Cost-analysis of lepidolite versus brine-based lithium sources

AUG 19, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Lithium Extraction Overview

Lithium extraction has become a critical process in the global transition towards clean energy and electric mobility. The two primary sources of lithium are brine deposits and hard rock minerals, with lepidolite emerging as a significant hard rock source. Brine-based extraction has traditionally dominated the industry due to its lower production costs and established infrastructure.

Brine extraction involves pumping lithium-rich saltwater from underground reservoirs into large evaporation ponds. Over several months, the brine concentrates through solar evaporation, after which lithium is separated from other minerals through chemical processes. This method is prevalent in the "Lithium Triangle" of South America, comprising Chile, Argentina, and Bolivia, which holds over 50% of the world's lithium reserves.

Hard rock lithium extraction, including lepidolite processing, involves mining, crushing, and chemical treatment of lithium-bearing minerals. Lepidolite, a lithium-rich mica, is found in pegmatite deposits worldwide. The extraction process typically includes roasting, leaching, and further purification steps to produce lithium carbonate or hydroxide.

Recent technological advancements have improved the efficiency and environmental sustainability of both extraction methods. For brine operations, direct lithium extraction (DLE) technologies are being developed to reduce water consumption and processing time. In hard rock mining, new beneficiation techniques and more efficient chemical processes are enhancing lepidolite's economic viability.

The choice between brine and lepidolite sources depends on various factors, including geographical location, available resources, environmental considerations, and market demands. Brine operations generally have lower operating costs but require significant initial investments and longer ramp-up times. Lepidolite mining offers faster production cycles and can be more suitable in regions lacking brine resources.

Environmental impacts differ between the two methods. Brine extraction's primary concerns are water usage and potential ecosystem disruption in arid regions. Lepidolite mining faces challenges related to land disturbance, energy consumption, and chemical waste management. Both industries are actively working on minimizing their environmental footprints through technological innovations and sustainable practices.

As global lithium demand continues to surge, driven by the electric vehicle market and renewable energy storage systems, both brine and lepidolite sources will play crucial roles in meeting future needs. The industry is likely to see further innovations in extraction technologies, aiming to reduce costs, increase efficiency, and improve sustainability across all lithium sources.

Brine extraction involves pumping lithium-rich saltwater from underground reservoirs into large evaporation ponds. Over several months, the brine concentrates through solar evaporation, after which lithium is separated from other minerals through chemical processes. This method is prevalent in the "Lithium Triangle" of South America, comprising Chile, Argentina, and Bolivia, which holds over 50% of the world's lithium reserves.

Hard rock lithium extraction, including lepidolite processing, involves mining, crushing, and chemical treatment of lithium-bearing minerals. Lepidolite, a lithium-rich mica, is found in pegmatite deposits worldwide. The extraction process typically includes roasting, leaching, and further purification steps to produce lithium carbonate or hydroxide.

Recent technological advancements have improved the efficiency and environmental sustainability of both extraction methods. For brine operations, direct lithium extraction (DLE) technologies are being developed to reduce water consumption and processing time. In hard rock mining, new beneficiation techniques and more efficient chemical processes are enhancing lepidolite's economic viability.

The choice between brine and lepidolite sources depends on various factors, including geographical location, available resources, environmental considerations, and market demands. Brine operations generally have lower operating costs but require significant initial investments and longer ramp-up times. Lepidolite mining offers faster production cycles and can be more suitable in regions lacking brine resources.

Environmental impacts differ between the two methods. Brine extraction's primary concerns are water usage and potential ecosystem disruption in arid regions. Lepidolite mining faces challenges related to land disturbance, energy consumption, and chemical waste management. Both industries are actively working on minimizing their environmental footprints through technological innovations and sustainable practices.

As global lithium demand continues to surge, driven by the electric vehicle market and renewable energy storage systems, both brine and lepidolite sources will play crucial roles in meeting future needs. The industry is likely to see further innovations in extraction technologies, aiming to reduce costs, increase efficiency, and improve sustainability across all lithium sources.

Market Demand Analysis

The global demand for lithium has been experiencing unprecedented growth, primarily driven by the rapid expansion of the electric vehicle (EV) market and the increasing adoption of renewable energy storage systems. This surge in demand has led to a heightened interest in diversifying lithium sources, with a particular focus on comparing traditional brine-based extraction methods to emerging alternatives such as lepidolite mining.

