Scaling production of EREV components: Challenges and solutions

AUG 14, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

EREV Component Evolution

The evolution of Extended Range Electric Vehicle (EREV) components has been marked by significant technological advancements and innovations over the past decade. Initially, EREVs were characterized by limited electric range and heavy reliance on internal combustion engines (ICEs) for extended trips. However, as battery technology progressed, the electric range of these vehicles substantially increased, reducing the dependency on ICEs.

One of the most notable developments in EREV components has been in battery technology. Early EREVs utilized nickel-metal hydride (NiMH) batteries, which were soon replaced by lithium-ion batteries. These offered higher energy density, longer lifespan, and improved charging efficiency. The energy density of lithium-ion batteries has seen a consistent annual increase of 5-8%, leading to lighter and more compact battery packs with greater capacity.

Electric motors have also undergone significant improvements. The shift from AC induction motors to permanent magnet synchronous motors (PMSMs) has resulted in higher efficiency and power density. Modern PMSMs achieve efficiency rates of up to 97%, compared to the 85-90% efficiency of earlier models. This advancement has contributed to extended electric range and overall vehicle performance.

Power electronics, particularly inverters and converters, have evolved to become more compact and efficient. The introduction of wide bandgap semiconductors, such as silicon carbide (SiC) and gallium nitride (GaN), has allowed for higher switching frequencies, reduced power losses, and improved thermal management. These advancements have led to smaller, lighter, and more efficient power electronic components.

The integration of regenerative braking systems has become more sophisticated, capturing a higher percentage of kinetic energy during deceleration. Early systems recovered about 30% of braking energy, while modern systems can recover up to 70%, significantly extending the electric range of EREVs.

Thermal management systems have also seen substantial improvements. The introduction of advanced cooling systems, including liquid cooling for batteries and power electronics, has enhanced performance and longevity of EREV components. This has allowed for faster charging rates and more consistent performance across various operating conditions.

The evolution of onboard chargers has been crucial in improving charging times and efficiency. Early EREVs were limited to slow charging rates, but advancements in power electronics and charging protocols have enabled faster charging capabilities. Modern EREVs can now support high-power DC fast charging, significantly reducing charging times and enhancing user convenience.

As EREV technology continues to mature, the focus has shifted towards optimizing the integration of these components. Advanced control systems and software algorithms have been developed to maximize energy efficiency, optimize power distribution, and enhance overall vehicle performance. This holistic approach to component integration has resulted in EREVs that offer improved range, performance, and user experience compared to their early counterparts.

One of the most notable developments in EREV components has been in battery technology. Early EREVs utilized nickel-metal hydride (NiMH) batteries, which were soon replaced by lithium-ion batteries. These offered higher energy density, longer lifespan, and improved charging efficiency. The energy density of lithium-ion batteries has seen a consistent annual increase of 5-8%, leading to lighter and more compact battery packs with greater capacity.

Electric motors have also undergone significant improvements. The shift from AC induction motors to permanent magnet synchronous motors (PMSMs) has resulted in higher efficiency and power density. Modern PMSMs achieve efficiency rates of up to 97%, compared to the 85-90% efficiency of earlier models. This advancement has contributed to extended electric range and overall vehicle performance.

Power electronics, particularly inverters and converters, have evolved to become more compact and efficient. The introduction of wide bandgap semiconductors, such as silicon carbide (SiC) and gallium nitride (GaN), has allowed for higher switching frequencies, reduced power losses, and improved thermal management. These advancements have led to smaller, lighter, and more efficient power electronic components.

The integration of regenerative braking systems has become more sophisticated, capturing a higher percentage of kinetic energy during deceleration. Early systems recovered about 30% of braking energy, while modern systems can recover up to 70%, significantly extending the electric range of EREVs.

Thermal management systems have also seen substantial improvements. The introduction of advanced cooling systems, including liquid cooling for batteries and power electronics, has enhanced performance and longevity of EREV components. This has allowed for faster charging rates and more consistent performance across various operating conditions.

