Innovative business models for second-life battery deployment in energy markets

SEP 3, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Second-Life Battery Technology Background and Objectives

The evolution of lithium-ion batteries in electric vehicles (EVs) has created a significant opportunity for repurposing these power sources after their primary automotive life cycle. Second-life battery technology refers to the redeployment of EV batteries that have reached 70-80% of their original capacity—no longer optimal for vehicle performance but still valuable for less demanding applications such as stationary energy storage.

The historical trajectory of this technology began around 2010 when early EV models started entering the market at scale. As these vehicles age, a growing volume of batteries becomes available for second-life applications. Industry projections indicate that by 2030, over 200 GWh of second-life battery capacity could be available globally, representing a substantial untapped resource.

The technical evolution of second-life batteries has been driven by advances in battery management systems (BMS), cell balancing technologies, and diagnostic tools that enable accurate assessment of remaining battery life and performance characteristics. These developments have significantly improved the viability of repurposing EV batteries for secondary applications.

Current objectives in second-life battery deployment focus on several key areas. First, developing standardized testing and grading protocols to accurately determine battery health and remaining useful life. Second, creating efficient refurbishment processes that can economically prepare batteries for their second use while ensuring safety and reliability. Third, designing modular systems that can integrate batteries from different manufacturers and with varying degradation profiles.

From a sustainability perspective, second-life applications aim to extend battery lifecycle by 5-10 years before recycling, significantly improving the environmental footprint of lithium-ion batteries. This aligns with circular economy principles and helps address concerns about resource scarcity and waste management in the rapidly growing EV sector.

The economic objectives include creating value from what would otherwise be waste, reducing the total cost of ownership for EVs by providing residual value for batteries, and offering lower-cost energy storage solutions compared to new battery systems. Initial studies suggest second-life batteries can be deployed at 30-70% of the cost of new batteries, depending on application requirements and refurbishment needs.

Technical objectives also include addressing challenges related to safety, reliability, and performance consistency. As these batteries have undergone different usage patterns and stress factors during their first life, ensuring predictable performance in second-life applications remains a critical goal for researchers and industry stakeholders.

The historical trajectory of this technology began around 2010 when early EV models started entering the market at scale. As these vehicles age, a growing volume of batteries becomes available for second-life applications. Industry projections indicate that by 2030, over 200 GWh of second-life battery capacity could be available globally, representing a substantial untapped resource.

The technical evolution of second-life batteries has been driven by advances in battery management systems (BMS), cell balancing technologies, and diagnostic tools that enable accurate assessment of remaining battery life and performance characteristics. These developments have significantly improved the viability of repurposing EV batteries for secondary applications.

Current objectives in second-life battery deployment focus on several key areas. First, developing standardized testing and grading protocols to accurately determine battery health and remaining useful life. Second, creating efficient refurbishment processes that can economically prepare batteries for their second use while ensuring safety and reliability. Third, designing modular systems that can integrate batteries from different manufacturers and with varying degradation profiles.

From a sustainability perspective, second-life applications aim to extend battery lifecycle by 5-10 years before recycling, significantly improving the environmental footprint of lithium-ion batteries. This aligns with circular economy principles and helps address concerns about resource scarcity and waste management in the rapidly growing EV sector.

The economic objectives include creating value from what would otherwise be waste, reducing the total cost of ownership for EVs by providing residual value for batteries, and offering lower-cost energy storage solutions compared to new battery systems. Initial studies suggest second-life batteries can be deployed at 30-70% of the cost of new batteries, depending on application requirements and refurbishment needs.

Technical objectives also include addressing challenges related to safety, reliability, and performance consistency. As these batteries have undergone different usage patterns and stress factors during their first life, ensuring predictable performance in second-life applications remains a critical goal for researchers and industry stakeholders.

Energy Storage Market Demand Analysis

The global energy storage market is experiencing unprecedented growth, driven by the increasing integration of renewable energy sources, grid modernization efforts, and the push for energy independence. Market analysis indicates that the energy storage sector is projected to grow at a compound annual growth rate of 20-30% through 2030, with total deployment expected to reach hundreds of gigawatt-hours globally. This robust growth trajectory creates a fertile environment for second-life battery applications.

