IP Landscape And Vendor Comparison For EUV Resist Materials

AUG 22, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

EUV Resist Evolution and Development Goals

Extreme Ultraviolet (EUV) lithography represents a revolutionary advancement in semiconductor manufacturing, enabling the continuation of Moore's Law through the production of increasingly smaller transistors. The evolution of EUV resist materials has been a critical component in this technological progression, with significant developments occurring over the past two decades.

Initially, EUV resist development focused on adapting existing 193nm photoresist technologies. These early attempts faced substantial challenges due to the fundamentally different physics involved with EUV's 13.5nm wavelength. The first generation of EUV resists exhibited poor sensitivity, requiring excessive exposure doses that reduced throughput and increased manufacturing costs.

By the mid-2010s, chemically amplified resists (CARs) emerged as the dominant approach, offering improved sensitivity through acid-catalyzed deprotection reactions. However, these materials struggled with the resolution-sensitivity-line edge roughness (RLS) trade-off, a fundamental challenge in resist design where improving one parameter typically degrades the others.

Metal-oxide resists appeared around 2016-2018, introducing inorganic components to enhance EUV absorption efficiency. These materials, particularly those incorporating hafnium, zirconium, or tin, demonstrated superior sensitivity compared to purely organic alternatives, addressing one of the key limitations in early EUV implementation.

Current development goals for EUV resist materials focus on several critical parameters. Resolution capabilities must reach below 10nm half-pitch to enable the production of 3nm node devices and beyond. Sensitivity targets aim for exposure doses under 20mJ/cm² to maximize wafer throughput while maintaining economic viability for high-volume manufacturing.

Line edge roughness (LER) requirements have become increasingly stringent, with targets below 2nm to ensure device performance and yield. Additionally, pattern collapse prevention has emerged as a crucial consideration as aspect ratios increase with smaller feature sizes.

Environmental and safety considerations are also shaping development goals, with efforts to reduce or eliminate perfluoroalkyl substances (PFAS) and other potentially harmful components from resist formulations. This aligns with broader industry sustainability initiatives and regulatory compliance requirements.

The ultimate development goal remains creating resist materials that can simultaneously optimize the RLS triangle while maintaining compatibility with existing manufacturing processes. Recent research indicates promising directions in hybrid organic-inorganic materials and multi-trigger resist mechanisms that may finally break through the traditional RLS trade-off limitations.

Initially, EUV resist development focused on adapting existing 193nm photoresist technologies. These early attempts faced substantial challenges due to the fundamentally different physics involved with EUV's 13.5nm wavelength. The first generation of EUV resists exhibited poor sensitivity, requiring excessive exposure doses that reduced throughput and increased manufacturing costs.

By the mid-2010s, chemically amplified resists (CARs) emerged as the dominant approach, offering improved sensitivity through acid-catalyzed deprotection reactions. However, these materials struggled with the resolution-sensitivity-line edge roughness (RLS) trade-off, a fundamental challenge in resist design where improving one parameter typically degrades the others.

Metal-oxide resists appeared around 2016-2018, introducing inorganic components to enhance EUV absorption efficiency. These materials, particularly those incorporating hafnium, zirconium, or tin, demonstrated superior sensitivity compared to purely organic alternatives, addressing one of the key limitations in early EUV implementation.

Current development goals for EUV resist materials focus on several critical parameters. Resolution capabilities must reach below 10nm half-pitch to enable the production of 3nm node devices and beyond. Sensitivity targets aim for exposure doses under 20mJ/cm² to maximize wafer throughput while maintaining economic viability for high-volume manufacturing.

Line edge roughness (LER) requirements have become increasingly stringent, with targets below 2nm to ensure device performance and yield. Additionally, pattern collapse prevention has emerged as a crucial consideration as aspect ratios increase with smaller feature sizes.

Environmental and safety considerations are also shaping development goals, with efforts to reduce or eliminate perfluoroalkyl substances (PFAS) and other potentially harmful components from resist formulations. This aligns with broader industry sustainability initiatives and regulatory compliance requirements.

The ultimate development goal remains creating resist materials that can simultaneously optimize the RLS triangle while maintaining compatibility with existing manufacturing processes. Recent research indicates promising directions in hybrid organic-inorganic materials and multi-trigger resist mechanisms that may finally break through the traditional RLS trade-off limitations.

