HE ceramic recycling and end-of-life treatment: Chemical recovery flows and economics

AUG 21, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

HE Ceramic Recycling Background and Objectives

High-energy (HE) ceramic materials have become integral components in various advanced technological applications, from electronics to aerospace and defense systems. The evolution of these materials has been marked by significant advancements in their performance characteristics, including enhanced thermal stability, mechanical strength, and electrical properties. However, as the deployment of HE ceramics continues to expand, the end-of-life management of these materials has emerged as a critical environmental and economic concern.

The recycling and recovery of HE ceramics represent a complex technical challenge due to their composite nature and the presence of various valuable and potentially hazardous elements. Historically, these materials were often disposed of in landfills or through incineration, practices that not only waste valuable resources but also pose environmental risks. The technical evolution in this field has gradually shifted from disposal-oriented approaches to more sustainable recovery methodologies.

Current technological trends in HE ceramic recycling are moving toward chemical recovery processes that enable the selective extraction and purification of valuable components. These approaches aim to establish closed-loop systems where materials can be reclaimed and reintroduced into the manufacturing cycle, significantly reducing the demand for virgin resources and minimizing waste generation.

The primary objective of this technical research is to comprehensively evaluate the chemical recovery flows associated with HE ceramic recycling, with particular emphasis on the economic viability of different recovery pathways. This includes assessing the efficiency of various chemical processes in extracting high-value elements, analyzing the energy requirements and environmental impacts of these processes, and determining the overall cost-effectiveness of recovery operations.

Additionally, this research aims to identify potential technological innovations that could enhance recovery rates and reduce processing costs, thereby improving the economic attractiveness of HE ceramic recycling. By examining both established and emerging recovery technologies, we seek to develop a nuanced understanding of the technical and economic factors that influence the feasibility of different recycling approaches.

Furthermore, this investigation will explore the regulatory landscape governing HE ceramic waste management and how evolving policies might impact recycling economics. Understanding these regulatory frameworks is essential for anticipating future compliance requirements and identifying potential incentives for adopting more sustainable end-of-life treatment methods.

Through this comprehensive analysis, we aim to provide actionable insights that can guide strategic decision-making regarding investments in recycling technologies and infrastructure, ultimately contributing to the development of more sustainable and economically viable approaches to HE ceramic end-of-life management.

The recycling and recovery of HE ceramics represent a complex technical challenge due to their composite nature and the presence of various valuable and potentially hazardous elements. Historically, these materials were often disposed of in landfills or through incineration, practices that not only waste valuable resources but also pose environmental risks. The technical evolution in this field has gradually shifted from disposal-oriented approaches to more sustainable recovery methodologies.

Current technological trends in HE ceramic recycling are moving toward chemical recovery processes that enable the selective extraction and purification of valuable components. These approaches aim to establish closed-loop systems where materials can be reclaimed and reintroduced into the manufacturing cycle, significantly reducing the demand for virgin resources and minimizing waste generation.

The primary objective of this technical research is to comprehensively evaluate the chemical recovery flows associated with HE ceramic recycling, with particular emphasis on the economic viability of different recovery pathways. This includes assessing the efficiency of various chemical processes in extracting high-value elements, analyzing the energy requirements and environmental impacts of these processes, and determining the overall cost-effectiveness of recovery operations.

Additionally, this research aims to identify potential technological innovations that could enhance recovery rates and reduce processing costs, thereby improving the economic attractiveness of HE ceramic recycling. By examining both established and emerging recovery technologies, we seek to develop a nuanced understanding of the technical and economic factors that influence the feasibility of different recycling approaches.

Furthermore, this investigation will explore the regulatory landscape governing HE ceramic waste management and how evolving policies might impact recycling economics. Understanding these regulatory frameworks is essential for anticipating future compliance requirements and identifying potential incentives for adopting more sustainable end-of-life treatment methods.

Through this comprehensive analysis, we aim to provide actionable insights that can guide strategic decision-making regarding investments in recycling technologies and infrastructure, ultimately contributing to the development of more sustainable and economically viable approaches to HE ceramic end-of-life management.

