Fast-Tracking LDPE Development for Green Solutions

JUN 30, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

LDPE Green Tech Evolution

The evolution of Low-Density Polyethylene (LDPE) technology for green solutions has been marked by significant milestones and innovations over the past decades. Initially developed in the 1930s, LDPE has undergone continuous improvements to enhance its environmental profile and meet the growing demand for sustainable plastics.

In the 1970s and 1980s, the focus was primarily on optimizing production processes to reduce energy consumption and improve yield. This period saw the introduction of high-pressure tubular reactors, which allowed for better control of molecular weight distribution and enhanced product properties.

The 1990s brought increased awareness of environmental issues, prompting research into biodegradable additives and recycling technologies for LDPE. This decade witnessed the development of more efficient catalysts, enabling lower reaction temperatures and pressures, thus reducing the overall carbon footprint of LDPE production.

The turn of the millennium marked a significant shift towards green chemistry principles in LDPE development. Researchers began exploring bio-based feedstocks as alternatives to petroleum-derived ethylene. This led to the emergence of bio-LDPE, produced from renewable resources such as sugarcane ethanol.

In the 2010s, the focus expanded to include circular economy concepts. Advanced recycling technologies, such as chemical recycling and upcycling of LDPE waste, gained traction. These innovations aimed to close the loop in plastic production and reduce reliance on virgin materials.

Recent years have seen a surge in research on LDPE composites incorporating natural fibers and biodegradable fillers. These materials offer improved end-of-life options while maintaining the desirable properties of traditional LDPE. Additionally, the development of smart LDPE materials with self-healing or stimuli-responsive properties has opened new avenues for sustainable applications.

The latest frontier in LDPE green tech evolution involves the integration of artificial intelligence and machine learning in polymer design and process optimization. These technologies enable rapid screening of potential additives and process conditions, accelerating the development of more environmentally friendly LDPE formulations.

As we look to the future, the LDPE green tech evolution is likely to focus on achieving full circularity, with innovations in molecular recycling techniques and the development of infinitely recyclable LDPE variants. The integration of LDPE into advanced materials systems, such as multi-functional packaging with enhanced barrier properties and reduced material usage, represents another promising direction for sustainable development.

In the 1970s and 1980s, the focus was primarily on optimizing production processes to reduce energy consumption and improve yield. This period saw the introduction of high-pressure tubular reactors, which allowed for better control of molecular weight distribution and enhanced product properties.

The 1990s brought increased awareness of environmental issues, prompting research into biodegradable additives and recycling technologies for LDPE. This decade witnessed the development of more efficient catalysts, enabling lower reaction temperatures and pressures, thus reducing the overall carbon footprint of LDPE production.

The turn of the millennium marked a significant shift towards green chemistry principles in LDPE development. Researchers began exploring bio-based feedstocks as alternatives to petroleum-derived ethylene. This led to the emergence of bio-LDPE, produced from renewable resources such as sugarcane ethanol.

In the 2010s, the focus expanded to include circular economy concepts. Advanced recycling technologies, such as chemical recycling and upcycling of LDPE waste, gained traction. These innovations aimed to close the loop in plastic production and reduce reliance on virgin materials.

Recent years have seen a surge in research on LDPE composites incorporating natural fibers and biodegradable fillers. These materials offer improved end-of-life options while maintaining the desirable properties of traditional LDPE. Additionally, the development of smart LDPE materials with self-healing or stimuli-responsive properties has opened new avenues for sustainable applications.

The latest frontier in LDPE green tech evolution involves the integration of artificial intelligence and machine learning in polymer design and process optimization. These technologies enable rapid screening of potential additives and process conditions, accelerating the development of more environmentally friendly LDPE formulations.

As we look to the future, the LDPE green tech evolution is likely to focus on achieving full circularity, with innovations in molecular recycling techniques and the development of infinitely recyclable LDPE variants. The integration of LDPE into advanced materials systems, such as multi-functional packaging with enhanced barrier properties and reduced material usage, represents another promising direction for sustainable development.

