Solvent Recovery Vs. Solvent Replacement: TCO Analysis

AUG 27, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Solvent Recovery and Replacement Background and Objectives

Solvent usage in industrial processes has been a critical component of manufacturing operations for decades, with applications spanning pharmaceuticals, electronics, automotive, and chemical industries. The evolution of solvent technologies has been driven by increasing environmental regulations, worker safety concerns, and economic pressures. Historically, industries relied heavily on petroleum-based solvents with little consideration for recovery or environmental impact. However, the paradigm has shifted significantly since the 1970s with the introduction of major environmental legislation worldwide.

The technical evolution trajectory shows three distinct phases: traditional solvent usage with minimal recovery (pre-1980s), improved recovery systems development (1980s-2000s), and the current era focused on sustainable alternatives and advanced recovery technologies. This progression reflects growing awareness of the total cost of ownership (TCO) beyond mere purchase price, incorporating disposal costs, regulatory compliance, worker safety, and environmental impact.

Current market dynamics indicate a tension between solvent recovery and replacement strategies. Recovery technologies have matured significantly, with distillation, adsorption, membrane separation, and condensation techniques achieving efficiency rates of 85-95% in optimal conditions. Simultaneously, bio-based and green solvents have emerged as viable alternatives, though often at premium prices and sometimes with performance limitations.

The primary technical objective of this analysis is to establish a comprehensive TCO framework that enables industries to make informed decisions between solvent recovery and replacement strategies. This framework must account for direct costs (capital expenditure, operational costs), indirect costs (regulatory compliance, worker safety measures), and externalities (environmental impact, corporate social responsibility considerations).

Secondary objectives include identifying industry-specific thresholds where recovery becomes more economical than replacement, mapping technological gaps in current recovery systems, and forecasting how emerging technologies might shift the economic equation in the next 5-10 years. Additionally, we aim to develop a decision matrix that incorporates both quantitative factors (recovery efficiency, energy consumption) and qualitative considerations (process complexity, implementation challenges).

This analysis recognizes that the optimal approach varies significantly by industry, solvent type, usage volume, and regulatory environment. Therefore, the goal is not to prescribe a universal solution but to provide a robust analytical framework that organizations can adapt to their specific operational contexts, enabling more sustainable and economically sound solvent management strategies.

The technical evolution trajectory shows three distinct phases: traditional solvent usage with minimal recovery (pre-1980s), improved recovery systems development (1980s-2000s), and the current era focused on sustainable alternatives and advanced recovery technologies. This progression reflects growing awareness of the total cost of ownership (TCO) beyond mere purchase price, incorporating disposal costs, regulatory compliance, worker safety, and environmental impact.

Current market dynamics indicate a tension between solvent recovery and replacement strategies. Recovery technologies have matured significantly, with distillation, adsorption, membrane separation, and condensation techniques achieving efficiency rates of 85-95% in optimal conditions. Simultaneously, bio-based and green solvents have emerged as viable alternatives, though often at premium prices and sometimes with performance limitations.

The primary technical objective of this analysis is to establish a comprehensive TCO framework that enables industries to make informed decisions between solvent recovery and replacement strategies. This framework must account for direct costs (capital expenditure, operational costs), indirect costs (regulatory compliance, worker safety measures), and externalities (environmental impact, corporate social responsibility considerations).

Secondary objectives include identifying industry-specific thresholds where recovery becomes more economical than replacement, mapping technological gaps in current recovery systems, and forecasting how emerging technologies might shift the economic equation in the next 5-10 years. Additionally, we aim to develop a decision matrix that incorporates both quantitative factors (recovery efficiency, energy consumption) and qualitative considerations (process complexity, implementation challenges).

This analysis recognizes that the optimal approach varies significantly by industry, solvent type, usage volume, and regulatory environment. Therefore, the goal is not to prescribe a universal solution but to provide a robust analytical framework that organizations can adapt to their specific operational contexts, enabling more sustainable and economically sound solvent management strategies.

Market Demand Analysis for Solvent Technologies

The global solvent market is experiencing significant shifts driven by environmental regulations, sustainability initiatives, and cost optimization strategies across industries. Current market analysis indicates that the solvent industry is valued at approximately $30 billion globally, with projected growth rates between 4-6% annually through 2028. This growth is primarily fueled by expanding applications in pharmaceuticals, paints and coatings, adhesives, and electronics manufacturing.

