Laser Source Types: Fiber, Diode, And Solid-State Tradeoffs

AUG 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Laser Technology Evolution and Objectives

Laser technology has evolved significantly since the first working laser was demonstrated by Theodore Maiman in 1960. The initial ruby laser represented a breakthrough in coherent light generation, but offered limited practical applications due to its inefficiency and operational constraints. Throughout the 1960s and 1970s, gas lasers including helium-neon and carbon dioxide variants dominated industrial applications, providing stable continuous wave operation but with inherent limitations in power scaling and maintenance requirements.

The 1980s marked a pivotal transition with the emergence of solid-state laser technology, particularly Nd:YAG systems, which offered improved reliability and higher power capabilities. This period established the foundation for modern laser source diversification, setting the stage for the three primary laser types that dominate today's market: fiber, diode, and traditional solid-state lasers.

Fiber laser technology gained significant momentum in the early 2000s, leveraging advances in telecommunications infrastructure and fiber optic manufacturing. These systems fundamentally changed the industrial laser landscape by offering unprecedented beam quality, maintenance-free operation, and exceptional wall-plug efficiency exceeding 30%. The evolution of fiber lasers represents one of the most disruptive technological shifts in the laser industry, enabling applications previously considered impractical.

Diode lasers have undergone parallel development, evolving from low-power telecommunications and consumer electronics applications to high-power direct diode systems capable of kilowatt-level output. The miniaturization and cost reduction of semiconductor manufacturing processes have dramatically improved diode laser accessibility and performance, with wall-plug efficiencies now approaching 60% in certain configurations.

Traditional solid-state lasers have maintained relevance through continuous refinement, particularly in specialized applications requiring specific wavelengths or pulse characteristics that fiber and diode technologies cannot easily provide. Disk laser architecture represents a notable advancement in this category, addressing thermal management challenges that previously limited power scaling.

The technological objectives driving current laser source development focus on several key parameters: further improvements in wall-plug efficiency to reduce operational costs and environmental impact; enhanced beam quality across wider power ranges; increased reliability and reduced maintenance requirements; expanded wavelength coverage for specialized applications; and cost reduction through manufacturing optimization and component standardization.

Future development trajectories aim to overcome the remaining limitations of each laser type while leveraging their inherent advantages. This includes addressing the nonlinear effects that limit fiber laser power scaling, improving diode laser beam quality without sacrificing efficiency, and reducing the complexity and cost of solid-state laser systems while maintaining their unique operational characteristics.

The 1980s marked a pivotal transition with the emergence of solid-state laser technology, particularly Nd:YAG systems, which offered improved reliability and higher power capabilities. This period established the foundation for modern laser source diversification, setting the stage for the three primary laser types that dominate today's market: fiber, diode, and traditional solid-state lasers.

Fiber laser technology gained significant momentum in the early 2000s, leveraging advances in telecommunications infrastructure and fiber optic manufacturing. These systems fundamentally changed the industrial laser landscape by offering unprecedented beam quality, maintenance-free operation, and exceptional wall-plug efficiency exceeding 30%. The evolution of fiber lasers represents one of the most disruptive technological shifts in the laser industry, enabling applications previously considered impractical.

Diode lasers have undergone parallel development, evolving from low-power telecommunications and consumer electronics applications to high-power direct diode systems capable of kilowatt-level output. The miniaturization and cost reduction of semiconductor manufacturing processes have dramatically improved diode laser accessibility and performance, with wall-plug efficiencies now approaching 60% in certain configurations.

Traditional solid-state lasers have maintained relevance through continuous refinement, particularly in specialized applications requiring specific wavelengths or pulse characteristics that fiber and diode technologies cannot easily provide. Disk laser architecture represents a notable advancement in this category, addressing thermal management challenges that previously limited power scaling.

The technological objectives driving current laser source development focus on several key parameters: further improvements in wall-plug efficiency to reduce operational costs and environmental impact; enhanced beam quality across wider power ranges; increased reliability and reduced maintenance requirements; expanded wavelength coverage for specialized applications; and cost reduction through manufacturing optimization and component standardization.

Future development trajectories aim to overcome the remaining limitations of each laser type while leveraging their inherent advantages. This includes addressing the nonlinear effects that limit fiber laser power scaling, improving diode laser beam quality without sacrificing efficiency, and reducing the complexity and cost of solid-state laser systems while maintaining their unique operational characteristics.

