Modularization Strategies For Rapid Deployment Of Solid Sorbent DAC

AUG 22, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

DAC Modularization Background and Objectives

Direct Air Capture (DAC) technology has emerged as a critical component in the global effort to combat climate change by removing carbon dioxide directly from the atmosphere. The evolution of DAC technologies has progressed significantly over the past decade, with solid sorbent-based systems gaining prominence due to their efficiency and scalability advantages compared to liquid solvent alternatives. This technological trajectory has been driven by the urgent need to develop negative emissions technologies capable of addressing the growing concentration of atmospheric CO2.

Modularization represents a transformative approach to DAC deployment, enabling more rapid scaling and flexible implementation across diverse geographical and operational contexts. The concept of modular DAC systems originated from the recognition that traditional monolithic carbon capture installations face significant barriers related to construction timelines, capital requirements, and site-specific engineering challenges. By contrast, modular approaches allow for standardized manufacturing, parallel assembly, and incremental capacity expansion.

The primary objective of modular solid sorbent DAC development is to accelerate the path to gigaton-scale carbon removal by reducing deployment timelines and costs while maintaining or improving capture efficiency. Current projections indicate that achieving climate targets will require removing 5-10 gigatons of CO2 annually by mid-century, necessitating unprecedented scaling of DAC technologies. Modularization strategies directly address this challenge by enabling manufacturing economies of scale and learning-by-doing improvements.

Technical objectives for modular solid sorbent DAC systems include optimizing the balance between module size and transportation constraints, standardizing interfaces between components, maximizing energy efficiency through innovative heat integration across modules, and developing robust control systems capable of managing distributed capture operations. Additionally, modular designs must accommodate the integration of renewable energy sources to minimize the carbon intensity of the capture process itself.

The evolution of modular approaches has been influenced by successful precedents in other industries, particularly modular construction in the building sector and standardized unit operations in chemical processing. Early DAC installations primarily employed custom, site-built designs, but recent developments have demonstrated the viability of factory-built modules that can be rapidly deployed and interconnected at the installation site.

Looking forward, the trajectory of modular solid sorbent DAC technology is expected to follow an accelerated development path, with increasing standardization of key components and growing integration with renewable energy infrastructure. The ultimate goal is to establish a scalable, replicable approach to atmospheric carbon removal that can be deployed globally at the scale necessary to meaningfully impact climate change mitigation efforts.

Modularization represents a transformative approach to DAC deployment, enabling more rapid scaling and flexible implementation across diverse geographical and operational contexts. The concept of modular DAC systems originated from the recognition that traditional monolithic carbon capture installations face significant barriers related to construction timelines, capital requirements, and site-specific engineering challenges. By contrast, modular approaches allow for standardized manufacturing, parallel assembly, and incremental capacity expansion.

The primary objective of modular solid sorbent DAC development is to accelerate the path to gigaton-scale carbon removal by reducing deployment timelines and costs while maintaining or improving capture efficiency. Current projections indicate that achieving climate targets will require removing 5-10 gigatons of CO2 annually by mid-century, necessitating unprecedented scaling of DAC technologies. Modularization strategies directly address this challenge by enabling manufacturing economies of scale and learning-by-doing improvements.

Technical objectives for modular solid sorbent DAC systems include optimizing the balance between module size and transportation constraints, standardizing interfaces between components, maximizing energy efficiency through innovative heat integration across modules, and developing robust control systems capable of managing distributed capture operations. Additionally, modular designs must accommodate the integration of renewable energy sources to minimize the carbon intensity of the capture process itself.

The evolution of modular approaches has been influenced by successful precedents in other industries, particularly modular construction in the building sector and standardized unit operations in chemical processing. Early DAC installations primarily employed custom, site-built designs, but recent developments have demonstrated the viability of factory-built modules that can be rapidly deployed and interconnected at the installation site.

Looking forward, the trajectory of modular solid sorbent DAC technology is expected to follow an accelerated development path, with increasing standardization of key components and growing integration with renewable energy infrastructure. The ultimate goal is to establish a scalable, replicable approach to atmospheric carbon removal that can be deployed globally at the scale necessary to meaningfully impact climate change mitigation efforts.