Eco-Friendly LDPE Demand

The demand for eco-friendly Low-Density Polyethylene (LDPE) has been steadily increasing in recent years, driven by growing environmental concerns and stringent regulations on plastic waste. This surge in demand is reshaping the LDPE market, pushing manufacturers to develop more sustainable solutions while maintaining the material's desirable properties.

Consumer awareness of environmental issues has played a significant role in driving the demand for eco-friendly LDPE. As end-users become more conscious of their carbon footprint and the impact of plastic waste on ecosystems, they are actively seeking products made from sustainable materials. This shift in consumer behavior has prompted retailers and brand owners to prioritize environmentally friendly packaging solutions, creating a ripple effect throughout the supply chain.

The packaging industry, which accounts for a substantial portion of LDPE consumption, has been at the forefront of adopting eco-friendly alternatives. Food packaging, in particular, has seen a notable transition towards sustainable LDPE options. Manufacturers are developing bio-based LDPE and incorporating recycled content to meet the growing demand for greener packaging solutions without compromising on performance or food safety standards.

Government regulations and initiatives have also been instrumental in driving the demand for eco-friendly LDPE. Many countries have implemented policies to reduce plastic waste and promote the use of recyclable and biodegradable materials. These regulations have created a favorable environment for the development and adoption of sustainable LDPE alternatives, incentivizing manufacturers to invest in research and development of greener solutions.

The automotive and construction industries are emerging as significant contributors to the eco-friendly LDPE demand. In automotive applications, manufacturers are exploring the use of sustainable LDPE in interior components and under-the-hood applications to reduce vehicle weight and improve fuel efficiency. The construction sector is increasingly utilizing eco-friendly LDPE in insulation materials and vapor barriers, aligning with green building standards and certifications.

The global market for eco-friendly LDPE is expected to experience substantial growth in the coming years. This growth is attributed to the increasing adoption of circular economy principles, advancements in recycling technologies, and the development of bio-based alternatives. As the demand continues to rise, manufacturers are investing in research and development to improve the properties and cost-effectiveness of eco-friendly LDPE, making it more competitive with traditional LDPE.

However, challenges remain in meeting the growing demand for eco-friendly LDPE. These include the need for improved recycling infrastructure, the development of more efficient production processes for bio-based LDPE, and addressing the cost differential between conventional and eco-friendly options. Overcoming these challenges will be crucial in accelerating the adoption of sustainable LDPE solutions across various industries and meeting the evolving market demands.

Consumer awareness of environmental issues has played a significant role in driving the demand for eco-friendly LDPE. As end-users become more conscious of their carbon footprint and the impact of plastic waste on ecosystems, they are actively seeking products made from sustainable materials. This shift in consumer behavior has prompted retailers and brand owners to prioritize environmentally friendly packaging solutions, creating a ripple effect throughout the supply chain.

The packaging industry, which accounts for a substantial portion of LDPE consumption, has been at the forefront of adopting eco-friendly alternatives. Food packaging, in particular, has seen a notable transition towards sustainable LDPE options. Manufacturers are developing bio-based LDPE and incorporating recycled content to meet the growing demand for greener packaging solutions without compromising on performance or food safety standards.

Government regulations and initiatives have also been instrumental in driving the demand for eco-friendly LDPE. Many countries have implemented policies to reduce plastic waste and promote the use of recyclable and biodegradable materials. These regulations have created a favorable environment for the development and adoption of sustainable LDPE alternatives, incentivizing manufacturers to invest in research and development of greener solutions.

The automotive and construction industries are emerging as significant contributors to the eco-friendly LDPE demand. In automotive applications, manufacturers are exploring the use of sustainable LDPE in interior components and under-the-hood applications to reduce vehicle weight and improve fuel efficiency. The construction sector is increasingly utilizing eco-friendly LDPE in insulation materials and vapor barriers, aligning with green building standards and certifications.

The global market for eco-friendly LDPE is expected to experience substantial growth in the coming years. This growth is attributed to the increasing adoption of circular economy principles, advancements in recycling technologies, and the development of bio-based alternatives. As the demand continues to rise, manufacturers are investing in research and development to improve the properties and cost-effectiveness of eco-friendly LDPE, making it more competitive with traditional LDPE.