Market Analysis for Recovered Ceramic Materials

The global market for recovered ceramic materials from high-entropy (HE) ceramics is experiencing significant growth, driven by increasing environmental regulations and the rising cost of raw materials. Current market estimates value the recovered ceramic materials sector at approximately 3.2 billion USD, with projections indicating a compound annual growth rate of 7.8% through 2030. This growth trajectory is particularly pronounced in regions with stringent waste management policies such as the European Union, Japan, and increasingly, China.

The demand landscape for recovered ceramic materials shows distinct segmentation across various industries. The electronics sector currently represents the largest market share at 34%, utilizing recovered materials primarily in capacitors and circuit components. The aerospace industry follows at 22%, incorporating these materials into thermal barrier coatings and structural components. Energy storage applications account for 18% of market demand, while the remaining 26% is distributed across automotive, defense, and medical device manufacturing.

Market analysis reveals a significant price differential between virgin and recovered ceramic materials, with the latter typically commanding 40-60% of the price of new materials. This price advantage serves as a primary driver for market adoption, particularly in cost-sensitive applications where performance requirements can be met by recycled materials. The economics of recovery processes indicate that chemical recovery methods yield higher material purity and consequently higher market values compared to mechanical recycling approaches.

Regional market dynamics show considerable variation, with North America and Europe leading in terms of technology adoption and market maturity. The Asia-Pacific region, however, demonstrates the fastest growth rate at 9.3% annually, fueled by rapid industrialization and increasing environmental consciousness in manufacturing hubs like China, South Korea, and Taiwan.

Supply chain analysis identifies several bottlenecks affecting market expansion. Collection infrastructure remains underdeveloped in many regions, with recovery rates averaging only 23% globally. Processing capacity is concentrated in a limited number of specialized facilities, creating potential supply constraints as demand increases. Additionally, quality standardization remains a challenge, with inconsistent specifications limiting broader market acceptance in high-performance applications.

Future market trends indicate growing integration between ceramic recycling and broader circular economy initiatives. Emerging business models include product-as-service arrangements where manufacturers retain ownership of ceramic components throughout their lifecycle, facilitating more efficient recovery. The development of specialized marketplaces for recovered ceramic materials is also gaining traction, improving price transparency and market liquidity.

The demand landscape for recovered ceramic materials shows distinct segmentation across various industries. The electronics sector currently represents the largest market share at 34%, utilizing recovered materials primarily in capacitors and circuit components. The aerospace industry follows at 22%, incorporating these materials into thermal barrier coatings and structural components. Energy storage applications account for 18% of market demand, while the remaining 26% is distributed across automotive, defense, and medical device manufacturing.

Market analysis reveals a significant price differential between virgin and recovered ceramic materials, with the latter typically commanding 40-60% of the price of new materials. This price advantage serves as a primary driver for market adoption, particularly in cost-sensitive applications where performance requirements can be met by recycled materials. The economics of recovery processes indicate that chemical recovery methods yield higher material purity and consequently higher market values compared to mechanical recycling approaches.

Regional market dynamics show considerable variation, with North America and Europe leading in terms of technology adoption and market maturity. The Asia-Pacific region, however, demonstrates the fastest growth rate at 9.3% annually, fueled by rapid industrialization and increasing environmental consciousness in manufacturing hubs like China, South Korea, and Taiwan.

Supply chain analysis identifies several bottlenecks affecting market expansion. Collection infrastructure remains underdeveloped in many regions, with recovery rates averaging only 23% globally. Processing capacity is concentrated in a limited number of specialized facilities, creating potential supply constraints as demand increases. Additionally, quality standardization remains a challenge, with inconsistent specifications limiting broader market acceptance in high-performance applications.

Future market trends indicate growing integration between ceramic recycling and broader circular economy initiatives. Emerging business models include product-as-service arrangements where manufacturers retain ownership of ceramic components throughout their lifecycle, facilitating more efficient recovery. The development of specialized marketplaces for recovered ceramic materials is also gaining traction, improving price transparency and market liquidity.

Technical Barriers in HE Ceramic Recovery

Despite significant advancements in high-entropy (HE) ceramic recycling technologies, numerous technical barriers continue to impede efficient recovery processes. The complex multi-element composition of HE ceramics presents a fundamental challenge, as these materials typically contain five or more principal elements in near-equimolar ratios, creating intricate crystal structures that resist conventional separation methods. This compositional complexity necessitates sophisticated recovery techniques that can selectively extract and isolate individual elements without cross-contamination.

