Standards and specifications for anodized aluminum in architecture and defense

OCT 11, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Anodized Aluminum Standards Evolution and Objectives

Anodized aluminum has evolved significantly since its commercial introduction in the early 20th century. The process, which creates a protective oxide layer on aluminum surfaces through electrolytic treatment, was first patented in 1923 by British metallurgist Bengough and Stuart. This innovation marked the beginning of standardized approaches to aluminum surface treatment, providing enhanced corrosion resistance, wear resistance, and aesthetic qualities that would prove invaluable across industries.

The evolution of anodizing standards has been driven by the dual demands of architectural applications requiring durability and visual appeal, alongside defense applications necessitating precise performance specifications. Early standards primarily focused on basic thickness requirements and salt spray resistance, with minimal color consistency parameters. By the 1950s and 1960s, as aluminum gained prominence in modern architecture, organizations like the Aluminum Association and ASTM International began developing more comprehensive specifications.

A significant milestone occurred in 1968 with the establishment of the Architectural Aluminum Manufacturers Association (now AAMA) standards, which introduced the class designations still used today: Class I (thick coating for severe environments) and Class II (moderate coating for less demanding applications). These classifications helped architects and specifiers select appropriate finishes based on environmental exposure and performance requirements.

The defense sector simultaneously drove development of military specifications (MIL-SPECs) for anodized aluminum, with MIL-A-8625 emerging as the cornerstone standard. This specification has undergone multiple revisions to address evolving requirements for aircraft, weapons systems, and military equipment, introducing Type I (chromic acid), Type II (sulfuric acid), and Type III (hard anodizing) classifications.

International standardization efforts accelerated in the 1980s and 1990s, with ISO developing the 7599 standard for general specifications and 10074 for hard anodizing. These standards facilitated global trade and manufacturing consistency across borders, particularly important as supply chains became increasingly international.

The technical objectives driving anodizing standards have expanded beyond basic protection to include precise color control, environmental sustainability, and specialized performance characteristics. Modern standards now incorporate testing protocols for UV resistance, abrasion resistance, and chemical stability, reflecting the sophisticated requirements of contemporary applications.

Current standardization efforts are focused on reducing environmental impact by eliminating hexavalent chromium and other hazardous substances, improving energy efficiency in the anodizing process, and developing metrics for sustainability certification. Additionally, there is growing emphasis on standards for innovative anodizing techniques such as pulse anodizing, two-step anodizing, and nano-structured oxide layers that offer enhanced performance characteristics.

The evolution of anodizing standards has been driven by the dual demands of architectural applications requiring durability and visual appeal, alongside defense applications necessitating precise performance specifications. Early standards primarily focused on basic thickness requirements and salt spray resistance, with minimal color consistency parameters. By the 1950s and 1960s, as aluminum gained prominence in modern architecture, organizations like the Aluminum Association and ASTM International began developing more comprehensive specifications.

A significant milestone occurred in 1968 with the establishment of the Architectural Aluminum Manufacturers Association (now AAMA) standards, which introduced the class designations still used today: Class I (thick coating for severe environments) and Class II (moderate coating for less demanding applications). These classifications helped architects and specifiers select appropriate finishes based on environmental exposure and performance requirements.

The defense sector simultaneously drove development of military specifications (MIL-SPECs) for anodized aluminum, with MIL-A-8625 emerging as the cornerstone standard. This specification has undergone multiple revisions to address evolving requirements for aircraft, weapons systems, and military equipment, introducing Type I (chromic acid), Type II (sulfuric acid), and Type III (hard anodizing) classifications.

International standardization efforts accelerated in the 1980s and 1990s, with ISO developing the 7599 standard for general specifications and 10074 for hard anodizing. These standards facilitated global trade and manufacturing consistency across borders, particularly important as supply chains became increasingly international.

The technical objectives driving anodizing standards have expanded beyond basic protection to include precise color control, environmental sustainability, and specialized performance characteristics. Modern standards now incorporate testing protocols for UV resistance, abrasion resistance, and chemical stability, reflecting the sophisticated requirements of contemporary applications.

Current standardization efforts are focused on reducing environmental impact by eliminating hexavalent chromium and other hazardous substances, improving energy efficiency in the anodizing process, and developing metrics for sustainability certification. Additionally, there is growing emphasis on standards for innovative anodizing techniques such as pulse anodizing, two-step anodizing, and nano-structured oxide layers that offer enhanced performance characteristics.

Market Demand Analysis for Architectural and Defense Applications

The global market for anodized aluminum in architectural and defense applications has witnessed substantial growth over the past decade, driven by increasing demand for durable, lightweight, and aesthetically pleasing materials. In the architectural sector, the market value reached approximately $3.2 billion in 2022, with projections indicating a compound annual growth rate (CAGR) of 6.8% through 2028. This growth is primarily fueled by the expanding construction industry, particularly in developing regions across Asia-Pacific and the Middle East.

