Exploring New Technologies in LDPE Recycling

JUN 30, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

LDPE Recycling Evolution

Low-density polyethylene (LDPE) recycling has undergone significant evolution since its inception in the 1970s. Initially, recycling efforts were limited due to technological constraints and lack of awareness about plastic waste's environmental impact. The early stages primarily involved manual sorting and basic mechanical recycling processes, which were inefficient and produced low-quality recycled materials.

In the 1980s and 1990s, advancements in sorting technologies, such as near-infrared (NIR) spectroscopy, improved the efficiency of LDPE separation from mixed plastic waste streams. This period also saw the development of more sophisticated washing and decontamination processes, enhancing the quality of recycled LDPE.

The turn of the millennium marked a significant shift in LDPE recycling. Improved extrusion and pelletizing technologies allowed for better quality control of recycled LDPE pellets. Additionally, the introduction of chemical recycling methods, such as pyrolysis and gasification, opened new avenues for handling contaminated or mixed LDPE waste that was previously difficult to recycle mechanically.

The past decade has witnessed a surge in innovative recycling technologies. Advanced sorting systems utilizing artificial intelligence and machine learning have dramatically increased the accuracy and speed of LDPE identification and separation. Solvent-based purification techniques have emerged, allowing for the removal of contaminants at the molecular level, thus producing higher quality recycled LDPE.

More recently, the focus has shifted towards developing closed-loop recycling systems for LDPE. This approach aims to maintain the material's quality through multiple recycling cycles, reducing the need for virgin plastic production. Alongside this, there has been growing interest in upcycling LDPE into higher-value products, expanding its potential applications beyond traditional uses.

The evolution of LDPE recycling has also been influenced by policy changes and increased consumer awareness. Extended Producer Responsibility (EPR) schemes and plastic bag bans in many countries have driven innovation in LDPE recycling technologies. Furthermore, the demand for recycled content in packaging has spurred investments in improving the quality and consistency of recycled LDPE.

Looking ahead, the LDPE recycling landscape continues to evolve. Emerging technologies such as chemical depolymerization and enzymatic recycling show promise in addressing the limitations of current mechanical recycling methods. These advancements aim to break down LDPE into its chemical building blocks, allowing for infinite recycling without quality loss. As research progresses, we can expect further innovations that will enhance the efficiency, sustainability, and economic viability of LDPE recycling processes.

In the 1980s and 1990s, advancements in sorting technologies, such as near-infrared (NIR) spectroscopy, improved the efficiency of LDPE separation from mixed plastic waste streams. This period also saw the development of more sophisticated washing and decontamination processes, enhancing the quality of recycled LDPE.

The turn of the millennium marked a significant shift in LDPE recycling. Improved extrusion and pelletizing technologies allowed for better quality control of recycled LDPE pellets. Additionally, the introduction of chemical recycling methods, such as pyrolysis and gasification, opened new avenues for handling contaminated or mixed LDPE waste that was previously difficult to recycle mechanically.

The past decade has witnessed a surge in innovative recycling technologies. Advanced sorting systems utilizing artificial intelligence and machine learning have dramatically increased the accuracy and speed of LDPE identification and separation. Solvent-based purification techniques have emerged, allowing for the removal of contaminants at the molecular level, thus producing higher quality recycled LDPE.

More recently, the focus has shifted towards developing closed-loop recycling systems for LDPE. This approach aims to maintain the material's quality through multiple recycling cycles, reducing the need for virgin plastic production. Alongside this, there has been growing interest in upcycling LDPE into higher-value products, expanding its potential applications beyond traditional uses.

The evolution of LDPE recycling has also been influenced by policy changes and increased consumer awareness. Extended Producer Responsibility (EPR) schemes and plastic bag bans in many countries have driven innovation in LDPE recycling technologies. Furthermore, the demand for recycled content in packaging has spurred investments in improving the quality and consistency of recycled LDPE.