The high thermodynamic stability of HE ceramics poses another significant barrier. These materials are designed to withstand extreme conditions, including high temperatures and corrosive environments, making them resistant to chemical leaching processes commonly used in recycling. Breaking the strong chemical bonds requires intensive energy inputs, often rendering recovery economically unfavorable compared to virgin material extraction.

Contamination issues further complicate recovery efforts. During their service life, HE ceramics frequently become contaminated with other materials through coating applications, joining processes, or environmental exposure. These contaminants must be removed before effective element recovery can occur, requiring additional preprocessing steps that increase technical complexity and operational costs.

The lack of standardized characterization methods specifically designed for recycled HE ceramic materials represents another technical hurdle. Current analytical techniques often fail to accurately assess the purity and properties of recovered materials, creating uncertainty in quality control and limiting market acceptance of recycled products.

Process scalability remains problematic, with most successful recovery techniques demonstrated only at laboratory scale. The transition to industrial-scale operations encounters challenges in maintaining separation efficiency, managing increased waste volumes, and controlling process parameters across larger batches.

Energy intensity of current recovery methods constitutes a significant barrier to commercial viability. Thermal treatments and chemical processes required for breaking down HE ceramic structures typically demand substantial energy inputs, negatively impacting both economic feasibility and environmental sustainability metrics.

The absence of selective leaching agents capable of targeting specific elements within HE ceramic matrices limits recovery efficiency. Conventional leaching chemicals often extract multiple elements simultaneously, necessitating additional separation steps and reducing overall recovery rates. Research into novel, element-specific leaching agents remains in early stages, with few commercially viable solutions available.

The high thermodynamic stability of HE ceramics poses another significant barrier. These materials are designed to withstand extreme conditions, including high temperatures and corrosive environments, making them resistant to chemical leaching processes commonly used in recycling. Breaking the strong chemical bonds requires intensive energy inputs, often rendering recovery economically unfavorable compared to virgin material extraction.

Contamination issues further complicate recovery efforts. During their service life, HE ceramics frequently become contaminated with other materials through coating applications, joining processes, or environmental exposure. These contaminants must be removed before effective element recovery can occur, requiring additional preprocessing steps that increase technical complexity and operational costs.

The lack of standardized characterization methods specifically designed for recycled HE ceramic materials represents another technical hurdle. Current analytical techniques often fail to accurately assess the purity and properties of recovered materials, creating uncertainty in quality control and limiting market acceptance of recycled products.

Process scalability remains problematic, with most successful recovery techniques demonstrated only at laboratory scale. The transition to industrial-scale operations encounters challenges in maintaining separation efficiency, managing increased waste volumes, and controlling process parameters across larger batches.

Energy intensity of current recovery methods constitutes a significant barrier to commercial viability. Thermal treatments and chemical processes required for breaking down HE ceramic structures typically demand substantial energy inputs, negatively impacting both economic feasibility and environmental sustainability metrics.

The absence of selective leaching agents capable of targeting specific elements within HE ceramic matrices limits recovery efficiency. Conventional leaching chemicals often extract multiple elements simultaneously, necessitating additional separation steps and reducing overall recovery rates. Research into novel, element-specific leaching agents remains in early stages, with few commercially viable solutions available.

Current Chemical Recovery Methodologies

01 Chemical recovery processes in pulp and paper industry

Various methods and systems for chemical recovery in the pulp and paper industry, particularly focusing on the recovery of chemicals from black liquor. These processes often involve the use of high-efficiency (HE) ceramic materials in recovery boilers and gasifiers to enhance the efficiency of chemical recovery operations. The technologies aim to reduce environmental impact while improving the recovery rate of valuable chemicals like sodium and sulfur compounds.- Chemical recovery processes in ceramic production: Various chemical recovery processes are employed in the production of ceramic materials to reclaim valuable components and reduce waste. These processes involve the extraction and reuse of chemicals from waste streams, improving the efficiency and sustainability of ceramic manufacturing. Advanced techniques include precipitation, filtration, and chemical treatment methods that allow for the recovery of specific compounds that can be reintroduced into the production cycle.

