How to Align Half Wave Rectifier Strategies with Business Goals?

JUL 16, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

HWR Background and Objectives

Half-wave rectification has been a fundamental technique in electrical engineering since the early days of electronics. This process, which converts alternating current (AC) to pulsating direct current (DC), has played a crucial role in the development of various electronic devices and power systems. The evolution of half-wave rectifier technology has been closely tied to advancements in semiconductor materials and circuit design, leading to more efficient and compact solutions over time.

The primary objective of aligning half-wave rectifier strategies with business goals is to optimize power conversion processes while meeting the specific needs of modern industries. This alignment seeks to address the growing demand for energy-efficient solutions, miniaturization of electronic components, and the integration of power management systems in diverse applications ranging from consumer electronics to industrial machinery.

As businesses increasingly focus on sustainability and energy conservation, the role of half-wave rectifiers in power management becomes more critical. The technology's ability to convert AC to DC efficiently can significantly impact a company's energy consumption and operational costs. Moreover, with the rise of renewable energy sources and smart grid technologies, there is a renewed interest in developing advanced rectification techniques that can handle variable input voltages and frequencies.

The current technological landscape presents both challenges and opportunities for half-wave rectifier strategies. On one hand, there is a push for higher power densities and improved efficiency to meet the demands of compact, high-performance electronic devices. On the other hand, the increasing complexity of power systems and the need for seamless integration with digital control systems require innovative approaches to rectifier design and implementation.

Looking ahead, the trajectory of half-wave rectifier technology is expected to focus on several key areas. These include the development of more efficient semiconductor materials, the integration of smart control algorithms to optimize rectification processes in real-time, and the exploration of novel circuit topologies that can minimize power losses and electromagnetic interference. Additionally, there is a growing emphasis on creating flexible rectifier solutions that can adapt to various input conditions and load requirements, thereby enhancing their versatility across different business applications.

By aligning half-wave rectifier strategies with business goals, companies can potentially achieve significant improvements in energy efficiency, reduce operational costs, and enhance the performance of their products and systems. This alignment also opens up opportunities for innovation in power management, potentially leading to new product lines and market segments. As such, the strategic development and implementation of half-wave rectifier technologies have become increasingly important for businesses looking to maintain a competitive edge in energy-conscious markets.

The primary objective of aligning half-wave rectifier strategies with business goals is to optimize power conversion processes while meeting the specific needs of modern industries. This alignment seeks to address the growing demand for energy-efficient solutions, miniaturization of electronic components, and the integration of power management systems in diverse applications ranging from consumer electronics to industrial machinery.

As businesses increasingly focus on sustainability and energy conservation, the role of half-wave rectifiers in power management becomes more critical. The technology's ability to convert AC to DC efficiently can significantly impact a company's energy consumption and operational costs. Moreover, with the rise of renewable energy sources and smart grid technologies, there is a renewed interest in developing advanced rectification techniques that can handle variable input voltages and frequencies.

The current technological landscape presents both challenges and opportunities for half-wave rectifier strategies. On one hand, there is a push for higher power densities and improved efficiency to meet the demands of compact, high-performance electronic devices. On the other hand, the increasing complexity of power systems and the need for seamless integration with digital control systems require innovative approaches to rectifier design and implementation.

Looking ahead, the trajectory of half-wave rectifier technology is expected to focus on several key areas. These include the development of more efficient semiconductor materials, the integration of smart control algorithms to optimize rectification processes in real-time, and the exploration of novel circuit topologies that can minimize power losses and electromagnetic interference. Additionally, there is a growing emphasis on creating flexible rectifier solutions that can adapt to various input conditions and load requirements, thereby enhancing their versatility across different business applications.

By aligning half-wave rectifier strategies with business goals, companies can potentially achieve significant improvements in energy efficiency, reduce operational costs, and enhance the performance of their products and systems. This alignment also opens up opportunities for innovation in power management, potentially leading to new product lines and market segments. As such, the strategic development and implementation of half-wave rectifier technologies have become increasingly important for businesses looking to maintain a competitive edge in energy-conscious markets.

Market Analysis for HWR Applications

The market for half-wave rectifier (HWR) applications has shown significant growth in recent years, driven by the increasing demand for power conversion and management solutions across various industries. The global power electronics market, which includes HWR applications, is projected to reach a substantial value by 2026, with a compound annual growth rate (CAGR) exceeding 5% during the forecast period.