Looking ahead, the LDPE recycling landscape continues to evolve. Emerging technologies such as chemical depolymerization and enzymatic recycling show promise in addressing the limitations of current mechanical recycling methods. These advancements aim to break down LDPE into its chemical building blocks, allowing for infinite recycling without quality loss. As research progresses, we can expect further innovations that will enhance the efficiency, sustainability, and economic viability of LDPE recycling processes.

Market Demand Analysis

The global market for LDPE recycling technologies is experiencing significant growth, driven by increasing environmental concerns and regulatory pressures. As the world grapples with plastic waste management, the demand for efficient and cost-effective LDPE recycling solutions continues to rise. The packaging industry, which is the largest consumer of LDPE, is under mounting pressure to adopt sustainable practices, creating a substantial market opportunity for innovative recycling technologies.

In recent years, there has been a notable shift in consumer preferences towards eco-friendly products and packaging. This trend has compelled major brands and retailers to commit to using recycled plastics in their packaging, further stimulating the demand for high-quality recycled LDPE. The food and beverage sector, in particular, has shown a strong interest in incorporating recycled LDPE into their packaging solutions, provided that the recycled material meets stringent quality and safety standards.

The construction industry also presents a growing market for recycled LDPE, with applications in products such as pipes, insulation materials, and geomembranes. As sustainable building practices gain traction globally, the demand for recycled plastics in construction is expected to increase substantially in the coming years.

Geographically, Europe and North America currently lead the market for LDPE recycling technologies, primarily due to stringent regulations and well-established recycling infrastructure. However, rapidly developing economies in Asia-Pacific, particularly China and India, are emerging as significant growth markets. These countries are investing heavily in recycling infrastructure and technologies to address their growing plastic waste challenges.

The market for chemical recycling technologies, which can process contaminated and mixed plastic waste streams, is gaining particular attention. These advanced recycling methods offer the potential to produce high-quality recycled LDPE suitable for food-grade applications, addressing a critical market need.

Despite the growing demand, several challenges persist in the LDPE recycling market. The volatility of oil prices affects the competitiveness of recycled LDPE against virgin materials. Additionally, the lack of standardized collection and sorting systems in many regions hampers the consistent supply of high-quality LDPE waste for recycling.

Looking ahead, the market for LDPE recycling technologies is projected to expand significantly over the next decade. Factors such as the implementation of circular economy principles, extended producer responsibility regulations, and technological advancements in sorting and recycling processes are expected to drive this growth. The development of more efficient and scalable recycling technologies that can produce high-quality recycled LDPE will be crucial in meeting the increasing market demand and achieving sustainability goals in plastic waste management.

In recent years, there has been a notable shift in consumer preferences towards eco-friendly products and packaging. This trend has compelled major brands and retailers to commit to using recycled plastics in their packaging, further stimulating the demand for high-quality recycled LDPE. The food and beverage sector, in particular, has shown a strong interest in incorporating recycled LDPE into their packaging solutions, provided that the recycled material meets stringent quality and safety standards.

The construction industry also presents a growing market for recycled LDPE, with applications in products such as pipes, insulation materials, and geomembranes. As sustainable building practices gain traction globally, the demand for recycled plastics in construction is expected to increase substantially in the coming years.

Geographically, Europe and North America currently lead the market for LDPE recycling technologies, primarily due to stringent regulations and well-established recycling infrastructure. However, rapidly developing economies in Asia-Pacific, particularly China and India, are emerging as significant growth markets. These countries are investing heavily in recycling infrastructure and technologies to address their growing plastic waste challenges.

The market for chemical recycling technologies, which can process contaminated and mixed plastic waste streams, is gaining particular attention. These advanced recycling methods offer the potential to produce high-quality recycled LDPE suitable for food-grade applications, addressing a critical market need.

Despite the growing demand, several challenges persist in the LDPE recycling market. The volatility of oil prices affects the competitiveness of recycled LDPE against virgin materials. Additionally, the lack of standardized collection and sorting systems in many regions hampers the consistent supply of high-quality LDPE waste for recycling.

