Comparative study of zinc coating versus aluminum coating for steel protection

OCT 11, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Steel Coating Evolution and Protection Goals

The evolution of steel coating technologies has undergone significant transformations since the early 20th century, driven by the critical need to protect steel structures from corrosion. Initially, simple oil-based paints and basic metallic coatings provided limited protection. The 1930s saw the emergence of hot-dip galvanization as a standardized industrial process, marking a pivotal advancement in steel protection methodologies.

Post-World War II industrial expansion accelerated coating innovation, with zinc emerging as the dominant protective material due to its sacrificial protection mechanism. The 1970s witnessed the introduction of aluminum coatings, offering alternative protection characteristics particularly suited for high-temperature applications. Recent decades have seen sophisticated developments including zinc-aluminum alloy coatings that combine beneficial properties of both metals.

The fundamental goal of steel coating technologies centers on corrosion prevention, which remains the primary challenge in steel utilization across industries. Unprotected steel structures can experience annual corrosion rates of 0.1-0.3 mm in moderate environments and up to 1.0 mm in aggressive conditions, significantly compromising structural integrity and safety while increasing maintenance costs.

Beyond corrosion resistance, modern coating technologies aim to achieve multiple protection objectives. These include enhanced durability under diverse environmental conditions, from marine environments with high salt content to industrial settings with chemical exposure. Coatings must also maintain effectiveness across wide temperature ranges, particularly critical in automotive, aerospace, and industrial applications where thermal cycling occurs regularly.

Cost-effectiveness represents another crucial goal, balancing initial application expenses against long-term protection value. Environmental sustainability has emerged as an increasingly important objective, with regulations driving development of coatings with reduced environmental impact throughout their lifecycle. This includes minimizing volatile organic compounds (VOCs) during application and ensuring recyclability at end-of-life.

The comparative analysis of zinc versus aluminum coatings must be contextualized within this evolutionary framework and these protection goals. Each coating system offers distinct advantages in specific applications, with selection criteria increasingly focused on optimizing performance for particular environmental conditions rather than seeking universal solutions. The industry continues to pursue innovations that enhance protection while addressing economic and environmental considerations.

Post-World War II industrial expansion accelerated coating innovation, with zinc emerging as the dominant protective material due to its sacrificial protection mechanism. The 1970s witnessed the introduction of aluminum coatings, offering alternative protection characteristics particularly suited for high-temperature applications. Recent decades have seen sophisticated developments including zinc-aluminum alloy coatings that combine beneficial properties of both metals.

The fundamental goal of steel coating technologies centers on corrosion prevention, which remains the primary challenge in steel utilization across industries. Unprotected steel structures can experience annual corrosion rates of 0.1-0.3 mm in moderate environments and up to 1.0 mm in aggressive conditions, significantly compromising structural integrity and safety while increasing maintenance costs.

Beyond corrosion resistance, modern coating technologies aim to achieve multiple protection objectives. These include enhanced durability under diverse environmental conditions, from marine environments with high salt content to industrial settings with chemical exposure. Coatings must also maintain effectiveness across wide temperature ranges, particularly critical in automotive, aerospace, and industrial applications where thermal cycling occurs regularly.

Cost-effectiveness represents another crucial goal, balancing initial application expenses against long-term protection value. Environmental sustainability has emerged as an increasingly important objective, with regulations driving development of coatings with reduced environmental impact throughout their lifecycle. This includes minimizing volatile organic compounds (VOCs) during application and ensuring recyclability at end-of-life.

The comparative analysis of zinc versus aluminum coatings must be contextualized within this evolutionary framework and these protection goals. Each coating system offers distinct advantages in specific applications, with selection criteria increasingly focused on optimizing performance for particular environmental conditions rather than seeking universal solutions. The industry continues to pursue innovations that enhance protection while addressing economic and environmental considerations.

Market Analysis of Protective Coating Industry

The global protective coating industry has witnessed substantial growth in recent years, reaching a market value of approximately $38.7 billion in 2022, with projections indicating a compound annual growth rate (CAGR) of 5.8% through 2030. This growth is primarily driven by increasing industrialization, infrastructure development, and the rising awareness about corrosion protection across various sectors including automotive, construction, marine, and aerospace.

