Future of LDPE in Automotive Applications

JUN 30, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

LDPE Automotive Evolution

Low-density polyethylene (LDPE) has been a staple material in automotive applications since its introduction in the 1930s. The evolution of LDPE in the automotive industry has been marked by continuous improvements in material properties and manufacturing processes, driven by the ever-increasing demands for lighter, more fuel-efficient vehicles.

In the early stages of automotive manufacturing, LDPE was primarily used for simple, non-critical components such as wire insulation and packaging materials. As the material's properties were better understood and refined, its applications expanded to include more complex parts like fuel tanks, interior trim, and fluid reservoirs.

The 1970s and 1980s saw a significant shift in the automotive industry's approach to materials, with a growing emphasis on weight reduction and fuel efficiency. This period marked a turning point for LDPE, as manufacturers began to explore its potential as a replacement for heavier materials in various vehicle components.

The 1990s brought about advancements in LDPE formulations and processing techniques, leading to improved mechanical properties and enhanced resistance to environmental factors. These developments enabled LDPE to be used in more demanding applications, such as under-the-hood components and exterior trim parts.

The turn of the millennium saw the automotive industry facing increasing pressure to reduce vehicle emissions and improve sustainability. This led to a renewed focus on lightweight materials, with LDPE playing a crucial role in achieving these goals. Manufacturers began to develop new grades of LDPE with enhanced strength-to-weight ratios, allowing for further weight reduction without compromising performance.

In recent years, the evolution of LDPE in automotive applications has been characterized by the integration of advanced technologies and innovative manufacturing processes. The development of multi-layer LDPE structures has enabled the creation of more complex and functional components, such as fuel tanks with improved barrier properties and reduced emissions.

The automotive industry's shift towards electric vehicles has presented new opportunities and challenges for LDPE applications. As vehicle architectures change, LDPE is finding new roles in battery enclosures, thermal management systems, and lightweight structural components.

Looking ahead, the future of LDPE in automotive applications is likely to be shaped by ongoing advancements in material science and manufacturing technologies. The development of bio-based and recycled LDPE grades is expected to play a significant role in meeting the industry's sustainability goals, while continued improvements in material properties will enable LDPE to compete with more advanced engineering plastics in high-performance applications.

In the early stages of automotive manufacturing, LDPE was primarily used for simple, non-critical components such as wire insulation and packaging materials. As the material's properties were better understood and refined, its applications expanded to include more complex parts like fuel tanks, interior trim, and fluid reservoirs.

The 1970s and 1980s saw a significant shift in the automotive industry's approach to materials, with a growing emphasis on weight reduction and fuel efficiency. This period marked a turning point for LDPE, as manufacturers began to explore its potential as a replacement for heavier materials in various vehicle components.

The 1990s brought about advancements in LDPE formulations and processing techniques, leading to improved mechanical properties and enhanced resistance to environmental factors. These developments enabled LDPE to be used in more demanding applications, such as under-the-hood components and exterior trim parts.

The turn of the millennium saw the automotive industry facing increasing pressure to reduce vehicle emissions and improve sustainability. This led to a renewed focus on lightweight materials, with LDPE playing a crucial role in achieving these goals. Manufacturers began to develop new grades of LDPE with enhanced strength-to-weight ratios, allowing for further weight reduction without compromising performance.

In recent years, the evolution of LDPE in automotive applications has been characterized by the integration of advanced technologies and innovative manufacturing processes. The development of multi-layer LDPE structures has enabled the creation of more complex and functional components, such as fuel tanks with improved barrier properties and reduced emissions.

The automotive industry's shift towards electric vehicles has presented new opportunities and challenges for LDPE applications. As vehicle architectures change, LDPE is finding new roles in battery enclosures, thermal management systems, and lightweight structural components.

Looking ahead, the future of LDPE in automotive applications is likely to be shaped by ongoing advancements in material science and manufacturing technologies. The development of bio-based and recycled LDPE grades is expected to play a significant role in meeting the industry's sustainability goals, while continued improvements in material properties will enable LDPE to compete with more advanced engineering plastics in high-performance applications.

Market Demand Analysis

The automotive industry's demand for Low-Density Polyethylene (LDPE) is experiencing significant growth, driven by the material's unique properties and the evolving needs of vehicle manufacturers. LDPE's lightweight nature, excellent chemical resistance, and flexibility make it an attractive option for various automotive applications, particularly in the context of the industry's push towards lighter, more fuel-efficient vehicles.

