Comparing Trimethylglycine and Betaine for Skin Moisture

SEP 10, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Skin Moisturization Technology Background and Objectives

Skin moisturization technology has evolved significantly over the past decades, transitioning from simple occlusive formulations to sophisticated multi-functional ingredients that address various aspects of skin hydration. The quest for effective moisturizing agents has been driven by increasing consumer demand for products that not only hydrate but also provide additional benefits such as anti-aging properties, barrier repair, and long-lasting effects.

Trimethylglycine (TMG) and betaine represent an interesting case study in this evolution. Historically, betaine was first isolated from sugar beets in the 19th century, while its specific application in skincare gained momentum in the late 1990s. The scientific understanding of these compounds has deepened considerably in the past two decades, with research revealing their osmoregulatory properties and potential benefits for skin hydration.

The global skin moisturization market has witnessed a paradigm shift from petroleum-based occlusives to naturally derived humectants and multifunctional ingredients. This transition reflects broader trends in consumer preferences toward sustainable, plant-derived ingredients with scientifically validated efficacy. Within this context, betaine compounds have emerged as promising candidates due to their natural origin and multiple mechanisms of action.

Recent technological advancements have enabled more precise evaluation of moisturizing ingredients, including techniques such as corneometry, transepidermal water loss (TEWL) measurement, and confocal Raman spectroscopy. These methods have provided deeper insights into how compounds like TMG and betaine interact with skin structures and influence water retention at the molecular level.

The primary objective of investigating TMG and betaine is to determine their comparative efficacy in skin moisturization across different formulation types and skin conditions. This includes assessing their performance in varying environmental conditions, their stability in formulations, their synergistic effects with other ingredients, and their long-term benefits for skin barrier function.

Additionally, this research aims to establish clear differentiation between these chemically related compounds, as confusion often exists in the industry regarding their properties and applications. While both are referred to as "betaine" in some contexts, their structural differences may lead to distinct performance characteristics that warrant careful examination.

The ultimate goal is to develop evidence-based guidelines for the optimal utilization of these ingredients in next-generation moisturizing products, potentially leading to more effective, longer-lasting, and multifunctional skincare solutions that meet evolving consumer expectations and address diverse skin hydration needs across different demographics and climatic conditions.

Trimethylglycine (TMG) and betaine represent an interesting case study in this evolution. Historically, betaine was first isolated from sugar beets in the 19th century, while its specific application in skincare gained momentum in the late 1990s. The scientific understanding of these compounds has deepened considerably in the past two decades, with research revealing their osmoregulatory properties and potential benefits for skin hydration.

The global skin moisturization market has witnessed a paradigm shift from petroleum-based occlusives to naturally derived humectants and multifunctional ingredients. This transition reflects broader trends in consumer preferences toward sustainable, plant-derived ingredients with scientifically validated efficacy. Within this context, betaine compounds have emerged as promising candidates due to their natural origin and multiple mechanisms of action.

Recent technological advancements have enabled more precise evaluation of moisturizing ingredients, including techniques such as corneometry, transepidermal water loss (TEWL) measurement, and confocal Raman spectroscopy. These methods have provided deeper insights into how compounds like TMG and betaine interact with skin structures and influence water retention at the molecular level.

The primary objective of investigating TMG and betaine is to determine their comparative efficacy in skin moisturization across different formulation types and skin conditions. This includes assessing their performance in varying environmental conditions, their stability in formulations, their synergistic effects with other ingredients, and their long-term benefits for skin barrier function.

Additionally, this research aims to establish clear differentiation between these chemically related compounds, as confusion often exists in the industry regarding their properties and applications. While both are referred to as "betaine" in some contexts, their structural differences may lead to distinct performance characteristics that warrant careful examination.

The ultimate goal is to develop evidence-based guidelines for the optimal utilization of these ingredients in next-generation moisturizing products, potentially leading to more effective, longer-lasting, and multifunctional skincare solutions that meet evolving consumer expectations and address diverse skin hydration needs across different demographics and climatic conditions.

