Silicon Anodes for Lithium-Ion Batteries: Key Failure Mechanisms and How to Mitigate Them

AUG 21, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Silicon Anode Evolution

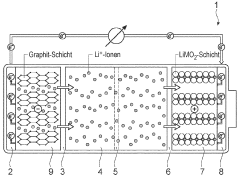

The evolution of silicon anodes in lithium-ion batteries represents a significant advancement in energy storage technology. Initially, graphite anodes dominated the market due to their stability and relatively high capacity. However, the theoretical capacity of graphite (372 mAh/g) limited further improvements in battery energy density. This limitation led researchers to explore alternative materials, with silicon emerging as a promising candidate due to its exceptionally high theoretical capacity of 4200 mAh/g.

The first attempts to incorporate silicon into lithium-ion battery anodes began in the early 2000s. These early efforts focused on using pure silicon particles or thin films. While these approaches demonstrated the potential for high capacity, they quickly revealed significant challenges. The primary issue was the enormous volume expansion (up to 400%) that silicon undergoes during lithiation, leading to rapid degradation of the anode structure and severe capacity fading.

To address these challenges, researchers developed various strategies throughout the 2000s and early 2010s. One approach involved the use of nanostructured silicon, such as silicon nanowires and nanoparticles. These structures provided better accommodation for volume changes and improved cycling stability. Another strategy focused on creating silicon-carbon composites, where carbon acted as a buffer to mitigate the volume expansion effects.

By the mid-2010s, silicon-graphite composite anodes began to gain traction. These anodes typically contained a small percentage of silicon (usually less than 10%) blended with graphite. This approach allowed for a significant increase in capacity compared to pure graphite anodes while maintaining acceptable cycle life. Companies like Panasonic and Tesla started incorporating these silicon-graphite composite anodes into their commercial batteries.

Recent years have seen further advancements in silicon anode technology. Researchers have explored more sophisticated nanostructures, such as porous silicon particles and silicon-carbon core-shell structures. These designs aim to better accommodate volume changes and protect the silicon from direct exposure to the electrolyte, which can lead to continuous SEI formation and capacity loss.

Additionally, the development of novel binders and electrolyte additives has played a crucial role in improving the performance of silicon anodes. Functional binders that can maintain strong adhesion during cycling and additives that form more stable SEI layers have contributed to enhanced cycle life and capacity retention.

Looking forward, the focus is on increasing the silicon content in anodes while maintaining long-term stability. Researchers are exploring advanced manufacturing techniques, such as 3D printing and atomic layer deposition, to create optimized silicon anode structures. The ultimate goal is to develop anodes with silicon as the primary active material, potentially enabling batteries with significantly higher energy densities than current lithium-ion technologies.

The first attempts to incorporate silicon into lithium-ion battery anodes began in the early 2000s. These early efforts focused on using pure silicon particles or thin films. While these approaches demonstrated the potential for high capacity, they quickly revealed significant challenges. The primary issue was the enormous volume expansion (up to 400%) that silicon undergoes during lithiation, leading to rapid degradation of the anode structure and severe capacity fading.

To address these challenges, researchers developed various strategies throughout the 2000s and early 2010s. One approach involved the use of nanostructured silicon, such as silicon nanowires and nanoparticles. These structures provided better accommodation for volume changes and improved cycling stability. Another strategy focused on creating silicon-carbon composites, where carbon acted as a buffer to mitigate the volume expansion effects.

By the mid-2010s, silicon-graphite composite anodes began to gain traction. These anodes typically contained a small percentage of silicon (usually less than 10%) blended with graphite. This approach allowed for a significant increase in capacity compared to pure graphite anodes while maintaining acceptable cycle life. Companies like Panasonic and Tesla started incorporating these silicon-graphite composite anodes into their commercial batteries.

