Cellophane as a Substitute for Synthetic Plastics in Packaging

JUL 9, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Cellophane Background and Objectives

Cellophane, a transparent sheet made from regenerated cellulose, has a rich history dating back to its invention in 1908 by Jacques E. Brandenberger. Initially developed as a waterproof tablecloth, cellophane quickly found its way into various applications, particularly in packaging. The evolution of cellophane technology has been driven by the need for sustainable and biodegradable alternatives to synthetic plastics, which have become a significant environmental concern.

The primary objective of researching cellophane as a substitute for synthetic plastics in packaging is to address the growing global plastic pollution crisis. With increasing awareness of the environmental impact of non-biodegradable plastics, there is a pressing need to develop eco-friendly packaging solutions. Cellophane, being derived from renewable resources and biodegradable, presents a promising alternative that aligns with circular economy principles and sustainability goals.

The technical evolution of cellophane has seen significant advancements since its inception. Early cellophane was moisture-sensitive and had limited barrier properties. However, ongoing research has led to improvements in its performance characteristics, including enhanced moisture resistance, better heat-sealability, and improved barrier properties against gases and aromas. These developments have expanded cellophane's potential applications in food packaging and other industries.

Current research objectives focus on further enhancing cellophane's properties to match or exceed those of synthetic plastics. Key areas of investigation include improving its mechanical strength, extending shelf life, and developing cost-effective production methods. Additionally, researchers are exploring ways to modify cellophane's surface properties to enhance its printability and compatibility with various products.

Another critical aspect of cellophane research is the development of sustainable production processes. This involves optimizing the use of renewable resources, reducing energy consumption, and minimizing waste generation during manufacturing. The goal is to create a truly circular lifecycle for cellophane, from production to disposal or recycling.

Interdisciplinary collaboration is crucial in advancing cellophane technology. Materials scientists, chemical engineers, and packaging experts are working together to overcome technical challenges and innovate new applications. This collaborative approach aims to accelerate the development of cellophane-based solutions that can effectively replace synthetic plastics across various packaging applications.

As the demand for sustainable packaging grows, the cellophane industry is poised for significant expansion. The research and development efforts in this field are expected to drive technological breakthroughs, potentially revolutionizing the packaging industry and contributing to global efforts in reducing plastic waste and environmental pollution.

The primary objective of researching cellophane as a substitute for synthetic plastics in packaging is to address the growing global plastic pollution crisis. With increasing awareness of the environmental impact of non-biodegradable plastics, there is a pressing need to develop eco-friendly packaging solutions. Cellophane, being derived from renewable resources and biodegradable, presents a promising alternative that aligns with circular economy principles and sustainability goals.

The technical evolution of cellophane has seen significant advancements since its inception. Early cellophane was moisture-sensitive and had limited barrier properties. However, ongoing research has led to improvements in its performance characteristics, including enhanced moisture resistance, better heat-sealability, and improved barrier properties against gases and aromas. These developments have expanded cellophane's potential applications in food packaging and other industries.

Current research objectives focus on further enhancing cellophane's properties to match or exceed those of synthetic plastics. Key areas of investigation include improving its mechanical strength, extending shelf life, and developing cost-effective production methods. Additionally, researchers are exploring ways to modify cellophane's surface properties to enhance its printability and compatibility with various products.

Another critical aspect of cellophane research is the development of sustainable production processes. This involves optimizing the use of renewable resources, reducing energy consumption, and minimizing waste generation during manufacturing. The goal is to create a truly circular lifecycle for cellophane, from production to disposal or recycling.

Interdisciplinary collaboration is crucial in advancing cellophane technology. Materials scientists, chemical engineers, and packaging experts are working together to overcome technical challenges and innovate new applications. This collaborative approach aims to accelerate the development of cellophane-based solutions that can effectively replace synthetic plastics across various packaging applications.

