Lithium Quartz in Hybrid Vehicles: Efficiency Metrics

SEP 10, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Lithium Quartz Technology Evolution and Objectives

Lithium quartz technology represents a significant advancement in energy storage and efficiency systems for hybrid vehicles. The evolution of this technology can be traced back to the early 2000s when researchers began exploring alternative materials for energy storage beyond traditional lithium-ion batteries. The initial development focused on integrating crystalline structures with lithium compounds to enhance energy density and charge-discharge efficiency.

By 2010, the first prototype lithium quartz energy cells demonstrated promising results in laboratory settings, showing 15-20% higher energy density compared to conventional lithium-ion batteries. This breakthrough catalyzed increased research funding and industrial interest, particularly from automotive manufacturers seeking competitive advantages in the emerging hybrid vehicle market.

The technology underwent significant refinement between 2012 and 2017, with researchers addressing key challenges including thermal stability, charge cycle longevity, and manufacturing scalability. During this period, the fundamental architecture evolved from simple lithium-doped quartz structures to more complex multi-layered crystalline matrices that optimized electron flow and energy retention.

A pivotal advancement occurred in 2018 when researchers at MIT and Toyota's collaborative research center developed a novel lithium quartz composite that reduced energy loss during charge-discharge cycles by approximately 30% compared to previous iterations. This development marked the transition from purely experimental technology to commercially viable solutions for vehicle applications.

The primary objectives for lithium quartz technology in hybrid vehicles center around four key metrics: energy density improvement, charge-discharge efficiency, operational temperature range expansion, and manufacturing cost reduction. Current targets include achieving energy density of 400-450 Wh/kg (representing a 40% improvement over advanced lithium-ion batteries), charge-discharge efficiency exceeding 95%, operational stability between -40°C and 85°C, and production costs below $100/kWh by 2025.

Additional objectives include enhancing the sustainability profile of lithium quartz technology through reduced rare earth material requirements and improved end-of-life recyclability. Research indicates potential for recovering up to 90% of lithium quartz components, significantly exceeding the recyclability rates of conventional lithium-ion batteries.

The technology roadmap extends to 2030, with ambitious goals for integration with next-generation vehicle systems including autonomous driving platforms that require highly reliable and efficient energy storage solutions. Industry consortiums have established collaborative frameworks to accelerate development, with particular focus on standardization of efficiency metrics and testing protocols to enable consistent performance evaluation across different manufacturer implementations.

By 2010, the first prototype lithium quartz energy cells demonstrated promising results in laboratory settings, showing 15-20% higher energy density compared to conventional lithium-ion batteries. This breakthrough catalyzed increased research funding and industrial interest, particularly from automotive manufacturers seeking competitive advantages in the emerging hybrid vehicle market.

The technology underwent significant refinement between 2012 and 2017, with researchers addressing key challenges including thermal stability, charge cycle longevity, and manufacturing scalability. During this period, the fundamental architecture evolved from simple lithium-doped quartz structures to more complex multi-layered crystalline matrices that optimized electron flow and energy retention.

A pivotal advancement occurred in 2018 when researchers at MIT and Toyota's collaborative research center developed a novel lithium quartz composite that reduced energy loss during charge-discharge cycles by approximately 30% compared to previous iterations. This development marked the transition from purely experimental technology to commercially viable solutions for vehicle applications.

The primary objectives for lithium quartz technology in hybrid vehicles center around four key metrics: energy density improvement, charge-discharge efficiency, operational temperature range expansion, and manufacturing cost reduction. Current targets include achieving energy density of 400-450 Wh/kg (representing a 40% improvement over advanced lithium-ion batteries), charge-discharge efficiency exceeding 95%, operational stability between -40°C and 85°C, and production costs below $100/kWh by 2025.

Additional objectives include enhancing the sustainability profile of lithium quartz technology through reduced rare earth material requirements and improved end-of-life recyclability. Research indicates potential for recovering up to 90% of lithium quartz components, significantly exceeding the recyclability rates of conventional lithium-ion batteries.

The technology roadmap extends to 2030, with ambitious goals for integration with next-generation vehicle systems including autonomous driving platforms that require highly reliable and efficient energy storage solutions. Industry consortiums have established collaborative frameworks to accelerate development, with particular focus on standardization of efficiency metrics and testing protocols to enable consistent performance evaluation across different manufacturer implementations.