The demand for energy storage solutions spans multiple segments, each presenting unique opportunities for repurposed electric vehicle (EV) batteries. In the utility-scale segment, grid operators are seeking cost-effective solutions for frequency regulation, peak shaving, and renewable energy integration. Second-life batteries, available at 30-70% lower costs than new batteries, can effectively serve these applications where energy density is less critical than in automotive applications.

Commercial and industrial (C&I) customers represent another significant market segment, driven by demand charge reduction, backup power provision, and increasing adoption of on-site renewable generation. These customers are particularly price-sensitive, making the value proposition of second-life batteries especially compelling. The C&I segment is expected to be an early adopter of second-life battery solutions due to the alignment between application requirements and second-life battery capabilities.

Residential energy storage demand is also accelerating, particularly in regions with high electricity prices, unreliable grids, or favorable net metering policies. While this segment traditionally demands higher performance specifications, certain applications like home backup power or self-consumption optimization can be well-served by properly configured second-life battery systems.

Emerging markets present perhaps the most promising opportunity for second-life battery deployment. In regions with underdeveloped grid infrastructure, distributed energy resources including repurposed batteries can provide essential services while avoiding costly transmission infrastructure investments. These markets often have less stringent performance requirements and regulatory barriers, creating an ideal entry point for second-life battery business models.

Geographic analysis reveals that demand is particularly strong in regions with high renewable energy penetration (such as Germany, California, and Australia), areas with grid reliability challenges (including developing economies and island communities), and markets with favorable regulatory frameworks for energy storage (Japan, South Korea, and parts of the United States).

The demand for energy storage solutions spans multiple segments, each presenting unique opportunities for repurposed electric vehicle (EV) batteries. In the utility-scale segment, grid operators are seeking cost-effective solutions for frequency regulation, peak shaving, and renewable energy integration. Second-life batteries, available at 30-70% lower costs than new batteries, can effectively serve these applications where energy density is less critical than in automotive applications.

Commercial and industrial (C&I) customers represent another significant market segment, driven by demand charge reduction, backup power provision, and increasing adoption of on-site renewable generation. These customers are particularly price-sensitive, making the value proposition of second-life batteries especially compelling. The C&I segment is expected to be an early adopter of second-life battery solutions due to the alignment between application requirements and second-life battery capabilities.

Residential energy storage demand is also accelerating, particularly in regions with high electricity prices, unreliable grids, or favorable net metering policies. While this segment traditionally demands higher performance specifications, certain applications like home backup power or self-consumption optimization can be well-served by properly configured second-life battery systems.

Emerging markets present perhaps the most promising opportunity for second-life battery deployment. In regions with underdeveloped grid infrastructure, distributed energy resources including repurposed batteries can provide essential services while avoiding costly transmission infrastructure investments. These markets often have less stringent performance requirements and regulatory barriers, creating an ideal entry point for second-life battery business models.

Geographic analysis reveals that demand is particularly strong in regions with high renewable energy penetration (such as Germany, California, and Australia), areas with grid reliability challenges (including developing economies and island communities), and markets with favorable regulatory frameworks for energy storage (Japan, South Korea, and parts of the United States).

Current Status and Challenges in Battery Repurposing

The global landscape of battery repurposing is experiencing significant growth, with the electric vehicle (EV) battery second-life market projected to reach $7.8 billion by 2030, growing at a CAGR of 23.1%. Currently, several pioneering projects are operational across North America, Europe, and Asia, demonstrating the technical feasibility of repurposing EV batteries for stationary energy storage applications. Companies like Nissan, BMW, and Renault have established commercial-scale second-life battery installations, while specialized firms such as Connected Energy and B2U Storage Solutions have developed proprietary systems for integrating used EV batteries into grid services.