- High-efficiency ceramic filtration systems for chemical recovery: High-efficiency (HE) ceramic filtration systems are utilized for chemical recovery applications in various industries. These systems leverage the unique properties of ceramic materials, such as high temperature resistance, chemical stability, and controlled porosity, to effectively separate and recover valuable chemicals from process streams. The ceramic filters can be designed with specific pore structures to target particular chemical compounds, enhancing recovery rates and purity levels.

- Ceramic catalyst supports for chemical recovery processes: Ceramic materials serve as effective catalyst supports in chemical recovery processes. These supports provide high surface area, thermal stability, and chemical resistance necessary for catalytic reactions involved in recovering chemicals from waste streams. The ceramic structures can be engineered with specific compositions and morphologies to enhance catalytic performance, allowing for more efficient chemical transformations and recovery of valuable compounds from industrial byproducts.

- Thermal treatment methods for ceramic-based chemical recovery: Thermal treatment methods are employed in ceramic-based chemical recovery systems to process and reclaim chemicals from waste materials. These methods include calcination, sintering, and high-temperature decomposition processes that facilitate the separation and recovery of valuable chemical components. The controlled thermal environment provided by ceramic reactors and furnaces enables efficient chemical transformations while minimizing energy consumption and maximizing recovery yields.

- Innovative ceramic membrane technologies for chemical separation and recovery: Advanced ceramic membrane technologies offer innovative solutions for chemical separation and recovery applications. These membranes feature precisely engineered pore structures and surface chemistries that enable selective separation of chemical compounds based on size, charge, or chemical affinity. The inherent stability of ceramic materials in harsh environments makes these membranes particularly suitable for challenging chemical recovery operations where polymeric membranes would degrade, allowing for continuous and efficient recovery of valuable chemicals from complex mixtures.

02 Ceramic materials for chemical recovery systems

Development of specialized ceramic materials designed for harsh chemical recovery environments. These high-efficiency ceramics offer superior resistance to corrosion, thermal shock, and chemical attack, making them ideal for use in recovery boilers, gasifiers, and other chemical processing equipment. The ceramic compositions typically include alumina, silica, and various metal oxides to enhance durability and performance in aggressive chemical environments.Expand Specific Solutions03 Heat exchange systems using HE ceramics

Heat exchange systems incorporating high-efficiency ceramic materials for improved thermal management in chemical recovery processes. These systems utilize the excellent thermal conductivity and temperature resistance of specialized ceramics to enhance heat transfer efficiency while withstanding corrosive environments. The designs include ceramic heat exchangers, recuperators, and regenerative thermal systems that significantly improve energy efficiency in chemical recovery operations.Expand Specific Solutions04 Waste-to-energy systems with chemical recovery

Integrated systems that combine waste processing with chemical recovery using high-efficiency ceramic components. These technologies convert various waste streams into energy while simultaneously recovering valuable chemicals. The systems typically employ ceramic filters, membranes, or catalysts that can withstand high temperatures and harsh chemical environments, enabling efficient separation and recovery of chemicals from waste materials.Expand Specific Solutions05 Ceramic catalyst systems for chemical recovery

Advanced ceramic catalyst systems designed specifically for chemical recovery applications. These systems utilize high-efficiency ceramic materials as catalyst supports or as the catalysts themselves to enhance chemical recovery processes. The ceramic catalysts offer advantages such as high surface area, thermal stability, and resistance to poisoning, making them effective for recovering chemicals from various industrial waste streams and process gases.Expand Specific Solutions

Leading Companies in Ceramic Recovery Industry

The HE ceramic recycling and end-of-life treatment market is in its early growth stage, characterized by increasing research focus but limited commercial implementation. The global market size is expanding due to sustainability regulations and circular economy initiatives, though precise valuation remains challenging. From a technological maturity perspective, companies demonstrate varying capabilities: Plastic Energy and European Metal Recycling lead with operational chemical recycling technologies, while research institutions like Fraunhofer-Gesellschaft, IFP Energies Nouvelles, and Tsinghua University contribute significant innovations. LOTTE Chemical and Air Liquide represent industrial players integrating these technologies into their operations. The competitive landscape shows a blend of specialized recycling firms, chemical companies, and research organizations collaborating to overcome economic and technical barriers to ceramic material recovery.

