Chemically Amplified Versus Metal Oxide EUV Resists: Trade-Offs And Integration

AUG 22, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

EUV Resist Evolution and Objectives

Extreme Ultraviolet (EUV) lithography represents a revolutionary advancement in semiconductor manufacturing, enabling the continuation of Moore's Law by facilitating the production of increasingly smaller transistors. The evolution of EUV resist technology has been marked by significant milestones since its conceptual introduction in the 1980s, with practical implementation gaining momentum in the early 2000s.

Initially, resist materials for EUV lithography were adapted from existing 193nm immersion lithography technologies, primarily utilizing chemically amplified resist (CAR) platforms. These early adaptations faced substantial challenges due to the fundamentally different interaction mechanisms between EUV photons (13.5nm wavelength) and resist materials compared to deep ultraviolet light sources.

The technical trajectory of EUV resists has been driven by increasingly stringent requirements for resolution, line edge roughness (LER), and sensitivity—collectively known as the RLS trade-off. As semiconductor manufacturers pushed toward sub-10nm feature sizes, traditional CAR systems began to exhibit fundamental limitations, particularly in achieving the necessary balance between sensitivity and resolution without compromising pattern fidelity.

This technological pressure catalyzed the emergence of alternative resist platforms, most notably metal oxide resists. These materials, incorporating elements such as hafnium, zirconium, or tin, offered potentially superior absorption cross-sections for EUV photons and different reaction mechanisms that could potentially circumvent some limitations of organic CAR systems.

The primary objectives in EUV resist development have evolved to address several critical parameters simultaneously. These include achieving resolution capabilities below 20nm half-pitch, reducing line edge roughness to sub-1nm levels, enhancing sensitivity to minimize exposure times (targeting <20mJ/cm²), improving pattern collapse resistance at high aspect ratios, and ensuring compatibility with existing semiconductor manufacturing infrastructure.

Additionally, environmental and health considerations have become increasingly important factors in resist development, with efforts to reduce or eliminate toxic components and minimize environmental impact throughout the manufacturing lifecycle.

Current research focuses on hybrid approaches that combine the advantages of both CAR and metal oxide systems, exploring novel chemical amplification mechanisms, metal-organic frameworks, and nanoparticle-based formulations. The ultimate goal remains developing resist technologies that can enable high-volume manufacturing of semiconductor devices at the 3nm node and beyond, with acceptable cost structures and integration capabilities.

The evolution continues toward materials that can support not only traditional 2D patterning but also emerging 3D architectures and novel device structures, positioning EUV resist technology as a critical enabler for the next generation of semiconductor innovation.

Initially, resist materials for EUV lithography were adapted from existing 193nm immersion lithography technologies, primarily utilizing chemically amplified resist (CAR) platforms. These early adaptations faced substantial challenges due to the fundamentally different interaction mechanisms between EUV photons (13.5nm wavelength) and resist materials compared to deep ultraviolet light sources.

The technical trajectory of EUV resists has been driven by increasingly stringent requirements for resolution, line edge roughness (LER), and sensitivity—collectively known as the RLS trade-off. As semiconductor manufacturers pushed toward sub-10nm feature sizes, traditional CAR systems began to exhibit fundamental limitations, particularly in achieving the necessary balance between sensitivity and resolution without compromising pattern fidelity.

This technological pressure catalyzed the emergence of alternative resist platforms, most notably metal oxide resists. These materials, incorporating elements such as hafnium, zirconium, or tin, offered potentially superior absorption cross-sections for EUV photons and different reaction mechanisms that could potentially circumvent some limitations of organic CAR systems.

The primary objectives in EUV resist development have evolved to address several critical parameters simultaneously. These include achieving resolution capabilities below 20nm half-pitch, reducing line edge roughness to sub-1nm levels, enhancing sensitivity to minimize exposure times (targeting <20mJ/cm²), improving pattern collapse resistance at high aspect ratios, and ensuring compatibility with existing semiconductor manufacturing infrastructure.

Additionally, environmental and health considerations have become increasingly important factors in resist development, with efforts to reduce or eliminate toxic components and minimize environmental impact throughout the manufacturing lifecycle.

