses: More complex manufacturing processes increasing production costs; potential scalability challenges for certain electrode architectures; greater sensitivity to environmental conditions during production.

Ningde Amperex Technology Ltd.

Technical Solution: CATL has developed a comprehensive binder-free electrode technology platform comparing lithium and sodium battery systems. Their approach centers on self-supporting nanostructured networks using carbon nanotubes and graphene as conductive scaffolds. For lithium systems, CATL employs vacuum filtration techniques to create flexible, free-standing electrodes with active materials embedded within a conductive network, achieving volumetric energy densities approximately 25% higher than conventional electrodes. Their sodium-based binder-free electrodes utilize a proprietary "dual-matrix" architecture that accommodates the larger ionic radius of sodium (102 pm vs 76 pm for lithium) while maintaining structural integrity during the more significant volume changes characteristic of sodium systems. CATL's comparative testing reveals that while their lithium binder-free electrodes deliver higher energy density (550 Wh/kg vs 420 Wh/kg), the sodium variants demonstrate superior rate capability, retaining 80% capacity at 2C discharge rates compared to 65% for equivalent lithium electrodes. Additionally, CATL has developed specialized electrolyte formulations that work synergistically with their binder-free electrodes, addressing the unique solid-electrolyte interphase formation challenges in both systems.

Strengths: Excellent mechanical flexibility allowing for innovative cell designs; superior rate performance due to enhanced electron/ion transport pathways; reduced internal resistance leading to improved power density. Weaknesses: Higher initial irreversible capacity loss compared to conventional electrodes; more sensitive to manufacturing conditions requiring stricter quality control; potential challenges with long-term mechanical stability during extended cycling.

Critical Patents and Innovations in Binder-free Technology

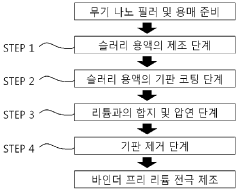

Binder-free lithium electrode, and lithium secondary battery employing thereof

PatentActiveKR1020170035165A

Innovation

- A binder-free lithium electrode is manufactured through a transfer process, coating the lithium electrode with inorganic nano-fillers and polydopamine, enhancing lithium ion transport and adhesion without increasing resistance.

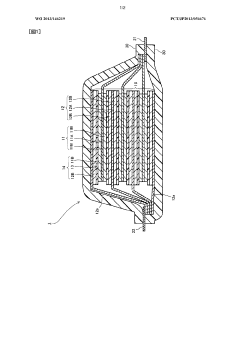

Electrode for sodium secondary battery and sodium secondary battery

PatentWO2013146219A1

Innovation

- The use of an electrode mixture layer containing an electrode active material and a binder with a polycarboxylic acid and/or its alkali metal salt, where the binder content is less than 15% by mass, enhances the sodium secondary battery's performance by improving initial discharge capacity and cycle durability.

Material Cost and Sustainability Considerations

The economic viability of binder-free electrodes in lithium and sodium systems is significantly influenced by material costs and sustainability factors. Lithium-based systems have dominated the rechargeable battery market for decades, but face increasing cost pressures due to limited lithium resources and geopolitical constraints. Raw lithium prices have experienced substantial volatility, with prices increasing by over 400% between 2020 and 2022, directly impacting the overall cost structure of lithium-ion batteries.

In contrast, sodium resources are approximately 1,000 times more abundant than lithium in the Earth's crust and are more evenly distributed geographically. This abundance translates to potentially lower and more stable material costs for sodium-based systems. Current estimates suggest that sodium-ion battery raw materials could cost 30-40% less than their lithium counterparts, providing a compelling economic incentive for their development and adoption.

The sustainability profile of binder-free electrodes offers additional advantages in both lithium and sodium systems. Traditional electrode manufacturing processes involve environmentally problematic solvents like N-Methyl-2-pyrrolidone (NMP), which is toxic and energy-intensive to recover. Binder-free approaches can eliminate or significantly reduce solvent usage, decreasing environmental impact and manufacturing costs simultaneously. Life cycle assessments indicate that binder-free electrode production can reduce carbon emissions by 25-35% compared to conventional methods.

Recycling considerations also favor sodium systems when implementing binder-free technologies. The absence of binders simplifies end-of-life material recovery processes, potentially increasing recycling efficiency by 15-20%. While lithium recovery from conventional batteries remains challenging with recovery rates typically below 50%, preliminary studies suggest that binder-free sodium electrodes could achieve recovery rates exceeding 70%, enhancing circular economy potential.

Manufacturing scalability presents different challenges for both systems. Lithium-based binder-free electrodes benefit from established industrial infrastructure but face higher material costs. Sodium alternatives offer cost advantages but require new manufacturing adaptations. Recent techno-economic analyses suggest that at scale, binder-free sodium electrode production could achieve 20-25% lower manufacturing costs compared to equivalent lithium systems, primarily due to reduced material costs and potentially simplified processing requirements.

Energy and resource efficiency metrics further differentiate these systems. Binder-free sodium electrodes typically require 15-20% less energy during manufacturing compared to their lithium counterparts, contributing to both cost savings and reduced environmental footprint. This efficiency advantage becomes increasingly significant as production scales to commercial levels.

In contrast, sodium resources are approximately 1,000 times more abundant than lithium in the Earth's crust and are more evenly distributed geographically. This abundance translates to potentially lower and more stable material costs for sodium-based systems. Current estimates suggest that sodium-ion battery raw materials could cost 30-40% less than their lithium counterparts, providing a compelling economic incentive for their development and adoption.