As the demand for sustainable packaging grows, the cellophane industry is poised for significant expansion. The research and development efforts in this field are expected to drive technological breakthroughs, potentially revolutionizing the packaging industry and contributing to global efforts in reducing plastic waste and environmental pollution.

Market Demand Analysis

The global packaging industry has witnessed a significant shift towards sustainable and eco-friendly materials in recent years, driven by increasing environmental concerns and regulatory pressures. This trend has created a growing market demand for alternatives to synthetic plastics, with cellophane emerging as a promising substitute. The market for biodegradable packaging materials is expected to experience substantial growth, with projections indicating a compound annual growth rate (CAGR) of over 17% from 2021 to 2026.

Consumer awareness and preferences play a crucial role in shaping market demand for cellophane packaging. A recent survey revealed that more than 60% of consumers are willing to pay a premium for products packaged in environmentally friendly materials. This shift in consumer behavior has prompted major retailers and brands to commit to reducing their plastic footprint, further driving the demand for sustainable packaging solutions like cellophane.

The food and beverage industry represents the largest market segment for cellophane packaging, accounting for approximately 40% of the total demand. Cellophane's excellent barrier properties against moisture, gases, and bacteria make it particularly suitable for food packaging applications. The pharmaceutical and personal care industries are also showing increased interest in cellophane packaging, driven by the material's biodegradability and compatibility with various products.

Geographically, Europe leads the market for cellophane packaging, followed closely by North America and Asia-Pacific. The European Union's stringent regulations on single-use plastics have created a favorable environment for cellophane adoption. In Asia-Pacific, rapid urbanization and changing consumer lifestyles are driving the demand for convenient and sustainable packaging solutions.

Despite the growing demand, challenges remain in the widespread adoption of cellophane as a substitute for synthetic plastics. Cost considerations and production scalability are key factors influencing market penetration. Currently, cellophane production costs are higher than those of conventional plastics, which may limit its adoption in price-sensitive markets. However, ongoing research and development efforts are focused on improving production efficiency and reducing costs, which is expected to enhance cellophane's competitiveness in the long term.

The COVID-19 pandemic has had a mixed impact on the market demand for cellophane packaging. While the initial stages of the pandemic saw a surge in demand for single-use plastic packaging due to hygiene concerns, the long-term outlook remains positive for sustainable packaging solutions. The pandemic has heightened awareness of environmental issues and reinforced the importance of sustainable practices, potentially accelerating the shift towards eco-friendly packaging materials like cellophane.

Consumer awareness and preferences play a crucial role in shaping market demand for cellophane packaging. A recent survey revealed that more than 60% of consumers are willing to pay a premium for products packaged in environmentally friendly materials. This shift in consumer behavior has prompted major retailers and brands to commit to reducing their plastic footprint, further driving the demand for sustainable packaging solutions like cellophane.

The food and beverage industry represents the largest market segment for cellophane packaging, accounting for approximately 40% of the total demand. Cellophane's excellent barrier properties against moisture, gases, and bacteria make it particularly suitable for food packaging applications. The pharmaceutical and personal care industries are also showing increased interest in cellophane packaging, driven by the material's biodegradability and compatibility with various products.

Geographically, Europe leads the market for cellophane packaging, followed closely by North America and Asia-Pacific. The European Union's stringent regulations on single-use plastics have created a favorable environment for cellophane adoption. In Asia-Pacific, rapid urbanization and changing consumer lifestyles are driving the demand for convenient and sustainable packaging solutions.

Despite the growing demand, challenges remain in the widespread adoption of cellophane as a substitute for synthetic plastics. Cost considerations and production scalability are key factors influencing market penetration. Currently, cellophane production costs are higher than those of conventional plastics, which may limit its adoption in price-sensitive markets. However, ongoing research and development efforts are focused on improving production efficiency and reducing costs, which is expected to enhance cellophane's competitiveness in the long term.