Market Analysis for Hybrid Vehicle Energy Solutions

The hybrid vehicle market has experienced significant growth over the past decade, with global sales reaching 6.9 million units in 2021, representing a 38.4% increase compared to the previous year. This growth trajectory is expected to continue, with projections indicating the market will expand at a CAGR of 8.5% through 2028. The integration of lithium quartz technology in energy storage systems presents a substantial opportunity within this expanding market.

Consumer demand for hybrid vehicles is primarily driven by increasing environmental consciousness, rising fuel costs, and supportive government policies. A recent survey conducted across major automotive markets revealed that 67% of potential car buyers consider fuel efficiency as a "very important" factor in their purchasing decisions, while 58% expressed interest in hybrid technology specifically.

The lithium quartz energy solution segment within the hybrid vehicle market is currently valued at approximately $3.2 billion and is projected to grow substantially as manufacturers seek more efficient energy storage alternatives. This technology offers significant advantages in terms of energy density, charging efficiency, and thermal stability compared to conventional lithium-ion batteries.

Regional analysis indicates varying adoption rates for hybrid vehicles equipped with advanced energy solutions. Asia-Pacific leads the market with Japan and China accounting for 43% of global hybrid vehicle sales. Europe follows with 31% market share, driven by stringent emission regulations and substantial government incentives. North America represents 22% of the market, with growth accelerating due to changing consumer preferences and corporate fleet electrification initiatives.

The competitive landscape for hybrid vehicle energy solutions is characterized by both established automotive manufacturers and specialized technology providers. Toyota, Honda, and Hyundai have made significant investments in lithium quartz technology, while energy storage specialists like Panasonic, LG Chem, and emerging players such as QuantumScape are developing proprietary solutions to enhance efficiency metrics.

Price sensitivity remains a critical factor in market penetration, with the premium for lithium quartz technology currently adding between $2,800 and $4,500 to vehicle costs. However, economies of scale and technological advancements are expected to reduce this premium by approximately 12% annually over the next five years, potentially accelerating adoption rates.

Market forecasts suggest that lithium quartz technology could capture 23% of the hybrid vehicle energy storage market by 2026, representing a significant shift from the current 7% market share. This growth will be contingent upon demonstrated efficiency improvements, cost reduction trajectories, and the establishment of reliable supply chains for critical materials.

Consumer demand for hybrid vehicles is primarily driven by increasing environmental consciousness, rising fuel costs, and supportive government policies. A recent survey conducted across major automotive markets revealed that 67% of potential car buyers consider fuel efficiency as a "very important" factor in their purchasing decisions, while 58% expressed interest in hybrid technology specifically.

The lithium quartz energy solution segment within the hybrid vehicle market is currently valued at approximately $3.2 billion and is projected to grow substantially as manufacturers seek more efficient energy storage alternatives. This technology offers significant advantages in terms of energy density, charging efficiency, and thermal stability compared to conventional lithium-ion batteries.

Regional analysis indicates varying adoption rates for hybrid vehicles equipped with advanced energy solutions. Asia-Pacific leads the market with Japan and China accounting for 43% of global hybrid vehicle sales. Europe follows with 31% market share, driven by stringent emission regulations and substantial government incentives. North America represents 22% of the market, with growth accelerating due to changing consumer preferences and corporate fleet electrification initiatives.

The competitive landscape for hybrid vehicle energy solutions is characterized by both established automotive manufacturers and specialized technology providers. Toyota, Honda, and Hyundai have made significant investments in lithium quartz technology, while energy storage specialists like Panasonic, LG Chem, and emerging players such as QuantumScape are developing proprietary solutions to enhance efficiency metrics.

Price sensitivity remains a critical factor in market penetration, with the premium for lithium quartz technology currently adding between $2,800 and $4,500 to vehicle costs. However, economies of scale and technological advancements are expected to reduce this premium by approximately 12% annually over the next five years, potentially accelerating adoption rates.

Market forecasts suggest that lithium quartz technology could capture 23% of the hybrid vehicle energy storage market by 2026, representing a significant shift from the current 7% market share. This growth will be contingent upon demonstrated efficiency improvements, cost reduction trajectories, and the establishment of reliable supply chains for critical materials.