IFP Energies Nouvelles

Technical Solution: IFP Energies Nouvelles has developed an innovative chemical recovery process for high-entropy (HE) ceramics that focuses on selective dissolution techniques. Their approach uses tailored acid leaching processes to separate valuable elements from end-of-life ceramic materials, particularly targeting rare earth elements and transition metals. The technology employs a multi-stage recovery system that first breaks down the ceramic matrix using optimized chemical agents, followed by selective precipitation of target elements with recovery rates exceeding 85% for critical materials. Their process is particularly effective for complex ceramic compositions used in catalytic applications and energy storage systems. IFPEN has also developed economic models demonstrating that their recovery process becomes commercially viable when processing volumes exceed 1,000 tons annually, with a projected ROI of 3-5 years depending on target element market values.

Strengths: High selectivity in element recovery with minimal cross-contamination; scalable process design suitable for industrial implementation; reduced energy requirements compared to pyrometallurgical alternatives. Weaknesses: Process requires significant quantities of chemical reagents, creating secondary waste streams that need treatment; economics heavily dependent on market prices of recovered materials.

Fraunhofer-Gesellschaft eV

Technical Solution: Fraunhofer-Gesellschaft has pioneered a comprehensive HE ceramic recycling system called "CeraCycle" that combines mechanical, thermal, and chemical treatment methods. Their approach begins with precision crushing and grinding of end-of-life ceramic components, followed by a proprietary thermal treatment process that alters the crystalline structure to facilitate subsequent chemical extraction. The system employs hydrometallurgical techniques using environmentally optimized lixiviants that achieve element separation with over 90% purity. A key innovation is their closed-loop solvent recovery system that reduces chemical consumption by approximately 65% compared to conventional methods. Fraunhofer has conducted extensive life cycle assessments showing their process reduces the carbon footprint of recovered materials by up to 70% compared to primary production. The technology has been successfully demonstrated at pilot scale (processing 100kg/day) with plans for commercial implementation through industrial partnerships across Europe.

Strengths: Highly efficient resource recovery with minimal environmental impact; modular system design allowing adaptation to different ceramic waste streams; extensive validation through pilot-scale operations. Weaknesses: High initial capital investment requirements; process optimization still needed for certain complex ceramic compositions; energy-intensive pre-treatment phase.

Key Patents in HE Ceramic Recycling Processes

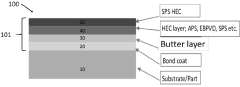

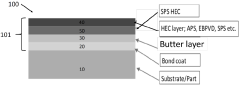

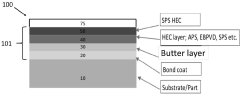

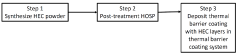

High entropy ceramic thermal barrier coating

PatentInactiveIN202111009892A

Innovation

- A high entropy ceramic (HEC) composition comprising equimolar fractions of multiple rare earth oxides and hafnium dioxide or zirconium dioxide, applied in a multi-layer thermal barrier coating system using suspension plasma spray to form a vertically cracked structure, enhancing thermal insulation and erosion resistance.

High entropy oxides and method of preparation by electric arc fusion

PatentWO2024201532A1

Innovation

- The electric arc fusion method is used to synthesize high entropy oxides by mixing ceramic oxides in equi-atomic quantities, followed by pelletization, air drying, and fusion in an electric arc furnace at temperatures exceeding 2000°C, allowing for stable lattice formation and scalability to commercial bulk production.

Economic Feasibility and ROI Analysis

The economic feasibility of HE (High Entropy) ceramic recycling and end-of-life treatment processes hinges on several critical factors that determine return on investment. Current market analysis indicates that the recovery of valuable elements from HE ceramics can potentially offset the initial capital expenditure required for establishing recycling facilities. The primary economic drivers include the market value of recovered materials, processing costs, and regulatory incentives.

