Exploring Renewable Feedstocks for LDPE Production

JUN 30, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

LDPE Renewable Feedstock Background and Objectives

Low-density polyethylene (LDPE) has been a cornerstone of the plastics industry since its discovery in 1933. Traditionally produced from fossil fuel-based feedstocks, LDPE has found widespread use in packaging, construction, and consumer goods. However, growing environmental concerns and the need for sustainable alternatives have sparked interest in exploring renewable feedstocks for LDPE production.

The primary objective of this technological exploration is to develop economically viable and environmentally friendly methods for producing LDPE from renewable sources. This shift aims to reduce the carbon footprint of LDPE production, decrease dependence on finite fossil resources, and contribute to the circular economy.

Renewable feedstocks for LDPE production encompass a wide range of biomass-derived materials, including agricultural residues, forestry byproducts, and dedicated energy crops. These feedstocks can be converted into ethylene, the key monomer for LDPE synthesis, through various biochemical and thermochemical processes.

The evolution of renewable LDPE production technology has seen significant advancements in recent years. Initial efforts focused on first-generation feedstocks, such as corn and sugarcane, which raised concerns about competition with food production. Subsequent research has shifted towards second-generation feedstocks, utilizing non-food biomass and waste materials.

Current technological trends in renewable LDPE production include the development of more efficient catalysts for biomass conversion, optimization of fermentation processes for bio-ethanol production, and exploration of novel thermochemical routes such as gasification and pyrolysis. Additionally, there is growing interest in integrating renewable LDPE production with existing petrochemical infrastructure to leverage existing assets and expertise.

The pursuit of renewable feedstocks for LDPE production aligns with broader sustainability goals and regulatory initiatives worldwide. Many countries have implemented policies to promote the use of bio-based plastics and reduce reliance on fossil fuels. This supportive regulatory environment, coupled with increasing consumer demand for eco-friendly products, is driving innovation and investment in renewable LDPE technologies.

As the field progresses, researchers and industry players are working to overcome key challenges, including improving the efficiency of biomass conversion processes, reducing production costs, and ensuring consistent product quality. The ultimate goal is to develop renewable LDPE that matches or exceeds the performance characteristics of its fossil-based counterpart while offering superior environmental benefits.

The primary objective of this technological exploration is to develop economically viable and environmentally friendly methods for producing LDPE from renewable sources. This shift aims to reduce the carbon footprint of LDPE production, decrease dependence on finite fossil resources, and contribute to the circular economy.

Renewable feedstocks for LDPE production encompass a wide range of biomass-derived materials, including agricultural residues, forestry byproducts, and dedicated energy crops. These feedstocks can be converted into ethylene, the key monomer for LDPE synthesis, through various biochemical and thermochemical processes.

The evolution of renewable LDPE production technology has seen significant advancements in recent years. Initial efforts focused on first-generation feedstocks, such as corn and sugarcane, which raised concerns about competition with food production. Subsequent research has shifted towards second-generation feedstocks, utilizing non-food biomass and waste materials.

Current technological trends in renewable LDPE production include the development of more efficient catalysts for biomass conversion, optimization of fermentation processes for bio-ethanol production, and exploration of novel thermochemical routes such as gasification and pyrolysis. Additionally, there is growing interest in integrating renewable LDPE production with existing petrochemical infrastructure to leverage existing assets and expertise.

The pursuit of renewable feedstocks for LDPE production aligns with broader sustainability goals and regulatory initiatives worldwide. Many countries have implemented policies to promote the use of bio-based plastics and reduce reliance on fossil fuels. This supportive regulatory environment, coupled with increasing consumer demand for eco-friendly products, is driving innovation and investment in renewable LDPE technologies.

As the field progresses, researchers and industry players are working to overcome key challenges, including improving the efficiency of biomass conversion processes, reducing production costs, and ensuring consistent product quality. The ultimate goal is to develop renewable LDPE that matches or exceeds the performance characteristics of its fossil-based counterpart while offering superior environmental benefits.

Market Analysis for Bio-based LDPE

The market for bio-based Low-Density Polyethylene (LDPE) is experiencing significant growth driven by increasing environmental concerns and the push for sustainable alternatives to traditional petroleum-based plastics. As consumers and businesses alike become more environmentally conscious, the demand for bio-based LDPE is expected to rise substantially in the coming years.