Current research focuses on hybrid approaches that combine the advantages of both CAR and metal oxide systems, exploring novel chemical amplification mechanisms, metal-organic frameworks, and nanoparticle-based formulations. The ultimate goal remains developing resist technologies that can enable high-volume manufacturing of semiconductor devices at the 3nm node and beyond, with acceptable cost structures and integration capabilities.

The evolution continues toward materials that can support not only traditional 2D patterning but also emerging 3D architectures and novel device structures, positioning EUV resist technology as a critical enabler for the next generation of semiconductor innovation.

Market Analysis for Advanced Lithography Materials

The global market for advanced lithography materials is experiencing significant growth, driven by the semiconductor industry's relentless pursuit of Moore's Law. The extreme ultraviolet (EUV) lithography materials segment is projected to reach $1.2 billion by 2025, with a compound annual growth rate of 21.3% from 2020. This accelerated growth reflects the industry's transition from deep ultraviolet (DUV) to EUV technology for manufacturing nodes below 7nm.

The EUV resist market is currently divided between chemically amplified resists (CARs) and metal oxide resists, with CARs holding approximately 65% market share due to their established position and compatibility with existing infrastructure. However, metal oxide resists are gaining traction, with market share expected to increase from 18% in 2021 to 32% by 2026 as manufacturers address sub-5nm node challenges.

Regional analysis reveals that East Asia dominates the advanced lithography materials market, with South Korea, Taiwan, and Japan collectively accounting for over 70% of global consumption. This concentration aligns with the geographic distribution of leading semiconductor fabrication facilities. North America and Europe represent smaller but technologically significant markets, focusing on specialized applications and research advancements.

Key market drivers include the explosive growth in data centers, artificial intelligence applications, and high-performance computing, all requiring increasingly sophisticated semiconductor devices. The automotive sector's transition to electric and autonomous vehicles is creating additional demand for advanced chips manufactured using EUV lithography, further stimulating the resist market.

Customer segmentation shows that integrated device manufacturers (IDMs) and foundries constitute the primary purchasers of advanced lithography materials, with foundries showing the fastest growth rate due to their expanding role in semiconductor manufacturing. Research institutions represent a smaller but influential segment, often pioneering new material formulations before commercial adoption.

Pricing trends indicate that metal oxide resists command a premium of 30-40% over traditional CARs, reflecting their enhanced resolution capabilities and reduced pattern collapse at extreme dimensions. However, this price differential is expected to narrow as manufacturing scales and competition intensifies among suppliers developing next-generation formulations.

Supply chain analysis reveals potential vulnerabilities, particularly regarding rare metal precursors used in metal oxide resists. Geopolitical tensions and resource concentration have prompted materials suppliers to develop alternative formulations and secure diversified supply sources, adding a strategic dimension to market dynamics beyond pure technical considerations.

The EUV resist market is currently divided between chemically amplified resists (CARs) and metal oxide resists, with CARs holding approximately 65% market share due to their established position and compatibility with existing infrastructure. However, metal oxide resists are gaining traction, with market share expected to increase from 18% in 2021 to 32% by 2026 as manufacturers address sub-5nm node challenges.

Regional analysis reveals that East Asia dominates the advanced lithography materials market, with South Korea, Taiwan, and Japan collectively accounting for over 70% of global consumption. This concentration aligns with the geographic distribution of leading semiconductor fabrication facilities. North America and Europe represent smaller but technologically significant markets, focusing on specialized applications and research advancements.

Key market drivers include the explosive growth in data centers, artificial intelligence applications, and high-performance computing, all requiring increasingly sophisticated semiconductor devices. The automotive sector's transition to electric and autonomous vehicles is creating additional demand for advanced chips manufactured using EUV lithography, further stimulating the resist market.

Customer segmentation shows that integrated device manufacturers (IDMs) and foundries constitute the primary purchasers of advanced lithography materials, with foundries showing the fastest growth rate due to their expanding role in semiconductor manufacturing. Research institutions represent a smaller but influential segment, often pioneering new material formulations before commercial adoption.

Pricing trends indicate that metal oxide resists command a premium of 30-40% over traditional CARs, reflecting their enhanced resolution capabilities and reduced pattern collapse at extreme dimensions. However, this price differential is expected to narrow as manufacturing scales and competition intensifies among suppliers developing next-generation formulations.