Environmental regulations, particularly in Europe and North America, have created substantial demand for greener solvent technologies. The European Union's REACH regulations and similar frameworks worldwide have accelerated the transition away from traditional hydrocarbon-based solvents toward more sustainable alternatives. This regulatory pressure has created a two-pronged market demand: enhanced recovery systems for existing solvents and development of bio-based or less toxic replacement solvents.

The pharmaceutical industry represents one of the largest demand segments, consuming nearly 20% of industrial solvents globally. This sector shows particular interest in solvent recovery technologies due to the high purity requirements and significant costs associated with specialty solvents used in API manufacturing. Recovery rates of 95% or higher are increasingly becoming standard expectations in this industry.

Manufacturing sectors collectively demonstrate growing demand for closed-loop solvent systems that minimize waste and emissions while reducing operational costs. Total Cost of Ownership (TCO) has become a critical decision factor, with companies increasingly willing to invest in higher upfront capital expenditures for recovery systems that demonstrate ROI within 2-3 years through reduced solvent purchase and waste disposal costs.

Regional market analysis reveals divergent trends: developing economies in Asia-Pacific continue to prioritize lower-cost conventional solvents with basic recovery systems, while North American and European markets show stronger preference for advanced recovery technologies or complete replacement with greener alternatives despite higher initial investments.

The electronics manufacturing industry presents a particularly promising growth segment for specialized solvent technologies, driven by increasingly stringent cleanliness requirements and the miniaturization trend in semiconductor production. This sector values both high-efficiency recovery systems and ultra-pure replacement solvents that leave minimal residues.

Consumer awareness and corporate sustainability commitments are creating additional market pull for environmentally friendly solvent solutions. Companies increasingly view solvent management strategies as components of their broader ESG commitments, with many publicly announcing targets to reduce VOC emissions and hazardous chemical usage by specific percentages within defined timeframes.

Environmental regulations, particularly in Europe and North America, have created substantial demand for greener solvent technologies. The European Union's REACH regulations and similar frameworks worldwide have accelerated the transition away from traditional hydrocarbon-based solvents toward more sustainable alternatives. This regulatory pressure has created a two-pronged market demand: enhanced recovery systems for existing solvents and development of bio-based or less toxic replacement solvents.

The pharmaceutical industry represents one of the largest demand segments, consuming nearly 20% of industrial solvents globally. This sector shows particular interest in solvent recovery technologies due to the high purity requirements and significant costs associated with specialty solvents used in API manufacturing. Recovery rates of 95% or higher are increasingly becoming standard expectations in this industry.

Manufacturing sectors collectively demonstrate growing demand for closed-loop solvent systems that minimize waste and emissions while reducing operational costs. Total Cost of Ownership (TCO) has become a critical decision factor, with companies increasingly willing to invest in higher upfront capital expenditures for recovery systems that demonstrate ROI within 2-3 years through reduced solvent purchase and waste disposal costs.

Regional market analysis reveals divergent trends: developing economies in Asia-Pacific continue to prioritize lower-cost conventional solvents with basic recovery systems, while North American and European markets show stronger preference for advanced recovery technologies or complete replacement with greener alternatives despite higher initial investments.

The electronics manufacturing industry presents a particularly promising growth segment for specialized solvent technologies, driven by increasingly stringent cleanliness requirements and the miniaturization trend in semiconductor production. This sector values both high-efficiency recovery systems and ultra-pure replacement solvents that leave minimal residues.

Consumer awareness and corporate sustainability commitments are creating additional market pull for environmentally friendly solvent solutions. Companies increasingly view solvent management strategies as components of their broader ESG commitments, with many publicly announcing targets to reduce VOC emissions and hazardous chemical usage by specific percentages within defined timeframes.

Current State and Challenges in Solvent Management

The global solvent management landscape is currently characterized by a complex interplay of regulatory pressures, sustainability initiatives, and economic considerations. Traditional solvent management practices have predominantly focused on end-of-pipe solutions, with limited emphasis on recovery or replacement strategies. Approximately 70% of industrial facilities worldwide still employ conventional disposal methods for spent solvents, resulting in significant environmental impacts and missed economic opportunities.

In the chemical processing industry, solvents account for 35-40% of total volatile organic compound (VOC) emissions, making solvent management a critical environmental challenge. Regulatory frameworks such as the EU's Industrial Emissions Directive, the US EPA's NESHAP standards, and China's increasingly stringent environmental protection laws are driving industries toward more sustainable solvent practices, though compliance levels vary significantly across regions.