The global bio-based LDPE market is currently in its nascent stage but shows promising potential. Major end-use industries for bio-based LDPE include packaging, agriculture, and consumer goods. The packaging sector, in particular, is expected to be a key driver of growth due to the increasing adoption of sustainable packaging solutions by major brands and retailers.

Geographically, Europe leads the bio-based LDPE market, followed by North America and Asia-Pacific. European countries, with their stringent environmental regulations and strong focus on sustainability, have been at the forefront of adopting bio-based plastics. North America is also seeing rapid growth in the market, driven by increasing consumer awareness and government initiatives promoting the use of bio-based materials.

The market for bio-based LDPE faces several challenges, including higher production costs compared to conventional LDPE and limited availability of renewable feedstocks. However, ongoing research and development efforts are focused on improving production efficiency and expanding the range of suitable feedstocks, which is expected to address these challenges in the coming years.

Key market players in the bio-based LDPE sector include Braskem, Dow Chemical Company, and NatureWorks LLC. These companies are investing heavily in research and development to improve the properties and cost-effectiveness of bio-based LDPE, aiming to make it more competitive with conventional LDPE.

The future outlook for the bio-based LDPE market is positive, with several factors contributing to its growth. These include increasing environmental regulations, growing consumer preference for sustainable products, and technological advancements in production processes. As the technology matures and economies of scale are achieved, the cost gap between bio-based and conventional LDPE is expected to narrow, further driving market growth.

In conclusion, the market analysis for bio-based LDPE reveals a sector with significant growth potential, driven by environmental concerns and the global shift towards sustainability. While challenges remain, ongoing research and development efforts, coupled with increasing market demand, are expected to propel the bio-based LDPE market forward in the coming years.

The global bio-based LDPE market is currently in its nascent stage but shows promising potential. Major end-use industries for bio-based LDPE include packaging, agriculture, and consumer goods. The packaging sector, in particular, is expected to be a key driver of growth due to the increasing adoption of sustainable packaging solutions by major brands and retailers.

Geographically, Europe leads the bio-based LDPE market, followed by North America and Asia-Pacific. European countries, with their stringent environmental regulations and strong focus on sustainability, have been at the forefront of adopting bio-based plastics. North America is also seeing rapid growth in the market, driven by increasing consumer awareness and government initiatives promoting the use of bio-based materials.

The market for bio-based LDPE faces several challenges, including higher production costs compared to conventional LDPE and limited availability of renewable feedstocks. However, ongoing research and development efforts are focused on improving production efficiency and expanding the range of suitable feedstocks, which is expected to address these challenges in the coming years.

Key market players in the bio-based LDPE sector include Braskem, Dow Chemical Company, and NatureWorks LLC. These companies are investing heavily in research and development to improve the properties and cost-effectiveness of bio-based LDPE, aiming to make it more competitive with conventional LDPE.

The future outlook for the bio-based LDPE market is positive, with several factors contributing to its growth. These include increasing environmental regulations, growing consumer preference for sustainable products, and technological advancements in production processes. As the technology matures and economies of scale are achieved, the cost gap between bio-based and conventional LDPE is expected to narrow, further driving market growth.

In conclusion, the market analysis for bio-based LDPE reveals a sector with significant growth potential, driven by environmental concerns and the global shift towards sustainability. While challenges remain, ongoing research and development efforts, coupled with increasing market demand, are expected to propel the bio-based LDPE market forward in the coming years.

Current Challenges in Renewable LDPE Production

The production of Low-Density Polyethylene (LDPE) from renewable feedstocks faces several significant challenges that hinder its widespread adoption and commercialization. One of the primary obstacles is the high cost associated with renewable raw materials compared to traditional petroleum-based feedstocks. This economic barrier makes it difficult for renewable LDPE to compete in the market, especially given the well-established and optimized production processes for conventional LDPE.

Another major challenge lies in the inconsistent quality and composition of renewable feedstocks. Unlike petroleum-based raw materials, which have relatively uniform characteristics, renewable sources such as biomass can vary significantly in their chemical makeup depending on factors like geographic origin, growing conditions, and harvesting methods. This variability complicates the production process and makes it challenging to maintain consistent product quality.