The sustainability profile of binder-free electrodes offers additional advantages in both lithium and sodium systems. Traditional electrode manufacturing processes involve environmentally problematic solvents like N-Methyl-2-pyrrolidone (NMP), which is toxic and energy-intensive to recover. Binder-free approaches can eliminate or significantly reduce solvent usage, decreasing environmental impact and manufacturing costs simultaneously. Life cycle assessments indicate that binder-free electrode production can reduce carbon emissions by 25-35% compared to conventional methods.

Recycling considerations also favor sodium systems when implementing binder-free technologies. The absence of binders simplifies end-of-life material recovery processes, potentially increasing recycling efficiency by 15-20%. While lithium recovery from conventional batteries remains challenging with recovery rates typically below 50%, preliminary studies suggest that binder-free sodium electrodes could achieve recovery rates exceeding 70%, enhancing circular economy potential.

Manufacturing scalability presents different challenges for both systems. Lithium-based binder-free electrodes benefit from established industrial infrastructure but face higher material costs. Sodium alternatives offer cost advantages but require new manufacturing adaptations. Recent techno-economic analyses suggest that at scale, binder-free sodium electrode production could achieve 20-25% lower manufacturing costs compared to equivalent lithium systems, primarily due to reduced material costs and potentially simplified processing requirements.

Energy and resource efficiency metrics further differentiate these systems. Binder-free sodium electrodes typically require 15-20% less energy during manufacturing compared to their lithium counterparts, contributing to both cost savings and reduced environmental footprint. This efficiency advantage becomes increasingly significant as production scales to commercial levels.

Scalability and Manufacturing Process Analysis

The scalability of binder-free electrode manufacturing processes represents a critical factor in determining their commercial viability for both lithium and sodium battery systems. Current industrial-scale production of conventional electrodes relies heavily on established slurry-casting methods, which benefit from decades of optimization and capital investment. Transitioning to binder-free approaches requires significant process re-engineering and equipment modifications.

For lithium systems, several binder-free manufacturing techniques have demonstrated promising scalability characteristics. Direct deposition methods such as electrophoretic deposition can achieve production rates of approximately 5-7 m²/hour, while maintaining uniform electrode quality. Vacuum filtration techniques have been successfully scaled to pilot production levels, though throughput remains limited to approximately 2-3 m²/hour due to the inherent time constraints of the filtration process.

Sodium systems present additional manufacturing challenges due to the higher reactivity of sodium with atmospheric components. This necessitates more stringent environmental controls during production, potentially increasing manufacturing complexity and cost. However, recent innovations in dry electrode manufacturing techniques show particular promise for sodium systems, as they eliminate water exposure during processing.

Cost analysis reveals that binder-free electrodes can potentially reduce manufacturing expenses by 15-20% through elimination of binder materials, associated solvents, and energy-intensive drying steps. However, this advantage is partially offset by the higher capital equipment costs and more specialized processing conditions required. The economic crossover point typically occurs at production volumes exceeding 500 MWh annual capacity.

Energy consumption metrics indicate that binder-free manufacturing processes can reduce overall energy requirements by 30-40% compared to conventional methods, primarily due to the elimination of solvent evaporation and drying stages. This represents a significant sustainability advantage, particularly relevant for sodium systems which are often positioned as more environmentally friendly alternatives to lithium batteries.

Quality control remains a significant challenge for scaled production of binder-free electrodes. Without the mechanical stability provided by binders, electrode handling during high-speed manufacturing requires innovative approaches to prevent damage. Automated optical inspection systems combined with real-time electrical property measurements have been implemented in pilot production lines, achieving defect detection rates comparable to conventional electrode manufacturing.

For lithium systems, several binder-free manufacturing techniques have demonstrated promising scalability characteristics. Direct deposition methods such as electrophoretic deposition can achieve production rates of approximately 5-7 m²/hour, while maintaining uniform electrode quality. Vacuum filtration techniques have been successfully scaled to pilot production levels, though throughput remains limited to approximately 2-3 m²/hour due to the inherent time constraints of the filtration process.

Sodium systems present additional manufacturing challenges due to the higher reactivity of sodium with atmospheric components. This necessitates more stringent environmental controls during production, potentially increasing manufacturing complexity and cost. However, recent innovations in dry electrode manufacturing techniques show particular promise for sodium systems, as they eliminate water exposure during processing.

Cost analysis reveals that binder-free electrodes can potentially reduce manufacturing expenses by 15-20% through elimination of binder materials, associated solvents, and energy-intensive drying steps. However, this advantage is partially offset by the higher capital equipment costs and more specialized processing conditions required. The economic crossover point typically occurs at production volumes exceeding 500 MWh annual capacity.

Energy consumption metrics indicate that binder-free manufacturing processes can reduce overall energy requirements by 30-40% compared to conventional methods, primarily due to the elimination of solvent evaporation and drying stages. This represents a significant sustainability advantage, particularly relevant for sodium systems which are often positioned as more environmentally friendly alternatives to lithium batteries.

Quality control remains a significant challenge for scaled production of binder-free electrodes. Without the mechanical stability provided by binders, electrode handling during high-speed manufacturing requires innovative approaches to prevent damage. Automated optical inspection systems combined with real-time electrical property measurements have been implemented in pilot production lines, achieving defect detection rates comparable to conventional electrode manufacturing.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!