Despite these advancements, the industry faces substantial technical challenges. Battery degradation heterogeneity remains a primary concern, as cells from the same vehicle often exhibit varying states of health, complicating uniform performance in second-life applications. Current diagnostic technologies struggle to efficiently and accurately assess large quantities of used batteries, creating bottlenecks in the repurposing workflow. The lack of standardization across battery manufacturers further exacerbates these issues, as different form factors, chemistries, and battery management systems require customized integration solutions.

Regulatory frameworks present another significant barrier, with unclear end-of-life responsibilities and inconsistent classification of used batteries across jurisdictions. In many regions, batteries are still categorized as hazardous waste, imposing additional handling requirements and costs. Furthermore, the absence of established safety standards specifically for repurposed batteries creates uncertainty for project developers and potential customers.

Economic viability remains questionable under current market conditions. The processing costs for battery disassembly, testing, and reconfiguration are substantial, often ranging from $50-100 per kWh. These costs, combined with declining prices for new batteries (projected to reach $58/kWh by 2030), create a narrowing window of opportunity for second-life applications. Additionally, warranty and liability concerns deter many potential customers, as repurposed batteries typically carry shorter performance guarantees than new systems.

The geographical distribution of battery repurposing activities shows concentration in regions with strong EV adoption and supportive policy frameworks. Japan, South Korea, and parts of Europe lead in commercial deployments, while China dominates in terms of volume potential due to its massive EV market. North America has seen numerous pilot projects but fewer scaled commercial applications, partly due to regulatory complexity across different states.

Supply chain logistics present ongoing challenges, with the need for efficient reverse logistics networks to collect, transport, and process end-of-life batteries. The current infrastructure is fragmented, with limited coordination between vehicle manufacturers, battery recyclers, and potential second-life application developers, resulting in higher costs and reduced economic viability.

Despite these advancements, the industry faces substantial technical challenges. Battery degradation heterogeneity remains a primary concern, as cells from the same vehicle often exhibit varying states of health, complicating uniform performance in second-life applications. Current diagnostic technologies struggle to efficiently and accurately assess large quantities of used batteries, creating bottlenecks in the repurposing workflow. The lack of standardization across battery manufacturers further exacerbates these issues, as different form factors, chemistries, and battery management systems require customized integration solutions.

Regulatory frameworks present another significant barrier, with unclear end-of-life responsibilities and inconsistent classification of used batteries across jurisdictions. In many regions, batteries are still categorized as hazardous waste, imposing additional handling requirements and costs. Furthermore, the absence of established safety standards specifically for repurposed batteries creates uncertainty for project developers and potential customers.

Economic viability remains questionable under current market conditions. The processing costs for battery disassembly, testing, and reconfiguration are substantial, often ranging from $50-100 per kWh. These costs, combined with declining prices for new batteries (projected to reach $58/kWh by 2030), create a narrowing window of opportunity for second-life applications. Additionally, warranty and liability concerns deter many potential customers, as repurposed batteries typically carry shorter performance guarantees than new systems.

The geographical distribution of battery repurposing activities shows concentration in regions with strong EV adoption and supportive policy frameworks. Japan, South Korea, and parts of Europe lead in commercial deployments, while China dominates in terms of volume potential due to its massive EV market. North America has seen numerous pilot projects but fewer scaled commercial applications, partly due to regulatory complexity across different states.

Supply chain logistics present ongoing challenges, with the need for efficient reverse logistics networks to collect, transport, and process end-of-life batteries. The current infrastructure is fragmented, with limited coordination between vehicle manufacturers, battery recyclers, and potential second-life application developers, resulting in higher costs and reduced economic viability.