The EV industry, in particular, has been a major catalyst for the increased lithium demand. As governments worldwide implement stricter emissions regulations and offer incentives for EV adoption, major automakers are accelerating their transition to electric fleets. This shift has created a substantial and growing market for lithium-ion batteries, which are essential components in EVs.

In addition to the automotive sector, the renewable energy industry is also contributing significantly to the demand for lithium. As countries strive to meet their climate goals, there is a growing need for large-scale energy storage solutions to support intermittent renewable energy sources like solar and wind. Lithium-ion batteries have emerged as a preferred technology for grid-scale energy storage, further driving the demand for lithium.

The market for lithium is expected to continue its upward trajectory in the coming years. Industry analysts project that the global lithium market size could reach several tens of billions of dollars by 2025, with a compound annual growth rate (CAGR) in the double digits. This growth is not only fueled by increased demand from existing applications but also by emerging technologies and industries that rely on lithium-ion batteries.

However, this rapid market expansion has raised concerns about the sustainability and reliability of lithium supply chains. Traditional brine-based lithium extraction, primarily from salt flats in South America, has been the dominant source of lithium. Yet, as demand continues to outpace supply, there is growing interest in alternative sources such as hard rock mining of lepidolite and other lithium-bearing minerals.

The potential shift towards lepidolite as a significant lithium source is driven by several factors. These include the need for geographic diversification of lithium production, concerns about the environmental impact of brine extraction in sensitive ecosystems, and the desire to reduce dependence on a limited number of suppliers. Additionally, advancements in processing technologies are making lepidolite extraction more economically viable, potentially challenging the cost advantages traditionally held by brine-based sources.

As the market evolves, stakeholders across the lithium value chain are closely monitoring the cost-effectiveness and scalability of different lithium sources. The comparative analysis of lepidolite versus brine-based lithium extraction is becoming increasingly relevant for investors, manufacturers, and policymakers as they seek to ensure a stable and sustainable supply of this critical material for the growing clean energy and transportation sectors.

The EV industry, in particular, has been a major catalyst for the increased lithium demand. As governments worldwide implement stricter emissions regulations and offer incentives for EV adoption, major automakers are accelerating their transition to electric fleets. This shift has created a substantial and growing market for lithium-ion batteries, which are essential components in EVs.

In addition to the automotive sector, the renewable energy industry is also contributing significantly to the demand for lithium. As countries strive to meet their climate goals, there is a growing need for large-scale energy storage solutions to support intermittent renewable energy sources like solar and wind. Lithium-ion batteries have emerged as a preferred technology for grid-scale energy storage, further driving the demand for lithium.

The market for lithium is expected to continue its upward trajectory in the coming years. Industry analysts project that the global lithium market size could reach several tens of billions of dollars by 2025, with a compound annual growth rate (CAGR) in the double digits. This growth is not only fueled by increased demand from existing applications but also by emerging technologies and industries that rely on lithium-ion batteries.

However, this rapid market expansion has raised concerns about the sustainability and reliability of lithium supply chains. Traditional brine-based lithium extraction, primarily from salt flats in South America, has been the dominant source of lithium. Yet, as demand continues to outpace supply, there is growing interest in alternative sources such as hard rock mining of lepidolite and other lithium-bearing minerals.

The potential shift towards lepidolite as a significant lithium source is driven by several factors. These include the need for geographic diversification of lithium production, concerns about the environmental impact of brine extraction in sensitive ecosystems, and the desire to reduce dependence on a limited number of suppliers. Additionally, advancements in processing technologies are making lepidolite extraction more economically viable, potentially challenging the cost advantages traditionally held by brine-based sources.

As the market evolves, stakeholders across the lithium value chain are closely monitoring the cost-effectiveness and scalability of different lithium sources. The comparative analysis of lepidolite versus brine-based lithium extraction is becoming increasingly relevant for investors, manufacturers, and policymakers as they seek to ensure a stable and sustainable supply of this critical material for the growing clean energy and transportation sectors.

