How to Integrate LDPE Recycling into Supply Chains?

JUN 30, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

LDPE Recycling Background and Objectives

Low-density polyethylene (LDPE) recycling has become a critical focus in the global effort to address plastic waste and promote sustainable practices within supply chains. The evolution of LDPE recycling technology has been driven by increasing environmental concerns and regulatory pressures, as well as the growing recognition of the economic potential in circular economy models.

The primary objective of integrating LDPE recycling into supply chains is to create a closed-loop system that minimizes waste, reduces the demand for virgin plastics, and lowers the overall environmental impact of plastic production and consumption. This integration aims to transform the linear "take-make-dispose" model into a circular economy approach, where LDPE products are designed, manufactured, used, and then recycled back into the production cycle.

Historically, LDPE recycling has faced numerous challenges, including contamination issues, degradation of material properties during recycling, and the lack of efficient collection and sorting systems. However, recent technological advancements have significantly improved the feasibility and quality of LDPE recycling processes. These developments include enhanced sorting technologies, such as near-infrared spectroscopy and artificial intelligence-driven systems, as well as improved washing and extrusion techniques that maintain the integrity of recycled LDPE.

The current technological landscape for LDPE recycling is characterized by a mix of mechanical and chemical recycling methods. Mechanical recycling, which involves sorting, grinding, washing, and re-pelletizing LDPE waste, remains the most widely used approach due to its relative simplicity and cost-effectiveness. Chemical recycling, including processes like pyrolysis and depolymerization, is gaining traction as a complementary method, particularly for handling more contaminated or mixed plastic waste streams.

Looking ahead, the integration of LDPE recycling into supply chains is expected to be driven by several key trends. These include the development of more sophisticated tracking and tracing technologies to improve the transparency and efficiency of recycling processes, the adoption of blockchain and other digital technologies to create verifiable recycling ecosystems, and the emergence of new business models that incentivize the collection and recycling of LDPE products.

The ultimate goal of this technological evolution is to create a seamless integration of LDPE recycling within existing supply chain structures, enabling a more sustainable and resource-efficient plastic economy. This integration will require not only technological innovation but also collaborative efforts across industries, policymakers, and consumers to create the necessary infrastructure, incentives, and behavioral changes to support widespread LDPE recycling practices.

The primary objective of integrating LDPE recycling into supply chains is to create a closed-loop system that minimizes waste, reduces the demand for virgin plastics, and lowers the overall environmental impact of plastic production and consumption. This integration aims to transform the linear "take-make-dispose" model into a circular economy approach, where LDPE products are designed, manufactured, used, and then recycled back into the production cycle.

Historically, LDPE recycling has faced numerous challenges, including contamination issues, degradation of material properties during recycling, and the lack of efficient collection and sorting systems. However, recent technological advancements have significantly improved the feasibility and quality of LDPE recycling processes. These developments include enhanced sorting technologies, such as near-infrared spectroscopy and artificial intelligence-driven systems, as well as improved washing and extrusion techniques that maintain the integrity of recycled LDPE.

The current technological landscape for LDPE recycling is characterized by a mix of mechanical and chemical recycling methods. Mechanical recycling, which involves sorting, grinding, washing, and re-pelletizing LDPE waste, remains the most widely used approach due to its relative simplicity and cost-effectiveness. Chemical recycling, including processes like pyrolysis and depolymerization, is gaining traction as a complementary method, particularly for handling more contaminated or mixed plastic waste streams.

Looking ahead, the integration of LDPE recycling into supply chains is expected to be driven by several key trends. These include the development of more sophisticated tracking and tracing technologies to improve the transparency and efficiency of recycling processes, the adoption of blockchain and other digital technologies to create verifiable recycling ecosystems, and the emergence of new business models that incentivize the collection and recycling of LDPE products.

The ultimate goal of this technological evolution is to create a seamless integration of LDPE recycling within existing supply chain structures, enabling a more sustainable and resource-efficient plastic economy. This integration will require not only technological innovation but also collaborative efforts across industries, policymakers, and consumers to create the necessary infrastructure, incentives, and behavioral changes to support widespread LDPE recycling practices.

