RO Membrane PFAS/Trace Organics: Rejection Factors And Breakthrough

SEP 22, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

RO Membrane PFAS Rejection Background and Objectives

Reverse osmosis (RO) membrane technology has emerged as a critical solution for water purification since its commercial introduction in the 1960s. The evolution of this technology has been marked by significant improvements in membrane materials, structure, and performance characteristics, enabling increasingly efficient removal of contaminants from water sources. In recent years, growing concern about per- and polyfluoroalkyl substances (PFAS) and other trace organic compounds has redirected research focus toward understanding rejection mechanisms and breakthrough phenomena in RO systems.

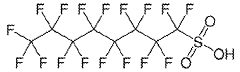

PFAS compounds, often referred to as "forever chemicals" due to their persistence in the environment, represent a significant public health concern. These synthetic chemicals have been widely used in industrial applications and consumer products since the 1940s, resulting in widespread environmental contamination. Their strong carbon-fluorine bonds make them extremely resistant to degradation, allowing them to accumulate in the environment, wildlife, and human bodies over time.

The historical trajectory of RO membrane development has seen several key technological advances, from cellulose acetate membranes to thin-film composite (TFC) polyamide membranes, which currently dominate the market. Each generation has brought improvements in rejection capabilities, energy efficiency, and operational longevity. However, the specific challenges posed by PFAS and other trace organics have necessitated further refinement and understanding of membrane performance under various conditions.

Current technical objectives in this field focus on several key areas: identifying the primary factors affecting PFAS rejection by RO membranes; understanding breakthrough mechanisms and predicting membrane failure points; optimizing membrane properties for enhanced PFAS removal; and developing reliable testing protocols to evaluate membrane performance against various PFAS compounds under different operational conditions.

The research aims to establish correlations between membrane characteristics (such as pore size, surface charge, hydrophobicity) and rejection efficiency for different PFAS compounds. Additionally, it seeks to understand how water chemistry parameters (pH, ionic strength, temperature) and operational factors (pressure, recovery rate, fouling) influence rejection performance over time.

This technical investigation is driven by increasingly stringent regulatory standards for PFAS in drinking water globally, with health authorities progressively lowering acceptable concentration limits as more is understood about their health impacts. The ultimate goal is to develop robust predictive models and design guidelines that can inform the next generation of RO membrane technologies specifically optimized for PFAS and trace organic compound removal, ensuring safer water supplies for communities worldwide.

PFAS compounds, often referred to as "forever chemicals" due to their persistence in the environment, represent a significant public health concern. These synthetic chemicals have been widely used in industrial applications and consumer products since the 1940s, resulting in widespread environmental contamination. Their strong carbon-fluorine bonds make them extremely resistant to degradation, allowing them to accumulate in the environment, wildlife, and human bodies over time.

The historical trajectory of RO membrane development has seen several key technological advances, from cellulose acetate membranes to thin-film composite (TFC) polyamide membranes, which currently dominate the market. Each generation has brought improvements in rejection capabilities, energy efficiency, and operational longevity. However, the specific challenges posed by PFAS and other trace organics have necessitated further refinement and understanding of membrane performance under various conditions.

Current technical objectives in this field focus on several key areas: identifying the primary factors affecting PFAS rejection by RO membranes; understanding breakthrough mechanisms and predicting membrane failure points; optimizing membrane properties for enhanced PFAS removal; and developing reliable testing protocols to evaluate membrane performance against various PFAS compounds under different operational conditions.

The research aims to establish correlations between membrane characteristics (such as pore size, surface charge, hydrophobicity) and rejection efficiency for different PFAS compounds. Additionally, it seeks to understand how water chemistry parameters (pH, ionic strength, temperature) and operational factors (pressure, recovery rate, fouling) influence rejection performance over time.