Market Applications and Demand Analysis

The laser technology market has witnessed substantial growth across diverse industrial sectors, driven by increasing demand for precision manufacturing, medical procedures, and advanced sensing applications. The global laser market was valued at approximately 16.7 billion USD in 2021 and is projected to reach 25.6 billion USD by 2027, exhibiting a compound annual growth rate of 7.5%. This growth trajectory is fueled by expanding applications across automotive, electronics, healthcare, defense, and telecommunications industries.

Fiber lasers have gained significant market traction, particularly in metal cutting, welding, and marking applications. The manufacturing sector represents the largest market segment for fiber lasers, accounting for nearly 40% of total fiber laser applications. Their high efficiency, compact size, and lower maintenance requirements have made them increasingly popular in production environments where precision and reliability are paramount. The automotive industry has emerged as a key adopter, utilizing fiber lasers for high-speed cutting and welding of specialized materials in vehicle production.

Diode lasers dominate in consumer electronics, telecommunications, and medical applications. The medical device market for diode lasers has expanded at 9.2% annually, driven by increasing adoption in dermatology, ophthalmology, and dental procedures. Additionally, the growing demand for high-speed data transmission has bolstered diode laser implementation in fiber optic communication systems, with the telecommunications sector accounting for approximately 30% of diode laser applications.

Solid-state lasers maintain strong demand in scientific research, defense applications, and high-precision manufacturing. The defense and aerospace sectors represent significant market segments, utilizing solid-state lasers for range finding, target designation, and directed energy weapons. The medical field has also embraced solid-state lasers for surgical procedures requiring extreme precision, with ophthalmology representing a particularly strong growth area.

Regional analysis reveals Asia-Pacific as the fastest-growing market for laser technologies, with China and South Korea leading manufacturing implementation. North America maintains dominance in medical and defense applications, while Europe shows strong adoption across automotive and scientific research sectors.

Market forecasts indicate that fiber lasers will continue gaining market share due to their cost-effectiveness and versatility, potentially reaching 45% of the industrial laser market by 2025. Diode lasers are expected to see accelerated growth in consumer electronics and autonomous vehicle sensing applications. Solid-state lasers, while growing more modestly, will maintain critical importance in specialized high-power applications where their unique capabilities remain unmatched.

Fiber lasers have gained significant market traction, particularly in metal cutting, welding, and marking applications. The manufacturing sector represents the largest market segment for fiber lasers, accounting for nearly 40% of total fiber laser applications. Their high efficiency, compact size, and lower maintenance requirements have made them increasingly popular in production environments where precision and reliability are paramount. The automotive industry has emerged as a key adopter, utilizing fiber lasers for high-speed cutting and welding of specialized materials in vehicle production.

Diode lasers dominate in consumer electronics, telecommunications, and medical applications. The medical device market for diode lasers has expanded at 9.2% annually, driven by increasing adoption in dermatology, ophthalmology, and dental procedures. Additionally, the growing demand for high-speed data transmission has bolstered diode laser implementation in fiber optic communication systems, with the telecommunications sector accounting for approximately 30% of diode laser applications.

Solid-state lasers maintain strong demand in scientific research, defense applications, and high-precision manufacturing. The defense and aerospace sectors represent significant market segments, utilizing solid-state lasers for range finding, target designation, and directed energy weapons. The medical field has also embraced solid-state lasers for surgical procedures requiring extreme precision, with ophthalmology representing a particularly strong growth area.

Regional analysis reveals Asia-Pacific as the fastest-growing market for laser technologies, with China and South Korea leading manufacturing implementation. North America maintains dominance in medical and defense applications, while Europe shows strong adoption across automotive and scientific research sectors.

Market forecasts indicate that fiber lasers will continue gaining market share due to their cost-effectiveness and versatility, potentially reaching 45% of the industrial laser market by 2025. Diode lasers are expected to see accelerated growth in consumer electronics and autonomous vehicle sensing applications. Solid-state lasers, while growing more modestly, will maintain critical importance in specialized high-power applications where their unique capabilities remain unmatched.

Current Laser Source Landscape and Technical Barriers

The current laser source landscape is characterized by three dominant technologies: fiber lasers, diode lasers, and solid-state lasers, each with distinct operational principles and performance characteristics. Fiber lasers utilize rare-earth-doped optical fibers as the gain medium, offering exceptional beam quality and thermal management due to their high surface-area-to-volume ratio. Diode lasers directly convert electrical energy to light through semiconductor junctions, providing high electrical-to-optical efficiency but often with lower beam quality. Solid-state lasers employ crystal or glass materials doped with rare-earth elements, delivering high peak powers and excellent beam characteristics.

