Repurposing logistics for second-life battery global supply chains

SEP 3, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Second-Life Battery Logistics Evolution and Objectives

The evolution of second-life battery logistics represents a significant shift in how energy storage systems are managed throughout their lifecycle. Initially, battery supply chains were primarily designed for unidirectional flow—from manufacturing to end-user to disposal. However, with the exponential growth of electric vehicles (EVs) and renewable energy systems, batteries that no longer meet the rigorous demands of their primary applications still retain 70-80% of their original capacity, creating substantial opportunities for repurposing.

The historical trajectory of second-life battery logistics began around 2010 when early EV manufacturers started exploring potential secondary applications. By 2015, pilot programs emerged, demonstrating technical feasibility but highlighting significant logistical challenges. The period from 2018 to present has seen accelerated development of standardized assessment protocols, reverse logistics networks, and regulatory frameworks specifically designed for battery reuse.

Current technological objectives focus on establishing efficient global supply chains that can handle the increasing volume of retired batteries from EVs, estimated to reach 200 GWh annually by 2030. This requires development of automated diagnostic systems capable of rapidly assessing battery health and remaining useful life, standardized battery management systems that facilitate seamless transition between applications, and modular design approaches enabling cost-effective repurposing.

Market-driven objectives include reducing the total cost of ownership for energy storage systems by leveraging second-life batteries at 30-70% lower cost than new batteries, creating circular economy business models that generate value across multiple battery lifecycles, and establishing regional processing hubs that minimize transportation costs while maximizing value recovery.

Environmental sustainability objectives are equally critical, aiming to extend battery useful life by 5-10 years before recycling, reduce carbon footprint associated with new battery production by 70%, and minimize hazardous waste through proper handling and repurposing protocols. These objectives align with global climate initiatives and circular economy principles.

Regulatory objectives focus on harmonizing international standards for battery transportation, testing, and certification, developing clear end-of-life responsibility frameworks, and creating traceability systems that track batteries throughout their complete lifecycle. The ultimate goal is creating a transparent, efficient global ecosystem that transforms what was once considered waste into valuable assets within a circular economy framework.

The historical trajectory of second-life battery logistics began around 2010 when early EV manufacturers started exploring potential secondary applications. By 2015, pilot programs emerged, demonstrating technical feasibility but highlighting significant logistical challenges. The period from 2018 to present has seen accelerated development of standardized assessment protocols, reverse logistics networks, and regulatory frameworks specifically designed for battery reuse.

Current technological objectives focus on establishing efficient global supply chains that can handle the increasing volume of retired batteries from EVs, estimated to reach 200 GWh annually by 2030. This requires development of automated diagnostic systems capable of rapidly assessing battery health and remaining useful life, standardized battery management systems that facilitate seamless transition between applications, and modular design approaches enabling cost-effective repurposing.

Market-driven objectives include reducing the total cost of ownership for energy storage systems by leveraging second-life batteries at 30-70% lower cost than new batteries, creating circular economy business models that generate value across multiple battery lifecycles, and establishing regional processing hubs that minimize transportation costs while maximizing value recovery.

Environmental sustainability objectives are equally critical, aiming to extend battery useful life by 5-10 years before recycling, reduce carbon footprint associated with new battery production by 70%, and minimize hazardous waste through proper handling and repurposing protocols. These objectives align with global climate initiatives and circular economy principles.

Regulatory objectives focus on harmonizing international standards for battery transportation, testing, and certification, developing clear end-of-life responsibility frameworks, and creating traceability systems that track batteries throughout their complete lifecycle. The ultimate goal is creating a transparent, efficient global ecosystem that transforms what was once considered waste into valuable assets within a circular economy framework.

Market Analysis for Battery Repurposing Services

The global market for battery repurposing services is experiencing significant growth, driven primarily by the rapid expansion of electric vehicle (EV) adoption worldwide. As EV batteries reach the end of their first-life applications, typically retaining 70-80% of their original capacity, they present substantial economic opportunities for second-life applications. Current market valuations estimate the second-life battery market to reach $4.2 billion by 2025, with projections exceeding $12 billion by 2030, representing a compound annual growth rate of approximately 23%.

Regional analysis reveals distinct market characteristics across different geographies. Asia-Pacific, particularly China, leads the market due to its dominant position in both EV manufacturing and battery production. Europe follows closely, propelled by stringent environmental regulations and circular economy initiatives. North America shows promising growth potential, though currently lags behind due to less developed regulatory frameworks for battery recycling and repurposing.

Demand segmentation indicates diverse applications for repurposed batteries. Stationary energy storage represents the largest segment, accounting for approximately 45% of the market, with applications in grid stabilization, renewable energy integration, and backup power systems. Commercial and industrial energy management systems constitute roughly 30% of demand, while residential energy storage applications make up about 15%. The remaining market share is distributed across niche applications including telecommunications infrastructure and portable power solutions.