Recent years have seen further advancements in silicon anode technology. Researchers have explored more sophisticated nanostructures, such as porous silicon particles and silicon-carbon core-shell structures. These designs aim to better accommodate volume changes and protect the silicon from direct exposure to the electrolyte, which can lead to continuous SEI formation and capacity loss.

Additionally, the development of novel binders and electrolyte additives has played a crucial role in improving the performance of silicon anodes. Functional binders that can maintain strong adhesion during cycling and additives that form more stable SEI layers have contributed to enhanced cycle life and capacity retention.

Looking forward, the focus is on increasing the silicon content in anodes while maintaining long-term stability. Researchers are exploring advanced manufacturing techniques, such as 3D printing and atomic layer deposition, to create optimized silicon anode structures. The ultimate goal is to develop anodes with silicon as the primary active material, potentially enabling batteries with significantly higher energy densities than current lithium-ion technologies.

Li-Ion Battery Market

The lithium-ion battery market has experienced exponential growth in recent years, driven by the increasing demand for electric vehicles, portable electronics, and renewable energy storage systems. This market is projected to continue its rapid expansion, with estimates suggesting a compound annual growth rate (CAGR) of over 12% from 2021 to 2028. The global market value is expected to reach several hundred billion dollars by 2028, reflecting the critical role of lithium-ion batteries in the transition to clean energy and electrification of transportation.

Electric vehicles (EVs) represent the largest and fastest-growing segment of the lithium-ion battery market. As governments worldwide implement stricter emissions regulations and offer incentives for EV adoption, major automakers are investing heavily in electric vehicle production. This shift is driving substantial demand for high-performance lithium-ion batteries with improved energy density, faster charging capabilities, and longer lifespans.

Consumer electronics, including smartphones, laptops, and wearable devices, continue to be a significant market for lithium-ion batteries. The trend towards more powerful and energy-intensive devices is pushing manufacturers to develop batteries with higher capacities and improved efficiency. Additionally, the growing popularity of Internet of Things (IoT) devices is creating new opportunities for small-format lithium-ion batteries.

The renewable energy sector is another key driver of lithium-ion battery demand. As solar and wind power generation increases, there is a growing need for large-scale energy storage solutions to address intermittency issues. Grid-scale lithium-ion battery installations are becoming increasingly common, enabling better integration of renewable energy sources into existing power grids.

Geographically, Asia-Pacific dominates the lithium-ion battery market, with China leading in both production and consumption. The region's strong position is attributed to its robust manufacturing capabilities, government support for electric vehicles, and the presence of major battery manufacturers. North America and Europe are also experiencing significant growth in the lithium-ion battery market, driven by increasing EV adoption and renewable energy initiatives.

The market is characterized by intense competition among established players and new entrants. Major battery manufacturers are investing heavily in research and development to improve battery performance, reduce costs, and develop new technologies. The race to develop solid-state batteries and other next-generation energy storage solutions is reshaping the competitive landscape and driving innovation across the industry.

Electric vehicles (EVs) represent the largest and fastest-growing segment of the lithium-ion battery market. As governments worldwide implement stricter emissions regulations and offer incentives for EV adoption, major automakers are investing heavily in electric vehicle production. This shift is driving substantial demand for high-performance lithium-ion batteries with improved energy density, faster charging capabilities, and longer lifespans.

Consumer electronics, including smartphones, laptops, and wearable devices, continue to be a significant market for lithium-ion batteries. The trend towards more powerful and energy-intensive devices is pushing manufacturers to develop batteries with higher capacities and improved efficiency. Additionally, the growing popularity of Internet of Things (IoT) devices is creating new opportunities for small-format lithium-ion batteries.

The renewable energy sector is another key driver of lithium-ion battery demand. As solar and wind power generation increases, there is a growing need for large-scale energy storage solutions to address intermittency issues. Grid-scale lithium-ion battery installations are becoming increasingly common, enabling better integration of renewable energy sources into existing power grids.