The COVID-19 pandemic has had a mixed impact on the market demand for cellophane packaging. While the initial stages of the pandemic saw a surge in demand for single-use plastic packaging due to hygiene concerns, the long-term outlook remains positive for sustainable packaging solutions. The pandemic has heightened awareness of environmental issues and reinforced the importance of sustainable practices, potentially accelerating the shift towards eco-friendly packaging materials like cellophane.

Current Status and Challenges

The current status of cellophane as a substitute for synthetic plastics in packaging presents both promising advancements and significant challenges. Globally, there is a growing interest in biodegradable and sustainable packaging materials, with cellophane emerging as a potential alternative to traditional petroleum-based plastics. Several companies and research institutions have made substantial progress in developing cellophane-based packaging solutions that offer comparable performance to synthetic plastics in terms of barrier properties and durability.

However, the widespread adoption of cellophane faces several hurdles. One of the primary challenges is the cost of production. Currently, cellophane remains more expensive to manufacture than many synthetic plastics, which limits its competitiveness in price-sensitive markets. This cost disparity is partly due to the lower economies of scale in cellophane production compared to well-established plastic manufacturing processes.

Another significant challenge is the technical limitations of cellophane. While it performs well in many applications, it still falls short in certain areas such as heat resistance and moisture barrier properties when compared to some advanced synthetic plastics. This restricts its use in specific packaging applications, particularly those requiring high-temperature processing or long shelf life for moisture-sensitive products.

The environmental impact of cellophane production is also a concern. Although cellophane is biodegradable, the manufacturing process can be energy-intensive and may involve the use of chemicals that raise environmental concerns. Efforts are underway to develop more eco-friendly production methods, but these are still in the early stages of development and implementation.

Regulatory frameworks and standards for biodegradable packaging materials vary across different regions, creating challenges for global adoption and standardization. This inconsistency can lead to confusion among consumers and complicate the marketing and distribution of cellophane-based packaging solutions.

Despite these challenges, there are notable advancements in cellophane technology. Researchers are exploring ways to enhance cellophane's properties through modifications and composites, aiming to improve its performance in areas where it currently lags behind synthetic plastics. Additionally, innovative production techniques are being developed to reduce costs and environmental impact, potentially making cellophane more competitive in the future.

The geographical distribution of cellophane technology development shows concentrations in regions with strong environmental policies and consumer demand for sustainable packaging. Countries in Europe, North America, and parts of Asia are leading in research and development efforts, with collaborations between academic institutions and industry players driving innovation in this field.

However, the widespread adoption of cellophane faces several hurdles. One of the primary challenges is the cost of production. Currently, cellophane remains more expensive to manufacture than many synthetic plastics, which limits its competitiveness in price-sensitive markets. This cost disparity is partly due to the lower economies of scale in cellophane production compared to well-established plastic manufacturing processes.

Another significant challenge is the technical limitations of cellophane. While it performs well in many applications, it still falls short in certain areas such as heat resistance and moisture barrier properties when compared to some advanced synthetic plastics. This restricts its use in specific packaging applications, particularly those requiring high-temperature processing or long shelf life for moisture-sensitive products.

The environmental impact of cellophane production is also a concern. Although cellophane is biodegradable, the manufacturing process can be energy-intensive and may involve the use of chemicals that raise environmental concerns. Efforts are underway to develop more eco-friendly production methods, but these are still in the early stages of development and implementation.

Regulatory frameworks and standards for biodegradable packaging materials vary across different regions, creating challenges for global adoption and standardization. This inconsistency can lead to confusion among consumers and complicate the marketing and distribution of cellophane-based packaging solutions.

Despite these challenges, there are notable advancements in cellophane technology. Researchers are exploring ways to enhance cellophane's properties through modifications and composites, aiming to improve its performance in areas where it currently lags behind synthetic plastics. Additionally, innovative production techniques are being developed to reduce costs and environmental impact, potentially making cellophane more competitive in the future.

