Strategic Insights into Growing CMOS Battery Market Opportunities

JUL 22, 20258 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

CMOS Battery Evolution

The evolution of CMOS batteries has been a critical factor in the advancement of modern electronics. Initially developed in the 1980s, these small but essential components have undergone significant improvements to meet the growing demands of increasingly sophisticated devices.

In the early stages, CMOS batteries were primarily used to maintain basic system settings and real-time clock functions in personal computers. These first-generation batteries were typically lithium-based and had a lifespan of about 3-5 years. As technology progressed, the role of CMOS batteries expanded to support more complex operations in a wider range of devices.

The 1990s saw a shift towards more energy-efficient CMOS designs, which helped extend battery life. Manufacturers began to focus on reducing power consumption in standby modes, a crucial factor for portable devices. This period also marked the introduction of rechargeable CMOS batteries, offering a more sustainable solution for long-term use.

The turn of the millennium brought about miniaturization trends in electronics, driving the need for smaller, yet more powerful CMOS batteries. This led to the development of thin-film lithium batteries, which offered higher energy density in a compact form factor. These advancements enabled the integration of CMOS batteries into smaller devices like smartphones and wearables.

In recent years, the focus has shifted towards enhancing the longevity and reliability of CMOS batteries. Improved chemical compositions and manufacturing processes have resulted in batteries that can maintain charge for up to 10 years or more. This extended lifespan is crucial for applications in industrial equipment, medical devices, and automotive systems where frequent battery replacement is impractical.

The latest developments in CMOS battery technology are centered around sustainability and environmental concerns. Manufacturers are exploring alternatives to traditional lithium-based batteries, such as solid-state electrolytes and bio-based materials. These innovations aim to reduce the environmental impact of battery production and disposal while maintaining or improving performance.

Looking ahead, the evolution of CMOS batteries is likely to be driven by the demands of emerging technologies such as Internet of Things (IoT) devices, autonomous systems, and advanced wearables. The focus will be on developing batteries that can provide longer-lasting power in even smaller form factors, while also addressing concerns about sustainability and recyclability.

In the early stages, CMOS batteries were primarily used to maintain basic system settings and real-time clock functions in personal computers. These first-generation batteries were typically lithium-based and had a lifespan of about 3-5 years. As technology progressed, the role of CMOS batteries expanded to support more complex operations in a wider range of devices.

The 1990s saw a shift towards more energy-efficient CMOS designs, which helped extend battery life. Manufacturers began to focus on reducing power consumption in standby modes, a crucial factor for portable devices. This period also marked the introduction of rechargeable CMOS batteries, offering a more sustainable solution for long-term use.

The turn of the millennium brought about miniaturization trends in electronics, driving the need for smaller, yet more powerful CMOS batteries. This led to the development of thin-film lithium batteries, which offered higher energy density in a compact form factor. These advancements enabled the integration of CMOS batteries into smaller devices like smartphones and wearables.

In recent years, the focus has shifted towards enhancing the longevity and reliability of CMOS batteries. Improved chemical compositions and manufacturing processes have resulted in batteries that can maintain charge for up to 10 years or more. This extended lifespan is crucial for applications in industrial equipment, medical devices, and automotive systems where frequent battery replacement is impractical.

The latest developments in CMOS battery technology are centered around sustainability and environmental concerns. Manufacturers are exploring alternatives to traditional lithium-based batteries, such as solid-state electrolytes and bio-based materials. These innovations aim to reduce the environmental impact of battery production and disposal while maintaining or improving performance.

Looking ahead, the evolution of CMOS batteries is likely to be driven by the demands of emerging technologies such as Internet of Things (IoT) devices, autonomous systems, and advanced wearables. The focus will be on developing batteries that can provide longer-lasting power in even smaller form factors, while also addressing concerns about sustainability and recyclability.

Market Demand Analysis

The CMOS battery market is experiencing significant growth, driven by the increasing demand for electronic devices and the expanding applications of CMOS technology. As consumer electronics, automotive systems, and industrial equipment continue to evolve, the need for reliable and long-lasting power sources has become paramount. CMOS batteries, known for their low power consumption and high stability, have emerged as a crucial component in maintaining system settings and real-time clocks in various electronic devices.

Market research indicates a robust growth trajectory for the CMOS battery sector. The global market size is expected to expand substantially over the next five years, with a compound annual growth rate (CAGR) outpacing many other segments in the battery industry. This growth is primarily attributed to the rising adoption of CMOS batteries in smartphones, laptops, tablets, and other portable electronic devices, where maintaining system integrity during power-off states is critical.