Looking ahead, the market for LDPE recycling technologies is projected to expand significantly over the next decade. Factors such as the implementation of circular economy principles, extended producer responsibility regulations, and technological advancements in sorting and recycling processes are expected to drive this growth. The development of more efficient and scalable recycling technologies that can produce high-quality recycled LDPE will be crucial in meeting the increasing market demand and achieving sustainability goals in plastic waste management.

Technical Challenges

The recycling of Low-Density Polyethylene (LDPE) presents several significant technical challenges that hinder widespread adoption and efficiency. One of the primary obstacles is the contamination of LDPE waste streams. LDPE is commonly used in packaging materials, which often come into contact with food residues, chemicals, and other contaminants. These impurities can significantly impact the quality of recycled LDPE and limit its potential applications.

Another major challenge lies in the sorting and separation of LDPE from other plastic types. LDPE is frequently mixed with other plastics in waste streams, making it difficult to isolate and process effectively. Current sorting technologies, such as near-infrared (NIR) spectroscopy, struggle to differentiate between various polyethylene types, leading to reduced recycling efficiency and increased costs.

The degradation of LDPE during the recycling process poses another significant hurdle. LDPE undergoes thermal and mechanical stress during recycling, which can lead to chain scission and oxidation. This degradation results in a decrease in molecular weight and a consequent reduction in the mechanical properties of the recycled material. As a result, recycled LDPE often exhibits inferior quality compared to virgin LDPE, limiting its use in high-value applications.

The presence of additives and colorants in LDPE products further complicates the recycling process. These additives, which are used to enhance the properties of LDPE products, can interfere with the recycling process and affect the quality of the recycled material. Removing or neutralizing these additives without compromising the integrity of the LDPE remains a significant technical challenge.

Energy consumption and environmental impact of LDPE recycling processes also present challenges. Current mechanical recycling methods are energy-intensive and may not always result in a net positive environmental impact when compared to the production of virgin LDPE. Developing more energy-efficient and environmentally friendly recycling technologies is crucial for improving the sustainability of LDPE recycling.

The scalability of LDPE recycling technologies is another area of concern. Many promising recycling technologies developed in laboratory settings face difficulties when scaled up to industrial levels. Issues such as process stability, equipment durability, and economic viability often arise during scale-up, hindering the widespread implementation of new recycling technologies.

Lastly, the development of high-value applications for recycled LDPE remains a challenge. Due to the quality issues mentioned earlier, recycled LDPE is often limited to low-value applications. Finding innovative ways to upcycle LDPE or develop new high-value applications for recycled LDPE is essential for creating a more robust and economically viable recycling ecosystem.

Another major challenge lies in the sorting and separation of LDPE from other plastic types. LDPE is frequently mixed with other plastics in waste streams, making it difficult to isolate and process effectively. Current sorting technologies, such as near-infrared (NIR) spectroscopy, struggle to differentiate between various polyethylene types, leading to reduced recycling efficiency and increased costs.

The degradation of LDPE during the recycling process poses another significant hurdle. LDPE undergoes thermal and mechanical stress during recycling, which can lead to chain scission and oxidation. This degradation results in a decrease in molecular weight and a consequent reduction in the mechanical properties of the recycled material. As a result, recycled LDPE often exhibits inferior quality compared to virgin LDPE, limiting its use in high-value applications.

The presence of additives and colorants in LDPE products further complicates the recycling process. These additives, which are used to enhance the properties of LDPE products, can interfere with the recycling process and affect the quality of the recycled material. Removing or neutralizing these additives without compromising the integrity of the LDPE remains a significant technical challenge.

Energy consumption and environmental impact of LDPE recycling processes also present challenges. Current mechanical recycling methods are energy-intensive and may not always result in a net positive environmental impact when compared to the production of virgin LDPE. Developing more energy-efficient and environmentally friendly recycling technologies is crucial for improving the sustainability of LDPE recycling.