Market Analysis for EUV Lithography Materials

The Extreme Ultraviolet (EUV) lithography materials market has experienced substantial growth in recent years, driven by the semiconductor industry's push toward smaller node sizes and more complex chip architectures. The global EUV lithography materials market was valued at approximately $456 million in 2022 and is projected to reach $1.2 billion by 2028, representing a compound annual growth rate (CAGR) of 17.5% during the forecast period.

EUV resist materials constitute the largest segment within this market, accounting for roughly 65% of the total market share. This dominance is attributed to the critical role these materials play in enabling high-resolution patterning at the 7nm node and below. The remaining market share is divided among ancillary materials such as underlayers, topcoats, and developers.

Geographically, Asia-Pacific dominates the EUV lithography materials market, with South Korea, Taiwan, and Japan collectively representing over 70% of global consumption. This regional concentration directly correlates with the presence of major semiconductor manufacturers like Samsung, TSMC, and Intel's expanding operations in these regions. North America and Europe follow with approximately 18% and 12% market share respectively.

The market dynamics are heavily influenced by the capital expenditure cycles of major semiconductor manufacturers. Recent announcements of fab expansions by TSMC, Samsung, and Intel are expected to significantly boost demand for EUV materials through 2025 and beyond. Industry analysts predict that the transition to 3nm and 2nm nodes will further accelerate market growth, potentially doubling the consumption of specialized EUV resist materials by 2026.

Customer segmentation reveals that integrated device manufacturers (IDMs) and foundries constitute approximately 85% of end-users, with research institutions and development facilities accounting for the remainder. The high-performance computing, mobile, and automotive sectors are driving the strongest demand growth, with annual increases of 22%, 19%, and 17% respectively.

Pricing trends indicate a gradual decrease in per-unit costs as production scales up, though this is partially offset by increasing performance requirements. The average selling price for advanced EUV resist formulations has decreased by approximately 8% annually over the past three years, while performance metrics such as sensitivity and resolution have improved by 15-20% during the same period.

Market barriers to entry remain substantial due to the highly specialized nature of EUV resist chemistry, extensive intellectual property protections, and the significant capital investment required for research and development. This has resulted in a concentrated supplier landscape dominated by a handful of specialized chemical companies with deep expertise in photoresist technology.

EUV resist materials constitute the largest segment within this market, accounting for roughly 65% of the total market share. This dominance is attributed to the critical role these materials play in enabling high-resolution patterning at the 7nm node and below. The remaining market share is divided among ancillary materials such as underlayers, topcoats, and developers.

Geographically, Asia-Pacific dominates the EUV lithography materials market, with South Korea, Taiwan, and Japan collectively representing over 70% of global consumption. This regional concentration directly correlates with the presence of major semiconductor manufacturers like Samsung, TSMC, and Intel's expanding operations in these regions. North America and Europe follow with approximately 18% and 12% market share respectively.

The market dynamics are heavily influenced by the capital expenditure cycles of major semiconductor manufacturers. Recent announcements of fab expansions by TSMC, Samsung, and Intel are expected to significantly boost demand for EUV materials through 2025 and beyond. Industry analysts predict that the transition to 3nm and 2nm nodes will further accelerate market growth, potentially doubling the consumption of specialized EUV resist materials by 2026.

Customer segmentation reveals that integrated device manufacturers (IDMs) and foundries constitute approximately 85% of end-users, with research institutions and development facilities accounting for the remainder. The high-performance computing, mobile, and automotive sectors are driving the strongest demand growth, with annual increases of 22%, 19%, and 17% respectively.

Pricing trends indicate a gradual decrease in per-unit costs as production scales up, though this is partially offset by increasing performance requirements. The average selling price for advanced EUV resist formulations has decreased by approximately 8% annually over the past three years, while performance metrics such as sensitivity and resolution have improved by 15-20% during the same period.

Market barriers to entry remain substantial due to the highly specialized nature of EUV resist chemistry, extensive intellectual property protections, and the significant capital investment required for research and development. This has resulted in a concentrated supplier landscape dominated by a handful of specialized chemical companies with deep expertise in photoresist technology.

Global EUV Resist Technology Status and Barriers

Extreme Ultraviolet (EUV) lithography represents a revolutionary advancement in semiconductor manufacturing, enabling the production of increasingly miniaturized and powerful microchips. At the heart of this technology are EUV resist materials, which play a crucial role in pattern formation during the lithography process. Currently, the global landscape of EUV resist technology faces several significant barriers that impede its widespread adoption and optimization.