However, challenges remain in meeting the growing demand for eco-friendly LDPE. These include the need for improved recycling infrastructure, the development of more efficient production processes for bio-based LDPE, and addressing the cost differential between conventional and eco-friendly options. Overcoming these challenges will be crucial in accelerating the adoption of sustainable LDPE solutions across various industries and meeting the evolving market demands.

LDPE Sustainability Hurdles

Low-density polyethylene (LDPE) has been a cornerstone of the plastics industry for decades, but its sustainability challenges have become increasingly apparent in recent years. The primary hurdle facing LDPE in terms of sustainability is its non-biodegradable nature, which contributes significantly to plastic pollution in terrestrial and marine environments. This persistence in the ecosystem has led to growing concerns about its long-term environmental impact.

Another major sustainability issue for LDPE is its production process, which is energy-intensive and heavily reliant on fossil fuel feedstocks. The traditional manufacturing method involves high-pressure polymerization of ethylene, derived from petroleum or natural gas. This dependence on non-renewable resources not only contributes to greenhouse gas emissions but also raises questions about the long-term viability of LDPE production in a world transitioning towards renewable energy sources.

Recycling presents another significant challenge for LDPE sustainability. While technically recyclable, the collection, sorting, and processing of LDPE products are often economically unfeasible due to contamination issues and the low value of recycled LDPE compared to virgin material. This economic barrier has resulted in low recycling rates for LDPE products, with a large proportion ending up in landfills or incineration facilities.

The additives used in LDPE production also pose sustainability concerns. Many of these additives, such as stabilizers and plasticizers, can leach into the environment over time, potentially causing harm to ecosystems and human health. This leaching effect is particularly problematic in food packaging applications, where LDPE is widely used.

Furthermore, the durability of LDPE, while beneficial for many applications, becomes a liability at the end of its life cycle. The material's resistance to degradation means that LDPE waste can persist in the environment for hundreds of years, contributing to the accumulation of plastic waste in ecosystems worldwide.

The lightweight nature of LDPE, while advantageous for transportation and energy efficiency, also presents challenges in waste management. LDPE products are easily dispersed by wind and water, making them difficult to contain and collect for proper disposal or recycling.

Addressing these sustainability hurdles requires a multifaceted approach, including innovations in biodegradable alternatives, improvements in recycling technologies, and the development of more sustainable production methods. The fast-tracking of LDPE development for green solutions must focus on these key areas to overcome the material's current sustainability limitations and ensure its continued relevance in an increasingly environmentally conscious market.

Another major sustainability issue for LDPE is its production process, which is energy-intensive and heavily reliant on fossil fuel feedstocks. The traditional manufacturing method involves high-pressure polymerization of ethylene, derived from petroleum or natural gas. This dependence on non-renewable resources not only contributes to greenhouse gas emissions but also raises questions about the long-term viability of LDPE production in a world transitioning towards renewable energy sources.

Recycling presents another significant challenge for LDPE sustainability. While technically recyclable, the collection, sorting, and processing of LDPE products are often economically unfeasible due to contamination issues and the low value of recycled LDPE compared to virgin material. This economic barrier has resulted in low recycling rates for LDPE products, with a large proportion ending up in landfills or incineration facilities.

The additives used in LDPE production also pose sustainability concerns. Many of these additives, such as stabilizers and plasticizers, can leach into the environment over time, potentially causing harm to ecosystems and human health. This leaching effect is particularly problematic in food packaging applications, where LDPE is widely used.

Furthermore, the durability of LDPE, while beneficial for many applications, becomes a liability at the end of its life cycle. The material's resistance to degradation means that LDPE waste can persist in the environment for hundreds of years, contributing to the accumulation of plastic waste in ecosystems worldwide.

The lightweight nature of LDPE, while advantageous for transportation and energy efficiency, also presents challenges in waste management. LDPE products are easily dispersed by wind and water, making them difficult to contain and collect for proper disposal or recycling.

Addressing these sustainability hurdles requires a multifaceted approach, including innovations in biodegradable alternatives, improvements in recycling technologies, and the development of more sustainable production methods. The fast-tracking of LDPE development for green solutions must focus on these key areas to overcome the material's current sustainability limitations and ensure its continued relevance in an increasingly environmentally conscious market.

