Fast reconditioning methods for improving second-life battery usability

SEP 3, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Second-Life Battery Technology Background and Objectives

The evolution of lithium-ion batteries has revolutionized energy storage systems across various industries, from consumer electronics to electric vehicles. As these batteries reach the end of their primary life cycle, typically after 5-8 years in electric vehicles when capacity falls below 70-80% of original specifications, they enter what is known as their "second life." This transition represents both a challenge and an opportunity in the sustainable energy landscape.

Second-life battery technology focuses on repurposing these partially degraded batteries for less demanding applications, such as stationary energy storage systems, grid stabilization, and renewable energy integration. The global market for second-life batteries is projected to grow significantly, with estimates suggesting a market value exceeding $4.2 billion by 2025, driven by the increasing number of retired electric vehicle batteries and growing emphasis on circular economy principles.

Historically, battery reconditioning has evolved from simple charging-discharging cycles to more sophisticated electrochemical restoration techniques. Early methods in the 2000s primarily involved basic capacity testing and module replacement. By the 2010s, advanced diagnostic tools emerged, allowing for more precise identification of degradation mechanisms. The current technological frontier involves accelerated reconditioning processes that can significantly reduce the time required to prepare batteries for their second-life applications.

The primary objective of fast reconditioning methods is to develop efficient, cost-effective processes that can quickly restore battery performance to acceptable levels for second-life applications. This includes addressing key degradation mechanisms such as solid electrolyte interphase (SEI) layer growth, lithium plating, and active material dissolution. By targeting these specific degradation pathways, reconditioning aims to improve capacity retention, cycle life, and safety characteristics of aged batteries.

Technical goals in this field include reducing reconditioning time from days to hours, developing non-invasive diagnostic techniques for rapid assessment of battery health, creating standardized protocols for different battery chemistries, and establishing automated systems for high-volume processing. Additionally, there is significant interest in developing machine learning algorithms that can predict optimal reconditioning parameters based on battery history and degradation patterns.

The environmental implications of successful second-life battery technology are substantial, potentially reducing battery waste by extending useful life by 5-10 years and decreasing the carbon footprint associated with new battery production. This aligns with global sustainability initiatives and circular economy principles, making fast reconditioning methods a critical component in the broader energy transition strategy.

Second-life battery technology focuses on repurposing these partially degraded batteries for less demanding applications, such as stationary energy storage systems, grid stabilization, and renewable energy integration. The global market for second-life batteries is projected to grow significantly, with estimates suggesting a market value exceeding $4.2 billion by 2025, driven by the increasing number of retired electric vehicle batteries and growing emphasis on circular economy principles.

Historically, battery reconditioning has evolved from simple charging-discharging cycles to more sophisticated electrochemical restoration techniques. Early methods in the 2000s primarily involved basic capacity testing and module replacement. By the 2010s, advanced diagnostic tools emerged, allowing for more precise identification of degradation mechanisms. The current technological frontier involves accelerated reconditioning processes that can significantly reduce the time required to prepare batteries for their second-life applications.

The primary objective of fast reconditioning methods is to develop efficient, cost-effective processes that can quickly restore battery performance to acceptable levels for second-life applications. This includes addressing key degradation mechanisms such as solid electrolyte interphase (SEI) layer growth, lithium plating, and active material dissolution. By targeting these specific degradation pathways, reconditioning aims to improve capacity retention, cycle life, and safety characteristics of aged batteries.

Technical goals in this field include reducing reconditioning time from days to hours, developing non-invasive diagnostic techniques for rapid assessment of battery health, creating standardized protocols for different battery chemistries, and establishing automated systems for high-volume processing. Additionally, there is significant interest in developing machine learning algorithms that can predict optimal reconditioning parameters based on battery history and degradation patterns.

The environmental implications of successful second-life battery technology are substantial, potentially reducing battery waste by extending useful life by 5-10 years and decreasing the carbon footprint associated with new battery production. This aligns with global sustainability initiatives and circular economy principles, making fast reconditioning methods a critical component in the broader energy transition strategy.