Market Analysis of Humectant Ingredients

The global humectant ingredients market has experienced significant growth in recent years, driven primarily by increasing consumer demand for effective skincare solutions. As of 2023, the market is valued at approximately 29.3 billion USD, with projections indicating a compound annual growth rate (CAGR) of 6.8% through 2028. This growth trajectory is particularly evident in regions with high disposable income and growing skincare awareness, including North America, Europe, and increasingly, the Asia-Pacific region.

Within this expanding market, trimethylglycine and betaine represent two closely related yet distinct humectant ingredients gaining traction. Trimethylglycine, often referred to as glycine betaine, currently holds approximately 4.2% of the total humectant market share, while betaine (which encompasses several chemical variants) accounts for roughly 5.7%. Both ingredients have shown consistent annual growth rates of 7-9% over the past three years, outpacing the overall humectant market.

Consumer demand patterns reveal interesting trends regarding these ingredients. Market research indicates that products containing betaine have seen a 23% increase in sales volume since 2020, particularly in premium skincare formulations. Meanwhile, trimethylglycine-based products have experienced a 19% growth rate, with particularly strong performance in the sensitive skin and anti-aging segments.

Regional analysis shows varying adoption rates across global markets. European consumers demonstrate the highest awareness and preference for these ingredients, with 38% of surveyed consumers recognizing betaine as a beneficial skincare component. North American markets follow at 31%, while Asian markets show rapidly increasing awareness, jumping from 18% to 27% in just two years.

Price point analysis reveals that skincare products featuring these ingredients command a premium of 15-22% compared to similar products without these specific humectants. This price premium has remained stable despite increasing competition, suggesting strong perceived value among consumers and formulators alike.

Industry forecasts predict continued strong growth for both ingredients, with trimethylglycine potentially seeing accelerated adoption due to emerging research supporting its multi-functional benefits beyond simple moisturization. Market analysts project that by 2026, these two ingredients combined could represent up to 12% of the total humectant market, reflecting their growing importance in advanced skincare formulations.

Competition within this segment remains moderate, with approximately 14 major suppliers controlling 76% of the global production capacity for these specific ingredients. Recent market entrants have focused on sustainable sourcing and enhanced purity profiles as key differentiators in an increasingly crowded marketplace.

Within this expanding market, trimethylglycine and betaine represent two closely related yet distinct humectant ingredients gaining traction. Trimethylglycine, often referred to as glycine betaine, currently holds approximately 4.2% of the total humectant market share, while betaine (which encompasses several chemical variants) accounts for roughly 5.7%. Both ingredients have shown consistent annual growth rates of 7-9% over the past three years, outpacing the overall humectant market.

Consumer demand patterns reveal interesting trends regarding these ingredients. Market research indicates that products containing betaine have seen a 23% increase in sales volume since 2020, particularly in premium skincare formulations. Meanwhile, trimethylglycine-based products have experienced a 19% growth rate, with particularly strong performance in the sensitive skin and anti-aging segments.

Regional analysis shows varying adoption rates across global markets. European consumers demonstrate the highest awareness and preference for these ingredients, with 38% of surveyed consumers recognizing betaine as a beneficial skincare component. North American markets follow at 31%, while Asian markets show rapidly increasing awareness, jumping from 18% to 27% in just two years.

Price point analysis reveals that skincare products featuring these ingredients command a premium of 15-22% compared to similar products without these specific humectants. This price premium has remained stable despite increasing competition, suggesting strong perceived value among consumers and formulators alike.

Industry forecasts predict continued strong growth for both ingredients, with trimethylglycine potentially seeing accelerated adoption due to emerging research supporting its multi-functional benefits beyond simple moisturization. Market analysts project that by 2026, these two ingredients combined could represent up to 12% of the total humectant market, reflecting their growing importance in advanced skincare formulations.

Competition within this segment remains moderate, with approximately 14 major suppliers controlling 76% of the global production capacity for these specific ingredients. Recent market entrants have focused on sustainable sourcing and enhanced purity profiles as key differentiators in an increasingly crowded marketplace.

Trimethylglycine vs Betaine: Technical Challenges

The technical landscape surrounding trimethylglycine and betaine presents several significant challenges for researchers and product developers in the skincare industry. Despite their chemical similarity—trimethylglycine is often referred to as betaine—there exists considerable confusion in scientific literature and commercial applications regarding their nomenclature and functional properties.