Supply chain analysis reveals potential vulnerabilities, particularly regarding rare metal precursors used in metal oxide resists. Geopolitical tensions and resource concentration have prompted materials suppliers to develop alternative formulations and secure diversified supply sources, adding a strategic dimension to market dynamics beyond pure technical considerations.

Current Challenges in EUV Resist Technology

Extreme Ultraviolet (EUV) lithography represents a significant advancement in semiconductor manufacturing, enabling the continuation of Moore's Law through the production of increasingly smaller transistors. However, the resist technology that enables pattern transfer in EUV lithography faces several critical challenges that impede its widespread adoption and optimal performance.

Resolution limitations remain a primary concern for EUV resist technology. While the theoretical resolution limit of EUV lithography is approximately 8nm, current resist materials struggle to achieve consistent sub-20nm features without pattern collapse or line edge roughness issues. This gap between theoretical capability and practical implementation represents a significant hurdle for semiconductor scaling roadmaps.

Sensitivity versus resolution trade-off presents another fundamental challenge. Chemically Amplified Resists (CARs) offer high sensitivity but suffer from acid diffusion that limits resolution and increases line edge roughness. Conversely, Metal Oxide Resists provide superior resolution but require significantly higher exposure doses, reducing throughput and increasing production costs. This inverse relationship between sensitivity and resolution creates a difficult engineering compromise.

Line Edge Roughness (LER) and Line Width Roughness (LWR) have emerged as critical metrics affecting device performance. Current EUV resists typically exhibit LER values of 3-5nm, which becomes increasingly problematic as feature sizes approach 10nm. The stochastic effects inherent to EUV exposure—where relatively few photons create the exposure pattern—exacerbate these roughness issues.

Pattern collapse represents another significant challenge, particularly as aspect ratios increase with smaller feature sizes. The mechanical stability of high-aspect-ratio features after development is compromised by capillary forces during the drying process, leading to pattern deformation or complete collapse.

Outgassing during EUV exposure poses unique challenges to tool maintenance and mask lifetime. The high-energy EUV photons can break chemical bonds in resist materials, releasing volatile compounds that can contaminate the optical system and reflective masks, which are prohibitively expensive to replace.

Integration challenges with existing semiconductor manufacturing processes further complicate EUV resist adoption. New resist platforms must be compatible with established pre- and post-exposure processing steps, including adhesion promotion, development, etching, and metrology.

Environmental and safety concerns also impact resist development, as the semiconductor industry moves away from perfluorinated compounds and other environmentally persistent chemicals. Finding alternatives that maintain performance while meeting increasingly stringent environmental regulations adds another dimension to the technical challenges.

Resolution limitations remain a primary concern for EUV resist technology. While the theoretical resolution limit of EUV lithography is approximately 8nm, current resist materials struggle to achieve consistent sub-20nm features without pattern collapse or line edge roughness issues. This gap between theoretical capability and practical implementation represents a significant hurdle for semiconductor scaling roadmaps.

Sensitivity versus resolution trade-off presents another fundamental challenge. Chemically Amplified Resists (CARs) offer high sensitivity but suffer from acid diffusion that limits resolution and increases line edge roughness. Conversely, Metal Oxide Resists provide superior resolution but require significantly higher exposure doses, reducing throughput and increasing production costs. This inverse relationship between sensitivity and resolution creates a difficult engineering compromise.

Line Edge Roughness (LER) and Line Width Roughness (LWR) have emerged as critical metrics affecting device performance. Current EUV resists typically exhibit LER values of 3-5nm, which becomes increasingly problematic as feature sizes approach 10nm. The stochastic effects inherent to EUV exposure—where relatively few photons create the exposure pattern—exacerbate these roughness issues.

Pattern collapse represents another significant challenge, particularly as aspect ratios increase with smaller feature sizes. The mechanical stability of high-aspect-ratio features after development is compromised by capillary forces during the drying process, leading to pattern deformation or complete collapse.

Outgassing during EUV exposure poses unique challenges to tool maintenance and mask lifetime. The high-energy EUV photons can break chemical bonds in resist materials, releasing volatile compounds that can contaminate the optical system and reflective masks, which are prohibitively expensive to replace.