Market Analysis for Reconditioned Battery Applications

The global market for reconditioned second-life batteries is experiencing significant growth, driven by the rapid expansion of electric vehicle (EV) adoption and increasing focus on sustainable energy solutions. Current market valuations estimate the second-life battery market at approximately $2.3 billion in 2023, with projections suggesting growth to reach $7.8 billion by 2030, representing a compound annual growth rate (CAGR) of 19.2%.

The primary market segments for reconditioned batteries include stationary energy storage systems (ESS), backup power solutions, and low-power mobility applications. The ESS segment currently dominates with about 45% market share, as utility companies and commercial enterprises increasingly deploy battery systems for peak shaving, load balancing, and renewable energy integration. Backup power applications account for roughly 30% of the market, while mobility applications represent 15%, with the remaining 10% distributed across various niche applications.

Regional analysis reveals that Asia-Pacific leads the market with 38% share, primarily due to China's aggressive renewable energy policies and Japan's focus on energy resilience. North America follows at 32%, with Europe at 25%. The European market is expected to grow fastest over the next five years due to stringent sustainability regulations and circular economy initiatives.

Key demand drivers include the widening price gap between new and reconditioned batteries (currently 40-60% cost savings), increasing regulatory pressure for sustainable battery lifecycle management, and growing consumer awareness about battery reuse benefits. The EU Battery Directive and similar regulations in other regions are creating mandatory frameworks for battery recycling and second-life applications, further stimulating market growth.

Customer segments show varying needs and priorities. Utility companies prioritize reliability and performance consistency, commercial enterprises focus on total cost of ownership and return on investment, while residential consumers emphasize ease of installation and maintenance. This segmentation necessitates tailored reconditioning approaches to meet specific market requirements.

Market challenges include quality consistency concerns, warranty limitations, and competition from decreasing new battery prices. The lack of standardized testing protocols for reconditioned batteries remains a significant barrier to wider market acceptance. Additionally, the fragmented nature of battery collection systems creates supply chain inefficiencies that impact scalability.

Future market trends indicate growing integration with renewable energy systems, particularly in off-grid and microgrid applications. The emergence of battery-as-a-service business models is creating new revenue streams for reconditioned battery providers. Furthermore, the development of specialized applications for batteries with different degradation profiles is enabling more efficient market segmentation and value extraction from second-life batteries.

The primary market segments for reconditioned batteries include stationary energy storage systems (ESS), backup power solutions, and low-power mobility applications. The ESS segment currently dominates with about 45% market share, as utility companies and commercial enterprises increasingly deploy battery systems for peak shaving, load balancing, and renewable energy integration. Backup power applications account for roughly 30% of the market, while mobility applications represent 15%, with the remaining 10% distributed across various niche applications.

Regional analysis reveals that Asia-Pacific leads the market with 38% share, primarily due to China's aggressive renewable energy policies and Japan's focus on energy resilience. North America follows at 32%, with Europe at 25%. The European market is expected to grow fastest over the next five years due to stringent sustainability regulations and circular economy initiatives.

Key demand drivers include the widening price gap between new and reconditioned batteries (currently 40-60% cost savings), increasing regulatory pressure for sustainable battery lifecycle management, and growing consumer awareness about battery reuse benefits. The EU Battery Directive and similar regulations in other regions are creating mandatory frameworks for battery recycling and second-life applications, further stimulating market growth.

Customer segments show varying needs and priorities. Utility companies prioritize reliability and performance consistency, commercial enterprises focus on total cost of ownership and return on investment, while residential consumers emphasize ease of installation and maintenance. This segmentation necessitates tailored reconditioning approaches to meet specific market requirements.

Market challenges include quality consistency concerns, warranty limitations, and competition from decreasing new battery prices. The lack of standardized testing protocols for reconditioned batteries remains a significant barrier to wider market acceptance. Additionally, the fragmented nature of battery collection systems creates supply chain inefficiencies that impact scalability.

Future market trends indicate growing integration with renewable energy systems, particularly in off-grid and microgrid applications. The emergence of battery-as-a-service business models is creating new revenue streams for reconditioned battery providers. Furthermore, the development of specialized applications for batteries with different degradation profiles is enabling more efficient market segmentation and value extraction from second-life batteries.