Geographically, Asia-Pacific dominates the lithium-ion battery market, with China leading in both production and consumption. The region's strong position is attributed to its robust manufacturing capabilities, government support for electric vehicles, and the presence of major battery manufacturers. North America and Europe are also experiencing significant growth in the lithium-ion battery market, driven by increasing EV adoption and renewable energy initiatives.

The market is characterized by intense competition among established players and new entrants. Major battery manufacturers are investing heavily in research and development to improve battery performance, reduce costs, and develop new technologies. The race to develop solid-state batteries and other next-generation energy storage solutions is reshaping the competitive landscape and driving innovation across the industry.

Si Anode Challenges

Silicon anodes have emerged as a promising alternative to traditional graphite anodes in lithium-ion batteries due to their significantly higher theoretical capacity. However, the widespread adoption of silicon anodes faces several critical challenges that need to be addressed.

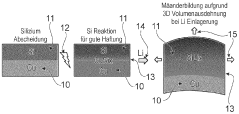

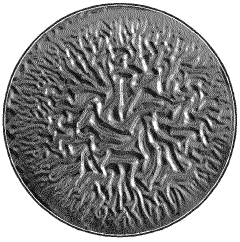

One of the primary issues is the substantial volume expansion and contraction of silicon during lithiation and delithiation cycles. This volume change can be as high as 300-400%, leading to mechanical stress and strain on the electrode structure. As a result, the silicon particles tend to pulverize and lose electrical contact with the current collector, causing rapid capacity fade and shortened battery life.

Another significant challenge is the formation of an unstable solid-electrolyte interphase (SEI) layer on the silicon surface. The continuous expansion and contraction of silicon lead to repeated breaking and reforming of the SEI layer, consuming electrolyte and lithium ions. This process not only reduces the battery's coulombic efficiency but also contributes to capacity loss over time.

The high reactivity of silicon with the electrolyte is another concern. Silicon particles tend to react with the electrolyte, forming various compounds that can further contribute to the degradation of the electrode and overall battery performance. This reactivity also leads to increased gas generation within the battery, potentially causing safety issues.

Furthermore, the low electrical conductivity of silicon poses a challenge for efficient electron transport within the electrode. This limitation can result in increased internal resistance and reduced rate capability of the battery, limiting its performance in high-power applications.

The integration of silicon anodes into existing battery manufacturing processes also presents difficulties. The unique properties of silicon require modifications to electrode formulation, coating techniques, and cell assembly processes, which can be costly and time-consuming to implement at scale.

Lastly, the long-term cycling stability of silicon anodes remains a significant hurdle. While initial capacities are often impressive, maintaining this performance over hundreds or thousands of cycles is challenging due to the cumulative effects of the aforementioned issues.

Addressing these challenges requires a multifaceted approach, combining materials science, nanotechnology, and advanced engineering solutions. Researchers and industry professionals are actively working on various strategies to mitigate these issues and unlock the full potential of silicon anodes in next-generation lithium-ion batteries.

One of the primary issues is the substantial volume expansion and contraction of silicon during lithiation and delithiation cycles. This volume change can be as high as 300-400%, leading to mechanical stress and strain on the electrode structure. As a result, the silicon particles tend to pulverize and lose electrical contact with the current collector, causing rapid capacity fade and shortened battery life.

Another significant challenge is the formation of an unstable solid-electrolyte interphase (SEI) layer on the silicon surface. The continuous expansion and contraction of silicon lead to repeated breaking and reforming of the SEI layer, consuming electrolyte and lithium ions. This process not only reduces the battery's coulombic efficiency but also contributes to capacity loss over time.

The high reactivity of silicon with the electrolyte is another concern. Silicon particles tend to react with the electrolyte, forming various compounds that can further contribute to the degradation of the electrode and overall battery performance. This reactivity also leads to increased gas generation within the battery, potentially causing safety issues.