The automotive industry represents a particularly promising market for CMOS batteries. As vehicles become increasingly computerized and electrified, the demand for reliable, low-power memory retention solutions has surged. CMOS batteries play a vital role in preserving vehicle settings, diagnostic information, and security codes, even when the main power source is disconnected. This application is expected to be a significant driver of market growth in the coming years.

In the industrial sector, CMOS batteries are finding new applications in smart manufacturing systems, IoT devices, and industrial control equipment. The need for uninterrupted operation and data retention in these systems has created a steady demand for high-quality CMOS batteries. This trend is likely to continue as Industry 4.0 initiatives gain momentum globally.

Geographically, Asia-Pacific is anticipated to be the fastest-growing market for CMOS batteries, fueled by the region's dominant position in electronics manufacturing and the rapid adoption of new technologies. North America and Europe are also expected to maintain strong market positions, driven by advancements in automotive and industrial applications.

The market demand for CMOS batteries is further influenced by the increasing focus on energy efficiency and environmental sustainability. As manufacturers strive to develop more eco-friendly and longer-lasting power solutions, innovations in CMOS battery technology are likely to emerge. This includes the development of higher capacity batteries, improved charge retention capabilities, and the exploration of new materials to enhance performance and reduce environmental impact.

Consumer preferences for devices with longer battery life and reduced maintenance requirements are also shaping the CMOS battery market. Manufacturers are responding by investing in research and development to create batteries that can support extended operational lifespans while maintaining reliability and performance. This trend is expected to drive market growth and foster innovation in the CMOS battery sector.

Market research indicates a robust growth trajectory for the CMOS battery sector. The global market size is expected to expand substantially over the next five years, with a compound annual growth rate (CAGR) outpacing many other segments in the battery industry. This growth is primarily attributed to the rising adoption of CMOS batteries in smartphones, laptops, tablets, and other portable electronic devices, where maintaining system integrity during power-off states is critical.

The automotive industry represents a particularly promising market for CMOS batteries. As vehicles become increasingly computerized and electrified, the demand for reliable, low-power memory retention solutions has surged. CMOS batteries play a vital role in preserving vehicle settings, diagnostic information, and security codes, even when the main power source is disconnected. This application is expected to be a significant driver of market growth in the coming years.

In the industrial sector, CMOS batteries are finding new applications in smart manufacturing systems, IoT devices, and industrial control equipment. The need for uninterrupted operation and data retention in these systems has created a steady demand for high-quality CMOS batteries. This trend is likely to continue as Industry 4.0 initiatives gain momentum globally.

Geographically, Asia-Pacific is anticipated to be the fastest-growing market for CMOS batteries, fueled by the region's dominant position in electronics manufacturing and the rapid adoption of new technologies. North America and Europe are also expected to maintain strong market positions, driven by advancements in automotive and industrial applications.

The market demand for CMOS batteries is further influenced by the increasing focus on energy efficiency and environmental sustainability. As manufacturers strive to develop more eco-friendly and longer-lasting power solutions, innovations in CMOS battery technology are likely to emerge. This includes the development of higher capacity batteries, improved charge retention capabilities, and the exploration of new materials to enhance performance and reduce environmental impact.

Consumer preferences for devices with longer battery life and reduced maintenance requirements are also shaping the CMOS battery market. Manufacturers are responding by investing in research and development to create batteries that can support extended operational lifespans while maintaining reliability and performance. This trend is expected to drive market growth and foster innovation in the CMOS battery sector.

Technical Challenges

The CMOS battery market faces several technical challenges that impact its growth and development. One of the primary issues is the limited energy density of CMOS batteries compared to other battery technologies. This constraint affects the overall performance and longevity of devices relying on CMOS batteries, particularly in applications requiring extended power backup.

Another significant challenge is the self-discharge rate of CMOS batteries. Over time, these batteries gradually lose their charge even when not in use, which can lead to data loss and system failures if not addressed properly. This characteristic necessitates regular replacement or recharging, increasing maintenance costs and potential downtime for critical systems.

The temperature sensitivity of CMOS batteries presents another hurdle. Extreme temperatures, both hot and cold, can significantly impact battery performance and lifespan. This sensitivity limits the use of CMOS batteries in certain environments and applications, particularly in industrial or outdoor settings where temperature fluctuations are common.

Miniaturization is an ongoing challenge in the CMOS battery market. As electronic devices continue to shrink in size, there is a growing demand for smaller, yet equally powerful CMOS batteries. Balancing size reduction with maintaining or improving energy capacity remains a complex technical problem for manufacturers.

The environmental impact of CMOS batteries is also a pressing concern. Many of these batteries contain materials that are not easily recyclable or pose environmental risks if not disposed of properly. Developing more eco-friendly alternatives while maintaining performance standards is a significant technical challenge facing the industry.