The primary technical challenge confronting EUV resist development is achieving the optimal balance between sensitivity, resolution, and line edge roughness (LER) - often referred to as the "triangle trade-off." As semiconductor nodes shrink below 7nm, conventional chemically amplified resists (CARs) struggle to meet the stringent requirements for high-volume manufacturing. The limited photon density of EUV sources necessitates highly sensitive resists, yet increasing sensitivity typically compromises resolution and pattern fidelity.

Material stability presents another substantial barrier. EUV photons carry approximately 14 times more energy than deep ultraviolet (DUV) photons, causing complex photochemical reactions and potential resist degradation. This high-energy exposure creates secondary electrons that can diffuse beyond intended exposure areas, resulting in pattern blur and reduced resolution. Controlling these secondary electron effects remains a significant technical hurdle.

Outgassing during EUV exposure represents a critical concern for manufacturing environments. Volatile compounds released from resists can contaminate expensive EUV optics, reducing tool lifetime and increasing maintenance costs. Developing low-outgassing resist formulations without sacrificing performance metrics continues to challenge material scientists and chemists worldwide.

From a geographical perspective, EUV resist technology development is concentrated primarily in Japan, South Korea, the United States, and increasingly in China. Japanese companies like JSR, TOK, and Fujifilm have established dominant positions, leveraging their extensive experience in photoresist chemistry. However, this concentration creates supply chain vulnerabilities, as evidenced during recent global disruptions.

The economic barrier to entry in EUV resist development is substantial. The specialized equipment required for testing and optimization, coupled with the need for access to limited EUV exposure tools, restricts innovation to well-funded entities. This financial threshold has led to industry consolidation, with fewer players capable of sustaining the necessary R&D investments.

Standardization and metrology challenges further complicate progress. The industry lacks unified testing protocols and measurement standards for EUV resists, making direct comparisons between different materials and approaches difficult. This hampers efficient knowledge sharing and slows the overall pace of innovation in the field.

The primary technical challenge confronting EUV resist development is achieving the optimal balance between sensitivity, resolution, and line edge roughness (LER) - often referred to as the "triangle trade-off." As semiconductor nodes shrink below 7nm, conventional chemically amplified resists (CARs) struggle to meet the stringent requirements for high-volume manufacturing. The limited photon density of EUV sources necessitates highly sensitive resists, yet increasing sensitivity typically compromises resolution and pattern fidelity.

Material stability presents another substantial barrier. EUV photons carry approximately 14 times more energy than deep ultraviolet (DUV) photons, causing complex photochemical reactions and potential resist degradation. This high-energy exposure creates secondary electrons that can diffuse beyond intended exposure areas, resulting in pattern blur and reduced resolution. Controlling these secondary electron effects remains a significant technical hurdle.

Outgassing during EUV exposure represents a critical concern for manufacturing environments. Volatile compounds released from resists can contaminate expensive EUV optics, reducing tool lifetime and increasing maintenance costs. Developing low-outgassing resist formulations without sacrificing performance metrics continues to challenge material scientists and chemists worldwide.

From a geographical perspective, EUV resist technology development is concentrated primarily in Japan, South Korea, the United States, and increasingly in China. Japanese companies like JSR, TOK, and Fujifilm have established dominant positions, leveraging their extensive experience in photoresist chemistry. However, this concentration creates supply chain vulnerabilities, as evidenced during recent global disruptions.

The economic barrier to entry in EUV resist development is substantial. The specialized equipment required for testing and optimization, coupled with the need for access to limited EUV exposure tools, restricts innovation to well-funded entities. This financial threshold has led to industry consolidation, with fewer players capable of sustaining the necessary R&D investments.

Standardization and metrology challenges further complicate progress. The industry lacks unified testing protocols and measurement standards for EUV resists, making direct comparisons between different materials and approaches difficult. This hampers efficient knowledge sharing and slows the overall pace of innovation in the field.