Integration challenges with existing semiconductor manufacturing processes further complicate EUV resist adoption. New resist platforms must be compatible with established pre- and post-exposure processing steps, including adhesion promotion, development, etching, and metrology.

Environmental and safety concerns also impact resist development, as the semiconductor industry moves away from perfluorinated compounds and other environmentally persistent chemicals. Finding alternatives that maintain performance while meeting increasingly stringent environmental regulations adds another dimension to the technical challenges.

Comparative Analysis of CA and MO Resist Solutions

01 Sensitivity and resolution trade-offs in EUV resists

EUV resists face fundamental trade-offs between sensitivity and resolution. Chemically amplified resists (CARs) offer high sensitivity but may struggle with resolution limits due to acid diffusion. Metal oxide resists can achieve higher resolution but typically require higher exposure doses. This trade-off is critical in EUV lithography where balancing throughput (requiring high sensitivity) with pattern fidelity (requiring high resolution) remains a key challenge for next-generation semiconductor manufacturing.- Sensitivity and resolution trade-offs in EUV resists: EUV resists face fundamental trade-offs between sensitivity and resolution. Chemically amplified resists (CARs) offer high sensitivity but may struggle with resolution limits due to acid diffusion. Metal oxide resists can achieve higher resolution but typically require higher exposure doses. This trade-off is critical in EUV lithography where balancing throughput (requiring high sensitivity) with pattern fidelity (requiring high resolution) remains a key challenge for semiconductor manufacturing.

- Line edge roughness considerations in EUV resist systems: Line edge roughness (LER) presents a significant challenge in EUV lithography. Chemically amplified resists often exhibit higher LER due to acid diffusion mechanisms, while metal oxide resists can provide improved LER performance through different reaction mechanisms. The trade-off between achieving acceptable LER while maintaining sufficient sensitivity impacts pattern transfer quality and ultimately device performance in advanced semiconductor nodes.

- Outgassing and contamination issues in EUV resist platforms: Outgassing during EUV exposure presents different challenges for chemically amplified versus metal oxide resists. CARs typically generate more volatile organic compounds during exposure that can contaminate expensive EUV optics. Metal oxide resists generally produce less outgassing but may introduce metal contamination concerns. This trade-off affects not only resist performance but also tool maintenance requirements and overall cost of ownership for EUV lithography systems.

- Pattern collapse and mechanical stability differences: Pattern collapse resistance varies significantly between resist types. Metal oxide resists often demonstrate superior mechanical stability and resistance to pattern collapse at high aspect ratios compared to chemically amplified resists. However, this advantage may come at the cost of more complex processing requirements. The trade-off between mechanical stability and ease of processing impacts yield and manufacturability, particularly as feature sizes continue to shrink in advanced semiconductor nodes.

- Integration challenges and process compatibility: Integration of different EUV resist platforms presents varying challenges in semiconductor manufacturing workflows. Chemically amplified resists benefit from established processing infrastructure but may require complex post-exposure bake optimization. Metal oxide resists often need specialized development processes and may introduce new materials compatibility issues. This trade-off between leveraging existing infrastructure versus adopting new processes impacts implementation timelines and manufacturing costs for advanced semiconductor devices.

02 Line edge roughness considerations in EUV resist systems

Line edge roughness (LER) is a critical parameter in EUV lithography that affects device performance. Metal oxide resists generally demonstrate better LER control compared to chemically amplified resists due to their smaller molecular size and more controlled reaction mechanisms. However, this advantage often comes at the cost of reduced sensitivity. Various approaches to mitigate LER in both resist types include incorporating specific functional groups, optimizing post-exposure bake conditions, and developing hybrid resist systems.Expand Specific Solutions03 Outgassing and contamination challenges

EUV resist outgassing presents significant challenges for lithography equipment. Chemically amplified resists typically generate more volatile compounds during exposure than metal oxide resists, potentially contaminating expensive EUV optics. Metal oxide resists offer advantages in reduced outgassing but may introduce metal contamination concerns in the fabrication process. Mitigation strategies include developing low-outgassing photoacid generators for CARs and implementing effective filtration systems for both resist types.Expand Specific Solutions04 Pattern collapse and mechanical stability