Key market drivers include decreasing costs of repurposing technologies, growing environmental concerns, regulatory pressures for sustainable battery lifecycle management, and increasing economic viability as scale economies develop. The cost differential between new and repurposed batteries—currently estimated at 30-50% lower for repurposed units—creates compelling value propositions for end-users seeking cost-effective energy storage solutions.

Market barriers remain significant, however. Technical challenges in battery assessment and standardization, logistical complexities in reverse supply chains, regulatory uncertainties regarding battery ownership and liability, and competition from increasingly affordable new batteries all constrain market development. Additionally, customer concerns regarding performance reliability and warranty issues present adoption hurdles.

Customer segmentation reveals utilities and grid operators as primary clients, followed by commercial property developers, industrial facilities with high energy demands, and renewable energy project developers. Emerging customer segments include telecommunications companies, data centers, and residential communities with microgrid implementations.

The competitive landscape features diverse participants, including original battery manufacturers expanding into repurposing services, specialized battery recycling firms, energy storage system integrators, and new entrants focused exclusively on battery second-life applications. Strategic partnerships between automotive manufacturers and energy companies are increasingly common, creating integrated value chains from first-life to second-life applications.

Regional analysis reveals distinct market characteristics across different geographies. Asia-Pacific, particularly China, leads the market due to its dominant position in both EV manufacturing and battery production. Europe follows closely, propelled by stringent environmental regulations and circular economy initiatives. North America shows promising growth potential, though currently lags behind due to less developed regulatory frameworks for battery recycling and repurposing.

Demand segmentation indicates diverse applications for repurposed batteries. Stationary energy storage represents the largest segment, accounting for approximately 45% of the market, with applications in grid stabilization, renewable energy integration, and backup power systems. Commercial and industrial energy management systems constitute roughly 30% of demand, while residential energy storage applications make up about 15%. The remaining market share is distributed across niche applications including telecommunications infrastructure and portable power solutions.

Key market drivers include decreasing costs of repurposing technologies, growing environmental concerns, regulatory pressures for sustainable battery lifecycle management, and increasing economic viability as scale economies develop. The cost differential between new and repurposed batteries—currently estimated at 30-50% lower for repurposed units—creates compelling value propositions for end-users seeking cost-effective energy storage solutions.

Market barriers remain significant, however. Technical challenges in battery assessment and standardization, logistical complexities in reverse supply chains, regulatory uncertainties regarding battery ownership and liability, and competition from increasingly affordable new batteries all constrain market development. Additionally, customer concerns regarding performance reliability and warranty issues present adoption hurdles.

Customer segmentation reveals utilities and grid operators as primary clients, followed by commercial property developers, industrial facilities with high energy demands, and renewable energy project developers. Emerging customer segments include telecommunications companies, data centers, and residential communities with microgrid implementations.

The competitive landscape features diverse participants, including original battery manufacturers expanding into repurposing services, specialized battery recycling firms, energy storage system integrators, and new entrants focused exclusively on battery second-life applications. Strategic partnerships between automotive manufacturers and energy companies are increasingly common, creating integrated value chains from first-life to second-life applications.

Global Technical Barriers in Battery Reverse Logistics

The global reverse logistics landscape for batteries faces significant technical barriers that impede efficient second-life utilization. These barriers span across collection, transportation, assessment, and repurposing stages, creating complex challenges for establishing seamless international supply chains.

Transportation regulations present a primary obstacle, with lithium-ion batteries classified as dangerous goods under international shipping codes. Different countries maintain varying safety protocols and documentation requirements, creating a fragmented regulatory environment that complicates cross-border movement of used batteries. The UN Model Regulations and International Maritime Dangerous Goods Code provide frameworks, but implementation remains inconsistent across jurisdictions.

Technical standardization represents another critical barrier. The absence of universally accepted testing protocols for determining battery state-of-health creates uncertainty in quality assessment. Without standardized grading systems, the market faces information asymmetry, where buyers cannot reliably verify battery condition, undermining trust in second-life applications. This technical gap significantly impacts valuation and marketability of used batteries internationally.

Battery design heterogeneity further complicates reverse logistics operations. The wide variety of battery chemistries, form factors, and management systems across manufacturers creates challenges in developing universal disassembly and testing equipment. This diversity necessitates specialized handling procedures and increases processing costs, particularly when batteries cross international boundaries where technical specifications may differ.

Data accessibility presents a substantial technical hurdle. Battery management systems contain valuable usage history that could inform second-life applications, but proprietary interfaces and encryption limit access to this information. Without standardized data protocols, reverse logistics operators struggle to efficiently assess battery condition, especially when batteries originate from different global markets with varying technical specifications.

Infrastructure limitations compound these challenges. Many regions lack specialized facilities for battery testing, disassembly, and repurposing. The capital-intensive nature of establishing such infrastructure creates geographic disparities in processing capabilities, forcing batteries to travel longer distances to reach appropriate facilities, increasing both costs and environmental impact.

Traceability systems represent a final technical barrier. The absence of robust chain-of-custody mechanisms makes it difficult to track batteries throughout their lifecycle across global supply chains. This limitation hampers quality assurance, regulatory compliance, and proper allocation of environmental responsibilities, particularly when batteries cross multiple international boundaries during their journey toward second-life applications.

