Strategic Insights into CMOS Battery Market Dynamics

JUL 22, 20258 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

CMOS Battery Evolution

The evolution of CMOS batteries has been a crucial aspect of computer technology since their introduction in the 1980s. These small, non-rechargeable lithium batteries have played a vital role in maintaining system settings and real-time clock information when the main power is disconnected. The journey of CMOS batteries began with the advent of personal computers, where they were initially used to power the real-time clock and preserve BIOS settings.

In the early stages, CMOS batteries were relatively large and had limited lifespan. As technology progressed, manufacturers focused on improving battery life and reducing size. The 1990s saw significant advancements in CMOS battery technology, with the introduction of more compact and efficient designs. This period also marked the standardization of CMOS battery types, with the CR2032 coin cell becoming the most widely used format.

The turn of the millennium brought about further refinements in CMOS battery technology. Manufacturers began to develop batteries with enhanced energy density and improved temperature resistance. These advancements allowed for longer battery life and better performance in varying environmental conditions. Additionally, efforts were made to reduce the environmental impact of CMOS batteries by developing more eco-friendly materials and improving recycling processes.

As computer systems became more sophisticated, the role of CMOS batteries expanded beyond just maintaining clock and BIOS settings. They began to support additional functions such as power management features and security settings. This evolution necessitated the development of CMOS batteries with higher capacity and reliability to meet the increasing demands of modern computing systems.

In recent years, the focus has shifted towards integrating CMOS battery functionality into the main system architecture. Some manufacturers have explored alternatives to traditional coin cell batteries, such as rechargeable options or capacitor-based solutions. These innovations aim to address the limitations of conventional CMOS batteries, including the need for periodic replacement and potential environmental concerns.

The ongoing evolution of CMOS batteries continues to be driven by the demands of emerging technologies. As computers become more energy-efficient and compact, there is a growing need for smaller, longer-lasting CMOS power solutions. Furthermore, the rise of Internet of Things (IoT) devices and embedded systems has created new applications for CMOS battery technology, prompting further research and development in this field.

In the early stages, CMOS batteries were relatively large and had limited lifespan. As technology progressed, manufacturers focused on improving battery life and reducing size. The 1990s saw significant advancements in CMOS battery technology, with the introduction of more compact and efficient designs. This period also marked the standardization of CMOS battery types, with the CR2032 coin cell becoming the most widely used format.

The turn of the millennium brought about further refinements in CMOS battery technology. Manufacturers began to develop batteries with enhanced energy density and improved temperature resistance. These advancements allowed for longer battery life and better performance in varying environmental conditions. Additionally, efforts were made to reduce the environmental impact of CMOS batteries by developing more eco-friendly materials and improving recycling processes.

As computer systems became more sophisticated, the role of CMOS batteries expanded beyond just maintaining clock and BIOS settings. They began to support additional functions such as power management features and security settings. This evolution necessitated the development of CMOS batteries with higher capacity and reliability to meet the increasing demands of modern computing systems.

In recent years, the focus has shifted towards integrating CMOS battery functionality into the main system architecture. Some manufacturers have explored alternatives to traditional coin cell batteries, such as rechargeable options or capacitor-based solutions. These innovations aim to address the limitations of conventional CMOS batteries, including the need for periodic replacement and potential environmental concerns.

The ongoing evolution of CMOS batteries continues to be driven by the demands of emerging technologies. As computers become more energy-efficient and compact, there is a growing need for smaller, longer-lasting CMOS power solutions. Furthermore, the rise of Internet of Things (IoT) devices and embedded systems has created new applications for CMOS battery technology, prompting further research and development in this field.

CMOS Battery Demand

The CMOS battery market is experiencing significant growth driven by the increasing demand for electronic devices and the expanding Internet of Things (IoT) ecosystem. As more devices incorporate CMOS technology for maintaining system settings and real-time clock functions, the need for reliable and long-lasting CMOS batteries continues to rise.

Consumer electronics, particularly laptops, desktops, and servers, remain the primary drivers of CMOS battery demand. The global shift towards remote work and digital transformation has accelerated the adoption of personal computing devices, further boosting the market. Additionally, the growing popularity of smart home devices and wearable technology has created new avenues for CMOS battery applications.