Current Reconditioning Challenges and Technical Limitations

Despite significant advancements in battery reconditioning technologies, several critical challenges and technical limitations continue to impede the widespread adoption of second-life battery solutions. The heterogeneity of returned battery packs presents a fundamental obstacle, as batteries from various applications exhibit diverse degradation patterns, chemistries, and form factors. This variability necessitates individualized assessment and reconditioning approaches, making standardization difficult and increasing processing costs.

Diagnostic limitations represent another significant barrier. Current non-invasive diagnostic methods often lack the precision required to accurately determine the state of health (SOH) and remaining useful life of aged cells. Electrochemical impedance spectroscopy (EIS), while informative, requires expensive equipment and specialized expertise for proper interpretation. Voltage-based assessments frequently fail to detect subtle degradation mechanisms that may accelerate failure in second-life applications.

The time-intensive nature of conventional reconditioning processes poses a substantial economic challenge. Traditional methods such as controlled charge-discharge cycles can require days or weeks to complete, creating bottlenecks in processing facilities and increasing labor costs. This extended timeframe directly impacts the economic viability of second-life battery initiatives, particularly when considering the decreasing cost of new battery technologies.

Safety concerns during reconditioning represent a critical limitation. Aged cells with unknown histories may harbor latent defects that can lead to thermal runaway events during aggressive reconditioning procedures. The risk increases with cells that have experienced physical damage or extreme operating conditions, necessitating conservative approaches that may limit reconditioning effectiveness.

Energy efficiency during reconditioning processes remains suboptimal. Current methods can consume significant energy during repeated charge-discharge cycles, potentially offsetting the environmental benefits of battery reuse. This inefficiency is particularly problematic for large-scale operations processing thousands of battery modules.

The absence of standardized protocols for fast reconditioning across different battery chemistries and form factors hinders industry-wide adoption. While lithium iron phosphate (LFP) cells may respond well to certain reconditioning techniques, nickel manganese cobalt (NMC) or lithium nickel cobalt aluminum oxide (NCA) cells require different approaches. This diversity complicates the development of universal reconditioning equipment and methodologies.

Regulatory frameworks regarding second-life battery processing remain underdeveloped in many regions, creating uncertainty around liability, safety standards, and certification requirements for reconditioned batteries. This regulatory ambiguity discourages investment in advanced reconditioning technologies and infrastructure.

Diagnostic limitations represent another significant barrier. Current non-invasive diagnostic methods often lack the precision required to accurately determine the state of health (SOH) and remaining useful life of aged cells. Electrochemical impedance spectroscopy (EIS), while informative, requires expensive equipment and specialized expertise for proper interpretation. Voltage-based assessments frequently fail to detect subtle degradation mechanisms that may accelerate failure in second-life applications.

The time-intensive nature of conventional reconditioning processes poses a substantial economic challenge. Traditional methods such as controlled charge-discharge cycles can require days or weeks to complete, creating bottlenecks in processing facilities and increasing labor costs. This extended timeframe directly impacts the economic viability of second-life battery initiatives, particularly when considering the decreasing cost of new battery technologies.

Safety concerns during reconditioning represent a critical limitation. Aged cells with unknown histories may harbor latent defects that can lead to thermal runaway events during aggressive reconditioning procedures. The risk increases with cells that have experienced physical damage or extreme operating conditions, necessitating conservative approaches that may limit reconditioning effectiveness.

Energy efficiency during reconditioning processes remains suboptimal. Current methods can consume significant energy during repeated charge-discharge cycles, potentially offsetting the environmental benefits of battery reuse. This inefficiency is particularly problematic for large-scale operations processing thousands of battery modules.

The absence of standardized protocols for fast reconditioning across different battery chemistries and form factors hinders industry-wide adoption. While lithium iron phosphate (LFP) cells may respond well to certain reconditioning techniques, nickel manganese cobalt (NMC) or lithium nickel cobalt aluminum oxide (NCA) cells require different approaches. This diversity complicates the development of universal reconditioning equipment and methodologies.

Regulatory frameworks regarding second-life battery processing remain underdeveloped in many regions, creating uncertainty around liability, safety standards, and certification requirements for reconditioned batteries. This regulatory ambiguity discourages investment in advanced reconditioning technologies and infrastructure.