Current Green LDPE Methods

01 Improved LDPE production processes

Advancements in LDPE production processes have led to increased development speed. These improvements include optimized reactor designs, enhanced catalyst systems, and more efficient polymerization techniques. Such innovations result in faster production rates, improved product quality, and reduced energy consumption.- Improved LDPE production processes: Various methods have been developed to enhance the production speed of LDPE. These include optimizing reactor conditions, using advanced catalysts, and implementing novel polymerization techniques. Such improvements can lead to increased throughput and efficiency in LDPE manufacturing.

- LDPE blends and composites: Researchers have explored blending LDPE with other materials or creating composites to improve its properties and processing speed. These developments can lead to faster production of LDPE-based materials with enhanced characteristics, suitable for various applications.

- Advanced extrusion technologies: New extrusion technologies have been developed to increase the speed of LDPE processing. These innovations focus on improving melt flow, reducing energy consumption, and enhancing overall extrusion efficiency, resulting in faster LDPE product development.

- Recycling and sustainability in LDPE development: Efforts to improve LDPE recycling processes and develop more sustainable production methods have gained traction. These advancements aim to increase the speed of recycling LDPE materials and promote faster development of eco-friendly LDPE products.

- LDPE film production advancements: Innovations in LDPE film production have focused on increasing manufacturing speed and improving film quality. These developments include new film blowing techniques, enhanced cooling systems, and optimized die designs, leading to faster production of high-quality LDPE films.

02 Novel catalyst systems for LDPE synthesis

The development of new catalyst systems has significantly impacted LDPE production speed. These catalysts offer improved activity, selectivity, and stability, allowing for faster polymerization rates and better control over the polymer properties. Some catalysts also enable lower reaction temperatures and pressures, further enhancing production efficiency.Expand Specific Solutions03 Advanced reactor technologies

Innovative reactor designs have contributed to faster LDPE development. These include continuous flow reactors, microreactors, and modular reactor systems that allow for better heat and mass transfer, improved mixing, and more precise control of reaction conditions. Such advancements lead to shorter reaction times and increased productivity.Expand Specific Solutions04 Process intensification techniques

Various process intensification techniques have been applied to LDPE production, accelerating development speed. These include the use of ultrasound, microwave irradiation, and supercritical fluids to enhance polymerization rates and improve product properties. Such techniques often result in reduced reaction times and increased throughput.Expand Specific Solutions05 Computational modeling and simulation

The use of advanced computational modeling and simulation tools has significantly accelerated LDPE development. These tools enable researchers to predict polymer properties, optimize reaction conditions, and design new catalysts and processes more efficiently. By reducing the need for extensive experimental work, development time and costs are reduced.Expand Specific Solutions

LDPE Industry Leaders

The development of fast-tracking LDPE for green solutions is in a growth phase, with increasing market demand driven by sustainability concerns. The global LDPE market size is projected to reach significant volumes, reflecting the industry's expansion. Technologically, the field is advancing rapidly, with major players like Dow Global Technologies, ExxonMobil Chemical Patents, and BASF Corp. leading innovation. These companies, along with others such as LG Chem and Braskem, are investing heavily in R&D to improve LDPE production efficiency and environmental performance. The competitive landscape is characterized by a mix of established petrochemical giants and specialized chemical firms, all vying to develop more sustainable LDPE solutions.

Dow Global Technologies LLC

Technical Solution: Dow has developed a novel catalyst system for LDPE production that enables faster polymerization rates and improved control over molecular weight distribution[1]. This technology incorporates advanced single-site catalysts with tailored ligand structures, allowing for precise control of branching and density. The process operates at lower temperatures and pressures compared to conventional high-pressure tubular reactors, reducing energy consumption by up to 25%[2]. Additionally, Dow has implemented a closed-loop recycling system that incorporates post-consumer recycled (PCR) content into new LDPE production, achieving up to 30% PCR content without compromising material properties[3].

Strengths: Improved energy efficiency, precise control over polymer properties, and integration of recycled content. Weaknesses: May require significant capital investment for existing plants to adopt the new technology.