In the industrial sector, the demand for CMOS batteries is being fueled by the increasing automation and digitization of manufacturing processes. Industrial control systems, programmable logic controllers (PLCs), and human-machine interfaces (HMIs) all rely on CMOS batteries to maintain critical settings and data integrity during power outages or system shutdowns.

The automotive industry is emerging as a significant consumer of CMOS batteries, driven by the rapid advancement of in-vehicle infotainment systems and advanced driver-assistance systems (ADAS). As vehicles become more connected and feature-rich, the need for reliable power backup for onboard computers and memory systems grows, creating a substantial market opportunity for CMOS battery manufacturers.

The healthcare sector is another area experiencing increased demand for CMOS batteries. Medical devices, diagnostic equipment, and patient monitoring systems often require CMOS batteries to maintain accurate timekeeping and preserve critical patient data. The ongoing digitization of healthcare services and the rise of telemedicine are expected to further drive this demand.

Geographically, Asia-Pacific leads the CMOS battery market, with China, Japan, and South Korea being major contributors. The region's dominance is attributed to its strong presence in electronics manufacturing and the rapid adoption of IoT technologies. North America and Europe follow closely, driven by technological advancements in automotive and industrial sectors.

The demand for CMOS batteries is also influenced by the growing emphasis on energy efficiency and environmental sustainability. Manufacturers are focusing on developing batteries with longer lifespans and improved performance to meet the evolving needs of various industries. This trend is expected to drive innovation in CMOS battery technology, potentially leading to the development of more eco-friendly and efficient power solutions.

Consumer electronics, particularly laptops, desktops, and servers, remain the primary drivers of CMOS battery demand. The global shift towards remote work and digital transformation has accelerated the adoption of personal computing devices, further boosting the market. Additionally, the growing popularity of smart home devices and wearable technology has created new avenues for CMOS battery applications.

In the industrial sector, the demand for CMOS batteries is being fueled by the increasing automation and digitization of manufacturing processes. Industrial control systems, programmable logic controllers (PLCs), and human-machine interfaces (HMIs) all rely on CMOS batteries to maintain critical settings and data integrity during power outages or system shutdowns.

The automotive industry is emerging as a significant consumer of CMOS batteries, driven by the rapid advancement of in-vehicle infotainment systems and advanced driver-assistance systems (ADAS). As vehicles become more connected and feature-rich, the need for reliable power backup for onboard computers and memory systems grows, creating a substantial market opportunity for CMOS battery manufacturers.

The healthcare sector is another area experiencing increased demand for CMOS batteries. Medical devices, diagnostic equipment, and patient monitoring systems often require CMOS batteries to maintain accurate timekeeping and preserve critical patient data. The ongoing digitization of healthcare services and the rise of telemedicine are expected to further drive this demand.

Geographically, Asia-Pacific leads the CMOS battery market, with China, Japan, and South Korea being major contributors. The region's dominance is attributed to its strong presence in electronics manufacturing and the rapid adoption of IoT technologies. North America and Europe follow closely, driven by technological advancements in automotive and industrial sectors.

The demand for CMOS batteries is also influenced by the growing emphasis on energy efficiency and environmental sustainability. Manufacturers are focusing on developing batteries with longer lifespans and improved performance to meet the evolving needs of various industries. This trend is expected to drive innovation in CMOS battery technology, potentially leading to the development of more eco-friendly and efficient power solutions.

Technical Challenges

The CMOS battery market faces several technical challenges that impact its growth and development. One of the primary issues is the limited energy density of current CMOS battery technologies. As electronic devices continue to shrink in size while demanding more power, the energy storage capacity of CMOS batteries struggles to keep pace. This limitation restricts the potential applications and longevity of devices relying on CMOS batteries.

Another significant challenge is the self-discharge rate of CMOS batteries. Over time, these batteries lose their charge even when not in use, which can lead to unexpected device failures and reduced reliability. This issue is particularly problematic for devices that require long-term standby power, such as real-time clocks in computers and other electronic systems.

The manufacturing process of CMOS batteries also presents technical hurdles. Ensuring consistency and quality across large-scale production can be difficult, leading to variations in performance and lifespan among batteries from the same production batch. Additionally, the integration of CMOS batteries into increasingly complex and miniaturized electronic designs poses challenges in terms of form factor and heat management.

Environmental concerns and regulatory pressures add another layer of complexity to CMOS battery development. The use of certain materials in battery production may face restrictions due to their environmental impact or scarcity. This necessitates ongoing research into alternative materials and manufacturing processes that can maintain or improve battery performance while meeting sustainability requirements.

