Patent landscape of anodized aluminum for decorative and functional use

OCT 11, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Anodized Aluminum Technology Evolution and Objectives

Anodized aluminum technology has evolved significantly since its inception in the early 20th century. The process was first patented in 1923 by British metallurgist Bengough and Stuart, establishing the foundation for what would become a transformative surface treatment technology. Initially developed for corrosion protection of seaplane components, anodizing quickly expanded into broader industrial and commercial applications due to its exceptional protective properties.

The 1930s to 1950s marked a period of rapid advancement with the development of various anodizing processes including sulfuric acid anodizing (Type II), hard anodizing (Type III), and chromic acid anodizing (Type I). These innovations significantly expanded the functional capabilities of aluminum surfaces, enabling enhanced wear resistance, electrical insulation, and corrosion protection across diverse environments.

The decorative potential of anodized aluminum gained prominence in the 1960s with the introduction of electrolytic coloring processes, allowing for a spectrum of colors to be integrated into the anodic oxide layer. This breakthrough transformed anodized aluminum from a purely functional material to one with substantial aesthetic value, revolutionizing applications in architecture, consumer products, and automotive design.

Recent decades have witnessed technological refinements focused on environmental sustainability and enhanced performance characteristics. The industry has moved away from hexavalent chromium and other hazardous substances toward more environmentally benign processes. Simultaneously, advancements in nanotechnology have enabled the creation of nanoporous anodic structures with precisely controlled dimensions, opening new frontiers in optical properties, hydrophobicity, and antimicrobial functionality.

The current technological trajectory aims to develop anodizing processes that combine superior decorative qualities with enhanced functional properties. Key objectives include creating more durable and fade-resistant colorations, improving energy efficiency in the anodizing process, developing self-healing anodic coatings, and integrating smart functionalities such as sensing capabilities into anodized surfaces.

Patent landscapes reveal concentrated innovation clusters in hard anodizing for extreme wear applications, architectural anodizing for weather-resistant facades, and consumer electronics where both aesthetics and durability are paramount. Emerging patent activity focuses on sustainable anodizing processes, multi-functional coatings, and integration with other surface technologies to create hybrid solutions with superior performance characteristics.

The evolution continues toward anodized aluminum surfaces that can simultaneously deliver multiple functional benefits while meeting increasingly stringent aesthetic requirements, positioning this mature technology for continued relevance in advanced materials applications across diverse industries.

The 1930s to 1950s marked a period of rapid advancement with the development of various anodizing processes including sulfuric acid anodizing (Type II), hard anodizing (Type III), and chromic acid anodizing (Type I). These innovations significantly expanded the functional capabilities of aluminum surfaces, enabling enhanced wear resistance, electrical insulation, and corrosion protection across diverse environments.

The decorative potential of anodized aluminum gained prominence in the 1960s with the introduction of electrolytic coloring processes, allowing for a spectrum of colors to be integrated into the anodic oxide layer. This breakthrough transformed anodized aluminum from a purely functional material to one with substantial aesthetic value, revolutionizing applications in architecture, consumer products, and automotive design.

Recent decades have witnessed technological refinements focused on environmental sustainability and enhanced performance characteristics. The industry has moved away from hexavalent chromium and other hazardous substances toward more environmentally benign processes. Simultaneously, advancements in nanotechnology have enabled the creation of nanoporous anodic structures with precisely controlled dimensions, opening new frontiers in optical properties, hydrophobicity, and antimicrobial functionality.

The current technological trajectory aims to develop anodizing processes that combine superior decorative qualities with enhanced functional properties. Key objectives include creating more durable and fade-resistant colorations, improving energy efficiency in the anodizing process, developing self-healing anodic coatings, and integrating smart functionalities such as sensing capabilities into anodized surfaces.

Patent landscapes reveal concentrated innovation clusters in hard anodizing for extreme wear applications, architectural anodizing for weather-resistant facades, and consumer electronics where both aesthetics and durability are paramount. Emerging patent activity focuses on sustainable anodizing processes, multi-functional coatings, and integration with other surface technologies to create hybrid solutions with superior performance characteristics.