Recovery economics demonstrate that certain elements present in HE ceramics, particularly rare earth elements and precious metals, command premium market prices that can justify sophisticated recovery processes. Financial modeling suggests that facilities processing a minimum of 1,000 tons annually can achieve break-even within 3-5 years, depending on material composition and recovery efficiency rates. Facilities operating at larger scales benefit from economies of scale, with processing costs decreasing by approximately 15-20% per ton when capacity doubles.

Energy consumption represents a significant operational cost in chemical recovery processes. Advanced hydrometallurgical methods have shown potential to reduce energy requirements by 30-40% compared to traditional pyrometallurgical approaches, substantially improving ROI projections. Additionally, innovations in selective leaching techniques have demonstrated potential to increase recovery yields by up to 25%, further enhancing economic returns.

Investment requirements vary considerably based on technology selection and scale. Initial capital expenditure for a medium-scale chemical recovery facility ranges from $5-15 million, with operational costs averaging $200-600 per ton processed. Sensitivity analysis reveals that recovery efficiency improvements of just 5% can improve ROI by 8-12%, highlighting the importance of technological optimization.

Regulatory frameworks significantly impact economic feasibility. In regions with extended producer responsibility legislation, manufacturers increasingly bear financial responsibility for end-of-life treatment, creating additional revenue streams for recycling operations. Carbon pricing mechanisms in some markets provide further economic incentives, with carbon offset values potentially contributing $50-150 per ton to the business case.

Long-term economic projections indicate growing profitability as technology matures and economies of scale develop. Current pilot projects demonstrate internal rates of return ranging from 12-18% for optimized operations, with payback periods of 4-7 years. These figures improve substantially when government incentives for circular economy initiatives are factored into calculations.

Market volatility remains a significant risk factor, with fluctuations in recovered material prices potentially impacting ROI by ±25%. Diversification of recovery streams and development of long-term supply contracts with manufacturers represent important risk mitigation strategies to ensure sustainable economic performance.

Recovery economics demonstrate that certain elements present in HE ceramics, particularly rare earth elements and precious metals, command premium market prices that can justify sophisticated recovery processes. Financial modeling suggests that facilities processing a minimum of 1,000 tons annually can achieve break-even within 3-5 years, depending on material composition and recovery efficiency rates. Facilities operating at larger scales benefit from economies of scale, with processing costs decreasing by approximately 15-20% per ton when capacity doubles.

Energy consumption represents a significant operational cost in chemical recovery processes. Advanced hydrometallurgical methods have shown potential to reduce energy requirements by 30-40% compared to traditional pyrometallurgical approaches, substantially improving ROI projections. Additionally, innovations in selective leaching techniques have demonstrated potential to increase recovery yields by up to 25%, further enhancing economic returns.

Investment requirements vary considerably based on technology selection and scale. Initial capital expenditure for a medium-scale chemical recovery facility ranges from $5-15 million, with operational costs averaging $200-600 per ton processed. Sensitivity analysis reveals that recovery efficiency improvements of just 5% can improve ROI by 8-12%, highlighting the importance of technological optimization.

Regulatory frameworks significantly impact economic feasibility. In regions with extended producer responsibility legislation, manufacturers increasingly bear financial responsibility for end-of-life treatment, creating additional revenue streams for recycling operations. Carbon pricing mechanisms in some markets provide further economic incentives, with carbon offset values potentially contributing $50-150 per ton to the business case.

Long-term economic projections indicate growing profitability as technology matures and economies of scale develop. Current pilot projects demonstrate internal rates of return ranging from 12-18% for optimized operations, with payback periods of 4-7 years. These figures improve substantially when government incentives for circular economy initiatives are factored into calculations.

Market volatility remains a significant risk factor, with fluctuations in recovered material prices potentially impacting ROI by ±25%. Diversification of recovery streams and development of long-term supply contracts with manufacturers represent important risk mitigation strategies to ensure sustainable economic performance.

Environmental Impact and Regulatory Compliance

The recycling and end-of-life treatment of high-entropy (HE) ceramics presents significant environmental challenges that must be addressed through comprehensive regulatory frameworks. These advanced materials, while offering superior performance characteristics, contain multiple elemental components that can pose environmental hazards if improperly managed. Current environmental impact assessments indicate that conventional disposal methods for HE ceramics can lead to soil contamination, groundwater pollution, and potential release of toxic elements into ecosystems.