One of the primary drivers of LDPE demand in the automotive sector is the increasing focus on weight reduction to improve fuel efficiency and reduce emissions. As governments worldwide implement stricter fuel economy standards, automakers are turning to lightweight materials like LDPE to replace heavier components. This trend is expected to continue, with the global automotive lightweight materials market projected to grow at a compound annual growth rate (CAGR) of over 7% in the coming years.

The electric vehicle (EV) revolution is also contributing to the rising demand for LDPE in automotive applications. EVs require extensive use of lightweight materials to offset the weight of battery packs and extend driving range. As EV production continues to ramp up globally, the demand for LDPE in this segment is expected to surge, creating new opportunities for material suppliers and automotive manufacturers alike.

In terms of specific applications, LDPE is finding increased use in automotive interiors, including door panels, dashboards, and seat components. Its ability to be molded into complex shapes while maintaining structural integrity makes it ideal for these applications. Additionally, LDPE is being increasingly utilized in automotive packaging and protective covers due to its excellent moisture resistance and durability.

The automotive industry's shift towards more sustainable practices is also influencing the demand for LDPE. Manufacturers are exploring recycled and bio-based LDPE options to reduce their environmental footprint and meet consumer expectations for greener vehicles. This trend is likely to drive innovation in LDPE production and recycling technologies, further expanding its potential applications in the automotive sector.

However, the market demand for LDPE in automotive applications is not without challenges. Competition from other lightweight materials, such as high-density polyethylene (HDPE) and polypropylene, could potentially limit LDPE's market growth. Additionally, fluctuations in raw material prices and concerns about the environmental impact of plastic use may influence demand dynamics in the coming years.

Despite these challenges, the overall outlook for LDPE in automotive applications remains positive. The material's versatility, cost-effectiveness, and performance characteristics position it well to meet the evolving needs of the automotive industry. As vehicle manufacturers continue to prioritize lightweight design and sustainable materials, LDPE is expected to play an increasingly important role in shaping the future of automotive manufacturing.

One of the primary drivers of LDPE demand in the automotive sector is the increasing focus on weight reduction to improve fuel efficiency and reduce emissions. As governments worldwide implement stricter fuel economy standards, automakers are turning to lightweight materials like LDPE to replace heavier components. This trend is expected to continue, with the global automotive lightweight materials market projected to grow at a compound annual growth rate (CAGR) of over 7% in the coming years.

The electric vehicle (EV) revolution is also contributing to the rising demand for LDPE in automotive applications. EVs require extensive use of lightweight materials to offset the weight of battery packs and extend driving range. As EV production continues to ramp up globally, the demand for LDPE in this segment is expected to surge, creating new opportunities for material suppliers and automotive manufacturers alike.

In terms of specific applications, LDPE is finding increased use in automotive interiors, including door panels, dashboards, and seat components. Its ability to be molded into complex shapes while maintaining structural integrity makes it ideal for these applications. Additionally, LDPE is being increasingly utilized in automotive packaging and protective covers due to its excellent moisture resistance and durability.

The automotive industry's shift towards more sustainable practices is also influencing the demand for LDPE. Manufacturers are exploring recycled and bio-based LDPE options to reduce their environmental footprint and meet consumer expectations for greener vehicles. This trend is likely to drive innovation in LDPE production and recycling technologies, further expanding its potential applications in the automotive sector.

However, the market demand for LDPE in automotive applications is not without challenges. Competition from other lightweight materials, such as high-density polyethylene (HDPE) and polypropylene, could potentially limit LDPE's market growth. Additionally, fluctuations in raw material prices and concerns about the environmental impact of plastic use may influence demand dynamics in the coming years.

Despite these challenges, the overall outlook for LDPE in automotive applications remains positive. The material's versatility, cost-effectiveness, and performance characteristics position it well to meet the evolving needs of the automotive industry. As vehicle manufacturers continue to prioritize lightweight design and sustainable materials, LDPE is expected to play an increasingly important role in shaping the future of automotive manufacturing.

LDPE Technical Challenges

Low-density polyethylene (LDPE) has been a staple material in automotive applications for decades, but it faces several technical challenges that need to be addressed to ensure its continued relevance in the industry. One of the primary concerns is the material's limited temperature resistance. LDPE begins to soften at relatively low temperatures, which can lead to deformation and reduced structural integrity in automotive components exposed to heat, such as those in the engine compartment or near exhaust systems.