Market distribution shows fiber lasers dominating industrial cutting and welding applications, capturing approximately 40% of the industrial laser market due to their reliability and maintenance-free operation. Diode lasers hold significant market share in medical applications, telecommunications, and as pump sources, representing about 35% of the global laser market. Solid-state lasers maintain prominence in scientific research, defense applications, and precision manufacturing, constituting roughly 25% of the market.

Despite technological advancements, each laser type faces significant technical barriers. Fiber lasers struggle with power scaling limitations due to nonlinear effects like stimulated Brillouin scattering (SBS) and stimulated Raman scattering (SRS) that emerge at high powers. Additionally, photodarkening in doped fibers reduces efficiency and operational lifetime in high-power applications. Thermal management becomes increasingly challenging as power levels exceed 10kW.

Diode lasers contend with beam quality limitations, with typical M² values of 20-100 compared to near-diffraction-limited fiber lasers (M²<1.1). Their temperature sensitivity necessitates sophisticated cooling systems, and wavelength stability remains problematic for precision applications. Wall-plug efficiency, while superior to other laser types at 50-60%, still presents opportunities for improvement.

Solid-state lasers face thermal lensing and birefringence issues that degrade beam quality at high powers. Their relatively low wall-plug efficiency (typically 20-30%) results in significant heat generation, requiring complex cooling solutions. Manufacturing consistency of doped crystals presents challenges in quality control and cost management.

Geographically, laser technology development centers primarily in North America, Europe, and East Asia. The United States leads in innovation with approximately 35% of laser-related patents, followed by China (25%), Germany (15%), and Japan (10%). Recent years have witnessed China's rapid advancement in fiber laser technology, challenging traditional market leaders through aggressive pricing strategies and government investment in photonics research.

Market distribution shows fiber lasers dominating industrial cutting and welding applications, capturing approximately 40% of the industrial laser market due to their reliability and maintenance-free operation. Diode lasers hold significant market share in medical applications, telecommunications, and as pump sources, representing about 35% of the global laser market. Solid-state lasers maintain prominence in scientific research, defense applications, and precision manufacturing, constituting roughly 25% of the market.

Despite technological advancements, each laser type faces significant technical barriers. Fiber lasers struggle with power scaling limitations due to nonlinear effects like stimulated Brillouin scattering (SBS) and stimulated Raman scattering (SRS) that emerge at high powers. Additionally, photodarkening in doped fibers reduces efficiency and operational lifetime in high-power applications. Thermal management becomes increasingly challenging as power levels exceed 10kW.

Diode lasers contend with beam quality limitations, with typical M² values of 20-100 compared to near-diffraction-limited fiber lasers (M²<1.1). Their temperature sensitivity necessitates sophisticated cooling systems, and wavelength stability remains problematic for precision applications. Wall-plug efficiency, while superior to other laser types at 50-60%, still presents opportunities for improvement.

Solid-state lasers face thermal lensing and birefringence issues that degrade beam quality at high powers. Their relatively low wall-plug efficiency (typically 20-30%) results in significant heat generation, requiring complex cooling solutions. Manufacturing consistency of doped crystals presents challenges in quality control and cost management.

Geographically, laser technology development centers primarily in North America, Europe, and East Asia. The United States leads in innovation with approximately 35% of laser-related patents, followed by China (25%), Germany (15%), and Japan (10%). Recent years have witnessed China's rapid advancement in fiber laser technology, challenging traditional market leaders through aggressive pricing strategies and government investment in photonics research.

Comparative Analysis of Fiber, Diode, and Solid-State Solutions

01 Fiber laser performance characteristics

Fiber lasers offer high beam quality, efficiency, and thermal management due to their large surface-to-volume ratio. They provide excellent power scaling capabilities while maintaining single-mode operation. The waveguide structure of fiber lasers enables compact designs with minimal alignment requirements. However, they may face limitations in peak power handling due to nonlinear effects and damage thresholds in the fiber core.- Fiber laser performance characteristics: Fiber lasers offer high beam quality, efficiency, and thermal management due to their large surface-to-volume ratio. They provide excellent power scaling capabilities while maintaining single-mode operation. The waveguide structure of fiber lasers enables efficient heat dissipation and reduces thermal lensing effects. However, they may face limitations in peak power handling due to nonlinear effects in the fiber core and typically operate in narrower wavelength ranges compared to other laser types.