Compatibility issues with evolving electronic systems pose another challenge. As new technologies and device architectures emerge, CMOS batteries must adapt to new power requirements and form factors. This necessitates continuous innovation in battery design and manufacturing processes.

Lastly, the cost of production remains a hurdle in the widespread adoption of advanced CMOS battery technologies. Developing batteries with improved performance characteristics often involves expensive materials and complex manufacturing processes, which can limit market penetration, especially in price-sensitive segments.

Addressing these technical challenges is crucial for unlocking the full potential of the CMOS battery market. Overcoming these hurdles will not only drive market growth but also enable new applications and improve the reliability of electronic systems across various industries.

Another significant challenge is the self-discharge rate of CMOS batteries. Over time, these batteries gradually lose their charge even when not in use, which can lead to data loss and system failures if not addressed properly. This characteristic necessitates regular replacement or recharging, increasing maintenance costs and potential downtime for critical systems.

The temperature sensitivity of CMOS batteries presents another hurdle. Extreme temperatures, both hot and cold, can significantly impact battery performance and lifespan. This sensitivity limits the use of CMOS batteries in certain environments and applications, particularly in industrial or outdoor settings where temperature fluctuations are common.

Miniaturization is an ongoing challenge in the CMOS battery market. As electronic devices continue to shrink in size, there is a growing demand for smaller, yet equally powerful CMOS batteries. Balancing size reduction with maintaining or improving energy capacity remains a complex technical problem for manufacturers.

The environmental impact of CMOS batteries is also a pressing concern. Many of these batteries contain materials that are not easily recyclable or pose environmental risks if not disposed of properly. Developing more eco-friendly alternatives while maintaining performance standards is a significant technical challenge facing the industry.

Compatibility issues with evolving electronic systems pose another challenge. As new technologies and device architectures emerge, CMOS batteries must adapt to new power requirements and form factors. This necessitates continuous innovation in battery design and manufacturing processes.

Lastly, the cost of production remains a hurdle in the widespread adoption of advanced CMOS battery technologies. Developing batteries with improved performance characteristics often involves expensive materials and complex manufacturing processes, which can limit market penetration, especially in price-sensitive segments.

Addressing these technical challenges is crucial for unlocking the full potential of the CMOS battery market. Overcoming these hurdles will not only drive market growth but also enable new applications and improve the reliability of electronic systems across various industries.

Current Solutions

01 Market analysis and forecasting for CMOS batteries

Analyzing market trends, consumer behavior, and industry forecasts to identify opportunities in the CMOS battery market. This includes studying demand patterns, technological advancements, and potential growth areas to make informed business decisions and develop strategic plans.- Market analysis and forecasting for CMOS batteries: Analyzing market trends, consumer behavior, and technological advancements to forecast demand and identify opportunities in the CMOS battery market. This includes studying market segmentation, competitive landscape, and potential growth areas to guide business strategies and investment decisions.

- Integration of CMOS batteries in IoT devices: Exploring opportunities for CMOS batteries in the rapidly growing Internet of Things (IoT) market. This involves developing compact, long-lasting CMOS batteries suitable for various IoT applications, such as smart home devices, wearables, and industrial sensors.

- Sustainable and eco-friendly CMOS battery solutions: Developing environmentally friendly CMOS batteries to meet growing consumer demand for sustainable products. This includes researching recyclable materials, improving energy efficiency, and implementing eco-friendly manufacturing processes to reduce the environmental impact of CMOS batteries.

- CMOS battery management systems: Creating advanced battery management systems specifically designed for CMOS batteries to optimize performance, extend lifespan, and improve overall efficiency. This involves developing software and hardware solutions for monitoring battery health, managing power consumption, and implementing smart charging technologies.

- CMOS battery supply chain optimization: Improving the supply chain for CMOS batteries to reduce costs, increase efficiency, and ensure a stable supply of components. This includes implementing advanced logistics systems, developing strategic partnerships with suppliers, and leveraging data analytics to optimize inventory management and production planning.