The scalability of LDPE recycling technologies is another area of concern. Many promising recycling technologies developed in laboratory settings face difficulties when scaled up to industrial levels. Issues such as process stability, equipment durability, and economic viability often arise during scale-up, hindering the widespread implementation of new recycling technologies.

Lastly, the development of high-value applications for recycled LDPE remains a challenge. Due to the quality issues mentioned earlier, recycled LDPE is often limited to low-value applications. Finding innovative ways to upcycle LDPE or develop new high-value applications for recycled LDPE is essential for creating a more robust and economically viable recycling ecosystem.

Current Recycling Methods

01 Composition and properties of LDPE

Low-Density Polyethylene (LDPE) is a thermoplastic polymer with a low density and high flexibility. It is characterized by its branched structure, which results in lower crystallinity and density compared to other polyethylene types. LDPE exhibits good chemical resistance, moisture barrier properties, and processability, making it suitable for various applications.- Composition and properties of LDPE: Low-Density Polyethylene (LDPE) is a thermoplastic polymer with a low density and high flexibility. It is characterized by its branched structure, which results in lower crystallinity and density compared to other polyethylene types. LDPE exhibits good chemical resistance, low water absorption, and excellent electrical insulation properties.

- Manufacturing processes for LDPE: LDPE is typically produced through high-pressure polymerization of ethylene using free-radical initiators. Various manufacturing techniques have been developed to improve the production efficiency and control the properties of LDPE, including the use of different catalysts, reactor designs, and process conditions.

- Applications of LDPE: LDPE finds widespread use in various industries due to its unique properties. Common applications include packaging materials, plastic bags, containers, tubing, and agricultural films. It is also used in the production of wire and cable insulation, toys, and household items.

- Modifications and blends of LDPE: To enhance its properties and expand its applications, LDPE is often modified or blended with other materials. This includes the incorporation of additives, crosslinking, and blending with other polymers to improve strength, heat resistance, or biodegradability. These modifications allow for tailored properties to meet specific requirements in various applications.

- Recycling and environmental considerations of LDPE: As a widely used plastic, the recycling and environmental impact of LDPE are important considerations. Research and development efforts focus on improving recycling processes, developing biodegradable alternatives, and reducing the environmental footprint of LDPE production and disposal. This includes the development of more efficient recycling technologies and the exploration of bio-based alternatives.

02 Manufacturing processes for LDPE

LDPE is typically produced through high-pressure polymerization of ethylene using free-radical initiators. Various manufacturing techniques have been developed to improve the production efficiency and control the properties of LDPE. These may include modifications to reactor design, catalyst systems, and process conditions to achieve desired molecular weight distribution and branching characteristics.Expand Specific Solutions03 Applications of LDPE in packaging

LDPE is widely used in the packaging industry due to its flexibility, transparency, and sealing properties. It is commonly employed in the production of plastic bags, food packaging films, and shrink wraps. Recent developments focus on enhancing the performance of LDPE in packaging applications, such as improving barrier properties or incorporating additives for specific functionalities.Expand Specific Solutions04 LDPE blends and composites

Research in LDPE materials often involves blending with other polymers or incorporating additives to enhance specific properties. These blends and composites aim to improve mechanical strength, thermal stability, or introduce new functionalities such as antimicrobial properties. The development of such materials expands the application range of LDPE in various industries.Expand Specific Solutions05 Recycling and sustainability of LDPE

With increasing focus on environmental sustainability, efforts are being made to improve the recycling and biodegradability of LDPE. This includes developing more efficient recycling processes, creating LDPE grades with enhanced recyclability, and exploring bio-based alternatives. Research also focuses on reducing the environmental impact of LDPE production and use.Expand Specific Solutions

Key Industry Players

The LDPE recycling technology market is in a growth phase, driven by increasing environmental concerns and regulatory pressures. The market size is expanding, with a projected global value of several billion dollars by 2025. Technologically, LDPE recycling is advancing, but still faces challenges in efficiency and scalability. Key players like Dow Global Technologies, SABIC, and LG Chem are investing heavily in R&D to improve recycling processes. Universities such as Jilin University and Sichuan University are contributing to fundamental research. Companies like Unisensor Sensorsysteme and Blue Earth Solutions are developing innovative sorting and processing technologies. The competitive landscape is diverse, with both established petrochemical companies and specialized recycling firms vying for market share.