The primary technical challenges in solvent recovery include energy-intensive separation processes, handling of azeotropic mixtures, and degradation of solvent quality over multiple recovery cycles. Current recovery technologies typically achieve 75-85% efficiency, with energy consumption representing 40-60% of recovery costs. Membrane-based systems show promise but face scaling limitations and fouling issues in industrial applications.

For solvent replacement initiatives, the major obstacles include performance gaps between conventional and alternative solvents, process revalidation requirements, and capital investment barriers. Bio-based solvents currently represent only 8% of the global solvent market, despite their growing potential. The transition to water-based systems remains challenging for applications requiring specific solvent properties such as high solvency power or low surface tension.

Geographically, solvent management technologies are unevenly distributed, with North America and Western Europe leading in recovery technology implementation, while emerging economies in Asia and Latin America are experiencing rapid growth in solvent consumption but slower adoption of advanced management techniques. This disparity creates both challenges and opportunities for technology transfer and market development.

Economic constraints further complicate the landscape, with many facilities—particularly small and medium enterprises—lacking the capital resources for advanced recovery systems. The average payback period for comprehensive solvent recovery systems ranges from 1.5 to 4 years, depending on solvent costs and recovery volumes, creating adoption barriers despite long-term economic benefits.

The integration of solvent management with broader sustainability initiatives remains suboptimal, with only 25% of companies reporting comprehensive solvent life-cycle management strategies that align with their overall environmental goals. This disconnect represents a significant challenge to holistic solvent management approaches that could maximize both environmental and economic benefits.

In the chemical processing industry, solvents account for 35-40% of total volatile organic compound (VOC) emissions, making solvent management a critical environmental challenge. Regulatory frameworks such as the EU's Industrial Emissions Directive, the US EPA's NESHAP standards, and China's increasingly stringent environmental protection laws are driving industries toward more sustainable solvent practices, though compliance levels vary significantly across regions.

The primary technical challenges in solvent recovery include energy-intensive separation processes, handling of azeotropic mixtures, and degradation of solvent quality over multiple recovery cycles. Current recovery technologies typically achieve 75-85% efficiency, with energy consumption representing 40-60% of recovery costs. Membrane-based systems show promise but face scaling limitations and fouling issues in industrial applications.

For solvent replacement initiatives, the major obstacles include performance gaps between conventional and alternative solvents, process revalidation requirements, and capital investment barriers. Bio-based solvents currently represent only 8% of the global solvent market, despite their growing potential. The transition to water-based systems remains challenging for applications requiring specific solvent properties such as high solvency power or low surface tension.

Geographically, solvent management technologies are unevenly distributed, with North America and Western Europe leading in recovery technology implementation, while emerging economies in Asia and Latin America are experiencing rapid growth in solvent consumption but slower adoption of advanced management techniques. This disparity creates both challenges and opportunities for technology transfer and market development.

Economic constraints further complicate the landscape, with many facilities—particularly small and medium enterprises—lacking the capital resources for advanced recovery systems. The average payback period for comprehensive solvent recovery systems ranges from 1.5 to 4 years, depending on solvent costs and recovery volumes, creating adoption barriers despite long-term economic benefits.

The integration of solvent management with broader sustainability initiatives remains suboptimal, with only 25% of companies reporting comprehensive solvent life-cycle management strategies that align with their overall environmental goals. This disconnect represents a significant challenge to holistic solvent management approaches that could maximize both environmental and economic benefits.

Current TCO Analysis Methodologies for Solvent Systems

01 TCO calculation methodologies for solvent systems

Various methodologies exist for calculating the total cost of ownership (TCO) for solvent systems, including recovery and replacement scenarios. These methodologies incorporate factors such as initial investment, operational costs, maintenance expenses, disposal costs, and environmental compliance. Advanced algorithms and software tools can be used to analyze complex cost structures and provide comprehensive TCO assessments that help organizations make informed decisions about solvent management strategies.- TCO analysis frameworks for solvent systems: Total Cost of Ownership (TCO) analysis frameworks specifically designed for evaluating solvent recovery and replacement options. These frameworks consider various cost factors including initial investment, operational expenses, maintenance, disposal costs, and environmental compliance. The analysis helps organizations make informed decisions by comparing the long-term economic impacts of different solvent systems throughout their lifecycle.