This technical investigation is driven by increasingly stringent regulatory standards for PFAS in drinking water globally, with health authorities progressively lowering acceptable concentration limits as more is understood about their health impacts. The ultimate goal is to develop robust predictive models and design guidelines that can inform the next generation of RO membrane technologies specifically optimized for PFAS and trace organic compound removal, ensuring safer water supplies for communities worldwide.

Market Demand Analysis for PFAS Removal Technologies

The global market for PFAS removal technologies has experienced significant growth in recent years, driven by increasing awareness of the health risks associated with per- and polyfluoroalkyl substances (PFAS) contamination in water sources. Current market estimates value the PFAS remediation sector at approximately $2.1 billion in 2023, with projections indicating a compound annual growth rate of 8.5% through 2030.

Regulatory developments have become a primary market driver, with the EPA's proposed regulations to establish maximum contaminant levels for PFAS in drinking water creating substantial demand for effective removal technologies. The European Union's similar regulatory framework under the Water Framework Directive has further expanded the global market opportunity. These regulatory pressures have transformed what was once a niche environmental concern into a mainstream water treatment requirement.

Municipal water treatment facilities represent the largest market segment, accounting for roughly 45% of current demand. These utilities face mounting pressure to implement PFAS removal solutions to comply with tightening regulations. The industrial sector follows closely, particularly industries with historical PFAS usage such as textiles, paper manufacturing, and firefighting equipment producers, which now face liability concerns and compliance requirements.

Consumer awareness has created a rapidly growing residential market segment, with point-of-use and point-of-entry treatment systems gaining popularity. This segment has seen 12% annual growth since 2020, outpacing the overall market as consumers seek protection from PFAS contamination in household water supplies.

Geographically, North America dominates the market with approximately 38% share, followed by Europe at 32%. However, the Asia-Pacific region is experiencing the fastest growth rate at 11.3% annually, driven by industrialization, urbanization, and increasing environmental regulations in countries like China, Japan, and South Korea.

Among removal technologies, reverse osmosis (RO) membrane systems have captured significant market share due to their proven effectiveness in PFAS rejection. The RO membrane segment for PFAS removal was valued at $780 million in 2022, with particular demand for systems demonstrating high rejection rates for short-chain PFAS compounds, which have traditionally been more challenging to remove.

Market research indicates growing customer preference for treatment solutions offering comprehensive removal of both legacy PFAS compounds and emerging variants. This trend has created substantial demand for advanced RO membrane technologies that can address breakthrough concerns and maintain consistent rejection performance across varying water chemistry conditions.

Industry analysts project that technological innovations improving RO membrane performance specifically for PFAS and trace organics rejection could capture premium market positioning, with customers demonstrating willingness to pay 15-20% price premiums for solutions offering documented superior performance and reliability in this application.

Regulatory developments have become a primary market driver, with the EPA's proposed regulations to establish maximum contaminant levels for PFAS in drinking water creating substantial demand for effective removal technologies. The European Union's similar regulatory framework under the Water Framework Directive has further expanded the global market opportunity. These regulatory pressures have transformed what was once a niche environmental concern into a mainstream water treatment requirement.

Municipal water treatment facilities represent the largest market segment, accounting for roughly 45% of current demand. These utilities face mounting pressure to implement PFAS removal solutions to comply with tightening regulations. The industrial sector follows closely, particularly industries with historical PFAS usage such as textiles, paper manufacturing, and firefighting equipment producers, which now face liability concerns and compliance requirements.

Consumer awareness has created a rapidly growing residential market segment, with point-of-use and point-of-entry treatment systems gaining popularity. This segment has seen 12% annual growth since 2020, outpacing the overall market as consumers seek protection from PFAS contamination in household water supplies.

Geographically, North America dominates the market with approximately 38% share, followed by Europe at 32%. However, the Asia-Pacific region is experiencing the fastest growth rate at 11.3% annually, driven by industrialization, urbanization, and increasing environmental regulations in countries like China, Japan, and South Korea.