The evolution continues toward anodized aluminum surfaces that can simultaneously deliver multiple functional benefits while meeting increasingly stringent aesthetic requirements, positioning this mature technology for continued relevance in advanced materials applications across diverse industries.

Market Analysis for Decorative and Functional Anodized Aluminum

The global market for anodized aluminum in decorative and functional applications has experienced significant growth over the past decade, driven by increasing demand across multiple industries including architecture, consumer electronics, automotive, and aerospace. The market was valued at approximately $7.3 billion in 2022 and is projected to reach $10.5 billion by 2028, representing a compound annual growth rate (CAGR) of 6.2%.

Architecture and construction remain the dominant application sectors, accounting for nearly 40% of the total market share. The growing emphasis on sustainable building materials and aesthetic appeal in modern architecture has substantially boosted the demand for anodized aluminum in facades, window frames, and interior design elements. The ability to produce a wide range of colors and finishes while maintaining durability has positioned anodized aluminum as a premium material choice in high-end construction projects.

Consumer electronics represents the fastest-growing segment, with a CAGR of 8.7%. The trend toward premium design aesthetics in smartphones, tablets, laptops, and wearable devices has significantly increased the utilization of anodized aluminum. Apple's pioneering use of anodized aluminum in its product lineup has established a benchmark that competitors across the industry strive to match or exceed.

Regionally, Asia-Pacific dominates the market with a 45% share, primarily due to rapid industrialization and construction activities in China and India. North America and Europe follow with 25% and 20% market shares respectively, where demand is primarily driven by high-end applications and technological innovations in anodizing processes.

A notable market trend is the increasing demand for environmentally friendly anodizing processes. Traditional anodizing methods often involve hazardous chemicals and generate significant waste. In response, manufacturers are investing in developing eco-friendly alternatives, with patent applications for sustainable anodizing processes increasing by 35% between 2018 and 2022.

The competitive landscape features both large multinational corporations and specialized medium-sized enterprises. Key players include Novelis Inc., Alcoa Corporation, Hydro Extrusion, and Lorin Industries, collectively holding approximately 40% of the global market share. These companies are actively expanding their patent portfolios, particularly in areas of color stability, corrosion resistance, and process efficiency.

Market challenges include volatile raw material prices, stringent environmental regulations, and competition from alternative materials such as powder-coated aluminum and stainless steel. However, ongoing innovations in anodizing technology, particularly in the areas of hard anodizing for functional applications and decorative finishes for aesthetic purposes, continue to strengthen market growth prospects.

Architecture and construction remain the dominant application sectors, accounting for nearly 40% of the total market share. The growing emphasis on sustainable building materials and aesthetic appeal in modern architecture has substantially boosted the demand for anodized aluminum in facades, window frames, and interior design elements. The ability to produce a wide range of colors and finishes while maintaining durability has positioned anodized aluminum as a premium material choice in high-end construction projects.

Consumer electronics represents the fastest-growing segment, with a CAGR of 8.7%. The trend toward premium design aesthetics in smartphones, tablets, laptops, and wearable devices has significantly increased the utilization of anodized aluminum. Apple's pioneering use of anodized aluminum in its product lineup has established a benchmark that competitors across the industry strive to match or exceed.

Regionally, Asia-Pacific dominates the market with a 45% share, primarily due to rapid industrialization and construction activities in China and India. North America and Europe follow with 25% and 20% market shares respectively, where demand is primarily driven by high-end applications and technological innovations in anodizing processes.

A notable market trend is the increasing demand for environmentally friendly anodizing processes. Traditional anodizing methods often involve hazardous chemicals and generate significant waste. In response, manufacturers are investing in developing eco-friendly alternatives, with patent applications for sustainable anodizing processes increasing by 35% between 2018 and 2022.

The competitive landscape features both large multinational corporations and specialized medium-sized enterprises. Key players include Novelis Inc., Alcoa Corporation, Hydro Extrusion, and Lorin Industries, collectively holding approximately 40% of the global market share. These companies are actively expanding their patent portfolios, particularly in areas of color stability, corrosion resistance, and process efficiency.