- Environmental and regulatory compliance considerations in solvent TCO: Environmental regulations and compliance requirements significantly impact the total cost of ownership for solvent systems. This includes costs associated with emissions control, waste management, regulatory reporting, and potential fines for non-compliance. Advanced TCO models incorporate these environmental factors to provide a more comprehensive cost assessment, helping businesses balance economic considerations with sustainability goals when selecting solvent recovery or replacement options.

- Predictive analytics for solvent system optimization: Predictive analytics and machine learning techniques are being applied to optimize solvent recovery and replacement decisions. These technologies analyze historical performance data, maintenance records, and operational parameters to forecast future costs and system performance. By identifying patterns and potential issues before they occur, organizations can proactively manage their solvent systems to minimize downtime, extend equipment life, and reduce overall ownership costs.

- Supply chain and lifecycle management for solvents: Supply chain considerations play a crucial role in the total cost of ownership for solvent systems. This includes procurement strategies, inventory management, supplier relationships, and logistics costs. Effective lifecycle management of solvents from acquisition through disposal impacts overall TCO by addressing potential supply disruptions, price volatility, and storage requirements. Integrated approaches that optimize the entire solvent supply chain can significantly reduce total ownership costs.

- Digital transformation and automation in solvent management: Digital transformation and automation technologies are revolutionizing solvent management systems. IoT sensors, digital twins, and automated monitoring systems provide real-time data on solvent performance, recovery rates, and system efficiency. These technologies enable more precise TCO calculations by capturing actual usage patterns and maintenance needs. Automation of solvent recovery processes reduces labor costs and human error while improving consistency and recovery yields, ultimately lowering the total cost of ownership.

02 Environmental and regulatory considerations in solvent TCO

Environmental regulations and compliance requirements significantly impact the total cost of ownership for solvent systems. TCO models for solvent recovery and replacement must account for emissions control, waste management, regulatory reporting, and potential future regulatory changes. These considerations include costs associated with permits, monitoring equipment, specialized handling procedures, and potential penalties for non-compliance. Incorporating these factors provides a more accurate assessment of the true costs of different solvent options.Expand Specific Solutions03 Predictive analytics for solvent lifecycle management

Predictive analytics and machine learning techniques can be applied to optimize solvent lifecycle management and improve TCO calculations. These technologies enable more accurate forecasting of solvent degradation rates, maintenance requirements, and replacement schedules. By analyzing historical data and operational patterns, organizations can develop predictive models that help minimize unexpected costs, optimize recovery processes, and extend solvent lifespans, ultimately reducing the total cost of ownership.Expand Specific Solutions04 Supply chain optimization for solvent systems

Supply chain optimization plays a crucial role in managing the total cost of ownership for solvent systems. This includes strategic sourcing of solvents, inventory management, logistics planning, and supplier relationship management. Advanced supply chain models can help organizations balance the costs of procurement, storage, handling, and disposal while ensuring continuous availability of required solvents. Integration with enterprise resource planning systems enables real-time visibility and more effective decision-making regarding solvent acquisition and replacement.Expand Specific Solutions05 Digital transformation and automation in solvent management

Digital transformation and automation technologies are revolutionizing solvent management and TCO analysis. IoT sensors, digital twins, automated monitoring systems, and integrated software platforms enable real-time tracking of solvent performance, recovery efficiency, and cost factors. These technologies facilitate more precise TCO calculations by providing accurate data on solvent usage patterns, recovery rates, energy consumption, and maintenance needs. Automation of recovery processes can significantly reduce labor costs and improve consistency, further optimizing the total cost of ownership.Expand Specific Solutions

Key Industry Players in Solvent Technology Solutions

The solvent recovery versus replacement market is currently in a growth phase, with increasing environmental regulations driving adoption. The global solvent recovery market is projected to expand significantly due to cost-efficiency benefits and sustainability requirements. Technologically, the field shows varying maturity levels across different applications. Leading players like ExxonMobil Chemical, Shell Oil, and Sinopec are advancing proprietary recovery technologies, while LG Chem and AGC focus on developing environmentally friendly solvent alternatives. Research institutions including Rice University and Dalian Institute of Chemical Physics are contributing breakthrough innovations in green chemistry approaches. The competitive landscape features both established petrochemical giants investing in efficiency improvements and specialized technology providers offering targeted solutions for specific industrial applications.

China Petroleum & Chemical Corp.