Among removal technologies, reverse osmosis (RO) membrane systems have captured significant market share due to their proven effectiveness in PFAS rejection. The RO membrane segment for PFAS removal was valued at $780 million in 2022, with particular demand for systems demonstrating high rejection rates for short-chain PFAS compounds, which have traditionally been more challenging to remove.

Market research indicates growing customer preference for treatment solutions offering comprehensive removal of both legacy PFAS compounds and emerging variants. This trend has created substantial demand for advanced RO membrane technologies that can address breakthrough concerns and maintain consistent rejection performance across varying water chemistry conditions.

Industry analysts project that technological innovations improving RO membrane performance specifically for PFAS and trace organics rejection could capture premium market positioning, with customers demonstrating willingness to pay 15-20% price premiums for solutions offering documented superior performance and reliability in this application.

Current RO Membrane Technology Status and Challenges

Reverse Osmosis (RO) membrane technology has evolved significantly over the past decades, becoming a cornerstone in water purification systems globally. Currently, RO membranes demonstrate high efficiency in removing various contaminants, including salts, microorganisms, and certain organic compounds. However, the removal of Per- and Polyfluoroalkyl Substances (PFAS) and trace organics presents unique challenges due to their molecular characteristics and persistence.

The state-of-the-art RO membranes typically achieve 95-99% rejection rates for many conventional contaminants, but their effectiveness against PFAS compounds varies considerably. Recent studies indicate rejection rates ranging from 70% to over 99% depending on the specific PFAS compound, membrane properties, and operational conditions. This variability represents a significant challenge in ensuring consistent water quality standards.

Geographically, RO membrane technology development is concentrated in North America, Europe, and East Asia, with the United States, Japan, and China leading in research publications and patent filings. The global market for PFAS-specific treatment technologies is expanding rapidly, driven by increasing regulatory scrutiny and public awareness of these "forever chemicals."

Technical limitations of current RO membranes include membrane fouling when treating water with high organic content, which reduces efficiency and increases operational costs. Additionally, the trade-off between water flux and rejection rate remains a critical challenge, particularly for smaller PFAS molecules that can sometimes penetrate the membrane structure.

Energy consumption represents another significant constraint, as high-pressure operation necessary for effective PFAS rejection increases the carbon footprint and operational expenses of treatment facilities. This energy intensity makes widespread implementation challenging, especially in resource-limited regions.

Material science limitations also affect performance, with current membrane materials struggling to maintain structural integrity and separation efficiency over extended operational periods when exposed to complex mixtures containing PFAS and other trace organics. Breakthrough phenomena, where contaminants suddenly appear in permeate after periods of successful rejection, remain poorly understood and difficult to predict.

Monitoring capabilities present additional challenges, as real-time detection of PFAS breakthrough events requires sophisticated analytical techniques not readily available in many treatment facilities. This detection gap complicates operational management and quality assurance protocols.

The regulatory landscape adds complexity, with evolving standards for PFAS in drinking water creating a moving target for technology developers and water utilities. The recent trend toward stricter limits approaches the detection limits of current analytical methods, further challenging compliance verification.

The state-of-the-art RO membranes typically achieve 95-99% rejection rates for many conventional contaminants, but their effectiveness against PFAS compounds varies considerably. Recent studies indicate rejection rates ranging from 70% to over 99% depending on the specific PFAS compound, membrane properties, and operational conditions. This variability represents a significant challenge in ensuring consistent water quality standards.

Geographically, RO membrane technology development is concentrated in North America, Europe, and East Asia, with the United States, Japan, and China leading in research publications and patent filings. The global market for PFAS-specific treatment technologies is expanding rapidly, driven by increasing regulatory scrutiny and public awareness of these "forever chemicals."

Technical limitations of current RO membranes include membrane fouling when treating water with high organic content, which reduces efficiency and increases operational costs. Additionally, the trade-off between water flux and rejection rate remains a critical challenge, particularly for smaller PFAS molecules that can sometimes penetrate the membrane structure.