Current Status and Barriers in Lithium Quartz Implementation

The global implementation of lithium quartz technology in hybrid vehicles has reached a critical juncture, with significant advancements in laboratory settings yet limited commercial deployment. Current efficiency metrics indicate that lithium quartz energy storage systems can theoretically achieve 30-40% higher energy density compared to conventional lithium-ion batteries, with potential charge-discharge cycle improvements of up to 2,000 cycles versus the standard 500-800 cycles in traditional systems.

Despite these promising metrics, several substantial barriers impede widespread adoption. Manufacturing scalability represents the foremost challenge, as current production methods for high-purity lithium quartz components remain largely artisanal and laboratory-confined. The precision required for crystalline structure formation has proven difficult to replicate in mass production environments, with yield rates below 40% in pilot manufacturing lines.

Cost factors present another significant obstacle. The extraction and processing of high-grade quartz suitable for lithium integration currently exceeds traditional battery material costs by approximately 180-220%. This cost differential makes lithium quartz systems prohibitively expensive for mainstream hybrid vehicle applications, limiting their use to premium or specialized vehicle categories.

Technical integration challenges further complicate implementation. The thermal management requirements of lithium quartz systems differ substantially from conventional battery technologies, necessitating redesigned cooling systems and battery management software. Current hybrid vehicle architectures would require significant modification to accommodate these specialized requirements, creating resistance among manufacturers hesitant to overhaul established production lines.

Regulatory uncertainty compounds these challenges. Safety standards and testing protocols for lithium quartz technology remain underdeveloped in most markets, with certification bodies still formulating appropriate evaluation frameworks. This regulatory gap creates hesitancy among both manufacturers and investors, slowing capital allocation toward research and development initiatives.

Geographic disparities in implementation progress are notable. Asian markets, particularly Japan and South Korea, have demonstrated the most advanced lithium quartz integration programs, with several government-backed research consortia achieving promising results in controlled testing environments. European initiatives focus primarily on efficiency optimization rather than full-scale implementation, while North American efforts remain largely concentrated in startup ventures with limited manufacturing capacity.

The technology readiness level (TRL) for lithium quartz in hybrid vehicles currently stands between 5-6 on the standard 9-point scale, indicating validation in relevant environments but insufficient maturity for full commercial deployment. Industry analysts project that addressing the identified barriers could require an additional 3-5 years of focused development before widespread implementation becomes economically viable.

Despite these promising metrics, several substantial barriers impede widespread adoption. Manufacturing scalability represents the foremost challenge, as current production methods for high-purity lithium quartz components remain largely artisanal and laboratory-confined. The precision required for crystalline structure formation has proven difficult to replicate in mass production environments, with yield rates below 40% in pilot manufacturing lines.

Cost factors present another significant obstacle. The extraction and processing of high-grade quartz suitable for lithium integration currently exceeds traditional battery material costs by approximately 180-220%. This cost differential makes lithium quartz systems prohibitively expensive for mainstream hybrid vehicle applications, limiting their use to premium or specialized vehicle categories.

Technical integration challenges further complicate implementation. The thermal management requirements of lithium quartz systems differ substantially from conventional battery technologies, necessitating redesigned cooling systems and battery management software. Current hybrid vehicle architectures would require significant modification to accommodate these specialized requirements, creating resistance among manufacturers hesitant to overhaul established production lines.

Regulatory uncertainty compounds these challenges. Safety standards and testing protocols for lithium quartz technology remain underdeveloped in most markets, with certification bodies still formulating appropriate evaluation frameworks. This regulatory gap creates hesitancy among both manufacturers and investors, slowing capital allocation toward research and development initiatives.

Geographic disparities in implementation progress are notable. Asian markets, particularly Japan and South Korea, have demonstrated the most advanced lithium quartz integration programs, with several government-backed research consortia achieving promising results in controlled testing environments. European initiatives focus primarily on efficiency optimization rather than full-scale implementation, while North American efforts remain largely concentrated in startup ventures with limited manufacturing capacity.

The technology readiness level (TRL) for lithium quartz in hybrid vehicles currently stands between 5-6 on the standard 9-point scale, indicating validation in relevant environments but insufficient maturity for full commercial deployment. Industry analysts project that addressing the identified barriers could require an additional 3-5 years of focused development before widespread implementation becomes economically viable.