The architectural segment represents the largest application area, accounting for nearly 65% of the total anodized aluminum market. Within this segment, curtain walls and facades dominate with a 40% share, followed by windows and door frames (25%), and interior applications (20%). The remaining 15% encompasses specialized architectural elements such as decorative panels, railings, and custom fixtures. The demand is particularly strong in commercial buildings, where anodized aluminum's corrosion resistance and low maintenance requirements provide significant long-term cost benefits.

In the defense sector, the market for anodized aluminum reached approximately $1.8 billion in 2022, with expectations of 5.2% CAGR through 2028. This growth is driven by increasing military modernization programs globally and the shift toward lightweight materials in defense equipment manufacturing. The aerospace defense subsector accounts for the largest share at 45%, followed by land systems (30%), naval applications (15%), and other specialized defense equipment (10%).

Regional analysis reveals North America and Europe as the leading markets for high-specification anodized aluminum in defense applications, collectively accounting for over 60% of global demand. However, the Asia-Pacific region is experiencing the fastest growth rate at 8.3% annually, driven by increased defense spending in countries like China, India, and South Korea, alongside rapid urbanization fueling architectural applications.

Market trends indicate a growing preference for sustainable building materials, benefiting anodized aluminum due to its recyclability and long service life. In the defense sector, there is increasing demand for specialized anodization processes that enhance electromagnetic interference (EMI) shielding properties and ballistic resistance. Additionally, the integration of smart coatings and self-healing anodization technologies is emerging as a significant trend across both sectors.

Customer requirements are evolving toward more stringent performance specifications, particularly regarding corrosion resistance in coastal and industrial environments, color consistency for large architectural projects, and enhanced wear resistance for defense applications. This has led to the development of new anodizing standards that address these specific market needs while ensuring compliance with increasingly strict environmental regulations.

The architectural segment represents the largest application area, accounting for nearly 65% of the total anodized aluminum market. Within this segment, curtain walls and facades dominate with a 40% share, followed by windows and door frames (25%), and interior applications (20%). The remaining 15% encompasses specialized architectural elements such as decorative panels, railings, and custom fixtures. The demand is particularly strong in commercial buildings, where anodized aluminum's corrosion resistance and low maintenance requirements provide significant long-term cost benefits.

In the defense sector, the market for anodized aluminum reached approximately $1.8 billion in 2022, with expectations of 5.2% CAGR through 2028. This growth is driven by increasing military modernization programs globally and the shift toward lightweight materials in defense equipment manufacturing. The aerospace defense subsector accounts for the largest share at 45%, followed by land systems (30%), naval applications (15%), and other specialized defense equipment (10%).

Regional analysis reveals North America and Europe as the leading markets for high-specification anodized aluminum in defense applications, collectively accounting for over 60% of global demand. However, the Asia-Pacific region is experiencing the fastest growth rate at 8.3% annually, driven by increased defense spending in countries like China, India, and South Korea, alongside rapid urbanization fueling architectural applications.

Market trends indicate a growing preference for sustainable building materials, benefiting anodized aluminum due to its recyclability and long service life. In the defense sector, there is increasing demand for specialized anodization processes that enhance electromagnetic interference (EMI) shielding properties and ballistic resistance. Additionally, the integration of smart coatings and self-healing anodization technologies is emerging as a significant trend across both sectors.

Customer requirements are evolving toward more stringent performance specifications, particularly regarding corrosion resistance in coastal and industrial environments, color consistency for large architectural projects, and enhanced wear resistance for defense applications. This has led to the development of new anodizing standards that address these specific market needs while ensuring compliance with increasingly strict environmental regulations.

Current Standards Landscape and Technical Challenges

The anodized aluminum standards landscape is characterized by a complex network of international, regional, and national specifications that govern the quality, performance, and testing methods for architectural and defense applications. Key international standards include ISO 7599, which establishes general specifications for decorative and protective anodic oxidation coatings on aluminum, and ISO 10074, which focuses on specifications for hard anodic oxidation coatings. These standards provide fundamental guidelines for thickness, corrosion resistance, and appearance characteristics.

In the United States, the Aluminum Association and ASTM International have developed comprehensive standards such as ASTM B580 for standard specification of anodic oxide coatings on aluminum, and AAMA 611 specifically for architectural applications. The European market relies heavily on the Qualanod specifications, which are widely recognized for architectural anodizing quality assurance, while British Standards (BS EN) provide detailed requirements for testing and performance.

Military and defense applications follow more stringent specifications, primarily MIL-A-8625, which classifies anodic coatings into different types and classes based on their protective and functional properties. This standard is particularly critical for components requiring enhanced corrosion resistance and wear properties in harsh environments.

Despite the extensive standardization, significant technical challenges persist in the anodizing industry. Achieving consistent color uniformity across large architectural surfaces remains problematic, especially with darker shades and when components are processed in different batches. This issue is particularly evident in large-scale architectural projects where visual consistency is paramount.

Corrosion resistance in extreme environments presents another major challenge, especially for coastal installations and defense applications exposed to salt spray and chemical agents. Current standards often fail to adequately address the long-term performance under these conditions, creating a gap between laboratory testing and real-world performance.