Technical Solution: China Petroleum & Chemical Corp. (Sinopec) has developed advanced solvent recovery systems utilizing membrane separation technology combined with multi-stage distillation. Their approach focuses on energy-efficient recovery of high-value solvents in petrochemical processes, achieving recovery rates of up to 98% for common industrial solvents. Sinopec's integrated solution incorporates real-time monitoring systems that optimize recovery parameters based on solvent composition and process conditions. Their TCO analysis framework evaluates recovery versus replacement by considering energy consumption (typically 30-40% lower with recovery), equipment maintenance costs, and environmental compliance expenses. Sinopec has implemented these systems across multiple refineries, demonstrating payback periods of 1.5-3 years depending on solvent costs and processing volumes[1][3].

Strengths: High recovery efficiency with minimal solvent degradation; integrated with existing refinery infrastructure; reduced waste disposal costs and environmental impact. Weaknesses: Higher initial capital investment compared to simple replacement strategies; requires specialized technical expertise for operation and maintenance.

ExxonMobil Chemical Patents, Inc.

Technical Solution: ExxonMobil Chemical has developed a comprehensive solvent management system that integrates both recovery and strategic replacement technologies. Their approach utilizes a hybrid distillation-adsorption process that achieves recovery rates of 95-99% for most industrial solvents while maintaining solvent purity specifications. ExxonMobil's proprietary adsorbent materials extend recovery cycles by selectively removing contaminants that would otherwise degrade solvent performance. Their TCO analysis framework incorporates sophisticated modeling of energy consumption, maintenance requirements, and environmental compliance costs. The company's data indicates that solvent recovery becomes economically advantageous when annual solvent usage exceeds approximately 20,000 gallons and when solvent costs exceed $3.00/gallon. Their systems typically demonstrate ROI periods of 12-24 months in high-volume applications. ExxonMobil has also developed green solvent alternatives that can replace traditional petrochemical solvents in specific applications, providing a complementary replacement strategy when recovery is not feasible[4][7].

Strengths: Flexible hybrid approach that can be optimized for specific solvent types; proprietary adsorbent materials extend recovery cycles; comprehensive TCO modeling capabilities. Weaknesses: Complex system requires specialized technical expertise; higher initial capital investment; may require significant process modifications for integration.

Critical Technical Innovations in Solvent Management

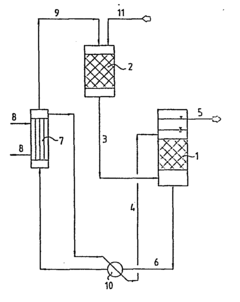

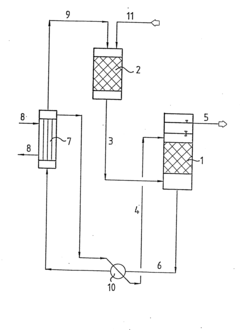

Solvent Recovery System

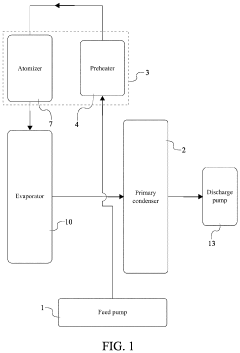

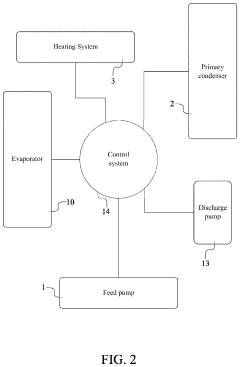

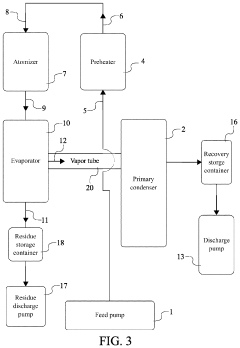

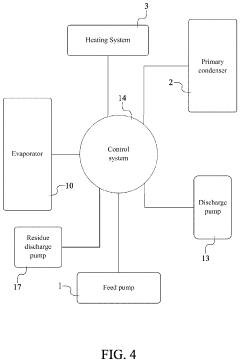

PatentInactiveUS20200070061A1

Innovation

- A solvent recovery system with an improved feed and distribution system using a gear pump and vacuum to continuously feed material to the top of the heat exchanger column, atomizing and evaporating it as it falls, combined with a control system for efficient processing and solvent discharge.

