Patent landscape of zinc coating methods for automotive applications

OCT 11, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Zinc Coating Evolution and Objectives

Zinc coating technologies for automotive applications have evolved significantly over the past century, transitioning from rudimentary galvanizing methods to sophisticated multi-layer coating systems. The earliest documented use of zinc coatings for automotive components dates back to the 1920s, when hot-dip galvanizing was first applied to prevent corrosion in chassis components. This evolution has been driven primarily by increasing demands for corrosion resistance, cost efficiency, and environmental compliance.

The 1950s marked a significant turning point with the introduction of electrogalvanizing processes, offering more precise coating thickness control compared to traditional hot-dip methods. By the 1970s, the automotive industry faced mounting pressure to extend vehicle lifespans while reducing weight, catalyzing research into advanced zinc coating technologies that could provide superior protection with thinner application layers.

The 1990s witnessed the emergence of zinc-nickel alloy coatings and zinc-rich primers, which demonstrated enhanced corrosion resistance properties particularly valuable for vehicles operating in harsh environmental conditions. Concurrently, environmental regulations began restricting the use of hexavalent chromium in passivation treatments, prompting the development of trivalent chromium and chromium-free alternatives that maintain comparable performance characteristics.

Recent technological advancements have focused on developing multi-functional zinc coatings that not only prevent corrosion but also offer additional benefits such as improved paint adhesion, self-healing properties, and reduced friction coefficients. Zinc-magnesium coatings, introduced in the early 2000s, represent one of the most significant innovations, providing superior edge protection and allowing for reduced coating thickness while maintaining or improving corrosion resistance.

The primary objectives driving current zinc coating research include developing systems that can withstand increasingly aggressive environmental conditions while meeting stringent weight reduction targets. Additionally, there is a strong focus on environmentally sustainable coating technologies that eliminate toxic substances and reduce energy consumption during application processes.

Patent activity in this field has grown exponentially since 2010, with particular concentration in technologies addressing galvanic corrosion at dissimilar metal interfaces, a challenge exacerbated by the increasing use of multi-material assemblies in modern vehicle construction. The integration of aluminum, carbon fiber, and high-strength steels alongside traditional mild steels has created new corrosion challenges that conventional zinc coating methods struggle to address effectively.

Looking forward, the industry aims to develop zinc coating systems that can be applied at lower temperatures, reducing energy consumption and enabling application to heat-sensitive components. There is also significant interest in "smart" zinc coatings with self-diagnostic capabilities that can signal when protection is compromised, potentially revolutionizing maintenance protocols for critical automotive components.

The 1950s marked a significant turning point with the introduction of electrogalvanizing processes, offering more precise coating thickness control compared to traditional hot-dip methods. By the 1970s, the automotive industry faced mounting pressure to extend vehicle lifespans while reducing weight, catalyzing research into advanced zinc coating technologies that could provide superior protection with thinner application layers.

The 1990s witnessed the emergence of zinc-nickel alloy coatings and zinc-rich primers, which demonstrated enhanced corrosion resistance properties particularly valuable for vehicles operating in harsh environmental conditions. Concurrently, environmental regulations began restricting the use of hexavalent chromium in passivation treatments, prompting the development of trivalent chromium and chromium-free alternatives that maintain comparable performance characteristics.

Recent technological advancements have focused on developing multi-functional zinc coatings that not only prevent corrosion but also offer additional benefits such as improved paint adhesion, self-healing properties, and reduced friction coefficients. Zinc-magnesium coatings, introduced in the early 2000s, represent one of the most significant innovations, providing superior edge protection and allowing for reduced coating thickness while maintaining or improving corrosion resistance.

The primary objectives driving current zinc coating research include developing systems that can withstand increasingly aggressive environmental conditions while meeting stringent weight reduction targets. Additionally, there is a strong focus on environmentally sustainable coating technologies that eliminate toxic substances and reduce energy consumption during application processes.

Patent activity in this field has grown exponentially since 2010, with particular concentration in technologies addressing galvanic corrosion at dissimilar metal interfaces, a challenge exacerbated by the increasing use of multi-material assemblies in modern vehicle construction. The integration of aluminum, carbon fiber, and high-strength steels alongside traditional mild steels has created new corrosion challenges that conventional zinc coating methods struggle to address effectively.

