Exploring Biodegradable Alternatives to LDPE

JUN 30, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Biodegradable Plastics Evolution and Objectives

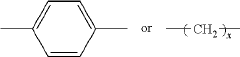

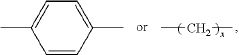

The evolution of biodegradable plastics has been driven by the growing environmental concerns associated with conventional plastics, particularly Low-Density Polyethylene (LDPE). This journey began in the late 20th century when scientists and environmentalists started recognizing the long-term ecological impact of non-biodegradable plastics. The primary objective of developing biodegradable alternatives to LDPE is to create materials that can perform similarly in various applications while significantly reducing environmental persistence.

The technological progression in this field has been marked by several key milestones. Initially, the focus was on developing naturally derived polymers, such as those based on starch or cellulose. These early attempts, while biodegradable, often lacked the durability and versatility of LDPE. The next phase saw the emergence of synthetic biodegradable polymers like polylactic acid (PLA) and polyhydroxyalkanoates (PHAs), which offered improved mechanical properties and processability.

Recent advancements have led to the development of more sophisticated biodegradable plastics that closely mimic the properties of LDPE. These include blends of biodegradable polymers with natural fibers or minerals, and the creation of novel copolymers that combine biodegradability with enhanced performance characteristics. The current technological frontier involves the exploration of bio-based and biodegradable polyethylene alternatives, aiming to replicate LDPE's versatility while ensuring complete biodegradation.

The objectives of this ongoing research are multifaceted. Primarily, there is a push to develop materials that can biodegrade in various environments – from industrial composting facilities to marine ecosystems – without leaving harmful residues. Another key goal is to achieve cost-effectiveness in production, making biodegradable alternatives economically viable for widespread adoption. Additionally, researchers are striving to improve the mechanical and barrier properties of these materials to match or exceed those of LDPE, ensuring they can serve as direct replacements in packaging and other applications.

Looking ahead, the field is trending towards more integrated approaches. This includes the development of biodegradable additives that can enhance the degradation of existing plastics, as well as the exploration of hybrid materials that combine biodegradability with other desirable properties like antimicrobial activity or improved recyclability. The ultimate aim is to create a new generation of plastics that can seamlessly replace LDPE across its wide range of applications, from food packaging to agricultural films, while offering a sustainable end-of-life solution that aligns with circular economy principles.

The technological progression in this field has been marked by several key milestones. Initially, the focus was on developing naturally derived polymers, such as those based on starch or cellulose. These early attempts, while biodegradable, often lacked the durability and versatility of LDPE. The next phase saw the emergence of synthetic biodegradable polymers like polylactic acid (PLA) and polyhydroxyalkanoates (PHAs), which offered improved mechanical properties and processability.

Recent advancements have led to the development of more sophisticated biodegradable plastics that closely mimic the properties of LDPE. These include blends of biodegradable polymers with natural fibers or minerals, and the creation of novel copolymers that combine biodegradability with enhanced performance characteristics. The current technological frontier involves the exploration of bio-based and biodegradable polyethylene alternatives, aiming to replicate LDPE's versatility while ensuring complete biodegradation.

The objectives of this ongoing research are multifaceted. Primarily, there is a push to develop materials that can biodegrade in various environments – from industrial composting facilities to marine ecosystems – without leaving harmful residues. Another key goal is to achieve cost-effectiveness in production, making biodegradable alternatives economically viable for widespread adoption. Additionally, researchers are striving to improve the mechanical and barrier properties of these materials to match or exceed those of LDPE, ensuring they can serve as direct replacements in packaging and other applications.

Looking ahead, the field is trending towards more integrated approaches. This includes the development of biodegradable additives that can enhance the degradation of existing plastics, as well as the exploration of hybrid materials that combine biodegradability with other desirable properties like antimicrobial activity or improved recyclability. The ultimate aim is to create a new generation of plastics that can seamlessly replace LDPE across its wide range of applications, from food packaging to agricultural films, while offering a sustainable end-of-life solution that aligns with circular economy principles.