The evolution of onboard chargers has been crucial in improving charging times and efficiency. Early EREVs were limited to slow charging rates, but advancements in power electronics and charging protocols have enabled faster charging capabilities. Modern EREVs can now support high-power DC fast charging, significantly reducing charging times and enhancing user convenience.

As EREV technology continues to mature, the focus has shifted towards optimizing the integration of these components. Advanced control systems and software algorithms have been developed to maximize energy efficiency, optimize power distribution, and enhance overall vehicle performance. This holistic approach to component integration has resulted in EREVs that offer improved range, performance, and user experience compared to their early counterparts.

Market Demand Analysis

The market demand for Extended Range Electric Vehicle (EREV) components has been experiencing significant growth in recent years, driven by the increasing adoption of electric vehicles and the need for solutions that address range anxiety. As governments worldwide implement stricter emissions regulations and offer incentives for electric vehicle adoption, the demand for EREV technology has surged.

The global EREV market is projected to expand rapidly, with a compound annual growth rate (CAGR) exceeding that of traditional internal combustion engine vehicles. This growth is particularly pronounced in regions with well-developed charging infrastructure and supportive government policies, such as Europe, North America, and parts of Asia.

Consumer preferences are shifting towards vehicles that offer both the benefits of electric propulsion and the convenience of extended range capabilities. This trend is especially evident in markets where long-distance travel is common, and charging infrastructure is still developing. EREV technology addresses these concerns by providing a bridge between fully electric vehicles and traditional hybrid vehicles.

The automotive industry's major players are increasingly investing in EREV technology, recognizing its potential to meet consumer demands and comply with evolving regulations. This has led to a surge in demand for key EREV components, including range extenders, battery systems, power electronics, and control units.

Market analysis indicates that the demand for EREV components is not uniform across all vehicle segments. The technology is particularly popular in mid-size to large passenger vehicles and light commercial vehicles, where the balance between electric range and overall vehicle utility is crucial. The luxury vehicle segment has also shown strong interest in EREV technology, as it allows for high performance while meeting emissions standards.

Supply chain dynamics play a critical role in the market demand for EREV components. The increasing demand has put pressure on suppliers to scale up production rapidly. This has led to challenges in sourcing raw materials, particularly for battery components and specialized electronics. As a result, there is a growing emphasis on developing robust and diversified supply chains to meet the escalating demand.

The aftermarket for EREV components is also emerging as a significant sector. As the first generation of EREVs ages, there is an increasing need for replacement parts and upgrades. This creates additional opportunities for component manufacturers and service providers specializing in EREV technology.

Looking ahead, the market demand for EREV components is expected to continue its upward trajectory. However, the rate of growth may be influenced by advancements in battery technology, the expansion of charging infrastructure, and the evolution of consumer preferences. As the technology matures and economies of scale are achieved, the cost of EREV components is likely to decrease, potentially accelerating market adoption and further driving demand.

The global EREV market is projected to expand rapidly, with a compound annual growth rate (CAGR) exceeding that of traditional internal combustion engine vehicles. This growth is particularly pronounced in regions with well-developed charging infrastructure and supportive government policies, such as Europe, North America, and parts of Asia.

Consumer preferences are shifting towards vehicles that offer both the benefits of electric propulsion and the convenience of extended range capabilities. This trend is especially evident in markets where long-distance travel is common, and charging infrastructure is still developing. EREV technology addresses these concerns by providing a bridge between fully electric vehicles and traditional hybrid vehicles.

The automotive industry's major players are increasingly investing in EREV technology, recognizing its potential to meet consumer demands and comply with evolving regulations. This has led to a surge in demand for key EREV components, including range extenders, battery systems, power electronics, and control units.