Dow Global Technologies LLC

Technical Solution: Dow has developed a revolutionary recycling process for LDPE called REVOLOOP™. This technology enables the recycling of previously hard-to-recycle plastic waste, including flexible packaging materials. The process involves advanced sorting, cleaning, and extrusion techniques to produce high-quality recycled LDPE that can be used in various applications. REVOLOOP™ technology can process mixed plastic waste streams, including multi-layer films, and produce recycled LDPE with properties comparable to virgin materials[1][2]. The process also incorporates a proprietary additive package that enhances the mechanical properties and processability of the recycled LDPE.

Strengths: Ability to recycle complex mixed plastic waste streams, high-quality output comparable to virgin materials, and improved sustainability. Weaknesses: Potentially higher processing costs compared to traditional recycling methods, and may require significant infrastructure investments.

SABIC Global Technologies BV

Technical Solution: SABIC has introduced TRUCIRCLE™, an innovative portfolio of circular solutions for LDPE recycling. This technology encompasses mechanical recycling, certified circular products from chemical recycling of used plastics, and certified renewable polymers from bio-based feedstock. For LDPE specifically, SABIC employs advanced sorting and purification techniques, followed by a proprietary chemical recycling process that breaks down LDPE waste into its molecular components. These components are then used as feedstock to create new, high-quality LDPE indistinguishable from virgin material[3]. The process can handle contaminated and mixed plastic waste streams, significantly expanding the range of recyclable LDPE products.

Strengths: Produces virgin-quality LDPE from waste, can process contaminated and mixed plastics, and offers a comprehensive circular economy solution. Weaknesses: Energy-intensive process, potentially higher costs compared to mechanical recycling, and may require specialized facilities.

Innovative Technologies

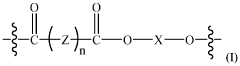

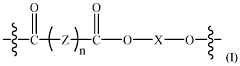

Repeatedly recyclable polymer mimics (RR-pm) of low-density polyethylene (LDPE) polymers

PatentWO2024133401A2

Innovation

- Development of repeatedly recyclable polymer mimics (RR-PM) of LDPE, which are created from a reaction product of difunctional oligomers and linkers obtained through depolymerization of used articles, allowing for repeated recycling with minimal loss of properties and reduced need for virgin materials.

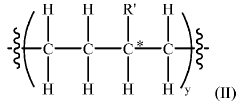

Method and apparatus for the recycling of low-density polyethylene (LDPE)

PatentWO2022218765A1

Innovation

- A method involving selective dissolution of LDPE in an organic solvent at a temperature where HDPE and PP do not dissolve, followed by ultrafiltration or nanofiltration to concentrate LDPE, allowing for its efficient recovery through evaporation, eliminating the need for additional separation steps and reducing energy consumption.

Environmental Regulations

Environmental regulations play a crucial role in shaping the landscape of LDPE recycling technologies. As governments worldwide increasingly focus on sustainable waste management, the regulatory framework surrounding plastic recycling has become more stringent and comprehensive. These regulations aim to reduce environmental impact, promote circular economy principles, and drive innovation in recycling technologies.

In recent years, many countries have implemented extended producer responsibility (EPR) schemes for plastic packaging, including LDPE. These policies hold manufacturers accountable for the entire lifecycle of their products, including disposal and recycling. This shift has incentivized companies to invest in more efficient and environmentally friendly recycling technologies for LDPE.