Market Demand for LDPE Alternatives

The market demand for biodegradable alternatives to Low-Density Polyethylene (LDPE) has been steadily increasing in recent years, driven by growing environmental concerns and regulatory pressures. LDPE, a widely used plastic in packaging and consumer goods, has come under scrutiny due to its persistence in the environment and contribution to plastic pollution. This has created a significant opportunity for biodegradable alternatives that can offer similar performance characteristics while addressing environmental issues.

Consumer awareness and preference for eco-friendly products have been key drivers in the demand for LDPE alternatives. A shift in consumer behavior towards sustainable choices has prompted many companies to seek out biodegradable packaging solutions. This trend is particularly evident in the food and beverage industry, where single-use plastics are prevalent. Retailers and brand owners are increasingly adopting biodegradable packaging to meet consumer expectations and differentiate their products in a competitive market.

Government regulations and policies aimed at reducing plastic waste have also played a crucial role in stimulating market demand for LDPE alternatives. Many countries have implemented or are considering bans on single-use plastics, creating a regulatory environment that favors biodegradable materials. These legislative measures have accelerated research and development efforts in the field of biodegradable plastics, leading to increased investment and innovation in this sector.

The agriculture sector represents another significant market for biodegradable LDPE alternatives. Mulch films and other agricultural plastics made from LDPE contribute to soil pollution when not properly disposed of. Biodegradable alternatives offer farmers a solution that can decompose naturally in the soil, reducing environmental impact and labor costs associated with film removal.

In the packaging industry, there is a growing demand for flexible packaging solutions that are both functional and environmentally friendly. Biodegradable alternatives to LDPE are being explored for applications such as food packaging, shopping bags, and protective wraps. The challenge lies in developing materials that can match LDPE's barrier properties, durability, and cost-effectiveness while offering enhanced biodegradability.

The healthcare sector is also showing interest in biodegradable LDPE alternatives, particularly for disposable medical devices and packaging. As hospitals and healthcare facilities strive to reduce their environmental footprint, there is an increasing demand for biodegradable materials that can meet stringent medical standards while offering improved end-of-life options.

Despite the growing demand, challenges remain in scaling up production and reducing costs of biodegradable alternatives to compete with conventional LDPE. However, ongoing research and development efforts, coupled with increasing economies of scale, are expected to improve the cost-competitiveness of these materials over time. As the market continues to evolve, collaborations between material scientists, manufacturers, and end-users will be crucial in developing biodegradable alternatives that can effectively meet the diverse needs of various industries while addressing environmental concerns.

Consumer awareness and preference for eco-friendly products have been key drivers in the demand for LDPE alternatives. A shift in consumer behavior towards sustainable choices has prompted many companies to seek out biodegradable packaging solutions. This trend is particularly evident in the food and beverage industry, where single-use plastics are prevalent. Retailers and brand owners are increasingly adopting biodegradable packaging to meet consumer expectations and differentiate their products in a competitive market.

Government regulations and policies aimed at reducing plastic waste have also played a crucial role in stimulating market demand for LDPE alternatives. Many countries have implemented or are considering bans on single-use plastics, creating a regulatory environment that favors biodegradable materials. These legislative measures have accelerated research and development efforts in the field of biodegradable plastics, leading to increased investment and innovation in this sector.

The agriculture sector represents another significant market for biodegradable LDPE alternatives. Mulch films and other agricultural plastics made from LDPE contribute to soil pollution when not properly disposed of. Biodegradable alternatives offer farmers a solution that can decompose naturally in the soil, reducing environmental impact and labor costs associated with film removal.

In the packaging industry, there is a growing demand for flexible packaging solutions that are both functional and environmentally friendly. Biodegradable alternatives to LDPE are being explored for applications such as food packaging, shopping bags, and protective wraps. The challenge lies in developing materials that can match LDPE's barrier properties, durability, and cost-effectiveness while offering enhanced biodegradability.