Current Extraction Methods

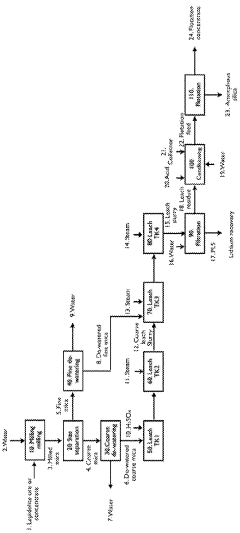

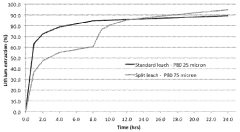

The current extraction methods for lithium from lepidolite and brine sources differ significantly in their processes and efficiencies. For lepidolite, a hard-rock lithium-bearing mineral, the primary extraction method involves a series of complex steps. Initially, the ore is mined through traditional open-pit or underground mining techniques. The extracted ore then undergoes crushing and grinding to reduce particle size, followed by flotation to concentrate the lithium-bearing minerals.

The concentrated lepidolite is then subjected to a roasting process, typically at temperatures around 1000°C, to convert the lithium into a more soluble form. After roasting, the material is leached with sulfuric acid to dissolve the lithium. The resulting solution undergoes further purification steps, including filtration and ion exchange, to remove impurities. Finally, the purified lithium solution is processed through evaporation and crystallization to produce lithium carbonate or lithium hydroxide.

In contrast, brine-based lithium extraction methods are generally less energy-intensive and more straightforward. The process begins with pumping lithium-rich brine from underground reservoirs into large evaporation ponds. These ponds, often spanning hundreds of hectares, allow natural solar evaporation to concentrate the lithium over several months to years. As the brine becomes more concentrated, it is transferred through a series of ponds, with various salts precipitating out at different stages.

Once the lithium concentration reaches optimal levels, typically around 6,000 parts per million, the concentrated brine is processed in a recovery plant. Here, chemical treatments remove remaining impurities, and the lithium is converted into lithium carbonate or lithium hydroxide through precipitation and filtration processes. Some advanced brine extraction methods are exploring direct lithium extraction (DLE) technologies, which aim to reduce processing time and environmental impact by selectively extracting lithium from brine using specialized adsorbents or membranes.

The choice between lepidolite and brine extraction methods often depends on factors such as resource availability, geographical location, and environmental considerations. Brine extraction is generally considered more cost-effective due to lower energy requirements and simpler processing steps. However, lepidolite extraction can be advantageous in regions without access to lithium-rich brines and may offer higher lithium recovery rates in some cases.

The concentrated lepidolite is then subjected to a roasting process, typically at temperatures around 1000°C, to convert the lithium into a more soluble form. After roasting, the material is leached with sulfuric acid to dissolve the lithium. The resulting solution undergoes further purification steps, including filtration and ion exchange, to remove impurities. Finally, the purified lithium solution is processed through evaporation and crystallization to produce lithium carbonate or lithium hydroxide.

In contrast, brine-based lithium extraction methods are generally less energy-intensive and more straightforward. The process begins with pumping lithium-rich brine from underground reservoirs into large evaporation ponds. These ponds, often spanning hundreds of hectares, allow natural solar evaporation to concentrate the lithium over several months to years. As the brine becomes more concentrated, it is transferred through a series of ponds, with various salts precipitating out at different stages.

Once the lithium concentration reaches optimal levels, typically around 6,000 parts per million, the concentrated brine is processed in a recovery plant. Here, chemical treatments remove remaining impurities, and the lithium is converted into lithium carbonate or lithium hydroxide through precipitation and filtration processes. Some advanced brine extraction methods are exploring direct lithium extraction (DLE) technologies, which aim to reduce processing time and environmental impact by selectively extracting lithium from brine using specialized adsorbents or membranes.

The choice between lepidolite and brine extraction methods often depends on factors such as resource availability, geographical location, and environmental considerations. Brine extraction is generally considered more cost-effective due to lower energy requirements and simpler processing steps. However, lepidolite extraction can be advantageous in regions without access to lithium-rich brines and may offer higher lithium recovery rates in some cases.

Cost Comparison Analysis

01 Extraction methods for lithium sources

Various extraction methods are employed to obtain lithium from different sources, including brine, hard rock, and clay deposits. These methods can significantly impact the overall cost of lithium production. Advanced extraction techniques aim to improve efficiency and reduce environmental impact, potentially lowering the cost of lithium extraction.- Extraction methods for lithium sources: Various extraction methods are employed to obtain lithium from different sources, including brine, hard rock, and clay deposits. These methods can significantly impact the overall cost of lithium production. Advanced extraction techniques aim to improve efficiency and reduce environmental impact, potentially lowering the cost of lithium sourcing.