The charging efficiency and cycle life of CMOS batteries also remain areas of concern. Improving these aspects is crucial for enhancing the overall lifespan and reliability of devices powered by CMOS batteries. Furthermore, as the Internet of Things (IoT) and wearable technologies expand, there is a growing demand for CMOS batteries that can operate effectively in diverse environmental conditions, including extreme temperatures and humidity levels.

Lastly, the cost of production remains a significant challenge in the CMOS battery market. Balancing the need for advanced features and improved performance with cost-effective manufacturing processes is essential for widespread adoption and market growth. This challenge is particularly acute when competing with other battery technologies that may offer certain advantages in terms of cost or performance in specific applications.

Another significant challenge is the self-discharge rate of CMOS batteries. Over time, these batteries lose their charge even when not in use, which can lead to unexpected device failures and reduced reliability. This issue is particularly problematic for devices that require long-term standby power, such as real-time clocks in computers and other electronic systems.

The manufacturing process of CMOS batteries also presents technical hurdles. Ensuring consistency and quality across large-scale production can be difficult, leading to variations in performance and lifespan among batteries from the same production batch. Additionally, the integration of CMOS batteries into increasingly complex and miniaturized electronic designs poses challenges in terms of form factor and heat management.

Environmental concerns and regulatory pressures add another layer of complexity to CMOS battery development. The use of certain materials in battery production may face restrictions due to their environmental impact or scarcity. This necessitates ongoing research into alternative materials and manufacturing processes that can maintain or improve battery performance while meeting sustainability requirements.

The charging efficiency and cycle life of CMOS batteries also remain areas of concern. Improving these aspects is crucial for enhancing the overall lifespan and reliability of devices powered by CMOS batteries. Furthermore, as the Internet of Things (IoT) and wearable technologies expand, there is a growing demand for CMOS batteries that can operate effectively in diverse environmental conditions, including extreme temperatures and humidity levels.

Lastly, the cost of production remains a significant challenge in the CMOS battery market. Balancing the need for advanced features and improved performance with cost-effective manufacturing processes is essential for widespread adoption and market growth. This challenge is particularly acute when competing with other battery technologies that may offer certain advantages in terms of cost or performance in specific applications.

Current Solutions

01 CMOS battery power management

CMOS batteries play a crucial role in maintaining system settings and real-time clock functions in electronic devices. Power management techniques are implemented to optimize battery life and performance, including low-power modes and efficient charging mechanisms.- CMOS battery power management: CMOS batteries play a crucial role in maintaining system settings and real-time clock functions in electronic devices. Power management techniques are implemented to optimize battery life and performance, including low-power modes and efficient charging mechanisms.

- Market trends in CMOS battery technology: The CMOS battery market is evolving with advancements in battery chemistry, form factors, and integration techniques. Trends include the development of longer-lasting batteries, miniaturization for portable devices, and increased demand in various electronic sectors.

- CMOS battery applications in imaging devices: CMOS batteries are essential components in digital cameras, smartphones, and other imaging devices. They support various functions, including maintaining camera settings, powering image sensors, and enabling quick start-up capabilities.

- CMOS battery market analysis and forecasting: Market analysis tools and methods are employed to study CMOS battery market dynamics, including demand forecasting, competitive landscape assessment, and identification of growth opportunities in different regions and application sectors.

- CMOS battery integration in semiconductor devices: The integration of CMOS batteries with semiconductor devices is a key area of development. This includes on-chip battery solutions, advanced packaging techniques, and the optimization of battery-semiconductor interfaces for improved performance and reliability.

02 Market trends in CMOS battery technology

The CMOS battery market is evolving with advancements in battery chemistry, form factors, and integration techniques. Trends include the development of longer-lasting batteries, miniaturization for portable devices, and increased demand in various electronic applications.Expand Specific Solutions03 CMOS battery replacement and monitoring systems

Innovations in CMOS battery replacement and monitoring systems are emerging to address the need for timely battery replacement and prevent data loss. These systems include predictive maintenance algorithms and remote monitoring capabilities for efficient battery management.Expand Specific Solutions04 Integration of CMOS batteries in semiconductor devices

The integration of CMOS batteries with semiconductor devices is advancing, leading to more compact and efficient electronic systems. This includes on-chip battery solutions and improved packaging techniques for better performance and reliability.Expand Specific Solutions05 Environmental and regulatory factors affecting CMOS battery market