Market Analysis for Recycled LDPE

The market for recycled Low-Density Polyethylene (LDPE) has been experiencing significant growth in recent years, driven by increasing environmental awareness and regulatory pressures to reduce plastic waste. LDPE, commonly used in packaging materials, plastic bags, and various consumer products, represents a substantial portion of plastic waste globally. The recycling of LDPE not only addresses environmental concerns but also presents economic opportunities within the circular economy framework.

The demand for recycled LDPE is primarily fueled by industries seeking to incorporate sustainable materials into their supply chains. Packaging manufacturers, in particular, are showing keen interest in recycled LDPE as they strive to meet sustainability targets and consumer expectations. The construction industry is another significant consumer, utilizing recycled LDPE in products such as plastic lumber and outdoor furniture.

Market trends indicate a growing preference for recycled plastics among consumers, with many willing to pay a premium for products made from recycled materials. This shift in consumer behavior is encouraging more companies to integrate recycled LDPE into their product lines, further stimulating market growth.

Geographically, Europe leads the recycled LDPE market, owing to stringent regulations and well-established recycling infrastructure. North America follows closely, with increasing adoption rates driven by corporate sustainability initiatives. The Asia-Pacific region is emerging as a rapidly growing market, propelled by improving waste management systems and rising environmental consciousness.

Despite the positive outlook, the recycled LDPE market faces challenges. The quality and consistency of recycled LDPE can vary, affecting its suitability for certain applications. Additionally, the cost of recycling and processing LDPE can sometimes exceed that of virgin plastic production, particularly when oil prices are low.

The market is also influenced by technological advancements in recycling processes. Innovations in sorting, cleaning, and reprocessing technologies are improving the quality of recycled LDPE, expanding its potential applications. Chemical recycling methods, which break down plastics into their chemical components, are gaining traction as they can produce higher quality recycled materials.

Looking ahead, the recycled LDPE market is projected to continue its growth trajectory. Factors such as increasing plastic waste generation, stricter environmental regulations, and growing corporate commitments to sustainability are expected to drive demand. The development of more efficient recycling technologies and the expansion of collection and processing infrastructure will be crucial in meeting this growing demand and overcoming current market limitations.

The demand for recycled LDPE is primarily fueled by industries seeking to incorporate sustainable materials into their supply chains. Packaging manufacturers, in particular, are showing keen interest in recycled LDPE as they strive to meet sustainability targets and consumer expectations. The construction industry is another significant consumer, utilizing recycled LDPE in products such as plastic lumber and outdoor furniture.

Market trends indicate a growing preference for recycled plastics among consumers, with many willing to pay a premium for products made from recycled materials. This shift in consumer behavior is encouraging more companies to integrate recycled LDPE into their product lines, further stimulating market growth.

Geographically, Europe leads the recycled LDPE market, owing to stringent regulations and well-established recycling infrastructure. North America follows closely, with increasing adoption rates driven by corporate sustainability initiatives. The Asia-Pacific region is emerging as a rapidly growing market, propelled by improving waste management systems and rising environmental consciousness.

Despite the positive outlook, the recycled LDPE market faces challenges. The quality and consistency of recycled LDPE can vary, affecting its suitability for certain applications. Additionally, the cost of recycling and processing LDPE can sometimes exceed that of virgin plastic production, particularly when oil prices are low.

The market is also influenced by technological advancements in recycling processes. Innovations in sorting, cleaning, and reprocessing technologies are improving the quality of recycled LDPE, expanding its potential applications. Chemical recycling methods, which break down plastics into their chemical components, are gaining traction as they can produce higher quality recycled materials.

Looking ahead, the recycled LDPE market is projected to continue its growth trajectory. Factors such as increasing plastic waste generation, stricter environmental regulations, and growing corporate commitments to sustainability are expected to drive demand. The development of more efficient recycling technologies and the expansion of collection and processing infrastructure will be crucial in meeting this growing demand and overcoming current market limitations.