Current Business Models for Second-Life Batteries

01 Battery Management Systems for Second-Life Applications

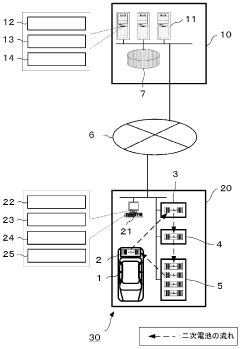

Advanced battery management systems are essential for repurposing used batteries in second-life applications. These systems monitor battery health, state of charge, and performance parameters to ensure safe and efficient operation. They incorporate algorithms that can adapt to the degraded characteristics of used batteries, optimizing their remaining useful life while preventing safety issues such as overcharging or thermal runaway.- Battery Management Systems for Second-Life Applications: Advanced battery management systems are essential for repurposing used batteries in second-life applications. These systems monitor battery health, state of charge, and performance parameters to ensure safe and efficient operation. They incorporate algorithms that can adapt to the degraded characteristics of used batteries, optimizing their remaining useful life while preventing unsafe operating conditions. These management systems enable the integration of second-life batteries into various applications including stationary energy storage and grid support.

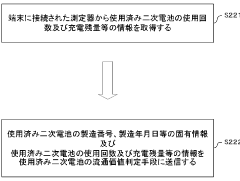

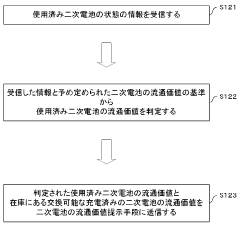

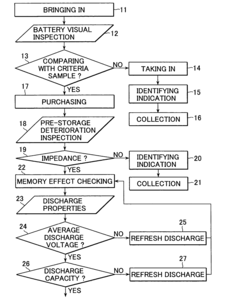

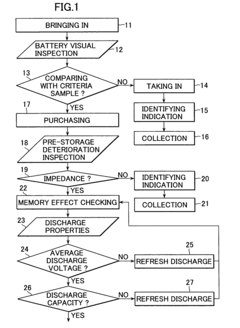

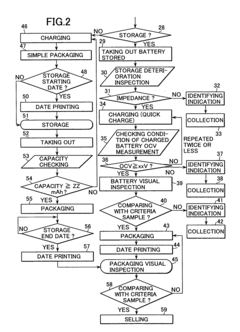

- Assessment and Classification of Used Batteries: Methods and systems for evaluating the condition of used batteries to determine their suitability for second-life applications. These technologies involve testing procedures that assess remaining capacity, internal resistance, cycle life, and other key parameters. Advanced diagnostic tools and algorithms analyze battery performance data to classify batteries according to their potential second-life applications. This enables efficient sorting and matching of used batteries to appropriate secondary uses based on their remaining capabilities.

- Electric Vehicle Battery Repurposing: Technologies specifically focused on repurposing electric vehicle batteries for second-life applications after they no longer meet the demanding requirements of automotive use. These innovations include methods for disassembling battery packs, testing individual modules, and reconfiguring them into new energy storage systems. The approaches address the challenges of dealing with different battery chemistries, form factors, and management systems from various vehicle manufacturers, enabling standardized second-life solutions.

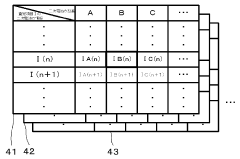

- Energy Storage Systems Using Second-Life Batteries: Designs and implementations of energy storage systems that utilize second-life batteries. These systems integrate batteries from different sources and with varying levels of degradation into functional energy storage units. The innovations include power electronics interfaces that can accommodate batteries with different characteristics, thermal management systems adapted for aged cells, and control strategies that maximize the performance of heterogeneous battery arrays. Applications range from residential backup power to commercial peak shaving and grid services.

- Predictive Analytics for Second-Life Battery Performance: Advanced algorithms and models that predict the remaining useful life and performance characteristics of second-life batteries. These technologies use historical data, real-time measurements, and machine learning techniques to forecast how repurposed batteries will perform in various applications. The predictive models account for different degradation mechanisms and operating conditions to provide accurate estimates of capacity fade, power capability, and expected lifetime. This enables more effective planning and economic valuation of second-life battery deployments.