Within this broader market, metal protective coatings represent a significant segment, accounting for roughly 27% of the total protective coating market. The steel protection segment specifically has been expanding at a faster rate than the overall market, driven by the critical need to extend the service life of steel structures and components in increasingly demanding environments.

Zinc and aluminum coatings collectively dominate approximately 65% of the steel protection coating market. Historically, zinc coatings (galvanization) have maintained the largest market share due to their established technology, cost-effectiveness, and widespread application infrastructure. However, aluminum coatings have been gaining market traction, particularly in high-temperature and specialized applications.

Regional analysis reveals distinct market preferences. North America and Europe have mature markets with a growing shift toward environmentally friendly coating solutions and advanced protection systems. Asia-Pacific represents the fastest-growing region, with China, India, and Japan leading consumption due to rapid industrialization and massive infrastructure projects. The Middle East shows increasing demand driven by oil and gas industries requiring superior corrosion protection in harsh environments.

End-user segmentation indicates that the construction sector consumes approximately 32% of protective steel coatings, followed by automotive (18%), industrial equipment (15%), marine (12%), and other applications (23%). The automotive industry specifically has been showing increased interest in aluminum coatings due to their superior performance in certain conditions.

Market dynamics are increasingly influenced by environmental regulations, particularly restrictions on volatile organic compounds (VOCs) and heavy metals. This regulatory landscape has accelerated innovation in water-based and powder coating technologies, creating new market opportunities for both zinc and aluminum coating manufacturers who can adapt to these requirements.

Price sensitivity analysis indicates that while zinc coatings generally maintain a cost advantage, the total lifecycle cost comparison increasingly favors aluminum coatings in specific applications where longer service life and reduced maintenance requirements offset higher initial costs.

Within this broader market, metal protective coatings represent a significant segment, accounting for roughly 27% of the total protective coating market. The steel protection segment specifically has been expanding at a faster rate than the overall market, driven by the critical need to extend the service life of steel structures and components in increasingly demanding environments.

Zinc and aluminum coatings collectively dominate approximately 65% of the steel protection coating market. Historically, zinc coatings (galvanization) have maintained the largest market share due to their established technology, cost-effectiveness, and widespread application infrastructure. However, aluminum coatings have been gaining market traction, particularly in high-temperature and specialized applications.

Regional analysis reveals distinct market preferences. North America and Europe have mature markets with a growing shift toward environmentally friendly coating solutions and advanced protection systems. Asia-Pacific represents the fastest-growing region, with China, India, and Japan leading consumption due to rapid industrialization and massive infrastructure projects. The Middle East shows increasing demand driven by oil and gas industries requiring superior corrosion protection in harsh environments.

End-user segmentation indicates that the construction sector consumes approximately 32% of protective steel coatings, followed by automotive (18%), industrial equipment (15%), marine (12%), and other applications (23%). The automotive industry specifically has been showing increased interest in aluminum coatings due to their superior performance in certain conditions.

Market dynamics are increasingly influenced by environmental regulations, particularly restrictions on volatile organic compounds (VOCs) and heavy metals. This regulatory landscape has accelerated innovation in water-based and powder coating technologies, creating new market opportunities for both zinc and aluminum coating manufacturers who can adapt to these requirements.

Price sensitivity analysis indicates that while zinc coatings generally maintain a cost advantage, the total lifecycle cost comparison increasingly favors aluminum coatings in specific applications where longer service life and reduced maintenance requirements offset higher initial costs.

Current Challenges in Steel Corrosion Protection

Despite significant advancements in corrosion protection technologies, the steel industry continues to face substantial challenges in developing optimal protective coating solutions. Corrosion remains a persistent problem, causing approximately $2.5 trillion in global economic losses annually, equivalent to about 3.4% of global GDP. The steel protection sector specifically accounts for a significant portion of these costs, highlighting the critical importance of effective corrosion prevention strategies.