The healthcare sector is also showing interest in biodegradable LDPE alternatives, particularly for disposable medical devices and packaging. As hospitals and healthcare facilities strive to reduce their environmental footprint, there is an increasing demand for biodegradable materials that can meet stringent medical standards while offering improved end-of-life options.

Despite the growing demand, challenges remain in scaling up production and reducing costs of biodegradable alternatives to compete with conventional LDPE. However, ongoing research and development efforts, coupled with increasing economies of scale, are expected to improve the cost-competitiveness of these materials over time. As the market continues to evolve, collaborations between material scientists, manufacturers, and end-users will be crucial in developing biodegradable alternatives that can effectively meet the diverse needs of various industries while addressing environmental concerns.

Current State of Biodegradable Plastics

The field of biodegradable plastics has seen significant advancements in recent years, driven by the growing concern over environmental pollution caused by conventional plastics like Low-Density Polyethylene (LDPE). Currently, several biodegradable alternatives are being explored and developed to replace LDPE in various applications.

One of the most promising biodegradable alternatives is Polylactic Acid (PLA), derived from renewable resources such as corn starch or sugarcane. PLA has gained traction in the packaging industry due to its biodegradability and compostability. It offers similar properties to LDPE in terms of flexibility and transparency, making it suitable for food packaging and disposable items.

Another notable biodegradable plastic is Polyhydroxyalkanoates (PHAs), which are produced by microorganisms through fermentation of organic materials. PHAs have shown potential in replacing LDPE in applications requiring higher durability and water resistance. However, their production costs remain a challenge for widespread adoption.

Starch-based plastics have also emerged as a viable alternative to LDPE, particularly in the packaging sector. These materials are often blended with other biodegradable polymers to enhance their mechanical properties and moisture resistance. While they offer good biodegradability, their performance in high-humidity environments can be limited.

Cellulose-based plastics, derived from wood pulp or other plant sources, have shown promise in replacing LDPE for certain applications. These materials offer excellent biodegradability and can be engineered to mimic the properties of conventional plastics. However, their production process is still being optimized to improve cost-effectiveness and scalability.

Recent developments in the field include the exploration of algae-based bioplastics, which offer the potential for rapid biodegradation in marine environments. These materials are still in the early stages of development but show promise in addressing the issue of marine plastic pollution.

Despite these advancements, challenges remain in the widespread adoption of biodegradable alternatives to LDPE. Issues such as production costs, scalability, and performance in specific applications continue to be addressed through ongoing research and development efforts. Additionally, the establishment of proper waste management infrastructure for biodegradable plastics is crucial for realizing their full environmental benefits.

The current state of biodegradable plastics also involves efforts to improve their mechanical properties and durability to match those of LDPE more closely. This includes research into novel polymer blends and additives that can enhance the strength, flexibility, and barrier properties of biodegradable materials without compromising their biodegradability.

One of the most promising biodegradable alternatives is Polylactic Acid (PLA), derived from renewable resources such as corn starch or sugarcane. PLA has gained traction in the packaging industry due to its biodegradability and compostability. It offers similar properties to LDPE in terms of flexibility and transparency, making it suitable for food packaging and disposable items.

Another notable biodegradable plastic is Polyhydroxyalkanoates (PHAs), which are produced by microorganisms through fermentation of organic materials. PHAs have shown potential in replacing LDPE in applications requiring higher durability and water resistance. However, their production costs remain a challenge for widespread adoption.

Starch-based plastics have also emerged as a viable alternative to LDPE, particularly in the packaging sector. These materials are often blended with other biodegradable polymers to enhance their mechanical properties and moisture resistance. While they offer good biodegradability, their performance in high-humidity environments can be limited.

Cellulose-based plastics, derived from wood pulp or other plant sources, have shown promise in replacing LDPE for certain applications. These materials offer excellent biodegradability and can be engineered to mimic the properties of conventional plastics. However, their production process is still being optimized to improve cost-effectiveness and scalability.

Recent developments in the field include the exploration of algae-based bioplastics, which offer the potential for rapid biodegradation in marine environments. These materials are still in the early stages of development but show promise in addressing the issue of marine plastic pollution.