02 Assessment and Classification of Used Batteries

Methods for evaluating and categorizing used batteries based on their remaining capacity, internal resistance, and degradation patterns are crucial for second-life applications. These assessment techniques involve diagnostic testing, data analysis, and predictive modeling to determine which batteries are suitable for repurposing and what applications they best fit. Classification systems help match battery characteristics with appropriate second-life use cases.Expand Specific Solutions03 Energy Storage Systems Using Repurposed Batteries

Second-life batteries can be integrated into stationary energy storage systems for applications such as grid support, renewable energy integration, and backup power. These systems combine multiple used battery modules with power electronics and thermal management to create functional storage units. Design considerations include addressing the variability in performance among repurposed cells and ensuring system reliability despite using previously degraded components.Expand Specific Solutions04 Reconfiguration and Adaptation Technologies

Technologies for reconfiguring and adapting used batteries involve hardware and software solutions that allow for flexible connection topologies and operational parameters. These include modular designs that can accommodate batteries of different types, ages, and capacities, as well as adaptive control systems that optimize performance based on the specific characteristics of each repurposed battery. Such technologies enable the creation of functional systems from heterogeneous battery collections.Expand Specific Solutions05 Life Extension and Performance Optimization

Methods for extending the useful life of second-life batteries focus on optimizing charging/discharging protocols, thermal management, and usage patterns. These approaches include partial cycling to avoid stress on degraded components, temperature control systems to prevent accelerated aging, and smart algorithms that distribute load based on the condition of individual cells or modules. Such techniques can significantly increase the economic value of repurposed batteries.Expand Specific Solutions

Key Industry Players and Ecosystem Analysis

The second-life battery market is currently in its early growth phase, characterized by increasing adoption as energy storage solutions transition from pilot projects to commercial deployment. The global market size for repurposed EV batteries is projected to reach $4-5 billion by 2030, driven by the expanding electric vehicle sector generating a substantial supply of retired batteries. Technologically, the field is maturing rapidly with key players developing innovative business models. LG Energy Solution and CATL lead with advanced battery management systems for second-life applications, while automotive manufacturers like Honda and SK Innovation are establishing closed-loop ecosystems for their used EV batteries. Research institutions including Central South University and SRI International are advancing critical technologies for battery health assessment and repurposing methodologies, accelerating the commercial viability of this circular economy approach.

LG Energy Solution Ltd.

Technical Solution: LG Energy Solution has developed a "Battery Value Chain Integration" model that creates closed-loop systems for battery deployment across multiple use cases. Their technical approach includes advanced ultrasonic and electrochemical diagnostic tools that can assess individual cell health with high precision, enabling optimal grouping of cells for second-life applications. LG has implemented a distributed energy resource management system specifically designed to integrate second-life batteries with renewable energy generation, creating microgrid solutions for commercial and industrial customers. Their technology includes adaptive inverter systems that can accommodate the changing characteristics of aging battery cells, maintaining stable performance despite degradation. LG has pioneered a "Battery Energy Storage as a Service" (BESaaS) business model that eliminates upfront capital costs for customers while creating long-term revenue streams from repurposed batteries. The company has also developed specialized thermal management systems for second-life batteries that address the increased safety concerns associated with aged cells, incorporating multiple redundant protection mechanisms.

Strengths: Extensive experience with various battery chemistries enables precise application matching; established relationships with automotive OEMs ensures steady supply of end-of-life batteries. Weaknesses: Complex logistics network required for battery collection and processing; solution requires significant technical expertise for implementation and maintenance.

Contemporary Amperex Technology Co., Ltd.

Technical Solution: CATL has developed a comprehensive Battery-as-a-Service (BaaS) model for second-life batteries that integrates cloud-based battery management systems to monitor and optimize performance throughout the battery lifecycle. Their technical solution includes a standardized battery swapping infrastructure that facilitates the transition of EV batteries to stationary energy storage applications. CATL's approach incorporates advanced battery health diagnostics that can accurately determine remaining capacity and optimal use cases for degraded batteries. The company has implemented a blockchain-based battery passport system that tracks the complete history of each battery pack, enabling precise valuation and appropriate second-life application matching. Their modular design allows for easy disassembly and reconfiguration of battery packs for various grid-scale and commercial energy storage applications.