Another significant challenge is LDPE's susceptibility to environmental stress cracking. This phenomenon occurs when the material is subjected to both mechanical stress and exposure to certain chemicals, leading to premature failure. In automotive applications, where components are frequently exposed to various fluids and environmental factors, this vulnerability can compromise the longevity and reliability of LDPE parts.

The material's relatively low impact strength is also a concern, particularly in safety-critical applications. While LDPE offers good flexibility, it may not provide sufficient protection in the event of a collision, necessitating the use of alternative materials or reinforcement strategies in certain automotive components.

LDPE's permeability to gases and liquids poses challenges in applications where barrier properties are crucial. This characteristic can limit its use in fuel system components or other areas where containment of fluids or vapors is essential. Additionally, the material's poor resistance to UV radiation can lead to degradation and discoloration over time, affecting both the appearance and performance of exterior automotive parts.

The recyclability of LDPE in automotive applications presents another technical hurdle. While the material is theoretically recyclable, the presence of additives, coatings, and contaminants in automotive LDPE components can complicate the recycling process. This challenge is particularly relevant as the automotive industry faces increasing pressure to improve the sustainability and end-of-life management of vehicle materials.

Addressing these technical challenges requires innovative approaches in material science and engineering. Researchers and manufacturers are exploring various strategies, including the development of LDPE blends with enhanced properties, the incorporation of nanofillers to improve strength and barrier characteristics, and the use of advanced surface treatments to enhance UV resistance and chemical compatibility. Additionally, efforts are being made to improve the recyclability of LDPE in automotive applications through the development of more easily separable composites and improved recycling technologies.

Another significant challenge is LDPE's susceptibility to environmental stress cracking. This phenomenon occurs when the material is subjected to both mechanical stress and exposure to certain chemicals, leading to premature failure. In automotive applications, where components are frequently exposed to various fluids and environmental factors, this vulnerability can compromise the longevity and reliability of LDPE parts.

The material's relatively low impact strength is also a concern, particularly in safety-critical applications. While LDPE offers good flexibility, it may not provide sufficient protection in the event of a collision, necessitating the use of alternative materials or reinforcement strategies in certain automotive components.

LDPE's permeability to gases and liquids poses challenges in applications where barrier properties are crucial. This characteristic can limit its use in fuel system components or other areas where containment of fluids or vapors is essential. Additionally, the material's poor resistance to UV radiation can lead to degradation and discoloration over time, affecting both the appearance and performance of exterior automotive parts.

The recyclability of LDPE in automotive applications presents another technical hurdle. While the material is theoretically recyclable, the presence of additives, coatings, and contaminants in automotive LDPE components can complicate the recycling process. This challenge is particularly relevant as the automotive industry faces increasing pressure to improve the sustainability and end-of-life management of vehicle materials.

Addressing these technical challenges requires innovative approaches in material science and engineering. Researchers and manufacturers are exploring various strategies, including the development of LDPE blends with enhanced properties, the incorporation of nanofillers to improve strength and barrier characteristics, and the use of advanced surface treatments to enhance UV resistance and chemical compatibility. Additionally, efforts are being made to improve the recyclability of LDPE in automotive applications through the development of more easily separable composites and improved recycling technologies.

Current LDPE Solutions

01 Composition and properties of LDPE

Low-Density Polyethylene (LDPE) is a thermoplastic polymer with a low density and high flexibility. It is characterized by its branched molecular structure, which results in lower crystallinity and density compared to other polyethylene types. LDPE exhibits good chemical resistance, electrical insulation properties, and processability, making it suitable for various applications.- Composition and properties of LDPE: Low-Density Polyethylene (LDPE) is a thermoplastic polymer with a low density and high flexibility. It is characterized by its branched structure, which results in lower crystallinity and density compared to other polyethylene types. LDPE exhibits good chemical resistance, low water absorption, and excellent electrical insulation properties.

- Manufacturing processes for LDPE: LDPE is typically produced through high-pressure polymerization of ethylene using free-radical initiators. Various manufacturing techniques have been developed to improve the production efficiency and control the properties of LDPE, including the use of different catalysts, reactor designs, and process conditions.