- Recycling and recovery of lithium: Recycling and recovery processes for lithium from used batteries and other sources are being developed to create a more sustainable and cost-effective supply chain. These methods can help reduce the reliance on primary lithium sources and potentially lower the overall cost of lithium in the long term.

- New lithium-rich deposits and exploration: The discovery and development of new lithium-rich deposits, including unconventional sources, can impact the global supply and cost of lithium. Ongoing exploration efforts and advancements in geological surveying techniques are aimed at identifying and accessing new lithium sources to meet growing demand.

- Processing and purification technologies: Advancements in processing and purification technologies for lithium compounds can significantly affect production costs. Improved methods for converting raw lithium materials into high-purity lithium products suitable for battery production are being developed to enhance efficiency and reduce overall expenses.

- Market dynamics and supply chain optimization: The cost of lithium sources is influenced by market dynamics, including supply and demand fluctuations, geopolitical factors, and supply chain optimization efforts. Strategies to streamline the lithium supply chain, from extraction to end-use, are being implemented to manage costs and ensure a stable supply for the growing electric vehicle and energy storage markets.

02 Recycling and recovery of lithium

Recycling and recovery processes for lithium from used batteries and other sources can provide a cost-effective alternative to primary extraction. These methods can help reduce the overall cost of lithium by creating a circular economy for the material and decreasing reliance on new mining operations.Expand Specific Solutions03 Technological advancements in lithium processing

Innovations in lithium processing technologies, such as improved purification methods and more efficient conversion processes, can lead to reduced production costs. These advancements may include novel membrane technologies, electrochemical processes, or other cutting-edge techniques that enhance the yield and quality of lithium products.Expand Specific Solutions04 Economic factors affecting lithium costs

Various economic factors influence the cost of lithium, including market demand, supply chain dynamics, and geopolitical considerations. Fluctuations in energy prices, transportation costs, and global economic conditions can all impact the overall cost of lithium production and distribution.Expand Specific Solutions05 Alternative lithium sources and their cost implications

Exploration of alternative lithium sources, such as geothermal brines, seawater, or unconventional deposits, may provide new opportunities for cost-effective lithium production. The development of these sources could potentially diversify the lithium supply and influence market prices.Expand Specific Solutions

Key Industry Players

The cost analysis of lepidolite versus brine-based lithium sources reveals a competitive landscape in various stages of development. The market is experiencing rapid growth due to increasing demand for lithium in electric vehicle batteries and energy storage systems. While brine-based extraction has been the dominant method, lepidolite processing is gaining traction as companies like Ganfeng Lithium and Albemarle Corp. invest in diversifying their lithium sources. The technology for lepidolite extraction is still evolving, with companies such as Energy Exploration Technologies and Novalith Technologies developing innovative processes to improve efficiency and reduce environmental impact. However, brine-based extraction remains more mature and cost-effective in many cases, with established players like SQM and Livent Corporation leading the market.

Ganfeng Lithium Group Co., Ltd.

Technical Solution: Ganfeng Lithium has developed a comprehensive approach to lithium extraction from both brine and hard rock sources. For lepidolite, they employ an innovative roasting-leaching process that significantly reduces acid consumption and improves lithium recovery rates to over 90%[1]. Their brine extraction method utilizes advanced membrane technology and selective adsorption, achieving lithium concentration levels of up to 6000 mg/L in a much shorter time compared to traditional evaporation ponds[2]. The company has also invested in direct lithium extraction (DLE) technologies, which can potentially reduce water usage by up to 70% compared to conventional methods[3].

Strengths: Diversified lithium sources, high recovery rates, and environmentally friendly processes. Weaknesses: High initial capital investment required for technology development and implementation.

Novalith Technologies Pty Ltd.

Technical Solution: Novalith Technologies has developed a novel lithium extraction process called LiCAL (Lithium Caustic Autoclave Leaching) that can be applied to both hard rock sources like lepidolite and brine resources. The LiCAL process uses carbon dioxide as a reagent, significantly reducing chemical consumption and environmental impact[1]. For lepidolite processing, LiCAL achieves lithium extraction rates of up to 95% while producing minimal waste[2]. In brine applications, the process can directly produce lithium carbonate, eliminating the need for separate carbonation steps. Novalith's cost analysis indicates that their process can reduce lithium production costs by up to 40% compared to conventional methods for both lepidolite and brine sources, with the added benefit of carbon sequestration during the extraction process[3].