The geographical distribution of cellophane technology development shows concentrations in regions with strong environmental policies and consumer demand for sustainable packaging. Countries in Europe, North America, and parts of Asia are leading in research and development efforts, with collaborations between academic institutions and industry players driving innovation in this field.

Existing Cellophane Solutions

01 Cellophane production and modification

Various methods and processes for producing and modifying cellophane are described. These include techniques for improving the properties of cellophane, such as its strength, flexibility, and barrier characteristics. The modifications may involve chemical treatments or the incorporation of additives to enhance the material's performance for specific applications.- Cellophane in packaging applications: Cellophane is widely used in packaging applications due to its transparency, flexibility, and barrier properties. It is commonly employed in food packaging, gift wrapping, and industrial packaging solutions. The material's ability to protect products from moisture and air makes it suitable for various packaging needs.

- Biodegradable cellophane alternatives: Research and development efforts are focused on creating biodegradable alternatives to traditional cellophane. These eco-friendly materials aim to maintain the desirable properties of cellophane while reducing environmental impact. Innovations in this area include the use of plant-based polymers and other sustainable materials.

- Cellophane in textile and fiber applications: Cellophane finds applications in the textile and fiber industry. It can be used to create unique fabric effects, as a component in composite materials, or as a protective layer for textiles. The material's properties allow for innovative applications in fashion and technical textiles.

- Modified cellophane for enhanced properties: Researchers are developing modified cellophane materials with enhanced properties such as improved strength, heat resistance, or barrier capabilities. These modifications can involve chemical treatments, coatings, or the incorporation of additives to tailor the material's characteristics for specific applications.

- Cellophane in medical and pharmaceutical applications: Cellophane has potential applications in the medical and pharmaceutical fields. Its properties make it suitable for use in certain medical devices, drug delivery systems, or as a component in diagnostic tools. Research is ongoing to explore new ways to utilize cellophane in healthcare-related products.

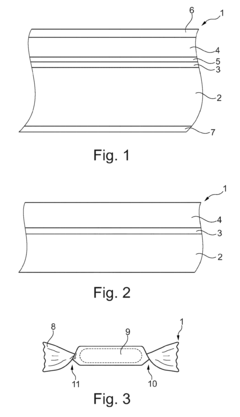

02 Packaging applications of cellophane

Cellophane is widely used in packaging applications due to its transparency, flexibility, and barrier properties. The patents describe various packaging solutions utilizing cellophane, including food packaging, consumer product packaging, and industrial packaging. Some innovations focus on improving the sealing properties and extending the shelf life of packaged products.Expand Specific Solutions03 Biodegradable and eco-friendly cellophane

Developments in biodegradable and environmentally friendly cellophane materials are presented. These innovations aim to address sustainability concerns by creating cellophane-like materials that can decompose naturally or be recycled more easily. Some approaches involve incorporating natural additives or modifying the cellulose structure to enhance biodegradability.Expand Specific Solutions04 Cellophane-based composite materials

The creation of composite materials incorporating cellophane is described in several patents. These composites may combine cellophane with other materials to achieve specific properties or functionalities. Applications include reinforced materials, multi-layer films, and advanced packaging solutions with enhanced barrier or mechanical properties.Expand Specific Solutions05 Cellophane in medical and pharmaceutical applications

The use of cellophane in medical and pharmaceutical applications is explored in some patents. These innovations may include drug delivery systems, wound dressings, or other medical devices that utilize the unique properties of cellophane. The material's biocompatibility and ability to be sterilized make it suitable for various healthcare-related applications.Expand Specific Solutions

Key Industry Players

The research on cellophane as a substitute for synthetic plastics in packaging is gaining momentum as the industry shifts towards sustainable alternatives. The market is in a growth phase, driven by increasing environmental concerns and regulatory pressures. While the global market size for biodegradable packaging is expanding rapidly, cellophane's share remains relatively small but growing. Technologically, cellophane is mature, but innovations in production and properties are ongoing. Companies like Stora Enso, Billerud, and Mitsubishi Polyester Film are at the forefront, developing advanced cellophane-based solutions. However, challenges remain in scaling production and matching the performance of traditional plastics, indicating that the technology is still evolving to meet diverse packaging needs.