02 Integration of CMOS batteries in electronic devices

Exploring opportunities for integrating CMOS batteries into various electronic devices, such as computers, smartphones, and IoT devices. This involves developing innovative designs, improving battery performance, and enhancing compatibility with different device architectures to meet evolving market demands.Expand Specific Solutions03 E-commerce and digital platforms for CMOS battery sales

Leveraging e-commerce platforms and digital marketplaces to expand the reach of CMOS battery products. This includes developing online sales strategies, implementing digital marketing techniques, and utilizing data analytics to optimize sales and customer engagement in the digital space.Expand Specific Solutions04 Sustainable and eco-friendly CMOS battery solutions

Developing environmentally friendly CMOS battery technologies and recycling programs to address growing consumer demand for sustainable products. This involves researching new materials, improving energy efficiency, and implementing responsible disposal methods to reduce environmental impact.Expand Specific Solutions05 CMOS battery market expansion in emerging economies

Identifying and capitalizing on opportunities in emerging markets for CMOS batteries. This includes adapting products to local needs, establishing distribution networks, and developing market entry strategies to tap into the growing demand for electronic devices in developing countries.Expand Specific Solutions

Key Industry Players

The CMOS battery market is in a growth phase, driven by increasing demand for electronic devices and automotive applications. The market size is expanding rapidly, with projections indicating significant growth in the coming years. Technologically, CMOS batteries are evolving to meet higher performance and longevity requirements. Key players like Texas Instruments, NXP Semiconductors, and GLOBALFOUNDRIES are investing in R&D to enhance battery efficiency and reduce power consumption. Taiwan Semiconductor Manufacturing Co. and Samsung SDI are also making strides in advanced manufacturing processes for CMOS batteries. The competitive landscape is intensifying as companies like LG Energy Solution and Panasonic enter the market, focusing on innovative energy storage solutions for diverse applications.

Taiwan Semiconductor Manufacturing Co., Ltd.

Technical Solution: TSMC has developed advanced CMOS battery management ICs using their leading-edge process nodes. Their 16nm FinFET and 7nm processes enable highly integrated, low-power battery management systems for various applications. TSMC's CMOS battery solutions incorporate precision analog circuits, efficient power conversion, and advanced security features. The company has also made progress in 3D IC integration, allowing for more compact and efficient battery management designs[1][3]. TSMC's foundry capabilities enable fabless companies to innovate in CMOS battery technologies, fostering a diverse ecosystem of solutions.

Strengths: Advanced process nodes, high integration capabilities, and ecosystem support. Weaknesses: Reliance on fabless customers for end-product development and market-specific optimizations.

Texas Instruments Incorporated

Technical Solution: Texas Instruments has developed a comprehensive portfolio of CMOS battery management solutions. Their BQ series of ICs includes advanced features such as high-precision coulomb counting, cell balancing, and safety monitoring. TI's CMOS battery products utilize their proprietary mixed-signal process technology, enabling high integration and low power consumption. The company has also introduced innovations like the bq34z100-G1, which incorporates machine learning algorithms for improved battery life estimation[2][4]. TI's solutions cater to a wide range of applications, from consumer electronics to industrial and automotive sectors.

Strengths: Broad product portfolio, advanced features, and strong presence in multiple markets. Weaknesses: Potential challenges in competing with more specialized battery management startups in emerging applications.

Innovative Patents

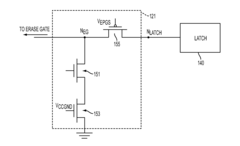

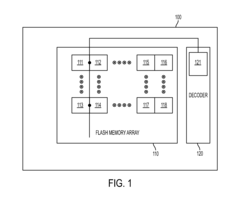

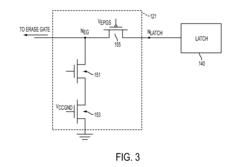

Operating methods of flash memory and decoding circuits thereof

PatentActiveUS20120201084A1

Innovation

- The erase gate decoding circuit is configured to electrically float the erase gates of unselected FLASH memory cells during programming, reducing punch-through disturbs and reverse tunneling, and uses a cascode transistor, ground transistor, and switch to minimize area by avoiding circuits that provide fixed voltage levels.

