Expanding LDPE's Potential in Diverse Markets

LDPE Evolution and Objectives

Low-density polyethylene (LDPE) has been a cornerstone of the plastics industry since its accidental discovery in 1933 by Imperial Chemical Industries. This versatile polymer has undergone significant evolution over the decades, driven by technological advancements and changing market demands. The primary objective in expanding LDPE's potential lies in enhancing its properties and exploring novel applications across diverse markets.

The development of LDPE has been marked by continuous improvements in production processes and material characteristics. Initially produced through high-pressure polymerization, LDPE manufacturing has seen innovations such as the introduction of tubular reactors and the development of more efficient catalysts. These advancements have led to better control over molecular weight distribution and branching, resulting in LDPE grades with tailored properties for specific applications.

In recent years, the focus has shifted towards sustainability and circular economy principles. The industry aims to develop LDPE variants with improved recyclability and biodegradability, addressing growing environmental concerns. Concurrently, efforts are being made to incorporate renewable feedstocks into LDPE production, reducing reliance on fossil fuels and minimizing carbon footprint.

The expansion of LDPE's potential is closely tied to emerging market trends and technological innovations. One key objective is to enhance LDPE's barrier properties, making it more suitable for packaging applications that require extended shelf life and protection against moisture and oxygen. This involves developing multi-layer structures or incorporating nanocomposites to improve gas and vapor barrier characteristics.

Another significant goal is to broaden LDPE's temperature resistance range, enabling its use in more demanding environments. This includes developing heat-resistant grades for automotive and construction applications, as well as improving low-temperature flexibility for cryogenic storage and transportation.

The integration of smart technologies into LDPE products represents a frontier for innovation. Objectives in this area include incorporating sensors or conductive materials into LDPE matrices to create intelligent packaging solutions capable of monitoring product freshness or tracking environmental conditions during transit.

As the industry moves towards more sustainable practices, a critical objective is to develop closed-loop recycling systems for LDPE products. This involves improving sorting and recycling technologies to maintain material quality through multiple use cycles, as well as designing products with end-of-life considerations in mind.

In conclusion, the evolution of LDPE and the objectives for expanding its potential are driven by a combination of technological advancements, market demands, and sustainability imperatives. By focusing on these key areas, the industry aims to position LDPE as a versatile, sustainable, and innovative material capable of meeting the diverse needs of modern markets.

Market Demand Analysis for LDPE

The global market for Low-Density Polyethylene (LDPE) continues to exhibit robust growth, driven by its versatile properties and wide-ranging applications across various industries. The packaging sector remains the primary consumer of LDPE, accounting for a significant portion of the total demand. This sector's growth is fueled by the increasing need for flexible packaging solutions in food, beverages, and consumer goods industries.

In recent years, there has been a notable shift towards sustainable packaging solutions, which has both challenged and created opportunities for LDPE manufacturers. While this trend has led to increased scrutiny of plastic usage, it has also spurred innovation in recyclable and bio-based LDPE formulations, opening new market segments for environmentally conscious consumers and businesses.

The construction industry represents another key market for LDPE, particularly in developing economies where infrastructure development is booming. LDPE's use in geomembranes, pipes, and insulation materials has seen steady growth, driven by urbanization and large-scale construction projects.

The agricultural sector has emerged as a promising market for LDPE, with increasing adoption in greenhouse films, mulch films, and silage wraps. The growing focus on precision agriculture and crop yield optimization has bolstered the demand for LDPE products in this sector.

In the healthcare industry, LDPE finds applications in medical packaging, disposable medical devices, and pharmaceutical packaging. The ongoing global health concerns have further accelerated the demand for LDPE in this sector, particularly for personal protective equipment (PPE) and medical packaging.

The automotive industry, while not a traditional stronghold for LDPE, is showing potential for growth. As vehicle manufacturers strive for lighter, more fuel-efficient designs, LDPE's lightweight properties make it an attractive option for certain components and interior applications.

Geographically, Asia-Pacific remains the largest and fastest-growing market for LDPE, driven by rapid industrialization, population growth, and increasing consumer spending power. North America and Europe, while mature markets, continue to show steady demand, particularly in high-value applications and innovative, sustainable products.