Stora Enso Oyj

Technical Solution: Stora Enso has developed a novel cellophane-based packaging solution called "Paptic" as a sustainable alternative to synthetic plastics. This material combines the biodegradability of cellulose with the strength and flexibility of plastic films. Paptic is produced using a foam-forming technology that creates a porous structure, enhancing its durability and reducing material usage[1]. The company has also invested in research to improve the moisture barrier properties of cellophane through surface treatments and coatings, making it suitable for a wider range of packaging applications[2]. Additionally, Stora Enso is exploring the integration of nanocellulose into cellophane films to further enhance their mechanical and barrier properties[3].

Strengths: Biodegradable, renewable resource-based, good mechanical properties. Weaknesses: Higher production costs compared to conventional plastics, limited moisture barrier without additional treatments.

Tetra Laval Holdings & Finance SA

Technical Solution: Tetra Laval, through its Tetra Pak division, has been researching cellophane-based alternatives for their packaging solutions. Their approach focuses on developing a multi-layer packaging material that incorporates cellophane as a key component. The company has invested in technologies to improve the moisture resistance of cellophane through the application of bio-based coatings and treatments[10]. Tetra Pak's research also includes the development of cellophane-based aseptic packaging solutions, which require advanced barrier properties against oxygen and light[11]. Additionally, the company is exploring the use of nanocellulose reinforcement in cellophane films to enhance their mechanical strength and reduce material usage[12].

Strengths: Expertise in multi-layer packaging, potential for aseptic packaging applications. Weaknesses: Challenges in achieving the same level of barrier properties as current synthetic plastic-based solutions.

Core Cellophane Innovations

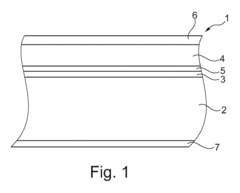

Multilayer laminate comprising a paper-layer and a polymeric-layer

PatentInactiveEP2979863A1

Innovation

- A multilayer laminate comprising a paper-layer and a polymeric-layer, laminated together with an adhesive lamination-layer, achieving a grammage of ≤45 g/m², providing structural stability and deadfold properties for high-speed packaging while being environmentally friendly.

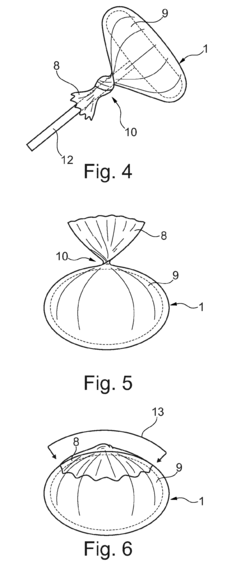

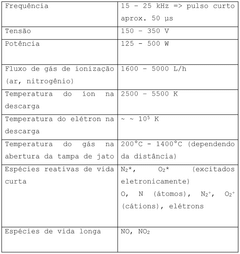

Base material for forming a cellulose packaging material and the use thereof

PatentWO2024164057A1

Innovation

- A base material composed of 98% to 99% cellulose and 1% to 2% inert silicon-based material, featuring a plasma-pre-treated cellulosic substrate, a nanofibrillated cellulose film layer for gas barrier, and an atmospheric plasma-coated inner layer for liquid barrier, ensuring waterproof and recyclable packaging.