- Applications of LDPE: LDPE finds widespread use in various industries due to its unique properties. Common applications include packaging materials, plastic bags, containers, toys, and agricultural films. It is also used in the production of wire and cable insulation, as well as in the construction industry for pipes and fittings.

- Modifications and blends of LDPE: To enhance its properties and expand its applications, LDPE is often modified or blended with other materials. This includes the incorporation of additives, crosslinking agents, or blending with other polymers to improve mechanical strength, thermal stability, or specific functional properties.

- Recycling and environmental considerations of LDPE: As a widely used plastic, the recycling and environmental impact of LDPE have become important considerations. Research and development efforts focus on improving recycling processes, developing biodegradable alternatives, and reducing the environmental footprint of LDPE production and disposal.

02 Manufacturing processes for LDPE

LDPE is typically produced through high-pressure polymerization of ethylene using free-radical initiators. Various manufacturing techniques have been developed to improve the production efficiency and control the properties of LDPE. These may include modifications to reactor design, catalyst systems, and process conditions to achieve desired molecular weight distribution and branching characteristics.Expand Specific Solutions03 Applications of LDPE in packaging

LDPE is widely used in the packaging industry due to its flexibility, transparency, and moisture resistance. It is commonly employed in the production of plastic bags, food packaging films, and shrink wraps. Recent innovations focus on improving the barrier properties and recyclability of LDPE packaging materials to meet environmental and performance requirements.Expand Specific Solutions04 LDPE blends and composites

To enhance the properties of LDPE, it is often blended with other polymers or reinforced with various fillers and additives. These blends and composites can exhibit improved mechanical strength, thermal stability, or specific functional properties. Research in this area focuses on developing novel LDPE-based materials with tailored characteristics for specialized applications.Expand Specific Solutions05 Recycling and sustainability of LDPE

With increasing environmental concerns, there is a growing focus on the recycling and sustainable use of LDPE. Efforts are being made to develop more efficient recycling processes, improve the quality of recycled LDPE, and explore biodegradable or bio-based alternatives. Research also aims at reducing the environmental impact of LDPE production and enhancing its end-of-life management.Expand Specific Solutions

Key Industry Players

The automotive LDPE market is in a mature growth phase, with a global market size estimated to reach $7.2 billion by 2025. Major players like Dow, ExxonMobil, and Braskem dominate the industry, leveraging their advanced technologies and extensive R&D capabilities. The technology is well-established, with ongoing innovations focused on enhancing performance properties and sustainability. Companies such as Borealis and SABIC are investing in bio-based LDPE solutions to address environmental concerns. While the market is competitive, there's still room for growth, particularly in emerging economies and eco-friendly applications within the automotive sector.

Dow Global Technologies LLC

Technical Solution: Dow has developed advanced LDPE resins specifically tailored for automotive applications. Their ELITE™ Enhanced Polyethylene technology combines the processability of LDPE with the strength and toughness of LLDPE, resulting in improved performance for automotive parts[1]. Dow's AGILITY™ CE LDPE resins offer enhanced melt strength and elasticity, making them ideal for automotive foams and lightweight components[2]. The company has also introduced INNATE™ Precision Packaging Resins, which provide excellent toughness and stiffness balance, suitable for automotive interior parts[3].

Strengths: Wide range of specialized LDPE products for automotive use, strong R&D capabilities, global presence. Weaknesses: Potential higher costs compared to standard LDPE, may require specialized processing equipment.

ExxonMobil Chemical Patents, Inc.

Technical Solution: ExxonMobil has developed Exceed™ XP performance polymers, which are metallocene LLDPE resins that can be blended with LDPE for automotive applications. These blends offer improved impact resistance and tear strength, making them suitable for automotive interior parts and under-the-hood components[4]. The company's Vistamaxx™ performance polymers, when combined with LDPE, enhance flexibility and impact resistance in automotive applications such as weather seals and gaskets[5]. ExxonMobil's proprietary catalyst technology allows for precise control of molecular structure, resulting in LDPE with tailored properties for specific automotive needs[6].

Strengths: Advanced catalyst technology, wide range of complementary polymers for blending with LDPE. Weaknesses: May require more complex blending processes, potential higher material costs.