Market challenges include volatile raw material prices, stringent environmental regulations, and competition from alternative materials such as powder-coated aluminum and stainless steel. However, ongoing innovations in anodizing technology, particularly in the areas of hard anodizing for functional applications and decorative finishes for aesthetic purposes, continue to strengthen market growth prospects.

Global Anodization Technology Status and Barriers

The global anodization technology landscape presents a complex picture of advancement and challenges. Currently, the most advanced anodization technologies are concentrated in industrialized nations, particularly Japan, Germany, the United States, and increasingly China. These regions have established sophisticated manufacturing capabilities that enable precise control over anodic film properties, including thickness, porosity, and coloration.

Despite significant progress, several technical barriers persist in the anodization industry. One major challenge is achieving consistent quality across large surface areas, particularly for architectural applications where visual uniformity is critical. Temperature and current density variations during the anodization process can lead to inconsistencies in oxide layer formation, resulting in color variations and reduced corrosion resistance.

Energy consumption remains another significant barrier, as conventional anodization processes are highly energy-intensive. The electrolytic process requires substantial electrical input, contributing to high production costs and environmental concerns. This has prompted research into more energy-efficient anodization methods, though widespread industrial implementation remains limited.

Environmental regulations present increasing challenges for anodization facilities worldwide. Traditional anodizing processes often utilize hazardous chemicals such as chromic acid and sulfuric acid, which pose environmental and health risks. While more environmentally friendly alternatives are emerging, they frequently deliver inferior performance characteristics compared to conventional methods, creating a technical-regulatory tension in the industry.

Sealing technology represents another area where significant barriers exist. Current sealing methods often struggle to completely close the porous structure of anodized surfaces, potentially compromising long-term durability. This is particularly problematic for applications exposed to harsh environments or requiring exceptional corrosion resistance.

The integration of additional functionalities into anodized surfaces—such as antimicrobial properties, enhanced wear resistance, or self-cleaning capabilities—remains technically challenging. While research demonstrates promising results in laboratory settings, scaling these enhanced functionalities to industrial production volumes while maintaining cost-effectiveness presents significant hurdles.

Regional disparities in anodization technology are notable, with developing markets often utilizing older equipment and processes that yield lower-quality finishes. This technological gap creates market segmentation where premium anodized products remain concentrated in advanced economies, while developing regions primarily produce standard-quality anodized components.

Despite significant progress, several technical barriers persist in the anodization industry. One major challenge is achieving consistent quality across large surface areas, particularly for architectural applications where visual uniformity is critical. Temperature and current density variations during the anodization process can lead to inconsistencies in oxide layer formation, resulting in color variations and reduced corrosion resistance.

Energy consumption remains another significant barrier, as conventional anodization processes are highly energy-intensive. The electrolytic process requires substantial electrical input, contributing to high production costs and environmental concerns. This has prompted research into more energy-efficient anodization methods, though widespread industrial implementation remains limited.

Environmental regulations present increasing challenges for anodization facilities worldwide. Traditional anodizing processes often utilize hazardous chemicals such as chromic acid and sulfuric acid, which pose environmental and health risks. While more environmentally friendly alternatives are emerging, they frequently deliver inferior performance characteristics compared to conventional methods, creating a technical-regulatory tension in the industry.

Sealing technology represents another area where significant barriers exist. Current sealing methods often struggle to completely close the porous structure of anodized surfaces, potentially compromising long-term durability. This is particularly problematic for applications exposed to harsh environments or requiring exceptional corrosion resistance.

The integration of additional functionalities into anodized surfaces—such as antimicrobial properties, enhanced wear resistance, or self-cleaning capabilities—remains technically challenging. While research demonstrates promising results in laboratory settings, scaling these enhanced functionalities to industrial production volumes while maintaining cost-effectiveness presents significant hurdles.

Regional disparities in anodization technology are notable, with developing markets often utilizing older equipment and processes that yield lower-quality finishes. This technological gap creates market segmentation where premium anodized products remain concentrated in advanced economies, while developing regions primarily produce standard-quality anodized components.