Environmental Impact Assessment

The environmental impact assessment of cellophane as a substitute for synthetic plastics in packaging reveals both positive and negative aspects. On the positive side, cellophane is derived from renewable resources, primarily wood pulp or cotton linters, making it a more sustainable option compared to petroleum-based plastics. Its biodegradability is a significant advantage, as it can decompose naturally in the environment within a few months to a year, depending on conditions. This characteristic greatly reduces the long-term environmental burden associated with plastic waste accumulation in landfills and oceans.

Furthermore, the production process of cellophane generally has a lower carbon footprint compared to many synthetic plastics. The raw materials used in cellophane production are often byproducts of other industries, promoting resource efficiency. Additionally, cellophane does not release harmful microplastics into the environment during degradation, a growing concern with traditional plastics.

However, the environmental impact of cellophane is not entirely benign. The production process involves the use of chemicals such as carbon disulfide and sodium hydroxide, which can be harmful if not properly managed. Proper waste treatment and disposal systems are crucial to mitigate potential environmental risks associated with these chemicals. Moreover, while cellophane is biodegradable, it may not be compostable in all settings, particularly in home composting systems.

Water usage in cellophane production is another environmental consideration. The process requires significant amounts of water, which can strain local water resources if not managed sustainably. Additionally, the energy requirements for cellophane production, while generally lower than those for synthetic plastics, still contribute to greenhouse gas emissions.

The end-of-life management of cellophane also presents challenges. While biodegradable, improper disposal can still lead to litter and short-term environmental impacts. Education and infrastructure development are necessary to ensure proper disposal and maximize the environmental benefits of cellophane over synthetic plastics.

In terms of recycling, cellophane presents both opportunities and challenges. Unlike many synthetic plastics, cellophane can be recycled through composting facilities, potentially reducing waste sent to landfills. However, the current recycling infrastructure in many regions is not equipped to handle cellophane effectively, which may limit its recyclability in practice.

Overall, while cellophane offers significant environmental advantages over synthetic plastics, particularly in terms of biodegradability and renewable sourcing, its widespread adoption as a packaging material requires careful consideration of production processes, disposal methods, and recycling infrastructure to fully realize its potential environmental benefits.

Furthermore, the production process of cellophane generally has a lower carbon footprint compared to many synthetic plastics. The raw materials used in cellophane production are often byproducts of other industries, promoting resource efficiency. Additionally, cellophane does not release harmful microplastics into the environment during degradation, a growing concern with traditional plastics.

However, the environmental impact of cellophane is not entirely benign. The production process involves the use of chemicals such as carbon disulfide and sodium hydroxide, which can be harmful if not properly managed. Proper waste treatment and disposal systems are crucial to mitigate potential environmental risks associated with these chemicals. Moreover, while cellophane is biodegradable, it may not be compostable in all settings, particularly in home composting systems.

Water usage in cellophane production is another environmental consideration. The process requires significant amounts of water, which can strain local water resources if not managed sustainably. Additionally, the energy requirements for cellophane production, while generally lower than those for synthetic plastics, still contribute to greenhouse gas emissions.

The end-of-life management of cellophane also presents challenges. While biodegradable, improper disposal can still lead to litter and short-term environmental impacts. Education and infrastructure development are necessary to ensure proper disposal and maximize the environmental benefits of cellophane over synthetic plastics.

In terms of recycling, cellophane presents both opportunities and challenges. Unlike many synthetic plastics, cellophane can be recycled through composting facilities, potentially reducing waste sent to landfills. However, the current recycling infrastructure in many regions is not equipped to handle cellophane effectively, which may limit its recyclability in practice.

Overall, while cellophane offers significant environmental advantages over synthetic plastics, particularly in terms of biodegradability and renewable sourcing, its widespread adoption as a packaging material requires careful consideration of production processes, disposal methods, and recycling infrastructure to fully realize its potential environmental benefits.

Regulatory Framework

The regulatory framework surrounding the use of cellophane as a substitute for synthetic plastics in packaging is complex and evolving. As environmental concerns grow, governments worldwide are implementing stricter regulations on single-use plastics, creating opportunities for alternative materials like cellophane.