Environmental regulations have emerged as a major constraint in steel protection technologies. Traditional coating methods often involve hazardous substances that face increasing restrictions worldwide. The phase-out of hexavalent chromium compounds, previously essential in many coating processes, has forced manufacturers to seek alternative solutions that maintain performance while meeting stringent environmental standards.

The durability-cost balance presents another significant challenge. While zinc coatings offer excellent galvanic protection at reasonable costs, they typically have shorter lifespans in aggressive environments compared to aluminum coatings. Conversely, aluminum coatings provide superior high-temperature resistance but at higher implementation costs, creating difficult trade-offs for engineers and manufacturers.

Application consistency across complex geometries remains problematic for both zinc and aluminum coating technologies. Ensuring uniform coating thickness on intricate steel components, especially those with recessed areas or sharp edges, continues to challenge coating applicators. This inconsistency can create weak points vulnerable to accelerated corrosion, compromising the overall protection system.

The industry also struggles with compatibility issues between protective coatings and subsequent finishing layers. Both zinc and aluminum coatings can present challenges when additional paint systems or functional coatings are required, sometimes necessitating complex pretreatment processes that add cost and complexity to manufacturing operations.

Testing methodologies present another obstacle, as accelerated corrosion tests often fail to accurately predict real-world performance. The correlation between laboratory results and actual field performance remains imperfect, making it difficult to confidently predict coating lifespans in varied environmental conditions.

Finally, emerging applications in renewable energy infrastructure, particularly offshore wind and solar installations, demand unprecedented levels of corrosion resistance in extremely harsh environments. Current coating technologies struggle to provide the 25+ year protection required without significant maintenance, creating an urgent need for innovation in this rapidly growing sector.

Environmental regulations have emerged as a major constraint in steel protection technologies. Traditional coating methods often involve hazardous substances that face increasing restrictions worldwide. The phase-out of hexavalent chromium compounds, previously essential in many coating processes, has forced manufacturers to seek alternative solutions that maintain performance while meeting stringent environmental standards.

The durability-cost balance presents another significant challenge. While zinc coatings offer excellent galvanic protection at reasonable costs, they typically have shorter lifespans in aggressive environments compared to aluminum coatings. Conversely, aluminum coatings provide superior high-temperature resistance but at higher implementation costs, creating difficult trade-offs for engineers and manufacturers.

Application consistency across complex geometries remains problematic for both zinc and aluminum coating technologies. Ensuring uniform coating thickness on intricate steel components, especially those with recessed areas or sharp edges, continues to challenge coating applicators. This inconsistency can create weak points vulnerable to accelerated corrosion, compromising the overall protection system.

The industry also struggles with compatibility issues between protective coatings and subsequent finishing layers. Both zinc and aluminum coatings can present challenges when additional paint systems or functional coatings are required, sometimes necessitating complex pretreatment processes that add cost and complexity to manufacturing operations.

Testing methodologies present another obstacle, as accelerated corrosion tests often fail to accurately predict real-world performance. The correlation between laboratory results and actual field performance remains imperfect, making it difficult to confidently predict coating lifespans in varied environmental conditions.

Finally, emerging applications in renewable energy infrastructure, particularly offshore wind and solar installations, demand unprecedented levels of corrosion resistance in extremely harsh environments. Current coating technologies struggle to provide the 25+ year protection required without significant maintenance, creating an urgent need for innovation in this rapidly growing sector.

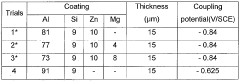

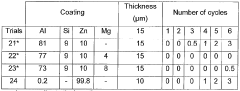

Zinc vs Aluminum Coating Technical Specifications

01 Zinc and aluminum coating compositions for corrosion protection

Specialized coating compositions combining zinc and aluminum provide superior corrosion protection for metal substrates. These formulations typically contain specific ratios of zinc and aluminum particles suspended in suitable binders or matrices. The synergistic effect of both metals offers enhanced protection against various environmental conditions, with the zinc providing cathodic protection while aluminum forms a passive oxide layer, resulting in longer-lasting protection than either metal alone.- Zinc and aluminum coating compositions for corrosion protection: Specialized coating compositions combining zinc and aluminum provide enhanced corrosion protection for metal substrates. These formulations typically contain specific ratios of zinc and aluminum particles suspended in suitable binders or matrices. The dual-metal composition creates a synergistic protective effect that exceeds the protection offered by either metal alone, providing both barrier protection and galvanic protection to the underlying substrate.