Pattern collapse becomes increasingly problematic as feature sizes decrease in EUV lithography. Metal oxide resists generally exhibit superior mechanical stability and resistance to pattern collapse compared to chemically amplified resists, particularly at high aspect ratios. This advantage stems from their inorganic backbone structure and stronger intermolecular forces. However, chemically amplified resists can be modified with specific polymers and additives to improve their mechanical properties, though often with impacts on sensitivity or resolution.Expand Specific Solutions05 Processing compatibility and integration challenges

Integration of EUV resists into existing semiconductor manufacturing flows presents different challenges for each resist type. Chemically amplified resists benefit from decades of processing experience and compatibility with established equipment, while metal oxide resists often require new development of deposition, etching, and removal processes. Metal oxide resists may offer advantages in etch resistance and pattern transfer fidelity but can introduce new contamination concerns and require specialized handling. The selection between resist types often depends on the specific manufacturing infrastructure and process requirements.Expand Specific Solutions

Leading Manufacturers and Research Institutions

The EUV resist technology landscape is currently in a transitional phase, with the market evolving from early adoption to broader implementation. The competition between chemically amplified resists (CARs) and metal oxide resists represents a critical technological inflection point, with market size projected to grow significantly as EUV lithography expands in advanced semiconductor manufacturing. Leading semiconductor equipment providers like ASML, Tokyo Electron, and Lam Research are driving infrastructure development, while materials companies including JSR, TOK, FUJIFILM, and Shin-Etsu Chemical dominate the CAR segment. Emerging players like PiBond and Inpria (acquired by JSR) are advancing metal oxide alternatives, with major semiconductor manufacturers such as TSMC, Samsung, and IBM actively evaluating both technologies based on resolution, sensitivity, and integration requirements for sub-5nm nodes.

ASML Netherlands BV

Technical Solution: ASML has developed advanced EUV lithography systems that work with both chemically amplified resists (CARs) and metal oxide resists. Their NXE series EUV lithography tools operate at 13.5nm wavelength and are specifically optimized to address the trade-offs between these resist types. For CARs, ASML has implemented specialized dose control mechanisms to manage acid diffusion issues, while for metal oxide resists, they've developed enhanced optical systems to compensate for lower sensitivity. Their latest systems incorporate computational lithography techniques that optimize exposure parameters based on resist characteristics. ASML's holistic approach includes co-optimization of the light source, optics, and resist interaction, enabling resolution down to 13nm half-pitch in production environments. Their systems also feature specialized vacuum handling systems that minimize outgassing concerns with different resist types[1][3].

Strengths: Unparalleled expertise in EUV lithography systems integration; comprehensive understanding of resist-tool interactions; ability to optimize exposure conditions for different resist types. Weaknesses: Heavily dependent on resist manufacturers for material innovation; systems require significant customization for different resist chemistries; high capital costs for implementation.

Applied Materials, Inc.

Technical Solution: Applied Materials has developed specialized deposition and etching solutions tailored for both chemically amplified and metal oxide EUV resist processing. Their Sym3® platform specifically addresses the integration challenges of different resist types through precision materials engineering. For metal oxide resists, they've created advanced atomic layer deposition (ALD) systems that enable precise control of metal oxide film composition and thickness uniformity down to the atomic scale. Their etching technologies incorporate specialized plasma chemistry formulations that selectively remove either resist type while maintaining pattern fidelity. Applied Materials has also introduced innovative post-exposure bake (PEB) systems with temperature control precision of ±0.1°C for chemically amplified resists, while developing room-temperature processing solutions for metal oxide alternatives that eliminate PEB sensitivity issues[2][4].

Strengths: Comprehensive portfolio covering the entire resist processing workflow; strong expertise in both deposition and etching technologies; ability to customize solutions for specific resist chemistries. Weaknesses: Less direct involvement in resist formulation compared to chemical companies; solutions require integration with other vendors' technologies; higher implementation complexity for full process integration.

Key Patents and Scientific Breakthroughs

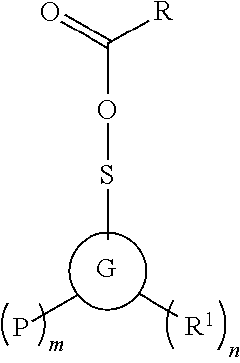

Monomers, polymers and lithographic compositions comprising same

PatentActiveUS11932713B2

Innovation

- Development of new monomer and polymer materials containing tellurium (Te) atoms for improved photoresist compositions, including addition-type polymers and monomers with unsaturated polymerizable groups, acid-cleavable, and polar groups, which enhance imaging capabilities and sensitivity.