Energy efficiency in the anodizing process represents a growing concern, as traditional anodizing is energy-intensive and generates significant waste. While standards specify the quality of the end product, they provide limited guidance on sustainable production methods, creating a disconnect between environmental goals and technical requirements.

Emerging technologies such as pre-anodized aluminum and new sealing methods are outpacing standardization efforts, resulting in innovative products that may not fit neatly within existing specification frameworks. This creates challenges for architects and defense contractors seeking to incorporate these advanced materials while ensuring compliance with established standards.

The integration of anodized aluminum with other materials in composite structures introduces additional complexities regarding galvanic corrosion and interface integrity that are not comprehensively addressed in current standards, particularly for advanced defense applications where material performance is critical.

In the United States, the Aluminum Association and ASTM International have developed comprehensive standards such as ASTM B580 for standard specification of anodic oxide coatings on aluminum, and AAMA 611 specifically for architectural applications. The European market relies heavily on the Qualanod specifications, which are widely recognized for architectural anodizing quality assurance, while British Standards (BS EN) provide detailed requirements for testing and performance.

Military and defense applications follow more stringent specifications, primarily MIL-A-8625, which classifies anodic coatings into different types and classes based on their protective and functional properties. This standard is particularly critical for components requiring enhanced corrosion resistance and wear properties in harsh environments.

Despite the extensive standardization, significant technical challenges persist in the anodizing industry. Achieving consistent color uniformity across large architectural surfaces remains problematic, especially with darker shades and when components are processed in different batches. This issue is particularly evident in large-scale architectural projects where visual consistency is paramount.

Corrosion resistance in extreme environments presents another major challenge, especially for coastal installations and defense applications exposed to salt spray and chemical agents. Current standards often fail to adequately address the long-term performance under these conditions, creating a gap between laboratory testing and real-world performance.

Energy efficiency in the anodizing process represents a growing concern, as traditional anodizing is energy-intensive and generates significant waste. While standards specify the quality of the end product, they provide limited guidance on sustainable production methods, creating a disconnect between environmental goals and technical requirements.

Emerging technologies such as pre-anodized aluminum and new sealing methods are outpacing standardization efforts, resulting in innovative products that may not fit neatly within existing specification frameworks. This creates challenges for architects and defense contractors seeking to incorporate these advanced materials while ensuring compliance with established standards.

The integration of anodized aluminum with other materials in composite structures introduces additional complexities regarding galvanic corrosion and interface integrity that are not comprehensively addressed in current standards, particularly for advanced defense applications where material performance is critical.

Current Anodizing Technical Requirements and Protocols

01 Anodizing processes for aluminum

Various processes for anodizing aluminum surfaces to create protective oxide layers. These processes typically involve electrolytic treatment in acidic solutions to form controlled, uniform oxide films on aluminum substrates. Different electrolytes and process parameters can be used to achieve specific properties in the anodized layer, such as thickness, hardness, and corrosion resistance.- Anodizing processes and methods: Various processes and methods for anodizing aluminum are disclosed, including electrolytic anodization techniques that create protective oxide layers on aluminum surfaces. These methods involve specific electrolyte compositions, current densities, and temperature controls to achieve desired oxide film properties. The anodizing processes can be tailored to produce specific characteristics such as corrosion resistance, wear resistance, and aesthetic appearance.

- Surface treatments and pre/post-anodizing processes: Surface treatments applied before or after anodizing can significantly enhance the properties of anodized aluminum. Pre-treatments include cleaning, etching, and brightening processes that prepare the aluminum surface for anodization. Post-treatments involve sealing the porous oxide layer to improve corrosion resistance and durability. These treatments can modify surface characteristics such as color, texture, and reflectivity of the anodized aluminum.

- Colored and decorative anodized aluminum: Techniques for coloring and creating decorative effects on anodized aluminum surfaces include organic dye absorption, electrolytic coloring, and interference coloring methods. These processes allow for a wide range of colors and visual effects to be achieved on anodized aluminum surfaces. The coloring can be integrated into the anodizing process or applied as a separate step, resulting in durable and aesthetically pleasing finishes for architectural, consumer, and industrial applications.

- Enhanced properties of anodized aluminum: Methods to enhance specific properties of anodized aluminum such as corrosion resistance, wear resistance, thermal stability, and electrical insulation are described. These enhancements can be achieved through modifications to the anodizing process, incorporation of additives, or application of specialized coatings. The resulting anodized aluminum products exhibit superior performance characteristics for demanding applications in aerospace, automotive, electronics, and architectural industries.

- Applications and products using anodized aluminum: Various applications and products utilizing anodized aluminum are presented, including components for electronics, architectural elements, consumer goods, and industrial equipment. The unique properties of anodized aluminum, such as lightweight, corrosion resistance, and aesthetic appeal, make it suitable for diverse applications. Specific manufacturing techniques and design considerations for creating effective anodized aluminum products are discussed, along with examples of successful implementations across different industries.