Despite these advancements, challenges remain in the widespread adoption of biodegradable alternatives to LDPE. Issues such as production costs, scalability, and performance in specific applications continue to be addressed through ongoing research and development efforts. Additionally, the establishment of proper waste management infrastructure for biodegradable plastics is crucial for realizing their full environmental benefits.

The current state of biodegradable plastics also involves efforts to improve their mechanical properties and durability to match those of LDPE more closely. This includes research into novel polymer blends and additives that can enhance the strength, flexibility, and barrier properties of biodegradable materials without compromising their biodegradability.

Existing Biodegradable LDPE Alternatives

01 Biodegradable polymers as alternatives

Various biodegradable polymers are being developed and used as alternatives to conventional non-biodegradable materials. These polymers can break down naturally in the environment, reducing long-term pollution. Examples include polylactic acid (PLA), polyhydroxyalkanoates (PHA), and starch-based polymers. These materials are being applied in packaging, disposable products, and other applications where biodegradability is desirable.- Biodegradable polymers as alternatives: Various biodegradable polymers are being developed and used as alternatives to conventional non-biodegradable materials. These polymers can break down naturally in the environment, reducing long-term pollution. Examples include polylactic acid (PLA), polyhydroxyalkanoates (PHAs), and starch-based polymers. These materials are being applied in packaging, disposable products, and other applications where biodegradability is desirable.

- Biodegradable composites and blends: Research is focused on developing biodegradable composites and blends that combine different biodegradable materials to enhance overall performance. These composites often incorporate natural fibers or fillers to improve mechanical properties while maintaining biodegradability. Such materials are finding applications in automotive parts, construction materials, and consumer goods.

- Biodegradable packaging solutions: Innovative biodegradable packaging solutions are being developed to replace traditional plastic packaging. These include films, coatings, and containers made from biodegradable materials such as cellulose derivatives, chitosan, and alginate. The focus is on creating packaging that maintains product integrity while ensuring complete biodegradation after disposal.

- Biodegradable agricultural products: The agricultural sector is adopting biodegradable alternatives for various applications. These include biodegradable mulch films, seed coatings, and controlled-release fertilizers. These products are designed to break down naturally in soil, reducing plastic pollution in agricultural environments and potentially improving soil health.

- Enhancing biodegradability of existing materials: Research is ongoing to enhance the biodegradability of existing materials through various methods. These include the incorporation of pro-oxidant additives, development of oxo-biodegradable plastics, and modification of polymer structures to increase susceptibility to microbial degradation. The goal is to create materials that maintain their useful properties during use but degrade more rapidly after disposal.

02 Biodegradable composites and blends

Research is focused on developing biodegradable composites and blends that combine different biodegradable materials to enhance overall performance. These composites often incorporate natural fibers or other biodegradable reinforcements to improve mechanical properties while maintaining biodegradability. Such materials are finding applications in automotive parts, construction materials, and consumer goods.Expand Specific Solutions03 Biodegradable packaging solutions

Innovative biodegradable packaging solutions are being developed to replace traditional plastic packaging. These include films, coatings, and containers made from biodegradable materials such as cellulose, chitosan, and other plant-based substances. The focus is on creating packaging that can protect products effectively while decomposing naturally after use, reducing environmental impact.Expand Specific Solutions04 Biodegradable agricultural products

The agricultural sector is adopting biodegradable alternatives for various applications. This includes biodegradable mulch films, plant pots, and controlled-release fertilizer coatings. These products are designed to break down in soil after use, reducing plastic accumulation in agricultural environments and potentially improving soil health.Expand Specific Solutions05 Enhancing biodegradability of existing materials

Research is ongoing to improve the biodegradability of existing materials through various methods. This includes the development of additives that can accelerate the breakdown of polymers, the modification of polymer structures to increase susceptibility to biodegradation, and the use of pro-oxidants to initiate degradation processes. These approaches aim to make a wider range of materials more environmentally friendly without completely replacing existing manufacturing processes.Expand Specific Solutions