Looking forward, the industry aims to develop zinc coating systems that can be applied at lower temperatures, reducing energy consumption and enabling application to heat-sensitive components. There is also significant interest in "smart" zinc coatings with self-diagnostic capabilities that can signal when protection is compromised, potentially revolutionizing maintenance protocols for critical automotive components.

Automotive Industry Demand for Corrosion Protection

The automotive industry faces significant challenges in protecting vehicles from corrosion, particularly in harsh environmental conditions. Corrosion protection has become a critical requirement for automotive manufacturers worldwide, driven by consumer expectations for longer vehicle lifespans and warranty periods that now commonly extend to 10-12 years for corrosion perforation. This demand has intensified as vehicles are increasingly exposed to aggressive environments, including road salts used in cold regions, coastal areas with high salt content in the air, and industrial zones with elevated pollution levels.

Vehicle manufacturers must balance corrosion protection with cost efficiency, as protective coatings represent a significant portion of production expenses. The global automotive corrosion protection market was valued at over 9 billion USD in 2022, with projections indicating continued growth at a compound annual rate of approximately 6% through 2030, highlighting the economic significance of this technical challenge.

Environmental regulations have dramatically reshaped corrosion protection requirements in the automotive sector. Legislation in major markets has restricted the use of hexavalent chromium and other hazardous substances previously common in traditional zinc coating processes. This regulatory landscape has accelerated the development of more environmentally friendly zinc coating technologies that maintain or exceed previous performance standards.

Weight reduction initiatives, central to improving fuel efficiency and reducing emissions in modern vehicles, have created additional demands for advanced corrosion protection. As manufacturers increasingly incorporate lightweight materials like aluminum and advanced high-strength steels, they require specialized zinc coating methods compatible with these diverse substrates while maintaining structural integrity.

The electrification trend in the automotive industry presents unique corrosion protection challenges. Electric vehicle battery enclosures and related components demand exceptional corrosion resistance to ensure safety and longevity, while also requiring coatings that provide electrical conductivity or isolation as needed. This has spurred innovation in zinc coating technologies specifically tailored for EV applications.

Consumer expectations for vehicle aesthetics have elevated the importance of appearance retention in corrosion protection solutions. Modern zinc coating methods must not only prevent structural deterioration but also maintain surface quality and appearance throughout the vehicle's service life, particularly for visible components and luxury vehicles where cosmetic standards are exceptionally high.

Vehicle manufacturers must balance corrosion protection with cost efficiency, as protective coatings represent a significant portion of production expenses. The global automotive corrosion protection market was valued at over 9 billion USD in 2022, with projections indicating continued growth at a compound annual rate of approximately 6% through 2030, highlighting the economic significance of this technical challenge.

Environmental regulations have dramatically reshaped corrosion protection requirements in the automotive sector. Legislation in major markets has restricted the use of hexavalent chromium and other hazardous substances previously common in traditional zinc coating processes. This regulatory landscape has accelerated the development of more environmentally friendly zinc coating technologies that maintain or exceed previous performance standards.

Weight reduction initiatives, central to improving fuel efficiency and reducing emissions in modern vehicles, have created additional demands for advanced corrosion protection. As manufacturers increasingly incorporate lightweight materials like aluminum and advanced high-strength steels, they require specialized zinc coating methods compatible with these diverse substrates while maintaining structural integrity.

The electrification trend in the automotive industry presents unique corrosion protection challenges. Electric vehicle battery enclosures and related components demand exceptional corrosion resistance to ensure safety and longevity, while also requiring coatings that provide electrical conductivity or isolation as needed. This has spurred innovation in zinc coating technologies specifically tailored for EV applications.

Consumer expectations for vehicle aesthetics have elevated the importance of appearance retention in corrosion protection solutions. Modern zinc coating methods must not only prevent structural deterioration but also maintain surface quality and appearance throughout the vehicle's service life, particularly for visible components and luxury vehicles where cosmetic standards are exceptionally high.

Global Zinc Coating Technology Status and Barriers

The global zinc coating landscape for automotive applications presents a complex picture of technological advancement and regional disparities. Currently, hot-dip galvanizing dominates approximately 70% of the automotive zinc coating market, followed by electrogalvanizing at 20% and thermal spraying methods at 10%. These technologies have evolved significantly over the past two decades, with substantial improvements in coating uniformity, adhesion strength, and corrosion resistance.