Market Analysis for Modular DAC Solutions

The Direct Air Capture (DAC) market is experiencing significant growth, driven by increasing global focus on carbon neutrality targets and the urgent need for negative emissions technologies. The modular DAC solutions segment, particularly those utilizing solid sorbents, represents a rapidly expanding market opportunity with distinctive characteristics and dynamics.

Current market estimates value the global DAC market at approximately $2 billion, with projections suggesting growth to $15 billion by 2030. Within this broader market, modular solid sorbent systems are gaining traction due to their scalability and deployment flexibility. The compound annual growth rate for modular DAC solutions specifically is outpacing the overall DAC market, with estimates ranging between 35-40% through 2028.

Demand drivers for modular DAC solutions include corporate carbon neutrality commitments, government incentives like the U.S. 45Q tax credits, and the increasing integration of carbon removal into ESG frameworks. The market for modular solutions is particularly strong in regions with ambitious climate targets such as the European Union, North America, and parts of Asia-Pacific, especially Japan and South Korea.

Customer segmentation reveals three primary market categories: industrial emitters seeking on-site carbon capture capabilities, carbon removal marketplaces and brokers, and government/research institutions. The industrial segment currently represents the largest market share at approximately 45%, followed by carbon removal marketplaces at 30%.

Pricing models for modular DAC solutions remain in flux, with current costs ranging from $250-600 per ton of CO2 captured. However, the modularization approach is demonstrating promising cost reduction potential, with projections suggesting a 50-60% cost decrease over the next decade through standardization and economies of scale.

Market barriers include high upfront capital requirements, uncertain regulatory frameworks in many regions, and competition from alternative carbon removal approaches. Nevertheless, the modular approach addresses several key market pain points, including deployment speed, scalability concerns, and site-specific customization needs.

The serviceable addressable market for modular solid sorbent DAC solutions is estimated at $3-4 billion by 2025, with early adoption concentrated in carbon-intensive industries seeking to offset emissions. Geographic distribution of demand shows North America leading with approximately 40% market share, followed by Europe at 35% and Asia-Pacific at 20%.

Future market growth will likely be influenced by carbon pricing mechanisms, technological advancements in sorbent materials, and the development of carbon utilization pathways that create additional revenue streams for captured carbon.

Current market estimates value the global DAC market at approximately $2 billion, with projections suggesting growth to $15 billion by 2030. Within this broader market, modular solid sorbent systems are gaining traction due to their scalability and deployment flexibility. The compound annual growth rate for modular DAC solutions specifically is outpacing the overall DAC market, with estimates ranging between 35-40% through 2028.

Demand drivers for modular DAC solutions include corporate carbon neutrality commitments, government incentives like the U.S. 45Q tax credits, and the increasing integration of carbon removal into ESG frameworks. The market for modular solutions is particularly strong in regions with ambitious climate targets such as the European Union, North America, and parts of Asia-Pacific, especially Japan and South Korea.

Customer segmentation reveals three primary market categories: industrial emitters seeking on-site carbon capture capabilities, carbon removal marketplaces and brokers, and government/research institutions. The industrial segment currently represents the largest market share at approximately 45%, followed by carbon removal marketplaces at 30%.

Pricing models for modular DAC solutions remain in flux, with current costs ranging from $250-600 per ton of CO2 captured. However, the modularization approach is demonstrating promising cost reduction potential, with projections suggesting a 50-60% cost decrease over the next decade through standardization and economies of scale.

Market barriers include high upfront capital requirements, uncertain regulatory frameworks in many regions, and competition from alternative carbon removal approaches. Nevertheless, the modular approach addresses several key market pain points, including deployment speed, scalability concerns, and site-specific customization needs.

The serviceable addressable market for modular solid sorbent DAC solutions is estimated at $3-4 billion by 2025, with early adoption concentrated in carbon-intensive industries seeking to offset emissions. Geographic distribution of demand shows North America leading with approximately 40% market share, followed by Europe at 35% and Asia-Pacific at 20%.

Future market growth will likely be influenced by carbon pricing mechanisms, technological advancements in sorbent materials, and the development of carbon utilization pathways that create additional revenue streams for captured carbon.