02 Coloring and sealing of anodized aluminum

Methods for coloring and sealing anodized aluminum surfaces to enhance their appearance and durability. Coloring can be achieved through various techniques including electrolytic deposition of metals, organic dyes, or inorganic pigments into the porous anodic layer. Sealing processes close the pores of the anodic film to improve corrosion resistance and color fastness, typically using hot water, nickel acetate, or other sealing agents.Expand Specific Solutions03 Enhanced properties of anodized aluminum coatings

Techniques for improving the functional properties of anodized aluminum surfaces, such as wear resistance, corrosion protection, and thermal stability. These enhancements can be achieved through incorporation of nanoparticles, polymers, or other materials into the anodic layer, or through post-treatment processes. Modified anodizing electrolytes and multi-step processes can create specialized coatings with superior performance characteristics.Expand Specific Solutions04 Applications of anodized aluminum in electronics and semiconductors

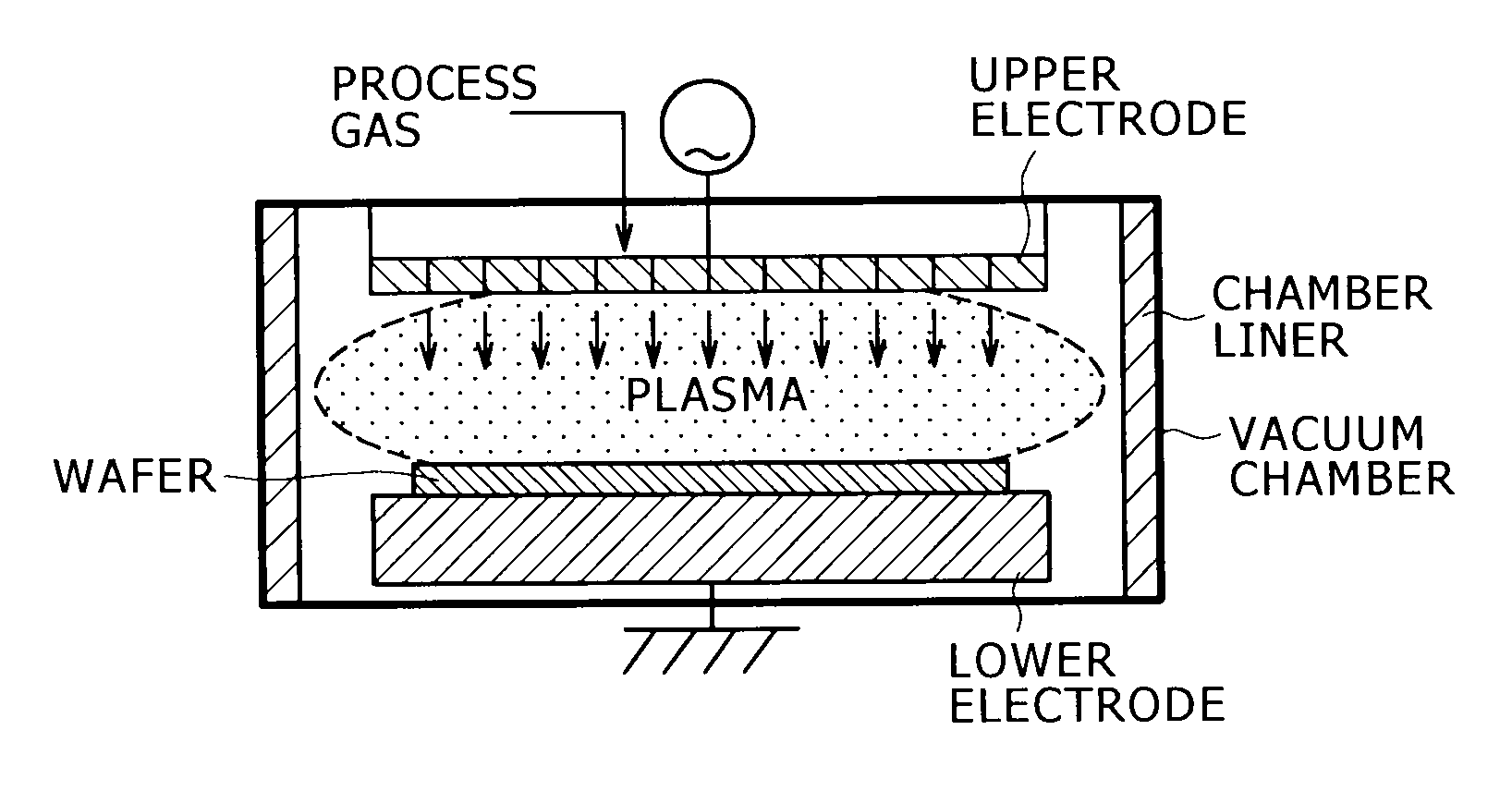

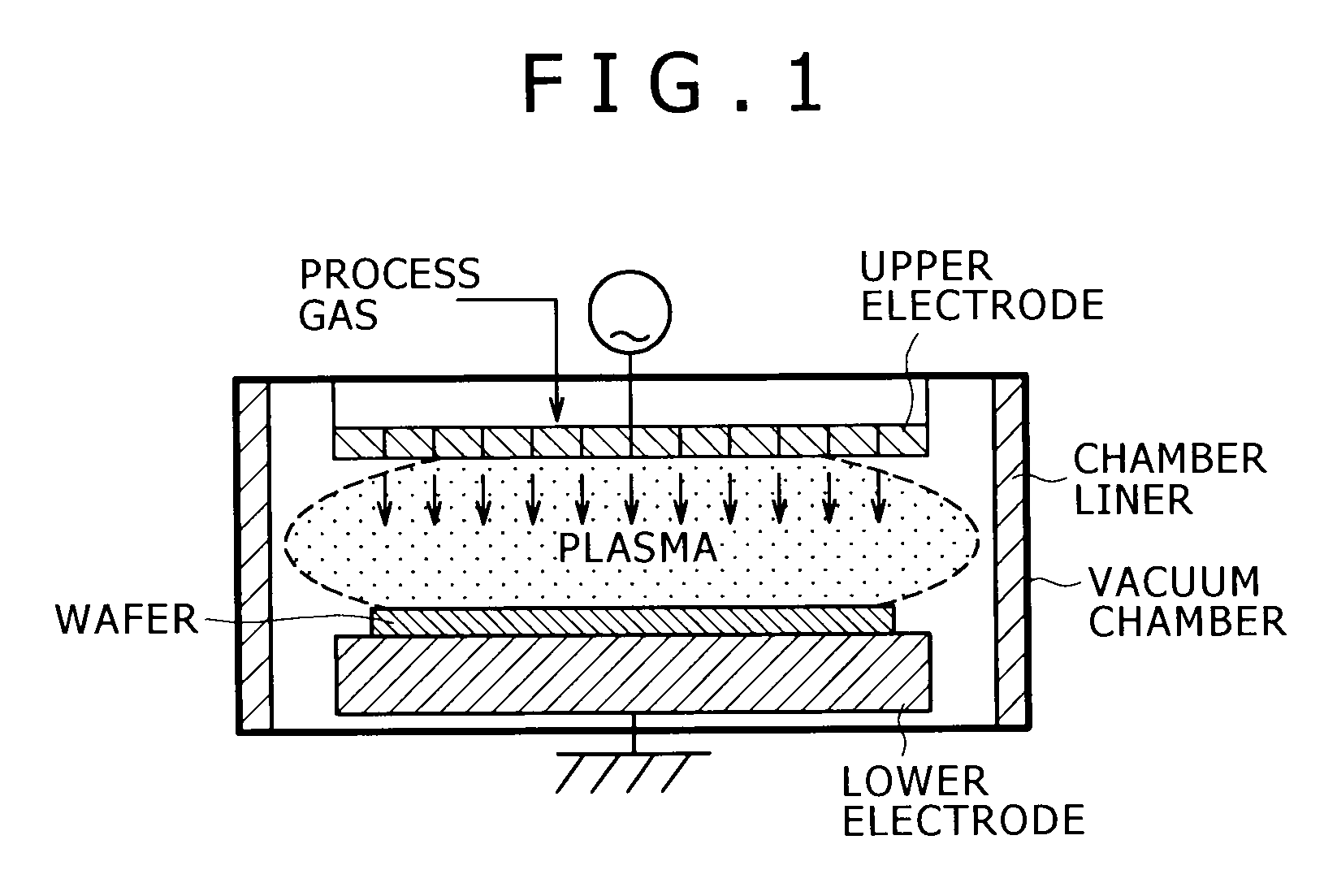

Use of anodized aluminum in electronic components and semiconductor manufacturing. The electrical insulation properties and thermal conductivity of anodized aluminum make it suitable for various electronic applications. Specialized anodizing processes can create dielectric layers with controlled thickness and electrical properties for use in capacitors, circuit boards, and semiconductor packaging. The precision and uniformity of these anodic films are critical for microelectronic applications.Expand Specific Solutions05 Architectural and consumer applications of anodized aluminum

Implementation of anodized aluminum in architectural elements and consumer products. The aesthetic appeal, durability, and weather resistance of anodized aluminum make it ideal for building facades, windows, doors, and decorative elements. In consumer products, anodized aluminum provides a lightweight, corrosion-resistant finish with various color options. Special finishing techniques can create matte, glossy, or textured surfaces to meet specific design requirements.Expand Specific Solutions

Key Industry Players and Certification Bodies

The anodized aluminum standards market is in a mature growth phase, characterized by established specifications across architectural and defense sectors. The global market size is estimated at $3-4 billion, with steady annual growth of 5-7%. Technologically, the field has reached high maturity with ongoing refinements rather than disruptive innovations. Key players demonstrate specialized focus: Boeing and Safran dominate defense applications; UACJ, Novelis, and Kobe Steel lead architectural aluminum production; while Applied Materials and Materion advance surface treatment technologies. Research institutions like Beihang University and Naval Research Laboratory continue developing enhanced anodizing processes for extreme environments, focusing on durability and corrosion resistance improvements.