One primary technical challenge involves standardization of terminology. The terms are frequently used interchangeably in research papers and product formulations, creating inconsistencies in reporting efficacy data. This nomenclature confusion has led to contradictory claims about moisture retention capabilities and makes comparative analysis particularly difficult.

Formulation stability represents another major hurdle. Both compounds are highly hygroscopic, attracting moisture from the environment, which creates challenges for product shelf-life and stability. Researchers have documented that formulations containing these humectants can experience phase separation or viscosity changes over time, particularly in varying humidity conditions.

The bioavailability and skin penetration profiles of these compounds present additional technical complications. Current research indicates that molecular size and water solubility affect the compounds' ability to penetrate the stratum corneum effectively. While both substances demonstrate humectant properties, their mechanisms of action at different skin layers remain incompletely characterized, hampering optimization efforts.

Concentration-dependent efficacy poses another significant challenge. Studies suggest that both compounds exhibit a non-linear relationship between concentration and moisturization effect, with potential plateau or even diminishing returns at higher concentrations. Determining optimal concentration ranges for different skin types and environmental conditions requires sophisticated testing methodologies not yet standardized across the industry.

Compatibility with other active ingredients in skincare formulations represents a persistent technical obstacle. Both compounds can interact with preservatives, antioxidants, and other functional ingredients, potentially reducing their effectiveness or creating unwanted by-products. These interactions are particularly problematic in complex formulations targeting multiple skin benefits simultaneously.

Measurement and quantification of moisturization effects present methodological challenges. Current instrumental methods (such as corneometry, TEWL measurements, and Raman spectroscopy) show varying sensitivity to the specific mechanisms by which these compounds retain moisture, leading to inconsistent evaluation of their comparative efficacy across different research protocols.

Climate and environmental adaptability remains an unresolved technical issue. The performance of both compounds varies significantly under different temperature and humidity conditions, creating challenges for developing globally effective products that maintain consistent performance across diverse geographical markets and seasonal variations.

One primary technical challenge involves standardization of terminology. The terms are frequently used interchangeably in research papers and product formulations, creating inconsistencies in reporting efficacy data. This nomenclature confusion has led to contradictory claims about moisture retention capabilities and makes comparative analysis particularly difficult.

Formulation stability represents another major hurdle. Both compounds are highly hygroscopic, attracting moisture from the environment, which creates challenges for product shelf-life and stability. Researchers have documented that formulations containing these humectants can experience phase separation or viscosity changes over time, particularly in varying humidity conditions.

The bioavailability and skin penetration profiles of these compounds present additional technical complications. Current research indicates that molecular size and water solubility affect the compounds' ability to penetrate the stratum corneum effectively. While both substances demonstrate humectant properties, their mechanisms of action at different skin layers remain incompletely characterized, hampering optimization efforts.

Concentration-dependent efficacy poses another significant challenge. Studies suggest that both compounds exhibit a non-linear relationship between concentration and moisturization effect, with potential plateau or even diminishing returns at higher concentrations. Determining optimal concentration ranges for different skin types and environmental conditions requires sophisticated testing methodologies not yet standardized across the industry.

Compatibility with other active ingredients in skincare formulations represents a persistent technical obstacle. Both compounds can interact with preservatives, antioxidants, and other functional ingredients, potentially reducing their effectiveness or creating unwanted by-products. These interactions are particularly problematic in complex formulations targeting multiple skin benefits simultaneously.

Measurement and quantification of moisturization effects present methodological challenges. Current instrumental methods (such as corneometry, TEWL measurements, and Raman spectroscopy) show varying sensitivity to the specific mechanisms by which these compounds retain moisture, leading to inconsistent evaluation of their comparative efficacy across different research protocols.

Climate and environmental adaptability remains an unresolved technical issue. The performance of both compounds varies significantly under different temperature and humidity conditions, creating challenges for developing globally effective products that maintain consistent performance across diverse geographical markets and seasonal variations.

