How to Implement LDPE Recycling Programs in Industry?

JUN 30, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

LDPE Recycling Background and Objectives

Low-density polyethylene (LDPE) recycling has become a critical focus in the plastics industry due to increasing environmental concerns and regulatory pressures. The evolution of LDPE recycling technology has been driven by the need to address the growing volume of plastic waste and its impact on ecosystems. Over the past decades, significant advancements have been made in collection, sorting, and processing techniques, enabling more efficient and cost-effective recycling of LDPE materials.

The primary objective of implementing LDPE recycling programs in industry is to create a circular economy for plastic materials, reducing the reliance on virgin plastics and minimizing waste sent to landfills or incineration. This aligns with broader sustainability goals and helps companies meet increasingly stringent environmental regulations. Additionally, successful recycling programs can provide economic benefits through reduced raw material costs and potential revenue streams from recycled products.

LDPE recycling faces unique challenges due to its properties and common applications. Unlike rigid plastics, LDPE is often used in flexible packaging and films, which can be more difficult to collect, sort, and process. Contamination from food residues, labels, and other materials also poses significant hurdles in achieving high-quality recycled LDPE. Overcoming these obstacles requires innovative technologies and processes specifically tailored to LDPE characteristics.

The development of LDPE recycling technologies has seen several key milestones. Early efforts focused on mechanical recycling, which involved shredding, washing, and re-pelletizing LDPE waste. More recently, advanced sorting technologies using near-infrared spectroscopy and artificial intelligence have improved the purity of recycled LDPE streams. Chemical recycling methods, such as pyrolysis and depolymerization, have also emerged as promising approaches to handle mixed or contaminated LDPE waste.

Looking ahead, the LDPE recycling landscape is poised for further innovation. Research is ongoing to develop more efficient cleaning processes, improve the quality of recycled LDPE for high-value applications, and explore novel recycling pathways. The integration of digital technologies and automation in recycling facilities is expected to enhance sorting accuracy and overall process efficiency. Furthermore, efforts are being made to standardize LDPE packaging designs to facilitate easier recycling and promote the use of recycled content in new products.

Implementing effective LDPE recycling programs in industry requires a multifaceted approach. This includes establishing robust collection systems, investing in state-of-the-art sorting and processing technologies, and fostering partnerships across the value chain. Education and awareness campaigns are also crucial to ensure proper disposal and reduce contamination at the source. By addressing these aspects comprehensively, industries can make significant strides in closing the loop on LDPE materials and contributing to a more sustainable future.

The primary objective of implementing LDPE recycling programs in industry is to create a circular economy for plastic materials, reducing the reliance on virgin plastics and minimizing waste sent to landfills or incineration. This aligns with broader sustainability goals and helps companies meet increasingly stringent environmental regulations. Additionally, successful recycling programs can provide economic benefits through reduced raw material costs and potential revenue streams from recycled products.

LDPE recycling faces unique challenges due to its properties and common applications. Unlike rigid plastics, LDPE is often used in flexible packaging and films, which can be more difficult to collect, sort, and process. Contamination from food residues, labels, and other materials also poses significant hurdles in achieving high-quality recycled LDPE. Overcoming these obstacles requires innovative technologies and processes specifically tailored to LDPE characteristics.

The development of LDPE recycling technologies has seen several key milestones. Early efforts focused on mechanical recycling, which involved shredding, washing, and re-pelletizing LDPE waste. More recently, advanced sorting technologies using near-infrared spectroscopy and artificial intelligence have improved the purity of recycled LDPE streams. Chemical recycling methods, such as pyrolysis and depolymerization, have also emerged as promising approaches to handle mixed or contaminated LDPE waste.

Looking ahead, the LDPE recycling landscape is poised for further innovation. Research is ongoing to develop more efficient cleaning processes, improve the quality of recycled LDPE for high-value applications, and explore novel recycling pathways. The integration of digital technologies and automation in recycling facilities is expected to enhance sorting accuracy and overall process efficiency. Furthermore, efforts are being made to standardize LDPE packaging designs to facilitate easier recycling and promote the use of recycled content in new products.

Implementing effective LDPE recycling programs in industry requires a multifaceted approach. This includes establishing robust collection systems, investing in state-of-the-art sorting and processing technologies, and fostering partnerships across the value chain. Education and awareness campaigns are also crucial to ensure proper disposal and reduce contamination at the source. By addressing these aspects comprehensively, industries can make significant strides in closing the loop on LDPE materials and contributing to a more sustainable future.