Energy consumption represents another significant constraint, as high-pressure operation necessary for effective PFAS rejection increases the carbon footprint and operational expenses of treatment facilities. This energy intensity makes widespread implementation challenging, especially in resource-limited regions.

Material science limitations also affect performance, with current membrane materials struggling to maintain structural integrity and separation efficiency over extended operational periods when exposed to complex mixtures containing PFAS and other trace organics. Breakthrough phenomena, where contaminants suddenly appear in permeate after periods of successful rejection, remain poorly understood and difficult to predict.

Monitoring capabilities present additional challenges, as real-time detection of PFAS breakthrough events requires sophisticated analytical techniques not readily available in many treatment facilities. This detection gap complicates operational management and quality assurance protocols.

The regulatory landscape adds complexity, with evolving standards for PFAS in drinking water creating a moving target for technology developers and water utilities. The recent trend toward stricter limits approaches the detection limits of current analytical methods, further challenging compliance verification.

Current RO Membrane Solutions for PFAS/Trace Organics Rejection

01 Factors affecting RO membrane rejection performance

Various factors influence the rejection performance of reverse osmosis (RO) membranes, including membrane material composition, operating pressure, feed water characteristics, and temperature. The membrane's physical and chemical properties determine its selectivity for different solutes. Higher operating pressures generally improve rejection rates by increasing the driving force for water permeation while maintaining solute rejection. Feed water characteristics such as pH, ionic strength, and concentration of specific contaminants significantly impact rejection efficiency. Temperature affects both water flux and solute rejection through changes in solution viscosity and diffusion rates.- Factors affecting RO membrane rejection performance: Various factors influence the rejection performance of reverse osmosis (RO) membranes, including membrane material composition, operating pressure, feed water characteristics, and temperature. The membrane's physical and chemical properties determine its selectivity for different solutes. Higher operating pressures generally improve rejection rates by overcoming osmotic pressure, while feed water characteristics such as pH, ionic strength, and concentration of contaminants can significantly impact rejection efficiency. Temperature affects both water flux and solute rejection through changes in solution viscosity and diffusion rates.

- Breakthrough prevention mechanisms in RO systems: RO systems employ various mechanisms to prevent breakthrough of contaminants, including multi-stage filtration, monitoring systems, and membrane integrity testing. Pre-treatment processes remove particles and substances that could damage or compromise membrane performance. Real-time monitoring systems detect changes in permeate quality, pressure differential, and flow rates to identify potential breakthrough events before they become critical. Regular integrity testing helps identify microscopic defects or damage that could lead to contaminant passage. Advanced control systems can automatically adjust operating parameters or trigger alarms when conditions indicate potential breakthrough risks.

- Enhanced rejection through membrane modifications: Membrane modifications can significantly improve rejection factors and reduce breakthrough risks. Surface modifications using nanomaterials, polymeric coatings, or chemical treatments can enhance selectivity and reduce fouling propensity. Incorporation of functional groups can improve rejection of specific contaminants through electrostatic repulsion or size exclusion mechanisms. Composite membrane structures with multiple functional layers optimize both water flux and contaminant rejection. Some modifications include self-cleaning or antimicrobial properties that maintain high rejection performance over extended operation periods by reducing biofouling and organic fouling.

- Monitoring and detection of rejection failure: Advanced monitoring systems are crucial for detecting rejection failures or breakthrough events in RO systems. Continuous conductivity monitoring provides real-time indication of salt passage through membranes. Specialized sensors can detect specific contaminants in permeate streams at trace levels. Automated monitoring systems with alarm thresholds alert operators to deviations from normal rejection performance. Some systems incorporate predictive analytics that identify trends indicating potential future breakthrough events before they occur, allowing for preventive maintenance or operational adjustments to maintain rejection performance.