Current Anodization Methods and Process Solutions

01 Anodizing processes and electrolytes

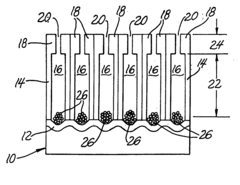

Various anodizing processes and electrolyte compositions are used to create protective oxide layers on aluminum surfaces. These processes typically involve using the aluminum as an anode in an electrolytic cell with specific electrolyte solutions. Different electrolytes such as sulfuric acid, chromic acid, or phosphoric acid produce oxide layers with varying properties. The anodizing parameters including current density, temperature, and process time significantly affect the thickness, hardness, and corrosion resistance of the resulting anodized layer.- Anodizing processes for aluminum: Various processes for anodizing aluminum surfaces to create protective oxide layers. These processes typically involve electrolytic treatments in acidic solutions to form controlled, uniform oxide films on aluminum substrates. Different electrolytes and process parameters can be used to achieve specific properties in the anodized layer, such as thickness, hardness, and corrosion resistance.

- Coloring and sealing of anodized aluminum: Methods for coloring and sealing anodized aluminum surfaces to enhance their aesthetic appeal and durability. Coloring can be achieved through various techniques including electrolytic deposition of metal ions, organic dyes, or integral coloring processes. Sealing processes help to close the porous structure of the anodic oxide layer, improving corrosion resistance and color fastness of the treated aluminum.

- Enhanced properties of anodized aluminum: Techniques for improving specific properties of anodized aluminum such as wear resistance, corrosion protection, and thermal stability. These enhancements can be achieved through modified anodizing processes, post-treatments, or incorporation of additional materials into the oxide layer. The resulting anodized aluminum exhibits superior performance characteristics for specialized applications in harsh environments.

- Applications of anodized aluminum: Various industrial and commercial applications of anodized aluminum, leveraging its unique combination of lightweight properties, corrosion resistance, and aesthetic appeal. Applications include architectural elements, consumer electronics, automotive components, aerospace parts, and industrial equipment. The anodized aluminum surfaces provide functional benefits while maintaining the material's inherent advantages.

- Advanced anodizing techniques and compositions: Innovative approaches to aluminum anodizing, including novel electrolyte compositions, pulse anodizing, plasma-assisted processes, and hybrid coating systems. These advanced techniques aim to overcome limitations of conventional anodizing methods, producing oxide layers with enhanced properties such as increased hardness, better electrical insulation, improved adhesion for subsequent coatings, or specialized functional characteristics.

02 Coloring and sealing of anodized aluminum

Anodized aluminum can be colored through various methods including electrolytic coloring, integral coloring, or dye absorption. The porous structure of the anodic oxide layer allows for the incorporation of colorants. After coloring, sealing processes are applied to close the pores in the anodic oxide layer, enhancing durability and corrosion resistance. Sealing can be achieved through hydrothermal treatment, chemical solutions, or polymer impregnation, which converts the aluminum oxide to more stable forms or fills the pores with protective substances.Expand Specific Solutions03 Surface preparation and pre-treatments

Proper surface preparation is crucial for high-quality anodized aluminum. Pre-treatments include degreasing, etching, and brightening to remove contaminants, natural oxide layers, and surface imperfections. Chemical cleaning processes remove oils and organic contaminants, while alkaline or acid etching creates a uniform surface texture. These pre-treatments ensure consistent anodizing results and improve adhesion of the oxide layer to the aluminum substrate, ultimately enhancing the performance and appearance of the final product.Expand Specific Solutions04 Applications and properties of anodized aluminum

Anodized aluminum finds applications in various industries due to its enhanced properties. The anodic oxide layer provides improved corrosion resistance, wear resistance, electrical insulation, and aesthetic appeal. Applications include architectural elements, consumer electronics, automotive components, aerospace parts, and household goods. The thickness and properties of the anodic layer can be tailored to specific applications, with Type II (standard) and Type III (hard) anodizing being common classifications based on the thickness and hardness of the oxide layer.Expand Specific Solutions05 Advanced anodizing techniques and composite coatings