Current EUV Resist Material Solutions and Performance

01 Metal-containing EUV resist materials

Metal-containing compounds are incorporated into EUV resist materials to enhance sensitivity and absorption of EUV radiation. These materials typically include transition metals such as tin, zinc, or hafnium that provide higher EUV absorption cross-sections compared to traditional organic resists. The metal components can be integrated as metal oxide nanoparticles or organometallic complexes, improving pattern resolution and reducing line edge roughness while maintaining good etch resistance.- Metal-containing EUV resist materials: Metal-containing compounds are incorporated into EUV resist materials to enhance sensitivity and absorption of EUV radiation. These materials typically include metal oxides, organometallic compounds, or metal nanoparticles that can significantly improve pattern resolution and reduce line edge roughness. The metal atoms provide higher EUV absorption cross-sections compared to traditional organic materials, enabling thinner resist films and better lithographic performance.

- Polymer-based EUV resist formulations: Specialized polymers are developed for EUV resist applications, including fluorinated polymers, silicon-containing polymers, and hybrid organic-inorganic polymer systems. These polymers are designed with specific functional groups that enhance sensitivity to EUV radiation while providing the necessary etch resistance and pattern stability. Chemical amplification mechanisms are often incorporated to improve sensitivity through acid-catalyzed reactions triggered by EUV exposure.

- Non-chemically amplified EUV resist materials: Non-chemically amplified resist materials are developed to overcome limitations of traditional chemically amplified resists, such as acid diffusion issues and pattern collapse. These materials rely on direct photochemical reactions rather than acid catalysis, offering improved resolution and reduced line edge roughness. They typically include photoactive compounds that undergo structural changes upon EUV exposure, creating solubility differences for pattern development.

- Multi-layer EUV resist systems: Multi-layer resist systems are designed to optimize EUV lithography performance by separating the imaging and pattern transfer functions. These systems typically include a thin imaging layer sensitive to EUV radiation on top of underlayers that provide planarization and enhanced pattern transfer capabilities. The multi-layer approach helps overcome limitations in resist thickness requirements while maintaining high resolution and minimizing pattern collapse during development.

- Additives and processing techniques for EUV resists: Various additives and processing techniques are employed to enhance EUV resist performance. These include quenchers to control acid diffusion, sensitizers to improve quantum yield, surfactants for better coating uniformity, and nanoparticles for mechanical strength. Post-exposure bake optimization, development process modifications, and specialized rinse solutions are also utilized to improve pattern fidelity, reduce line edge roughness, and prevent pattern collapse in high-resolution features.

02 Polymer-based EUV resist formulations

Polymer-based EUV resist formulations utilize specialized polymers as the main platform for resist materials. These formulations typically include acid-labile protecting groups that undergo chemical amplification upon exposure to EUV radiation. The polymers are designed with specific functional groups that enhance sensitivity, resolution, and pattern fidelity. Various additives such as photoacid generators, quenchers, and surfactants are incorporated to optimize performance characteristics including line edge roughness and exposure latitude.Expand Specific Solutions03 Non-chemically amplified EUV resist materials

Non-chemically amplified resist materials for EUV lithography operate without the traditional acid-catalyzed deprotection mechanism. These materials rely on direct photochemical reactions triggered by EUV photons, such as main chain scission, crosslinking, or polarity changes. This approach reduces issues related to acid diffusion like pattern blur and line edge roughness. Materials in this category include molecular glasses, nanoparticle-based resists, and metal oxide resists that offer improved resolution capabilities for advanced node semiconductor manufacturing.Expand Specific Solutions04 Multi-layer EUV resist systems

Multi-layer EUV resist systems employ a stack of different materials to optimize lithographic performance. These systems typically include a top imaging layer sensitive to EUV radiation, underlayers for pattern transfer enhancement, and anti-reflective coatings to minimize reflection issues. The layered approach allows for better control of pattern collapse, improved aspect ratios, and enhanced etch selectivity. Advanced multi-layer systems may incorporate specialized interface materials to manage the interaction between layers and improve adhesion properties.Expand Specific Solutions05 EUV resist additives and performance enhancers

Various additives are incorporated into EUV resist formulations to enhance specific performance characteristics. These include sensitizers that improve quantum efficiency, quenchers that control acid diffusion, surfactants that improve coating uniformity, and plasticizers that modify mechanical properties. Specialized nanoparticles and molecular additives can be used to enhance sensitivity, reduce line edge roughness, and improve pattern fidelity. Recent developments focus on additives that specifically address stochastic effects and shot noise issues that become critical at extreme ultraviolet wavelengths.Expand Specific Solutions