LDPE Patent Landscape

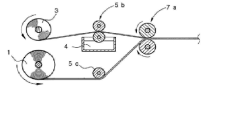

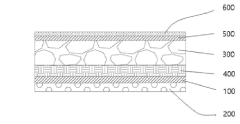

Product apparatus of LDPE vinyl bonded felt for the interior materials of a vehicle

PatentInactiveKR1020210146754A

Innovation

- A manufacturing apparatus using LDPE vinyl as an adhesive to bond with felt, reducing complexity by eliminating adhesive application and spraying, and integrating LDPE vinyl with P.P bubble paper to enhance adhesion, sound insulation, and moisture barrier, while maintaining lightweight and strong structure.

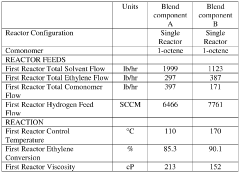

Resin compositions for extrusion coating

PatentWO2016182727A1

Innovation

- A resin composition comprising a blend of two linear low density polyethylenes with specific density and melt index ranges, where 20-40% is a homogeneously branched ethylene/a-olefin interpolymer and 60-80% is a higher-density, higher-melt-index ethylene/a-olefin interpolymer, providing improved hot tack strength across a broad temperature range without significant density reduction.

Environmental Regulations

Environmental regulations play a crucial role in shaping the future of Low-Density Polyethylene (LDPE) in automotive applications. As governments worldwide intensify their efforts to combat climate change and reduce environmental impact, the automotive industry faces increasing pressure to adopt more sustainable materials and practices.

The European Union's End-of-Life Vehicles (ELV) Directive has been a significant driver in this regard. It mandates that 95% of a vehicle's weight must be reusable or recyclable, pushing manufacturers to reconsider their material choices. LDPE, being a thermoplastic, offers advantages in terms of recyclability, but its widespread use in automotive applications is still limited by other environmental concerns.

Emissions regulations, such as the Corporate Average Fuel Economy (CAFE) standards in the United States and similar policies in other regions, indirectly impact LDPE usage. These regulations drive the need for lightweight materials to improve fuel efficiency and reduce emissions. While LDPE is lightweight, it often competes with other materials that may offer better strength-to-weight ratios or additional functional benefits.

The push for circular economy principles in the automotive sector is another regulatory trend affecting LDPE's future. Regulations are increasingly focusing on the entire lifecycle of materials, from production to disposal. This has led to growing interest in bio-based and biodegradable plastics, which could potentially compete with or complement traditional LDPE in certain applications.

Waste management regulations, particularly those targeting single-use plastics, may indirectly influence LDPE use in automotive applications. While these regulations primarily focus on consumer goods, they contribute to a broader shift in public perception and policy-making regarding plastic use. This could lead to more stringent requirements for plastic use in vehicles, potentially affecting LDPE applications.

Chemical regulations, such as the Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH) in the EU, also impact LDPE's future in automotive applications. These regulations aim to protect human health and the environment from risks posed by chemicals. As LDPE production involves various additives and processing aids, ensuring compliance with evolving chemical regulations is crucial for its continued use in the automotive sector.

Looking ahead, the regulatory landscape is likely to become more complex and stringent. Emerging regulations around microplastics and their environmental impact could pose new challenges for LDPE use. Additionally, as countries set more ambitious targets for reducing greenhouse gas emissions, regulations may increasingly focus on the carbon footprint of materials throughout their lifecycle, potentially influencing material choices in automotive design and manufacturing.

The European Union's End-of-Life Vehicles (ELV) Directive has been a significant driver in this regard. It mandates that 95% of a vehicle's weight must be reusable or recyclable, pushing manufacturers to reconsider their material choices. LDPE, being a thermoplastic, offers advantages in terms of recyclability, but its widespread use in automotive applications is still limited by other environmental concerns.

Emissions regulations, such as the Corporate Average Fuel Economy (CAFE) standards in the United States and similar policies in other regions, indirectly impact LDPE usage. These regulations drive the need for lightweight materials to improve fuel efficiency and reduce emissions. While LDPE is lightweight, it often competes with other materials that may offer better strength-to-weight ratios or additional functional benefits.

The push for circular economy principles in the automotive sector is another regulatory trend affecting LDPE's future. Regulations are increasingly focusing on the entire lifecycle of materials, from production to disposal. This has led to growing interest in bio-based and biodegradable plastics, which could potentially compete with or complement traditional LDPE in certain applications.

Waste management regulations, particularly those targeting single-use plastics, may indirectly influence LDPE use in automotive applications. While these regulations primarily focus on consumer goods, they contribute to a broader shift in public perception and policy-making regarding plastic use. This could lead to more stringent requirements for plastic use in vehicles, potentially affecting LDPE applications.