- Diode laser advantages and limitations: Diode lasers offer high electrical-to-optical conversion efficiency, compact size, and direct electrical pumping capabilities. They are cost-effective for mass production and can be designed for specific wavelength outputs. However, diode lasers typically produce lower beam quality with higher divergence compared to other laser types. They also have temperature-dependent performance characteristics and may require sophisticated cooling systems for high-power applications. Their output power is generally lower than fiber or solid-state lasers for high-precision applications.

- Solid-state laser performance factors: Solid-state lasers provide high peak power capabilities and excellent beam quality for specific applications. They can operate across a wide range of wavelengths through various gain media selections. These lasers offer good pulse characteristics for applications requiring high-energy pulses. However, they typically have lower electrical-to-optical efficiency compared to diode or fiber lasers and often require complex cooling systems to manage thermal issues. The bulk gain medium can suffer from thermal lensing effects at high power levels, affecting beam quality.

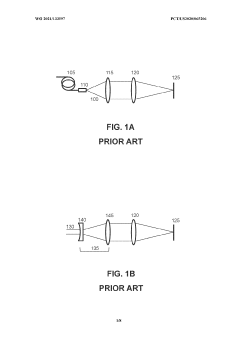

- Hybrid laser systems and pumping configurations: Hybrid laser systems combine different laser technologies to leverage their respective advantages. Diode-pumped solid-state lasers use diode lasers as pump sources for solid-state gain media, offering improved efficiency over traditional lamp pumping. Similarly, fiber lasers often utilize diode pumping for enhanced performance. These hybrid approaches can optimize overall system efficiency, beam quality, and thermal management. The pumping configuration significantly impacts the overall performance, with end-pumping and side-pumping offering different trade-offs between efficiency, thermal management, and beam quality.

- Wavelength and power scaling considerations: Different laser types offer varying capabilities in wavelength selection and power scaling. Fiber lasers excel in power scaling while maintaining beam quality but may have wavelength limitations. Diode lasers provide direct wavelength selection through semiconductor composition but face power scaling challenges. Solid-state lasers offer versatile wavelength options through different gain media and can achieve high peak powers. The choice between laser types often involves trade-offs between output power, beam quality, wavelength requirements, and system complexity. Applications requiring specific wavelengths or power characteristics may dictate the optimal laser technology.

02 Diode laser advantages and limitations

Diode lasers are highly efficient, compact, and cost-effective laser sources with direct electrical pumping. They offer rapid modulation capabilities and wavelength tunability. However, they typically produce lower beam quality compared to other laser types, with higher divergence and astigmatism. Power scaling often requires arrays or stacks, which further impacts beam quality. Thermal management becomes critical at higher power levels.Expand Specific Solutions03 Solid-state laser performance tradeoffs

Solid-state lasers provide high peak powers and good beam quality using crystalline gain media. They can operate in various modes including continuous wave, Q-switched, and mode-locked operation. While they offer excellent energy storage capabilities, they face thermal lensing and birefringence issues at high powers. Heat dissipation is a significant challenge compared to fiber lasers, often requiring complex cooling systems.Expand Specific Solutions04 Hybrid and pumping configurations

Various hybrid configurations combine different laser technologies to leverage their respective advantages. Diode-pumped solid-state lasers use efficient diode lasers to pump solid gain media, offering better efficiency than lamp-pumped systems. Similarly, fiber lasers often employ diode pumping. These hybrid approaches aim to optimize overall system performance by balancing factors such as efficiency, beam quality, power scaling, and thermal management.Expand Specific Solutions05 Wavelength and spectral characteristics

Different laser sources offer distinct wavelength capabilities and spectral characteristics. Fiber lasers excel in narrow linewidth operation and can be designed for specific wavelengths using rare-earth dopants. Diode lasers provide direct emission at various wavelengths but with broader linewidth. Solid-state lasers offer access to specific wavelengths determined by the gain medium. Wavelength conversion techniques can extend the operating range of all laser types but with varying efficiency tradeoffs.Expand Specific Solutions