Market analysis indicates that the demand for EREV components is not uniform across all vehicle segments. The technology is particularly popular in mid-size to large passenger vehicles and light commercial vehicles, where the balance between electric range and overall vehicle utility is crucial. The luxury vehicle segment has also shown strong interest in EREV technology, as it allows for high performance while meeting emissions standards.

Supply chain dynamics play a critical role in the market demand for EREV components. The increasing demand has put pressure on suppliers to scale up production rapidly. This has led to challenges in sourcing raw materials, particularly for battery components and specialized electronics. As a result, there is a growing emphasis on developing robust and diversified supply chains to meet the escalating demand.

The aftermarket for EREV components is also emerging as a significant sector. As the first generation of EREVs ages, there is an increasing need for replacement parts and upgrades. This creates additional opportunities for component manufacturers and service providers specializing in EREV technology.

Looking ahead, the market demand for EREV components is expected to continue its upward trajectory. However, the rate of growth may be influenced by advancements in battery technology, the expansion of charging infrastructure, and the evolution of consumer preferences. As the technology matures and economies of scale are achieved, the cost of EREV components is likely to decrease, potentially accelerating market adoption and further driving demand.

Production Challenges

The production of Extended Range Electric Vehicle (EREV) components presents several significant challenges as manufacturers aim to scale up operations to meet growing demand. One of the primary obstacles is the complexity of the EREV powertrain, which combines both electric and internal combustion engine technologies. This dual-system approach requires intricate manufacturing processes and specialized equipment, often leading to increased production costs and potential bottlenecks in the supply chain.

Material sourcing and supply chain management pose another critical challenge. The production of EREV components relies heavily on rare earth elements and specialized materials, which can be subject to price volatility and supply constraints. Ensuring a stable and cost-effective supply of these materials is crucial for maintaining consistent production levels and controlling costs.

Quality control and consistency in manufacturing are paramount concerns when scaling up production. As production volumes increase, maintaining stringent quality standards across all components becomes more challenging. This is particularly critical for battery systems and power electronics, where even minor defects can have significant implications for vehicle performance and safety.

Workforce development and training represent another hurdle in scaling EREV component production. The specialized nature of EREV technology requires a highly skilled workforce capable of handling complex manufacturing processes and adapting to rapidly evolving technologies. Recruiting and training qualified personnel at the pace required for production scaling can be a significant challenge for manufacturers.

Automation and robotics integration present both opportunities and challenges in EREV component production. While automation can significantly increase production efficiency and consistency, it requires substantial upfront investment and ongoing maintenance. Balancing the level of automation with the need for human expertise and flexibility in manufacturing processes is a delicate task that manufacturers must navigate.

Regulatory compliance and certification processes can also impede rapid scaling of production. As EREV technology evolves, manufacturers must ensure that all components meet stringent safety and environmental standards across different markets. This often involves time-consuming testing and certification procedures, which can slow down the scaling process.

To address these challenges, manufacturers are exploring various solutions. Advanced manufacturing techniques, such as additive manufacturing and modular production systems, are being implemented to increase flexibility and efficiency in component production. Vertical integration strategies are being adopted by some companies to gain greater control over the supply chain and reduce dependencies on external suppliers.

Material sourcing and supply chain management pose another critical challenge. The production of EREV components relies heavily on rare earth elements and specialized materials, which can be subject to price volatility and supply constraints. Ensuring a stable and cost-effective supply of these materials is crucial for maintaining consistent production levels and controlling costs.

Quality control and consistency in manufacturing are paramount concerns when scaling up production. As production volumes increase, maintaining stringent quality standards across all components becomes more challenging. This is particularly critical for battery systems and power electronics, where even minor defects can have significant implications for vehicle performance and safety.

Workforce development and training represent another hurdle in scaling EREV component production. The specialized nature of EREV technology requires a highly skilled workforce capable of handling complex manufacturing processes and adapting to rapidly evolving technologies. Recruiting and training qualified personnel at the pace required for production scaling can be a significant challenge for manufacturers.