Environmental concerns and regulatory requirements are influencing the CMOS battery market. This includes the development of more eco-friendly battery materials, recycling initiatives, and compliance with international standards for battery production and disposal.Expand Specific Solutions

Market Competitors

The CMOS battery market is in a mature stage, characterized by steady growth and widespread adoption across various electronic devices. The global market size is estimated to be in the billions of dollars, driven by the increasing demand for portable electronics and automotive applications. Technologically, CMOS batteries have reached a high level of maturity, with incremental improvements focusing on longevity, size reduction, and environmental sustainability. Key players like GLOBALFOUNDRIES, Taiwan Semiconductor Manufacturing Co., and Renesas Electronics are at the forefront of innovation, leveraging their semiconductor expertise to enhance CMOS battery performance. Emerging trends include the integration of CMOS batteries with advanced power management systems and the development of more energy-efficient designs to meet the demands of next-generation devices.

Taiwan Semiconductor Manufacturing Co., Ltd.

Technical Solution: TSMC has developed advanced CMOS battery technology for IoT and wearable devices. Their ultra-low-power CMOS process allows for extended battery life in small form factor applications. TSMC's 22nm ultra-low leakage (22ULL) process technology enables up to 30% lower power consumption compared to their previous generation[1]. They have also introduced innovative packaging solutions like InFO (Integrated Fan-Out) that allow for thinner devices with improved thermal performance, which is crucial for battery-powered devices[2].

Strengths: Industry-leading process technology, high manufacturing capacity, and strong R&D capabilities. Weaknesses: High capital expenditure requirements and potential geopolitical risks due to its location.

Infineon Technologies AG

Technical Solution: Infineon has made significant strides in CMOS battery management systems (BMS) for electric vehicles and energy storage systems. Their AURIX™ microcontroller family, based on advanced CMOS technology, offers high-performance computing for battery management in EVs. Infineon's BMS solutions provide accurate cell voltage and temperature measurements, with a measurement accuracy of up to 1mV[3]. They have also developed intelligent battery sensors that can measure current with an accuracy of ±1% and voltage with ±0.1% accuracy, enhancing overall battery performance and longevity[4].

Strengths: Strong presence in automotive and power management markets, advanced BMS solutions. Weaknesses: Exposure to cyclical semiconductor market, intense competition in power semiconductor segment.

Key Innovations

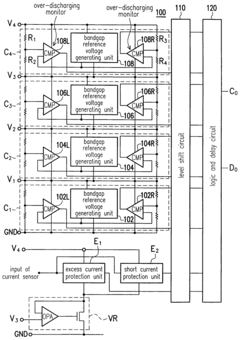

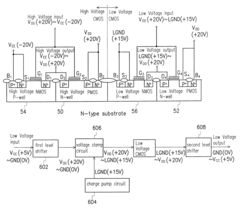

Complementary metal oxide semiconductor structure for battery protection circuit and battery protection circuit having the same

PatentInactiveUS20050052802A1

Innovation

- The implementation of a CMOS structure using tri-well or buried layer techniques allows for a battery protection circuit that operates at relatively low voltage, isolates substrate noise, and includes overcharging and over-discharging units, excess current protection, and short circuit protection, utilizing NMOS and PMOS transistors with specific voltage configurations and a bandgap reference voltage-generating unit to monitor and regulate battery voltage and current.