The conversion efficiency of renewable feedstocks into LDPE is also a significant hurdle. Current technologies for transforming biomass or other renewable sources into ethylene, the primary building block for LDPE, often have lower yields compared to traditional petrochemical routes. This inefficiency not only increases production costs but also raises questions about the overall sustainability of the process.

Environmental concerns present another set of challenges. While renewable feedstocks are often touted as more environmentally friendly, the cultivation and processing of these materials can have significant ecological impacts. Issues such as land use change, water consumption, and the use of fertilizers and pesticides in biomass production need to be carefully considered and addressed to ensure that renewable LDPE truly offers environmental benefits over its fossil fuel-based counterpart.

Technical limitations in processing renewable feedstocks also pose challenges. Many existing LDPE production facilities are designed specifically for petroleum-based raw materials, and retrofitting these plants to handle renewable feedstocks can be complex and costly. Additionally, renewable feedstocks may contain impurities or compounds that are not present in traditional raw materials, necessitating the development of new purification and processing techniques.

Scalability remains a significant challenge for renewable LDPE production. While small-scale or pilot projects have demonstrated the feasibility of using renewable feedstocks, scaling up to commercial production levels presents numerous technical and logistical hurdles. These include securing a stable and sufficient supply of renewable raw materials, optimizing large-scale production processes, and managing the increased complexity of supply chains.

Regulatory and market acceptance issues also contribute to the challenges faced by renewable LDPE production. Varying regulations across different regions regarding the use of renewable materials in packaging and other applications can create barriers to market entry. Moreover, consumer and industry perceptions about the performance and reliability of renewable LDPE compared to conventional options may slow adoption rates.

Another major challenge lies in the inconsistent quality and composition of renewable feedstocks. Unlike petroleum-based raw materials, which have relatively uniform characteristics, renewable sources such as biomass can vary significantly in their chemical makeup depending on factors like geographic origin, growing conditions, and harvesting methods. This variability complicates the production process and makes it challenging to maintain consistent product quality.

The conversion efficiency of renewable feedstocks into LDPE is also a significant hurdle. Current technologies for transforming biomass or other renewable sources into ethylene, the primary building block for LDPE, often have lower yields compared to traditional petrochemical routes. This inefficiency not only increases production costs but also raises questions about the overall sustainability of the process.

Environmental concerns present another set of challenges. While renewable feedstocks are often touted as more environmentally friendly, the cultivation and processing of these materials can have significant ecological impacts. Issues such as land use change, water consumption, and the use of fertilizers and pesticides in biomass production need to be carefully considered and addressed to ensure that renewable LDPE truly offers environmental benefits over its fossil fuel-based counterpart.

Technical limitations in processing renewable feedstocks also pose challenges. Many existing LDPE production facilities are designed specifically for petroleum-based raw materials, and retrofitting these plants to handle renewable feedstocks can be complex and costly. Additionally, renewable feedstocks may contain impurities or compounds that are not present in traditional raw materials, necessitating the development of new purification and processing techniques.

Scalability remains a significant challenge for renewable LDPE production. While small-scale or pilot projects have demonstrated the feasibility of using renewable feedstocks, scaling up to commercial production levels presents numerous technical and logistical hurdles. These include securing a stable and sufficient supply of renewable raw materials, optimizing large-scale production processes, and managing the increased complexity of supply chains.

Regulatory and market acceptance issues also contribute to the challenges faced by renewable LDPE production. Varying regulations across different regions regarding the use of renewable materials in packaging and other applications can create barriers to market entry. Moreover, consumer and industry perceptions about the performance and reliability of renewable LDPE compared to conventional options may slow adoption rates.

Existing Renewable Feedstock Solutions for LDPE

01 Composition and properties of LDPE

Low-Density Polyethylene (LDPE) is a thermoplastic polymer with a low density and high flexibility. It is characterized by its branched molecular structure, which results in lower crystallinity and density compared to other polyethylene types. LDPE exhibits good chemical resistance, electrical insulation properties, and processability, making it suitable for various applications.- Composition and properties of LDPE: Low-Density Polyethylene (LDPE) is a thermoplastic polymer with a low density and high flexibility. It is characterized by its branched molecular structure, which results in lower crystallinity and density compared to other polyethylene types. LDPE exhibits good chemical resistance, electrical insulation properties, and processability, making it suitable for various applications.