Leading Manufacturers and Competitive Dynamics

The laser source technology market is currently in a growth phase, with increasing applications across industrial, medical, and consumer sectors. The market is projected to expand significantly due to advancements in fiber, diode, and solid-state laser technologies. Companies like TeraDiode and TRUMPF Photonics lead in direct-diode laser innovation, while Industrial Technology Research Institute and Technical Institute of Physics & Chemistry CAS drive research advancements. Major corporations including Northrop Grumman, Boeing, and Robert Bosch are integrating laser technologies into their product ecosystems. The competitive landscape shows a mix of specialized laser manufacturers (Applied Optoelectronics, Foro Energy) and diversified technology conglomerates (Sony, Samsung, Signify), indicating the technology's growing maturity and cross-industry adoption potential.

TeraDiode, Inc.

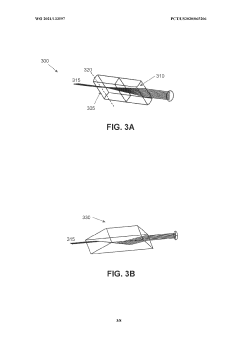

Technical Solution: TeraDiode has pioneered direct diode laser technology with their patented Wavelength Beam Combining (WBC) approach. This technology combines multiple diode laser emitters into a single high-quality output beam, achieving brightness levels previously only possible with fiber and solid-state lasers. Their TeraBlade platform delivers multi-kilowatt power with near-diffraction-limited beam quality, enabling industrial cutting and welding applications that were traditionally dominated by fiber lasers. The technology maintains the inherent efficiency advantages of diode lasers (>40% electrical-to-optical efficiency) while overcoming the beam quality limitations that historically restricted direct diode lasers to lower-power applications. TeraDiode's systems operate in the 900-1000nm wavelength range, optimized for metal processing with absorption characteristics comparable to 1μm fiber lasers.

Strengths: Higher wall-plug efficiency than fiber or solid-state lasers (40-50% vs 25-35%), significantly lower operating costs, smaller form factor, and reduced cooling requirements. Direct diode architecture eliminates the need for complex optical components found in other laser types. Weaknesses: More sensitive to temperature fluctuations than fiber lasers, potentially shorter operational lifetime than fiber systems, and beam parameter product still slightly inferior to the best fiber lasers in some applications.

Industrial Technology Research Institute

Technical Solution: The Industrial Technology Research Institute (ITRI) has developed a diverse portfolio of laser technologies with particular emphasis on fiber and diode laser systems for industrial applications. Their fiber laser research has focused on high-power single-mode architectures utilizing advanced doping profiles and innovative fiber designs to achieve excellent beam quality while managing thermal effects. ITRI's work in this area has resulted in kilowatt-class fiber lasers with beam parameter products below 1.3 mm·mrad. In the diode laser domain, ITRI has pioneered high-brightness semiconductor laser arrays with improved beam quality through novel epitaxial structures and waveguide designs. Their research includes vertical external-cavity surface-emitting lasers (VECSELs) that bridge the gap between traditional diode and solid-state lasers, offering improved beam quality over conventional diode lasers while maintaining higher efficiency than typical solid-state systems. ITRI has also developed hybrid laser systems that combine the advantages of different laser types, such as diode-pumped solid-state lasers optimized for specific industrial processes like precision micromachining and semiconductor manufacturing applications.

Strengths: Strong focus on cost-effective manufacturing techniques making advanced laser technology more accessible to Taiwan's industrial base. Excellent integration capabilities between laser sources and application-specific systems. Comprehensive understanding of semiconductor manufacturing requirements. Weaknesses: Less vertical integration than some competitors, often requiring partnerships for complete system development. More focused on regional industrial applications rather than global markets for high-power systems.

Key Patents and Innovations in Laser Source Design

Laser head configurations and techniques for materials processing

PatentWO2021133597A1

Innovation

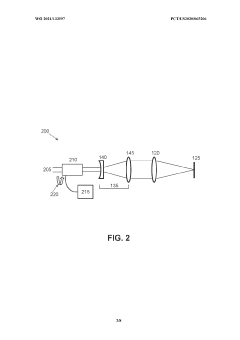

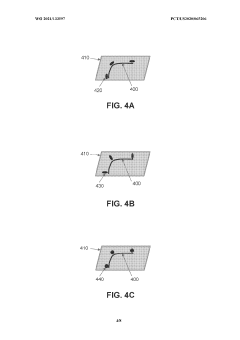

- The system eliminates the use of optical delivery fibers by transmitting laser beams directly from the resonator to the laser head through free space, maintaining asymmetric beam properties and allowing for direct integration of wavelength beam combining systems, thereby reducing system failure risks and costs while enabling more efficient processing.