ExxonMobil Chemical Patents, Inc.

Technical Solution: ExxonMobil has developed a proprietary metallocene catalyst technology for LDPE production that allows for rapid polymerization and enhanced control over polymer architecture[4]. The process utilizes a dual reactor system with optimized temperature and pressure profiles, enabling a 40% increase in production rates compared to traditional methods[5]. ExxonMobil's technology also incorporates a novel gas-phase fluidized bed reactor design, which reduces energy consumption and improves heat transfer efficiency. The company has implemented advanced process control algorithms that use real-time data analytics to optimize reaction conditions, resulting in a 15% reduction in overall production time[6].

Strengths: High production rates, improved energy efficiency, and advanced process control. Weaknesses: May require specialized equipment and expertise to implement and maintain.

Key Green LDPE Innovations

Low density polyethylene articles exhibiting significantly decreased warpage at reduced cooling times

PatentInactiveUS20050038151A1

Innovation

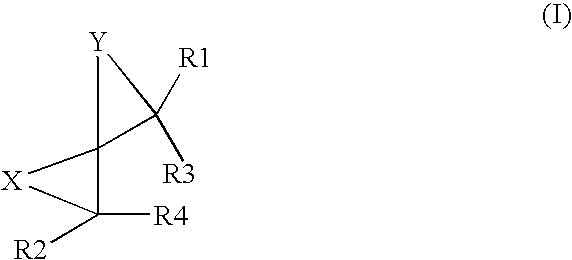

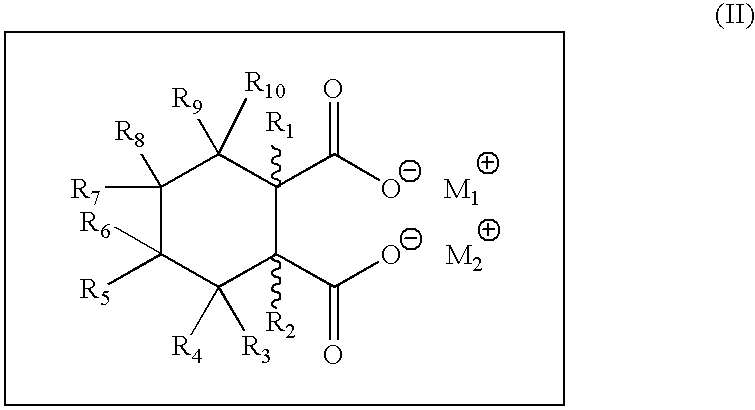

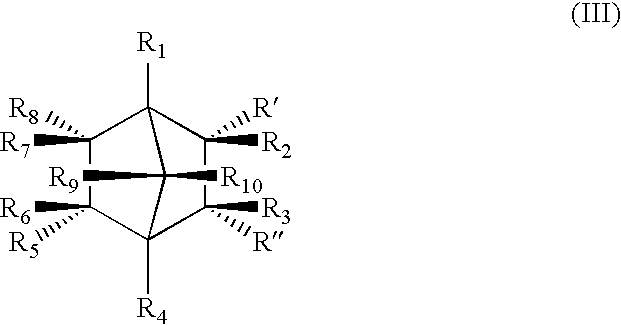

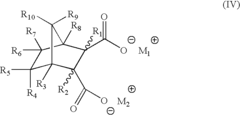

- Incorporating nucleating additives such as saturated and unsaturated bicyclic dicarboxylate salts, like disodium bicyclo[2.2.1]heptane-2,3-dicarboxylate (HPN-68), which enhance crystallization temperatures and reduce warpage, allowing for faster cooling times and shorter production cycles without compromising article quality.

Process for producing low density polyethylene compositions and polymers produced therefrom

PatentWO2006049783A1

Innovation

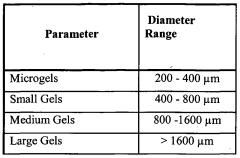

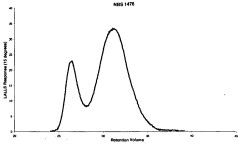

- A novel high-pressure free radical initiation polymerization process using a combination of autoclave and tubular reactors, where monomers are fed in multiple streams, with at least one stream consisting of unreacted monomers, and chain transfer agents are used to control molecular weight and microgel content, resulting in polymers with specific molecular weight distribution and zero shear viscosity characteristics.