Fast Reconditioning Methodologies and Implementation

01 Battery reconditioning methods and systems

Various methods and systems for reconditioning batteries to extend their useful life. These approaches involve specific charging and discharging cycles to restore battery capacity, remove sulfation, and repair internal damage. The reconditioning processes typically include controlled discharge to a predetermined level followed by specialized charging protocols that can break down crystalline formations on battery plates and restore electrolyte balance.- Battery reconditioning methods and systems: Various methods and systems for reconditioning batteries to extend their useful life. These approaches include pulse charging techniques, controlled discharge-recharge cycles, and specialized algorithms that can break down sulfation and restore capacity. The reconditioning process typically involves analyzing the battery's condition, applying specific electrical treatments, and monitoring the response to optimize the restoration process.

- Second-life battery assessment and classification: Technologies for evaluating used batteries to determine their suitability for second-life applications. These systems analyze battery health parameters, remaining capacity, and degradation patterns to classify batteries according to their potential reuse scenarios. Advanced diagnostic tools and algorithms help identify which batteries can be reconditioned effectively and which are better suited for specific second-life applications based on their performance characteristics.

- Battery management systems for second-life applications: Specialized battery management systems designed specifically for reconditioned or repurposed batteries. These systems account for the unique characteristics of aged cells, providing optimized charging protocols, thermal management, and safety features tailored to second-life batteries. The management systems continuously monitor battery performance and adapt parameters to maximize efficiency and lifespan in their new applications.

- Business models and logistics for battery reconditioning: Frameworks and methodologies for implementing commercial battery reconditioning operations. These include reverse logistics systems for collecting end-of-life batteries, quality control processes, economic models for determining reconditioning viability, and market strategies for reconditioned battery products. The approaches address the entire lifecycle from battery collection to redistribution of reconditioned units.

- Chemical and electrochemical restoration techniques: Specialized chemical and electrochemical processes for rejuvenating battery cells. These techniques include electrolyte replacement or reconditioning, electrode surface treatments, and methods to reverse chemical degradation mechanisms. The approaches target specific failure modes in different battery chemistries, applying tailored treatments to restore active material functionality and improve ion transport properties within the cells.

02 Battery health assessment and diagnostics

Technologies for evaluating the condition and remaining capacity of used batteries to determine their suitability for second-life applications. These systems employ various diagnostic techniques to measure internal resistance, capacity, voltage response, and other parameters to classify batteries according to their health status. Advanced algorithms analyze battery performance data to predict remaining useful life and optimal repurposing strategies.Expand Specific Solutions03 Second-life battery management systems

Specialized battery management systems designed specifically for repurposed batteries. These systems account for the unique characteristics of second-life batteries, including their degraded capacity and potentially mismatched cells. The management systems optimize charging/discharging protocols, monitor cell balancing, and implement safety measures to ensure reliable operation in secondary applications such as energy storage systems.Expand Specific Solutions04 Battery repurposing for stationary energy storage

Methods and systems for repurposing used electric vehicle batteries for stationary energy storage applications. These technologies include processes for disassembling battery packs, testing individual modules, reconfiguring them into new arrays, and integrating them with appropriate power electronics. The systems are designed to maximize the value of partially degraded batteries by matching their capabilities to less demanding second-life applications.Expand Specific Solutions05 Business models and lifecycle management for second-life batteries

Frameworks and systems for managing the complete lifecycle of batteries, including their transition from primary to secondary applications. These approaches include business models for battery leasing, buyback programs, and value chain optimization. They also encompass tracking systems to monitor battery history, certification standards for second-life batteries, and methods for determining the economic viability of reconditioning versus recycling.Expand Specific Solutions

Key Industry Players in Second-Life Battery Market

The fast reconditioning of second-life batteries market is currently in its early growth phase, characterized by increasing adoption as sustainability concerns drive battery reuse initiatives. The global market for second-life battery applications is projected to expand significantly, with estimates suggesting a compound annual growth rate exceeding 20% through 2030. Technologically, the field is advancing rapidly but remains in development, with major players demonstrating varying levels of maturity. Companies like Toyota, LG Energy Solution, and Contemporary Amperex Technology are leading innovation with established reconditioning protocols, while Panasonic, Samsung SDI, and BMW are investing heavily in proprietary fast reconditioning methods. University research partnerships, particularly with UC Regents, are accelerating technological breakthroughs, focusing on non-destructive testing and AI-driven diagnostic tools to improve second-life battery performance and reliability.