- Operational strategies to maintain high rejection factors: Proper operational strategies are essential for maintaining high rejection factors in RO systems. Optimized cleaning protocols remove foulants that can compromise rejection performance. Controlled flux operation prevents excessive compaction and maintains membrane integrity. Proper pressure management balances rejection performance with energy efficiency and membrane lifespan. Feed water pre-treatment reduces fouling potential and protects membrane surfaces. Regular performance testing and data analysis help identify early signs of rejection decline, allowing for timely intervention before breakthrough occurs.

02 Breakthrough mechanisms and prevention strategies

Breakthrough in RO membranes occurs when contaminants pass through the membrane barrier, compromising rejection performance. Common breakthrough mechanisms include concentration polarization, membrane fouling, scaling, and physical damage to the membrane structure. Prevention strategies involve pretreatment of feed water to remove foulants, optimization of operating conditions to minimize concentration polarization, implementation of cleaning protocols to restore membrane performance, and monitoring systems to detect early signs of breakthrough. Advanced membrane materials with enhanced chemical resistance and anti-fouling properties can also help prevent breakthrough events.Expand Specific Solutions03 Innovative RO membrane designs for improved rejection

Recent innovations in RO membrane design focus on enhancing rejection capabilities through novel material compositions and structural modifications. These include thin-film composite membranes with specialized functional layers, incorporation of nanomaterials to create more selective barriers, surface modifications to reduce fouling propensity, and biomimetic approaches inspired by natural water filtration systems. Some designs feature self-cleaning mechanisms or responsive elements that adapt to changing feed water conditions. These innovations aim to achieve higher rejection rates for specific contaminants while maintaining or improving water flux and energy efficiency.Expand Specific Solutions04 Monitoring and testing methods for rejection performance

Accurate monitoring and testing of RO membrane rejection performance is essential for ensuring system reliability and product water quality. Methods include conductivity measurements to assess salt rejection, spectroscopic techniques for organic contaminant detection, particle counting for colloidal material breakthrough, and integrity testing to identify membrane defects. Online monitoring systems provide real-time data on rejection performance, allowing for prompt intervention when breakthrough occurs. Laboratory testing protocols help characterize membrane rejection capabilities under controlled conditions, while accelerated aging tests predict long-term rejection stability.Expand Specific Solutions05 System configurations to enhance rejection factors

Optimized system configurations can significantly enhance RO membrane rejection factors and minimize breakthrough risks. These include multi-stage RO arrangements where permeate from one stage becomes feed for subsequent stages, hybrid systems combining RO with other treatment technologies, concentrate recycling to increase recovery while maintaining rejection performance, and specialized flow distribution designs to minimize concentration polarization. Pressure vessel arrangements, feed spacer designs, and permeate collection systems also influence rejection efficiency. Advanced control systems that adjust operating parameters based on feed water quality fluctuations help maintain consistent rejection performance under varying conditions.Expand Specific Solutions

Leading Companies and Research Institutions in RO Membrane Development

The PFAS/trace organics rejection in RO membranes market is in a growth phase, driven by increasing regulatory pressure and public concern over these persistent contaminants. The global water treatment membrane market is projected to reach $12 billion by 2026, with PFAS treatment representing a rapidly expanding segment. Technologically, companies are at varying maturity levels: established players like Dow Global Technologies, Honeywell, and Kurita Water Industries lead with commercial solutions, while research institutions (Yale, Duke, UNC-Chapel Hill) focus on breakthrough technologies. Newer entrants like Aquaporin and Fluid Technology Solutions are developing biomimetic approaches. The competitive landscape shows collaboration between academic institutions and industry partners to address rejection factors and breakthrough challenges, with increasing focus on sustainable, high-efficiency membrane technologies for comprehensive PFAS removal.

Kurita Water Industries Ltd.