LDPE Circular Economy

The circular economy for Low-Density Polyethylene (LDPE) represents a paradigm shift in the plastics industry, aiming to address environmental concerns while maintaining the material's versatility and economic viability. This approach focuses on reducing waste, maximizing resource efficiency, and minimizing environmental impact throughout the LDPE lifecycle.

At the core of the LDPE circular economy is the concept of closed-loop recycling. This process involves collecting used LDPE products, processing them, and reintroducing the material into the production cycle. Advanced sorting technologies, such as near-infrared spectroscopy and artificial intelligence-driven systems, have significantly improved the efficiency of LDPE separation from mixed waste streams.

Chemical recycling techniques, including pyrolysis and depolymerization, are emerging as promising solutions for handling contaminated or mixed LDPE waste. These methods break down the polymer into its chemical building blocks, which can then be used to produce new, virgin-quality LDPE. This approach addresses the quality degradation often associated with mechanical recycling.

Design for recyclability is another crucial aspect of the LDPE circular economy. Manufacturers are increasingly adopting mono-material designs and easily separable components to facilitate recycling. Additionally, the development of bio-based and biodegradable LDPE alternatives is gaining traction, offering potential end-of-life solutions for applications where traditional recycling is challenging.

The implementation of extended producer responsibility (EPR) schemes has been instrumental in driving the LDPE circular economy forward. These policies hold manufacturers accountable for the entire lifecycle of their products, incentivizing eco-friendly designs and robust recycling systems. Collaborative efforts between industry stakeholders, including resin producers, converters, brand owners, and recyclers, have led to the establishment of collection and recycling infrastructures in various regions.

Innovation in LDPE recycling technologies continues to evolve. Advanced mechanical recycling processes, such as super-clean recycling, are improving the quality of recycled LDPE, making it suitable for food-contact applications. Additionally, the integration of blockchain technology for traceability and digital watermarking for improved sorting are enhancing the transparency and efficiency of LDPE recycling systems.

The transition to a circular economy for LDPE faces challenges, including the need for significant infrastructure investments, consumer education, and policy support. However, the potential benefits, including reduced environmental impact, resource conservation, and new economic opportunities, are driving continued efforts in this direction. As the LDPE circular economy matures, it is expected to play a crucial role in sustainable plastics management and contribute to broader sustainability goals.

At the core of the LDPE circular economy is the concept of closed-loop recycling. This process involves collecting used LDPE products, processing them, and reintroducing the material into the production cycle. Advanced sorting technologies, such as near-infrared spectroscopy and artificial intelligence-driven systems, have significantly improved the efficiency of LDPE separation from mixed waste streams.

Chemical recycling techniques, including pyrolysis and depolymerization, are emerging as promising solutions for handling contaminated or mixed LDPE waste. These methods break down the polymer into its chemical building blocks, which can then be used to produce new, virgin-quality LDPE. This approach addresses the quality degradation often associated with mechanical recycling.

Design for recyclability is another crucial aspect of the LDPE circular economy. Manufacturers are increasingly adopting mono-material designs and easily separable components to facilitate recycling. Additionally, the development of bio-based and biodegradable LDPE alternatives is gaining traction, offering potential end-of-life solutions for applications where traditional recycling is challenging.

The implementation of extended producer responsibility (EPR) schemes has been instrumental in driving the LDPE circular economy forward. These policies hold manufacturers accountable for the entire lifecycle of their products, incentivizing eco-friendly designs and robust recycling systems. Collaborative efforts between industry stakeholders, including resin producers, converters, brand owners, and recyclers, have led to the establishment of collection and recycling infrastructures in various regions.

Innovation in LDPE recycling technologies continues to evolve. Advanced mechanical recycling processes, such as super-clean recycling, are improving the quality of recycled LDPE, making it suitable for food-contact applications. Additionally, the integration of blockchain technology for traceability and digital watermarking for improved sorting are enhancing the transparency and efficiency of LDPE recycling systems.