Process for the separation of a mixture of organic compounds and water resulting from the solvent recovery by absorption and desorption

PatentInactiveEP0136539A1

Innovation

- The process involves using an extraction column with highly concentrated lye to separate water from organic compounds, followed by evaporation and recycling the water vapor for desorption, while re-circulating the concentrated liquor to minimize energy use and waste discharge.

Environmental Regulations Impact on Solvent Selection

Environmental regulations have become increasingly stringent worldwide, significantly influencing solvent selection decisions in industrial processes. The regulatory landscape is characterized by a complex web of international, national, and regional frameworks aimed at reducing volatile organic compound (VOC) emissions, hazardous air pollutants (HAPs), and greenhouse gases. These regulations have created a paradigm shift in how industries approach solvent usage, driving both recovery and replacement strategies.

The European Union's REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) regulation and the RoHS (Restriction of Hazardous Substances) directive have established comprehensive frameworks that restrict or phase out certain solvents with adverse environmental profiles. Similarly, the U.S. Environmental Protection Agency's Clean Air Act amendments have imposed strict limitations on solvent emissions, particularly in manufacturing sectors.

These regulatory pressures have created a two-pronged effect on Total Cost of Ownership (TCO) calculations. First, they have increased the operational costs associated with traditional solvent usage through mandatory emission control equipment, monitoring requirements, and compliance documentation. Second, they have introduced potential liability costs through non-compliance penalties, which can range from thousands to millions of dollars depending on the jurisdiction and severity of violations.

For solvent recovery systems, regulatory compliance often necessitates additional capital investments in advanced recovery technologies that can achieve higher capture efficiencies. While these investments increase initial costs, they typically reduce long-term regulatory risks and may qualify for governmental incentives in certain regions, positively affecting the TCO calculation.

Conversely, solvent replacement strategies must navigate a complex approval process for alternative substances. New solvents must undergo extensive toxicological and environmental impact assessments before gaining regulatory acceptance. This creates a significant time-to-market consideration in TCO analysis, as regulatory approval timelines can extend from months to years, depending on the jurisdiction and substance properties.

Regional variations in regulatory frameworks add another layer of complexity to solvent selection decisions. Companies operating globally must consider the most stringent applicable regulations in their TCO analyses, as products and processes may need to comply with multiple regulatory regimes simultaneously. This often favors solvent replacement with universally compliant alternatives rather than maintaining different solvent systems for different markets.

Future regulatory trends indicate continued tightening of restrictions on traditional solvents, particularly those with high global warming potential or persistent environmental impacts. This regulatory forecast must be incorporated into forward-looking TCO analyses, as investments in either recovery or replacement technologies must remain viable under increasingly stringent future regulatory scenarios.

The European Union's REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) regulation and the RoHS (Restriction of Hazardous Substances) directive have established comprehensive frameworks that restrict or phase out certain solvents with adverse environmental profiles. Similarly, the U.S. Environmental Protection Agency's Clean Air Act amendments have imposed strict limitations on solvent emissions, particularly in manufacturing sectors.

These regulatory pressures have created a two-pronged effect on Total Cost of Ownership (TCO) calculations. First, they have increased the operational costs associated with traditional solvent usage through mandatory emission control equipment, monitoring requirements, and compliance documentation. Second, they have introduced potential liability costs through non-compliance penalties, which can range from thousands to millions of dollars depending on the jurisdiction and severity of violations.

For solvent recovery systems, regulatory compliance often necessitates additional capital investments in advanced recovery technologies that can achieve higher capture efficiencies. While these investments increase initial costs, they typically reduce long-term regulatory risks and may qualify for governmental incentives in certain regions, positively affecting the TCO calculation.

Conversely, solvent replacement strategies must navigate a complex approval process for alternative substances. New solvents must undergo extensive toxicological and environmental impact assessments before gaining regulatory acceptance. This creates a significant time-to-market consideration in TCO analysis, as regulatory approval timelines can extend from months to years, depending on the jurisdiction and substance properties.

Regional variations in regulatory frameworks add another layer of complexity to solvent selection decisions. Companies operating globally must consider the most stringent applicable regulations in their TCO analyses, as products and processes may need to comply with multiple regulatory regimes simultaneously. This often favors solvent replacement with universally compliant alternatives rather than maintaining different solvent systems for different markets.