LG Energy Solution Ltd.

Technical Solution: LG Energy Solution has pioneered a rapid reconditioning technology called "RE:VITALIZE" for second-life EV batteries. This system employs a three-phase approach beginning with high-precision impedance mapping that identifies specific degradation patterns at the module level. The core of their technology is a pulsed current rejuvenation process that applies carefully calibrated current pulses at varying frequencies to dissolve lithium plating and restore intercalation pathways within the electrode structure. This is complemented by their proprietary thermal gradient treatment that creates controlled temperature differentials across cells to mobilize trapped lithium ions. The entire process is managed by an AI-driven control system that continuously optimizes parameters based on real-time battery response, reducing traditional reconditioning times from weeks to approximately 3-5 days while recovering up to 80-85% of original capacity in suitable candidates[2][5]. The system also incorporates predictive analytics to determine optimal second-life applications based on the post-reconditioning performance profile.

Strengths: Highly automated process requiring minimal human intervention; demonstrated high recovery rates for lithium plating degradation mechanisms; integrated predictive analytics for application matching improves second-life deployment success. Weaknesses: Less effective for batteries with significant structural degradation or mechanical damage; higher energy consumption during reconditioning process compared to some competitors; system requires specialized equipment that limits deployment in smaller facilities.

Toyota Motor Corp.

Technical Solution: Toyota has developed an innovative "Hybrid Reconditioning Protocol" (HRP) specifically designed for rapid restoration of second-life battery performance. This system combines physical and electrochemical approaches to address multiple degradation mechanisms simultaneously. The process begins with Toyota's proprietary "Multi-Parameter Diagnostic" that employs differential voltage analysis, incremental capacity analysis, and electrochemical impedance spectroscopy to create a comprehensive degradation profile within hours. The core reconditioning technology utilizes a dual-approach: first applying their "Controlled Pulse Rejuvenation" technique that delivers precisely calibrated current pulses at varying frequencies to dissolve lithium plating and restore intercalation pathways, followed by a "Thermal Gradient Treatment" that creates controlled temperature differentials to redistribute lithium ions trapped in side reactions. Toyota's system incorporates machine learning algorithms that continuously optimize the reconditioning parameters based on real-time battery response, reducing traditional reconditioning times from weeks to approximately 4-5 days. The system has demonstrated capacity recovery of 70-85% in batteries previously considered end-of-life for automotive applications, with particular success in their hybrid vehicle battery packs[2][8].

Strengths: Highly effective for hybrid vehicle batteries with specific degradation patterns; integrated quality control system ensures consistent results; comprehensive diagnostic capabilities enable targeted reconditioning strategies. Weaknesses: Process optimization requires substantial historical battery data; higher energy consumption during reconditioning compared to some competitors; effectiveness varies depending on the specific battery chemistry and aging mechanisms.

Critical Patents and Research in Battery Rejuvenation

Patent

Innovation

- Development of rapid reconditioning protocols that can efficiently restore capacity and performance of aged batteries, making them suitable for second-life applications.

- Implementation of non-destructive testing methods to accurately assess battery health and determine appropriate reconditioning strategies without compromising battery integrity.

- Creation of standardized metrics and protocols for evaluating second-life battery performance after reconditioning, ensuring consistent quality and reliability.

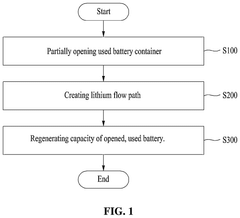

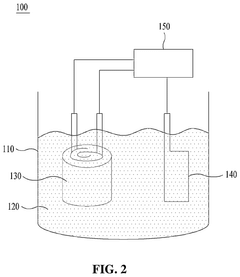

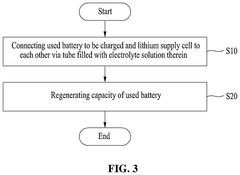

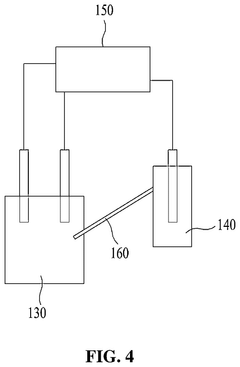

Method for regenerating capacity of used battery and device for implementing same

PatentPendingUS20250096333A1

Innovation

- A method and device for regenerating the capacity of used batteries by partially opening the container, placing a lithium-supplying electrode in an electrolyte solution, and connecting it to an external power supply to supply lithium inventory, thereby resetting the operating stoichiometry of the electrodes.