Market Analysis for Recycled LDPE

The market for recycled Low-Density Polyethylene (LDPE) has been experiencing significant growth in recent years, driven by increasing environmental awareness and regulatory pressures. LDPE, commonly used in packaging materials, plastic bags, and various consumer products, represents a substantial portion of plastic waste. The global recycled LDPE market is expected to continue its upward trajectory, with projections indicating robust growth over the next decade.

Several factors contribute to the expanding market for recycled LDPE. Firstly, there is a growing demand from end-use industries seeking to incorporate recycled materials into their products. This trend is particularly evident in the packaging sector, where major brands are committing to increasing the use of recycled plastics in their packaging solutions. The automotive and construction industries are also showing increased interest in recycled LDPE for various applications.

Government regulations and policies play a crucial role in shaping the market landscape. Many countries have implemented or are in the process of implementing stricter regulations on plastic waste management and recycling targets. These regulatory frameworks create a favorable environment for the recycled LDPE market by incentivizing the use of recycled materials and penalizing the excessive use of virgin plastics.

Consumer awareness and preferences are also driving market growth. As consumers become more environmentally conscious, there is a growing demand for products made from recycled materials. This shift in consumer behavior is pressuring companies to adopt more sustainable practices, including the use of recycled LDPE in their products and packaging.

The market for recycled LDPE faces certain challenges, including quality concerns and competition from virgin LDPE. However, technological advancements in recycling processes are gradually addressing these issues, improving the quality and consistency of recycled LDPE. This progress is making recycled LDPE more attractive to a wider range of industries and applications.

Geographically, the market for recycled LDPE shows variations across regions. Developed economies in North America and Europe currently lead in terms of recycling infrastructure and market maturity. However, emerging economies in Asia-Pacific and Latin America are expected to witness rapid growth in the coming years, driven by increasing industrialization, urbanization, and environmental regulations.

The competitive landscape of the recycled LDPE market is characterized by a mix of established plastic recycling companies and new entrants. Key players are investing in advanced recycling technologies and expanding their collection and processing capacities to meet the growing demand. Partnerships between recyclers, brand owners, and packaging manufacturers are becoming increasingly common, fostering innovation and market growth.

Several factors contribute to the expanding market for recycled LDPE. Firstly, there is a growing demand from end-use industries seeking to incorporate recycled materials into their products. This trend is particularly evident in the packaging sector, where major brands are committing to increasing the use of recycled plastics in their packaging solutions. The automotive and construction industries are also showing increased interest in recycled LDPE for various applications.

Government regulations and policies play a crucial role in shaping the market landscape. Many countries have implemented or are in the process of implementing stricter regulations on plastic waste management and recycling targets. These regulatory frameworks create a favorable environment for the recycled LDPE market by incentivizing the use of recycled materials and penalizing the excessive use of virgin plastics.

Consumer awareness and preferences are also driving market growth. As consumers become more environmentally conscious, there is a growing demand for products made from recycled materials. This shift in consumer behavior is pressuring companies to adopt more sustainable practices, including the use of recycled LDPE in their products and packaging.

The market for recycled LDPE faces certain challenges, including quality concerns and competition from virgin LDPE. However, technological advancements in recycling processes are gradually addressing these issues, improving the quality and consistency of recycled LDPE. This progress is making recycled LDPE more attractive to a wider range of industries and applications.

Geographically, the market for recycled LDPE shows variations across regions. Developed economies in North America and Europe currently lead in terms of recycling infrastructure and market maturity. However, emerging economies in Asia-Pacific and Latin America are expected to witness rapid growth in the coming years, driven by increasing industrialization, urbanization, and environmental regulations.

The competitive landscape of the recycled LDPE market is characterized by a mix of established plastic recycling companies and new entrants. Key players are investing in advanced recycling technologies and expanding their collection and processing capacities to meet the growing demand. Partnerships between recyclers, brand owners, and packaging manufacturers are becoming increasingly common, fostering innovation and market growth.

Current LDPE Recycling Challenges

The recycling of Low-Density Polyethylene (LDPE) in industrial settings faces several significant challenges that hinder widespread implementation. One of the primary obstacles is the contamination of LDPE waste streams. Industrial LDPE often contains various additives, labels, and other materials that complicate the recycling process. These contaminants can degrade the quality of recycled LDPE, making it less suitable for high-value applications and reducing its market appeal.