Environmental Impact and Sustainability Considerations

The environmental impact of photoresist technologies has become increasingly important as semiconductor manufacturing scales to meet global demand. Chemically Amplified Resists (CARs) and Metal Oxide Resists present distinctly different environmental footprints throughout their lifecycle. CARs typically contain organic solvents, photoacid generators, and polymers that may pose environmental hazards during production, use, and disposal phases. These components often include volatile organic compounds (VOCs) that contribute to air pollution and potential groundwater contamination if not properly managed.

Metal Oxide Resists, while reducing some chemical concerns associated with CARs, introduce their own environmental considerations. The production of metal oxides frequently requires energy-intensive processes and mining operations that can lead to habitat disruption and resource depletion. However, these resists generally demonstrate greater stability and may require fewer processing steps, potentially reducing overall chemical waste generation in manufacturing environments.

Water consumption represents a critical sustainability metric for both resist technologies. CARs typically require extensive rinsing and development steps that consume significant quantities of ultra-pure water. Metal Oxide Resists may offer advantages in this regard, with some formulations requiring less intensive development processes, though comprehensive lifecycle assessments are still emerging in scientific literature.

Energy efficiency comparisons reveal that Metal Oxide Resists often require higher exposure doses for pattern formation, potentially increasing the energy footprint of lithography operations. Conversely, the higher sensitivity of CARs translates to lower energy requirements during exposure, though this advantage must be balanced against their more complex processing requirements.

Waste management considerations differ substantially between these technologies. CARs generate organic chemical waste streams that require specialized treatment protocols, while Metal Oxide Resists produce waste containing metal compounds that may require different remediation approaches. The semiconductor industry has established advanced waste treatment facilities for both technologies, though the long-term environmental persistence of metal-containing waste remains a concern for some regulatory bodies.

Recent sustainability initiatives within the semiconductor industry have focused on developing more environmentally benign resist formulations for both technology paths. These include water-developable resists, reduced metal content formulations, and recycling programs for solvents and developers. Several leading manufacturers have published sustainability roadmaps that include specific targets for reducing the environmental impact of lithographic materials, recognizing that environmental considerations will increasingly influence technology adoption decisions.

Metal Oxide Resists, while reducing some chemical concerns associated with CARs, introduce their own environmental considerations. The production of metal oxides frequently requires energy-intensive processes and mining operations that can lead to habitat disruption and resource depletion. However, these resists generally demonstrate greater stability and may require fewer processing steps, potentially reducing overall chemical waste generation in manufacturing environments.

Water consumption represents a critical sustainability metric for both resist technologies. CARs typically require extensive rinsing and development steps that consume significant quantities of ultra-pure water. Metal Oxide Resists may offer advantages in this regard, with some formulations requiring less intensive development processes, though comprehensive lifecycle assessments are still emerging in scientific literature.

Energy efficiency comparisons reveal that Metal Oxide Resists often require higher exposure doses for pattern formation, potentially increasing the energy footprint of lithography operations. Conversely, the higher sensitivity of CARs translates to lower energy requirements during exposure, though this advantage must be balanced against their more complex processing requirements.

Waste management considerations differ substantially between these technologies. CARs generate organic chemical waste streams that require specialized treatment protocols, while Metal Oxide Resists produce waste containing metal compounds that may require different remediation approaches. The semiconductor industry has established advanced waste treatment facilities for both technologies, though the long-term environmental persistence of metal-containing waste remains a concern for some regulatory bodies.

Recent sustainability initiatives within the semiconductor industry have focused on developing more environmentally benign resist formulations for both technology paths. These include water-developable resists, reduced metal content formulations, and recycling programs for solvents and developers. Several leading manufacturers have published sustainability roadmaps that include specific targets for reducing the environmental impact of lithographic materials, recognizing that environmental considerations will increasingly influence technology adoption decisions.