Furthermore, the low electrical conductivity of silicon poses a challenge for efficient electron transport within the electrode. This limitation can result in increased internal resistance and reduced rate capability of the battery, limiting its performance in high-power applications.

The integration of silicon anodes into existing battery manufacturing processes also presents difficulties. The unique properties of silicon require modifications to electrode formulation, coating techniques, and cell assembly processes, which can be costly and time-consuming to implement at scale.

Lastly, the long-term cycling stability of silicon anodes remains a significant hurdle. While initial capacities are often impressive, maintaining this performance over hundreds or thousands of cycles is challenging due to the cumulative effects of the aforementioned issues.

Addressing these challenges requires a multifaceted approach, combining materials science, nanotechnology, and advanced engineering solutions. Researchers and industry professionals are actively working on various strategies to mitigate these issues and unlock the full potential of silicon anodes in next-generation lithium-ion batteries.

Current Si Solutions

01 Volume expansion and pulverization

Silicon anodes experience significant volume expansion during lithiation, leading to mechanical stress and pulverization. This causes loss of electrical contact and capacity fading over repeated charge-discharge cycles. Strategies to mitigate this include nanostructuring, porous designs, and composite materials to accommodate volume changes.- Volume expansion and pulverization: Silicon anodes experience significant volume expansion during lithiation, leading to mechanical stress and pulverization of the material. This causes loss of electrical contact and capacity fading over repeated charge-discharge cycles.

- Solid Electrolyte Interphase (SEI) instability: The continuous formation and breakdown of the SEI layer on silicon anodes due to volume changes leads to electrolyte consumption and loss of active material. This results in increased internal resistance and decreased battery performance over time.

- Lithium trapping and irreversible capacity loss: Silicon anodes can trap lithium ions in their structure, leading to irreversible capacity loss. This phenomenon is exacerbated by the formation of inactive lithium silicide phases and the isolation of active material due to pulverization.

- Electrode delamination and binder degradation: The extreme volume changes in silicon anodes can cause delamination from the current collector and degradation of the binder material. This leads to loss of electrical contact and decreased mechanical stability of the electrode structure.

- Electrolyte decomposition and gassing: Silicon anodes can catalyze electrolyte decomposition, leading to gas formation and increased internal pressure in the battery. This can cause swelling of the cell and accelerated degradation of the electrode materials.

02 Solid Electrolyte Interphase (SEI) instability

The formation of an unstable SEI layer on silicon anodes contributes to continuous electrolyte decomposition and loss of active material. This results in increased internal resistance and capacity fade. Research focuses on developing artificial SEI layers and electrolyte additives to enhance stability and cycling performance.Expand Specific Solutions03 Lithium trapping and irreversible capacity loss

Silicon anodes suffer from lithium trapping within the structure, leading to irreversible capacity loss. This is due to the formation of stable Li-Si phases and incomplete delithiation. Approaches to address this include doping, surface modification, and optimized cycling protocols to enhance lithium extraction.Expand Specific Solutions04 Electrical conductivity degradation

The repeated volume changes in silicon anodes can lead to loss of electrical contact between particles and with the current collector. This results in increased internal resistance and power fade. Conductive coatings, 3D current collectors, and conductive binders are being explored to maintain electrical pathways throughout cycling.Expand Specific Solutions05 Electrolyte depletion and gassing

Silicon anodes can cause accelerated electrolyte decomposition, leading to electrolyte depletion and gas generation. This results in increased internal pressure, safety concerns, and performance degradation. Research is focused on developing stable electrolyte formulations, additives, and gas recombination strategies to mitigate these issues.Expand Specific Solutions

Key Si Anode Players

The silicon anode technology for lithium-ion batteries is in a growth phase, with significant market potential due to increasing demand for high-performance energy storage solutions. The global market for silicon anodes is projected to expand rapidly, driven by the electric vehicle and consumer electronics sectors. While the technology shows promise, it faces challenges in commercialization, particularly in addressing issues like volume expansion and capacity fading. Companies like A123 Systems, Enevate, and Nexeon are at the forefront of developing advanced silicon anode technologies, with established players such as Robert Bosch GmbH and 3M Innovative Properties Co. also investing in this field. The involvement of research institutions like Arizona State University and the National Synchrotron Radiation Research Center indicates ongoing efforts to overcome technical hurdles and improve performance.