Despite these positive trends, the LDPE market faces challenges from increasing environmental regulations, particularly concerning single-use plastics. This has led to a growing emphasis on recycling and circular economy initiatives within the industry, driving research into more easily recyclable LDPE formulations and improved recycling technologies.

LDPE Technical Challenges

Low-density polyethylene (LDPE) has been a staple in the plastics industry for decades, but its potential for expansion into diverse markets faces several technical challenges. These challenges primarily stem from the inherent properties of LDPE and the evolving demands of various industries.

One of the main technical hurdles is improving the mechanical strength of LDPE without compromising its desirable flexibility and processability. LDPE's relatively low tensile strength and impact resistance limit its applications in high-performance sectors. Enhancing these properties while maintaining the material's low density and ease of processing is a complex balancing act that requires innovative approaches in polymer science.

Another significant challenge lies in enhancing the barrier properties of LDPE. While it offers good moisture resistance, its permeability to gases and certain chemicals restricts its use in packaging applications that demand high barrier performance. Developing LDPE formulations with improved oxygen and aroma barrier properties could open up new opportunities in food packaging and other sensitive product markets.

The thermal stability of LDPE presents another area for improvement. Its relatively low melting point and susceptibility to degradation at higher temperatures limit its use in applications involving heat exposure or sterilization processes. Enhancing the thermal resistance of LDPE without altering its fundamental characteristics is crucial for expanding its potential in sectors such as medical devices and automotive components.

Addressing the environmental concerns associated with LDPE is perhaps one of the most pressing technical challenges. Improving the biodegradability or recyclability of LDPE without sacrificing its performance characteristics is essential for its continued use and expansion in an increasingly eco-conscious market. This involves developing new additives, modifying the polymer structure, or creating innovative recycling technologies specific to LDPE.

The challenge of enhancing the compatibility of LDPE with other materials is also significant. Improving its adhesion properties and its ability to form stable blends with other polymers could lead to new composite materials with unique properties, expanding LDPE's application range in industries such as construction and consumer goods.

Lastly, there's a need to develop more efficient and cost-effective production methods for specialized LDPE grades. Current processes for producing high-performance LDPE variants often involve complex and energy-intensive steps, limiting their economic viability. Innovations in catalysis and polymerization technology could pave the way for more streamlined production of advanced LDPE materials, making them more accessible to a broader range of markets.

Current LDPE Solutions

01 LDPE applications in packaging

Low-Density Polyethylene (LDPE) shows significant potential in packaging applications due to its flexibility, durability, and moisture resistance. It is widely used in the production of plastic bags, food packaging, and various container types. LDPE's properties make it suitable for both rigid and flexible packaging solutions, offering advantages in terms of cost-effectiveness and recyclability.- LDPE applications in packaging: Low-Density Polyethylene (LDPE) shows significant potential in packaging applications due to its flexibility, transparency, and moisture resistance. It is widely used in food packaging, plastic bags, and various container linings. The material's properties make it suitable for both rigid and flexible packaging solutions, offering improved product protection and extended shelf life.

- LDPE in agricultural applications: LDPE has potential in agricultural applications, particularly in greenhouse films, mulch films, and irrigation systems. Its durability, UV resistance, and ability to retain moisture make it an ideal material for these purposes. LDPE films can help in controlling soil temperature, reducing weed growth, and improving crop yields.

- LDPE blends and composites: There is potential in developing LDPE blends and composites to enhance its properties. By combining LDPE with other materials or polymers, it is possible to improve its strength, barrier properties, and thermal stability. These blends and composites can find applications in various industries, including automotive, construction, and consumer goods.

- Recycling and sustainability of LDPE: The recycling potential of LDPE is significant, as it can be easily reprocessed and reused in various applications. Developing efficient recycling technologies and promoting the use of recycled LDPE can contribute to sustainability efforts and reduce environmental impact. There is also potential in creating biodegradable or bio-based LDPE alternatives to address environmental concerns.

- LDPE in medical and healthcare applications: LDPE shows potential in medical and healthcare applications due to its chemical resistance, flexibility, and ease of sterilization. It can be used in medical packaging, disposable medical devices, and pharmaceutical containers. The material's properties make it suitable for creating sterile, safe, and cost-effective medical products.