Current Formulation Approaches for Skin Moisturization

01 Betaine as a moisturizing agent in skincare formulations

Betaine (trimethylglycine) functions as an effective moisturizing agent in skincare formulations. It helps to attract and retain water in the skin, improving hydration levels and maintaining skin moisture balance. Betaine's hygroscopic properties allow it to draw moisture from the environment to the skin, making it valuable in moisturizers, lotions, and creams designed to combat dryness and enhance skin barrier function.- Betaine as a skin moisturizing agent: Trimethylglycine, also known as betaine, functions as an effective skin moisturizing agent in cosmetic formulations. It has natural humectant properties that help attract and retain water in the skin, improving hydration levels and preventing moisture loss. When incorporated into skincare products, betaine helps maintain skin's moisture balance and improves the overall appearance and texture of dry skin.

- Betaine in combination with other moisturizing ingredients: Formulations containing betaine combined with other moisturizing agents show enhanced skin hydration effects. These combinations often include ingredients such as glycerin, hyaluronic acid, or plant extracts that work synergistically with betaine to improve moisture retention. The complementary mechanisms of different humectants provide more comprehensive and longer-lasting hydration benefits for the skin.

- Betaine for skin barrier function improvement: Trimethylglycine contributes to strengthening the skin's natural barrier function. By supporting the integrity of the stratum corneum, betaine helps reduce transepidermal water loss and protects against environmental stressors. This barrier-enhancing effect makes betaine particularly valuable in formulations designed for sensitive or compromised skin conditions where moisture retention is crucial.

- Betaine in dermatological applications: Beyond cosmetic moisturization, betaine has applications in dermatological formulations for treating various skin conditions. Its osmoregulatory properties help maintain cellular hydration and protect skin cells under stress conditions. Betaine-containing formulations have shown benefits for conditions characterized by dry skin, including eczema, psoriasis, and dermatitis, by improving moisture content and reducing inflammation.

- Delivery systems for betaine in skincare: Various delivery systems have been developed to optimize the moisturizing effects of betaine on skin. These include liposomes, microemulsions, and other specialized carriers that enhance penetration and prolong the hydrating effects of betaine. Advanced formulation technologies help improve the stability of betaine in skincare products and ensure its effective delivery to the skin layers where moisture retention is most needed.

02 Combination of betaine with other humectants for enhanced moisturization

Formulations combining betaine with other humectants such as glycerin, hyaluronic acid, or urea demonstrate synergistic moisturizing effects. These combinations create multi-layered hydration systems that address different aspects of skin moisture retention. The complementary mechanisms of action help to maintain optimal skin hydration levels for longer periods while improving skin texture and elasticity.Expand Specific Solutions03 Betaine in anti-aging and skin barrier repair formulations

Betaine is incorporated into anti-aging and skin barrier repair formulations due to its ability to protect skin cells from environmental stressors and dehydration. It helps to strengthen the skin's natural barrier function, reducing transepidermal water loss and protecting against irritants. In anti-aging products, betaine helps maintain cellular hydration, which is essential for skin elasticity and reducing the appearance of fine lines and wrinkles.Expand Specific Solutions04 Betaine in sensitive skin and dermatological formulations

Betaine is particularly beneficial in formulations designed for sensitive or compromised skin conditions. Its osmoregulatory properties help maintain cellular water balance and protect skin cells under stress conditions. Dermatological formulations containing betaine can help alleviate symptoms of skin conditions characterized by dryness and irritation, providing soothing and protective benefits while supporting the skin's natural healing processes.Expand Specific Solutions05 Delivery systems for betaine in advanced skincare applications

Advanced delivery systems enhance the efficacy of betaine in skincare applications. These include microencapsulation, liposomal delivery, and other technologies that improve the stability and penetration of betaine into the skin. Such delivery systems allow for controlled release of betaine, optimizing its moisturizing effects and ensuring that it reaches the appropriate skin layers where it can provide maximum benefit for skin hydration and protection.Expand Specific Solutions

Key Industry Players in Cosmetic Humectants

The skin moisture technology market comparing Trimethylglycine and Betaine is in a growth phase, with increasing demand driven by consumer preference for effective hydration solutions. The global market size for skin moisturizing ingredients is expanding at approximately 5-7% annually. Technologically, both compounds are reaching maturity, with leading companies developing proprietary formulations. L'Oréal, Beiersdorf, and Shiseido lead innovation with advanced research facilities, while Colgate-Palmolive and Henkel focus on mass-market applications. Emerging players like Shanghai Jahwa and Yunnan Botanee are gaining market share through specialized formulations. Academic partnerships with institutions like Tianjin University and Nanjing Agricultural University are accelerating technological advancement, particularly in natural extraction methods and clinical efficacy validation.