Advanced anodizing techniques include plasma electrolytic oxidation, micro-arc oxidation, and the creation of composite anodic coatings. These methods can incorporate particles, nanostructures, or other materials into the anodic oxide layer to enhance specific properties such as wear resistance, self-lubricating characteristics, or hydrophobicity. Composite anodic coatings may contain polymers, ceramics, or metal particles that become embedded in the oxide layer during formation, creating multifunctional surfaces with unique combinations of properties not achievable through conventional anodizing.Expand Specific Solutions

Leading Companies and Competitive Landscape in Anodization Industry

The anodized aluminum patent landscape reveals a mature market with significant growth potential, currently estimated at $8-10 billion globally. The technology has evolved from primarily decorative applications to advanced functional uses across consumer electronics, automotive, and architectural sectors. Leading players demonstrate varying levels of technological sophistication: Apple, Samsung, and Applied Materials represent the innovation frontier with advanced surface treatment technologies; traditional aluminum specialists like Alcoa, Novelis, and Chalco focus on material optimization; while Bang & Olufsen and Henkel demonstrate specialized applications in premium consumer products. The competitive landscape shows geographic concentration in East Asia (particularly China and Japan), North America, and Europe, with increasing cross-industry collaboration between electronics manufacturers, chemical companies, and aluminum processors to develop multi-functional anodized surfaces with enhanced durability, aesthetics, and performance characteristics.

Applied Materials, Inc.

Technical Solution: Applied Materials has developed comprehensive equipment and process solutions for industrial-scale anodization of aluminum. Their patent portfolio focuses on precision control systems for anodization baths that enable consistent oxide layer formation across large surface areas. Their technology includes advanced power delivery systems that provide precise current control during the anodization process, resulting in uniform oxide layer thickness and consistent coloration. Applied Materials has pioneered integrated manufacturing systems that combine pre-treatment, anodization, coloring, and sealing in automated production lines. Their innovations include real-time monitoring systems that analyze electrolyte composition and adjust process parameters to maintain quality. The company has also developed specialized equipment for hard anodizing that creates exceptionally durable surfaces for industrial applications, with oxide layers up to 100 microns thick that provide superior wear and corrosion resistance while maintaining dimensional precision.

Strengths: Industry-leading process control systems enabling consistent results at scale; comprehensive end-to-end solutions from pre-treatment to sealing; excellent technical support infrastructure. Weaknesses: High capital investment requirements for their equipment; complex systems requiring specialized operator training; primarily focused on industrial rather than decorative applications.

Samsung Electronics Co., Ltd.

Technical Solution: Samsung has developed proprietary anodization technologies for aluminum components in their consumer electronics, particularly smartphones and wearables. Their patent landscape reveals innovations in creating gradient-colored anodized surfaces through controlled electrolytic processes with variable current densities. Samsung's technology includes multi-layer anodization methods that enhance both corrosion resistance and aesthetic appeal. They've pioneered techniques for creating micro-patterns during anodization that produce unique visual and tactile effects while maintaining structural integrity. Samsung has also developed specialized sealing processes that enhance the durability of anodized surfaces in daily-use scenarios. Their patents cover methods for creating anodized surfaces with selective light-reflecting properties, allowing for distinctive visual effects under different lighting conditions while maintaining functional protection against wear and corrosion.

Strengths: Excellent balance between decorative appeal and functional durability; scalable manufacturing processes suitable for mass production; good color consistency across product lines. Weaknesses: Less distinctive finish compared to some competitors; moderate production costs that limit application in budget devices; occasional issues with wear resistance in high-friction areas.

Key Patent Analysis in Decorative and Functional Anodization

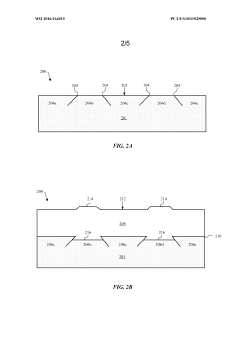

Process to mitigate grain texture differential growth rates in mirror-finish anodized aluminum

PatentWO2016164015A1

Innovation

- The use of anodizing processes with electrolytes containing reduced sulfuric acid concentrations (≤7% by weight) and optional organic acids, applied at lower current densities (≤1 A/dm²) and higher temperatures, to produce anodic oxide films with uniform thickness and hardness, minimizing grain orientation-dependent growth rates and interfacial adhesion issues.