Another major challenge is the lack of efficient sorting and separation technologies. LDPE is frequently mixed with other types of plastics in industrial waste, and separating it effectively requires advanced sorting systems. Many facilities lack the necessary equipment or expertise to perform this separation accurately, leading to lower-quality recycled materials or increased costs associated with manual sorting.

The economic viability of LDPE recycling programs also presents a significant hurdle. The costs associated with collecting, sorting, and processing LDPE can be substantial, especially when dealing with low volumes or geographically dispersed sources. These costs often outweigh the potential revenue from selling recycled LDPE, particularly when virgin LDPE prices are low. This economic imbalance discourages many industries from investing in comprehensive recycling programs.

Technical limitations in recycling processes pose another challenge. LDPE can degrade during repeated recycling cycles, losing some of its desirable properties. This degradation limits the number of times LDPE can be recycled and narrows the range of potential applications for recycled LDPE. Developing technologies to maintain or enhance the properties of recycled LDPE is crucial for expanding its use in industrial applications.

Regulatory and policy frameworks also play a role in the challenges facing LDPE recycling. In many regions, there is a lack of clear guidelines or incentives for industrial LDPE recycling. This regulatory gap can lead to inconsistent practices across industries and regions, making it difficult to establish standardized recycling programs. Additionally, the absence of strong policy support may result in insufficient investment in recycling infrastructure and research.

Lastly, market demand for recycled LDPE remains a challenge. Many industries have specific quality requirements that recycled LDPE may struggle to meet consistently. Overcoming the perception that recycled materials are inferior to virgin plastics is crucial for expanding the market for recycled LDPE. Developing new applications and markets for recycled LDPE is essential to drive demand and make recycling programs more economically viable.

Another major challenge is the lack of efficient sorting and separation technologies. LDPE is frequently mixed with other types of plastics in industrial waste, and separating it effectively requires advanced sorting systems. Many facilities lack the necessary equipment or expertise to perform this separation accurately, leading to lower-quality recycled materials or increased costs associated with manual sorting.

The economic viability of LDPE recycling programs also presents a significant hurdle. The costs associated with collecting, sorting, and processing LDPE can be substantial, especially when dealing with low volumes or geographically dispersed sources. These costs often outweigh the potential revenue from selling recycled LDPE, particularly when virgin LDPE prices are low. This economic imbalance discourages many industries from investing in comprehensive recycling programs.

Technical limitations in recycling processes pose another challenge. LDPE can degrade during repeated recycling cycles, losing some of its desirable properties. This degradation limits the number of times LDPE can be recycled and narrows the range of potential applications for recycled LDPE. Developing technologies to maintain or enhance the properties of recycled LDPE is crucial for expanding its use in industrial applications.

Regulatory and policy frameworks also play a role in the challenges facing LDPE recycling. In many regions, there is a lack of clear guidelines or incentives for industrial LDPE recycling. This regulatory gap can lead to inconsistent practices across industries and regions, making it difficult to establish standardized recycling programs. Additionally, the absence of strong policy support may result in insufficient investment in recycling infrastructure and research.

Lastly, market demand for recycled LDPE remains a challenge. Many industries have specific quality requirements that recycled LDPE may struggle to meet consistently. Overcoming the perception that recycled materials are inferior to virgin plastics is crucial for expanding the market for recycled LDPE. Developing new applications and markets for recycled LDPE is essential to drive demand and make recycling programs more economically viable.

Existing LDPE Recycling Solutions

01 Composition and properties of LDPE

Low-Density Polyethylene (LDPE) is a thermoplastic polymer with a low density and high flexibility. It is characterized by its branched structure, which results in lower crystallinity and density compared to other polyethylene types. LDPE exhibits good chemical resistance, electrical insulation properties, and processability, making it suitable for various applications.- Composition and properties of LDPE: Low-Density Polyethylene (LDPE) is a thermoplastic polymer with a low density and high flexibility. It is characterized by its branched structure, which results in lower crystallinity and density compared to other polyethylene types. LDPE exhibits good chemical resistance, low water absorption, and excellent electrical insulation properties.

- Manufacturing processes for LDPE: LDPE is typically produced through high-pressure polymerization of ethylene using free-radical initiators. Various manufacturing techniques have been developed to improve the production efficiency and control the properties of LDPE, including the use of different catalysts, reactor designs, and process conditions.

- Applications of LDPE: LDPE finds widespread use in various industries due to its unique properties. Common applications include packaging materials, plastic bags, containers, tubing, and agricultural films. It is also used in the production of wire and cable insulation, toys, and household items.