Strengths: Extensive manufacturing scale provides access to large volumes of returned batteries; proprietary battery chemistry knowledge enables precise health assessment and application matching. Weaknesses: Heavy dependence on partnerships with utilities and grid operators; requires significant infrastructure investment for full implementation of their battery swapping ecosystem.

Technical Innovations in Battery Assessment and Refurbishment

Secondary battery distribution system, terminal in secondary battery distribution system, and server in secondary battery distribution system

PatentWO2010035605A1

Innovation

- A secondary battery distribution system that determines the distribution value of used batteries based on their condition and compares it to available charged batteries, allowing for efficient replacement and management through a network-connected management station, charging stand, and terminal, enabling standardized and efficient inventory management and user convenience.

Trade-in battery system

PatentInactiveUS20050001591A1

Innovation

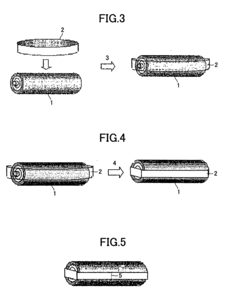

- A trade-in battery system that includes a purchasing step, pre-storage deterioration inspection, charging, storage, packaging, and selling steps, with the use of heat-shrinkable polymer film for packaging and biodegradable materials to facilitate easy identification and reduce waste, and an automated apparatus for streamlining these processes.

Regulatory Framework and Policy Implications

The regulatory landscape surrounding second-life battery deployment in energy markets is complex and evolving rapidly across different jurisdictions. Current regulations often fail to adequately address the unique characteristics of repurposed batteries, creating significant barriers to market entry. In the European Union, the Battery Directive is undergoing revision to include specific provisions for second-life applications, with emphasis on extended producer responsibility and clear definitions of when a battery transitions from waste to product status.

In North America, regulations vary by state and province, with California leading through initiatives like the Electric Program Investment Charge (EPIC) that provides funding for second-life battery demonstration projects. However, the lack of standardized testing protocols and certification procedures remains a critical regulatory gap across most regions, creating uncertainty for investors and businesses.

Policy frameworks are increasingly recognizing the role of second-life batteries in achieving renewable energy and circular economy goals. Several countries have implemented incentive structures, including tax benefits for companies utilizing repurposed batteries and subsidies for grid-scale storage projects incorporating second-life solutions. These policies aim to create market pull while technical standards continue to develop.

Safety regulations present particular challenges, as existing standards for new batteries may be overly restrictive when applied to second-life applications. Regulatory bodies like UL in the United States and IEC internationally are working to develop specific safety standards for repurposed batteries, but progress remains slow compared to market developments.

The classification of second-life batteries within waste management frameworks also presents significant policy implications. The Basel Convention's restrictions on transboundary movements of hazardous waste can impact international supply chains for battery repurposing, while extended producer responsibility schemes are being adapted to accommodate second-life business models.

Looking forward, policy harmonization across regions will be crucial for scaling second-life battery markets. Regulatory sandboxes being implemented in countries like Singapore and the UK allow for controlled testing of innovative business models while informing future policy development. The most effective regulatory approaches will balance safety concerns with the need to foster innovation and recognize the environmental benefits of battery reuse over premature recycling.

In North America, regulations vary by state and province, with California leading through initiatives like the Electric Program Investment Charge (EPIC) that provides funding for second-life battery demonstration projects. However, the lack of standardized testing protocols and certification procedures remains a critical regulatory gap across most regions, creating uncertainty for investors and businesses.

Policy frameworks are increasingly recognizing the role of second-life batteries in achieving renewable energy and circular economy goals. Several countries have implemented incentive structures, including tax benefits for companies utilizing repurposed batteries and subsidies for grid-scale storage projects incorporating second-life solutions. These policies aim to create market pull while technical standards continue to develop.

Safety regulations present particular challenges, as existing standards for new batteries may be overly restrictive when applied to second-life applications. Regulatory bodies like UL in the United States and IEC internationally are working to develop specific safety standards for repurposed batteries, but progress remains slow compared to market developments.