Automation and robotics integration present both opportunities and challenges in EREV component production. While automation can significantly increase production efficiency and consistency, it requires substantial upfront investment and ongoing maintenance. Balancing the level of automation with the need for human expertise and flexibility in manufacturing processes is a delicate task that manufacturers must navigate.

Regulatory compliance and certification processes can also impede rapid scaling of production. As EREV technology evolves, manufacturers must ensure that all components meet stringent safety and environmental standards across different markets. This often involves time-consuming testing and certification procedures, which can slow down the scaling process.

To address these challenges, manufacturers are exploring various solutions. Advanced manufacturing techniques, such as additive manufacturing and modular production systems, are being implemented to increase flexibility and efficiency in component production. Vertical integration strategies are being adopted by some companies to gain greater control over the supply chain and reduce dependencies on external suppliers.

Current Manufacturing

01 Battery management and control systems

Advanced battery management and control systems are crucial for optimizing EREV component production scaling. These systems monitor and regulate battery performance, temperature, and charging processes, ensuring efficient operation and longevity of the battery pack. Implementing sophisticated control algorithms and sensors can enhance overall system efficiency and reliability in large-scale production.- Battery management and scaling: Efficient battery management systems are crucial for scaling EREV production. This includes optimizing battery performance, monitoring charge levels, and implementing advanced thermal management techniques to enhance overall efficiency and longevity of the electric components.

- Electric motor production and integration: Scaling up the production of electric motors for EREVs involves improving manufacturing processes, enhancing motor efficiency, and developing better integration techniques with other powertrain components. This includes advancements in motor design, materials, and assembly methods to meet increasing demand.

- Power electronics and control systems: Developing and scaling production of advanced power electronics and control systems is essential for EREV performance. This includes inverters, converters, and sophisticated software algorithms to manage power flow between the battery, electric motor, and internal combustion engine.

- Range extender engine optimization: Scaling production of optimized range extender engines involves improving fuel efficiency, reducing emissions, and enhancing integration with electric components. This includes developing compact, lightweight engines specifically designed for EREV applications.

- Manufacturing process automation: Implementing advanced automation technologies in the production of EREV components is crucial for scaling. This includes robotics, AI-driven quality control, and smart manufacturing systems to increase production efficiency, reduce costs, and maintain consistent quality across large-scale manufacturing.

02 Electric motor and generator scaling

Scaling up production of electric motors and generators for EREVs involves optimizing manufacturing processes and materials. This includes developing more efficient winding techniques, improving magnetic core designs, and implementing advanced cooling systems. Automated assembly lines and quality control measures are essential for maintaining consistency in large-scale production.Expand Specific Solutions03 Power electronics and inverter production

Scaling production of power electronics and inverters for EREVs requires focus on miniaturization, thermal management, and efficiency improvements. Advanced semiconductor materials and packaging techniques can enhance performance and reliability. Automated testing and quality assurance processes are crucial for maintaining high standards in mass production.Expand Specific Solutions04 Range extender engine optimization

Optimizing range extender engines for large-scale EREV production involves improving fuel efficiency, reducing emissions, and enhancing integration with electric components. This may include developing specialized combustion processes, lightweight materials, and advanced control systems. Streamlining assembly processes and implementing modular designs can facilitate efficient scaling of production.Expand Specific Solutions05 Integration and assembly line optimization

Efficient integration and assembly of EREV components at scale requires optimized production line layouts, automated guided vehicles, and advanced robotics. Implementing smart manufacturing techniques, such as IoT sensors and real-time data analytics, can improve production efficiency and quality control. Developing standardized interfaces and modular designs can facilitate easier assembly and maintenance of EREV systems.Expand Specific Solutions

Key Industry Players

The Extended Range Electric Vehicle (EREV) component production landscape is evolving rapidly, with the market in a growth phase characterized by increasing demand and technological advancements. The global EREV market is expanding, driven by environmental concerns and government incentives. Companies like Zhejiang Geely, CHERY NEW ENERGY, and Beijing Electric Vehicle are leading in production scaling, leveraging their automotive expertise. Tech giants such as Intel and TSMC are contributing to the semiconductor aspects of EREV components. The technology is maturing, with firms like Panasonic and TDK advancing battery technologies. However, challenges in supply chain management and manufacturing efficiency persist, requiring collaborative efforts across the industry to meet growing demand.