The Boeing Co.

Technical Solution: Boeing has developed proprietary anodizing specifications that exceed standard MIL-A-8625 requirements for aerospace applications. Their technical approach includes a multi-stage anodizing process with specialized sealing methods that enhance corrosion resistance while maintaining dimensional stability. Boeing's Type III hard anodizing specifications incorporate precise thickness control (typically 50-100 micrometers) and enhanced wear resistance through modified sulfuric acid electrolytes with additives that promote uniform oxide layer formation. The company has pioneered the integration of chromate-free sealing technologies that comply with REACH regulations while maintaining performance standards required for defense applications. Boeing's specifications also address the challenges of anodizing complex geometries and dissimilar metal interfaces through controlled current density distribution and masking techniques that prevent preferential etching.

Strengths: Superior corrosion resistance in extreme environments; excellent wear resistance for high-stress components; comprehensive quality control protocols. Weaknesses: Higher production costs compared to commercial standards; longer processing times; requires specialized equipment and expertise for implementation.

BAC Corrosion Control Ltd

Technical Solution: BAC Corrosion Control has developed comprehensive anodizing specifications tailored specifically for architectural and defense applications in harsh environments. Their technical solution incorporates a multi-stage process with proprietary pre-treatment methods that enhance adhesion and corrosion resistance. BAC's specifications detail precise control parameters for electrolyte composition, temperature gradients, and current density profiles optimized for different aluminum alloys and component geometries. Their approach includes specialized sealing techniques using nickel acetate and dichromate solutions that exceed BS EN ISO 7599 requirements. BAC has pioneered the development of duplex sealing systems that combine conventional hydrothermal sealing with polymer impregnation to enhance long-term performance. Their specifications address the challenges of anodizing large architectural components through specialized racking techniques and controlled agitation systems that ensure uniform oxide layer formation. BAC's process also incorporates advanced quality control methods including eddy current testing and accelerated weathering protocols that exceed AAMA 611 requirements.

Strengths: Exceptional long-term durability in coastal and industrial environments; comprehensive quality assurance protocols; excellent color retention under UV exposure. Weaknesses: Higher processing costs; longer production times; requires specialized equipment and expertise for implementation.