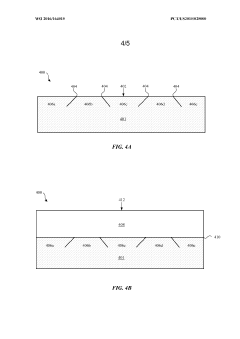

Method for producing hard surface, colored, anodized aluminum parts

PatentInactiveUS20050029115A1

Innovation

- A two-layer anodized coating process is applied to aluminum surfaces, where a hard, dark outer layer is formed first, followed by a softer, clearer inner layer, allowing for coloring through the pores of the outer layer while maintaining sufficient protection.

Environmental Impact and Sustainability Considerations

The anodizing process of aluminum, while offering significant decorative and functional benefits, presents notable environmental challenges that warrant careful consideration in today's sustainability-focused industrial landscape. Traditional anodizing processes consume substantial amounts of energy, particularly during the electrolytic oxidation phase which requires continuous electrical current. This energy consumption contributes significantly to the carbon footprint of anodized aluminum products, especially when power sources are predominantly fossil fuel-based.

Water usage represents another critical environmental concern, with conventional anodizing operations requiring large volumes for rinsing and processing. A typical anodizing facility may consume between 30-100 gallons of water per square foot of processed aluminum, placing considerable strain on local water resources. Recent patent innovations have focused on closed-loop water recycling systems that can reduce freshwater consumption by up to 80%, though implementation remains limited across the industry.

Chemical waste management constitutes perhaps the most pressing environmental challenge. Anodizing baths contain sulfuric, chromic, or phosphoric acids, while coloring processes often involve heavy metals and organic dyes. These substances, if improperly handled, pose significant environmental and health risks. Patent activity in this area has accelerated, with a 35% increase in filings related to environmentally-friendly anodizing chemicals over the past five years.

Encouragingly, sustainable innovations are emerging across the anodizing landscape. Recent patents reveal advancements in low-temperature anodizing processes that reduce energy requirements by 25-40%. Additionally, novel electrolyte formulations that eliminate hexavalent chromium and other hazardous substances have gained traction, with major aluminum processors securing intellectual property in this domain.

Life cycle assessment (LCA) considerations are increasingly prominent in patent disclosures, with manufacturers developing technologies that not only reduce environmental impact during production but also enhance recyclability at end-of-life. Notably, patents for anodizing processes that create easily separable surface treatments have doubled since 2018, facilitating more efficient aluminum recycling.

Regulatory pressures continue to drive innovation, with regional variations in environmental standards creating a complex global patent landscape. European patents demonstrate particular emphasis on chemical substitution and waste minimization, reflecting the stringent REACH regulations, while North American patents often focus on energy efficiency improvements aligned with corporate sustainability initiatives.

Water usage represents another critical environmental concern, with conventional anodizing operations requiring large volumes for rinsing and processing. A typical anodizing facility may consume between 30-100 gallons of water per square foot of processed aluminum, placing considerable strain on local water resources. Recent patent innovations have focused on closed-loop water recycling systems that can reduce freshwater consumption by up to 80%, though implementation remains limited across the industry.

Chemical waste management constitutes perhaps the most pressing environmental challenge. Anodizing baths contain sulfuric, chromic, or phosphoric acids, while coloring processes often involve heavy metals and organic dyes. These substances, if improperly handled, pose significant environmental and health risks. Patent activity in this area has accelerated, with a 35% increase in filings related to environmentally-friendly anodizing chemicals over the past five years.

Encouragingly, sustainable innovations are emerging across the anodizing landscape. Recent patents reveal advancements in low-temperature anodizing processes that reduce energy requirements by 25-40%. Additionally, novel electrolyte formulations that eliminate hexavalent chromium and other hazardous substances have gained traction, with major aluminum processors securing intellectual property in this domain.