Current Challenges in Solid Sorbent DAC Deployment

Despite the promising potential of Direct Air Capture (DAC) technologies using solid sorbents, several significant challenges impede their rapid deployment at scale. The current solid sorbent DAC systems face efficiency limitations, with most commercial systems requiring substantial energy inputs ranging from 5-10 GJ per ton of CO2 captured. This energy demand creates a paradoxical situation where carbon capture processes themselves generate significant emissions if powered by fossil fuels.

Material durability presents another critical challenge. Solid sorbents typically degrade after repeated adsorption-desorption cycles, necessitating frequent replacement and increasing operational costs. Current materials show performance degradation of 10-30% after just 100-200 cycles, far below the thousands of cycles needed for economically viable operations.

Cost remains perhaps the most significant barrier to widespread deployment. Current DAC technologies using solid sorbents operate at costs between $250-600 per ton of CO2 captured, substantially higher than the carbon pricing in most markets. This economic gap makes commercial viability difficult without significant subsidies or carbon price increases.

Scalability challenges are equally concerning. Most existing solid sorbent DAC installations remain at pilot or small demonstration scale (capturing hundreds to thousands of tons annually), while climate impact requires gigaton-scale deployment. The manufacturing capacity for specialized sorbent materials and components cannot currently meet the demands of rapid global scaling.

Land and resource requirements pose additional constraints. Current solid sorbent DAC designs require significant physical footprints—approximately 1-2 km² per million tons of annual CO2 capture capacity. This land requirement creates potential conflicts with other land uses, particularly in densely populated regions.

Integration with existing infrastructure presents logistical hurdles. Many potential DAC deployment locations lack the necessary connections to renewable energy sources, CO2 transportation networks, or geological storage sites. This infrastructure gap significantly limits deployment options and increases project complexity.

Regulatory frameworks and standards for DAC deployment remain underdeveloped in most jurisdictions. The absence of clear permitting processes, monitoring requirements, and liability frameworks creates uncertainty that discourages investment and slows project development. Additionally, public acceptance varies considerably across regions, with concerns about safety, environmental impacts, and the perception that DAC might reduce incentives for emissions reductions.

Material durability presents another critical challenge. Solid sorbents typically degrade after repeated adsorption-desorption cycles, necessitating frequent replacement and increasing operational costs. Current materials show performance degradation of 10-30% after just 100-200 cycles, far below the thousands of cycles needed for economically viable operations.

Cost remains perhaps the most significant barrier to widespread deployment. Current DAC technologies using solid sorbents operate at costs between $250-600 per ton of CO2 captured, substantially higher than the carbon pricing in most markets. This economic gap makes commercial viability difficult without significant subsidies or carbon price increases.

Scalability challenges are equally concerning. Most existing solid sorbent DAC installations remain at pilot or small demonstration scale (capturing hundreds to thousands of tons annually), while climate impact requires gigaton-scale deployment. The manufacturing capacity for specialized sorbent materials and components cannot currently meet the demands of rapid global scaling.

Land and resource requirements pose additional constraints. Current solid sorbent DAC designs require significant physical footprints—approximately 1-2 km² per million tons of annual CO2 capture capacity. This land requirement creates potential conflicts with other land uses, particularly in densely populated regions.

Integration with existing infrastructure presents logistical hurdles. Many potential DAC deployment locations lack the necessary connections to renewable energy sources, CO2 transportation networks, or geological storage sites. This infrastructure gap significantly limits deployment options and increases project complexity.

Regulatory frameworks and standards for DAC deployment remain underdeveloped in most jurisdictions. The absence of clear permitting processes, monitoring requirements, and liability frameworks creates uncertainty that discourages investment and slows project development. Additionally, public acceptance varies considerably across regions, with concerns about safety, environmental impacts, and the perception that DAC might reduce incentives for emissions reductions.