Transportation regulations present a primary obstacle, with lithium-ion batteries classified as dangerous goods under international shipping codes. Different countries maintain varying safety protocols and documentation requirements, creating a fragmented regulatory environment that complicates cross-border movement of used batteries. The UN Model Regulations and International Maritime Dangerous Goods Code provide frameworks, but implementation remains inconsistent across jurisdictions.

Technical standardization represents another critical barrier. The absence of universally accepted testing protocols for determining battery state-of-health creates uncertainty in quality assessment. Without standardized grading systems, the market faces information asymmetry, where buyers cannot reliably verify battery condition, undermining trust in second-life applications. This technical gap significantly impacts valuation and marketability of used batteries internationally.

Battery design heterogeneity further complicates reverse logistics operations. The wide variety of battery chemistries, form factors, and management systems across manufacturers creates challenges in developing universal disassembly and testing equipment. This diversity necessitates specialized handling procedures and increases processing costs, particularly when batteries cross international boundaries where technical specifications may differ.

Data accessibility presents a substantial technical hurdle. Battery management systems contain valuable usage history that could inform second-life applications, but proprietary interfaces and encryption limit access to this information. Without standardized data protocols, reverse logistics operators struggle to efficiently assess battery condition, especially when batteries originate from different global markets with varying technical specifications.

Infrastructure limitations compound these challenges. Many regions lack specialized facilities for battery testing, disassembly, and repurposing. The capital-intensive nature of establishing such infrastructure creates geographic disparities in processing capabilities, forcing batteries to travel longer distances to reach appropriate facilities, increasing both costs and environmental impact.

Traceability systems represent a final technical barrier. The absence of robust chain-of-custody mechanisms makes it difficult to track batteries throughout their lifecycle across global supply chains. This limitation hampers quality assurance, regulatory compliance, and proper allocation of environmental responsibilities, particularly when batteries cross multiple international boundaries during their journey toward second-life applications.

Current Logistics Solutions for Battery Recirculation

01 Battery assessment and classification for repurposing

Systems and methods for evaluating used batteries to determine their suitability for second-life applications. This involves testing battery performance parameters, analyzing degradation levels, and classifying batteries based on their remaining capacity and health. Advanced diagnostic tools and algorithms help identify which batteries can be repurposed for specific applications, optimizing the selection process for second-life use.- Battery assessment and classification for repurposing: Systems and methods for evaluating used batteries to determine their suitability for second-life applications. This involves testing battery performance parameters, analyzing degradation levels, and classifying batteries based on their remaining capacity and health. Advanced diagnostic tools and algorithms help identify which batteries can be repurposed for specific applications, optimizing the selection process for second-life use.

- Logistics management for battery collection and distribution: Specialized logistics networks and systems designed for the efficient collection, transportation, and distribution of end-of-life batteries. These systems include tracking mechanisms, optimized routing algorithms, and inventory management solutions specifically tailored for used battery handling. The logistics frameworks ensure proper handling of batteries from multiple collection points to repurposing facilities, minimizing transportation costs and environmental impact.

- Repurposing technologies and refurbishment processes: Technical methods and processes for converting used EV batteries into energy storage systems for secondary applications. This includes disassembly techniques, cell reconfiguration, battery module redesign, and integration of new battery management systems. The technologies focus on maximizing the remaining utility of batteries while ensuring safety and reliability in their second-life applications.

- Battery management systems for second-life applications: Specialized software and hardware solutions designed to monitor and control repurposed batteries in their second-life applications. These systems adapt to the unique characteristics of aged batteries, providing optimized charging/discharging protocols, thermal management, and safety features. The management systems compensate for degradation patterns in used batteries and extend their useful life in stationary storage applications.

- Business models and economic frameworks for battery repurposing: Economic models and business frameworks that enable profitable second-life battery operations. These include valuation methodologies for used batteries, cost-benefit analyses for repurposing versus recycling, and market development strategies for second-life battery products. The frameworks address the economic challenges of battery repurposing and create sustainable business models that connect battery suppliers with potential second-life application markets.

02 Logistics management systems for battery repurposing

Specialized logistics platforms and management systems designed to handle the collection, transportation, and tracking of used batteries throughout the repurposing supply chain. These systems incorporate inventory management, route optimization, and real-time tracking capabilities to efficiently move batteries from end-of-first-life locations to refurbishment facilities and ultimately to second-life deployment sites.Expand Specific Solutions03 Battery refurbishment and reconfiguration techniques

Technical approaches for refurbishing and reconfiguring used batteries to prepare them for second-life applications. This includes disassembly methods, cell matching processes, and reassembly techniques to create new battery packs with consistent performance characteristics. The processes involve cleaning, testing individual cells, replacing damaged components, and reconfiguring batteries into appropriate form factors for their intended second-life applications.Expand Specific Solutions04 Energy storage system integration for repurposed batteries