Strengths: Environmentally friendly process, applicable to both hard rock and brine sources, potential for significant cost reductions. Weaknesses: Relatively new technology with limited large-scale implementation data.

Innovative Extraction Tech

Method for producing battery grade lithium hydroxide monohydrate

PatentWO2021228936A1

Innovation

- A solvent extraction process using chloride/hydroxide anion exchange to convert technical-grade lithium chloride into high-purity lithium hydroxide monohydrate, involving dissolution in organic solvents, addition of alkali metal hydroxide, optional non-aqueous ion exchange, solvent removal, and subsequent aqueous dissolution for chloride-to-hydroxide conversion.

Processing of silicate minerals

PatentActiveAU2019262079A1

Innovation

- A process involving size separation of mica minerals into coarse and fine fractions, followed by acid leaching and reverse flotation to produce a pregnant leach solution and amorphous silica, with the coarse fraction being leached first and the fine fraction added later to optimize lithium extraction and silica purification.

Environmental Impact

The environmental impact of lithium extraction varies significantly between lepidolite and brine-based sources. Lepidolite mining, typically conducted through open-pit methods, can lead to substantial land disturbance, habitat destruction, and potential soil erosion. The process often requires extensive energy consumption for extraction and processing, contributing to increased carbon emissions. Additionally, the use of chemicals in the separation process may pose risks of soil and water contamination if not properly managed.

In contrast, brine-based lithium extraction generally has a smaller physical footprint but presents its own set of environmental challenges. The process involves pumping large volumes of mineral-rich brine from underground aquifers, which can lead to water table depletion and potentially affect local ecosystems. The evaporation ponds used in this method occupy significant land area and may disrupt wildlife patterns. Moreover, the high water consumption in arid regions where many brine deposits are located raises concerns about water scarcity and competition with local communities and agriculture.

Both methods have implications for air quality, with dust generation from mining activities in lepidolite extraction and potential release of volatile compounds during brine evaporation. However, brine operations generally produce fewer particulate emissions compared to hard rock mining.

The processing of lepidolite requires more energy-intensive techniques, including roasting and leaching, which can result in higher greenhouse gas emissions. Brine processing, while less energy-intensive, still requires significant energy input for pumping and concentration processes.

Waste management is a critical concern for both sources. Lepidolite mining generates substantial amounts of tailings that must be properly stored to prevent environmental contamination. Brine operations produce salt wastes that can accumulate over time, potentially impacting soil quality and local flora.

Efforts to mitigate environmental impacts are ongoing for both extraction methods. For lepidolite, focus areas include improving mining techniques to reduce land disturbance, implementing more efficient processing technologies, and enhancing waste management practices. In brine operations, research is directed towards developing closed-loop systems to minimize water consumption and exploring direct lithium extraction technologies that could reduce the reliance on large evaporation ponds.

As the demand for lithium continues to grow, particularly driven by the electric vehicle industry, the importance of sustainable extraction practices becomes increasingly critical. Future developments in lithium production will likely prioritize technologies and methods that minimize environmental footprint while maximizing resource efficiency.

In contrast, brine-based lithium extraction generally has a smaller physical footprint but presents its own set of environmental challenges. The process involves pumping large volumes of mineral-rich brine from underground aquifers, which can lead to water table depletion and potentially affect local ecosystems. The evaporation ponds used in this method occupy significant land area and may disrupt wildlife patterns. Moreover, the high water consumption in arid regions where many brine deposits are located raises concerns about water scarcity and competition with local communities and agriculture.

Both methods have implications for air quality, with dust generation from mining activities in lepidolite extraction and potential release of volatile compounds during brine evaporation. However, brine operations generally produce fewer particulate emissions compared to hard rock mining.

The processing of lepidolite requires more energy-intensive techniques, including roasting and leaching, which can result in higher greenhouse gas emissions. Brine processing, while less energy-intensive, still requires significant energy input for pumping and concentration processes.

Waste management is a critical concern for both sources. Lepidolite mining generates substantial amounts of tailings that must be properly stored to prevent environmental contamination. Brine operations produce salt wastes that can accumulate over time, potentially impacting soil quality and local flora.