A123 Systems LLC

Technical Solution: A123 Systems has developed a silicon-graphite composite anode technology called UltraPhosphate™ that addresses the key failure mechanisms of silicon anodes. Their approach involves blending silicon nanoparticles with graphite and proprietary binders to create a stable anode structure[7]. The company's technology utilizes a gradient distribution of silicon within the anode, with higher concentrations near the current collector, to manage volume expansion and maintain electrode integrity[8]. To mitigate the issue of continuous SEI formation, A123 Systems employs electrolyte additives and surface treatments that promote the formation of a more stable and flexible SEI layer[9]. Their silicon-graphite anodes demonstrate improved cycle life and capacity retention compared to traditional graphite anodes.

Strengths: Balanced approach combining silicon and graphite for improved performance and stability, compatibility with existing manufacturing processes. Weaknesses: Lower silicon content compared to pure silicon anodes, potentially limiting maximum energy density gains.

Ningde Amperex Technology Ltd.

Technical Solution: CATL (Ningde Amperex Technology Ltd.) has developed a silicon-carbon anode technology that addresses the volume expansion and SEI instability issues associated with silicon anodes. Their approach involves using a nano-structured silicon-carbon composite material that allows for controlled volume expansion during cycling[10]. CATL's technology incorporates silicon nanoparticles within a porous carbon framework, which provides mechanical support and improves electrical conductivity[11]. To mitigate SEI instability, CATL employs advanced electrolyte formulations and surface modification techniques that promote the formation of a more stable and flexible SEI layer[12]. The company's silicon-carbon anodes demonstrate improved energy density and cycle life compared to traditional graphite anodes.

Strengths: Large-scale production capabilities, integration with existing battery manufacturing processes. Weaknesses: Potential trade-off between silicon content and long-term stability, ongoing research needed for further optimization.

Si Anode Innovations

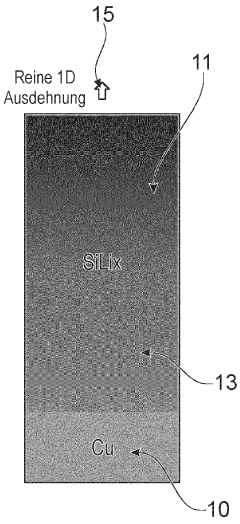

Silicon anode for lithium-ion batteries, and method for producing same

PatentWO2023118095A1

Innovation

- The method involves depositing a silicon active layer on a copper substrate and subjecting it to short-term annealing, followed by structuring the substrate surface or active layer to create segmented areas, reducing stress and maintaining strong adhesion, using techniques like laser structuring, embossing, or applying a functional layer to control expansion and prevent warping.

Lithium ion batteries

PatentWO2019105544A1

Innovation

- The use of lithium-ion batteries with anodes containing silicon particles and an electrolyte comprising specific inorganic salts and hydrocarbons, which reduces mechanical stress and stabilizes electrochemical behavior by minimizing capacity decline through partial lithiation and optimized particle size distribution.

Safety Regulations

The development and implementation of silicon anodes in lithium-ion batteries necessitate a comprehensive understanding and adherence to safety regulations. These regulations are crucial for ensuring the safe operation, transportation, and disposal of batteries incorporating silicon anodes.

At the international level, the United Nations (UN) has established regulations for the transport of dangerous goods, including lithium-ion batteries. The UN Manual of Tests and Criteria outlines specific tests that batteries must pass to be considered safe for transport. For silicon anode batteries, these tests may need to be adapted to address the unique characteristics and potential failure modes associated with silicon expansion and contraction during cycling.