Key Players in Bioplastics Industry

The biodegradable alternatives to LDPE market is in a growth phase, driven by increasing environmental concerns and regulatory pressures. The global market size for biodegradable plastics is projected to reach $6.12 billion by 2023, with a CAGR of 21.1%. The technology is maturing, but still faces challenges in performance and cost-effectiveness. Key players like Northern Technologies International Corp., 3M Innovative Properties Co., and SABIC Global Technologies BV are investing heavily in R&D to improve material properties and production efficiency. Companies such as Braskem SA and Archer-Daniels-Midland Co. are focusing on bio-based alternatives, while academic institutions like the University of Massachusetts and University of Houston are contributing to fundamental research in this field.

3M Innovative Properties Co.

Technical Solution: 3M has developed biodegradable alternatives to LDPE through their sustainable materials research. One of their innovations is a compostable adhesive made from polylactic acid (PLA) and other bio-based materials. This adhesive is designed to break down in industrial composting facilities, offering an environmentally friendly alternative to traditional petroleum-based adhesives[11]. 3M has also explored the use of biodegradable materials in their packaging solutions, including the development of compostable mailing envelopes and biodegradable bubble wrap alternatives. These materials are designed to maintain the protective properties of traditional packaging while offering improved end-of-life options[12]. Additionally, 3M has invested in research on biodegradable films and coatings that could potentially replace LDPE in various applications.

Strengths: Diverse range of biodegradable solutions, strong research and development capabilities, applications in multiple industries. Weaknesses: Some solutions may require specific composting conditions, potential higher costs compared to traditional materials.

SABIC Global Technologies BV

Technical Solution: SABIC has developed certified circular polymers and certified renewable polymers as alternatives to traditional LDPE. Their circular polymers are produced using advanced recycling technologies that break down mixed plastic waste into feedstock for new plastics production. This process, known as pyrolysis, converts plastic waste into pyrolysis oil, which is then used as a feedstock for steam crackers[9]. SABIC's certified renewable polymers are derived from bio-based feedstocks, such as tall oil, a by-product of the wood pulping process. These materials are produced using the mass balance approach, which allows for the gradual introduction of renewable feedstocks into existing production processes[10]. Both circular and renewable polymers offer similar properties to conventional LDPE while reducing reliance on fossil resources.

Strengths: Utilizes plastic waste or renewable resources, drop-in solution for existing processes, maintains properties of conventional LDPE. Weaknesses: Limited true biodegradability, reliance on waste plastic availability or renewable feedstock supply.

Core Innovations in Biopolymer Technology

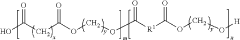

Biodegradable VCI packaging compositions

PatentActiveUS11939423B2

Innovation

- A breathable biodegradable volatile corrosion inhibitor composition comprising biodegradable polyester blends with volatile corrosion inhibitors and fillers, which improves mechanical properties and corrosion inhibition while allowing for higher water vapor transmission rates, enabling better activation of VCI chemistry and easier processing.

Biodegradable paper-based laminate with oxygen and moisture barrier properties and method for making biodegradable paper-based laminate

PatentInactiveBRPI0706888A2

Innovation

- A multi-layered paper-based laminate with biodegradable materials such as polyvinyl alcohol, polylactic acid, and polyhydroxyalkanoate, applied through coextrusion with a primer and potentially filled with calcium carbonate, talc, or diatomaceous earth to enhance adhesion and barrier properties, while using antiblock materials to prevent layer sticking.

Environmental Impact Assessment

The environmental impact assessment of biodegradable alternatives to Low-Density Polyethylene (LDPE) reveals significant potential for reducing plastic pollution and mitigating long-term ecological damage. These alternatives, primarily derived from renewable resources, offer a more sustainable approach to packaging and single-use plastics.