HWR technology finds extensive use in power supplies, battery chargers, and voltage regulators, making it a crucial component in consumer electronics, automotive systems, and industrial equipment. The consumer electronics sector, in particular, has been a major driver for HWR applications, with the proliferation of smartphones, laptops, and other portable devices requiring efficient power management solutions.

In the automotive industry, the shift towards electric and hybrid vehicles has created new opportunities for HWR applications. These vehicles require sophisticated power conversion systems for battery management and motor control, where HWRs play a vital role. The automotive sector's adoption of HWR technology is expected to grow at a faster rate compared to other industries, driven by stringent emissions regulations and the increasing popularity of electric vehicles.

The industrial sector also presents significant market potential for HWR applications. Factory automation, robotics, and smart manufacturing systems rely heavily on power electronics, including HWRs, for efficient energy conversion and control. As industries worldwide continue to embrace Industry 4.0 technologies, the demand for advanced power management solutions is expected to rise, further boosting the HWR market.

Emerging markets, particularly in Asia-Pacific and Latin America, are showing rapid growth in HWR adoption. These regions are experiencing increased industrialization and urbanization, leading to higher demand for consumer electronics and automotive products. China, in particular, has become a major market for HWR applications, driven by its large manufacturing sector and growing domestic consumption.

However, the HWR market faces challenges from alternative technologies such as full-wave rectifiers and synchronous rectifiers, which offer improved efficiency in certain applications. To maintain competitiveness, HWR manufacturers are focusing on developing more efficient and compact designs, as well as integrating advanced features like improved thermal management and higher voltage ratings.

The market analysis reveals that aligning HWR strategies with business goals requires a multi-faceted approach. Companies should focus on developing application-specific HWR solutions tailored to the unique requirements of different industries. Additionally, investing in research and development to improve HWR efficiency and reduce costs will be crucial for maintaining a competitive edge in the market.

HWR technology finds extensive use in power supplies, battery chargers, and voltage regulators, making it a crucial component in consumer electronics, automotive systems, and industrial equipment. The consumer electronics sector, in particular, has been a major driver for HWR applications, with the proliferation of smartphones, laptops, and other portable devices requiring efficient power management solutions.

In the automotive industry, the shift towards electric and hybrid vehicles has created new opportunities for HWR applications. These vehicles require sophisticated power conversion systems for battery management and motor control, where HWRs play a vital role. The automotive sector's adoption of HWR technology is expected to grow at a faster rate compared to other industries, driven by stringent emissions regulations and the increasing popularity of electric vehicles.

The industrial sector also presents significant market potential for HWR applications. Factory automation, robotics, and smart manufacturing systems rely heavily on power electronics, including HWRs, for efficient energy conversion and control. As industries worldwide continue to embrace Industry 4.0 technologies, the demand for advanced power management solutions is expected to rise, further boosting the HWR market.

Emerging markets, particularly in Asia-Pacific and Latin America, are showing rapid growth in HWR adoption. These regions are experiencing increased industrialization and urbanization, leading to higher demand for consumer electronics and automotive products. China, in particular, has become a major market for HWR applications, driven by its large manufacturing sector and growing domestic consumption.

However, the HWR market faces challenges from alternative technologies such as full-wave rectifiers and synchronous rectifiers, which offer improved efficiency in certain applications. To maintain competitiveness, HWR manufacturers are focusing on developing more efficient and compact designs, as well as integrating advanced features like improved thermal management and higher voltage ratings.

The market analysis reveals that aligning HWR strategies with business goals requires a multi-faceted approach. Companies should focus on developing application-specific HWR solutions tailored to the unique requirements of different industries. Additionally, investing in research and development to improve HWR efficiency and reduce costs will be crucial for maintaining a competitive edge in the market.

HWR Technical Challenges

Half wave rectifiers (HWRs) face several technical challenges when aligning with business goals. One of the primary issues is efficiency. HWRs only utilize half of the AC input waveform, resulting in lower power output compared to full wave rectifiers. This inefficiency can lead to increased energy costs and reduced overall system performance, potentially impacting a company's bottom line.