Zhejiang Geely Holding Group Co., Ltd.

Technical Solution: Geely has developed a modular EREV (Extended Range Electric Vehicle) architecture called Leishen Hi-X, which integrates a 1.5T high-efficiency engine with an electric powertrain. This system utilizes advanced thermal management and intelligent control strategies to optimize energy efficiency. The platform supports various vehicle types, from sedans to SUVs, allowing for scalable production[1]. Geely has also invested in battery swapping technology, which could potentially address some of the challenges in EREV component production by standardizing battery modules[2].

Strengths: Modular design allows for scalability across vehicle types. Integration of battery swapping technology may reduce production complexity. Weaknesses: Reliance on traditional ICE components may limit long-term sustainability in an increasingly electrified market.

Intel Corp.

Technical Solution: Intel's approach to scaling EREV component production focuses on advanced semiconductor solutions for power management and control systems. Their Atom processors and Mobileye EyeQ chips are designed for automotive applications, including EREVs. Intel's 10nm and 7nm manufacturing processes enable the production of high-performance, energy-efficient chips essential for EREV powertrains[3]. They've also developed specialized AI accelerators that can optimize range prediction and energy management in EREVs[4].

Strengths: Advanced semiconductor manufacturing capabilities ensure high-quality, efficient components. Expertise in AI and machine learning can enhance EREV performance. Weaknesses: Limited direct experience in automotive powertrain manufacturing may require strong partnerships.

Core Innovations

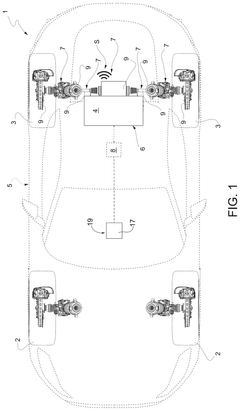

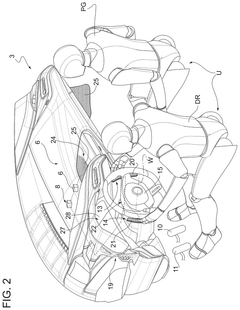

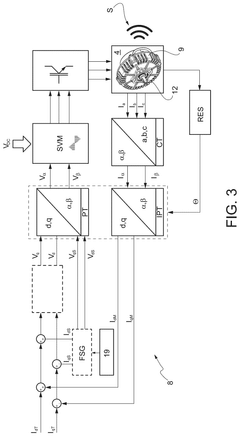

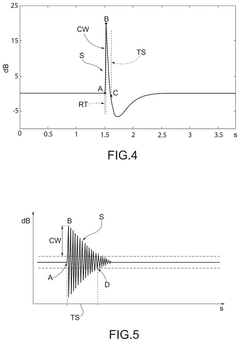

Electric road vehicle provided with a reproduction device for the realization of a sound associable with a gear shift and related method

PatentPendingUS20250087201A1

Innovation

- An electric road vehicle equipped with a reproduction device that generates a sound associable with an electric motor, using an acoustic system that includes an electric motor mechanically connected to a resonant mechanical element, and an electronic control unit that injects acoustical signals to excite the resonant element and produce audible sounds.

Supply Chain Optimization

Supply chain optimization is crucial for scaling the production of Extended Range Electric Vehicle (EREV) components efficiently and cost-effectively. As the demand for EREVs grows, manufacturers face significant challenges in managing complex supply chains that involve multiple tiers of suppliers, diverse components, and global logistics networks.