Methods and systems for integrating repurposed batteries into energy storage applications. This includes adapting battery management systems to accommodate the unique characteristics of second-life batteries, developing specialized power electronics interfaces, and implementing control strategies that optimize performance while accounting for the varied states of health within repurposed battery systems. These solutions enable effective deployment in applications such as grid storage, renewable energy integration, and backup power systems.Expand Specific Solutions05 Software platforms for second-life battery management

Software solutions specifically designed to manage the lifecycle of repurposed batteries. These platforms incorporate predictive analytics, performance monitoring, and decision support tools to optimize the operation of second-life battery systems. The software helps track battery history, predict remaining useful life, manage warranty information, and provide operational insights to maximize the value and reliability of repurposed battery assets.Expand Specific Solutions

Key Industry Players in Second-Life Battery Supply Chain

The second-life battery supply chain market is currently in its early growth phase, characterized by increasing momentum as electric vehicle adoption rises globally. The market size is projected to expand significantly, driven by sustainability initiatives and circular economy principles. From a technological maturity perspective, key players are at varying development stages. Industry leaders like CATL, LG Energy Solution, and Panasonic have established robust battery manufacturing capabilities but are still evolving their recycling and repurposing technologies. Emerging specialists like Northvolt are integrating recycling into their business models from inception. Traditional automotive manufacturers including Toyota and Honda are developing proprietary battery lifecycle management systems. The competitive landscape shows a convergence of battery manufacturers, automotive OEMs, and specialized recycling firms collaborating to overcome logistical challenges in creating efficient global reverse supply chains for used batteries.

LG Energy Solution Ltd.

Technical Solution: LG Energy Solution has implemented a comprehensive "Battery Value Chain Management" system for second-life battery logistics that integrates collection, assessment, repurposing, and distribution processes. Their approach includes AI-powered diagnostic tools that can rapidly evaluate large quantities of used battery modules, classifying them by remaining capacity, degradation patterns, and optimal second-life applications. LG has developed specialized packaging and transportation protocols that address the unique challenges of shipping partially degraded lithium-ion batteries across international borders, including real-time monitoring systems that track temperature, shock, and orientation during transit. The company operates a network of Battery Evaluation Centers strategically located near major EV markets, minimizing transportation distances for collection while enabling efficient redistribution to second-life application sites. Their logistics platform incorporates predictive analytics that forecast battery return volumes based on EV sales data and battery warranty information, allowing for optimized capacity planning. LG has also established partnerships with utility companies to create direct pathways for repurposed EV batteries into grid storage applications, streamlining the second-life supply chain.

Strengths: LG's vertical integration from cell manufacturing to energy storage system development enables comprehensive quality control throughout the repurposing process. Their established global distribution network supports efficient international logistics operations. Weaknesses: Complex battery designs with proprietary management systems can complicate assessment and repurposing processes, potentially limiting compatibility with third-party systems.

Panasonic EV Energy Co., Ltd.

Technical Solution: Panasonic EV Energy has developed an advanced battery repurposing logistics system called "Second Life Battery Exchange Platform" that connects EV manufacturers, dismantlers, and energy storage system integrators. Their approach includes a standardized battery assessment protocol that evaluates key performance metrics including capacity retention, internal resistance, and thermal behavior to determine optimal second-life applications. Panasonic has implemented specialized handling equipment and procedures for safe transportation of used lithium-ion batteries, addressing regulatory requirements across different regions. Their system incorporates a digital passport for each battery pack that tracks its history from manufacturing through first-life use and into second-life applications, enabling better value assessment and application matching. Panasonic has established regional processing hubs in North America, Europe, and Asia that serve as collection, assessment, and redistribution centers, optimizing transportation logistics while ensuring compliance with cross-border regulations for battery shipments. The company has also developed modular reconditioning processes that can restore battery packs to standardized configurations suitable for stationary storage applications.

Strengths: Panasonic's extensive experience as a battery supplier to major automakers provides deep technical expertise and established relationships throughout the supply chain. Their global presence enables efficient cross-regional logistics operations. Weaknesses: Higher costs associated with their comprehensive assessment and reconditioning processes may limit economic viability for lower-value applications.