In the United States, the Consumer Product Safety Commission (CPSC) and the Department of Transportation (DOT) play key roles in regulating battery safety. The CPSC focuses on consumer product safety, while the DOT regulates the transportation of hazardous materials, including lithium-ion batteries. Both agencies may need to update their guidelines to account for the specific risks associated with silicon anodes, such as the potential for increased swelling or thermal runaway.

The European Union has implemented the Battery Directive (2006/66/EC) and the REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulation. These regulations govern the manufacture, use, and disposal of batteries, as well as the chemicals used in their production. As silicon anodes become more prevalent, these regulations may need to be revised to address the specific environmental and safety concerns associated with silicon-based battery materials.

In Asia, countries like Japan, South Korea, and China have their own sets of safety standards for lithium-ion batteries. For instance, Japan's Ministry of Economy, Trade and Industry (METI) has established technical standards for lithium-ion batteries. These standards may need to be updated to include specific provisions for silicon anode batteries, particularly regarding their unique failure mechanisms and mitigation strategies.

Safety certifications such as UL (Underwriters Laboratories) and IEC (International Electrotechnical Commission) standards are widely recognized and often required for battery products. These certification bodies will likely need to develop new testing protocols or modify existing ones to adequately assess the safety of silicon anode batteries, taking into account their specific failure modes and mitigation techniques.

As research progresses and more data becomes available on the long-term performance and safety of silicon anode batteries, regulatory bodies will need to continuously update their guidelines. This may include establishing new safety thresholds, mandating specific mitigation strategies, or requiring additional testing procedures to address the unique challenges posed by silicon anodes.

At the international level, the United Nations (UN) has established regulations for the transport of dangerous goods, including lithium-ion batteries. The UN Manual of Tests and Criteria outlines specific tests that batteries must pass to be considered safe for transport. For silicon anode batteries, these tests may need to be adapted to address the unique characteristics and potential failure modes associated with silicon expansion and contraction during cycling.

In the United States, the Consumer Product Safety Commission (CPSC) and the Department of Transportation (DOT) play key roles in regulating battery safety. The CPSC focuses on consumer product safety, while the DOT regulates the transportation of hazardous materials, including lithium-ion batteries. Both agencies may need to update their guidelines to account for the specific risks associated with silicon anodes, such as the potential for increased swelling or thermal runaway.

The European Union has implemented the Battery Directive (2006/66/EC) and the REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulation. These regulations govern the manufacture, use, and disposal of batteries, as well as the chemicals used in their production. As silicon anodes become more prevalent, these regulations may need to be revised to address the specific environmental and safety concerns associated with silicon-based battery materials.

In Asia, countries like Japan, South Korea, and China have their own sets of safety standards for lithium-ion batteries. For instance, Japan's Ministry of Economy, Trade and Industry (METI) has established technical standards for lithium-ion batteries. These standards may need to be updated to include specific provisions for silicon anode batteries, particularly regarding their unique failure mechanisms and mitigation strategies.

Safety certifications such as UL (Underwriters Laboratories) and IEC (International Electrotechnical Commission) standards are widely recognized and often required for battery products. These certification bodies will likely need to develop new testing protocols or modify existing ones to adequately assess the safety of silicon anode batteries, taking into account their specific failure modes and mitigation techniques.

As research progresses and more data becomes available on the long-term performance and safety of silicon anode batteries, regulatory bodies will need to continuously update their guidelines. This may include establishing new safety thresholds, mandating specific mitigation strategies, or requiring additional testing procedures to address the unique challenges posed by silicon anodes.

Environmental Impact

The environmental impact of silicon anodes in lithium-ion batteries is a critical consideration as the technology advances. While silicon anodes offer significant improvements in energy density and battery performance, their production and use have both positive and negative environmental implications.