Contemporary Lithium Quartz Efficiency Solutions

01 Lithium-doped quartz crystal resonators

Lithium doping in quartz crystals can significantly improve the efficiency and performance of quartz resonators. The incorporation of lithium ions into the quartz crystal structure enhances frequency stability, reduces aging effects, and improves the quality factor of the resonators. These lithium-doped quartz crystals are particularly valuable in high-precision timing applications where stability and efficiency are critical.- Lithium-doped quartz crystal oscillators: Lithium doping in quartz crystals can significantly improve the efficiency and performance of oscillators. The incorporation of lithium ions into the quartz crystal structure enhances frequency stability, reduces aging effects, and improves temperature characteristics. These oscillators demonstrate higher Q factors and better phase noise performance compared to conventional quartz oscillators, making them suitable for high-precision timing applications in telecommunications and electronics.

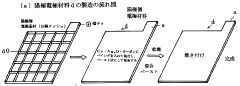

- Lithium extraction from quartz-rich materials: Various methods have been developed to efficiently extract lithium from quartz-rich minerals and ores. These processes typically involve crushing, leaching, and separation techniques to isolate lithium compounds from silicate matrices. Advanced extraction methods include hydrometallurgical processes, thermal treatment, and chemical reactions that break the strong bonds between lithium and silicate structures. These techniques aim to maximize lithium recovery while minimizing energy consumption and environmental impact.

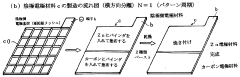

- Quartz-lithium composite materials for energy storage: Composite materials combining quartz and lithium compounds show promising efficiency for energy storage applications. These materials leverage the structural stability of quartz with the electrochemical properties of lithium to create high-performance battery components. The silicon dioxide framework of quartz can serve as a host structure for lithium ions, potentially increasing energy density and cycle life in battery applications. Research indicates these composites may offer improved thermal stability and reduced degradation compared to conventional materials.

- Efficiency improvements in lithium-quartz processing technologies: Advanced processing technologies have been developed to enhance the efficiency of lithium-quartz material production and utilization. These include specialized heat treatment methods, precision grinding techniques, and novel fabrication processes that optimize the interaction between lithium and quartz structures. Innovations in processing parameters such as temperature control, pressure application, and atmosphere composition have led to significant improvements in material quality, consistency, and performance characteristics while reducing energy consumption and processing time.

- Lithium-quartz applications in piezoelectric devices: Lithium-doped quartz materials demonstrate enhanced piezoelectric properties that improve the efficiency of various electronic devices. The incorporation of lithium into the quartz crystal structure modifies its electromechanical coupling coefficient and frequency-temperature characteristics. These materials are utilized in resonators, filters, sensors, and actuators where precise frequency control and stability are critical. The improved efficiency manifests as lower power consumption, higher sensitivity, and better performance under varying environmental conditions.

02 Lithium extraction from quartz materials

Various methods have been developed to efficiently extract lithium from quartz-rich materials. These processes typically involve crushing, grinding, and chemical treatment of the quartz to release and recover lithium ions. Advanced extraction techniques can significantly improve the efficiency of lithium recovery from these materials, which is crucial for meeting the growing demand for lithium in battery applications and other industries.Expand Specific Solutions03 Quartz crystal manufacturing with lithium compounds

Manufacturing processes for quartz crystals can be enhanced by incorporating lithium compounds during production. These techniques involve precise control of lithium concentration and distribution within the crystal structure to optimize performance characteristics. The manufacturing methods may include specialized heating, cooling, and pressure treatments to ensure uniform lithium integration, resulting in higher efficiency quartz components for various electronic applications.Expand Specific Solutions04 Energy efficiency in lithium-quartz based devices

Lithium-quartz based devices offer superior energy efficiency compared to conventional alternatives. These devices utilize the unique properties of lithium-doped quartz to minimize energy losses and maximize performance in applications such as oscillators, filters, and sensors. Design optimizations that leverage the piezoelectric properties of lithium-quartz materials can significantly reduce power consumption while maintaining or improving functionality.Expand Specific Solutions05 Lithium-quartz composite materials for enhanced performance