Despite these advancements, significant technical barriers persist across the global zinc coating industry. Coating thickness control remains challenging, particularly for complex automotive geometries with recessed areas and sharp edges. Current technologies struggle to maintain uniform zinc distribution, resulting in inconsistent corrosion protection across vehicle bodies. This issue is especially pronounced in regions with high humidity and coastal environments.

Environmental regulations present another substantial barrier, with different regions implementing varying standards for zinc waste management and VOC emissions. European manufacturers face the most stringent regulations under REACH and End-of-Life Vehicle directives, while North American and Asian markets operate under less restrictive frameworks, creating an uneven competitive landscape.

Energy consumption represents a critical challenge, particularly for hot-dip galvanizing processes which require temperatures exceeding 450°C. This energy intensity contributes significantly to production costs and carbon footprints, making it increasingly problematic as automotive manufacturers pursue sustainability goals. Alternative lower-temperature processes often sacrifice coating quality or production efficiency.

The geographical distribution of zinc coating technology shows clear regional specialization. Japan and Germany lead in high-precision electrogalvanizing innovations, with companies like Nippon Steel and ThyssenKrupp holding key patents for automotive applications. China dominates in production volume and cost efficiency but faces quality consistency challenges. North American manufacturers excel in specialized coatings for extreme weather conditions, particularly important for vehicles in northern markets.

Supply chain vulnerabilities have emerged as a significant barrier, with 60% of high-grade zinc production concentrated in just three countries. This concentration creates price volatility and potential disruptions, as evidenced during recent global supply chain crises. Furthermore, the integration of zinc coating processes with increasingly automated automotive manufacturing lines presents compatibility challenges that require substantial capital investment to overcome.

Quality control methodologies vary significantly across regions, with European and Japanese manufacturers implementing more sophisticated in-line monitoring systems compared to other markets. This technological gap creates inconsistent product quality and reliability across the global automotive supply chain.

Despite these advancements, significant technical barriers persist across the global zinc coating industry. Coating thickness control remains challenging, particularly for complex automotive geometries with recessed areas and sharp edges. Current technologies struggle to maintain uniform zinc distribution, resulting in inconsistent corrosion protection across vehicle bodies. This issue is especially pronounced in regions with high humidity and coastal environments.

Environmental regulations present another substantial barrier, with different regions implementing varying standards for zinc waste management and VOC emissions. European manufacturers face the most stringent regulations under REACH and End-of-Life Vehicle directives, while North American and Asian markets operate under less restrictive frameworks, creating an uneven competitive landscape.

Energy consumption represents a critical challenge, particularly for hot-dip galvanizing processes which require temperatures exceeding 450°C. This energy intensity contributes significantly to production costs and carbon footprints, making it increasingly problematic as automotive manufacturers pursue sustainability goals. Alternative lower-temperature processes often sacrifice coating quality or production efficiency.

The geographical distribution of zinc coating technology shows clear regional specialization. Japan and Germany lead in high-precision electrogalvanizing innovations, with companies like Nippon Steel and ThyssenKrupp holding key patents for automotive applications. China dominates in production volume and cost efficiency but faces quality consistency challenges. North American manufacturers excel in specialized coatings for extreme weather conditions, particularly important for vehicles in northern markets.

Supply chain vulnerabilities have emerged as a significant barrier, with 60% of high-grade zinc production concentrated in just three countries. This concentration creates price volatility and potential disruptions, as evidenced during recent global supply chain crises. Furthermore, the integration of zinc coating processes with increasingly automated automotive manufacturing lines presents compatibility challenges that require substantial capital investment to overcome.

Quality control methodologies vary significantly across regions, with European and Japanese manufacturers implementing more sophisticated in-line monitoring systems compared to other markets. This technological gap creates inconsistent product quality and reliability across the global automotive supply chain.