One of the primary environmental benefits of silicon anodes is their potential to increase the energy density of lithium-ion batteries. This improvement could lead to longer-lasting and more efficient batteries, reducing the overall number of batteries needed and potentially decreasing electronic waste. Additionally, the enhanced performance of silicon anodes could contribute to the wider adoption of electric vehicles, leading to reduced greenhouse gas emissions from transportation.

However, the production of silicon anodes presents several environmental challenges. The extraction and processing of silicon require significant energy inputs, often relying on fossil fuels. This energy-intensive process contributes to carbon emissions and may offset some of the environmental gains achieved through improved battery performance. Furthermore, the mining of silicon can lead to habitat destruction and water pollution if not managed responsibly.

The use of hydrofluoric acid in the etching process of silicon wafers is another environmental concern. This highly corrosive substance poses risks to both human health and the environment if not handled and disposed of properly. Stringent safety measures and waste management protocols are essential to mitigate these risks.

The lifecycle of silicon anode batteries also raises environmental questions. While they may offer improved performance, the potential for increased silicon content in batteries could complicate recycling processes. Developing efficient recycling methods for silicon-based anodes is crucial to ensure the sustainable use of resources and minimize environmental impact.

Water consumption is another factor to consider in the production of silicon anodes. The manufacturing process requires significant amounts of ultra-pure water, which can strain local water resources, particularly in water-scarce regions. Implementing water recycling and conservation measures in production facilities is essential to address this issue.

As research and development in silicon anode technology progress, there is a growing focus on more environmentally friendly production methods. These include exploring alternative silicon sources, such as rice husks or recycled silicon, which could reduce the environmental footprint of raw material extraction. Additionally, efforts are being made to develop less energy-intensive processing techniques and to incorporate renewable energy sources in manufacturing.

In conclusion, while silicon anodes offer promising advancements in battery technology, their environmental impact is complex and multifaceted. Balancing the potential benefits with the environmental challenges will be crucial as this technology continues to evolve and scale up for widespread use.

One of the primary environmental benefits of silicon anodes is their potential to increase the energy density of lithium-ion batteries. This improvement could lead to longer-lasting and more efficient batteries, reducing the overall number of batteries needed and potentially decreasing electronic waste. Additionally, the enhanced performance of silicon anodes could contribute to the wider adoption of electric vehicles, leading to reduced greenhouse gas emissions from transportation.

However, the production of silicon anodes presents several environmental challenges. The extraction and processing of silicon require significant energy inputs, often relying on fossil fuels. This energy-intensive process contributes to carbon emissions and may offset some of the environmental gains achieved through improved battery performance. Furthermore, the mining of silicon can lead to habitat destruction and water pollution if not managed responsibly.

The use of hydrofluoric acid in the etching process of silicon wafers is another environmental concern. This highly corrosive substance poses risks to both human health and the environment if not handled and disposed of properly. Stringent safety measures and waste management protocols are essential to mitigate these risks.

The lifecycle of silicon anode batteries also raises environmental questions. While they may offer improved performance, the potential for increased silicon content in batteries could complicate recycling processes. Developing efficient recycling methods for silicon-based anodes is crucial to ensure the sustainable use of resources and minimize environmental impact.

Water consumption is another factor to consider in the production of silicon anodes. The manufacturing process requires significant amounts of ultra-pure water, which can strain local water resources, particularly in water-scarce regions. Implementing water recycling and conservation measures in production facilities is essential to address this issue.

As research and development in silicon anode technology progress, there is a growing focus on more environmentally friendly production methods. These include exploring alternative silicon sources, such as rice husks or recycled silicon, which could reduce the environmental footprint of raw material extraction. Additionally, efforts are being made to develop less energy-intensive processing techniques and to incorporate renewable energy sources in manufacturing.

In conclusion, while silicon anodes offer promising advancements in battery technology, their environmental impact is complex and multifaceted. Balancing the potential benefits with the environmental challenges will be crucial as this technology continues to evolve and scale up for widespread use.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!