Chemical regulations, such as the Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH) in the EU, also impact LDPE's future in automotive applications. These regulations aim to protect human health and the environment from risks posed by chemicals. As LDPE production involves various additives and processing aids, ensuring compliance with evolving chemical regulations is crucial for its continued use in the automotive sector.

Looking ahead, the regulatory landscape is likely to become more complex and stringent. Emerging regulations around microplastics and their environmental impact could pose new challenges for LDPE use. Additionally, as countries set more ambitious targets for reducing greenhouse gas emissions, regulations may increasingly focus on the carbon footprint of materials throughout their lifecycle, potentially influencing material choices in automotive design and manufacturing.

LDPE Recycling Strategies

Recycling strategies for Low-Density Polyethylene (LDPE) in automotive applications are becoming increasingly crucial as the industry shifts towards more sustainable practices. The automotive sector's growing emphasis on environmental responsibility has led to a surge in research and development of effective LDPE recycling methods. One primary strategy involves the implementation of advanced sorting technologies to separate LDPE from other plastics and contaminants. This includes the use of near-infrared (NIR) spectroscopy and electrostatic separation techniques, which have shown promising results in achieving high-purity LDPE streams suitable for recycling.

Another key approach is the development of chemical recycling processes, such as pyrolysis and depolymerization. These methods break down LDPE into its basic chemical components, allowing for the production of new, high-quality plastics or other valuable chemicals. This strategy addresses the limitations of mechanical recycling, which often results in downcycled materials with reduced properties.

The automotive industry is also exploring the integration of design for recyclability principles in vehicle manufacturing. This involves creating components with easily separable materials and minimizing the use of additives or coatings that could hinder the recycling process. Additionally, some manufacturers are implementing closed-loop recycling systems, where LDPE from end-of-life vehicles is recovered and reprocessed for use in new automotive parts.

Collaboration between automotive manufacturers, recycling companies, and chemical industries is playing a vital role in advancing LDPE recycling strategies. These partnerships are fostering innovation in recycling technologies and creating more efficient supply chains for recycled materials. Furthermore, the development of standardized recycling processes and quality control measures is enhancing the consistency and reliability of recycled LDPE, making it more attractive for use in automotive applications.

As regulations on plastic waste and recycling continue to tighten globally, the automotive industry is also investing in research on alternative materials that could potentially replace LDPE in certain applications. This includes the exploration of bio-based plastics and other environmentally friendly materials that offer similar properties to LDPE but with improved recyclability or biodegradability.

The future of LDPE recycling in automotive applications will likely see a combination of these strategies, with continuous improvements in technology and processes. As recycling efficiencies increase and the quality of recycled LDPE improves, its use in automotive applications is expected to grow, contributing to a more circular economy in the automotive sector.

Another key approach is the development of chemical recycling processes, such as pyrolysis and depolymerization. These methods break down LDPE into its basic chemical components, allowing for the production of new, high-quality plastics or other valuable chemicals. This strategy addresses the limitations of mechanical recycling, which often results in downcycled materials with reduced properties.

The automotive industry is also exploring the integration of design for recyclability principles in vehicle manufacturing. This involves creating components with easily separable materials and minimizing the use of additives or coatings that could hinder the recycling process. Additionally, some manufacturers are implementing closed-loop recycling systems, where LDPE from end-of-life vehicles is recovered and reprocessed for use in new automotive parts.

Collaboration between automotive manufacturers, recycling companies, and chemical industries is playing a vital role in advancing LDPE recycling strategies. These partnerships are fostering innovation in recycling technologies and creating more efficient supply chains for recycled materials. Furthermore, the development of standardized recycling processes and quality control measures is enhancing the consistency and reliability of recycled LDPE, making it more attractive for use in automotive applications.

As regulations on plastic waste and recycling continue to tighten globally, the automotive industry is also investing in research on alternative materials that could potentially replace LDPE in certain applications. This includes the exploration of bio-based plastics and other environmentally friendly materials that offer similar properties to LDPE but with improved recyclability or biodegradability.

The future of LDPE recycling in automotive applications will likely see a combination of these strategies, with continuous improvements in technology and processes. As recycling efficiencies increase and the quality of recycled LDPE improves, its use in automotive applications is expected to grow, contributing to a more circular economy in the automotive sector.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!