- Hot-dip galvanizing and aluminizing processes: Hot-dip processes involve immersing metal substrates in molten zinc or aluminum baths to create protective coatings. These processes can be optimized through controlled bath compositions, immersion times, and post-treatment procedures. Advanced hot-dip techniques may involve sequential or simultaneous application of both metals to create layered or alloyed coatings with superior protection characteristics and extended service life.

- Thermal spray coating technologies: Thermal spray technologies apply zinc and aluminum coatings through high-temperature processes where metal feedstock is melted and propelled onto substrate surfaces. These methods include arc spray, flame spray, and plasma spray techniques, each offering different coating characteristics. Thermal spray coatings provide excellent adhesion and can be applied with precise thickness control, making them suitable for various environmental exposure conditions.

- Surface preparation and pre-treatment methods: Effective surface preparation is critical for optimal adhesion and performance of zinc and aluminum protective coatings. Preparation methods include mechanical cleaning, chemical etching, and application of conversion coatings. Proper pre-treatment removes contaminants, creates appropriate surface profiles, and enhances the chemical bonding between the coating and substrate, significantly improving coating durability and protective properties.

- Post-treatment and sealing technologies: Post-treatment processes for zinc and aluminum coatings include passivation, sealing, and application of topcoats to enhance protection. These treatments can include chromate and non-chromate conversion coatings, organic sealers, and specialized polymer topcoats. Post-treatments fill pores, reduce reactivity of the coating surface, and provide additional barrier protection, significantly extending the service life of the protective system in aggressive environments.

02 Hot-dip galvanizing and aluminizing processes

Hot-dip processes involve immersing steel or other metal substrates in molten zinc, aluminum, or zinc-aluminum alloys to form protective coatings. These processes create metallurgically bonded layers that provide excellent adhesion and corrosion resistance. Various process parameters including temperature control, immersion time, and post-treatment steps can be optimized to achieve specific coating properties such as thickness, appearance, and performance characteristics.Expand Specific Solutions03 Thermal spray coating technologies

Thermal spray techniques apply zinc, aluminum, or their alloys onto substrates using heat sources to melt the coating materials. These processes include arc spray, flame spray, plasma spray, and high-velocity oxy-fuel coating methods. The molten particles are propelled onto the substrate surface where they solidify rapidly, forming a protective layer. These technologies allow for coating application on large structures and complex geometries, providing effective protection in harsh environments.Expand Specific Solutions04 Multi-layer coating systems with zinc and aluminum

Advanced protection systems utilize multiple layers of zinc and aluminum coatings to maximize corrosion resistance. These systems typically include a zinc-rich base layer for cathodic protection, followed by aluminum-containing intermediate layers, and sometimes topped with organic sealers. Each layer serves specific protective functions, with the combined system providing synergistic benefits including barrier protection, sacrificial protection, and enhanced durability under various environmental conditions.Expand Specific Solutions05 Surface preparation and post-treatment methods

Effective surface preparation and post-treatment processes are critical for optimizing zinc and aluminum coating performance. Surface preparation techniques include abrasive blasting, chemical cleaning, and phosphating to ensure proper coating adhesion. Post-treatment methods such as chromating, passivation, and sealing enhance corrosion resistance and extend coating life. These processes improve coating uniformity, reduce defects, and create additional protective barriers against environmental factors.Expand Specific Solutions

Leading Manufacturers and Research Institutions

The zinc versus aluminum coating market for steel protection is in a mature growth phase, with an estimated global market size exceeding $15 billion annually. While zinc coatings (galvanization) remain dominant due to cost-effectiveness and established infrastructure, aluminum coatings are gaining traction for superior high-temperature performance. Leading steel producers like ArcelorMittal, Tata Steel, and POSCO Holdings have developed advanced versions of both coating technologies, with companies such as Bekaert and Henkel focusing on specialized coating formulations. Research institutions including Fraunhofer-Gesellschaft and university partnerships with thyssenkrupp Steel Europe are driving innovation in hybrid coating systems that combine the benefits of both metals, particularly for automotive and construction applications requiring enhanced corrosion resistance.