One key aspect of supply chain optimization for EREV components is the development of robust supplier networks. This involves identifying and qualifying reliable suppliers for critical components such as batteries, electric motors, and power electronics. Manufacturers must establish strategic partnerships with suppliers to ensure consistent quality, timely delivery, and competitive pricing. Implementing supplier development programs can help improve the capabilities of key suppliers, reducing the risk of supply chain disruptions.

Another important consideration is the implementation of just-in-time (JIT) manufacturing principles. By adopting JIT practices, EREV component manufacturers can reduce inventory costs, minimize waste, and improve production flexibility. This approach requires close coordination with suppliers and advanced forecasting techniques to ensure that components are delivered precisely when needed in the production process.

Digitalization and data analytics play a crucial role in optimizing EREV component supply chains. Advanced supply chain management systems can provide real-time visibility into inventory levels, production schedules, and logistics operations. By leveraging big data analytics and artificial intelligence, manufacturers can improve demand forecasting accuracy, optimize inventory levels, and identify potential bottlenecks in the supply chain.

Vertical integration strategies can also contribute to supply chain optimization for EREV components. Some manufacturers may choose to bring critical component production in-house to gain greater control over quality, costs, and production schedules. This approach can reduce dependency on external suppliers and potentially lead to economies of scale as production volumes increase.

Logistics optimization is another key focus area for scaling EREV component production. This involves designing efficient transportation networks, optimizing warehouse locations, and implementing advanced inventory management systems. The use of automated guided vehicles (AGVs) and robotics in warehouses can improve efficiency and reduce labor costs.

Sustainability considerations are increasingly important in supply chain optimization for EREV components. Manufacturers must work to reduce the carbon footprint of their supply chains by optimizing transportation routes, using renewable energy in production facilities, and implementing circular economy principles to minimize waste and maximize resource efficiency.

One key aspect of supply chain optimization for EREV components is the development of robust supplier networks. This involves identifying and qualifying reliable suppliers for critical components such as batteries, electric motors, and power electronics. Manufacturers must establish strategic partnerships with suppliers to ensure consistent quality, timely delivery, and competitive pricing. Implementing supplier development programs can help improve the capabilities of key suppliers, reducing the risk of supply chain disruptions.

Another important consideration is the implementation of just-in-time (JIT) manufacturing principles. By adopting JIT practices, EREV component manufacturers can reduce inventory costs, minimize waste, and improve production flexibility. This approach requires close coordination with suppliers and advanced forecasting techniques to ensure that components are delivered precisely when needed in the production process.

Digitalization and data analytics play a crucial role in optimizing EREV component supply chains. Advanced supply chain management systems can provide real-time visibility into inventory levels, production schedules, and logistics operations. By leveraging big data analytics and artificial intelligence, manufacturers can improve demand forecasting accuracy, optimize inventory levels, and identify potential bottlenecks in the supply chain.

Vertical integration strategies can also contribute to supply chain optimization for EREV components. Some manufacturers may choose to bring critical component production in-house to gain greater control over quality, costs, and production schedules. This approach can reduce dependency on external suppliers and potentially lead to economies of scale as production volumes increase.

Logistics optimization is another key focus area for scaling EREV component production. This involves designing efficient transportation networks, optimizing warehouse locations, and implementing advanced inventory management systems. The use of automated guided vehicles (AGVs) and robotics in warehouses can improve efficiency and reduce labor costs.

Sustainability considerations are increasingly important in supply chain optimization for EREV components. Manufacturers must work to reduce the carbon footprint of their supply chains by optimizing transportation routes, using renewable energy in production facilities, and implementing circular economy principles to minimize waste and maximize resource efficiency.

Regulatory Compliance

Regulatory compliance plays a crucial role in the scaling production of Extended Range Electric Vehicle (EREV) components. As manufacturers aim to increase production capacity, they must navigate a complex landscape of regulations that vary across regions and evolve over time. These regulations encompass safety standards, environmental protection, and energy efficiency requirements.