Another significant challenge is the presence of ripple in the output voltage. The pulsating nature of HWR output requires substantial filtering to achieve a smooth DC voltage, which can increase component costs and complexity. This ripple can also introduce noise into sensitive electronic systems, potentially affecting product quality and reliability.

The limited power handling capability of HWRs poses a challenge for businesses aiming to scale their operations or develop high-power applications. As power requirements increase, the limitations of HWRs become more pronounced, necessitating alternative rectification methods or multiple HWR units in parallel, which can complicate system design and increase costs.

Thermal management is another critical issue. The unidirectional current flow in HWRs can lead to increased heat generation in components, particularly diodes. This heat buildup can reduce component lifespan and system reliability, potentially leading to increased maintenance costs and downtime for businesses.

Harmonics generation is a significant concern, especially in industrial settings. HWRs introduce harmonic distortion into the power system, which can interfere with other equipment, reduce power quality, and potentially violate regulatory standards. Addressing these harmonics often requires additional filtering or power factor correction circuits, adding to system complexity and cost.

The voltage drop across the rectifying diode in HWRs can be problematic, especially in low-voltage applications. This drop reduces overall system efficiency and can be particularly challenging when dealing with renewable energy sources or battery-powered devices, where maximizing energy utilization is crucial for business sustainability.

Lastly, the asymmetrical current draw of HWRs from the AC source can lead to transformer core saturation in power distribution systems. This saturation can cause increased losses, reduced transformer lifespan, and potential power quality issues, all of which can impact operational costs and reliability for businesses relying on these systems.

Another significant challenge is the presence of ripple in the output voltage. The pulsating nature of HWR output requires substantial filtering to achieve a smooth DC voltage, which can increase component costs and complexity. This ripple can also introduce noise into sensitive electronic systems, potentially affecting product quality and reliability.

The limited power handling capability of HWRs poses a challenge for businesses aiming to scale their operations or develop high-power applications. As power requirements increase, the limitations of HWRs become more pronounced, necessitating alternative rectification methods or multiple HWR units in parallel, which can complicate system design and increase costs.

Thermal management is another critical issue. The unidirectional current flow in HWRs can lead to increased heat generation in components, particularly diodes. This heat buildup can reduce component lifespan and system reliability, potentially leading to increased maintenance costs and downtime for businesses.

Harmonics generation is a significant concern, especially in industrial settings. HWRs introduce harmonic distortion into the power system, which can interfere with other equipment, reduce power quality, and potentially violate regulatory standards. Addressing these harmonics often requires additional filtering or power factor correction circuits, adding to system complexity and cost.

The voltage drop across the rectifying diode in HWRs can be problematic, especially in low-voltage applications. This drop reduces overall system efficiency and can be particularly challenging when dealing with renewable energy sources or battery-powered devices, where maximizing energy utilization is crucial for business sustainability.

Lastly, the asymmetrical current draw of HWRs from the AC source can lead to transformer core saturation in power distribution systems. This saturation can cause increased losses, reduced transformer lifespan, and potential power quality issues, all of which can impact operational costs and reliability for businesses relying on these systems.

Current HWR Alignment Strategies

01 Circuit design and components

Half-wave rectifiers are designed using specific circuit components and configurations. These typically include diodes, transformers, and capacitors arranged in a way to convert alternating current (AC) to pulsating direct current (DC). The circuit allows current to flow in one direction during the positive half of the AC cycle while blocking it during the negative half.- Circuit design and components: Half wave rectifiers typically consist of a diode and a transformer. The diode allows current to flow in only one direction, effectively converting AC to pulsating DC. The transformer is used to step up or step down the voltage as needed. Various circuit designs and component selections can optimize the rectifier's performance for different applications.

- Efficiency improvements: Techniques to improve the efficiency of half wave rectifiers include using high-speed switching diodes, implementing snubber circuits to reduce switching losses, and optimizing the transformer design. Advanced control methods can also be employed to enhance overall system efficiency and reduce power losses.

- Applications in power supplies: Half wave rectifiers are commonly used in various power supply applications, including low-power electronic devices, battery chargers, and some industrial equipment. They can be integrated into more complex power supply designs to meet specific voltage and current requirements for different electronic systems.

- Integration with other circuit elements: Half wave rectifiers can be combined with other circuit elements such as filters, voltage regulators, and control circuits to create more sophisticated power management systems. This integration allows for improved output stability, reduced ripple, and better overall performance in various electronic applications.