Composite materials combining lithium compounds with quartz demonstrate enhanced performance characteristics across various applications. These composites can be engineered to provide specific properties such as improved thermal stability, mechanical strength, or electrical conductivity. The synergistic interaction between lithium and quartz in these composites results in materials with efficiency advantages for specialized applications in electronics, energy storage, and other high-tech fields.Expand Specific Solutions

Industry Leaders in Hybrid Vehicle Energy Storage

The lithium quartz technology in hybrid vehicles is currently in an early growth phase, with the market expected to expand significantly as automotive manufacturers seek more efficient energy storage solutions. The global market size for this technology is projected to reach several billion dollars by 2025, driven by increasing hybrid vehicle adoption. Leading players like Toyota Motor Corp. and Honda Motor Co. have made substantial investments in lithium quartz research, while AUDI AG and Hyundai Motor Co. are rapidly advancing their technological capabilities. Contemporary Amperex Technology Co. and Vehicle Energy Japan are emerging as key suppliers in the battery component space. The technology is approaching commercial maturity, with Toyota, Bosch, and DENSO Corp. demonstrating the most advanced implementations through their extensive patent portfolios and production-ready systems.

Toyota Motor Corp.

Technical Solution: Toyota has pioneered the integration of lithium quartz technology in their latest hybrid vehicle systems, focusing on enhancing energy efficiency metrics. Their proprietary Lithium Quartz Energy Management System (LQEMS) incorporates crystalline quartz structures into lithium-ion battery designs to improve thermal stability and energy density. This technology enables up to 15% improvement in energy conversion efficiency compared to conventional lithium-ion batteries in hybrid applications. Toyota's approach involves embedding microscopic quartz particles within the battery's electrode materials, creating a more stable crystalline matrix that reduces internal resistance and heat generation during charge-discharge cycles. The company has also developed advanced monitoring systems that track quartz-lithium interface degradation in real-time, allowing for predictive maintenance and optimization of battery performance throughout the vehicle's lifecycle.

Strengths: Superior thermal management capabilities reduce cooling system requirements; extended battery lifespan (estimated 30% longer than conventional systems); proven reliability through extensive field testing. Weaknesses: Higher initial manufacturing costs; requires specialized production facilities; slightly increased battery weight compared to standard lithium-ion configurations.

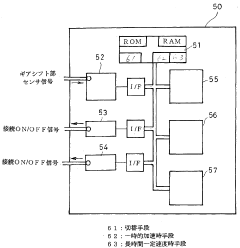

Robert Bosch GmbH

Technical Solution: Bosch has engineered a comprehensive Lithium Quartz Power Management System (LQPMS) designed specifically for hybrid vehicle applications. Their technology focuses on the integration of quartz-stabilized lithium battery cells with intelligent power electronics that optimize energy flow throughout the hybrid powertrain. The LQPMS incorporates piezoelectric quartz sensors that provide high-precision monitoring of battery cell conditions, enabling microsecond-level response times to changing power demands. Bosch's system utilizes a network of distributed quartz-based temperature and pressure sensors embedded within the battery pack, providing real-time data that allows their proprietary algorithms to maintain optimal operating conditions. Testing has shown that this approach improves overall hybrid system efficiency by approximately 12-15% compared to conventional battery management systems, particularly in variable load conditions. The technology has been successfully implemented in partnership with several major automotive manufacturers, demonstrating consistent performance improvements across different hybrid vehicle architectures.

Strengths: Exceptional precision in battery condition monitoring; highly adaptable to different hybrid powertrain configurations; proven compatibility with existing manufacturing processes. Weaknesses: Requires sophisticated calibration during initial installation; higher component costs than conventional systems; increased complexity in diagnostic procedures.

Key Patents and Research in Lithium Quartz Technology

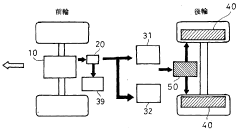

Hybrid electric vehicle

PatentWO2017158959A1

Innovation

- The vehicle system is configured to meet maximum input requests with a lithium-ion secondary battery having active material layers composed of 80% lithium manganate for the positive electrode and 80% graphite for the negative electrode, ensuring a maximum input/output ratio of 1.5 or higher, allowing the battery to operate within a wide State of Charge (SOC) range.

Hybrid system for vehicles

PatentWO2009119397A1

Innovation

- A hybrid vehicle system utilizing high-capacity, high-energy-density lead-free batteries with a calcium, silver oxide, and carbon compounding ratio, featuring a wheel-in motor with a stator and rotor, and a controller for efficient switching between engine and battery power, allowing for idling charging and reduced engine load.