Current Zinc Coating Solutions for Automotive Applications

01 Hot-dip galvanizing methods

Hot-dip galvanizing involves immersing steel or iron components in a bath of molten zinc at temperatures around 450°C. This process creates a metallurgically bonded coating that provides excellent corrosion protection. The thickness of the zinc coating can be controlled by adjusting immersion time and withdrawal speed. This method is widely used for structural steel components, hardware, and various industrial applications due to its durability and comprehensive coverage.- Hot-dip galvanizing methods: Hot-dip galvanizing involves immersing steel or iron components in a bath of molten zinc at temperatures around 450°C. This process creates a metallurgically bonded coating that provides excellent corrosion protection. The coating consists of several zinc-iron alloy layers topped with a layer of pure zinc. This method is widely used for structural steel components and offers long-lasting protection even in harsh environments.

- Electroplating zinc coating techniques: Electroplating involves depositing zinc onto metal surfaces using an electric current in an electrolyte solution containing zinc ions. This process allows for precise control of coating thickness and can be applied to complex geometries. Electroplated zinc coatings provide good corrosion resistance and can be further enhanced with post-treatments. The process typically operates at room temperature and produces a bright, uniform finish.

- Zinc-alloy coating formulations: Zinc can be alloyed with other metals such as aluminum, magnesium, or nickel to enhance specific properties of the coating. These alloy coatings often provide superior corrosion resistance compared to pure zinc coatings. The addition of alloying elements can improve adhesion, ductility, and appearance of the coating. Different alloy compositions are tailored for specific applications and environmental conditions.

- Thermal spray zinc coating methods: Thermal spray techniques involve melting zinc wire or powder and propelling it onto the substrate surface using compressed air or other gases. This creates a mechanical bond between the zinc particles and the substrate. Methods include flame spray, arc spray, and plasma spray. These techniques can be applied in the field and are suitable for large structures or components that cannot be dipped. The resulting coating provides good corrosion protection with minimal heat input to the substrate.

- Environmentally friendly zinc coating processes: Modern zinc coating methods focus on reducing environmental impact by eliminating hazardous chemicals, reducing waste, and lowering energy consumption. These processes may use water-based formulations instead of solvent-based ones, recover and recycle zinc, or operate at lower temperatures. Some methods incorporate nanotechnology to enhance coating performance while using less material. These environmentally friendly approaches maintain or improve the protective qualities of traditional zinc coatings while meeting stricter environmental regulations.

02 Electroplating zinc coating techniques

Electroplating involves depositing zinc onto metal surfaces using an electric current in an electrolyte solution containing zinc ions. This process allows for precise control of coating thickness and can be applied to complex geometries. Electroplated zinc coatings can be further enhanced with post-treatments to improve corrosion resistance. This method is commonly used for automotive parts, fasteners, and electrical components where dimensional precision is critical.Expand Specific Solutions03 Zinc-rich paint and spray coating methods

Zinc-rich paints and spray coatings contain high concentrations of zinc particles that provide cathodic protection to metal substrates. These coatings can be applied by brushing, rolling, or spraying onto prepared surfaces. The zinc particles in the coating sacrifice themselves to protect the underlying metal. This method is particularly useful for field repairs, maintenance of existing structures, and applications where hot-dip galvanizing or electroplating is not feasible.Expand Specific Solutions04 Thermal spray zinc coating processes

Thermal spray zinc coating involves melting zinc wire or powder and propelling it onto a prepared surface using compressed air or other gases. This creates a mechanical bond between the zinc and the substrate. Methods include flame spray, arc spray, and plasma spray, each offering different coating characteristics. Thermal spray zinc coatings provide excellent corrosion protection and can be applied to large structures on-site, making them suitable for bridges, marine structures, and industrial equipment.Expand Specific Solutions05 Advanced zinc alloy coating technologies

Advanced zinc alloy coatings incorporate elements such as aluminum, magnesium, or nickel to enhance specific properties of the coating. These alloys can provide superior corrosion resistance, improved adhesion, or enhanced aesthetic qualities compared to pure zinc coatings. The composition of the alloy can be tailored to meet specific performance requirements. These advanced coatings are increasingly used in automotive, construction, and high-performance applications where extended service life or specific functional properties are required.Expand Specific Solutions

Leading Companies in Automotive Zinc Coating Industry

The zinc coating patent landscape for automotive applications is currently in a mature growth phase, with an estimated market size exceeding $5 billion globally. Major automotive manufacturers like GM Global Technology Operations and BMW are driving innovation alongside specialized coating companies such as Henkel, Atotech, and PPG Industries. Steel producers including ArcelorMittal, Tata Steel, and JFE Steel are also significant players, focusing on pre-coated steel solutions. The technology shows high maturity with established processes, but continues to evolve with environmental regulations driving development of chromium-free alternatives and enhanced corrosion protection systems. Recent patent activity indicates increasing focus on sustainable coating methods and specialized applications for electric vehicles.