- Modifications and blends of LDPE: To enhance its properties and expand its applications, LDPE is often modified or blended with other materials. This includes the incorporation of additives, crosslinking, and blending with other polymers to improve mechanical strength, thermal stability, or specific functional properties.

- Recycling and environmental considerations of LDPE: As a widely used plastic, the recycling and environmental impact of LDPE are important considerations. Research and development efforts focus on improving LDPE recycling processes, developing biodegradable alternatives, and reducing its environmental footprint through sustainable production methods and end-of-life management strategies.

02 Manufacturing processes for LDPE

LDPE is typically produced through high-pressure polymerization of ethylene using free-radical initiators. Various manufacturing techniques have been developed to improve the production efficiency and control the properties of LDPE. These processes may involve different reactor designs, catalysts, and process conditions to achieve desired molecular weight distributions and branching characteristics.Expand Specific Solutions03 Applications of LDPE in packaging

LDPE is widely used in the packaging industry due to its flexibility, transparency, and moisture resistance. It is commonly employed in the production of plastic bags, food packaging films, and shrink wraps. Recent developments focus on improving the barrier properties and sustainability of LDPE packaging materials, including the incorporation of additives or the development of multi-layer structures.Expand Specific Solutions04 LDPE blends and composites

To enhance the performance of LDPE or create materials with tailored properties, it is often blended with other polymers or reinforced with various fillers. These blends and composites can exhibit improved mechanical strength, barrier properties, or specific functionalities. Research in this area focuses on optimizing blend ratios, compatibilization techniques, and the incorporation of nano-fillers.Expand Specific Solutions05 Recycling and sustainability of LDPE

With increasing environmental concerns, there is a growing focus on the recycling and sustainable use of LDPE. This includes the development of improved recycling technologies, the use of bio-based or biodegradable additives, and the design of LDPE products for easier recyclability. Efforts are also being made to reduce the environmental impact of LDPE production and to explore alternative feedstocks.Expand Specific Solutions

Key Players in LDPE Recycling Industry

The implementation of LDPE recycling programs in industry is currently in a growth phase, with increasing market demand driven by sustainability initiatives and regulatory pressures. The global market for recycled LDPE is expanding, though still relatively small compared to virgin LDPE production. Technologically, LDPE recycling processes are well-established but continue to evolve, with companies like ExxonMobil, SABIC, and LG Chem investing in advanced recycling technologies. Challenges remain in collection, sorting, and maintaining quality, but innovations from firms such as Braskem and Kingfa are improving recycling efficiency and end-product performance. Overall, the industry is progressing towards more circular economy models, with collaboration between chemical companies, recyclers, and brand owners accelerating development.

China Petroleum & Chemical Corp.

Technical Solution: China Petroleum & Chemical Corp. (Sinopec) has developed a comprehensive LDPE recycling program that integrates collection, sorting, and processing technologies. Their approach includes the use of advanced optical sorting systems to separate LDPE from other plastics, followed by a proprietary chemical recycling process that breaks down LDPE into its molecular components. This allows for the production of high-quality recycled LDPE that can be used in a wide range of applications. Sinopec has also implemented a closed-loop recycling system in their manufacturing facilities, which has reportedly reduced virgin LDPE usage by up to 30% in certain product lines[1][3].

Strengths: Large-scale implementation capability, advanced sorting technology, and chemical recycling expertise. Weaknesses: High initial investment costs and potential dependency on consistent waste plastic supply.

SABIC Global Technologies BV

Technical Solution: SABIC has pioneered a circular economy approach to LDPE recycling through their TRUCIRCLE™ portfolio. This initiative includes mechanical recycling of LDPE waste and innovative chemical recycling processes. SABIC's chemical recycling technology converts mixed plastic waste, including LDPE, back into feedstock for new plastics production. This process, known as pyrolysis, breaks down plastic waste into oil, which is then used as a raw material for new LDPE production. SABIC claims that this method can recycle plastics that are typically difficult to recycle mechanically, and the resulting products have properties identical to those made from virgin fossil resources[2][5].

Strengths: Innovative chemical recycling technology, ability to handle mixed plastic waste, and production of high-quality recycled LDPE. Weaknesses: Energy-intensive process and potential scalability challenges.