ArcelorMittal SA

Technical Solution: ArcelorMittal has developed advanced galvanizing and aluminizing technologies for steel protection. Their Magnelis® coating technology combines zinc with aluminum and magnesium (ZnAlMg) in a precise ratio (93.5% Zn, 3.5% Al, 3% Mg), offering superior corrosion resistance compared to conventional hot-dip galvanized coatings. This technology provides self-healing properties at cut edges and scratches through the formation of a stable protective film containing magnesium. Their research demonstrates that Magnelis® provides up to 10 times better protection against corrosion than standard galvanized steel, particularly in high-chloride environments. ArcelorMittal also produces Alusi®, an aluminum-silicon coating (90% Al, 10% Si) that offers exceptional heat resistance up to 650°C while maintaining good formability and weldability.

Strengths: Superior corrosion resistance in aggressive environments; reduced coating thickness requirements; environmentally friendly with lower zinc usage; excellent edge protection. Weaknesses: Higher production costs compared to traditional galvanized coatings; specialized application equipment required; limited availability compared to conventional zinc coatings.

Tata Steel Ltd.

Technical Solution: Tata Steel has pioneered innovative coating technologies for steel protection, including both zinc and aluminum-based solutions. Their Galvalloy® coating combines zinc with aluminum (95% Zn, 5% Al) to create a microstructure that provides enhanced corrosion protection compared to conventional galvanized steel. The aluminum content forms a stable barrier layer that slows corrosion progression. For high-temperature applications, Tata Steel offers Aluminized Type 1 coating (pure aluminum coating) and Type 2 (aluminum-silicon alloy coating), which provide excellent heat reflection, oxidation resistance at temperatures up to 650°C, and good formability. Their research has demonstrated that aluminized coatings offer superior performance in high-temperature environments, while their zinc-based coatings provide better sacrificial protection in atmospheric conditions. Tata Steel has also developed MagiZinc®, a zinc-magnesium-aluminum coating that reduces zinc consumption while improving corrosion resistance.

Strengths: Comprehensive range of coating solutions for different environmental conditions; strong technical expertise in both zinc and aluminum coating technologies; global manufacturing capabilities. Weaknesses: Higher production costs for specialized coatings; some aluminum coatings show reduced performance in highly acidic environments; requires careful control of coating parameters.

Key Patents in Metal Coating Innovations

Hot-dip aluminum-zinc coating method and product

PatentInactiveUS4456663A

Innovation

- A hot-dip coating bath composition of 12 to 24% zinc, less than 4% silicon, 0.3 to 3.5% iron, and balance aluminum provides superior corrosion resistance and ductility, reducing rust staining and crazing tendencies, while allowing for effective coatings with reduced silicon content.

Steel sheet coated with a metallic coating based on aluminum

PatentWO2017017483A1

Innovation

- A steel sheet coated with a metallic layer comprising 2.0-24.0% zinc, 7.1-12.0% silicon, and optional magnesium, with an Al/Zn ratio above 2.9, forming a microstructure with a Mg2Si phase for enhanced sacrificial cathodic protection and barrier protection, deposited via hot-dip galvanization, ensuring improved corrosion resistance and formability.

Environmental Impact Assessment

The environmental impact of protective coatings for steel structures represents a critical consideration in material selection processes. Zinc and aluminum coatings exhibit distinctly different environmental footprints throughout their lifecycle, from raw material extraction to end-of-life disposal.