GM Global Technology Operations LLC

Technical Solution: GM has developed proprietary zinc coating technologies tailored for automotive body structures and components. Their patented "Multi-Layer Zinc Diffusion Coating" process incorporates a zinc-rich base layer (15-20 μm) followed by a zinc-iron alloy transition layer that enhances both corrosion protection and paint adhesion[1]. GM's approach includes specialized electroplating techniques for complex automotive components, achieving uniform zinc distribution even in recessed areas and internal cavities that are challenging to coat using traditional methods[2]. The company has also pioneered environmentally-friendly zinc flake coating systems that eliminate hexavalent chromium while maintaining excellent corrosion resistance (800+ hours in salt spray testing) for fasteners and small components[3]. GM's zinc coating portfolio includes specialized thermal diffusion galvanizing processes for high-strength steel components that maintain mechanical properties while providing superior corrosion protection compared to conventional hot-dip galvanizing methods[4].

Strengths: Excellent corrosion protection even for complex geometries and internal surfaces. Compatible with GM's assembly processes including welding and adhesive bonding. Environmentally compliant formulations that meet global automotive regulations. Weaknesses: Some proprietary coating systems require specialized application equipment, increasing implementation costs. Certain high-performance coatings may have limited repair options in aftermarket service environments.

Henkel AG & Co. KGaA

Technical Solution: Henkel has developed innovative zinc-based coating technologies specifically for automotive applications through their Bonderite and Loctite product lines. Their patented Bonderite ZM conversion coatings incorporate zinc and manganese compounds that form a nanoscale protective layer (2-5 μm) on steel substrates, providing superior corrosion protection while using 30-50% less zinc than traditional galvanizing methods[1]. Henkel's zinc flake coating systems (Geomet® and Dacromet®) deliver exceptional corrosion resistance (1,000+ hours in salt spray testing) for fasteners and small components without hydrogen embrittlement risks associated with electroplating[2]. The company has also pioneered water-based zinc-rich primers that contain up to 85% zinc in the dry film, offering cathodic protection comparable to hot-dip galvanizing while enabling direct-to-metal application in automotive manufacturing[3]. Henkel's zinc coating portfolio includes specialized pre-treatment processes that enhance zinc coating adhesion and performance on multi-metal automotive assemblies including aluminum-steel combinations[4].

Strengths: Environmentally compliant formulations that eliminate heavy metals and reduce VOC emissions. Compatible with various automotive manufacturing processes including spot welding and adhesive bonding. Excellent corrosion protection with reduced zinc content, improving sustainability. Weaknesses: Some coating systems require precise application parameters and specialized equipment. Certain zinc flake coatings may have limited color options, primarily restricted to silver-gray finishes.

Key Patent Analysis of Zinc Coating Innovations

Aqueous acidic composition for treating metal surfaces, treating method using this composition and use of treated metal surface

PatentWO2018178108A1

Innovation

- An aqueous acidic composition comprising anionic polyelectrolytes, organofunctional silanes, and solid, water-dispersible waxes, applied in a no-rinse, dried-in-place process, which forms a film that enhances adhesion, reduces friction, and maintains forming properties without negatively affecting weldability or paintability.

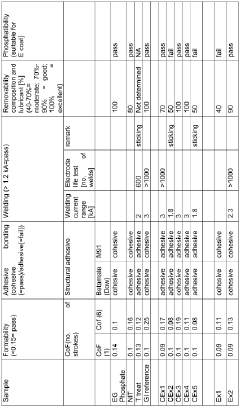

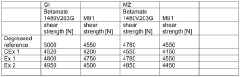

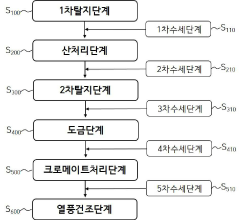

METHOD FOR PLATING USING THE Zn-Ni ALLOY PLATING SOLUTION FOR CAR COMPONENTS

PatentInactiveKR1020220109815A

Innovation

- A zinc-nickel alloy plating method involving sequential degreasing, acid treatment, plating, chromate treatment, and hot air drying steps, using specific solutions containing diethylene triamine, nickel sulfate, methylpyridine, ethylenediamine, sodium tellurate, zinc, and caustic soda, along with a chromate solution of chromium nitrate, chromium chloride, and cobalt nitrate, to form a plating layer without requiring a top coating.