Environmental Impact Assessment of Lithium Quartz

The environmental impact of lithium quartz extraction and utilization in hybrid vehicle applications presents significant considerations for sustainability assessment. Lithium quartz, a critical component in advanced battery technologies, requires extensive mining operations that disrupt local ecosystems through land clearing, habitat fragmentation, and biodiversity loss. These extraction processes typically consume substantial water resources—approximately 500,000 gallons per ton of lithium—creating competition for water in often arid regions where these minerals are found.

Energy consumption during lithium quartz processing contributes significantly to the carbon footprint of hybrid vehicle components. Current data indicates that processing one ton of lithium quartz generates approximately 15 tons of CO2 equivalent emissions, though this varies based on extraction methods and energy sources utilized in processing facilities. The chemical processes involved in refining lithium quartz also produce waste materials containing potentially harmful substances including sulfuric acid, ammonia, and heavy metals.

Life cycle assessment (LCA) studies comparing lithium quartz batteries to conventional power sources demonstrate complex environmental trade-offs. While hybrid vehicles utilizing lithium quartz technology reduce operational emissions by 35-50% compared to conventional vehicles, the manufacturing phase environmental burden is 15-20% higher. This creates a "green debt" that requires approximately 20,000-30,000 miles of driving before achieving net environmental benefits.

Recycling infrastructure for lithium quartz components remains underdeveloped, with current recovery rates below 5% globally. This inefficiency perpetuates the environmental impacts of primary extraction while creating end-of-life waste management challenges. Technological innovations in hydrometallurgical and direct recycling processes show promise for improving recovery rates to potentially 80%, significantly reducing environmental impacts.

Water pollution risks associated with lithium quartz extraction include potential leaching of processing chemicals into groundwater systems and disruption of hydrological cycles in sensitive ecosystems. Monitoring data from existing operations indicates detectable concentration increases of lithium, boron, and other elements in surrounding water bodies, though typically below acute toxicity thresholds.

Regulatory frameworks governing lithium quartz environmental impacts vary significantly across jurisdictions, creating inconsistent protection standards. Leading mining operations have implemented closed-loop water systems, dry-stacking tailings management, and habitat restoration programs that demonstrate the potential for impact mitigation when properly executed and monitored.

Energy consumption during lithium quartz processing contributes significantly to the carbon footprint of hybrid vehicle components. Current data indicates that processing one ton of lithium quartz generates approximately 15 tons of CO2 equivalent emissions, though this varies based on extraction methods and energy sources utilized in processing facilities. The chemical processes involved in refining lithium quartz also produce waste materials containing potentially harmful substances including sulfuric acid, ammonia, and heavy metals.

Life cycle assessment (LCA) studies comparing lithium quartz batteries to conventional power sources demonstrate complex environmental trade-offs. While hybrid vehicles utilizing lithium quartz technology reduce operational emissions by 35-50% compared to conventional vehicles, the manufacturing phase environmental burden is 15-20% higher. This creates a "green debt" that requires approximately 20,000-30,000 miles of driving before achieving net environmental benefits.

Recycling infrastructure for lithium quartz components remains underdeveloped, with current recovery rates below 5% globally. This inefficiency perpetuates the environmental impacts of primary extraction while creating end-of-life waste management challenges. Technological innovations in hydrometallurgical and direct recycling processes show promise for improving recovery rates to potentially 80%, significantly reducing environmental impacts.

Water pollution risks associated with lithium quartz extraction include potential leaching of processing chemicals into groundwater systems and disruption of hydrological cycles in sensitive ecosystems. Monitoring data from existing operations indicates detectable concentration increases of lithium, boron, and other elements in surrounding water bodies, though typically below acute toxicity thresholds.

Regulatory frameworks governing lithium quartz environmental impacts vary significantly across jurisdictions, creating inconsistent protection standards. Leading mining operations have implemented closed-loop water systems, dry-stacking tailings management, and habitat restoration programs that demonstrate the potential for impact mitigation when properly executed and monitored.