02 LDPE in agricultural applications

LDPE has potential in agricultural applications, particularly in the production of greenhouse films, mulch films, and irrigation systems. Its properties, such as UV resistance and flexibility, make it suitable for these outdoor uses. LDPE films can help in moisture retention, weed control, and temperature regulation in agricultural settings, contributing to improved crop yields and resource efficiency.Expand Specific Solutions03 LDPE in construction and insulation

The construction industry can benefit from LDPE's potential, particularly in insulation and waterproofing applications. LDPE can be used in the production of vapor barriers, damp-proof membranes, and pipe insulation. Its low thermal conductivity and moisture resistance make it an effective material for improving energy efficiency in buildings and protecting structures from water damage.Expand Specific Solutions04 LDPE in medical and healthcare products

LDPE shows potential in the medical and healthcare sectors due to its chemical resistance and flexibility. It can be used in the production of medical packaging, disposable medical devices, and pharmaceutical containers. LDPE's properties make it suitable for applications requiring sterility and protection against contamination, while also offering ease of use and cost-effectiveness.Expand Specific Solutions05 LDPE recycling and sustainability

There is growing potential for LDPE in recycling and sustainability initiatives. Research and development efforts are focused on improving LDPE recycling processes, developing bio-based LDPE alternatives, and enhancing the material's biodegradability. These advancements aim to address environmental concerns associated with plastic waste and promote a more circular economy for LDPE products.Expand Specific Solutions

Key LDPE Industry Players

The market for expanding LDPE's potential in diverse markets is in a growth phase, driven by increasing demand for flexible packaging and sustainable materials. The global LDPE market size is projected to reach $70 billion by 2027, with a CAGR of 3.5%. Technologically, LDPE production is mature, but innovations in catalysts and processes are ongoing to improve properties and efficiency. Key players like Dow, ExxonMobil, and SABIC are investing in R&D to develop enhanced LDPE grades for emerging applications. Chinese companies such as Sinopec and PetroChina are also expanding their LDPE capacities and capabilities to capture growing domestic and international demand.

Dow Global Technologies LLC

ExxonMobil Chemical Patents, Inc.

LDPE Innovation Analysis

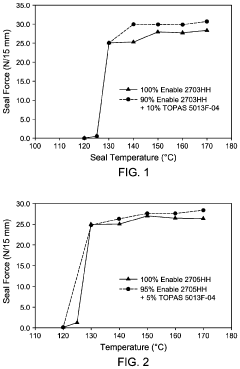

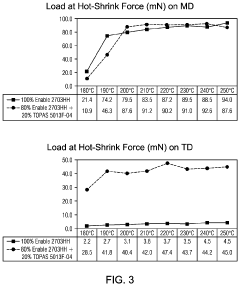

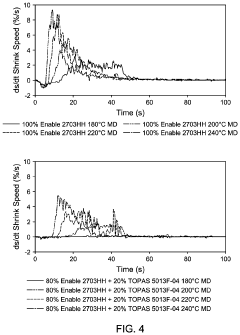

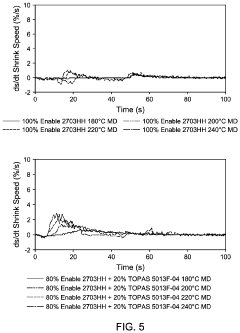

- Incorporating a cyclic-olefin copolymer (COC) into the polymer composition of polyethylene films, with COC levels between 1-25 wt% and polyethylene levels between 75-99 wt%, which enhances TD shrinkage, stiffness, and load retention resistance while maintaining excellent optical properties and processability.

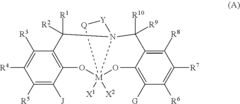

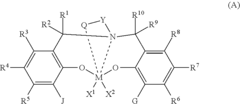

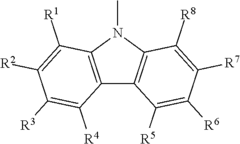

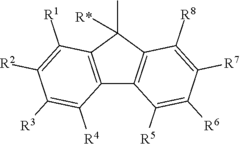

- A catalyst system comprising an organoaluminum treated layered silicate and an inorganic oxide, combined with a bisphenolate catalyst compound represented by a specific formula, which allows for the polymerization of olefins, including ethylene, to produce high molecular weight polyethylenes without additional activators like alumoxane or non-coordinating anions, and is used in the form of spheroidal particles with controlled particle size and surface area.