Life cycle assessment (LCA) considerations are increasingly prominent in patent disclosures, with manufacturers developing technologies that not only reduce environmental impact during production but also enhance recyclability at end-of-life. Notably, patents for anodizing processes that create easily separable surface treatments have doubled since 2018, facilitating more efficient aluminum recycling.

Regulatory pressures continue to drive innovation, with regional variations in environmental standards creating a complex global patent landscape. European patents demonstrate particular emphasis on chemical substitution and waste minimization, reflecting the stringent REACH regulations, while North American patents often focus on energy efficiency improvements aligned with corporate sustainability initiatives.

Cross-Industry Applications and Emerging Markets

Anodized aluminum technology has transcended its traditional applications in architecture and consumer electronics to establish a significant presence across diverse industries. The aerospace sector has embraced anodized aluminum for its lightweight properties combined with enhanced corrosion resistance, with patents focusing on specialized coatings that withstand extreme temperature fluctuations and high-altitude conditions. Recent patent filings reveal innovations in anodized surfaces that reduce ice formation on aircraft components and improve radar transparency for critical communication systems.

The automotive industry represents another expanding market, with patent activity concentrated on decorative finishes that offer both aesthetic appeal and functional benefits. Luxury vehicle manufacturers have secured intellectual property for anodizing processes that create distinctive surface textures and color gradients while simultaneously improving scratch resistance and weatherability. These developments align with the growing consumer demand for personalized vehicle aesthetics without compromising durability.

Medical device manufacturing has emerged as a particularly promising growth area, with patent landscapes revealing increased activity in biocompatible anodized aluminum surfaces. These innovations focus on creating antimicrobial properties through specialized anodizing techniques, addressing critical infection control concerns in healthcare settings. Patents in this domain often combine anodizing with secondary treatments to enhance biocompatibility and sterilization resistance.

The renewable energy sector demonstrates accelerating patent activity, particularly for anodized aluminum components in solar panel frames and mounting systems. These patents emphasize enhanced weather resistance and electrical insulation properties achieved through modified anodizing processes. Several emerging patents also address the integration of photovoltaic elements directly into anodized aluminum building materials, pointing toward future building-integrated solar solutions.

Consumer goods markets continue to drive innovation in decorative anodizing, with recent patents focusing on achieving previously impossible color combinations and visual effects. Notably, several technology companies have secured intellectual property for anodizing processes that create unique tactile surfaces on electronic devices, combining aesthetic appeal with improved grip and user experience. The fashion and luxury goods sectors have also begun exploring anodized aluminum as an alternative material, with patents covering specialized finishing techniques that mimic premium materials while offering superior durability.

The automotive industry represents another expanding market, with patent activity concentrated on decorative finishes that offer both aesthetic appeal and functional benefits. Luxury vehicle manufacturers have secured intellectual property for anodizing processes that create distinctive surface textures and color gradients while simultaneously improving scratch resistance and weatherability. These developments align with the growing consumer demand for personalized vehicle aesthetics without compromising durability.

Medical device manufacturing has emerged as a particularly promising growth area, with patent landscapes revealing increased activity in biocompatible anodized aluminum surfaces. These innovations focus on creating antimicrobial properties through specialized anodizing techniques, addressing critical infection control concerns in healthcare settings. Patents in this domain often combine anodizing with secondary treatments to enhance biocompatibility and sterilization resistance.

The renewable energy sector demonstrates accelerating patent activity, particularly for anodized aluminum components in solar panel frames and mounting systems. These patents emphasize enhanced weather resistance and electrical insulation properties achieved through modified anodizing processes. Several emerging patents also address the integration of photovoltaic elements directly into anodized aluminum building materials, pointing toward future building-integrated solar solutions.

Consumer goods markets continue to drive innovation in decorative anodizing, with recent patents focusing on achieving previously impossible color combinations and visual effects. Notably, several technology companies have secured intellectual property for anodizing processes that create unique tactile surfaces on electronic devices, combining aesthetic appeal with improved grip and user experience. The fashion and luxury goods sectors have also begun exploring anodized aluminum as an alternative material, with patents covering specialized finishing techniques that mimic premium materials while offering superior durability.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!