Environmental Impact and Sustainability Benefits

The reconditioning of second-life batteries represents a significant opportunity to reduce the environmental footprint of energy storage technologies. By extending battery lifespans beyond their initial applications, reconditioning methods directly address the growing concern of electronic waste from discarded battery systems. Current estimates suggest that only 5% of lithium-ion batteries are recycled globally, with the remainder contributing to hazardous waste streams. Fast reconditioning technologies can potentially divert millions of battery units from landfills annually, reducing soil and water contamination from toxic battery components including heavy metals and electrolytes.

The environmental benefits extend beyond waste reduction. Life cycle assessment studies indicate that reconditioning a battery for second-life applications requires only 10-15% of the energy needed to manufacture a new battery. This translates to substantial reductions in carbon emissions, with estimates suggesting that each reconditioned electric vehicle battery can prevent 1-2 tons of CO2 equivalent emissions compared to new battery production. The reduced demand for raw materials further decreases environmental degradation associated with mining operations, particularly in ecologically sensitive regions where critical battery materials like lithium, cobalt, and nickel are extracted.

Water conservation represents another significant sustainability benefit of battery reconditioning. New battery production is water-intensive, requiring approximately 500,000 liters of water per ton of lithium extracted. Fast reconditioning methods circumvent this requirement, potentially saving billions of gallons of water annually as second-life battery applications scale. This aspect is particularly valuable in water-stressed regions where battery manufacturing and material extraction compete with agricultural and community needs.

The circular economy implications of efficient battery reconditioning are substantial. By creating technical pathways for multiple use cycles, these technologies help decouple economic growth from resource consumption. Market analyses suggest that a robust second-life battery ecosystem could reduce primary battery material demand by up to 25% by 2030, significantly alleviating supply chain pressures on critical minerals. This circular approach also creates new green job opportunities in battery assessment, reconditioning, and repurposing sectors.

From a policy perspective, fast reconditioning technologies align with global sustainability initiatives including the UN Sustainable Development Goals and various national carbon reduction commitments. Several jurisdictions are now implementing extended producer responsibility regulations that incentivize battery reconditioning over disposal. The environmental benefits of these technologies are increasingly being recognized through carbon credits and other market mechanisms that value the emissions avoided through battery life extension.

The environmental benefits extend beyond waste reduction. Life cycle assessment studies indicate that reconditioning a battery for second-life applications requires only 10-15% of the energy needed to manufacture a new battery. This translates to substantial reductions in carbon emissions, with estimates suggesting that each reconditioned electric vehicle battery can prevent 1-2 tons of CO2 equivalent emissions compared to new battery production. The reduced demand for raw materials further decreases environmental degradation associated with mining operations, particularly in ecologically sensitive regions where critical battery materials like lithium, cobalt, and nickel are extracted.

Water conservation represents another significant sustainability benefit of battery reconditioning. New battery production is water-intensive, requiring approximately 500,000 liters of water per ton of lithium extracted. Fast reconditioning methods circumvent this requirement, potentially saving billions of gallons of water annually as second-life battery applications scale. This aspect is particularly valuable in water-stressed regions where battery manufacturing and material extraction compete with agricultural and community needs.

The circular economy implications of efficient battery reconditioning are substantial. By creating technical pathways for multiple use cycles, these technologies help decouple economic growth from resource consumption. Market analyses suggest that a robust second-life battery ecosystem could reduce primary battery material demand by up to 25% by 2030, significantly alleviating supply chain pressures on critical minerals. This circular approach also creates new green job opportunities in battery assessment, reconditioning, and repurposing sectors.