Critical Standards Analysis and Performance Benchmarks

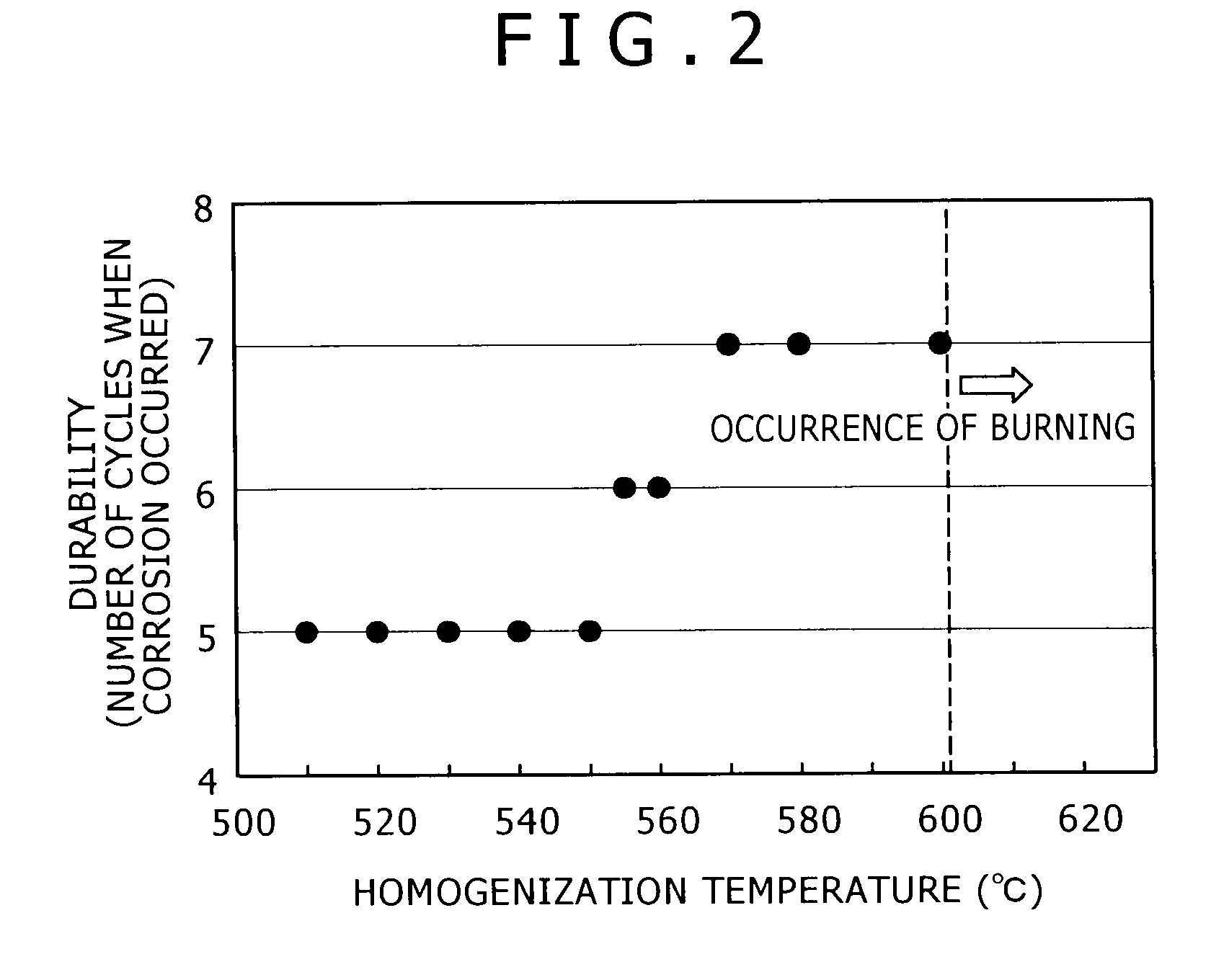

Aluminum alloy for anodizing having durability, contamination resistance and productivity, method for producing the same, aluminum alloy member having anodic oxide coating, and plasma processing apparatus

PatentInactiveUS20100018617A1

Innovation

- An aluminum alloy composition with 0.1 to 2.0 mass % Mg, 0.1 to 2.0 mass % Si, and 0.1 to 2.0 mass % Mn, with limited Fe, Cr, and Cu content, subjected to a homogenization treatment at 500° C. to 600° C., forming an anodic oxidation coating that enhances durability, contamination resistance, and productivity.

Anodized-quality aluminum alloys and related products and methods

PatentWO2018005442A1

Innovation

- Aluminum alloys with specific compositions, such as 0.10-0.30 wt.% Fe, 0.10-0.30 wt.% Si, 2.0-3.0 wt.% Mg, and controlled impurities, are used to minimize cathodic intermetallic particles, allowing for the production of high-quality sheets with recycled content, involving processes like homogenization, hot rolling, cold rolling, interannealing, and annealing to achieve excellent surface quality.

Regulatory Compliance and International Harmonization

The regulatory landscape for anodized aluminum spans multiple jurisdictions with varying degrees of stringency and focus. In the United States, the Architectural Aluminum Manufacturers Association (AAMA) has established comprehensive standards such as AAMA 611 for architectural anodized aluminum, which specifies testing procedures, quality requirements, and film thickness classifications. These standards are widely adopted across North America and serve as benchmarks for quality assurance in architectural applications.

European regulations are governed by the European Committee for Standardization (CEN), which has developed EN 12373 series standards specifically addressing anodized aluminum for architectural purposes. These standards are harmonized across EU member states, ensuring consistency in quality and performance requirements throughout the European market. The QUALANOD certification, established by the European Anodizers Association, provides an additional layer of quality assurance that is recognized internationally.

In the defense sector, military specifications such as MIL-A-8625 define stringent requirements for anodized aluminum components used in defense applications. These specifications are particularly focused on corrosion resistance, wear properties, and electrical insulation characteristics critical for military hardware operating in extreme environments.

International harmonization efforts have been led by the International Organization for Standardization (ISO), which has developed ISO 7599 and related standards to establish globally recognized specifications for anodized aluminum. These standards facilitate international trade by providing common reference points for quality assessment and performance expectations across different markets.

The challenge of regulatory compliance is compounded by regional variations in environmental regulations. For instance, the European Union's REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) regulations impose strict controls on chemicals used in anodizing processes, particularly chromium compounds. Similar environmental considerations are addressed in North America through EPA regulations, though with different implementation approaches.

Recent trends indicate movement toward greater international harmonization, with industry stakeholders working to align standards across major markets. The International Anodizing Association has been instrumental in facilitating dialogue between regulatory bodies in different regions, aiming to reduce trade barriers while maintaining high quality and safety standards.

Compliance verification methodologies are also evolving, with increased emphasis on third-party certification and digital traceability systems that document regulatory adherence throughout the supply chain. These developments are particularly relevant for defense applications, where material provenance and performance verification are critical security considerations.

European regulations are governed by the European Committee for Standardization (CEN), which has developed EN 12373 series standards specifically addressing anodized aluminum for architectural purposes. These standards are harmonized across EU member states, ensuring consistency in quality and performance requirements throughout the European market. The QUALANOD certification, established by the European Anodizers Association, provides an additional layer of quality assurance that is recognized internationally.

In the defense sector, military specifications such as MIL-A-8625 define stringent requirements for anodized aluminum components used in defense applications. These specifications are particularly focused on corrosion resistance, wear properties, and electrical insulation characteristics critical for military hardware operating in extreme environments.