The European Union's Circular Economy Action Plan, adopted in 2020, sets ambitious targets for plastic recycling and reuse. It mandates that all plastic packaging in the EU market should be recyclable or reusable by 2030. This directive has spurred research and development in LDPE recycling technologies, as manufacturers seek to comply with these requirements and maintain market access.

Similarly, China's National Sword policy, implemented in 2018, has had a significant impact on global plastic recycling practices. By restricting the import of plastic waste, this policy has forced many countries to develop domestic recycling capabilities, including advanced technologies for LDPE recycling. This has led to increased investment in chemical recycling and other innovative approaches to plastic waste management.

In the United States, while federal regulations on plastic recycling remain limited, many states have enacted their own laws to address plastic waste. California, for instance, has set aggressive recycling targets and banned single-use plastic bags, driving demand for improved LDPE recycling technologies. These state-level initiatives often serve as testing grounds for policies that may later be adopted at the national level.

The Basel Convention on the Control of Transboundary Movements of Hazardous Wastes and Their Disposal has also been amended to include plastic waste. This international treaty now regulates the global trade of plastic waste, encouraging countries to develop domestic recycling capabilities and promoting the adoption of advanced recycling technologies.

As environmental regulations continue to evolve, they are likely to drive further innovation in LDPE recycling technologies. Future policies may include mandatory recycled content requirements, carbon pricing mechanisms that favor recycled materials, and stricter regulations on landfilling and incineration of plastic waste. These regulatory trends will continue to shape the development and adoption of new technologies in LDPE recycling, pushing the industry towards more sustainable and efficient practices.

In recent years, many countries have implemented extended producer responsibility (EPR) schemes for plastic packaging, including LDPE. These policies hold manufacturers accountable for the entire lifecycle of their products, including disposal and recycling. This shift has incentivized companies to invest in more efficient and environmentally friendly recycling technologies for LDPE.

The European Union's Circular Economy Action Plan, adopted in 2020, sets ambitious targets for plastic recycling and reuse. It mandates that all plastic packaging in the EU market should be recyclable or reusable by 2030. This directive has spurred research and development in LDPE recycling technologies, as manufacturers seek to comply with these requirements and maintain market access.

Similarly, China's National Sword policy, implemented in 2018, has had a significant impact on global plastic recycling practices. By restricting the import of plastic waste, this policy has forced many countries to develop domestic recycling capabilities, including advanced technologies for LDPE recycling. This has led to increased investment in chemical recycling and other innovative approaches to plastic waste management.

In the United States, while federal regulations on plastic recycling remain limited, many states have enacted their own laws to address plastic waste. California, for instance, has set aggressive recycling targets and banned single-use plastic bags, driving demand for improved LDPE recycling technologies. These state-level initiatives often serve as testing grounds for policies that may later be adopted at the national level.

The Basel Convention on the Control of Transboundary Movements of Hazardous Wastes and Their Disposal has also been amended to include plastic waste. This international treaty now regulates the global trade of plastic waste, encouraging countries to develop domestic recycling capabilities and promoting the adoption of advanced recycling technologies.

As environmental regulations continue to evolve, they are likely to drive further innovation in LDPE recycling technologies. Future policies may include mandatory recycled content requirements, carbon pricing mechanisms that favor recycled materials, and stricter regulations on landfilling and incineration of plastic waste. These regulatory trends will continue to shape the development and adoption of new technologies in LDPE recycling, pushing the industry towards more sustainable and efficient practices.

Economic Feasibility Study

The economic feasibility of new technologies in LDPE recycling is a critical factor in determining their potential for widespread adoption and implementation. A comprehensive analysis of the economic aspects reveals both challenges and opportunities in this evolving field.

The current recycling processes for LDPE often face economic hurdles due to the high costs associated with collection, sorting, and processing. Traditional mechanical recycling methods, while established, can be cost-intensive and may not always produce high-quality recycled materials. This economic barrier has historically limited the scalability of LDPE recycling initiatives.