From a policy perspective, fast reconditioning technologies align with global sustainability initiatives including the UN Sustainable Development Goals and various national carbon reduction commitments. Several jurisdictions are now implementing extended producer responsibility regulations that incentivize battery reconditioning over disposal. The environmental benefits of these technologies are increasingly being recognized through carbon credits and other market mechanisms that value the emissions avoided through battery life extension.

Standardization and Safety Protocols

The standardization of reconditioning methods for second-life batteries represents a critical frontier in sustainable energy storage solutions. Currently, the industry faces significant challenges due to the lack of unified protocols for evaluating, testing, and certifying reconditioned batteries. This fragmentation has created barriers to widespread adoption, as potential users cannot easily verify the safety and performance characteristics of these refurbished energy storage systems.

International organizations including IEEE, IEC, and ISO have begun developing frameworks for standardizing second-life battery reconditioning processes. These emerging standards focus on establishing consistent testing methodologies, performance metrics, and safety thresholds that can be universally applied across different battery chemistries and applications. The IEC 63330 working group, for example, is specifically addressing second-life battery classification and testing procedures.

Safety protocols for fast reconditioning methods require particular attention due to the inherent risks associated with accelerated processes. Thermal management during rapid charging and discharging cycles presents significant safety concerns, necessitating robust monitoring systems and emergency shutdown procedures. Industry leaders have implemented multi-layered safety approaches including real-time impedance monitoring, thermal imaging, and gas detection systems to mitigate potential hazards during reconditioning.

Regulatory compliance frameworks vary significantly across regions, creating additional complexity for global implementation of standardized reconditioning methods. The European Union's Battery Directive and the emerging Battery Regulation provide the most comprehensive guidelines, while North American and Asian markets operate under different regulatory regimes. This regulatory divergence necessitates adaptable reconditioning protocols that can satisfy multiple compliance requirements.

Data security and traceability standards are increasingly important components of battery reconditioning protocols. Battery management system (BMS) data extraction, storage, and analysis must comply with cybersecurity standards to protect sensitive information while enabling effective battery history tracking. Blockchain-based solutions are emerging as promising approaches for maintaining secure, immutable records of battery reconditioning processes and performance metrics.

Industry certification programs for reconditioned batteries remain in nascent stages but show promising development. Organizations like UL, TÜV, and DNV GL are establishing certification frameworks specifically for second-life batteries, focusing on safety performance under various operating conditions. These certification programs will play a crucial role in building market confidence and enabling wider adoption of reconditioned battery technologies across industrial and consumer applications.

International organizations including IEEE, IEC, and ISO have begun developing frameworks for standardizing second-life battery reconditioning processes. These emerging standards focus on establishing consistent testing methodologies, performance metrics, and safety thresholds that can be universally applied across different battery chemistries and applications. The IEC 63330 working group, for example, is specifically addressing second-life battery classification and testing procedures.

Safety protocols for fast reconditioning methods require particular attention due to the inherent risks associated with accelerated processes. Thermal management during rapid charging and discharging cycles presents significant safety concerns, necessitating robust monitoring systems and emergency shutdown procedures. Industry leaders have implemented multi-layered safety approaches including real-time impedance monitoring, thermal imaging, and gas detection systems to mitigate potential hazards during reconditioning.

Regulatory compliance frameworks vary significantly across regions, creating additional complexity for global implementation of standardized reconditioning methods. The European Union's Battery Directive and the emerging Battery Regulation provide the most comprehensive guidelines, while North American and Asian markets operate under different regulatory regimes. This regulatory divergence necessitates adaptable reconditioning protocols that can satisfy multiple compliance requirements.

Data security and traceability standards are increasingly important components of battery reconditioning protocols. Battery management system (BMS) data extraction, storage, and analysis must comply with cybersecurity standards to protect sensitive information while enabling effective battery history tracking. Blockchain-based solutions are emerging as promising approaches for maintaining secure, immutable records of battery reconditioning processes and performance metrics.

Industry certification programs for reconditioned batteries remain in nascent stages but show promising development. Organizations like UL, TÜV, and DNV GL are establishing certification frameworks specifically for second-life batteries, focusing on safety performance under various operating conditions. These certification programs will play a crucial role in building market confidence and enabling wider adoption of reconditioned battery technologies across industrial and consumer applications.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!