Integration Pathways for Next-Generation Semiconductor Manufacturing

The integration of next-generation lithography technologies requires careful consideration of resist materials and their compatibility with existing semiconductor manufacturing processes. For EUV lithography, two primary resist types have emerged: chemically amplified resists (CARs) and metal oxide resists. Each presents distinct integration challenges and opportunities that must be addressed to enable high-volume manufacturing.

Chemically amplified resists offer advantages in sensitivity and processing familiarity, as they build upon established 193nm lithography infrastructure. Integration pathways for CARs involve optimizing post-exposure bake (PEB) conditions to control acid diffusion while maintaining pattern fidelity. The integration of these resists requires careful management of contamination control systems, as they are particularly sensitive to airborne molecular contaminants that can neutralize the photoacid generator components.

Metal oxide resists, conversely, present different integration considerations. Their non-chemically amplified nature eliminates concerns about acid diffusion but introduces challenges related to metal contamination in the fab environment. Integration pathways must include enhanced metrology capabilities to monitor potential metal migration into underlying device layers. Additionally, the development and etching processes for metal oxide resists often require modification of existing toolsets to accommodate their unique chemical properties.

Both resist platforms necessitate careful evaluation of pattern collapse mitigation strategies. For CARs, this typically involves rinse chemistry optimization and surface tension control during development. Metal oxide resists may require different approaches, such as supercritical CO2 drying or specialized surface treatments to maintain high-aspect-ratio features.

The integration of either resist type must also consider downstream compatibility with subsequent process steps. CARs generally offer well-established etch resistance characteristics, while metal oxide resists may provide enhanced etch selectivity but require process adjustments. The selection of hardmask materials and etch chemistries must be tailored to the specific resist platform chosen.

From a manufacturing perspective, integration pathways must address defectivity concerns unique to each resist type. CARs typically struggle with stochastic effects at small dimensions, while metal oxide resists may face challenges with material homogeneity and particle generation. Defect inspection and classification systems require calibration specific to the failure modes of the selected resist platform.

Ultimately, successful integration requires a holistic approach that considers not only the lithographic performance of the resist but also its compatibility with the entire manufacturing flow, from substrate preparation through final device testing. This necessitates close collaboration between material suppliers, equipment manufacturers, and semiconductor fabrication teams to develop optimized integration pathways for next-generation manufacturing.

Chemically amplified resists offer advantages in sensitivity and processing familiarity, as they build upon established 193nm lithography infrastructure. Integration pathways for CARs involve optimizing post-exposure bake (PEB) conditions to control acid diffusion while maintaining pattern fidelity. The integration of these resists requires careful management of contamination control systems, as they are particularly sensitive to airborne molecular contaminants that can neutralize the photoacid generator components.

Metal oxide resists, conversely, present different integration considerations. Their non-chemically amplified nature eliminates concerns about acid diffusion but introduces challenges related to metal contamination in the fab environment. Integration pathways must include enhanced metrology capabilities to monitor potential metal migration into underlying device layers. Additionally, the development and etching processes for metal oxide resists often require modification of existing toolsets to accommodate their unique chemical properties.

Both resist platforms necessitate careful evaluation of pattern collapse mitigation strategies. For CARs, this typically involves rinse chemistry optimization and surface tension control during development. Metal oxide resists may require different approaches, such as supercritical CO2 drying or specialized surface treatments to maintain high-aspect-ratio features.

The integration of either resist type must also consider downstream compatibility with subsequent process steps. CARs generally offer well-established etch resistance characteristics, while metal oxide resists may provide enhanced etch selectivity but require process adjustments. The selection of hardmask materials and etch chemistries must be tailored to the specific resist platform chosen.

From a manufacturing perspective, integration pathways must address defectivity concerns unique to each resist type. CARs typically struggle with stochastic effects at small dimensions, while metal oxide resists may face challenges with material homogeneity and particle generation. Defect inspection and classification systems require calibration specific to the failure modes of the selected resist platform.

Ultimately, successful integration requires a holistic approach that considers not only the lithographic performance of the resist but also its compatibility with the entire manufacturing flow, from substrate preparation through final device testing. This necessitates close collaboration between material suppliers, equipment manufacturers, and semiconductor fabrication teams to develop optimized integration pathways for next-generation manufacturing.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!