One of the primary challenges in regulatory compliance for EREV component production is the need to adhere to diverse international standards. Different countries and regions have established their own sets of regulations, which can create obstacles for manufacturers seeking to expand their production globally. For instance, the European Union's End-of-Life Vehicles (ELV) Directive imposes strict requirements on the recyclability and recoverability of vehicle components, including those used in EREVs.

To address these challenges, manufacturers are implementing comprehensive compliance management systems. These systems integrate regulatory tracking, risk assessment, and documentation processes to ensure that production practices align with current and upcoming regulations. Advanced software solutions are being employed to monitor regulatory changes in real-time, allowing companies to proactively adapt their production processes and component designs.

Another significant aspect of regulatory compliance in EREV component production is the management of hazardous materials. Many countries have implemented regulations such as the Restriction of Hazardous Substances (RoHS) directive, which limits the use of certain hazardous substances in electrical and electronic equipment. Manufacturers must carefully select materials and develop alternative solutions to meet these requirements without compromising component performance or durability.

Certification processes present an additional hurdle in scaling production. As production volumes increase, manufacturers must ensure that each component meets the necessary certifications and standards. This often requires extensive testing and documentation, which can be time-consuming and resource-intensive. To streamline this process, some companies are investing in automated testing systems and establishing dedicated compliance teams to manage certification requirements efficiently.

Environmental regulations, particularly those related to emissions and energy efficiency, also impact the production of EREV components. Manufacturers must design and produce components that enable vehicles to meet increasingly stringent emissions standards, such as the Corporate Average Fuel Economy (CAFE) standards in the United States or the European Union's CO2 emissions targets for new vehicles.

To overcome these regulatory challenges and successfully scale production, EREV component manufacturers are adopting several strategies. These include early engagement with regulatory bodies to anticipate future requirements, collaboration with industry partners to develop standardized compliance approaches, and investment in research and development to create innovative solutions that meet or exceed regulatory standards.

One of the primary challenges in regulatory compliance for EREV component production is the need to adhere to diverse international standards. Different countries and regions have established their own sets of regulations, which can create obstacles for manufacturers seeking to expand their production globally. For instance, the European Union's End-of-Life Vehicles (ELV) Directive imposes strict requirements on the recyclability and recoverability of vehicle components, including those used in EREVs.

To address these challenges, manufacturers are implementing comprehensive compliance management systems. These systems integrate regulatory tracking, risk assessment, and documentation processes to ensure that production practices align with current and upcoming regulations. Advanced software solutions are being employed to monitor regulatory changes in real-time, allowing companies to proactively adapt their production processes and component designs.

Another significant aspect of regulatory compliance in EREV component production is the management of hazardous materials. Many countries have implemented regulations such as the Restriction of Hazardous Substances (RoHS) directive, which limits the use of certain hazardous substances in electrical and electronic equipment. Manufacturers must carefully select materials and develop alternative solutions to meet these requirements without compromising component performance or durability.

Certification processes present an additional hurdle in scaling production. As production volumes increase, manufacturers must ensure that each component meets the necessary certifications and standards. This often requires extensive testing and documentation, which can be time-consuming and resource-intensive. To streamline this process, some companies are investing in automated testing systems and establishing dedicated compliance teams to manage certification requirements efficiently.

Environmental regulations, particularly those related to emissions and energy efficiency, also impact the production of EREV components. Manufacturers must design and produce components that enable vehicles to meet increasingly stringent emissions standards, such as the Corporate Average Fuel Economy (CAFE) standards in the United States or the European Union's CO2 emissions targets for new vehicles.

To overcome these regulatory challenges and successfully scale production, EREV component manufacturers are adopting several strategies. These include early engagement with regulatory bodies to anticipate future requirements, collaboration with industry partners to develop standardized compliance approaches, and investment in research and development to create innovative solutions that meet or exceed regulatory standards.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!