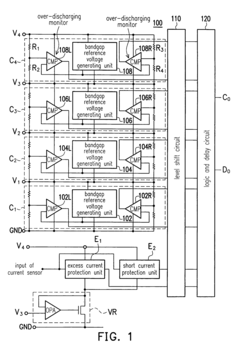

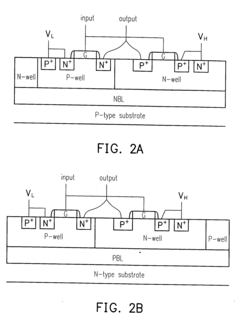

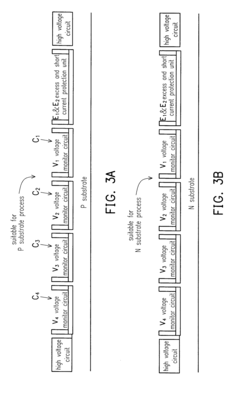

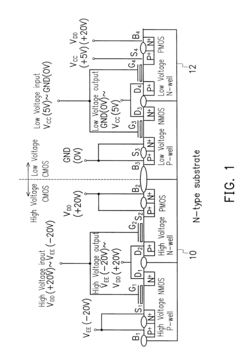

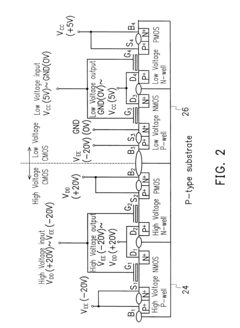

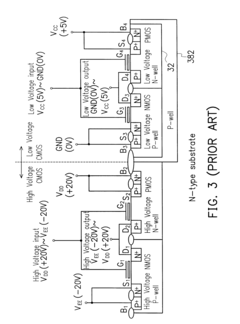

Complementary metal-oxide semiconductor device

PatentInactiveUS6403992B1

Innovation

- Employs circuit conversion to achieve coexistent multiple voltage levels without body effect in a CMOS device.

- Utilizes a typical twin-well process to form high voltage and low voltage CMOS structures within the same device.

- Implements a circuit converter to adjust operation voltages between high and low voltage CMOS components, eliminating body effect.

Regulatory Framework

The regulatory framework surrounding CMOS battery production, distribution, and disposal plays a crucial role in shaping market dynamics and industry practices. Environmental regulations, particularly those focused on hazardous waste management and electronic waste (e-waste) disposal, significantly impact the CMOS battery market.

Many countries have implemented strict regulations governing the use of certain materials in electronic components, including batteries. The European Union's Restriction of Hazardous Substances (RoHS) Directive, for instance, limits the use of lead, mercury, and other harmful substances in electronic equipment. This has prompted manufacturers to develop CMOS batteries that comply with these standards, driving innovation in materials and design.

Battery disposal regulations also influence market strategies and product lifecycles. The EU's Battery Directive mandates the collection and recycling of batteries, including those used in electronic devices. Similar regulations exist in other regions, such as North America and Asia, creating a global push towards more sustainable battery production and disposal practices.

Safety standards for lithium-based batteries, which are commonly used in CMOS applications, have become increasingly stringent. Regulations such as the UN Manual of Tests and Criteria for lithium batteries set requirements for transportation and storage, impacting supply chain logistics and costs for manufacturers and distributors.

Energy efficiency regulations indirectly affect the CMOS battery market by driving demand for low-power electronic devices. As governments worldwide implement stricter energy consumption standards for consumer electronics and industrial equipment, there is a growing need for CMOS batteries that can support longer standby times and more efficient power management systems.

Intellectual property regulations also play a significant role in the CMOS battery market. Patent laws and licensing agreements can influence market entry barriers, technology transfer, and innovation rates within the industry. Companies must navigate complex patent landscapes to develop and commercialize new CMOS battery technologies.

As the Internet of Things (IoT) and wearable technologies continue to expand, regulatory bodies are increasingly focusing on the security and privacy implications of battery-powered devices. This has led to the development of new standards and regulations that CMOS battery manufacturers must consider in their product designs, particularly for applications in sensitive sectors such as healthcare and finance.

Many countries have implemented strict regulations governing the use of certain materials in electronic components, including batteries. The European Union's Restriction of Hazardous Substances (RoHS) Directive, for instance, limits the use of lead, mercury, and other harmful substances in electronic equipment. This has prompted manufacturers to develop CMOS batteries that comply with these standards, driving innovation in materials and design.

Battery disposal regulations also influence market strategies and product lifecycles. The EU's Battery Directive mandates the collection and recycling of batteries, including those used in electronic devices. Similar regulations exist in other regions, such as North America and Asia, creating a global push towards more sustainable battery production and disposal practices.

Safety standards for lithium-based batteries, which are commonly used in CMOS applications, have become increasingly stringent. Regulations such as the UN Manual of Tests and Criteria for lithium batteries set requirements for transportation and storage, impacting supply chain logistics and costs for manufacturers and distributors.

Energy efficiency regulations indirectly affect the CMOS battery market by driving demand for low-power electronic devices. As governments worldwide implement stricter energy consumption standards for consumer electronics and industrial equipment, there is a growing need for CMOS batteries that can support longer standby times and more efficient power management systems.