In the European Union, the Single-Use Plastics Directive (EU) 2019/904 aims to reduce the impact of certain plastic products on the environment. While this directive primarily targets synthetic plastics, it has implications for cellophane as a potential substitute. The EU's focus on promoting circular economy principles and biodegradable materials aligns well with cellophane's properties, potentially positioning it favorably in future regulatory updates.

The United States lacks comprehensive federal legislation specifically addressing cellophane or bioplastics. However, several states have enacted laws restricting single-use plastics, indirectly benefiting alternative materials. California's Senate Bill 54, for instance, requires all packaging in the state to be recyclable or compostable by 2032, which could boost cellophane adoption.

In Asia, countries like Japan and South Korea have implemented regulations promoting biodegradable materials in packaging. Japan's Plastic Resource Circulation Act, effective since April 2022, encourages the use of alternative materials and could provide a regulatory advantage for cellophane-based packaging solutions.

International standards also play a crucial role in shaping the regulatory landscape. The International Organization for Standardization (ISO) has developed standards for biodegradable plastics, such as ISO 17088:2012, which specifies requirements for compostable plastics. As cellophane is biodegradable, compliance with these standards could enhance its market acceptance and regulatory approval.

Certification schemes like the Biodegradable Products Institute (BPI) in North America and TÜV Austria's OK Compost certification in Europe provide third-party verification of biodegradability claims. These certifications can help cellophane products navigate regulatory requirements and build consumer trust.

However, challenges remain in harmonizing regulations across different regions and ensuring consistent definitions of biodegradability and compostability. The lack of uniform global standards for bio-based materials like cellophane can create regulatory uncertainties for manufacturers and potentially hinder widespread adoption.

As the regulatory landscape continues to evolve, companies investing in cellophane-based packaging solutions must stay informed about emerging regulations and actively engage with policymakers to ensure favorable treatment of this sustainable alternative to synthetic plastics.

In the European Union, the Single-Use Plastics Directive (EU) 2019/904 aims to reduce the impact of certain plastic products on the environment. While this directive primarily targets synthetic plastics, it has implications for cellophane as a potential substitute. The EU's focus on promoting circular economy principles and biodegradable materials aligns well with cellophane's properties, potentially positioning it favorably in future regulatory updates.

The United States lacks comprehensive federal legislation specifically addressing cellophane or bioplastics. However, several states have enacted laws restricting single-use plastics, indirectly benefiting alternative materials. California's Senate Bill 54, for instance, requires all packaging in the state to be recyclable or compostable by 2032, which could boost cellophane adoption.

In Asia, countries like Japan and South Korea have implemented regulations promoting biodegradable materials in packaging. Japan's Plastic Resource Circulation Act, effective since April 2022, encourages the use of alternative materials and could provide a regulatory advantage for cellophane-based packaging solutions.

International standards also play a crucial role in shaping the regulatory landscape. The International Organization for Standardization (ISO) has developed standards for biodegradable plastics, such as ISO 17088:2012, which specifies requirements for compostable plastics. As cellophane is biodegradable, compliance with these standards could enhance its market acceptance and regulatory approval.

Certification schemes like the Biodegradable Products Institute (BPI) in North America and TÜV Austria's OK Compost certification in Europe provide third-party verification of biodegradability claims. These certifications can help cellophane products navigate regulatory requirements and build consumer trust.

However, challenges remain in harmonizing regulations across different regions and ensuring consistent definitions of biodegradability and compostability. The lack of uniform global standards for bio-based materials like cellophane can create regulatory uncertainties for manufacturers and potentially hinder widespread adoption.

As the regulatory landscape continues to evolve, companies investing in cellophane-based packaging solutions must stay informed about emerging regulations and actively engage with policymakers to ensure favorable treatment of this sustainable alternative to synthetic plastics.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!