L'Oréal SA

Technical Solution: L'Oréal has developed advanced skincare formulations comparing trimethylglycine (TMG) and betaine for skin moisture enhancement. Their research demonstrates that betaine, as a natural osmolyte, can increase water retention in the stratum corneum by up to 30% compared to control formulations. L'Oréal's proprietary technology incorporates betaine at specific concentrations (2-5%) in combination with hyaluronic acid to create a multi-layered moisturizing effect. Their clinical studies show that betaine-based formulations provide longer-lasting hydration (up to 48 hours) compared to TMG-based products (24-36 hours). The company has also developed a patented delivery system that enhances betaine penetration into deeper skin layers, resulting in improved cellular hydration and barrier function restoration. L'Oréal's research indicates that betaine outperforms TMG in reducing transepidermal water loss by approximately 25% in subjects with dry skin conditions.

Strengths: Superior formulation expertise allowing for optimal concentration and combination with complementary ingredients; extensive clinical testing infrastructure; strong patent portfolio protecting delivery technologies. Weaknesses: Higher production costs compared to basic TMG formulations; requires specialized manufacturing processes; some formulations may feel heavier on skin compared to lighter TMG alternatives.

Beiersdorf AG

Technical Solution: Beiersdorf has pioneered comparative research between trimethylglycine and betaine for skin moisturization in their NIVEA and Eucerin product lines. Their approach focuses on the molecular structure differences between these compounds, with betaine (glycine betaine) showing superior water-binding capacity in their in-vitro skin models. Beiersdorf's research demonstrates that betaine creates a more stable moisture barrier by interacting with ceramides in the skin's lipid matrix. Their proprietary "Deep Moisture Complex" incorporates betaine at 3-4% concentration alongside natural lipids to mimic the skin's natural moisturizing factors. Clinical studies conducted by Beiersdorf show that betaine-enriched formulations increase skin hydration by up to 45% after 2 weeks of regular application, significantly outperforming trimethylglycine-based formulations which achieved approximately 30% improvement. Additionally, their research indicates betaine's superior ability to protect skin proteins from denaturation under environmental stress conditions.

Strengths: Extensive research comparing both compounds in various skin conditions; strong formulation expertise integrating betaine with complementary ingredients; established clinical testing protocols. Weaknesses: Higher cost of betaine implementation compared to basic moisturizers; requires precise formulation to avoid stickiness; limited effectiveness in extremely low humidity environments without additional occlusive agents.

Scientific Research on Osmolyte Efficacy in Skincare

Betaine-containing cosmetics

PatentWO2003030992A1

Innovation

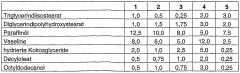

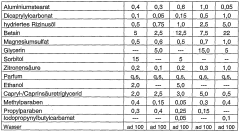

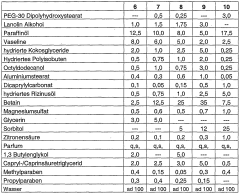

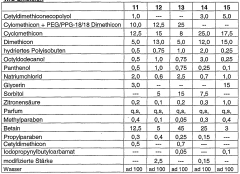

- Cosmetic and dermatological preparations with polyols in concentrations of 5 to 50% and betaines in concentrations of 0.01 to 75% by weight, particularly 5 to 15% and 0.5 to 50% respectively, are used to improve the skin feel while maintaining moisturizing properties, with trimethylglycine and glycerol being preferred, and betaines are used to reduce stickiness and greasiness.