International harmonization efforts have been led by the International Organization for Standardization (ISO), which has developed ISO 7599 and related standards to establish globally recognized specifications for anodized aluminum. These standards facilitate international trade by providing common reference points for quality assessment and performance expectations across different markets.

The challenge of regulatory compliance is compounded by regional variations in environmental regulations. For instance, the European Union's REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) regulations impose strict controls on chemicals used in anodizing processes, particularly chromium compounds. Similar environmental considerations are addressed in North America through EPA regulations, though with different implementation approaches.

Recent trends indicate movement toward greater international harmonization, with industry stakeholders working to align standards across major markets. The International Anodizing Association has been instrumental in facilitating dialogue between regulatory bodies in different regions, aiming to reduce trade barriers while maintaining high quality and safety standards.

Compliance verification methodologies are also evolving, with increased emphasis on third-party certification and digital traceability systems that document regulatory adherence throughout the supply chain. These developments are particularly relevant for defense applications, where material provenance and performance verification are critical security considerations.

Sustainability and Environmental Impact Assessment

The anodizing process of aluminum, while offering significant durability and aesthetic benefits, presents important sustainability considerations that must be addressed in both architectural and defense applications. The environmental impact of anodized aluminum begins with raw material extraction, where bauxite mining causes habitat disruption and biodiversity loss. However, aluminum's infinite recyclability partially offsets these initial environmental costs, as recycled aluminum requires only 5% of the energy needed for primary production.

During the anodizing process itself, several environmental challenges emerge. Traditional sulfuric acid anodizing consumes substantial electrical energy and generates wastewater containing heavy metals, acids, and other contaminants. Recent advancements have introduced more environmentally responsible alternatives, including titanium-based anodizing processes that reduce toxic byproducts and energy consumption by up to 30% compared to conventional methods.

Life cycle assessment (LCA) studies demonstrate that anodized aluminum components typically outperform alternatives like steel or PVC in long-term environmental impact metrics. The extended service life of properly anodized aluminum—often exceeding 30 years in architectural applications—significantly reduces replacement frequency and associated resource consumption. Defense applications benefit similarly from reduced maintenance requirements and extended operational lifespans.

Regulatory frameworks governing anodized aluminum's environmental impact continue to evolve globally. The European Union's RoHS and REACH regulations have driven innovation in hexavalent chromium-free sealing methods, while the U.S. Department of Defense has implemented Environmental Management Systems requiring contractors to minimize environmental impacts throughout the supply chain. These regulations have catalyzed the development of zero-discharge anodizing systems that recycle process water and recover valuable metals from waste streams.

Carbon footprint considerations have become increasingly central to anodized aluminum specifications. Recent industry initiatives have established certification programs for low-carbon aluminum production, with some manufacturers achieving carbon reductions of 75% through renewable energy integration and process optimization. Building certification systems like LEED and BREEAM now award points for using anodized aluminum with verified environmental performance documentation.

Future sustainability improvements in anodized aluminum will likely focus on closed-loop manufacturing systems, bio-based sealing alternatives, and energy-efficient anodizing technologies. Research into ambient-temperature anodizing processes shows promise for reducing energy requirements by up to 60%, while maintaining performance specifications required for demanding architectural and defense applications.

During the anodizing process itself, several environmental challenges emerge. Traditional sulfuric acid anodizing consumes substantial electrical energy and generates wastewater containing heavy metals, acids, and other contaminants. Recent advancements have introduced more environmentally responsible alternatives, including titanium-based anodizing processes that reduce toxic byproducts and energy consumption by up to 30% compared to conventional methods.

Life cycle assessment (LCA) studies demonstrate that anodized aluminum components typically outperform alternatives like steel or PVC in long-term environmental impact metrics. The extended service life of properly anodized aluminum—often exceeding 30 years in architectural applications—significantly reduces replacement frequency and associated resource consumption. Defense applications benefit similarly from reduced maintenance requirements and extended operational lifespans.

Regulatory frameworks governing anodized aluminum's environmental impact continue to evolve globally. The European Union's RoHS and REACH regulations have driven innovation in hexavalent chromium-free sealing methods, while the U.S. Department of Defense has implemented Environmental Management Systems requiring contractors to minimize environmental impacts throughout the supply chain. These regulations have catalyzed the development of zero-discharge anodizing systems that recycle process water and recover valuable metals from waste streams.

Carbon footprint considerations have become increasingly central to anodized aluminum specifications. Recent industry initiatives have established certification programs for low-carbon aluminum production, with some manufacturers achieving carbon reductions of 75% through renewable energy integration and process optimization. Building certification systems like LEED and BREEAM now award points for using anodized aluminum with verified environmental performance documentation.

Future sustainability improvements in anodized aluminum will likely focus on closed-loop manufacturing systems, bio-based sealing alternatives, and energy-efficient anodizing technologies. Research into ambient-temperature anodizing processes shows promise for reducing energy requirements by up to 60%, while maintaining performance specifications required for demanding architectural and defense applications.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!