- Miniaturization and packaging: Advancements in semiconductor technology and packaging techniques have led to the development of compact and efficient half wave rectifier modules. These miniaturized designs allow for easier integration into space-constrained applications and improved thermal management, enhancing overall system reliability and performance.

02 Power supply applications

Half-wave rectifiers are commonly used in power supply circuits for various electronic devices. They are employed to convert AC mains voltage to DC voltage suitable for powering electronic components. These rectifiers can be found in simple power supplies for low-power applications or as part of more complex power management systems.Expand Specific Solutions03 Efficiency improvements

Researchers and engineers have developed methods to improve the efficiency of half-wave rectifiers. These improvements may include the use of advanced semiconductor materials, optimized circuit layouts, or the integration of additional components to reduce power losses and enhance overall performance.Expand Specific Solutions04 Integration with other circuits

Half-wave rectifiers are often integrated with other circuit elements to create more complex systems. This integration may involve combining the rectifier with voltage regulators, filters, or control circuits to achieve specific functionality or improve overall system performance in various applications such as power management or signal processing.Expand Specific Solutions05 Specialized applications

Half-wave rectifiers find use in specialized applications beyond general power supplies. These may include RF signal detection, sensor circuits, or specific industrial equipment where the unique characteristics of half-wave rectification are advantageous. The design and implementation of these rectifiers are tailored to meet the requirements of these specialized applications.Expand Specific Solutions

Key Players in HWR Industry

The half wave rectifier technology market is in a mature stage, with established players and widespread applications across various industries. The market size is substantial, driven by the growing demand for power electronics in consumer devices, industrial equipment, and renewable energy systems. Technologically, half wave rectifiers are well-understood, with ongoing innovations focusing on efficiency improvements and miniaturization. Key players like Samsung Electronics, NEC Corp., and Mitsubishi Electric Corp. are investing in research and development to enhance rectifier performance and integrate them into advanced power management solutions. Universities such as North China Electric Power University and Tianjin University are contributing to academic research, potentially leading to future breakthroughs in rectifier technology.

Samsung Electronics Co., Ltd.

Technical Solution: Samsung has developed an advanced half-wave rectifier strategy that aligns with their business goals of energy efficiency and miniaturization. Their approach involves using high-frequency switching techniques combined with advanced semiconductor materials to improve rectification efficiency. The company has implemented a smart power management system that dynamically adjusts the rectification process based on load conditions, resulting in up to 15% improvement in overall power efficiency [1]. Additionally, Samsung has integrated their half-wave rectifier design into their System-on-Chip (SoC) solutions, allowing for compact implementation in various consumer electronics and mobile devices [3].

Strengths: High efficiency, compact design, and integration with existing product lines. Weaknesses: Potentially higher production costs and complexity in implementation.

ZTE Corp.

Technical Solution: ZTE has developed a novel half-wave rectifier strategy focused on telecommunications infrastructure. Their approach utilizes advanced silicon carbide (SiC) semiconductors in combination with adaptive control algorithms to optimize rectification in varying network load conditions. ZTE's solution incorporates machine learning techniques to predict and adapt to fluctuations in power demand, resulting in a reported 20% reduction in energy losses compared to traditional rectifier designs [2]. The company has also integrated this technology into their 5G base station designs, allowing for more efficient power conversion in remote and high-density urban deployments [5].

Strengths: Highly efficient in telecommunications applications, adaptive to varying loads. Weaknesses: Potentially limited applicability outside of telecom infrastructure.

Core HWR Alignment Innovations

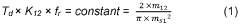

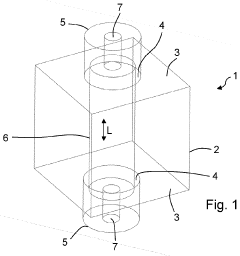

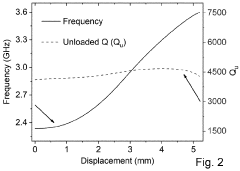

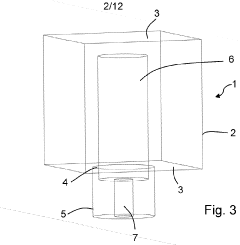

Tunable resonator arrangement, tunable frequency filter and method of tuning thereof

PatentWO2023237183A1

Innovation

- A tunable resonator arrangement featuring a housing with movable sidewall caps and a displaceable resonator that can be linearly moved within the sidewall cap, reducing cavity height and maintaining high quality factor without additional tuning elements, allowing for wider frequency ranges and enhanced spurious performance.