Laser Markable Medical Devices

PatentActiveUS20190054214A1

Innovation

- The development of amphiphilic graft copolymers with a polypropylene backbone and hybrid micromolecule side-chains based on organo-functional silanes, combined with inorganic fillers, enhances the laser markability of polypropylene-based materials by improving their absorption of laser energy and thermal degradation, allowing for precise and permanent markings.

Energy Efficiency and Thermal Management Considerations

Energy efficiency and thermal management represent critical considerations in the selection and implementation of laser technologies. Fiber lasers demonstrate superior energy efficiency, typically converting 25-30% of input electrical power to usable laser output, significantly outperforming traditional solid-state lasers which often operate at 10-15% efficiency. This efficiency advantage translates directly to reduced operational costs and smaller environmental footprints in industrial applications.

Diode lasers exhibit even higher wall-plug efficiencies, sometimes exceeding 50%, making them particularly valuable in energy-constrained environments. However, this advantage must be balanced against their typically lower beam quality and power limitations compared to fiber or solid-state alternatives. The efficiency profile of each laser type creates distinct operational cost structures that significantly impact total ownership costs over system lifetimes.

Thermal management challenges vary substantially across laser technologies. Solid-state lasers generate considerable waste heat concentrated in the gain medium, necessitating sophisticated cooling systems that add complexity, cost, and potential points of failure. These systems typically require water cooling with precise temperature control to maintain beam stability and prevent thermal lensing effects that degrade performance.

Fiber lasers distribute heat generation along the active fiber length, creating inherently better thermal characteristics. This distributed heat profile allows for simpler cooling solutions, often enabling air-cooling for lower-power systems and less complex water cooling for higher-power applications. The superior surface-to-volume ratio of fiber architecture facilitates more efficient heat extraction, contributing to the technology's reliability advantage.

Diode lasers present unique thermal challenges related to temperature sensitivity of wavelength output and beam characteristics. Small temperature fluctuations can cause significant wavelength drift, requiring precise thermal stabilization in applications demanding spectral stability. However, their compact form factor and high efficiency generally result in manageable thermal loads.

Recent advancements in thermal management include micro-channel cooling technologies for solid-state lasers, phase-change materials for transient heat loads, and advanced thermal simulation capabilities that optimize heat dissipation pathways. These innovations are progressively narrowing the thermal management gap between different laser technologies, though fundamental architectural differences maintain fiber lasers' inherent advantage in this domain.

The energy efficiency and thermal management characteristics of each laser type significantly influence their suitability for specific applications, with considerations extending beyond initial acquisition costs to include operational expenses, system reliability, and maintenance requirements over the entire lifecycle of the laser system.

Diode lasers exhibit even higher wall-plug efficiencies, sometimes exceeding 50%, making them particularly valuable in energy-constrained environments. However, this advantage must be balanced against their typically lower beam quality and power limitations compared to fiber or solid-state alternatives. The efficiency profile of each laser type creates distinct operational cost structures that significantly impact total ownership costs over system lifetimes.

Thermal management challenges vary substantially across laser technologies. Solid-state lasers generate considerable waste heat concentrated in the gain medium, necessitating sophisticated cooling systems that add complexity, cost, and potential points of failure. These systems typically require water cooling with precise temperature control to maintain beam stability and prevent thermal lensing effects that degrade performance.

Fiber lasers distribute heat generation along the active fiber length, creating inherently better thermal characteristics. This distributed heat profile allows for simpler cooling solutions, often enabling air-cooling for lower-power systems and less complex water cooling for higher-power applications. The superior surface-to-volume ratio of fiber architecture facilitates more efficient heat extraction, contributing to the technology's reliability advantage.

Diode lasers present unique thermal challenges related to temperature sensitivity of wavelength output and beam characteristics. Small temperature fluctuations can cause significant wavelength drift, requiring precise thermal stabilization in applications demanding spectral stability. However, their compact form factor and high efficiency generally result in manageable thermal loads.

Recent advancements in thermal management include micro-channel cooling technologies for solid-state lasers, phase-change materials for transient heat loads, and advanced thermal simulation capabilities that optimize heat dissipation pathways. These innovations are progressively narrowing the thermal management gap between different laser technologies, though fundamental architectural differences maintain fiber lasers' inherent advantage in this domain.