- Manufacturing processes for LDPE: LDPE is typically produced through high-pressure polymerization of ethylene using free-radical initiators. Various manufacturing techniques have been developed to improve the production efficiency and control the properties of LDPE. These may include modifications to reactor design, catalyst systems, and process conditions to achieve desired molecular weight distribution and branching characteristics.

- Applications of LDPE in packaging: LDPE is widely used in the packaging industry due to its flexibility, transparency, and moisture resistance. It is commonly employed in the production of plastic bags, food packaging films, and squeeze bottles. Recent developments focus on improving the barrier properties and recyclability of LDPE packaging materials to meet sustainability requirements.

- LDPE blends and composites: Research in LDPE technology includes the development of blends and composites to enhance its properties. By combining LDPE with other polymers or additives, improved mechanical strength, thermal stability, or specific functional properties can be achieved. These modified materials find applications in various sectors, including automotive, construction, and consumer goods.

- Recycling and sustainability of LDPE: With increasing focus on environmental sustainability, efforts are being made to improve the recycling and biodegradability of LDPE. This includes developing more efficient recycling processes, incorporating biodegradable additives, and creating LDPE grades that are more compatible with existing recycling streams. Research also explores the use of bio-based feedstocks for LDPE production to reduce reliance on fossil fuels.

02 Manufacturing processes for LDPE

LDPE is typically produced through high-pressure polymerization of ethylene using free-radical initiators. Various manufacturing techniques have been developed to improve the production efficiency and control the properties of LDPE. These may include modifications to reactor design, catalyst systems, and process conditions to achieve desired molecular weight distribution and branching characteristics.Expand Specific Solutions03 Applications of LDPE in packaging

LDPE is widely used in the packaging industry due to its flexibility, transparency, and moisture resistance. It is commonly employed in the production of plastic bags, food packaging films, and squeeze bottles. Recent innovations focus on improving the barrier properties and recyclability of LDPE packaging materials to meet sustainability requirements.Expand Specific Solutions04 LDPE blends and composites

To enhance the performance of LDPE, it is often blended with other polymers or reinforced with various fillers and additives. These blends and composites can exhibit improved mechanical properties, thermal stability, or specific functionalities. Research in this area aims to develop novel LDPE-based materials with tailored characteristics for specialized applications.Expand Specific Solutions05 Recycling and sustainability of LDPE

As environmental concerns grow, there is an increasing focus on the recycling and sustainable use of LDPE. Efforts are being made to develop more efficient recycling processes, improve the quality of recycled LDPE, and explore biodegradable or bio-based alternatives. This includes research into chemical recycling methods and the incorporation of recycled LDPE into new products.Expand Specific Solutions

Key Players in Renewable LDPE Industry

The renewable feedstock market for LDPE production is in its early growth stage, with increasing interest driven by sustainability goals. The market size is expanding, though still relatively small compared to traditional petrochemical-based LDPE production. Technological maturity varies among players, with companies like Neste, Braskem, and BASF leading in bio-based plastics development. ExxonMobil and Dow are leveraging their petrochemical expertise to explore renewable feedstocks, while newer entrants like Novita Nutrition focus on specific bio-based inputs. Overall, the competitive landscape is dynamic, with both established petrochemical giants and innovative startups vying for position in this emerging field.

Neste Oyj

Technical Solution: Neste has pioneered the use of waste and residue oils and fats as renewable feedstocks for plastics production, including LDPE. Their NEXBTL technology converts these feedstocks into high-quality renewable hydrocarbons, which can be used to produce bio-based plastics[7]. Neste's process is particularly innovative as it can utilize low-quality waste streams that are not suitable for food production, addressing concerns about competition with food resources. The company has partnered with several major plastic producers to integrate their renewable feedstocks into existing production lines, demonstrating the scalability of their approach[8]. Neste's renewable plastics have been shown to reduce greenhouse gas emissions by up to 80% over the life cycle compared to fossil-based alternatives[9].