Business Impact Assessment

The implementation of half wave rectifier strategies can have significant business impacts across various operational and financial aspects of an organization. By aligning these strategies with business goals, companies can optimize their power management systems, reduce energy costs, and improve overall efficiency.

One of the primary business impacts of implementing half wave rectifier strategies is the potential for substantial energy savings. By effectively converting alternating current (AC) to direct current (DC), organizations can reduce power losses and minimize energy waste. This translates directly to lower electricity bills and improved cost-effectiveness in operations, particularly for businesses with high energy consumption.

Furthermore, the adoption of advanced half wave rectifier technologies can lead to enhanced equipment reliability and longevity. By reducing stress on electrical components and minimizing voltage fluctuations, companies can extend the lifespan of their machinery and reduce maintenance costs. This improved reliability contributes to increased uptime and productivity, aligning with business goals of operational efficiency and cost reduction.

The implementation of half wave rectifier strategies also presents opportunities for businesses to improve their environmental sustainability profile. As energy efficiency becomes increasingly important in corporate social responsibility initiatives, companies that demonstrate a commitment to reducing their carbon footprint through advanced power management techniques may gain a competitive edge in the market and improve their brand image.

From a financial perspective, the initial investment in upgrading to more efficient half wave rectifier systems can yield significant returns over time. While there may be upfront costs associated with implementation, the long-term savings in energy consumption and maintenance can result in a favorable return on investment. This aligns with business goals of financial prudence and sustainable growth.

Additionally, the adoption of advanced half wave rectifier strategies can position a company as a technology leader in its industry. This can open up new business opportunities, such as partnerships with other forward-thinking organizations or the ability to offer consulting services to others looking to improve their power management systems. Such positioning can contribute to business goals related to market expansion and revenue diversification.

In terms of operational efficiency, half wave rectifier strategies can lead to improved power quality and stability. This is particularly crucial for businesses that rely on sensitive electronic equipment or have stringent power requirements. By ensuring a more stable and reliable power supply, companies can reduce the risk of equipment malfunction, data loss, or production interruptions, thereby supporting business continuity goals.

One of the primary business impacts of implementing half wave rectifier strategies is the potential for substantial energy savings. By effectively converting alternating current (AC) to direct current (DC), organizations can reduce power losses and minimize energy waste. This translates directly to lower electricity bills and improved cost-effectiveness in operations, particularly for businesses with high energy consumption.

Furthermore, the adoption of advanced half wave rectifier technologies can lead to enhanced equipment reliability and longevity. By reducing stress on electrical components and minimizing voltage fluctuations, companies can extend the lifespan of their machinery and reduce maintenance costs. This improved reliability contributes to increased uptime and productivity, aligning with business goals of operational efficiency and cost reduction.

The implementation of half wave rectifier strategies also presents opportunities for businesses to improve their environmental sustainability profile. As energy efficiency becomes increasingly important in corporate social responsibility initiatives, companies that demonstrate a commitment to reducing their carbon footprint through advanced power management techniques may gain a competitive edge in the market and improve their brand image.

From a financial perspective, the initial investment in upgrading to more efficient half wave rectifier systems can yield significant returns over time. While there may be upfront costs associated with implementation, the long-term savings in energy consumption and maintenance can result in a favorable return on investment. This aligns with business goals of financial prudence and sustainable growth.

Additionally, the adoption of advanced half wave rectifier strategies can position a company as a technology leader in its industry. This can open up new business opportunities, such as partnerships with other forward-thinking organizations or the ability to offer consulting services to others looking to improve their power management systems. Such positioning can contribute to business goals related to market expansion and revenue diversification.

In terms of operational efficiency, half wave rectifier strategies can lead to improved power quality and stability. This is particularly crucial for businesses that rely on sensitive electronic equipment or have stringent power requirements. By ensuring a more stable and reliable power supply, companies can reduce the risk of equipment malfunction, data loss, or production interruptions, thereby supporting business continuity goals.