Technical Solution: Kurita has developed specialized RO membrane technology for PFAS rejection through their advanced water treatment research division. Their approach focuses on optimizing membrane chemistry and operational parameters to maximize PFAS removal while minimizing energy consumption. Kurita's research demonstrates that controlling concentration polarization at the membrane surface is critical for preventing PFAS breakthrough. Their membranes incorporate hydrophilic surface modifications that reduce PFAS adsorption while maintaining high water flux. Kurita has developed a comprehensive approach that combines specialized membrane materials with optimized system design, including innovative flow distribution technology that minimizes boundary layer effects that can lead to PFAS breakthrough. Their systems include specialized cleaning protocols specifically designed to restore membrane performance after PFAS fouling, extending effective membrane lifetime in challenging applications.

Strengths: Integrated system approach addressing both membrane materials and operational parameters; energy-efficient design; specialized cleaning and maintenance protocols for PFAS applications. Weaknesses: Slightly lower rejection rates for some short-chain PFAS compounds compared to top competitors; requires more frequent cleaning cycles in high-fouling applications.

Dow Global Technologies LLC

Technical Solution: Dow has developed advanced FilmTec™ RO membrane technology specifically engineered for PFAS rejection. Their approach combines tight polyamide thin-film composite membranes with optimized surface chemistry to enhance PFAS removal. Their research demonstrates that membrane surface charge, hydrophobicity, and pore size distribution are critical factors affecting PFAS rejection. Dow's membranes achieve >99% rejection of long-chain PFAS compounds and 90-95% rejection of short-chain variants through a combination of size exclusion, electrostatic repulsion, and hydrophobic interactions. Their technology incorporates specialized surface modifications that minimize fouling while maintaining high flux rates, addressing the challenge of membrane performance decline during PFAS filtration. Recent innovations include multi-layer barrier technology that creates additional rejection mechanisms for persistent organic pollutants.

Strengths: Industry-leading rejection rates for both long and short-chain PFAS; extensive commercial deployment experience; advanced fouling resistance technology. Weaknesses: Higher energy consumption compared to some competing technologies; potential for concentration polarization at membrane surface during high PFAS loading conditions.

Key Technical Innovations in PFAS Rejection Mechanisms

Salt separation and destruction of PFAS utilizing reverse osmosis and salt separation

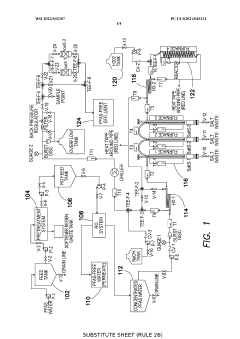

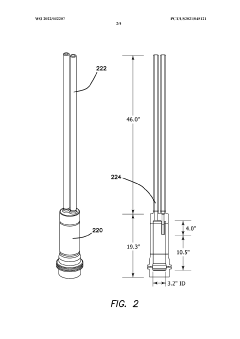

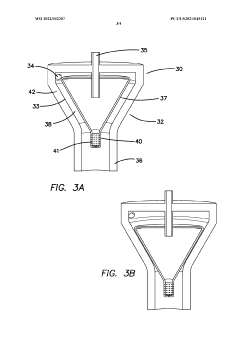

PatentWO2022032207A1

Innovation

- A method combining reverse osmosis and supercritical water oxidation (SCWO) to concentrate and destroy PFAS, where PFAS-containing solutions are first subjected to reverse osmosis to create a brine fraction, which is then preheated and converted to supercritical conditions to precipitate sodium chloride, followed by oxidation in a SCWO reactor, achieving a significant reduction in PFAS concentration.

Perfluoroalkyl and polyfluoroalkyl sorbent materials and methods of use

PatentActiveUS11911743B2

Innovation

- The development of sorbent materials incorporating specific ions, salts, oxides, or carbonates of magnesium, calcium, strontium, or barium, combined with carbonaceous materials like activated carbon or reactivated carbon, which increase the sorbent capacity for PFAS and improve their removal efficiency from liquids and gases.

Environmental Regulations Impact on PFAS Treatment Standards

The regulatory landscape for PFAS (Per- and Polyfluoroalkyl Substances) treatment is rapidly evolving globally, creating significant implications for RO membrane technology development and implementation. In the United States, the Environmental Protection Agency (EPA) has established health advisory levels for certain PFAS compounds, with PFOA and PFOS initially set at 70 parts per trillion (ppt). However, in 2022, the EPA dramatically lowered these advisory levels to near-zero concentrations, signaling a much stricter regulatory approach.