Existing Modular Design Solutions for Solid Sorbent DAC

01 Modular design of solid sorbent DAC systems

Modular design approaches for direct air capture systems using solid sorbents allow for scalable and flexible deployment. These modular units can be manufactured off-site and transported to installation locations, reducing construction time and costs. The modular architecture enables systems to be expanded incrementally as needed and facilitates maintenance by allowing individual modules to be serviced without shutting down the entire system.- Modular design of solid sorbent DAC systems: Modular designs for solid sorbent Direct Air Capture (DAC) systems allow for scalable and flexible deployment. These modular units can be manufactured off-site and assembled on location, reducing construction time and costs. The modular approach enables standardization of components while allowing customization based on specific deployment requirements. This design philosophy facilitates easier maintenance, replacement of components, and capacity expansion through the addition of more modules.

- Sorbent material optimization for modular DAC: Various sorbent materials are optimized for use in modular DAC systems, including amine-functionalized materials, metal-organic frameworks (MOFs), and zeolites. These materials are engineered to maximize CO2 capture efficiency while maintaining structural integrity over multiple adsorption-desorption cycles. The sorbent formulations are designed to operate effectively under varying environmental conditions and to be compatible with modular system requirements, including considerations for packing density, pressure drop, and heat transfer characteristics.

- Energy integration and efficiency in modular DAC: Energy integration strategies are crucial for modular DAC systems to reduce operational costs and environmental impact. These include waste heat recovery systems, renewable energy integration, and optimized thermal management for the sorbent regeneration process. Modular designs incorporate energy-efficient components and control systems that minimize energy consumption during both the adsorption and desorption phases. Some systems utilize low-grade heat sources or integrate with existing industrial processes to improve overall energy efficiency.

- Automated control and monitoring systems for modular DAC: Advanced control and monitoring systems are integrated into modular DAC units to optimize performance and enable remote operation. These systems include sensors for measuring CO2 concentration, temperature, humidity, and pressure throughout the capture process. Machine learning algorithms and predictive analytics are employed to adjust operating parameters in real-time, maximizing capture efficiency while minimizing energy consumption. The automation systems also facilitate seamless integration of multiple modules and provide diagnostic capabilities for maintenance planning.

- Deployment strategies for modular DAC systems: Various deployment strategies are developed for modular DAC systems to address different geographical, environmental, and economic constraints. These include distributed deployment of smaller units versus centralized facilities with multiple modules, co-location with CO2 utilization or storage infrastructure, and integration with existing industrial facilities. The modular nature allows for phased deployment, starting with pilot installations that can be expanded as needed. Site selection considerations include air flow patterns, available energy sources, transportation infrastructure, and proximity to CO2 sequestration or utilization opportunities.

02 Sorbent material optimization for modular DAC

Various solid sorbent materials are optimized for use in modular direct air capture systems. These include engineered amine-functionalized materials, metal-organic frameworks (MOFs), and specialized porous structures designed to maximize CO2 capture efficiency. The sorbent materials are formulated to maintain performance over multiple adsorption-desorption cycles and to operate effectively under varying environmental conditions while being compatible with modular system requirements.Expand Specific Solutions03 Energy integration and thermal management in modular DAC

Energy integration strategies for modular direct air capture systems focus on optimizing thermal management during the adsorption and desorption cycles. These approaches include waste heat recovery systems, renewable energy integration, and innovative heating and cooling configurations designed specifically for modular units. The thermal management systems are designed to reduce energy consumption and operational costs while maintaining capture efficiency in the modular format.Expand Specific Solutions04 Automated control systems for modular DAC operations

Advanced control systems are developed for managing the operation of modular direct air capture units. These systems incorporate sensors, monitoring equipment, and automated control algorithms to optimize the capture process across multiple modules. The control architecture enables coordinated operation of distributed modules, remote monitoring capabilities, and adaptive responses to changing environmental conditions or operational requirements.Expand Specific Solutions05 Scalable manufacturing and deployment of DAC modules

Manufacturing processes and deployment strategies are developed specifically for modular direct air capture systems. These include standardized production methods for module components, assembly line approaches for module fabrication, and optimized logistics for transporting and installing modules at deployment sites. The manufacturing techniques focus on cost reduction through economies of scale while maintaining quality and performance standards across all produced modules.Expand Specific Solutions