The classification of second-life batteries within waste management frameworks also presents significant policy implications. The Basel Convention's restrictions on transboundary movements of hazardous waste can impact international supply chains for battery repurposing, while extended producer responsibility schemes are being adapted to accommodate second-life business models.

Looking forward, policy harmonization across regions will be crucial for scaling second-life battery markets. Regulatory sandboxes being implemented in countries like Singapore and the UK allow for controlled testing of innovative business models while informing future policy development. The most effective regulatory approaches will balance safety concerns with the need to foster innovation and recognize the environmental benefits of battery reuse over premature recycling.

Economic Viability and ROI Analysis

The economic viability of second-life battery deployment in energy markets hinges on several critical factors that determine return on investment. Initial acquisition costs of used batteries typically range from 30-70% lower than new batteries, creating a compelling entry point for investors. However, these savings must be balanced against refurbishment costs, which can vary significantly based on battery condition, chemistry type, and intended application. Current market data indicates refurbishment expenses typically constitute 15-25% of total project costs, with economies of scale favoring larger deployments.

Operational expenditures present another crucial consideration, encompassing battery management systems, cooling infrastructure, and regular maintenance. These ongoing costs generally represent 5-8% of initial capital investment annually, though this percentage tends to increase as batteries age. Energy arbitrage applications in particular require sophisticated forecasting capabilities to maximize revenue generation, adding further operational complexity and associated costs.

Revenue streams from second-life battery deployments vary by application. Grid services such as frequency regulation offer premium returns of $25-40/kW-year in mature markets, while peak shaving applications typically yield $50-150/kW-year depending on local demand charges. Energy arbitrage returns fluctuate significantly based on market volatility, averaging $20-60/MWh in price differential. Capacity markets provide more stable but generally lower returns of $30-80/kW-year.

Lifecycle economic analysis reveals that most second-life battery projects achieve payback periods of 3-7 years, with internal rates of return ranging from 8-22% depending on application and market conditions. Stationary storage applications typically demonstrate better economics than mobile applications due to less stringent performance requirements and lower operational stresses. Projects leveraging multiple value streams through revenue stacking consistently outperform single-application deployments by 30-50% in terms of ROI.

Risk factors significantly impact economic viability. Performance degradation rates represent the foremost concern, with current data suggesting 3-8% annual capacity loss in second-life applications. Warranty structures remain underdeveloped in this emerging market, creating uncertainty around long-term performance guarantees. Regulatory frameworks across different markets also introduce variability in revenue potential, with some jurisdictions offering additional incentives for circular economy initiatives that can improve project economics by 10-15%.

Operational expenditures present another crucial consideration, encompassing battery management systems, cooling infrastructure, and regular maintenance. These ongoing costs generally represent 5-8% of initial capital investment annually, though this percentage tends to increase as batteries age. Energy arbitrage applications in particular require sophisticated forecasting capabilities to maximize revenue generation, adding further operational complexity and associated costs.

Revenue streams from second-life battery deployments vary by application. Grid services such as frequency regulation offer premium returns of $25-40/kW-year in mature markets, while peak shaving applications typically yield $50-150/kW-year depending on local demand charges. Energy arbitrage returns fluctuate significantly based on market volatility, averaging $20-60/MWh in price differential. Capacity markets provide more stable but generally lower returns of $30-80/kW-year.

Lifecycle economic analysis reveals that most second-life battery projects achieve payback periods of 3-7 years, with internal rates of return ranging from 8-22% depending on application and market conditions. Stationary storage applications typically demonstrate better economics than mobile applications due to less stringent performance requirements and lower operational stresses. Projects leveraging multiple value streams through revenue stacking consistently outperform single-application deployments by 30-50% in terms of ROI.

Risk factors significantly impact economic viability. Performance degradation rates represent the foremost concern, with current data suggesting 3-8% annual capacity loss in second-life applications. Warranty structures remain underdeveloped in this emerging market, creating uncertainty around long-term performance guarantees. Regulatory frameworks across different markets also introduce variability in revenue potential, with some jurisdictions offering additional incentives for circular economy initiatives that can improve project economics by 10-15%.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!