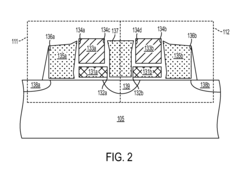

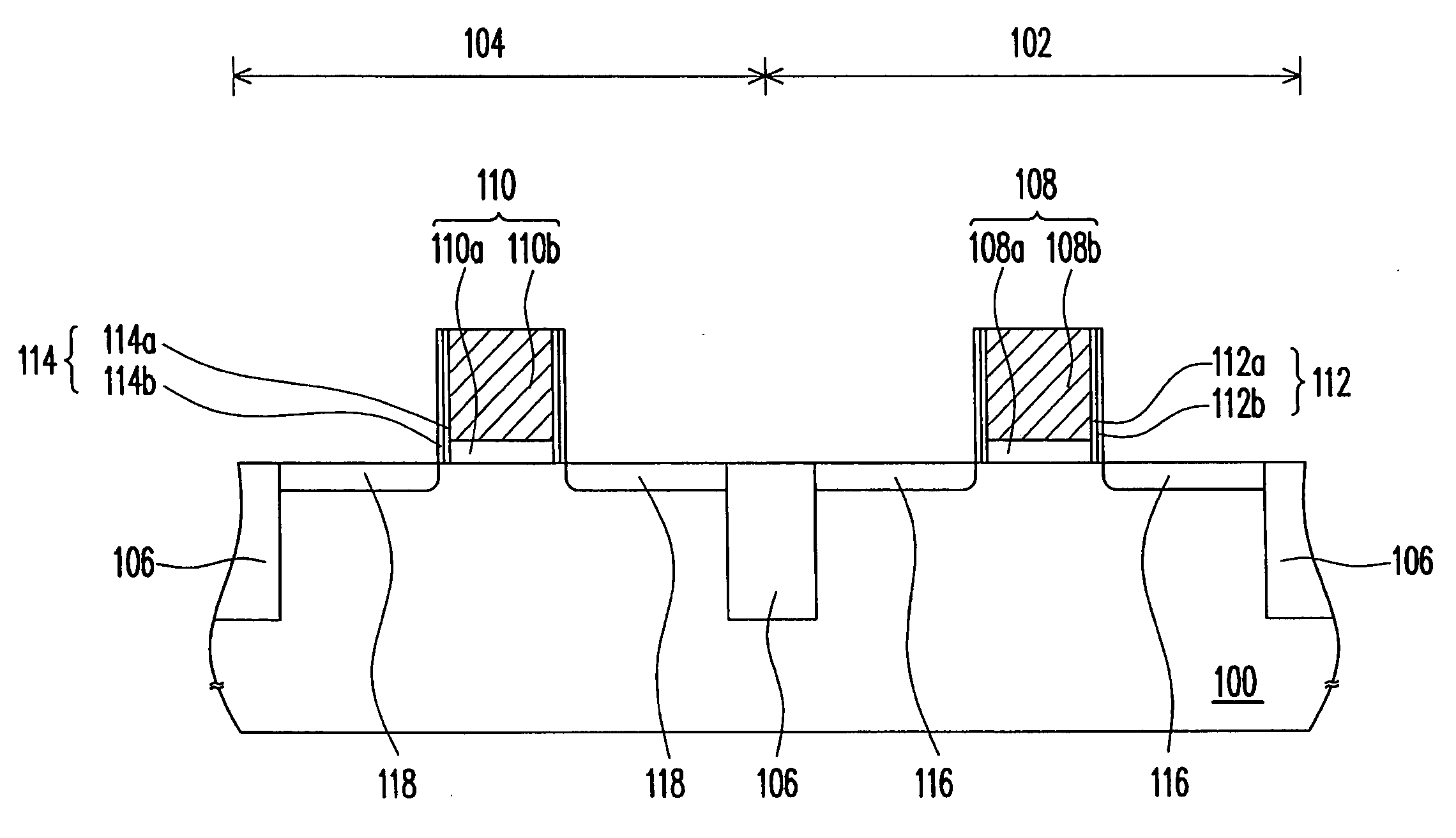

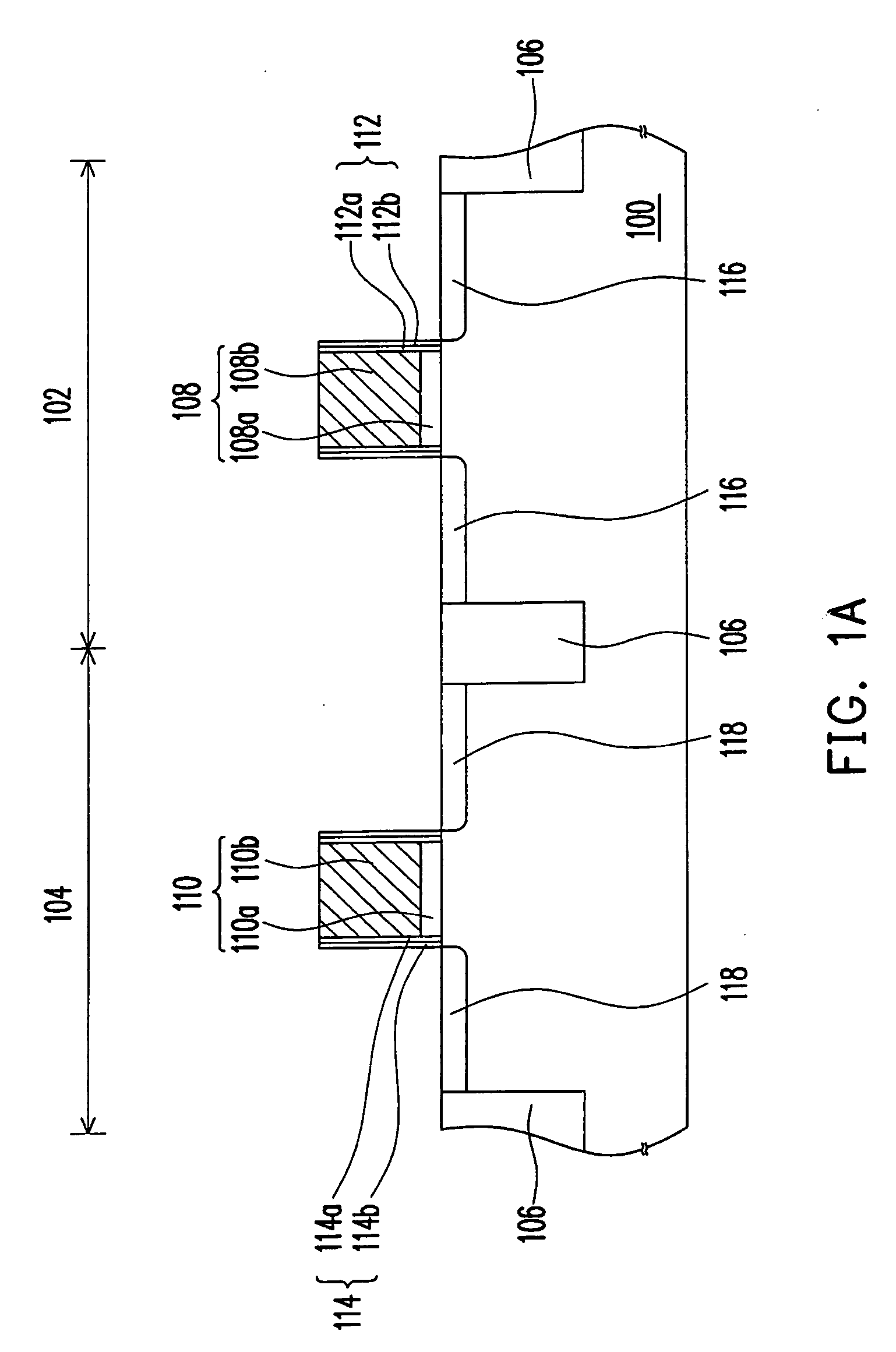

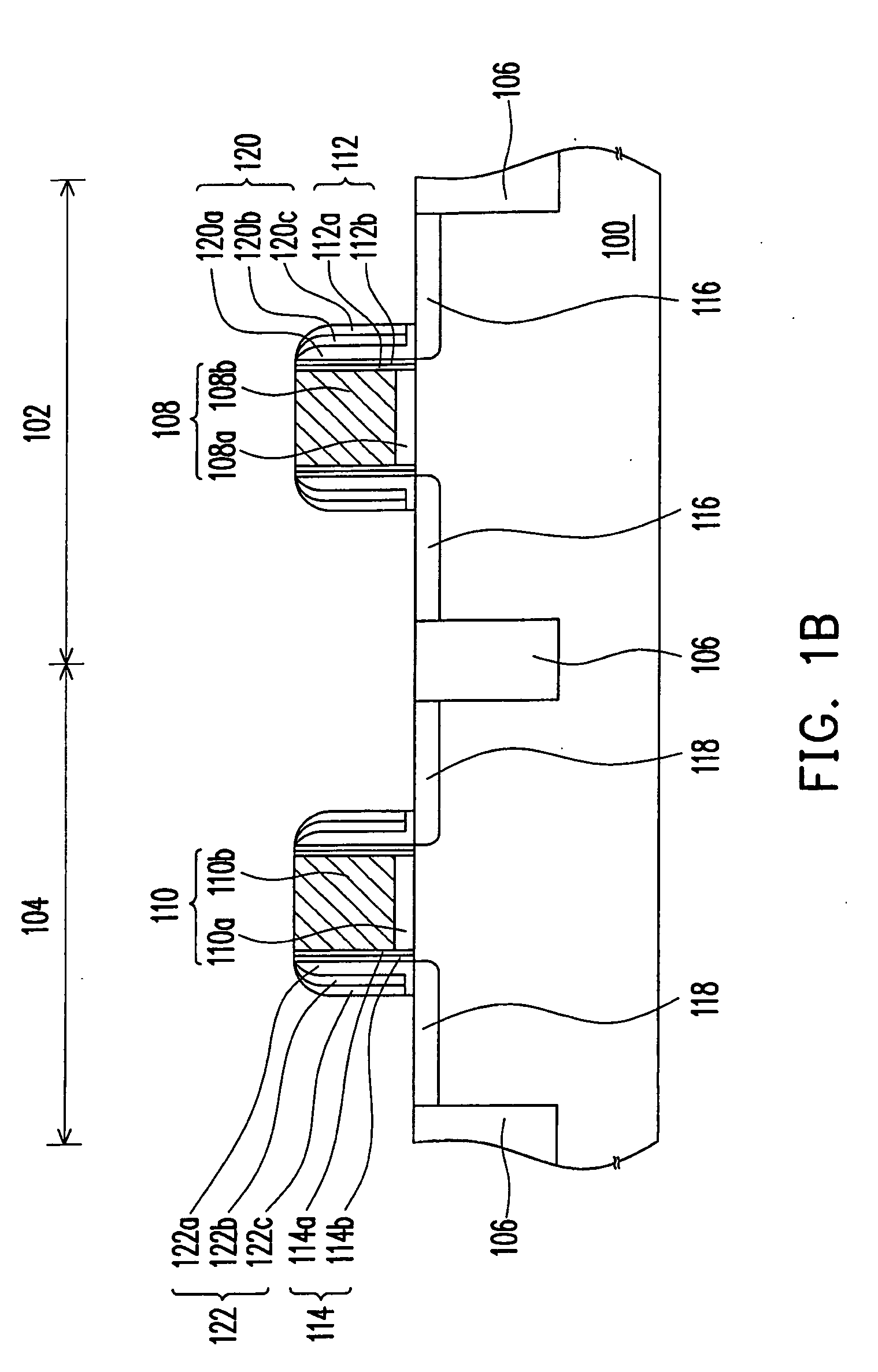

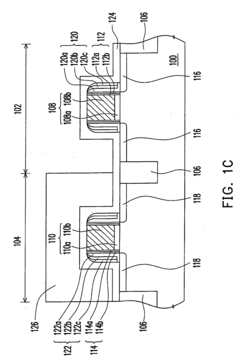

Complementary metal-oxide-semiconductor device

PatentInactiveUS20080116525A1

Innovation

- A method involving the use of a carbon-containing oxynitride passivation layer with a low etching rate, formed through low-pressure chemical-vapor deposition, is employed to prevent the removal of the passivation layer during photoresist removal and trench formation, and a thermal process is applied to densify the passivation layer, reducing the etching rate and avoiding poly bump generation.

Supply Chain Analysis

The CMOS battery market's supply chain is a complex network of manufacturers, suppliers, and distributors that play crucial roles in the production and distribution of these essential components. The supply chain begins with raw material suppliers, providing key materials such as lithium, manganese dioxide, and zinc for battery production. These materials are sourced from various regions globally, with significant contributions from countries like Chile, Australia, and China.