Key Vendors and Competitive Landscape in EUV Resist Market

The EUV resist materials market is currently in a growth phase, driven by the semiconductor industry's transition to advanced nodes requiring extreme ultraviolet lithography. The global market is expanding rapidly, with projections exceeding $500 million by 2025. Technologically, the field remains challenging with only a few players achieving commercial maturity. Leading companies include JSR Corp., Tokyo Ohka Kogyo, and Shin-Etsu Chemical dominating material development, while ASML Netherlands provides the essential EUV lithography systems. Samsung SDI, TSMC, and IBM represent key end-users driving requirements. Emerging players like Irresistible Materials and Shanghai Sinyang are developing next-generation solutions, while research institutions such as Chinese Academy of Science contribute fundamental innovations. The competitive landscape features strategic partnerships between material suppliers and equipment manufacturers to overcome technical challenges in resolution, sensitivity, and line edge roughness.

TOKYO OHKA KOGYO CO., LTD.

Technical Solution: Tokyo Ohka Kogyo (TOK) has developed a comprehensive EUV resist portfolio centered around their EUVJ™ resist platform. Their technology employs a unique molecular design approach that incorporates radiation-sensitive protecting groups with optimized acid diffusion control mechanisms. TOK's resist materials achieve sensitivity in the 20-30mJ/cm² range while supporting resolution down to 12nm half-pitch patterns. A key innovation in their formulation is the incorporation of quencher compounds that significantly improve exposure latitude and pattern collapse resistance, critical for high-aspect-ratio features. TOK has also developed specialized topcoat materials that work synergistically with their resist platform to reduce outgassing during exposure, addressing a major concern for EUV scanner maintenance. Their materials demonstrate excellent etch resistance with selectivity ratios exceeding 3:1 for typical underlayer materials, enabling effective pattern transfer in multi-patterning schemes required for advanced nodes.

Strengths: Exceptional pattern fidelity and dimensional control; reduced outgassing properties; strong integration with existing semiconductor manufacturing processes. Weaknesses: Moderate sensitivity requiring longer exposure times; more complex processing steps compared to competitors; limited performance data at high-NA EUV conditions.

Taiwan Semiconductor Manufacturing Co., Ltd.

Technical Solution: TSMC has developed proprietary EUV resist processing techniques and material specifications as part of their advanced node manufacturing processes. As the world's leading semiconductor foundry, TSMC has created a comprehensive resist qualification program that has become a de facto industry standard. Their approach focuses on process integration rather than base material development, with innovations in post-exposure processing, pattern transfer optimization, and defect mitigation strategies. TSMC has pioneered multi-layer resist systems specifically designed for EUV lithography that improve pattern transfer fidelity while reducing line edge roughness. Their material specifications emphasize manufacturability aspects including coating uniformity, thermal stability, and batch-to-batch consistency that are critical for high-volume production. TSMC has also developed specialized metrology techniques for evaluating resist performance in production environments, providing feedback that has guided material suppliers' development efforts. Their process integration expertise has enabled the successful implementation of EUV lithography in volume production at the 7nm node and beyond, demonstrating the practical viability of current-generation EUV resist materials.

Strengths: Unmatched process integration expertise; extensive real-world manufacturing data; ability to drive industry specifications through purchasing power. Weaknesses: Limited fundamental materials research compared to specialized chemical companies; heavily dependent on supplier innovations; primarily focused on immediate manufacturing needs rather than long-term material development.

Critical Patents and Technical Literature in EUV Resist Field

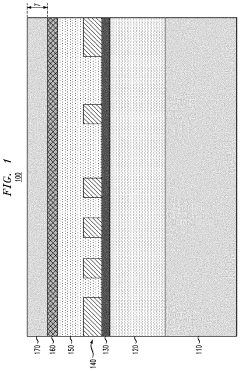

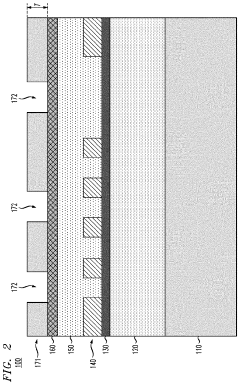

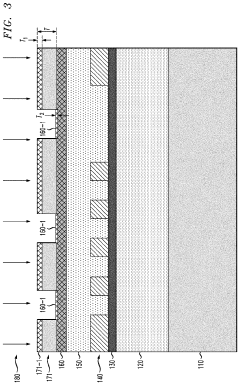

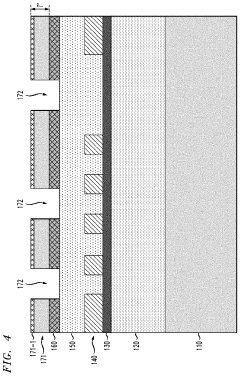

Extreme ultraviolet (EUV) lithography patterning methods utilizing EUV resist hardening

PatentInactiveUS20190384180A1

Innovation

- Implementing a surface-hardened EUV resist mask with an etch-resistant layer formed by a neutral atom beam process that implants chemical or metallic species into the EUV resist mask to enhance etch resistance, allowing for patterning of sub-36 nm pitch features without significant mask thickness reduction.