Regulatory compliance for HE ceramic recycling varies significantly across global jurisdictions. In the European Union, the Waste Electrical and Electronic Equipment (WEEE) Directive and Restriction of Hazardous Substances (RoHS) Directive establish stringent requirements for the recovery and treatment of ceramic materials containing potentially hazardous elements. Similarly, in North America, the Resource Conservation and Recovery Act (RCRA) classifies certain ceramic waste streams as hazardous, necessitating specialized handling and processing protocols.

Life cycle assessment (LCA) studies reveal that the environmental footprint of HE ceramics can be substantially reduced through effective chemical recovery processes. When properly implemented, these recovery methods can decrease energy consumption by 40-60% compared to primary production, while reducing greenhouse gas emissions by approximately 35%. However, these benefits are contingent upon the development of economically viable recovery technologies that comply with increasingly stringent environmental regulations.

Emerging regulatory trends indicate a shift toward circular economy principles, with greater emphasis on producer responsibility and closed-loop material flows. The implementation of Extended Producer Responsibility (EPR) schemes in several countries has created financial incentives for manufacturers to design HE ceramic products with end-of-life recovery in mind. These regulatory frameworks are increasingly incorporating specific provisions for critical raw materials recovery, recognizing the strategic importance of elements commonly found in HE ceramics.

Compliance challenges remain significant, particularly regarding the classification and transboundary movement of HE ceramic waste. The Basel Convention's restrictions on hazardous waste shipments can complicate international recovery efforts, while varying national interpretations of waste definitions create regulatory uncertainty. Industry stakeholders must navigate this complex landscape while developing standardized testing protocols to accurately determine the environmental impact of novel HE ceramic compositions.

Future regulatory developments are likely to focus on harmonizing international standards for HE ceramic recycling, establishing minimum recovery rates for specific elements, and implementing more sophisticated tracking systems for material flows throughout product lifecycles. Companies investing in chemical recovery technologies must anticipate these regulatory changes and develop flexible systems capable of adapting to evolving compliance requirements.

Regulatory compliance for HE ceramic recycling varies significantly across global jurisdictions. In the European Union, the Waste Electrical and Electronic Equipment (WEEE) Directive and Restriction of Hazardous Substances (RoHS) Directive establish stringent requirements for the recovery and treatment of ceramic materials containing potentially hazardous elements. Similarly, in North America, the Resource Conservation and Recovery Act (RCRA) classifies certain ceramic waste streams as hazardous, necessitating specialized handling and processing protocols.

Life cycle assessment (LCA) studies reveal that the environmental footprint of HE ceramics can be substantially reduced through effective chemical recovery processes. When properly implemented, these recovery methods can decrease energy consumption by 40-60% compared to primary production, while reducing greenhouse gas emissions by approximately 35%. However, these benefits are contingent upon the development of economically viable recovery technologies that comply with increasingly stringent environmental regulations.

Emerging regulatory trends indicate a shift toward circular economy principles, with greater emphasis on producer responsibility and closed-loop material flows. The implementation of Extended Producer Responsibility (EPR) schemes in several countries has created financial incentives for manufacturers to design HE ceramic products with end-of-life recovery in mind. These regulatory frameworks are increasingly incorporating specific provisions for critical raw materials recovery, recognizing the strategic importance of elements commonly found in HE ceramics.

Compliance challenges remain significant, particularly regarding the classification and transboundary movement of HE ceramic waste. The Basel Convention's restrictions on hazardous waste shipments can complicate international recovery efforts, while varying national interpretations of waste definitions create regulatory uncertainty. Industry stakeholders must navigate this complex landscape while developing standardized testing protocols to accurately determine the environmental impact of novel HE ceramic compositions.

Future regulatory developments are likely to focus on harmonizing international standards for HE ceramic recycling, establishing minimum recovery rates for specific elements, and implementing more sophisticated tracking systems for material flows throughout product lifecycles. Companies investing in chemical recovery technologies must anticipate these regulatory changes and develop flexible systems capable of adapting to evolving compliance requirements.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!