Component manufacturers form the next link in the chain, producing specialized parts such as cathodes, anodes, and electrolytes. These components are then assembled by battery manufacturers, who integrate them into finished CMOS batteries. Major players in this segment include Panasonic, Murata, and Maxell, with production facilities strategically located in Asia, Europe, and North America.

Distribution channels for CMOS batteries are diverse, encompassing direct sales to original equipment manufacturers (OEMs), wholesalers, and retailers. The automotive and consumer electronics industries are significant end-users, driving demand through their extensive supply networks. E-commerce platforms have also emerged as important distribution channels, offering direct-to-consumer sales and expanding market reach.

The global nature of the CMOS battery supply chain introduces challenges related to logistics and inventory management. Just-in-time manufacturing practices and efficient inventory control systems are crucial for maintaining a steady supply while minimizing costs. Additionally, the supply chain must adapt to fluctuations in demand, particularly in response to technological advancements and shifts in consumer preferences.

Sustainability considerations are increasingly shaping the CMOS battery supply chain. Manufacturers are exploring eco-friendly production methods and materials, while also implementing recycling programs to address end-of-life battery disposal. This focus on sustainability is driven by both regulatory pressures and growing consumer awareness of environmental issues.

The COVID-19 pandemic has highlighted the vulnerability of global supply chains, prompting a reevaluation of supply chain strategies in the CMOS battery market. Efforts to diversify sourcing and increase supply chain resilience are underway, with companies exploring options such as nearshoring and developing alternative supplier relationships to mitigate risks associated with geopolitical tensions and natural disasters.

Component manufacturers form the next link in the chain, producing specialized parts such as cathodes, anodes, and electrolytes. These components are then assembled by battery manufacturers, who integrate them into finished CMOS batteries. Major players in this segment include Panasonic, Murata, and Maxell, with production facilities strategically located in Asia, Europe, and North America.

Distribution channels for CMOS batteries are diverse, encompassing direct sales to original equipment manufacturers (OEMs), wholesalers, and retailers. The automotive and consumer electronics industries are significant end-users, driving demand through their extensive supply networks. E-commerce platforms have also emerged as important distribution channels, offering direct-to-consumer sales and expanding market reach.