Leading Companies in Modular DAC Technology

The solid sorbent Direct Air Capture (DAC) technology market is currently in an early growth phase, characterized by rapid innovation and increasing commercial interest. The global DAC market is projected to expand significantly, driven by decarbonization goals and carbon pricing mechanisms. Technologically, modularization strategies are advancing but remain at varying maturity levels across key players. Leading companies like Siemens Energy AG are leveraging their industrial expertise to develop scalable DAC modules, while academic institutions such as Shanghai Jiao Tong University and Southeast University are contributing fundamental research. Chinese entities including Xi'an Thermal Power Research Institute and Suzhou Tpri Ener & Enviro Tech are focusing on integration with existing power infrastructure, while global technology firms like Huawei and NXP Semiconductors are enhancing control systems for modular deployment.

Xi'an Thermal Power Research Institute Co., Ltd.

Technical Solution: Xi'an Thermal Power Research Institute has developed "ThermoSorb" - a modular solid sorbent DAC system specifically designed for integration with thermal power plants. Their approach centers on a novel amine-functionalized porous ceramic material with exceptional CO2 selectivity and thermal stability. The system utilizes standardized adsorption modules arranged in parallel arrays that can be incrementally added or removed to adjust capture capacity. Each module incorporates a unique thermal management system that leverages low-grade waste heat (80-120°C) from power plant operations for sorbent regeneration, significantly improving overall energy efficiency. The institute's modular design features rapid-connect interfaces for steam, condensate, and CO2 processing systems, enabling installation during regular plant maintenance periods without extended downtime. Their approach includes a sophisticated control system that optimizes the adsorption-desorption cycle timing based on ambient conditions and available waste heat, maximizing capture efficiency while minimizing operational costs.

Strengths: Exceptional integration with existing thermal power infrastructure; highly efficient use of waste heat for regeneration; modular design allows for incremental capacity expansion with minimal disruption. Weaknesses: Performance heavily dependent on consistent waste heat availability; less suitable for standalone deployment away from thermal power sources; higher maintenance requirements for the specialized sorbent materials.

Siemens Energy AG

Technical Solution: Siemens Energy has developed a modular solid sorbent DAC system called "DACCORD" (Direct Air Capture with Carbon-Optimized Rapid Deployment). Their approach utilizes standardized shipping container-sized modules that can be rapidly deployed and scaled according to capacity requirements. Each module contains proprietary structured adsorbent materials with optimized air flow patterns that maximize CO2 capture while minimizing pressure drop. The system employs a temperature-vacuum swing adsorption (TVSA) process where ambient air passes through the solid sorbent modules, capturing CO2 which is then released through controlled heating and vacuum application. Siemens' modular design allows for factory pre-assembly and testing, significantly reducing on-site construction time and enabling deployment in diverse geographical locations. Their system architecture includes integrated heat management systems that utilize low-grade waste heat from industrial processes or renewable energy sources to power the regeneration cycle.

Strengths: Highly standardized modular approach enables rapid scaling and deployment flexibility; integration with existing industrial infrastructure for energy efficiency; advanced manufacturing capabilities for mass production of modules. Weaknesses: Higher capital costs compared to some competing technologies; requires significant energy input for the regeneration process; performance may vary based on ambient conditions and available heat sources.

Key Technical Innovations in DAC Modularization

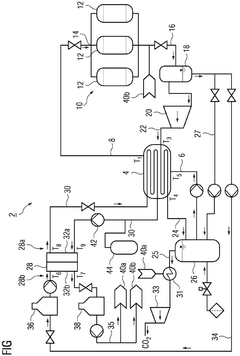

Modular multi-cartridge structural frame with water management and integrated heating for sorbent articles in direct air capture systems

PatentPendingUS20240198275A1

Innovation

- A DAC device with a multi-cartridge structure that allows for variable volume configurations and efficient fluid flow management, including angled cartridges and perforation control mechanisms, to enhance CO2 capture efficiency by facilitating air and desorbing media flow, and integrated heating elements to optimize energy use.

Method for operating a direct air capture plant and direct air capture plant

PatentPendingEP4585293A1

Innovation

- A self-sustained heating system is implemented in the direct air capture plant using a heat pump to recycle heat and cold from plant components, integrating a closed and open circuit system to optimize steam generation, with buffering tanks for hot and cold water to manage fluctuations and reduce energy consumption.