Environmental Impact of LDPE

The environmental impact of Low-Density Polyethylene (LDPE) is a critical consideration as its usage expands across diverse markets. LDPE, while versatile and widely used, poses significant environmental challenges throughout its lifecycle.

Production of LDPE involves the use of fossil fuels, contributing to greenhouse gas emissions and climate change. The manufacturing process requires substantial energy inputs and can release harmful pollutants into the air and water. Additionally, the extraction of raw materials for LDPE production, primarily ethylene derived from natural gas or petroleum, has its own set of environmental consequences, including habitat disruption and potential for oil spills.

Once in use, LDPE products often have a short lifespan, particularly in single-use applications. This leads to rapid accumulation in waste streams. The disposal of LDPE presents a major environmental concern. When improperly discarded, it can persist in the environment for hundreds of years, contributing to litter and pollution in terrestrial and aquatic ecosystems.

In marine environments, LDPE waste is particularly problematic. It can break down into microplastics, which are ingested by marine life, potentially entering the food chain and affecting biodiversity. These microplastics can also adsorb and concentrate toxic chemicals, further exacerbating their environmental impact.

Recycling offers a partial solution to LDPE's environmental footprint. However, the recycling rates for LDPE remain low in many regions due to challenges in collection, sorting, and processing. The quality of recycled LDPE is often inferior to virgin material, limiting its applications and market value.

Efforts to mitigate LDPE's environmental impact include the development of biodegradable alternatives, improved recycling technologies, and initiatives to reduce single-use plastic consumption. Some companies are exploring bio-based LDPE, which could potentially reduce reliance on fossil fuels. However, these alternatives often come with their own set of environmental trade-offs and are not yet widely adopted.

As LDPE continues to expand into new markets, balancing its utility with environmental sustainability remains a significant challenge. Innovations in production methods, product design for recyclability, and end-of-life management are crucial for minimizing LDPE's environmental footprint. Additionally, policy measures such as extended producer responsibility and plastic bag bans are being implemented in various regions to address the environmental concerns associated with LDPE use.

LDPE Regulatory Landscape

The regulatory landscape for Low-Density Polyethylene (LDPE) is complex and multifaceted, reflecting the material's widespread use across various industries and its environmental implications. As LDPE continues to expand its potential in diverse markets, understanding and navigating this regulatory environment becomes crucial for manufacturers, distributors, and end-users alike.

At the global level, organizations such as the United Nations Environment Programme (UNEP) and the World Health Organization (WHO) have established guidelines and recommendations for plastic use and disposal. These international frameworks often inform national and regional policies, creating a ripple effect across the LDPE value chain.

In the European Union, the regulatory approach to LDPE is primarily governed by the REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulation and the Plastic Materials and Articles in Contact with Food Regulation. These comprehensive frameworks set stringent standards for the production, use, and disposal of LDPE products, particularly in food packaging applications.

The United States regulatory landscape for LDPE is overseen by multiple agencies, including the Food and Drug Administration (FDA) for food contact materials and the Environmental Protection Agency (EPA) for environmental concerns. The FDA's Code of Federal Regulations Title 21 provides specific guidelines for LDPE use in food packaging, while the EPA regulates aspects such as emissions during production and waste management.

In emerging markets, such as China and India, regulatory frameworks for LDPE are evolving rapidly. These countries are implementing stricter environmental policies, often modeled after Western standards, to address growing concerns about plastic pollution and sustainability.

A significant trend in LDPE regulation is the increasing focus on circular economy principles. Many jurisdictions are introducing Extended Producer Responsibility (EPR) schemes, which require manufacturers to take responsibility for the entire lifecycle of their LDPE products, including collection and recycling.

The regulatory landscape also reflects growing consumer awareness and demand for sustainable packaging solutions. This has led to the development of regulations promoting the use of recycled content in LDPE products and incentivizing the development of bio-based alternatives.

As LDPE expands into new markets and applications, regulatory bodies are adapting their frameworks to address novel uses. For instance, the medical device industry sees increasing scrutiny of LDPE materials used in healthcare applications, with regulatory bodies like the FDA and the European Medicines Agency (EMA) developing specific guidelines.