The global nature of the CMOS battery supply chain introduces challenges related to logistics and inventory management. Just-in-time manufacturing practices and efficient inventory control systems are crucial for maintaining a steady supply while minimizing costs. Additionally, the supply chain must adapt to fluctuations in demand, particularly in response to technological advancements and shifts in consumer preferences.

Sustainability considerations are increasingly shaping the CMOS battery supply chain. Manufacturers are exploring eco-friendly production methods and materials, while also implementing recycling programs to address end-of-life battery disposal. This focus on sustainability is driven by both regulatory pressures and growing consumer awareness of environmental issues.

The COVID-19 pandemic has highlighted the vulnerability of global supply chains, prompting a reevaluation of supply chain strategies in the CMOS battery market. Efforts to diversify sourcing and increase supply chain resilience are underway, with companies exploring options such as nearshoring and developing alternative supplier relationships to mitigate risks associated with geopolitical tensions and natural disasters.

Environmental Impact

The growing CMOS battery market presents both opportunities and challenges from an environmental perspective. As these batteries become more prevalent in various electronic devices, their impact on the environment throughout their lifecycle must be carefully considered.

CMOS batteries, typically lithium-based, contain materials that can be harmful if not properly managed. The mining and processing of lithium and other raw materials used in these batteries can have significant environmental consequences, including habitat destruction, water pollution, and greenhouse gas emissions. However, advancements in mining techniques and increased focus on sustainable practices are helping to mitigate some of these impacts.

During the manufacturing phase, energy consumption and chemical processes involved in battery production contribute to the overall environmental footprint. Many manufacturers are now implementing cleaner production methods and adopting renewable energy sources to reduce their carbon emissions and minimize waste generation.

The use phase of CMOS batteries generally has a minimal direct environmental impact due to their long lifespan and low power consumption. However, the increasing number of devices utilizing these batteries means that even small individual impacts can accumulate to significant levels on a global scale.

End-of-life management of CMOS batteries is a critical environmental concern. Improper disposal can lead to soil and water contamination, as well as potential health hazards. Recycling programs for these batteries are becoming more widespread, allowing for the recovery of valuable materials and reducing the need for new raw material extraction. However, the efficiency and availability of recycling infrastructure vary greatly across different regions.

The electronic waste (e-waste) generated from devices containing CMOS batteries also poses environmental challenges. As consumer electronics become more disposable, the volume of e-waste continues to grow, putting pressure on waste management systems and increasing the risk of environmental contamination.

On a positive note, the long lifespan of CMOS batteries compared to other battery types can contribute to reduced overall waste generation. Additionally, their small size and low material content relative to larger batteries mean that their individual environmental impact is comparatively lower.

As the market for CMOS batteries expands, there is an increasing focus on developing more environmentally friendly alternatives. Research into bio-based materials, improved recycling technologies, and design for disassembly are all contributing to a more sustainable future for these essential components of modern electronics.

CMOS batteries, typically lithium-based, contain materials that can be harmful if not properly managed. The mining and processing of lithium and other raw materials used in these batteries can have significant environmental consequences, including habitat destruction, water pollution, and greenhouse gas emissions. However, advancements in mining techniques and increased focus on sustainable practices are helping to mitigate some of these impacts.

During the manufacturing phase, energy consumption and chemical processes involved in battery production contribute to the overall environmental footprint. Many manufacturers are now implementing cleaner production methods and adopting renewable energy sources to reduce their carbon emissions and minimize waste generation.

The use phase of CMOS batteries generally has a minimal direct environmental impact due to their long lifespan and low power consumption. However, the increasing number of devices utilizing these batteries means that even small individual impacts can accumulate to significant levels on a global scale.

End-of-life management of CMOS batteries is a critical environmental concern. Improper disposal can lead to soil and water contamination, as well as potential health hazards. Recycling programs for these batteries are becoming more widespread, allowing for the recovery of valuable materials and reducing the need for new raw material extraction. However, the efficiency and availability of recycling infrastructure vary greatly across different regions.

The electronic waste (e-waste) generated from devices containing CMOS batteries also poses environmental challenges. As consumer electronics become more disposable, the volume of e-waste continues to grow, putting pressure on waste management systems and increasing the risk of environmental contamination.

On a positive note, the long lifespan of CMOS batteries compared to other battery types can contribute to reduced overall waste generation. Additionally, their small size and low material content relative to larger batteries mean that their individual environmental impact is comparatively lower.

As the market for CMOS batteries expands, there is an increasing focus on developing more environmentally friendly alternatives. Research into bio-based materials, improved recycling technologies, and design for disassembly are all contributing to a more sustainable future for these essential components of modern electronics.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!