Scalability and Cost Optimization Strategies

Scalability and cost optimization represent critical challenges for the widespread adoption of Direct Air Capture (DAC) technologies using solid sorbents. Current modular DAC systems face significant economic barriers with costs ranging from $250-600 per ton of CO2 captured, substantially higher than the $100/ton threshold considered economically viable for large-scale implementation.

Economies of scale present a primary pathway to cost reduction. By standardizing modular components and implementing mass production techniques, manufacturers can achieve substantial unit cost reductions. Analysis indicates that scaling production from prototype levels to industrial manufacturing volumes could reduce capital expenditures by 35-45%. Companies like Carbon Engineering and Climeworks have demonstrated this principle by progressively increasing their module production capacity, resulting in documented cost reductions of approximately 20-30% with each doubling of manufacturing volume.

Supply chain optimization offers another crucial strategy for cost reduction. The development of specialized supplier networks for critical components such as sorbent materials, heat exchangers, and control systems can significantly reduce procurement costs. Strategic co-location of manufacturing facilities near material suppliers or transportation hubs can further reduce logistics expenses by 15-25%, according to industry case studies.

Process intensification techniques represent a technological approach to cost optimization. By increasing the CO2 adsorption capacity per unit volume and reducing energy requirements for regeneration cycles, overall system efficiency can be improved substantially. Advanced heat integration strategies that recover and reuse thermal energy during the sorbent regeneration process have demonstrated potential to reduce operational energy costs by 20-40% in pilot installations.

Automation and digital optimization of modular DAC operations present additional cost-saving opportunities. Implementation of advanced control systems, predictive maintenance algorithms, and remote monitoring capabilities can reduce operational staff requirements while improving system uptime and performance. Early adopters of these technologies have reported operational cost reductions of 15-30% compared to manually operated systems.

Financing innovations also play a critical role in scaling modular DAC deployment. Novel approaches such as carbon removal purchase agreements, technology leasing models, and project finance structures that monetize carbon credits can significantly improve project economics. These financial mechanisms help distribute capital costs over longer operational periods, reducing the initial investment barrier and improving return profiles for project developers and investors.

Economies of scale present a primary pathway to cost reduction. By standardizing modular components and implementing mass production techniques, manufacturers can achieve substantial unit cost reductions. Analysis indicates that scaling production from prototype levels to industrial manufacturing volumes could reduce capital expenditures by 35-45%. Companies like Carbon Engineering and Climeworks have demonstrated this principle by progressively increasing their module production capacity, resulting in documented cost reductions of approximately 20-30% with each doubling of manufacturing volume.

Supply chain optimization offers another crucial strategy for cost reduction. The development of specialized supplier networks for critical components such as sorbent materials, heat exchangers, and control systems can significantly reduce procurement costs. Strategic co-location of manufacturing facilities near material suppliers or transportation hubs can further reduce logistics expenses by 15-25%, according to industry case studies.

Process intensification techniques represent a technological approach to cost optimization. By increasing the CO2 adsorption capacity per unit volume and reducing energy requirements for regeneration cycles, overall system efficiency can be improved substantially. Advanced heat integration strategies that recover and reuse thermal energy during the sorbent regeneration process have demonstrated potential to reduce operational energy costs by 20-40% in pilot installations.

Automation and digital optimization of modular DAC operations present additional cost-saving opportunities. Implementation of advanced control systems, predictive maintenance algorithms, and remote monitoring capabilities can reduce operational staff requirements while improving system uptime and performance. Early adopters of these technologies have reported operational cost reductions of 15-30% compared to manually operated systems.

Financing innovations also play a critical role in scaling modular DAC deployment. Novel approaches such as carbon removal purchase agreements, technology leasing models, and project finance structures that monetize carbon credits can significantly improve project economics. These financial mechanisms help distribute capital costs over longer operational periods, reducing the initial investment barrier and improving return profiles for project developers and investors.