Critical Patents in Battery Repurposing Technologies

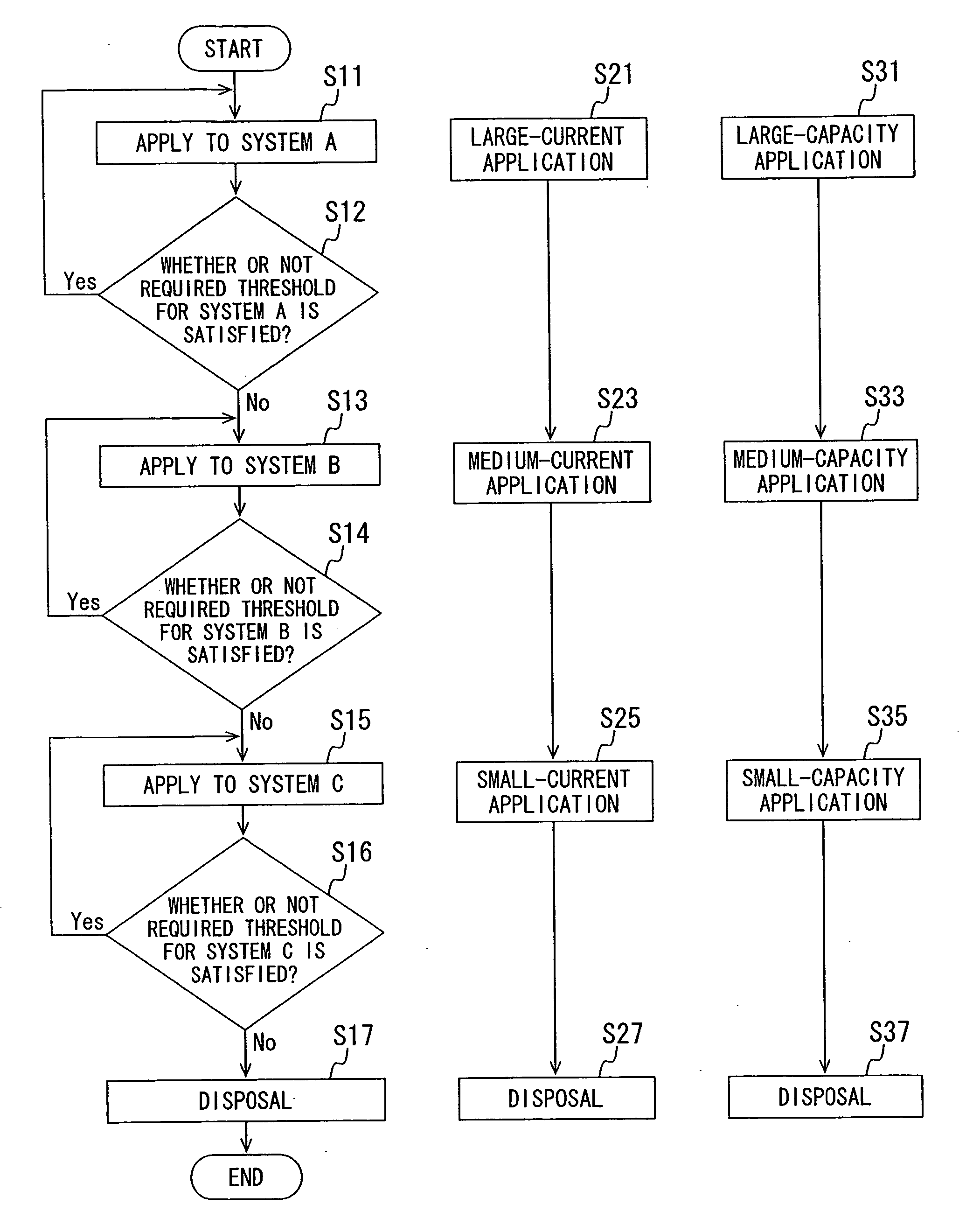

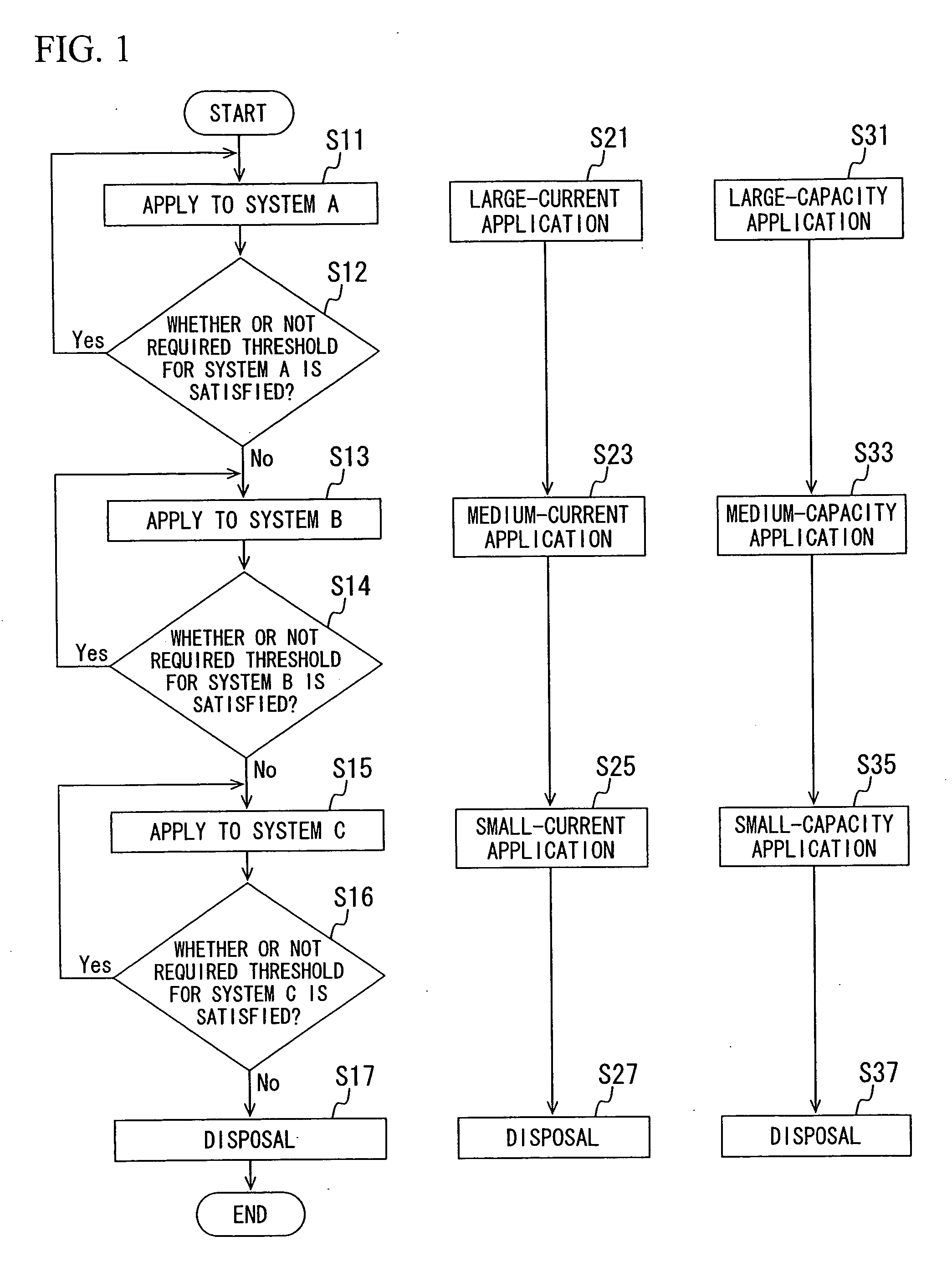

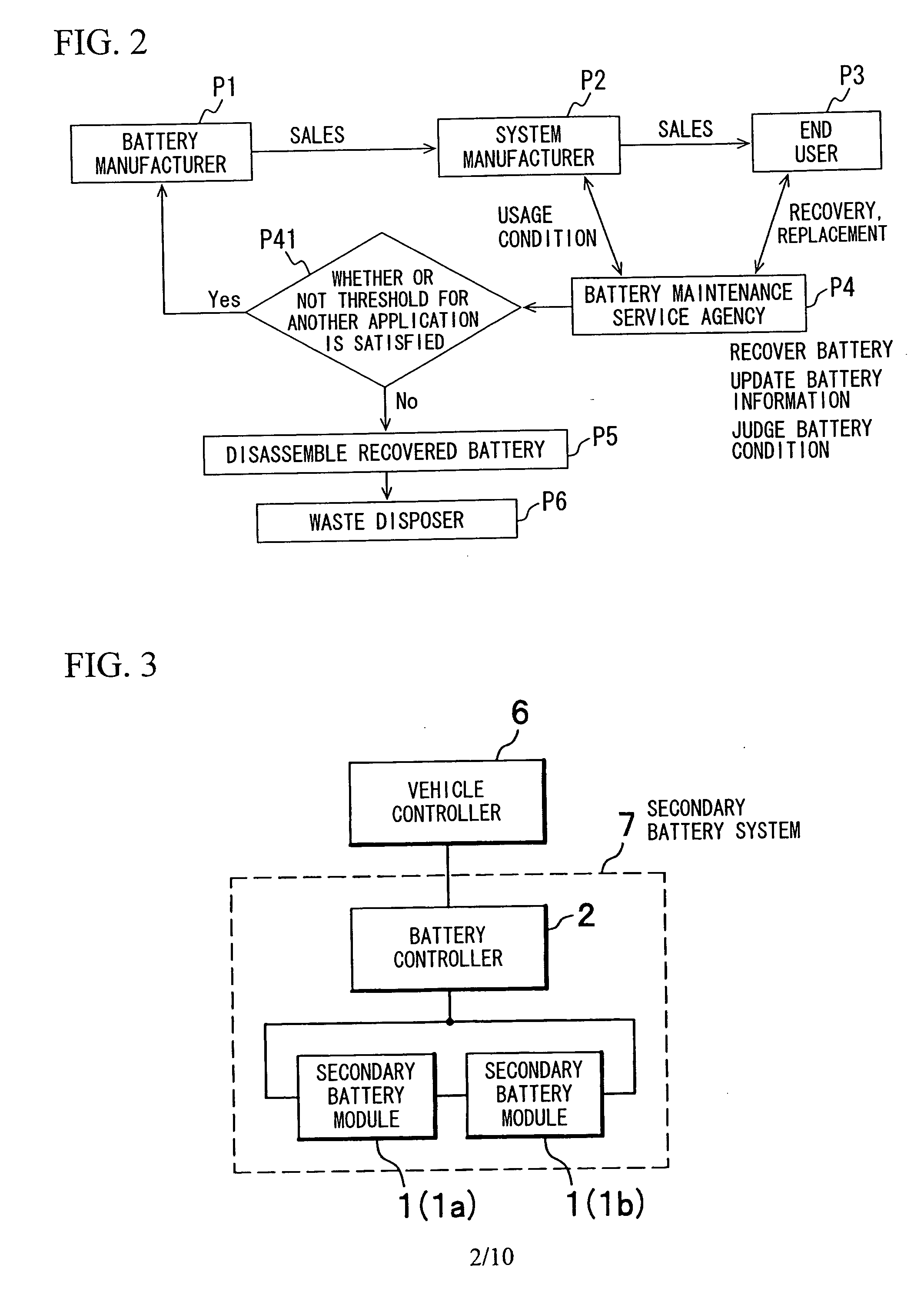

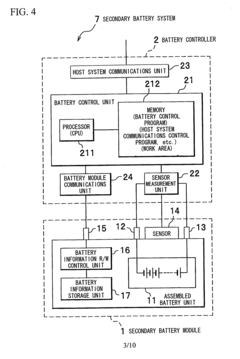

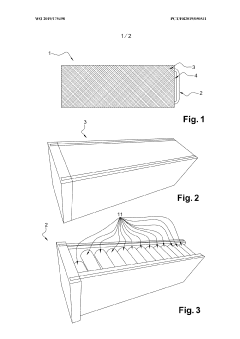

Secondary battery module, battery information management device, battery information management system, secondary battery reuse system, secondary battery recovery and sales system, secondary battery reuse method, and secondary battery recovery and sales method

PatentActiveUS20070108946A1

Innovation

- A secondary battery module with integrated battery information storage means and interface connections to a battery controller, allowing for the storage and retrieval of electrical characteristic and usage history information, even when the battery system is disassembled, and a battery information management system for grading and reusing the modules based on predetermined thresholds.

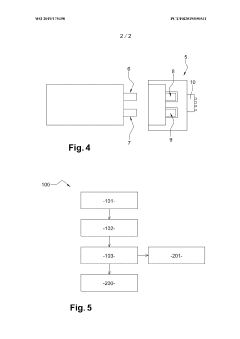

Battery with optimised life

PatentWO2019175498A1

Innovation

- A method for managing electrical energy storage batteries that automatically transitions from a primary mobility configuration to a secondary stationary configuration based on measured operating parameters, such as charge cycles and health indicators, allowing for continued use in a different environment with optimized thermal management and connectivity adaptation.

Regulatory Framework for Cross-Border Battery Transport