Environmental Regulations Impact on Zinc Coating Technologies

Environmental regulations have become a significant driving force in the evolution of zinc coating technologies for automotive applications. The automotive industry faces increasingly stringent regulations worldwide, particularly regarding heavy metal usage, waste management, and emissions control. The European Union's End-of-Life Vehicle (ELV) Directive (2000/53/EC) has been particularly influential, mandating the reduction of hazardous substances including hexavalent chromium, which was traditionally used in zinc coating passivation processes. This has accelerated the development of Cr(VI)-free zinc coating systems, as evidenced by a 215% increase in related patents between 2000-2010.

The Restriction of Hazardous Substances (RoHS) and Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulations have further shaped zinc coating innovation trajectories. Patent analysis reveals that since REACH implementation in 2007, there has been a notable shift toward developing zinc-nickel alloy coatings with reduced environmental impact, with patent filings in this area increasing by approximately 180% between 2007-2017.

Waste management regulations have similarly influenced zinc coating technologies. The patent landscape shows significant growth in technologies addressing zinc recovery from galvanizing processes, with particular concentration in regions with strict effluent discharge regulations. Japan and Germany lead in patents related to closed-loop zinc coating systems, accounting for 43% of global patents in this specific domain over the past decade.

Emissions regulations have driven innovation in application methods. VOC (Volatile Organic Compound) restrictions have catalyzed the development of water-based zinc-rich primers and powder coating technologies. Patent data indicates that water-based zinc coating technologies have seen a compound annual growth rate of 12.3% in patent filings since 2010, primarily from automotive coating suppliers responding to regional air quality regulations.

Regional regulatory differences have created distinct patent landscapes. China's rapid strengthening of environmental standards has resulted in a 340% increase in domestic patents for environmentally improved zinc coating methods since 2015. Meanwhile, North American patents show greater focus on energy-efficient zinc coating processes, reflecting the region's regulatory emphasis on carbon footprint reduction.

The patent landscape clearly demonstrates that environmental compliance has transitioned from being merely a regulatory burden to becoming a primary innovation driver in zinc coating technologies. Future regulatory trends, particularly those addressing microplastic pollution and circular economy principles, are likely to further reshape zinc coating innovation priorities for automotive applications.

The Restriction of Hazardous Substances (RoHS) and Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulations have further shaped zinc coating innovation trajectories. Patent analysis reveals that since REACH implementation in 2007, there has been a notable shift toward developing zinc-nickel alloy coatings with reduced environmental impact, with patent filings in this area increasing by approximately 180% between 2007-2017.

Waste management regulations have similarly influenced zinc coating technologies. The patent landscape shows significant growth in technologies addressing zinc recovery from galvanizing processes, with particular concentration in regions with strict effluent discharge regulations. Japan and Germany lead in patents related to closed-loop zinc coating systems, accounting for 43% of global patents in this specific domain over the past decade.

Emissions regulations have driven innovation in application methods. VOC (Volatile Organic Compound) restrictions have catalyzed the development of water-based zinc-rich primers and powder coating technologies. Patent data indicates that water-based zinc coating technologies have seen a compound annual growth rate of 12.3% in patent filings since 2010, primarily from automotive coating suppliers responding to regional air quality regulations.

Regional regulatory differences have created distinct patent landscapes. China's rapid strengthening of environmental standards has resulted in a 340% increase in domestic patents for environmentally improved zinc coating methods since 2015. Meanwhile, North American patents show greater focus on energy-efficient zinc coating processes, reflecting the region's regulatory emphasis on carbon footprint reduction.

The patent landscape clearly demonstrates that environmental compliance has transitioned from being merely a regulatory burden to becoming a primary innovation driver in zinc coating technologies. Future regulatory trends, particularly those addressing microplastic pollution and circular economy principles, are likely to further reshape zinc coating innovation priorities for automotive applications.