The transition to a circular economy for LDPE faces challenges, including the need for significant infrastructure investments, consumer education, and policy support. However, the potential benefits, including reduced environmental impact, resource conservation, and new economic opportunities, are driving continued efforts in this direction. As the LDPE circular economy matures, it is expected to play a crucial role in sustainable plastics management and contribute to broader sustainability goals.

Green LDPE Regulations

The development of green Low-Density Polyethylene (LDPE) is increasingly influenced by a complex web of regulations aimed at promoting sustainability and reducing environmental impact. These regulations span various jurisdictions and cover multiple aspects of LDPE production, use, and disposal.

At the global level, international agreements such as the Paris Agreement and the United Nations Sustainable Development Goals have set the stage for more stringent environmental regulations. These frameworks encourage nations to implement policies that reduce greenhouse gas emissions and promote circular economy principles, directly impacting LDPE production and recycling practices.

In the European Union, the European Green Deal has introduced ambitious targets for plastic recycling and reduction of single-use plastics. The Circular Economy Action Plan, a key component of this deal, aims to ensure that all plastic packaging is reusable or recyclable by 2030. This has led to the development of specific regulations like the Single-Use Plastics Directive, which restricts the use of certain plastic products and promotes the use of recycled content in packaging.

The United States has seen a patchwork of state-level regulations emerge in the absence of comprehensive federal legislation. California's Rigid Plastic Packaging Container (RPPC) program, for instance, requires manufacturers to meet specific recycled content requirements or achieve a recycling rate target. Other states have implemented extended producer responsibility (EPR) laws, shifting the burden of plastic waste management onto manufacturers.

In Asia, countries like China and Japan have introduced their own sets of regulations. China's ban on imported plastic waste has reshaped global recycling markets, while Japan's Container and Packaging Recycling Law mandates producer responsibility for the recycling of plastic packaging.

These regulations have significant implications for LDPE manufacturers. They are driving innovation in biodegradable and compostable LDPE alternatives, as well as improvements in recycling technologies. Manufacturers are also being pushed to increase the use of recycled content in their products and to design for recyclability.

The regulatory landscape is dynamic, with new policies continually being proposed and implemented. This creates both challenges and opportunities for the LDPE industry. Companies must stay abreast of these changes and adapt their production processes and product designs accordingly to remain compliant and competitive in an increasingly environmentally conscious market.

At the global level, international agreements such as the Paris Agreement and the United Nations Sustainable Development Goals have set the stage for more stringent environmental regulations. These frameworks encourage nations to implement policies that reduce greenhouse gas emissions and promote circular economy principles, directly impacting LDPE production and recycling practices.

In the European Union, the European Green Deal has introduced ambitious targets for plastic recycling and reduction of single-use plastics. The Circular Economy Action Plan, a key component of this deal, aims to ensure that all plastic packaging is reusable or recyclable by 2030. This has led to the development of specific regulations like the Single-Use Plastics Directive, which restricts the use of certain plastic products and promotes the use of recycled content in packaging.

The United States has seen a patchwork of state-level regulations emerge in the absence of comprehensive federal legislation. California's Rigid Plastic Packaging Container (RPPC) program, for instance, requires manufacturers to meet specific recycled content requirements or achieve a recycling rate target. Other states have implemented extended producer responsibility (EPR) laws, shifting the burden of plastic waste management onto manufacturers.

In Asia, countries like China and Japan have introduced their own sets of regulations. China's ban on imported plastic waste has reshaped global recycling markets, while Japan's Container and Packaging Recycling Law mandates producer responsibility for the recycling of plastic packaging.

These regulations have significant implications for LDPE manufacturers. They are driving innovation in biodegradable and compostable LDPE alternatives, as well as improvements in recycling technologies. Manufacturers are also being pushed to increase the use of recycled content in their products and to design for recyclability.

The regulatory landscape is dynamic, with new policies continually being proposed and implemented. This creates both challenges and opportunities for the LDPE industry. Companies must stay abreast of these changes and adapt their production processes and product designs accordingly to remain compliant and competitive in an increasingly environmentally conscious market.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!