The energy efficiency and thermal management characteristics of each laser type significantly influence their suitability for specific applications, with considerations extending beyond initial acquisition costs to include operational expenses, system reliability, and maintenance requirements over the entire lifecycle of the laser system.

Manufacturing Scalability and Cost Structure Analysis

The manufacturing scalability of different laser source types presents distinct challenges and opportunities that significantly impact their cost structures and market viability. Fiber lasers demonstrate superior manufacturing scalability due to their modular design architecture, which facilitates automated production processes and economies of scale. The primary components—fiber gain medium, pump diodes, and coupling optics—can be mass-produced with high consistency, resulting in reduced unit costs as production volumes increase. This manufacturing advantage has contributed to fiber lasers' declining cost trajectory, with approximately 10-15% annual price reductions observed over the past decade.

Diode lasers offer the highest theoretical manufacturing scalability among the three types, leveraging semiconductor fabrication techniques similar to those used in the electronics industry. The ability to produce thousands of diode emitters on a single wafer creates significant cost efficiencies at scale. However, this advantage is partially offset by challenges in beam quality management and thermal control systems, which require additional manufacturing steps and precision components. Despite these challenges, diode lasers maintain the lowest cost-per-watt metric, making them particularly competitive in applications where beam quality requirements are moderate.

Solid-state lasers present the most complex manufacturing considerations, with their discrete optical components and precision alignment requirements creating inherent scaling limitations. The production of high-quality crystal gain media involves time-intensive growth processes with lower yields compared to fiber or semiconductor fabrication. These manufacturing constraints translate to a relatively flat cost curve, with diminishing returns on scale beyond certain production thresholds. The cost structure typically includes higher fixed costs for specialized equipment and skilled labor, resulting in greater sensitivity to production volume fluctuations.

The supply chain dynamics also differ significantly across these laser types. Fiber lasers benefit from a diversified component ecosystem with multiple suppliers for critical elements, reducing supply chain risks. Diode lasers face periodic supply constraints for specialized semiconductor materials, creating potential bottlenecks during demand surges. Solid-state lasers often rely on more specialized suppliers for precision optics and crystals, increasing vulnerability to supply chain disruptions.

From a capital investment perspective, establishing production capacity for fiber and diode lasers typically requires higher initial investment but offers better long-term cost amortization. Solid-state laser manufacturing can be initiated with lower capital requirements but faces steeper unit cost challenges at higher volumes. These manufacturing and cost structure differences significantly influence market adoption patterns and competitive positioning across different application segments.

Diode lasers offer the highest theoretical manufacturing scalability among the three types, leveraging semiconductor fabrication techniques similar to those used in the electronics industry. The ability to produce thousands of diode emitters on a single wafer creates significant cost efficiencies at scale. However, this advantage is partially offset by challenges in beam quality management and thermal control systems, which require additional manufacturing steps and precision components. Despite these challenges, diode lasers maintain the lowest cost-per-watt metric, making them particularly competitive in applications where beam quality requirements are moderate.

Solid-state lasers present the most complex manufacturing considerations, with their discrete optical components and precision alignment requirements creating inherent scaling limitations. The production of high-quality crystal gain media involves time-intensive growth processes with lower yields compared to fiber or semiconductor fabrication. These manufacturing constraints translate to a relatively flat cost curve, with diminishing returns on scale beyond certain production thresholds. The cost structure typically includes higher fixed costs for specialized equipment and skilled labor, resulting in greater sensitivity to production volume fluctuations.

The supply chain dynamics also differ significantly across these laser types. Fiber lasers benefit from a diversified component ecosystem with multiple suppliers for critical elements, reducing supply chain risks. Diode lasers face periodic supply constraints for specialized semiconductor materials, creating potential bottlenecks during demand surges. Solid-state lasers often rely on more specialized suppliers for precision optics and crystals, increasing vulnerability to supply chain disruptions.

From a capital investment perspective, establishing production capacity for fiber and diode lasers typically requires higher initial investment but offers better long-term cost amortization. Solid-state laser manufacturing can be initiated with lower capital requirements but faces steeper unit cost challenges at higher volumes. These manufacturing and cost structure differences significantly influence market adoption patterns and competitive positioning across different application segments.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!