The regulatory landscape governing cross-border transportation of second-life batteries presents significant complexity due to varying international standards, classification challenges, and evolving legislation. Currently, the Basel Convention serves as the primary international framework regulating transboundary movements of hazardous wastes, including lithium-ion batteries. However, inconsistent interpretation of whether used batteries constitute "waste" creates regulatory ambiguity across different jurisdictions.

Within the European Union, the Waste Shipment Regulation (WSR) and Battery Directive establish specific requirements for battery transport, with the recent Battery Regulation update (2023) introducing dedicated provisions for second-life applications. These regulations mandate detailed documentation, proper packaging, and specific handling procedures when transporting batteries across EU borders.

In North America, the US Department of Transportation's Pipeline and Hazardous Materials Safety Administration (PHMSA) and Transport Canada enforce strict regulations on battery transportation, with particular emphasis on safety protocols for damaged or defective batteries. The UN Model Regulations on the Transport of Dangerous Goods provide the foundation for these national frameworks, classifying lithium batteries under Class 9 dangerous goods.

Asia-Pacific regions demonstrate significant regulatory divergence, with China implementing the China Compulsory Certification (CCC) system for battery imports and Japan requiring compliance with specific technical standards under their Electrical Appliance and Material Safety Law. This regulatory fragmentation creates substantial compliance challenges for global second-life battery supply chains.

Recent regulatory developments include the implementation of battery passports in the EU, which track batteries throughout their lifecycle, and enhanced traceability requirements that document battery condition, composition, and history. These innovations aim to facilitate safer cross-border movement while ensuring environmental compliance.

Compliance costs represent a significant barrier to efficient second-life battery logistics, with estimates suggesting regulatory compliance accounts for 15-20% of total transportation costs. This burden falls disproportionately on smaller market participants, potentially limiting market access and innovation in circular economy initiatives.

Looking forward, international harmonization efforts through the World Customs Organization and UN bodies seek to standardize classification and documentation requirements. Industry stakeholders are advocating for regulatory frameworks that distinguish between new and second-life batteries, recognizing their unique characteristics and safety profiles while maintaining necessary safeguards for public health and environmental protection.

Within the European Union, the Waste Shipment Regulation (WSR) and Battery Directive establish specific requirements for battery transport, with the recent Battery Regulation update (2023) introducing dedicated provisions for second-life applications. These regulations mandate detailed documentation, proper packaging, and specific handling procedures when transporting batteries across EU borders.

In North America, the US Department of Transportation's Pipeline and Hazardous Materials Safety Administration (PHMSA) and Transport Canada enforce strict regulations on battery transportation, with particular emphasis on safety protocols for damaged or defective batteries. The UN Model Regulations on the Transport of Dangerous Goods provide the foundation for these national frameworks, classifying lithium batteries under Class 9 dangerous goods.