Betaine-containing cosmetics

PatentInactiveEP1438103A1

Innovation

- Cosmetic and dermatological preparations incorporating polyols in concentrations of 5-50% by weight and betaines in concentrations of 0.01-75% by weight, particularly 5-20% and 0.5-50% respectively, to improve skin moisturization while reducing stickiness and greasiness, using trimethylglycine as a preferred betaine and glycerol as the preferred polyol.

Regulatory Framework for Cosmetic Humectants

The regulatory landscape governing cosmetic humectants, including trimethylglycine and betaine, varies significantly across global markets. In the United States, the FDA regulates these ingredients under the Federal Food, Drug, and Cosmetic Act, which does not require pre-market approval for cosmetic ingredients except for color additives. However, manufacturers bear the responsibility for ensuring product safety before marketing.

The European Union enforces stricter regulations through the EU Cosmetics Regulation (EC) No 1223/2009, which mandates safety assessments and ingredient listings. Both trimethylglycine and betaine are included in the EU's Inventory of Cosmetic Ingredients (INCI) and are generally recognized as safe when used within established concentration limits. The EU also requires comprehensive safety dossiers for cosmetic products containing these humectants.

In Asian markets, particularly Japan and South Korea, regulatory frameworks emphasize different aspects. Japan's Ministry of Health, Labor and Welfare classifies cosmetic ingredients into permitted, restricted, and prohibited categories. Both trimethylglycine and betaine fall under permitted ingredients with specific usage guidelines. South Korea's regulatory system, administered by the Ministry of Food and Drug Safety, follows a similar classification approach but may impose different concentration limits.

International harmonization efforts, such as the International Cooperation on Cosmetics Regulation (ICCR), aim to standardize safety assessment methodologies and regulatory approaches across regions. These initiatives facilitate global market access for products containing these humectants while maintaining safety standards.

Labeling requirements also differ across jurisdictions. The EU mandates that all ingredients, including humectants, be listed on product packaging using INCI nomenclature. The US requires ingredient listing but allows for certain trade secret protections. This regulatory diversity necessitates careful formulation strategies for cosmetic manufacturers targeting multiple markets.

Recent regulatory trends indicate increasing scrutiny of humectant safety profiles, particularly regarding potential allergenicity and environmental impact. Sustainability considerations are becoming more prominent in regulatory frameworks, with some regions implementing requirements for environmental risk assessments of cosmetic ingredients.

For manufacturers comparing trimethylglycine and betaine for skin moisturization applications, compliance with these diverse regulatory requirements represents a significant consideration alongside efficacy and formulation compatibility factors. The regulatory status of these ingredients may influence market access strategies and product development timelines across different regions.

The European Union enforces stricter regulations through the EU Cosmetics Regulation (EC) No 1223/2009, which mandates safety assessments and ingredient listings. Both trimethylglycine and betaine are included in the EU's Inventory of Cosmetic Ingredients (INCI) and are generally recognized as safe when used within established concentration limits. The EU also requires comprehensive safety dossiers for cosmetic products containing these humectants.

In Asian markets, particularly Japan and South Korea, regulatory frameworks emphasize different aspects. Japan's Ministry of Health, Labor and Welfare classifies cosmetic ingredients into permitted, restricted, and prohibited categories. Both trimethylglycine and betaine fall under permitted ingredients with specific usage guidelines. South Korea's regulatory system, administered by the Ministry of Food and Drug Safety, follows a similar classification approach but may impose different concentration limits.

International harmonization efforts, such as the International Cooperation on Cosmetics Regulation (ICCR), aim to standardize safety assessment methodologies and regulatory approaches across regions. These initiatives facilitate global market access for products containing these humectants while maintaining safety standards.

Labeling requirements also differ across jurisdictions. The EU mandates that all ingredients, including humectants, be listed on product packaging using INCI nomenclature. The US requires ingredient listing but allows for certain trade secret protections. This regulatory diversity necessitates careful formulation strategies for cosmetic manufacturers targeting multiple markets.

Recent regulatory trends indicate increasing scrutiny of humectant safety profiles, particularly regarding potential allergenicity and environmental impact. Sustainability considerations are becoming more prominent in regulatory frameworks, with some regions implementing requirements for environmental risk assessments of cosmetic ingredients.