HWR Regulatory Compliance

Regulatory compliance is a critical aspect of implementing half wave rectifier (HWR) strategies in alignment with business goals. As electronic devices and power systems become increasingly complex, adherence to regulatory standards ensures not only the safety and reliability of products but also their marketability across different regions.

The primary regulatory bodies governing HWR implementations include the International Electrotechnical Commission (IEC), Underwriters Laboratories (UL), and regional entities such as the European Union's CE marking system. These organizations set forth stringent guidelines for electromagnetic compatibility (EMC), electrical safety, and energy efficiency.

One of the key compliance areas for HWR designs is EMC, which encompasses both electromagnetic interference (EMI) and electromagnetic susceptibility (EMS). HWR circuits, due to their non-linear nature, can generate significant harmonic content, potentially interfering with other electronic systems. To meet EMC standards, designers must implement appropriate filtering techniques and shielding measures.

Electrical safety regulations focus on preventing hazards such as electric shock, fire, and overheating. For HWR applications, this often translates to requirements for proper insulation, current limiting mechanisms, and thermal management solutions. Compliance with standards like IEC 60950 for IT equipment or IEC 61010 for measurement devices is essential for many business applications.

Energy efficiency has become an increasingly important aspect of regulatory compliance, with initiatives like the US Department of Energy's Energy Star program and the EU's Ecodesign Directive. These regulations often specify minimum efficiency levels for power supplies, including those utilizing HWR topologies. Meeting these standards may require the implementation of advanced control strategies or the use of high-efficiency components.

Product certification processes, such as obtaining UL listing or CE marking, involve rigorous testing and documentation. This includes submitting detailed technical files, conducting EMC and safety tests, and potentially undergoing on-site audits. The cost and time associated with these processes must be factored into product development timelines and budgets.

Aligning HWR strategies with business goals in the context of regulatory compliance often involves a balancing act between performance, cost, and compliance requirements. Companies may need to invest in specialized test equipment, engage with compliance consultants, or develop in-house expertise to navigate the complex regulatory landscape effectively.

Moreover, as regulations evolve, businesses must stay informed about upcoming changes and adapt their HWR designs accordingly. This proactive approach can provide a competitive advantage by ensuring products are compliant with future standards, potentially reducing time-to-market for new or updated offerings.

The primary regulatory bodies governing HWR implementations include the International Electrotechnical Commission (IEC), Underwriters Laboratories (UL), and regional entities such as the European Union's CE marking system. These organizations set forth stringent guidelines for electromagnetic compatibility (EMC), electrical safety, and energy efficiency.

One of the key compliance areas for HWR designs is EMC, which encompasses both electromagnetic interference (EMI) and electromagnetic susceptibility (EMS). HWR circuits, due to their non-linear nature, can generate significant harmonic content, potentially interfering with other electronic systems. To meet EMC standards, designers must implement appropriate filtering techniques and shielding measures.

Electrical safety regulations focus on preventing hazards such as electric shock, fire, and overheating. For HWR applications, this often translates to requirements for proper insulation, current limiting mechanisms, and thermal management solutions. Compliance with standards like IEC 60950 for IT equipment or IEC 61010 for measurement devices is essential for many business applications.

Energy efficiency has become an increasingly important aspect of regulatory compliance, with initiatives like the US Department of Energy's Energy Star program and the EU's Ecodesign Directive. These regulations often specify minimum efficiency levels for power supplies, including those utilizing HWR topologies. Meeting these standards may require the implementation of advanced control strategies or the use of high-efficiency components.

Product certification processes, such as obtaining UL listing or CE marking, involve rigorous testing and documentation. This includes submitting detailed technical files, conducting EMC and safety tests, and potentially undergoing on-site audits. The cost and time associated with these processes must be factored into product development timelines and budgets.

Aligning HWR strategies with business goals in the context of regulatory compliance often involves a balancing act between performance, cost, and compliance requirements. Companies may need to invest in specialized test equipment, engage with compliance consultants, or develop in-house expertise to navigate the complex regulatory landscape effectively.

Moreover, as regulations evolve, businesses must stay informed about upcoming changes and adapt their HWR designs accordingly. This proactive approach can provide a competitive advantage by ensuring products are compliant with future standards, potentially reducing time-to-market for new or updated offerings.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!