Biodegradable materials, such as polylactic acid (PLA), polyhydroxyalkanoates (PHAs), and starch-based plastics, demonstrate a markedly reduced environmental footprint compared to traditional LDPE. These materials break down into natural components within months to years, depending on environmental conditions, as opposed to the centuries required for LDPE degradation.

The production of biodegradable alternatives generally results in lower greenhouse gas emissions and reduced energy consumption compared to LDPE manufacturing. For instance, PLA production can emit up to 80% less CO2 than traditional petroleum-based plastics. Additionally, these materials often require less water and generate fewer toxic byproducts during their lifecycle.

However, the environmental benefits of biodegradable alternatives are not without caveats. The agricultural production of feedstocks for these materials can lead to land-use changes, potentially impacting biodiversity and food security. There are also concerns about the proper disposal and composting infrastructure needed to fully realize the benefits of biodegradable plastics.

Marine ecosystems stand to benefit significantly from the adoption of biodegradable alternatives. Unlike LDPE, which persists in oceans and poses severe threats to marine life, biodegradable plastics can decompose in marine environments, reducing the risk of entanglement and ingestion by sea creatures.

The end-of-life management of biodegradable plastics presents both opportunities and challenges. While they offer the potential for composting and integration into circular economy models, improper disposal can lead to methane emissions in landfills. Effective waste management systems and consumer education are crucial to maximizing the environmental benefits of these materials.

Life cycle assessments (LCAs) comparing biodegradable alternatives to LDPE show varying results depending on the specific material and application. Generally, biodegradable options outperform LDPE in terms of fossil fuel depletion and marine ecotoxicity. However, some alternatives may have higher impacts in categories such as eutrophication or land use, highlighting the need for continued research and development to optimize their environmental performance.

In conclusion, while biodegradable alternatives to LDPE offer promising environmental benefits, particularly in reducing plastic pollution and fossil fuel dependence, their overall impact depends on factors such as production methods, disposal practices, and the specific applications. Continued innovation and policy support are necessary to fully realize the potential of these materials in creating a more sustainable future.

Biodegradable materials, such as polylactic acid (PLA), polyhydroxyalkanoates (PHAs), and starch-based plastics, demonstrate a markedly reduced environmental footprint compared to traditional LDPE. These materials break down into natural components within months to years, depending on environmental conditions, as opposed to the centuries required for LDPE degradation.

The production of biodegradable alternatives generally results in lower greenhouse gas emissions and reduced energy consumption compared to LDPE manufacturing. For instance, PLA production can emit up to 80% less CO2 than traditional petroleum-based plastics. Additionally, these materials often require less water and generate fewer toxic byproducts during their lifecycle.

However, the environmental benefits of biodegradable alternatives are not without caveats. The agricultural production of feedstocks for these materials can lead to land-use changes, potentially impacting biodiversity and food security. There are also concerns about the proper disposal and composting infrastructure needed to fully realize the benefits of biodegradable plastics.

Marine ecosystems stand to benefit significantly from the adoption of biodegradable alternatives. Unlike LDPE, which persists in oceans and poses severe threats to marine life, biodegradable plastics can decompose in marine environments, reducing the risk of entanglement and ingestion by sea creatures.

The end-of-life management of biodegradable plastics presents both opportunities and challenges. While they offer the potential for composting and integration into circular economy models, improper disposal can lead to methane emissions in landfills. Effective waste management systems and consumer education are crucial to maximizing the environmental benefits of these materials.

Life cycle assessments (LCAs) comparing biodegradable alternatives to LDPE show varying results depending on the specific material and application. Generally, biodegradable options outperform LDPE in terms of fossil fuel depletion and marine ecotoxicity. However, some alternatives may have higher impacts in categories such as eutrophication or land use, highlighting the need for continued research and development to optimize their environmental performance.

In conclusion, while biodegradable alternatives to LDPE offer promising environmental benefits, particularly in reducing plastic pollution and fossil fuel dependence, their overall impact depends on factors such as production methods, disposal practices, and the specific applications. Continued innovation and policy support are necessary to fully realize the potential of these materials in creating a more sustainable future.