Efforts to mitigate environmental impacts are ongoing for both extraction methods. For lepidolite, focus areas include improving mining techniques to reduce land disturbance, implementing more efficient processing technologies, and enhancing waste management practices. In brine operations, research is directed towards developing closed-loop systems to minimize water consumption and exploring direct lithium extraction technologies that could reduce the reliance on large evaporation ponds.

As the demand for lithium continues to grow, particularly driven by the electric vehicle industry, the importance of sustainable extraction practices becomes increasingly critical. Future developments in lithium production will likely prioritize technologies and methods that minimize environmental footprint while maximizing resource efficiency.

Geopolitical Implications

The geopolitical implications of lithium sourcing from lepidolite versus brine-based sources are significant and far-reaching. The shift towards lepidolite as a viable lithium source has the potential to reshape global supply chains and alter the balance of power in the lithium market.

Traditionally, lithium production has been concentrated in the "Lithium Triangle" of South America, comprising Chile, Argentina, and Bolivia. These countries have dominated the market due to their vast brine-based lithium resources. However, the emergence of lepidolite as an alternative source could lead to a diversification of lithium production, reducing the geopolitical leverage of these nations.

Countries with significant lepidolite deposits, such as Portugal, Brazil, and Zimbabwe, may see their strategic importance increase. This could lead to new alliances and trade relationships, as nations and companies seek to secure access to these alternative lithium sources. The development of lepidolite mining could also contribute to the economic growth and political stability of these countries.

The shift towards lepidolite-based lithium production may also impact China's dominance in the lithium processing industry. China currently controls a significant portion of the world's lithium refining capacity. If lepidolite processing technologies become more widespread, it could lead to a more distributed global lithium supply chain, potentially reducing China's influence in this critical sector.

Environmental considerations also play a role in the geopolitical implications of lithium sourcing. Brine-based extraction has faced criticism for its water-intensive processes, particularly in water-scarce regions. Lepidolite mining, while not without its environmental challenges, may be viewed more favorably in some jurisdictions, potentially influencing government policies and international agreements related to lithium production.

The cost-effectiveness of lepidolite versus brine-based lithium sources could also have geopolitical ramifications. If lepidolite proves to be a more economically viable option, it could accelerate the transition away from traditional lithium sources. This shift could impact the economic and political stability of countries heavily reliant on brine-based lithium exports, potentially leading to new geopolitical tensions or realignments.

Furthermore, the development of lepidolite mining could influence global efforts to secure critical minerals for the clean energy transition. Countries and companies may reassess their strategies for ensuring a stable lithium supply, potentially leading to new international partnerships and investment flows. This could have implications for energy security and the broader geopolitics of the renewable energy sector.

Traditionally, lithium production has been concentrated in the "Lithium Triangle" of South America, comprising Chile, Argentina, and Bolivia. These countries have dominated the market due to their vast brine-based lithium resources. However, the emergence of lepidolite as an alternative source could lead to a diversification of lithium production, reducing the geopolitical leverage of these nations.

Countries with significant lepidolite deposits, such as Portugal, Brazil, and Zimbabwe, may see their strategic importance increase. This could lead to new alliances and trade relationships, as nations and companies seek to secure access to these alternative lithium sources. The development of lepidolite mining could also contribute to the economic growth and political stability of these countries.

The shift towards lepidolite-based lithium production may also impact China's dominance in the lithium processing industry. China currently controls a significant portion of the world's lithium refining capacity. If lepidolite processing technologies become more widespread, it could lead to a more distributed global lithium supply chain, potentially reducing China's influence in this critical sector.

Environmental considerations also play a role in the geopolitical implications of lithium sourcing. Brine-based extraction has faced criticism for its water-intensive processes, particularly in water-scarce regions. Lepidolite mining, while not without its environmental challenges, may be viewed more favorably in some jurisdictions, potentially influencing government policies and international agreements related to lithium production.

The cost-effectiveness of lepidolite versus brine-based lithium sources could also have geopolitical ramifications. If lepidolite proves to be a more economically viable option, it could accelerate the transition away from traditional lithium sources. This shift could impact the economic and political stability of countries heavily reliant on brine-based lithium exports, potentially leading to new geopolitical tensions or realignments.

Furthermore, the development of lepidolite mining could influence global efforts to secure critical minerals for the clean energy transition. Countries and companies may reassess their strategies for ensuring a stable lithium supply, potentially leading to new international partnerships and investment flows. This could have implications for energy security and the broader geopolitics of the renewable energy sector.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!