Intellectual property regulations also play a significant role in the CMOS battery market. Patent laws and licensing agreements can influence market entry barriers, technology transfer, and innovation rates within the industry. Companies must navigate complex patent landscapes to develop and commercialize new CMOS battery technologies.

As the Internet of Things (IoT) and wearable technologies continue to expand, regulatory bodies are increasingly focusing on the security and privacy implications of battery-powered devices. This has led to the development of new standards and regulations that CMOS battery manufacturers must consider in their product designs, particularly for applications in sensitive sectors such as healthcare and finance.

Environmental Impact

The environmental impact of CMOS batteries in the market dynamics is a crucial aspect that requires careful consideration. These small but essential components play a significant role in maintaining system configurations and real-time clocks in various electronic devices. However, their production, use, and disposal have notable environmental implications.

The manufacturing process of CMOS batteries involves the use of various materials, including lithium, manganese dioxide, and other chemical compounds. The extraction and processing of these raw materials contribute to environmental degradation, including habitat destruction, water pollution, and greenhouse gas emissions. Additionally, the energy-intensive production processes further exacerbate the carbon footprint associated with CMOS batteries.

During their operational life, CMOS batteries have a relatively low environmental impact due to their long lifespan and low power consumption. However, the improper disposal of these batteries at the end of their life cycle poses significant environmental risks. When discarded in landfills, the chemicals within the batteries can leach into soil and groundwater, potentially contaminating ecosystems and posing threats to human health.

The growing demand for electronic devices has led to an increase in CMOS battery production and consumption. This trend raises concerns about the cumulative environmental impact of these components. As the market expands, there is a pressing need for sustainable practices throughout the battery lifecycle, from production to disposal.

Efforts to mitigate the environmental impact of CMOS batteries are gaining traction in the industry. Manufacturers are exploring more eco-friendly materials and production processes to reduce the environmental footprint of these components. Additionally, there is a growing focus on improving battery efficiency and lifespan, which can help reduce the overall number of batteries produced and discarded.

Recycling initiatives for CMOS batteries are also emerging as a critical strategy to address environmental concerns. Proper recycling can recover valuable materials, reduce the need for raw material extraction, and prevent hazardous substances from entering the environment. However, the small size of CMOS batteries often makes them challenging to collect and recycle efficiently, highlighting the need for improved recycling technologies and infrastructure.

As environmental regulations become more stringent globally, the CMOS battery market is likely to face increased pressure to adopt sustainable practices. This shift may drive innovation in battery design, materials, and recycling technologies, potentially reshaping the market dynamics and competitive landscape in the coming years.

The manufacturing process of CMOS batteries involves the use of various materials, including lithium, manganese dioxide, and other chemical compounds. The extraction and processing of these raw materials contribute to environmental degradation, including habitat destruction, water pollution, and greenhouse gas emissions. Additionally, the energy-intensive production processes further exacerbate the carbon footprint associated with CMOS batteries.

During their operational life, CMOS batteries have a relatively low environmental impact due to their long lifespan and low power consumption. However, the improper disposal of these batteries at the end of their life cycle poses significant environmental risks. When discarded in landfills, the chemicals within the batteries can leach into soil and groundwater, potentially contaminating ecosystems and posing threats to human health.

The growing demand for electronic devices has led to an increase in CMOS battery production and consumption. This trend raises concerns about the cumulative environmental impact of these components. As the market expands, there is a pressing need for sustainable practices throughout the battery lifecycle, from production to disposal.

Efforts to mitigate the environmental impact of CMOS batteries are gaining traction in the industry. Manufacturers are exploring more eco-friendly materials and production processes to reduce the environmental footprint of these components. Additionally, there is a growing focus on improving battery efficiency and lifespan, which can help reduce the overall number of batteries produced and discarded.

Recycling initiatives for CMOS batteries are also emerging as a critical strategy to address environmental concerns. Proper recycling can recover valuable materials, reduce the need for raw material extraction, and prevent hazardous substances from entering the environment. However, the small size of CMOS batteries often makes them challenging to collect and recycle efficiently, highlighting the need for improved recycling technologies and infrastructure.

As environmental regulations become more stringent globally, the CMOS battery market is likely to face increased pressure to adopt sustainable practices. This shift may drive innovation in battery design, materials, and recycling technologies, potentially reshaping the market dynamics and competitive landscape in the coming years.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!