Zinc coating production typically consumes more energy than aluminum coating manufacturing, with estimates suggesting zinc galvanizing requires approximately 3.2-4.5 MJ/kg compared to aluminum's 2.8-3.6 MJ/kg for comparable protection thickness. This energy differential translates to higher carbon emissions during the production phase for zinc coatings, averaging 0.28-0.35 kg CO2 equivalent per square meter versus 0.22-0.30 kg CO2 equivalent for aluminum coatings.

Water pollution profiles differ significantly between these coating technologies. Zinc production and application processes generate effluents containing zinc compounds that pose moderate toxicity to aquatic ecosystems, with potential bioaccumulation concerns. Studies indicate zinc concentrations in industrial wastewater from galvanizing operations typically range from 5-25 mg/L, exceeding many regulatory thresholds. Aluminum coating processes generally produce lower toxicity effluents, though they may contain fluoride compounds requiring specialized treatment.

Regarding resource depletion, zinc reserves face greater sustainability challenges. Current global zinc reserves are projected to last approximately 15-20 years at current extraction rates, while aluminum, being the third most abundant element in Earth's crust, presents fewer resource scarcity concerns despite its energy-intensive extraction process.

During service life, environmental leaching characteristics favor aluminum in many applications. Zinc coatings gradually release zinc ions through weathering processes, contributing to soil and water zinc loads at rates of 1-4 g/m²/year depending on environmental conditions. Aluminum coatings demonstrate superior stability with negligible leaching rates under normal atmospheric conditions, though they may release aluminum compounds in highly acidic environments.

End-of-life considerations reveal that both coating materials are recyclable, though zinc-coated steel recycling presents more complex separation challenges. Aluminum-coated steel typically achieves recycling efficiency rates of 92-97%, while zinc-coated steel averages 85-92% efficiency in modern recycling facilities.

Regulatory frameworks increasingly favor coating technologies with reduced environmental impact. The European Union's REACH regulations have placed additional restrictions on certain zinc compounds, while aluminum coatings generally face fewer regulatory hurdles due to their lower environmental persistence and toxicity profiles.

Zinc coating production typically consumes more energy than aluminum coating manufacturing, with estimates suggesting zinc galvanizing requires approximately 3.2-4.5 MJ/kg compared to aluminum's 2.8-3.6 MJ/kg for comparable protection thickness. This energy differential translates to higher carbon emissions during the production phase for zinc coatings, averaging 0.28-0.35 kg CO2 equivalent per square meter versus 0.22-0.30 kg CO2 equivalent for aluminum coatings.

Water pollution profiles differ significantly between these coating technologies. Zinc production and application processes generate effluents containing zinc compounds that pose moderate toxicity to aquatic ecosystems, with potential bioaccumulation concerns. Studies indicate zinc concentrations in industrial wastewater from galvanizing operations typically range from 5-25 mg/L, exceeding many regulatory thresholds. Aluminum coating processes generally produce lower toxicity effluents, though they may contain fluoride compounds requiring specialized treatment.

Regarding resource depletion, zinc reserves face greater sustainability challenges. Current global zinc reserves are projected to last approximately 15-20 years at current extraction rates, while aluminum, being the third most abundant element in Earth's crust, presents fewer resource scarcity concerns despite its energy-intensive extraction process.

During service life, environmental leaching characteristics favor aluminum in many applications. Zinc coatings gradually release zinc ions through weathering processes, contributing to soil and water zinc loads at rates of 1-4 g/m²/year depending on environmental conditions. Aluminum coatings demonstrate superior stability with negligible leaching rates under normal atmospheric conditions, though they may release aluminum compounds in highly acidic environments.

End-of-life considerations reveal that both coating materials are recyclable, though zinc-coated steel recycling presents more complex separation challenges. Aluminum-coated steel typically achieves recycling efficiency rates of 92-97%, while zinc-coated steel averages 85-92% efficiency in modern recycling facilities.

Regulatory frameworks increasingly favor coating technologies with reduced environmental impact. The European Union's REACH regulations have placed additional restrictions on certain zinc compounds, while aluminum coatings generally face fewer regulatory hurdles due to their lower environmental persistence and toxicity profiles.