For manufacturers comparing trimethylglycine and betaine for skin moisturization applications, compliance with these diverse regulatory requirements represents a significant consideration alongside efficacy and formulation compatibility factors. The regulatory status of these ingredients may influence market access strategies and product development timelines across different regions.

Sustainability Aspects of Betaine Production

The sustainability profile of betaine production has become increasingly important as cosmetic and personal care industries shift toward environmentally responsible practices. Betaine can be sourced from multiple pathways, with sugar beet processing being the most common commercial method. This agricultural approach offers significant sustainability advantages, as sugar beets require less water than many alternative crops and can be grown in rotation systems that enhance soil health and reduce the need for synthetic fertilizers.

The extraction process of betaine from sugar beet molasses utilizes chromatographic separation techniques that have been optimized to reduce energy consumption and minimize waste generation. Modern facilities have implemented closed-loop systems that recycle process water and recover solvents, substantially decreasing the environmental footprint of production operations. Additionally, the by-products from betaine extraction can be repurposed as agricultural inputs or animal feed supplements, creating a more circular economic model.

When comparing natural betaine with synthetic trimethylglycine production, the carbon footprint differential becomes apparent. Synthetic routes typically involve chemical synthesis from fossil fuel-derived precursors, resulting in higher greenhouse gas emissions. Life cycle assessments indicate that natural betaine production generates approximately 40% less carbon dioxide equivalent emissions compared to synthetic alternatives when accounting for the entire production chain.

Water usage metrics also favor natural betaine production, with recent industry reports documenting a 30-50% reduction in water consumption compared to synthetic manufacturing processes. This advantage becomes particularly significant in regions facing water scarcity challenges, where sustainable water management practices are critical for operational continuity and environmental stewardship.

Certification systems have emerged to validate sustainability claims in betaine production. Standards such as COSMOS for natural cosmetics ingredients require documentation of environmental management practices, biodegradability assessments, and responsible sourcing verification. Leading manufacturers have invested in obtaining these certifications to differentiate their products in increasingly eco-conscious markets.

Future sustainability improvements in betaine production focus on renewable energy integration, with several major producers committing to carbon neutrality targets by 2030. Biotechnological innovations are also being explored to enhance extraction efficiency and reduce resource requirements. These advancements promise to further strengthen betaine's position as a sustainable moisturizing agent for skin care applications compared to synthetic alternatives.

The extraction process of betaine from sugar beet molasses utilizes chromatographic separation techniques that have been optimized to reduce energy consumption and minimize waste generation. Modern facilities have implemented closed-loop systems that recycle process water and recover solvents, substantially decreasing the environmental footprint of production operations. Additionally, the by-products from betaine extraction can be repurposed as agricultural inputs or animal feed supplements, creating a more circular economic model.

When comparing natural betaine with synthetic trimethylglycine production, the carbon footprint differential becomes apparent. Synthetic routes typically involve chemical synthesis from fossil fuel-derived precursors, resulting in higher greenhouse gas emissions. Life cycle assessments indicate that natural betaine production generates approximately 40% less carbon dioxide equivalent emissions compared to synthetic alternatives when accounting for the entire production chain.

Water usage metrics also favor natural betaine production, with recent industry reports documenting a 30-50% reduction in water consumption compared to synthetic manufacturing processes. This advantage becomes particularly significant in regions facing water scarcity challenges, where sustainable water management practices are critical for operational continuity and environmental stewardship.

Certification systems have emerged to validate sustainability claims in betaine production. Standards such as COSMOS for natural cosmetics ingredients require documentation of environmental management practices, biodegradability assessments, and responsible sourcing verification. Leading manufacturers have invested in obtaining these certifications to differentiate their products in increasingly eco-conscious markets.

Future sustainability improvements in betaine production focus on renewable energy integration, with several major producers committing to carbon neutrality targets by 2030. Biotechnological innovations are also being explored to enhance extraction efficiency and reduce resource requirements. These advancements promise to further strengthen betaine's position as a sustainable moisturizing agent for skin care applications compared to synthetic alternatives.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!