Strengths: Utilization of waste streams, significant carbon footprint reduction, and compatibility with existing production infrastructure. Weaknesses: Limited by the availability of suitable waste feedstocks and potential competition for these resources.

ExxonMobil Technology & Engineering Co.

Technical Solution: ExxonMobil has been exploring advanced recycling technologies to produce LDPE from renewable and recycled feedstocks. Their proprietary Exxtend™ technology focuses on breaking down plastic waste into molecular building blocks, which can then be used to create new LDPE with properties identical to virgin materials[13]. The company has also invested in research on bio-based feedstocks, including algae-based plastics, which could potentially serve as a renewable source for LDPE production[14]. ExxonMobil's approach combines chemical recycling with renewable feedstock integration, aiming to reduce the carbon footprint of LDPE while maintaining product quality and performance. The company has announced plans to scale up its advanced recycling capacity to 500,000 metric tons per year by the end of 2026[15].

Strengths: Integration of recycling and renewable feedstocks, potential for closed-loop plastic production, and maintained product quality. Weaknesses: High energy requirements for chemical recycling processes and dependence on the development of efficient algae cultivation techniques for bio-based feedstocks.

Innovative Approaches in Renewable LDPE Synthesis

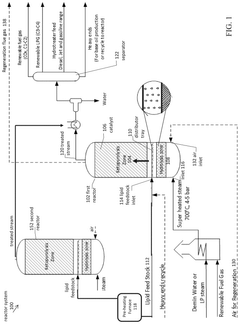

Renewable fuels, diesel and methods of generation from renewable oil sources

PatentWO2023147174A1

Innovation

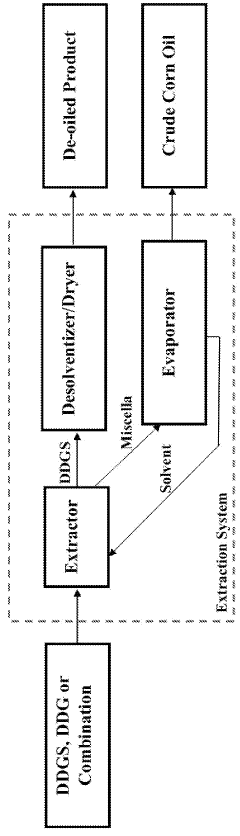

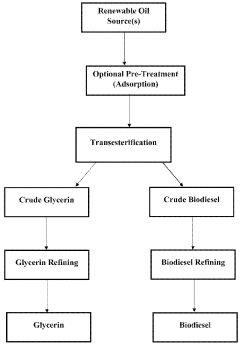

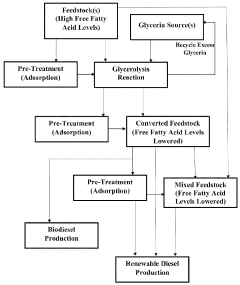

- A process involving glycerolysis of renewable oil feedstocks, particularly crude corn oil from DDGS and DDG, in the presence of a molar excess of glycerin to reduce FFA content, converting triglycerides to monoglycerides and diglycerides, thereby creating a feedstock suitable for renewable fuel production.

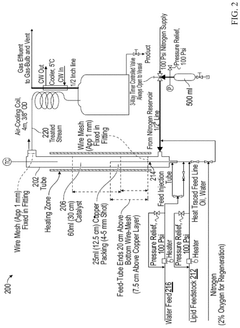

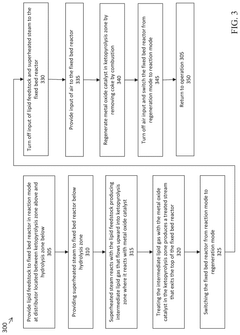

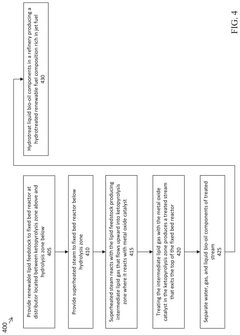

Intermediate and hydrotreated fuel compositions from renewable lipid feedstocks

PatentPendingUS20250027000A1

Innovation

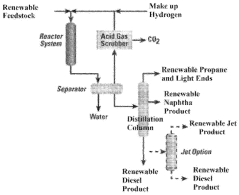

- A renewable fuel intermediate composition is produced through a process involving a fixed bed reactor with a ketopyrolysis zone and a hydrolysis zone, using a metal oxide catalyst on an oxide support, and treating a lipid feedstock with superheated steam to produce a renewable fuel intermediate composition that can be further hydrotreated.