Innovative LDPE Recycling Technologies

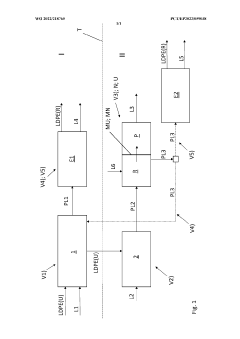

Method and apparatus for the recycling of low-density polyethylene (LDPE)

PatentWO2022218765A1

Innovation

- A method involving selective dissolution of LDPE in an organic solvent at a temperature where HDPE and PP do not dissolve, followed by ultrafiltration or nanofiltration to concentrate LDPE, allowing for its efficient recovery through evaporation, eliminating the need for additional separation steps and reducing energy consumption.

Method for obtaining LDPE from used plastic films

PatentInactiveEP1392766A1

Innovation

- A method involving the extraction of low molecular weight components using a second organic solvent, selective dissolution in another solvent to create a polymer solution, and shear precipitation to separate LDPE from interfering polymers, utilizing the distinct precipitation temperatures of LDPE, HDPE, and PP, with hexane being a preferred solvent, allowing for the recovery of high-purity LDPE.

Environmental Regulations Impact

Environmental regulations play a crucial role in shaping the implementation of LDPE recycling programs in industry. These regulations serve as a driving force for companies to adopt sustainable practices and invest in recycling infrastructure. In recent years, governments worldwide have been tightening their environmental policies to address the growing concern of plastic waste pollution.

One of the key regulatory frameworks impacting LDPE recycling is the Extended Producer Responsibility (EPR) system. This approach holds manufacturers accountable for the entire lifecycle of their products, including disposal and recycling. EPR regulations have been implemented in various countries, encouraging companies to design products with recyclability in mind and invest in recycling facilities.

The European Union's Circular Economy Action Plan has set ambitious targets for plastic recycling, aiming to recycle 55% of plastic packaging by 2030. This has led to increased pressure on industries to adopt LDPE recycling programs and improve their overall waste management practices. Similarly, China's National Sword Policy, which banned the import of certain types of plastic waste, has forced many countries to develop domestic recycling capabilities, including for LDPE materials.

In the United States, regulations vary by state, but there is a growing trend towards more stringent recycling requirements. California, for instance, has implemented the Rigid Plastic Packaging Container (RPPC) program, which mandates minimum recycled content in certain plastic packaging. This type of regulation directly impacts the demand for recycled LDPE and incentivizes the establishment of recycling programs.

Environmental regulations also influence the technical aspects of LDPE recycling. Many countries have set standards for the quality of recycled plastics, ensuring that the recycled materials meet specific criteria for use in new products. These standards often require advanced sorting and processing technologies, driving innovation in the recycling industry.

The impact of environmental regulations extends beyond direct recycling mandates. Carbon pricing mechanisms and emissions trading systems indirectly promote LDPE recycling by making virgin plastic production more expensive. This creates a more favorable economic environment for recycled materials, encouraging industries to invest in recycling programs.

As regulations continue to evolve, industries must stay informed and adapt their LDPE recycling strategies accordingly. Compliance with these regulations not only helps companies avoid penalties but also positions them as environmentally responsible entities, potentially leading to improved brand reputation and consumer loyalty.

One of the key regulatory frameworks impacting LDPE recycling is the Extended Producer Responsibility (EPR) system. This approach holds manufacturers accountable for the entire lifecycle of their products, including disposal and recycling. EPR regulations have been implemented in various countries, encouraging companies to design products with recyclability in mind and invest in recycling facilities.

The European Union's Circular Economy Action Plan has set ambitious targets for plastic recycling, aiming to recycle 55% of plastic packaging by 2030. This has led to increased pressure on industries to adopt LDPE recycling programs and improve their overall waste management practices. Similarly, China's National Sword Policy, which banned the import of certain types of plastic waste, has forced many countries to develop domestic recycling capabilities, including for LDPE materials.

In the United States, regulations vary by state, but there is a growing trend towards more stringent recycling requirements. California, for instance, has implemented the Rigid Plastic Packaging Container (RPPC) program, which mandates minimum recycled content in certain plastic packaging. This type of regulation directly impacts the demand for recycled LDPE and incentivizes the establishment of recycling programs.

Environmental regulations also influence the technical aspects of LDPE recycling. Many countries have set standards for the quality of recycled plastics, ensuring that the recycled materials meet specific criteria for use in new products. These standards often require advanced sorting and processing technologies, driving innovation in the recycling industry.

The impact of environmental regulations extends beyond direct recycling mandates. Carbon pricing mechanisms and emissions trading systems indirectly promote LDPE recycling by making virgin plastic production more expensive. This creates a more favorable economic environment for recycled materials, encouraging industries to invest in recycling programs.