The European Union has similarly implemented the Water Framework Directive, which classifies certain PFAS as priority hazardous substances requiring removal from water systems. The EU's "Zero Pollution Action Plan" aims to reduce PFAS pollution significantly by 2030, driving innovation in treatment technologies including advanced RO membrane systems.

These tightening regulations have direct implications for RO membrane technology research and development. Treatment standards now require detection and removal capabilities at increasingly lower concentrations, pushing membrane manufacturers to enhance rejection performance specifically for PFAS compounds. This regulatory pressure has accelerated research into membrane surface modifications and novel polymer compositions designed to target PFAS rejection mechanisms.

The economic impact of these regulations cannot be understated. Water utilities and industrial facilities face substantial compliance costs, creating market demand for cost-effective RO solutions that can achieve regulatory compliance. Industries particularly affected include semiconductor manufacturing, textile production, and firefighting training facilities where PFAS-containing foams have been extensively used.

Regulatory differences across jurisdictions create additional challenges for technology developers. While some regions have established enforceable maximum contaminant levels (MCLs), others rely on non-enforceable guidelines, creating a complex patchwork of requirements that RO membrane technologies must address to be commercially viable across markets.

Looking forward, pending regulations will likely continue to drive innovation in RO membrane technology. The EPA's PFAS Strategic Roadmap outlines plans to establish enforceable drinking water standards for multiple PFAS compounds by 2023-2024, while similar regulatory frameworks are emerging in Canada, Australia, and across Asia. These evolving standards will necessitate continuous advancement in membrane rejection capabilities and breakthrough prevention mechanisms.

The regulatory trend toward treating PFAS as a class rather than as individual compounds presents both challenges and opportunities for RO membrane research, potentially requiring broader-spectrum rejection capabilities rather than targeted approaches for specific PFAS molecules.

The European Union has similarly implemented the Water Framework Directive, which classifies certain PFAS as priority hazardous substances requiring removal from water systems. The EU's "Zero Pollution Action Plan" aims to reduce PFAS pollution significantly by 2030, driving innovation in treatment technologies including advanced RO membrane systems.

These tightening regulations have direct implications for RO membrane technology research and development. Treatment standards now require detection and removal capabilities at increasingly lower concentrations, pushing membrane manufacturers to enhance rejection performance specifically for PFAS compounds. This regulatory pressure has accelerated research into membrane surface modifications and novel polymer compositions designed to target PFAS rejection mechanisms.

The economic impact of these regulations cannot be understated. Water utilities and industrial facilities face substantial compliance costs, creating market demand for cost-effective RO solutions that can achieve regulatory compliance. Industries particularly affected include semiconductor manufacturing, textile production, and firefighting training facilities where PFAS-containing foams have been extensively used.

Regulatory differences across jurisdictions create additional challenges for technology developers. While some regions have established enforceable maximum contaminant levels (MCLs), others rely on non-enforceable guidelines, creating a complex patchwork of requirements that RO membrane technologies must address to be commercially viable across markets.

Looking forward, pending regulations will likely continue to drive innovation in RO membrane technology. The EPA's PFAS Strategic Roadmap outlines plans to establish enforceable drinking water standards for multiple PFAS compounds by 2023-2024, while similar regulatory frameworks are emerging in Canada, Australia, and across Asia. These evolving standards will necessitate continuous advancement in membrane rejection capabilities and breakthrough prevention mechanisms.

The regulatory trend toward treating PFAS as a class rather than as individual compounds presents both challenges and opportunities for RO membrane research, potentially requiring broader-spectrum rejection capabilities rather than targeted approaches for specific PFAS molecules.