Supply Chain Analysis for EUV Resist Manufacturing

The EUV resist manufacturing supply chain represents a critical component of the semiconductor industry's advanced lithography ecosystem. The supply chain is characterized by high complexity and significant barriers to entry, primarily due to the specialized materials and processes required for EUV resist production.

The supply chain begins with raw material suppliers providing specialized monomers, polymers, photoacid generators (PAGs), and quenchers. These components require ultra-high purity levels, often exceeding 99.999%, to prevent defects in the nanoscale patterns. Key raw material suppliers include Shin-Etsu Chemical, DuPont, and Sumitomo Chemical, who have established proprietary synthesis methods for these specialized chemicals.

Formulation represents the next critical stage, where resist manufacturers combine these raw materials according to precise recipes. This stage requires advanced mixing equipment, clean room facilities, and sophisticated quality control systems. The formulation process is highly guarded, with companies like JSR, TOK, and Fujifilm Electronic Materials maintaining significant IP portfolios around their formulation techniques.

Distribution and logistics present unique challenges in the EUV resist supply chain. These materials require specialized handling due to their photosensitivity, chemical reactivity, and short shelf life. Temperature-controlled transportation and storage are essential, with many resists requiring constant refrigeration between 2-8°C. Additionally, regulatory compliance for transporting these chemicals across international borders adds complexity.

The geographical distribution of the supply chain shows significant concentration in East Asia, particularly Japan and South Korea, creating potential vulnerabilities. Over 70% of advanced EUV resist production capacity is located in Japan, with limited secondary sources in Europe and North America. This concentration has prompted concerns about supply chain resilience, especially following recent global disruptions.

Vertical integration trends are becoming increasingly apparent, with major semiconductor manufacturers like Samsung and TSMC developing strategic partnerships or equity investments in resist suppliers to secure access to these critical materials. This trend reflects the strategic importance of EUV resists in maintaining competitive advantages in advanced semiconductor manufacturing.

The supply chain also faces sustainability challenges, particularly regarding the environmental impact of resist manufacturing and disposal. The industry is exploring greener chemistry approaches and recycling technologies to address these concerns while maintaining the stringent performance requirements of EUV lithography.

The supply chain begins with raw material suppliers providing specialized monomers, polymers, photoacid generators (PAGs), and quenchers. These components require ultra-high purity levels, often exceeding 99.999%, to prevent defects in the nanoscale patterns. Key raw material suppliers include Shin-Etsu Chemical, DuPont, and Sumitomo Chemical, who have established proprietary synthesis methods for these specialized chemicals.

Formulation represents the next critical stage, where resist manufacturers combine these raw materials according to precise recipes. This stage requires advanced mixing equipment, clean room facilities, and sophisticated quality control systems. The formulation process is highly guarded, with companies like JSR, TOK, and Fujifilm Electronic Materials maintaining significant IP portfolios around their formulation techniques.

Distribution and logistics present unique challenges in the EUV resist supply chain. These materials require specialized handling due to their photosensitivity, chemical reactivity, and short shelf life. Temperature-controlled transportation and storage are essential, with many resists requiring constant refrigeration between 2-8°C. Additionally, regulatory compliance for transporting these chemicals across international borders adds complexity.

The geographical distribution of the supply chain shows significant concentration in East Asia, particularly Japan and South Korea, creating potential vulnerabilities. Over 70% of advanced EUV resist production capacity is located in Japan, with limited secondary sources in Europe and North America. This concentration has prompted concerns about supply chain resilience, especially following recent global disruptions.

Vertical integration trends are becoming increasingly apparent, with major semiconductor manufacturers like Samsung and TSMC developing strategic partnerships or equity investments in resist suppliers to secure access to these critical materials. This trend reflects the strategic importance of EUV resists in maintaining competitive advantages in advanced semiconductor manufacturing.