As regulations continue to evolve, industries must stay informed and adapt their LDPE recycling strategies accordingly. Compliance with these regulations not only helps companies avoid penalties but also positions them as environmentally responsible entities, potentially leading to improved brand reputation and consumer loyalty.

Economic Feasibility Assessment

The economic feasibility of implementing LDPE recycling programs in industry is a critical factor that determines the long-term sustainability and success of such initiatives. A comprehensive assessment reveals that the economic viability of LDPE recycling is influenced by several interconnected factors.

Firstly, the cost of collecting and sorting LDPE waste plays a significant role. Efficient collection systems and advanced sorting technologies can reduce operational expenses, making the recycling process more economically attractive. However, initial investments in infrastructure and equipment may pose financial challenges for some industries.

The market demand for recycled LDPE is another crucial aspect. As more industries and consumers prioritize sustainability, the demand for recycled materials has been steadily increasing. This trend creates opportunities for recycled LDPE to compete with virgin materials, potentially leading to favorable pricing and improved economic returns.

Energy costs associated with the recycling process also impact economic feasibility. While recycling LDPE generally requires less energy compared to producing virgin plastic, optimizing energy efficiency in recycling facilities can further enhance economic viability. Implementing energy-saving technologies and practices can lead to significant cost reductions over time.

Government policies and incentives play a vital role in shaping the economic landscape for LDPE recycling. Tax breaks, subsidies, or penalties for non-compliance with recycling regulations can significantly influence the financial attractiveness of recycling programs. Industries operating in regions with supportive policies may find it more economically feasible to implement LDPE recycling initiatives.

The quality of recycled LDPE and its potential applications are essential considerations. High-quality recycled LDPE that can be used in a wide range of products commands better market prices, improving the economic outlook. Investing in advanced recycling technologies that produce high-grade recycled LDPE can lead to better economic returns in the long run.

Lastly, the scale of operations can greatly impact economic feasibility. Larger-scale recycling programs often benefit from economies of scale, reducing per-unit costs and improving overall profitability. Industries with substantial LDPE waste streams may find it more economically viable to implement in-house recycling programs, while smaller operations might benefit from collaborative or centralized recycling initiatives.

In conclusion, while the economic feasibility of LDPE recycling programs in industry faces some challenges, the growing market demand, technological advancements, and supportive policies create a favorable environment for their implementation. A careful analysis of these factors, tailored to specific industry contexts, is crucial for determining the economic viability and long-term success of LDPE recycling initiatives.

Firstly, the cost of collecting and sorting LDPE waste plays a significant role. Efficient collection systems and advanced sorting technologies can reduce operational expenses, making the recycling process more economically attractive. However, initial investments in infrastructure and equipment may pose financial challenges for some industries.

The market demand for recycled LDPE is another crucial aspect. As more industries and consumers prioritize sustainability, the demand for recycled materials has been steadily increasing. This trend creates opportunities for recycled LDPE to compete with virgin materials, potentially leading to favorable pricing and improved economic returns.

Energy costs associated with the recycling process also impact economic feasibility. While recycling LDPE generally requires less energy compared to producing virgin plastic, optimizing energy efficiency in recycling facilities can further enhance economic viability. Implementing energy-saving technologies and practices can lead to significant cost reductions over time.

Government policies and incentives play a vital role in shaping the economic landscape for LDPE recycling. Tax breaks, subsidies, or penalties for non-compliance with recycling regulations can significantly influence the financial attractiveness of recycling programs. Industries operating in regions with supportive policies may find it more economically feasible to implement LDPE recycling initiatives.

The quality of recycled LDPE and its potential applications are essential considerations. High-quality recycled LDPE that can be used in a wide range of products commands better market prices, improving the economic outlook. Investing in advanced recycling technologies that produce high-grade recycled LDPE can lead to better economic returns in the long run.

Lastly, the scale of operations can greatly impact economic feasibility. Larger-scale recycling programs often benefit from economies of scale, reducing per-unit costs and improving overall profitability. Industries with substantial LDPE waste streams may find it more economically viable to implement in-house recycling programs, while smaller operations might benefit from collaborative or centralized recycling initiatives.

In conclusion, while the economic feasibility of LDPE recycling programs in industry faces some challenges, the growing market demand, technological advancements, and supportive policies create a favorable environment for their implementation. A careful analysis of these factors, tailored to specific industry contexts, is crucial for determining the economic viability and long-term success of LDPE recycling initiatives.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!