Environmental Impact Assessment

The environmental impact assessment of exploring renewable feedstocks for LDPE production reveals significant potential for reducing the carbon footprint and overall environmental burden associated with traditional petrochemical-based production methods. Renewable feedstocks, such as biomass-derived ethanol or plant-based oils, offer a more sustainable alternative to fossil fuel-based raw materials.

One of the primary environmental benefits of using renewable feedstocks is the reduction in greenhouse gas emissions. Life cycle assessments have shown that LDPE produced from renewable sources can achieve up to 70% lower carbon emissions compared to conventional petroleum-based LDPE. This reduction is primarily due to the carbon sequestration that occurs during the growth of the biomass feedstock, effectively offsetting a significant portion of the emissions released during production and use.

Water consumption and pollution are also critical factors to consider. While some renewable feedstocks may require irrigation during cultivation, advanced agricultural practices and the selection of drought-resistant crops can mitigate water usage concerns. Additionally, the production process for renewable LDPE typically generates fewer toxic byproducts and wastewater contaminants compared to traditional petrochemical processes, leading to reduced water pollution risks.

Land use change is an important consideration when assessing the environmental impact of renewable feedstocks. The expansion of cropland for feedstock production could potentially lead to deforestation or the conversion of natural habitats. However, careful land management practices and the use of marginal or degraded lands for feedstock cultivation can minimize these negative impacts while potentially improving soil quality and biodiversity in certain areas.

Biodegradability and end-of-life considerations also favor renewable feedstocks. While LDPE itself is not biodegradable regardless of its source, the use of renewable feedstocks opens up possibilities for developing more environmentally friendly disposal methods or recycling processes that are better aligned with circular economy principles.

Energy efficiency in the production process is another area where renewable feedstocks show promise. As technologies for converting biomass to LDPE precursors improve, the energy requirements for production are expected to decrease, further enhancing the environmental benefits of this approach.

In conclusion, the environmental impact assessment of renewable feedstocks for LDPE production indicates a generally positive outlook, with significant potential for reducing environmental harm compared to traditional methods. However, careful consideration must be given to land use, water management, and production efficiencies to fully realize these benefits and ensure a truly sustainable production model.

One of the primary environmental benefits of using renewable feedstocks is the reduction in greenhouse gas emissions. Life cycle assessments have shown that LDPE produced from renewable sources can achieve up to 70% lower carbon emissions compared to conventional petroleum-based LDPE. This reduction is primarily due to the carbon sequestration that occurs during the growth of the biomass feedstock, effectively offsetting a significant portion of the emissions released during production and use.

Water consumption and pollution are also critical factors to consider. While some renewable feedstocks may require irrigation during cultivation, advanced agricultural practices and the selection of drought-resistant crops can mitigate water usage concerns. Additionally, the production process for renewable LDPE typically generates fewer toxic byproducts and wastewater contaminants compared to traditional petrochemical processes, leading to reduced water pollution risks.

Land use change is an important consideration when assessing the environmental impact of renewable feedstocks. The expansion of cropland for feedstock production could potentially lead to deforestation or the conversion of natural habitats. However, careful land management practices and the use of marginal or degraded lands for feedstock cultivation can minimize these negative impacts while potentially improving soil quality and biodiversity in certain areas.

Biodegradability and end-of-life considerations also favor renewable feedstocks. While LDPE itself is not biodegradable regardless of its source, the use of renewable feedstocks opens up possibilities for developing more environmentally friendly disposal methods or recycling processes that are better aligned with circular economy principles.

Energy efficiency in the production process is another area where renewable feedstocks show promise. As technologies for converting biomass to LDPE precursors improve, the energy requirements for production are expected to decrease, further enhancing the environmental benefits of this approach.