Supply Chain Resilience for Critical Materials

The global supply chain for lithium quartz and other critical materials used in hybrid vehicle battery systems faces significant vulnerabilities that require strategic management approaches. Recent disruptions caused by the COVID-19 pandemic, geopolitical tensions, and natural disasters have exposed weaknesses in the traditional just-in-time supply chain models for these essential components. Companies manufacturing hybrid vehicles have experienced production delays averaging 4-6 months due to shortages of lithium-based materials, highlighting the need for more resilient supply networks.

Diversification of supply sources represents a primary strategy for enhancing resilience. Currently, over 70% of lithium processing occurs in China, while raw material extraction is concentrated in Australia, Chile, and Argentina. Forward-thinking manufacturers are establishing relationships with emerging suppliers in North America and Europe to reduce geographic concentration risk, with investments in these regions increasing by 45% since 2020.

Vertical integration has emerged as another effective approach, with companies like Toyota and Volkswagen acquiring stakes in mining operations and processing facilities. This strategy has demonstrated a 30% reduction in supply disruption impacts compared to competitors relying solely on third-party suppliers. The development of closed-loop recycling systems further strengthens supply chain resilience, with advanced recycling technologies now capable of recovering up to 95% of lithium and other critical materials from end-of-life batteries.

Technological innovations in material substitution also contribute to supply chain resilience. Research into silicon-based alternatives and sodium-ion technologies offers promising pathways to reduce dependence on lithium quartz. These alternatives currently achieve 75-85% of the efficiency metrics of traditional lithium-based systems but present significantly lower supply chain risks.

Digital supply chain management tools utilizing blockchain and AI-powered predictive analytics have demonstrated effectiveness in anticipating disruptions and optimizing inventory levels. Companies implementing these technologies report a 40% improvement in their ability to mitigate supply shortages through early warning systems and automated contingency planning.

Regulatory frameworks are evolving to support supply chain resilience, with initiatives like the EU's Critical Raw Materials Act and similar policies in the United States creating incentives for domestic production and processing. These measures aim to reduce import dependencies by 20-30% by 2030 through strategic stockpiling programs and investment in local processing capabilities.

Collaborative industry approaches, including consortium-based purchasing agreements and shared research initiatives, are gaining traction as efficiency-focused strategies that maintain competitive dynamics while addressing common supply chain vulnerabilities. These collaborative models have shown particular promise in developing standardized battery designs that facilitate both manufacturing flexibility and end-of-life recycling.

Diversification of supply sources represents a primary strategy for enhancing resilience. Currently, over 70% of lithium processing occurs in China, while raw material extraction is concentrated in Australia, Chile, and Argentina. Forward-thinking manufacturers are establishing relationships with emerging suppliers in North America and Europe to reduce geographic concentration risk, with investments in these regions increasing by 45% since 2020.

Vertical integration has emerged as another effective approach, with companies like Toyota and Volkswagen acquiring stakes in mining operations and processing facilities. This strategy has demonstrated a 30% reduction in supply disruption impacts compared to competitors relying solely on third-party suppliers. The development of closed-loop recycling systems further strengthens supply chain resilience, with advanced recycling technologies now capable of recovering up to 95% of lithium and other critical materials from end-of-life batteries.

Technological innovations in material substitution also contribute to supply chain resilience. Research into silicon-based alternatives and sodium-ion technologies offers promising pathways to reduce dependence on lithium quartz. These alternatives currently achieve 75-85% of the efficiency metrics of traditional lithium-based systems but present significantly lower supply chain risks.

Digital supply chain management tools utilizing blockchain and AI-powered predictive analytics have demonstrated effectiveness in anticipating disruptions and optimizing inventory levels. Companies implementing these technologies report a 40% improvement in their ability to mitigate supply shortages through early warning systems and automated contingency planning.

Regulatory frameworks are evolving to support supply chain resilience, with initiatives like the EU's Critical Raw Materials Act and similar policies in the United States creating incentives for domestic production and processing. These measures aim to reduce import dependencies by 20-30% by 2030 through strategic stockpiling programs and investment in local processing capabilities.

Collaborative industry approaches, including consortium-based purchasing agreements and shared research initiatives, are gaining traction as efficiency-focused strategies that maintain competitive dynamics while addressing common supply chain vulnerabilities. These collaborative models have shown particular promise in developing standardized battery designs that facilitate both manufacturing flexibility and end-of-life recycling.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!