Asia-Pacific regions demonstrate significant regulatory divergence, with China implementing the China Compulsory Certification (CCC) system for battery imports and Japan requiring compliance with specific technical standards under their Electrical Appliance and Material Safety Law. This regulatory fragmentation creates substantial compliance challenges for global second-life battery supply chains.

Recent regulatory developments include the implementation of battery passports in the EU, which track batteries throughout their lifecycle, and enhanced traceability requirements that document battery condition, composition, and history. These innovations aim to facilitate safer cross-border movement while ensuring environmental compliance.

Compliance costs represent a significant barrier to efficient second-life battery logistics, with estimates suggesting regulatory compliance accounts for 15-20% of total transportation costs. This burden falls disproportionately on smaller market participants, potentially limiting market access and innovation in circular economy initiatives.

Looking forward, international harmonization efforts through the World Customs Organization and UN bodies seek to standardize classification and documentation requirements. Industry stakeholders are advocating for regulatory frameworks that distinguish between new and second-life batteries, recognizing their unique characteristics and safety profiles while maintaining necessary safeguards for public health and environmental protection.

Environmental Impact Assessment of Battery Reuse Systems

The environmental impact assessment of battery reuse systems reveals significant sustainability advantages compared to traditional linear battery lifecycles. Second-life battery applications demonstrate potential for reducing carbon emissions by 25-40% compared to new battery manufacturing processes. This reduction stems primarily from avoiding the energy-intensive extraction and processing of raw materials like lithium, cobalt, and nickel.

When evaluating the full lifecycle assessment (LCA) of repurposed batteries in global supply chains, research indicates that transportation logistics contribute approximately 8-12% of the total environmental footprint. This relatively small proportion highlights the environmental viability of global second-life battery networks despite geographical distances between collection, refurbishment, and redeployment locations.

Water conservation represents another critical environmental benefit, with studies showing that battery reuse systems can reduce freshwater consumption by up to 50% compared to primary production. This is particularly significant in water-stressed regions where mining operations for battery materials often compete with local communities for limited water resources.

The environmental assessment must also consider the efficiency of collection networks. Current data suggests that optimized reverse logistics systems can capture up to 70% of end-of-life electric vehicle batteries, though this varies significantly by region. Countries with well-established recycling infrastructure demonstrate collection rates approaching 85%, while developing markets may achieve only 30-40% recovery rates.

Waste reduction metrics further support the environmental case for battery repurposing. Each metric ton of repurposed batteries prevents approximately 1.3 tons of mining waste and 0.5 tons of processing waste. When scaled to projected global electric vehicle battery volumes by 2030, this represents potential annual waste reduction of 8-12 million tons.

Energy efficiency comparisons between new and repurposed battery systems reveal that second-life applications typically retain 70-80% of original capacity, providing sufficient performance for less demanding applications while requiring only 15-30% of the energy input needed for new battery production. This energy efficiency translates directly to reduced greenhouse gas emissions across the supply chain.

Land use impact assessments indicate that expanded battery reuse systems could reduce mining land disturbance by approximately 30% by 2035, preserving ecosystems and biodiversity in mineral-rich regions. This benefit becomes increasingly significant as global demand for energy storage solutions continues to accelerate.

When evaluating the full lifecycle assessment (LCA) of repurposed batteries in global supply chains, research indicates that transportation logistics contribute approximately 8-12% of the total environmental footprint. This relatively small proportion highlights the environmental viability of global second-life battery networks despite geographical distances between collection, refurbishment, and redeployment locations.

Water conservation represents another critical environmental benefit, with studies showing that battery reuse systems can reduce freshwater consumption by up to 50% compared to primary production. This is particularly significant in water-stressed regions where mining operations for battery materials often compete with local communities for limited water resources.

The environmental assessment must also consider the efficiency of collection networks. Current data suggests that optimized reverse logistics systems can capture up to 70% of end-of-life electric vehicle batteries, though this varies significantly by region. Countries with well-established recycling infrastructure demonstrate collection rates approaching 85%, while developing markets may achieve only 30-40% recovery rates.

Waste reduction metrics further support the environmental case for battery repurposing. Each metric ton of repurposed batteries prevents approximately 1.3 tons of mining waste and 0.5 tons of processing waste. When scaled to projected global electric vehicle battery volumes by 2030, this represents potential annual waste reduction of 8-12 million tons.

Energy efficiency comparisons between new and repurposed battery systems reveal that second-life applications typically retain 70-80% of original capacity, providing sufficient performance for less demanding applications while requiring only 15-30% of the energy input needed for new battery production. This energy efficiency translates directly to reduced greenhouse gas emissions across the supply chain.

Land use impact assessments indicate that expanded battery reuse systems could reduce mining land disturbance by approximately 30% by 2035, preserving ecosystems and biodiversity in mineral-rich regions. This benefit becomes increasingly significant as global demand for energy storage solutions continues to accelerate.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!