Future regulatory trends indicate continued tightening of restrictions on traditional solvents, particularly those with high global warming potential or persistent environmental impacts. This regulatory forecast must be incorporated into forward-looking TCO analyses, as investments in either recovery or replacement technologies must remain viable under increasingly stringent future regulatory scenarios.

Economic Feasibility Comparison Framework

The economic feasibility comparison framework for solvent recovery versus replacement requires a comprehensive analysis of both direct and indirect costs throughout the entire lifecycle of industrial processes. This framework establishes a structured approach to evaluate the total cost of ownership (TCO) for both strategies, enabling data-driven decision-making for manufacturing operations.

At its core, the framework incorporates capital expenditure (CAPEX) elements including initial equipment investment, installation costs, and facility modifications required for either recovery systems or alternative solvent implementation. For recovery systems, this encompasses distillation units, filtration systems, and storage infrastructure, while replacement scenarios must account for process redesign and compatibility testing with new solvents.

Operational expenditure (OPEX) analysis forms the second pillar of the framework, tracking ongoing costs such as energy consumption, maintenance requirements, and labor needs. Recovery systems typically demonstrate higher energy demands but reduced material costs, whereas replacement strategies may offer energy savings but potentially higher material expenses depending on the alternative solvent selected.

Environmental compliance costs represent a critical dimension often overlooked in traditional analyses. The framework quantifies expenses related to emissions monitoring, waste disposal, regulatory reporting, and potential environmental remediation. These factors have become increasingly significant as regulatory frameworks worldwide impose stricter controls on volatile organic compounds (VOCs) and hazardous air pollutants.

Risk assessment metrics are integrated to account for production disruption potential, market volatility of solvent prices, and regulatory change exposure. This probabilistic approach allows for sensitivity analysis across various scenarios, providing a more robust understanding of long-term economic implications beyond simple payback calculations.

The framework also incorporates productivity impact assessment, measuring throughput effects, product quality consistency, and process reliability under both approaches. This element acknowledges that economic feasibility extends beyond direct costs to include revenue-generating capabilities and market competitiveness.

Time-value adjustments ensure proper accounting for the different temporal profiles of investments and returns between recovery and replacement strategies. Using discounted cash flow analysis with appropriate industry-specific discount rates provides a more accurate comparison of options with different investment horizons and benefit realization timelines.

Finally, the framework includes scalability and flexibility considerations, evaluating how each approach performs under changing production volumes, product mixes, and potential future regulatory scenarios. This forward-looking component ensures that today's economically optimal decision remains viable as business conditions evolve.

At its core, the framework incorporates capital expenditure (CAPEX) elements including initial equipment investment, installation costs, and facility modifications required for either recovery systems or alternative solvent implementation. For recovery systems, this encompasses distillation units, filtration systems, and storage infrastructure, while replacement scenarios must account for process redesign and compatibility testing with new solvents.

Operational expenditure (OPEX) analysis forms the second pillar of the framework, tracking ongoing costs such as energy consumption, maintenance requirements, and labor needs. Recovery systems typically demonstrate higher energy demands but reduced material costs, whereas replacement strategies may offer energy savings but potentially higher material expenses depending on the alternative solvent selected.

Environmental compliance costs represent a critical dimension often overlooked in traditional analyses. The framework quantifies expenses related to emissions monitoring, waste disposal, regulatory reporting, and potential environmental remediation. These factors have become increasingly significant as regulatory frameworks worldwide impose stricter controls on volatile organic compounds (VOCs) and hazardous air pollutants.

Risk assessment metrics are integrated to account for production disruption potential, market volatility of solvent prices, and regulatory change exposure. This probabilistic approach allows for sensitivity analysis across various scenarios, providing a more robust understanding of long-term economic implications beyond simple payback calculations.

The framework also incorporates productivity impact assessment, measuring throughput effects, product quality consistency, and process reliability under both approaches. This element acknowledges that economic feasibility extends beyond direct costs to include revenue-generating capabilities and market competitiveness.

Time-value adjustments ensure proper accounting for the different temporal profiles of investments and returns between recovery and replacement strategies. Using discounted cash flow analysis with appropriate industry-specific discount rates provides a more accurate comparison of options with different investment horizons and benefit realization timelines.

Finally, the framework includes scalability and flexibility considerations, evaluating how each approach performs under changing production volumes, product mixes, and potential future regulatory scenarios. This forward-looking component ensures that today's economically optimal decision remains viable as business conditions evolve.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!