Regulatory Framework and Carbon Credit Implications

The regulatory landscape for Direct Air Capture (DAC) technologies is rapidly evolving as governments worldwide recognize the critical role of carbon dioxide removal in meeting climate goals. Current frameworks vary significantly across jurisdictions, with the United States leading through initiatives like the 45Q tax credit, which now offers up to $180 per ton of CO2 captured and sequestered. This enhanced incentive specifically benefits modular solid sorbent DAC systems by improving their economic viability at smaller scales.

The European Union has integrated DAC into its broader carbon management strategy through the Innovation Fund and the EU Emissions Trading System (ETS). These mechanisms create market-based incentives that can support modular deployment strategies by reducing initial capital requirements and allowing for incremental scaling. Japan and Canada have similarly developed regulatory frameworks that recognize DAC as an essential climate solution, with Canada's Clean Fuel Standard potentially providing additional revenue streams for DAC operators.

Carbon credit markets represent a crucial economic driver for modular solid sorbent DAC deployment. Voluntary carbon markets have seen significant growth, with high-quality DAC carbon removal credits commanding premium prices of $250-600 per ton. This price differential compared to other offset types reflects the permanence and verifiability of DAC-based carbon removal. The modular approach aligns particularly well with carbon credit frameworks, as each module can generate immediate credits upon deployment, creating cash flow that supports further expansion.

Standardization efforts for DAC carbon credits are advancing through organizations like the Carbon Dioxide Removal Certification Framework (CDRCF) and the Science Based Targets initiative (SBTi). These frameworks are increasingly recognizing the advantages of modular systems in terms of monitoring, reporting, and verification (MRV) protocols. Modular units with standardized performance metrics simplify the certification process and enhance credit quality.

Emerging policy innovations include carbon removal procurement programs, carbon border adjustment mechanisms, and technology-specific deployment targets. These developments create additional market certainty for modular DAC technologies. The interplay between regulatory frameworks and carbon markets is particularly favorable for modular solid sorbent systems, as their scalable nature allows for responsive deployment that can capitalize on evolving incentive structures while managing regulatory compliance costs effectively.

For companies developing modular solid sorbent DAC technologies, strategic engagement with policymakers and carbon market stakeholders is essential to ensure that future regulatory frameworks recognize the unique advantages of modular approaches and provide appropriate incentives for rapid, distributed deployment.

The European Union has integrated DAC into its broader carbon management strategy through the Innovation Fund and the EU Emissions Trading System (ETS). These mechanisms create market-based incentives that can support modular deployment strategies by reducing initial capital requirements and allowing for incremental scaling. Japan and Canada have similarly developed regulatory frameworks that recognize DAC as an essential climate solution, with Canada's Clean Fuel Standard potentially providing additional revenue streams for DAC operators.

Carbon credit markets represent a crucial economic driver for modular solid sorbent DAC deployment. Voluntary carbon markets have seen significant growth, with high-quality DAC carbon removal credits commanding premium prices of $250-600 per ton. This price differential compared to other offset types reflects the permanence and verifiability of DAC-based carbon removal. The modular approach aligns particularly well with carbon credit frameworks, as each module can generate immediate credits upon deployment, creating cash flow that supports further expansion.

Standardization efforts for DAC carbon credits are advancing through organizations like the Carbon Dioxide Removal Certification Framework (CDRCF) and the Science Based Targets initiative (SBTi). These frameworks are increasingly recognizing the advantages of modular systems in terms of monitoring, reporting, and verification (MRV) protocols. Modular units with standardized performance metrics simplify the certification process and enhance credit quality.

Emerging policy innovations include carbon removal procurement programs, carbon border adjustment mechanisms, and technology-specific deployment targets. These developments create additional market certainty for modular DAC technologies. The interplay between regulatory frameworks and carbon markets is particularly favorable for modular solid sorbent systems, as their scalable nature allows for responsive deployment that can capitalize on evolving incentive structures while managing regulatory compliance costs effectively.

For companies developing modular solid sorbent DAC technologies, strategic engagement with policymakers and carbon market stakeholders is essential to ensure that future regulatory frameworks recognize the unique advantages of modular approaches and provide appropriate incentives for rapid, distributed deployment.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!