The supply chain also faces sustainability challenges, particularly regarding the environmental impact of resist manufacturing and disposal. The industry is exploring greener chemistry approaches and recycling technologies to address these concerns while maintaining the stringent performance requirements of EUV lithography.

Environmental and Safety Considerations for EUV Materials

The environmental and safety considerations for EUV resist materials have become increasingly important as the semiconductor industry adopts extreme ultraviolet lithography technology. These materials, while critical for advancing chip manufacturing capabilities, present unique challenges related to their chemical composition, handling requirements, and disposal protocols.

EUV resist materials typically contain metal-organic compounds, photoacid generators, and various solvents that may pose environmental and health risks if not properly managed. The metal components, particularly tin and antimony, require careful monitoring due to their potential toxicity and environmental persistence. Industry leaders like JSR Corporation, TOK, and Shin-Etsu Chemical have implemented comprehensive safety protocols and invested in developing more environmentally friendly formulations with reduced metal content.

Regulatory frameworks governing these materials vary significantly across regions, creating compliance challenges for global manufacturers. The European Union's REACH regulations impose stringent requirements on chemical registration and safety assessment, while similar frameworks in the United States (EPA regulations) and Asia (particularly Japan and South Korea) create a complex regulatory landscape that vendors must navigate.

Waste management represents another critical environmental consideration. EUV resist materials generate specific waste streams during manufacturing and application processes that require specialized treatment. Leading vendors have developed closed-loop recycling systems to recover valuable components and minimize environmental impact. JSR's EcoAdvance program and Inpria's (now owned by JSR) metal recovery initiatives demonstrate industry commitment to sustainable practices.

Worker safety considerations have driven significant innovation in handling systems and exposure controls. The potential for respiratory and dermal exposure has led to the development of specialized containment technologies and personal protective equipment protocols. Vendors like TOK and DuPont have pioneered automated handling systems that minimize human contact with these materials.

The industry is actively pursuing "green chemistry" approaches to EUV resist development. Recent patent filings from major vendors reveal increasing focus on biodegradable components, reduced toxicity formulations, and lower process temperatures to minimize energy consumption. These innovations align with broader semiconductor industry sustainability goals while addressing specific EUV material challenges.

Collaborative industry initiatives, such as the Semiconductor Environmental Safety and Health Association's working groups, have established best practices for EUV material handling, storage, and disposal. These collaborative efforts have accelerated the development of standardized safety protocols and environmental management systems across the supply chain.

EUV resist materials typically contain metal-organic compounds, photoacid generators, and various solvents that may pose environmental and health risks if not properly managed. The metal components, particularly tin and antimony, require careful monitoring due to their potential toxicity and environmental persistence. Industry leaders like JSR Corporation, TOK, and Shin-Etsu Chemical have implemented comprehensive safety protocols and invested in developing more environmentally friendly formulations with reduced metal content.

Regulatory frameworks governing these materials vary significantly across regions, creating compliance challenges for global manufacturers. The European Union's REACH regulations impose stringent requirements on chemical registration and safety assessment, while similar frameworks in the United States (EPA regulations) and Asia (particularly Japan and South Korea) create a complex regulatory landscape that vendors must navigate.

Waste management represents another critical environmental consideration. EUV resist materials generate specific waste streams during manufacturing and application processes that require specialized treatment. Leading vendors have developed closed-loop recycling systems to recover valuable components and minimize environmental impact. JSR's EcoAdvance program and Inpria's (now owned by JSR) metal recovery initiatives demonstrate industry commitment to sustainable practices.

Worker safety considerations have driven significant innovation in handling systems and exposure controls. The potential for respiratory and dermal exposure has led to the development of specialized containment technologies and personal protective equipment protocols. Vendors like TOK and DuPont have pioneered automated handling systems that minimize human contact with these materials.

The industry is actively pursuing "green chemistry" approaches to EUV resist development. Recent patent filings from major vendors reveal increasing focus on biodegradable components, reduced toxicity formulations, and lower process temperatures to minimize energy consumption. These innovations align with broader semiconductor industry sustainability goals while addressing specific EUV material challenges.

Collaborative industry initiatives, such as the Semiconductor Environmental Safety and Health Association's working groups, have established best practices for EUV material handling, storage, and disposal. These collaborative efforts have accelerated the development of standardized safety protocols and environmental management systems across the supply chain.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!