Cost-Benefit Analysis of Advanced RO Membrane Technologies

When evaluating advanced RO membrane technologies for PFAS and trace organics removal, cost-benefit analysis reveals significant economic considerations that must be weighed against performance benefits. Initial capital expenditure for high-performance PFAS-rejecting membranes typically exceeds conventional RO systems by 20-35%, representing a substantial upfront investment for water treatment facilities.

Operational costs present a more nuanced picture. While advanced membranes designed specifically for PFAS rejection demonstrate higher removal efficiencies (often exceeding 99% for most PFAS compounds compared to 85-95% for standard membranes), they generally require 10-15% higher operating pressures, translating to increased energy consumption and associated costs.

Membrane lifespan and fouling resistance constitute critical economic factors. Research indicates that specialized PFAS-rejecting membranes with modified surface chemistries may experience accelerated fouling when treating complex water matrices, potentially reducing operational lifespans by 15-25% compared to conventional membranes. This necessitates more frequent replacement cycles, significantly impacting long-term operational expenses.

The economic benefits of advanced membrane technologies manifest primarily through improved treatment outcomes. Higher rejection rates for PFAS and trace organics reduce downstream treatment requirements and associated costs. Additionally, facilities employing high-performance membranes may avoid regulatory penalties and potential litigation costs related to PFAS contamination, representing substantial risk mitigation value.

Lifecycle cost analysis reveals that despite higher initial and operational costs, advanced RO membrane technologies often demonstrate favorable long-term economics when treating waters with significant PFAS contamination. The break-even point typically occurs within 3-5 years of operation, depending on influent PFAS concentrations and regulatory compliance requirements.

Scalability considerations further influence cost-benefit calculations. Large municipal systems benefit from economies of scale, reducing the per-volume treatment cost differential between conventional and advanced membranes. Conversely, smaller systems face proportionally higher implementation costs for specialized membrane technologies, potentially extending return-on-investment timelines.

Recent innovations in membrane manufacturing processes have begun narrowing the cost gap. Emerging fabrication techniques incorporating nanomaterials and precision polymer chemistry show promise for reducing production costs of high-performance membranes by 15-20% over the next 3-5 years, potentially accelerating adoption across various treatment applications.

Operational costs present a more nuanced picture. While advanced membranes designed specifically for PFAS rejection demonstrate higher removal efficiencies (often exceeding 99% for most PFAS compounds compared to 85-95% for standard membranes), they generally require 10-15% higher operating pressures, translating to increased energy consumption and associated costs.

Membrane lifespan and fouling resistance constitute critical economic factors. Research indicates that specialized PFAS-rejecting membranes with modified surface chemistries may experience accelerated fouling when treating complex water matrices, potentially reducing operational lifespans by 15-25% compared to conventional membranes. This necessitates more frequent replacement cycles, significantly impacting long-term operational expenses.

The economic benefits of advanced membrane technologies manifest primarily through improved treatment outcomes. Higher rejection rates for PFAS and trace organics reduce downstream treatment requirements and associated costs. Additionally, facilities employing high-performance membranes may avoid regulatory penalties and potential litigation costs related to PFAS contamination, representing substantial risk mitigation value.

Lifecycle cost analysis reveals that despite higher initial and operational costs, advanced RO membrane technologies often demonstrate favorable long-term economics when treating waters with significant PFAS contamination. The break-even point typically occurs within 3-5 years of operation, depending on influent PFAS concentrations and regulatory compliance requirements.

Scalability considerations further influence cost-benefit calculations. Large municipal systems benefit from economies of scale, reducing the per-volume treatment cost differential between conventional and advanced membranes. Conversely, smaller systems face proportionally higher implementation costs for specialized membrane technologies, potentially extending return-on-investment timelines.

Recent innovations in membrane manufacturing processes have begun narrowing the cost gap. Emerging fabrication techniques incorporating nanomaterials and precision polymer chemistry show promise for reducing production costs of high-performance membranes by 15-20% over the next 3-5 years, potentially accelerating adoption across various treatment applications.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!