In conclusion, the environmental impact assessment of renewable feedstocks for LDPE production indicates a generally positive outlook, with significant potential for reducing environmental harm compared to traditional methods. However, careful consideration must be given to land use, water management, and production efficiencies to fully realize these benefits and ensure a truly sustainable production model.

Regulatory Framework for Bio-based Plastics

The regulatory framework for bio-based plastics is evolving rapidly as governments and international organizations recognize the potential of these materials to reduce environmental impact and promote sustainability. In the context of exploring renewable feedstocks for LDPE production, understanding the current and emerging regulations is crucial for industry stakeholders.

At the European Union level, the European Commission has implemented several directives and regulations that impact the production and use of bio-based plastics. The Renewable Energy Directive (RED II) promotes the use of renewable resources in various sectors, including plastics production. Additionally, the EU Plastics Strategy aims to increase the uptake of recycled and bio-based plastics while reducing single-use plastic consumption.

In the United States, the USDA BioPreferred Program encourages the development and use of bio-based products, including plastics. This program provides certification and labeling for products that meet specific bio-based content requirements, potentially offering market advantages for LDPE produced from renewable feedstocks.

Many countries have implemented or are considering implementing plastic bag bans or taxes, which could create opportunities for bio-based LDPE alternatives. For instance, France has banned single-use plastic bags, with exceptions for compostable bags made from bio-based materials.

Certification schemes play a crucial role in the regulatory landscape for bio-based plastics. Organizations such as TÜV Austria and DIN CERTCO offer certifications for bio-based and biodegradable plastics, providing a standardized approach to verifying claims and ensuring product quality.

The regulatory framework also addresses end-of-life considerations for bio-based plastics. The EU's Waste Framework Directive and Packaging and Packaging Waste Directive set targets for recycling and recovery of plastic waste, including bio-based plastics. These regulations aim to promote circular economy principles and reduce the environmental impact of plastic waste.

As the industry moves towards renewable feedstocks for LDPE production, companies must navigate complex and sometimes conflicting regulations across different regions. Harmonization efforts are underway to create more consistent standards and definitions for bio-based plastics, which could facilitate international trade and market growth.

Emerging regulations are focusing on life cycle assessments (LCA) and carbon footprint calculations for bio-based plastics. These regulations aim to ensure that the environmental benefits of using renewable feedstocks are realized throughout the entire product lifecycle, from raw material sourcing to end-of-life management.

At the European Union level, the European Commission has implemented several directives and regulations that impact the production and use of bio-based plastics. The Renewable Energy Directive (RED II) promotes the use of renewable resources in various sectors, including plastics production. Additionally, the EU Plastics Strategy aims to increase the uptake of recycled and bio-based plastics while reducing single-use plastic consumption.

In the United States, the USDA BioPreferred Program encourages the development and use of bio-based products, including plastics. This program provides certification and labeling for products that meet specific bio-based content requirements, potentially offering market advantages for LDPE produced from renewable feedstocks.

Many countries have implemented or are considering implementing plastic bag bans or taxes, which could create opportunities for bio-based LDPE alternatives. For instance, France has banned single-use plastic bags, with exceptions for compostable bags made from bio-based materials.

Certification schemes play a crucial role in the regulatory landscape for bio-based plastics. Organizations such as TÜV Austria and DIN CERTCO offer certifications for bio-based and biodegradable plastics, providing a standardized approach to verifying claims and ensuring product quality.

The regulatory framework also addresses end-of-life considerations for bio-based plastics. The EU's Waste Framework Directive and Packaging and Packaging Waste Directive set targets for recycling and recovery of plastic waste, including bio-based plastics. These regulations aim to promote circular economy principles and reduce the environmental impact of plastic waste.

As the industry moves towards renewable feedstocks for LDPE production, companies must navigate complex and sometimes conflicting regulations across different regions. Harmonization efforts are underway to create more consistent standards and definitions for bio-based plastics, which could facilitate international trade and market growth.

Emerging regulations are focusing on life cycle assessments (LCA) and carbon footprint calculations for bio-based plastics. These regulations aim to ensure that the environmental benefits of using renewable feedstocks are realized throughout the entire product lifecycle, from raw material sourcing to end-of-life management.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!