Regulatory Framework for Bioplastics

The regulatory framework for bioplastics is a complex and evolving landscape that plays a crucial role in shaping the development, production, and adoption of biodegradable alternatives to LDPE. As governments and international organizations increasingly recognize the environmental impact of conventional plastics, they are implementing policies and regulations to promote sustainable alternatives.

At the international level, organizations such as the United Nations Environment Programme (UNEP) and the European Union (EU) have been instrumental in setting guidelines and standards for bioplastics. The EU, in particular, has taken a leading role with its Circular Economy Action Plan, which includes specific measures to address plastic waste and promote bio-based alternatives.

National governments are also implementing their own regulations and policies to support the bioplastics industry. For instance, many countries have introduced bans or restrictions on single-use plastics, creating opportunities for biodegradable alternatives. Some nations have established certification systems and labeling requirements to ensure that products marketed as biodegradable meet specific standards.

One of the key challenges in the regulatory framework is the lack of harmonized standards and definitions across different jurisdictions. This can create confusion for manufacturers and consumers alike, as well as hinder international trade. Efforts are underway to develop globally recognized standards for biodegradability and compostability, which would help streamline regulations and facilitate market growth.

The regulatory landscape also addresses end-of-life considerations for bioplastics. Composting and waste management regulations are being updated to accommodate these new materials, ensuring that they can be properly processed and do not contaminate existing recycling streams. Some jurisdictions are implementing extended producer responsibility (EPR) schemes, which require manufacturers to take responsibility for the entire lifecycle of their products, including disposal.

Incentives and support mechanisms form another important aspect of the regulatory framework. Many governments offer tax breaks, grants, or other financial incentives to companies investing in bioplastic research and development. These measures aim to accelerate innovation and scale-up production, making biodegradable alternatives more competitive with traditional plastics.

As the bioplastics industry continues to evolve, regulations are likely to become more stringent and comprehensive. Future regulatory developments may include stricter requirements for biodegradability testing, lifecycle assessments, and environmental impact studies. Additionally, there is growing interest in regulations that promote the use of sustainable feedstocks for bioplastic production, ensuring that these alternatives do not compete with food crops or contribute to deforestation.

At the international level, organizations such as the United Nations Environment Programme (UNEP) and the European Union (EU) have been instrumental in setting guidelines and standards for bioplastics. The EU, in particular, has taken a leading role with its Circular Economy Action Plan, which includes specific measures to address plastic waste and promote bio-based alternatives.

National governments are also implementing their own regulations and policies to support the bioplastics industry. For instance, many countries have introduced bans or restrictions on single-use plastics, creating opportunities for biodegradable alternatives. Some nations have established certification systems and labeling requirements to ensure that products marketed as biodegradable meet specific standards.

One of the key challenges in the regulatory framework is the lack of harmonized standards and definitions across different jurisdictions. This can create confusion for manufacturers and consumers alike, as well as hinder international trade. Efforts are underway to develop globally recognized standards for biodegradability and compostability, which would help streamline regulations and facilitate market growth.

The regulatory landscape also addresses end-of-life considerations for bioplastics. Composting and waste management regulations are being updated to accommodate these new materials, ensuring that they can be properly processed and do not contaminate existing recycling streams. Some jurisdictions are implementing extended producer responsibility (EPR) schemes, which require manufacturers to take responsibility for the entire lifecycle of their products, including disposal.

Incentives and support mechanisms form another important aspect of the regulatory framework. Many governments offer tax breaks, grants, or other financial incentives to companies investing in bioplastic research and development. These measures aim to accelerate innovation and scale-up production, making biodegradable alternatives more competitive with traditional plastics.

As the bioplastics industry continues to evolve, regulations are likely to become more stringent and comprehensive. Future regulatory developments may include stricter requirements for biodegradability testing, lifecycle assessments, and environmental impact studies. Additionally, there is growing interest in regulations that promote the use of sustainable feedstocks for bioplastic production, ensuring that these alternatives do not compete with food crops or contribute to deforestation.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!