Cost-Benefit Analysis

The cost-benefit analysis of zinc versus aluminum coatings for steel protection reveals significant economic implications for industrial applications. Initial acquisition costs show that zinc coatings generally range from $0.50 to $2.00 per square foot, while aluminum coatings typically cost between $1.00 and $3.50 per square foot. This price differential of approximately 30-75% higher for aluminum coatings represents a substantial initial investment consideration for large-scale projects.

However, lifecycle cost analysis demonstrates that aluminum coatings often provide superior longevity in certain environments. In marine or highly corrosive industrial settings, aluminum coatings can last 1.5-2.5 times longer than traditional zinc coatings, potentially offsetting the higher initial expenditure through reduced maintenance and replacement frequencies.

Maintenance requirements further differentiate these coating options. Zinc coatings typically require maintenance interventions every 5-7 years in moderate environments, while aluminum coatings may extend this interval to 8-15 years depending on exposure conditions. This maintenance differential translates to significant labor and downtime cost savings, particularly for structures with difficult access or in critical operational environments.

Environmental impact costs must also be factored into comprehensive analysis. Zinc coatings release zinc ions during weathering, potentially requiring environmental remediation costs in sensitive areas. Aluminum coatings generally present lower environmental leaching concerns but may involve higher energy consumption during production, creating a complex sustainability cost equation.

Application efficiency represents another economic consideration. Zinc coatings typically achieve effective protection at thicknesses of 50-100 microns, while aluminum coatings often require 75-150 microns to achieve comparable baseline protection. This thickness differential impacts material consumption rates and application labor costs.

Performance under extreme conditions reveals additional cost implications. In high-temperature environments (above 200°C), aluminum coatings maintain structural integrity while zinc coatings may deteriorate rapidly, necessitating more frequent replacement. Conversely, in abrasive environments, zinc's sacrificial protection mechanism may provide more cost-effective ongoing protection despite shorter overall lifespan.

Return on investment calculations indicate that aluminum coatings typically become economically advantageous for structures with planned service lives exceeding 15 years, particularly in aggressive environments. For temporary structures or applications with shorter service requirements, zinc coatings generally provide superior cost efficiency despite more frequent maintenance interventions.

However, lifecycle cost analysis demonstrates that aluminum coatings often provide superior longevity in certain environments. In marine or highly corrosive industrial settings, aluminum coatings can last 1.5-2.5 times longer than traditional zinc coatings, potentially offsetting the higher initial expenditure through reduced maintenance and replacement frequencies.

Maintenance requirements further differentiate these coating options. Zinc coatings typically require maintenance interventions every 5-7 years in moderate environments, while aluminum coatings may extend this interval to 8-15 years depending on exposure conditions. This maintenance differential translates to significant labor and downtime cost savings, particularly for structures with difficult access or in critical operational environments.

Environmental impact costs must also be factored into comprehensive analysis. Zinc coatings release zinc ions during weathering, potentially requiring environmental remediation costs in sensitive areas. Aluminum coatings generally present lower environmental leaching concerns but may involve higher energy consumption during production, creating a complex sustainability cost equation.

Application efficiency represents another economic consideration. Zinc coatings typically achieve effective protection at thicknesses of 50-100 microns, while aluminum coatings often require 75-150 microns to achieve comparable baseline protection. This thickness differential impacts material consumption rates and application labor costs.

Performance under extreme conditions reveals additional cost implications. In high-temperature environments (above 200°C), aluminum coatings maintain structural integrity while zinc coatings may deteriorate rapidly, necessitating more frequent replacement. Conversely, in abrasive environments, zinc's sacrificial protection mechanism may provide more cost-effective ongoing protection despite shorter overall lifespan.

Return on investment calculations indicate that aluminum coatings typically become economically advantageous for structures with planned service lives exceeding 15 years, particularly in aggressive environments. For temporary structures or applications with shorter service requirements, zinc coatings generally provide superior cost efficiency despite more frequent maintenance interventions.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!