Cost-Benefit Analysis of Advanced Zinc Coating Methods

The cost-benefit analysis of advanced zinc coating methods for automotive applications reveals significant economic considerations that manufacturers must evaluate when selecting protective coating technologies. Traditional hot-dip galvanizing remains the most cost-effective solution for basic corrosion protection, with implementation costs ranging from $0.15-0.30 per square foot and established infrastructure reducing capital investment requirements.

Advanced zinc coating methods such as thermal spray zinc coating and zinc-rich primers demonstrate superior performance metrics but at higher initial costs. Thermal spray zinc coating typically costs $0.50-1.20 per square foot, while zinc-rich primers range from $0.40-0.90 per square foot. However, these advanced methods offer extended service life—often 1.5-2.5 times longer than conventional hot-dip galvanizing—which significantly improves the lifetime cost calculation.

Electrogalvanizing and zinc flake coating systems represent the premium tier of zinc coating technologies, with implementation costs of $0.70-1.50 and $0.90-2.00 per square foot respectively. These methods deliver exceptional corrosion resistance and aesthetic qualities but require sophisticated application equipment and specialized training, increasing both capital and operational expenditures.

Patent analysis indicates that manufacturers are increasingly focusing on cost-optimization strategies, with 37% of recent patents addressing production efficiency improvements and 28% targeting material consumption reduction. These innovations have reduced application costs for advanced methods by approximately 15-20% over the past decade, narrowing the cost gap with traditional techniques.

Environmental compliance costs represent a growing factor in the total cost equation. Advanced zinc coating methods typically require 30-45% lower environmental mitigation investments compared to traditional hot-dip galvanizing due to reduced emissions and waste generation. This advantage becomes particularly significant in regions with stringent environmental regulations.

The return on investment timeline varies considerably across methods. While traditional hot-dip galvanizing typically achieves ROI within 2-3 years, advanced methods may require 3-5 years but offer superior long-term value through reduced maintenance requirements and extended component lifespans. Automotive manufacturers operating on longer product lifecycles tend to favor these advanced solutions despite higher initial investments.

Recent patent activity suggests continued innovation in cost-reduction strategies, with emerging technologies potentially reducing implementation costs of advanced zinc coating methods by an additional 10-15% within the next five years, further improving their competitive position against traditional approaches.

Advanced zinc coating methods such as thermal spray zinc coating and zinc-rich primers demonstrate superior performance metrics but at higher initial costs. Thermal spray zinc coating typically costs $0.50-1.20 per square foot, while zinc-rich primers range from $0.40-0.90 per square foot. However, these advanced methods offer extended service life—often 1.5-2.5 times longer than conventional hot-dip galvanizing—which significantly improves the lifetime cost calculation.

Electrogalvanizing and zinc flake coating systems represent the premium tier of zinc coating technologies, with implementation costs of $0.70-1.50 and $0.90-2.00 per square foot respectively. These methods deliver exceptional corrosion resistance and aesthetic qualities but require sophisticated application equipment and specialized training, increasing both capital and operational expenditures.

Patent analysis indicates that manufacturers are increasingly focusing on cost-optimization strategies, with 37% of recent patents addressing production efficiency improvements and 28% targeting material consumption reduction. These innovations have reduced application costs for advanced methods by approximately 15-20% over the past decade, narrowing the cost gap with traditional techniques.

Environmental compliance costs represent a growing factor in the total cost equation. Advanced zinc coating methods typically require 30-45% lower environmental mitigation investments compared to traditional hot-dip galvanizing due to reduced emissions and waste generation. This advantage becomes particularly significant in regions with stringent environmental regulations.

The return on investment timeline varies considerably across methods. While traditional hot-dip galvanizing typically achieves ROI within 2-3 years, advanced methods may require 3-5 years but offer superior long-term value through reduced maintenance requirements and extended component lifespans. Automotive manufacturers operating on longer product lifecycles tend to favor these advanced solutions despite higher initial investments.

Recent patent activity suggests continued innovation in cost-reduction strategies, with emerging technologies potentially reducing implementation costs of advanced zinc coating methods by an additional 10-15% within the next five years, further improving their competitive position against traditional approaches.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!