However, emerging technologies are showing promise in improving the economic viability of LDPE recycling. Advanced sorting technologies, such as near-infrared spectroscopy and artificial intelligence-driven systems, are enhancing the efficiency of plastic waste separation. These innovations can significantly reduce labor costs and increase the purity of recycled LDPE streams, potentially improving the value of the end product.

Chemical recycling methods, including pyrolysis and depolymerization, are gaining attention for their ability to break down LDPE into its chemical components. While these technologies require substantial initial investment, they offer the potential for higher-value end products, including feedstock for new plastic production or fuel alternatives. The economic feasibility of these methods depends largely on scale and the market value of the resulting products.

Energy recovery from LDPE waste through advanced incineration or gasification processes presents another economic avenue. These technologies can generate electricity or heat, offsetting operational costs and potentially creating additional revenue streams. However, their economic viability must be weighed against environmental considerations and regulatory frameworks.

The market demand for recycled LDPE plays a crucial role in economic feasibility. As more companies commit to using recycled plastics in their products, the value of recycled LDPE is likely to increase. This trend could improve the economic outlook for recycling technologies, making investments in advanced recycling processes more attractive.

Government policies and incentives also significantly impact the economic landscape of LDPE recycling. Extended Producer Responsibility (EPR) schemes, tax incentives for recycled content, and penalties for virgin plastic use can shift the economic balance in favor of recycling technologies. These policy instruments can help internalize the environmental costs of plastic waste, making recycling more economically competitive.

In conclusion, while challenges remain, the economic feasibility of new LDPE recycling technologies is improving. Continued technological advancements, coupled with supportive policies and growing market demand, are creating a more favorable economic environment for innovation in this sector. The key to unlocking the full economic potential lies in scaling these technologies and creating robust markets for recycled LDPE products.

The current recycling processes for LDPE often face economic hurdles due to the high costs associated with collection, sorting, and processing. Traditional mechanical recycling methods, while established, can be cost-intensive and may not always produce high-quality recycled materials. This economic barrier has historically limited the scalability of LDPE recycling initiatives.

However, emerging technologies are showing promise in improving the economic viability of LDPE recycling. Advanced sorting technologies, such as near-infrared spectroscopy and artificial intelligence-driven systems, are enhancing the efficiency of plastic waste separation. These innovations can significantly reduce labor costs and increase the purity of recycled LDPE streams, potentially improving the value of the end product.

Chemical recycling methods, including pyrolysis and depolymerization, are gaining attention for their ability to break down LDPE into its chemical components. While these technologies require substantial initial investment, they offer the potential for higher-value end products, including feedstock for new plastic production or fuel alternatives. The economic feasibility of these methods depends largely on scale and the market value of the resulting products.

Energy recovery from LDPE waste through advanced incineration or gasification processes presents another economic avenue. These technologies can generate electricity or heat, offsetting operational costs and potentially creating additional revenue streams. However, their economic viability must be weighed against environmental considerations and regulatory frameworks.

The market demand for recycled LDPE plays a crucial role in economic feasibility. As more companies commit to using recycled plastics in their products, the value of recycled LDPE is likely to increase. This trend could improve the economic outlook for recycling technologies, making investments in advanced recycling processes more attractive.

Government policies and incentives also significantly impact the economic landscape of LDPE recycling. Extended Producer Responsibility (EPR) schemes, tax incentives for recycled content, and penalties for virgin plastic use can shift the economic balance in favor of recycling technologies. These policy instruments can help internalize the environmental costs of plastic waste, making recycling more economically competitive.

In conclusion, while challenges remain, the economic feasibility of new LDPE recycling technologies is improving. Continued technological advancements, coupled with supportive policies and growing market demand, are creating a more favorable economic environment for innovation in this sector. The key to unlocking the full economic potential lies in scaling these technologies and creating robust markets for recycled LDPE products.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!