Current LDPE Recycling Challenges

The integration of LDPE recycling into supply chains faces several significant challenges that hinder widespread adoption and efficiency. One of the primary obstacles is the contamination of LDPE waste streams. LDPE products often contain various additives, labels, and mixed materials, making it difficult to achieve high-quality recycled outputs. This contamination issue necessitates advanced sorting and cleaning technologies, which can be costly and energy-intensive.

Another major challenge is the collection and transportation of LDPE waste. Unlike rigid plastics, LDPE films and bags are lightweight and voluminous, making them expensive to collect and transport. This logistical hurdle often results in low collection rates and inefficient recycling processes. Additionally, the lack of standardized collection systems across different regions further complicates the integration of LDPE recycling into existing supply chains.

The economic viability of LDPE recycling also poses a significant challenge. The cost of recycling LDPE can sometimes exceed the value of the recycled material, especially when oil prices are low, making virgin LDPE more attractive to manufacturers. This economic imbalance discourages investment in recycling infrastructure and technology, creating a bottleneck in the supply chain.

Technical limitations in recycling processes present another set of challenges. Current mechanical recycling methods often result in degradation of material properties, limiting the applications of recycled LDPE. While chemical recycling technologies show promise, they are still in the early stages of development and face scalability issues.

Market demand for recycled LDPE is another critical factor. Despite growing environmental awareness, many industries still prefer virgin LDPE due to its consistent quality and lower cost. The lack of strong market pull for recycled LDPE creates a circular problem, where insufficient demand leads to underinvestment in recycling capabilities, which in turn limits the supply of high-quality recycled LDPE.

Regulatory frameworks also play a crucial role in the challenges faced by LDPE recycling integration. Inconsistent policies across regions, lack of incentives for using recycled content, and inadequate extended producer responsibility schemes hinder the development of a robust LDPE recycling ecosystem within supply chains.

Lastly, the complexity of global supply chains adds another layer of difficulty. LDPE products often cross multiple borders during their lifecycle, making it challenging to implement cohesive recycling strategies. This global dispersion of LDPE waste and recycling facilities complicates efforts to create closed-loop systems and track the flow of materials effectively.

Another major challenge is the collection and transportation of LDPE waste. Unlike rigid plastics, LDPE films and bags are lightweight and voluminous, making them expensive to collect and transport. This logistical hurdle often results in low collection rates and inefficient recycling processes. Additionally, the lack of standardized collection systems across different regions further complicates the integration of LDPE recycling into existing supply chains.

The economic viability of LDPE recycling also poses a significant challenge. The cost of recycling LDPE can sometimes exceed the value of the recycled material, especially when oil prices are low, making virgin LDPE more attractive to manufacturers. This economic imbalance discourages investment in recycling infrastructure and technology, creating a bottleneck in the supply chain.

Technical limitations in recycling processes present another set of challenges. Current mechanical recycling methods often result in degradation of material properties, limiting the applications of recycled LDPE. While chemical recycling technologies show promise, they are still in the early stages of development and face scalability issues.

Market demand for recycled LDPE is another critical factor. Despite growing environmental awareness, many industries still prefer virgin LDPE due to its consistent quality and lower cost. The lack of strong market pull for recycled LDPE creates a circular problem, where insufficient demand leads to underinvestment in recycling capabilities, which in turn limits the supply of high-quality recycled LDPE.

Regulatory frameworks also play a crucial role in the challenges faced by LDPE recycling integration. Inconsistent policies across regions, lack of incentives for using recycled content, and inadequate extended producer responsibility schemes hinder the development of a robust LDPE recycling ecosystem within supply chains.

Lastly, the complexity of global supply chains adds another layer of difficulty. LDPE products often cross multiple borders during their lifecycle, making it challenging to implement cohesive recycling strategies. This global dispersion of LDPE waste and recycling facilities complicates efforts to create closed-loop systems and track the flow of materials effectively.

Existing LDPE Recycling Solutions

01 Mechanical recycling of LDPE

Mechanical recycling processes for LDPE involve sorting, washing, grinding, and melting the plastic to produce recycled pellets. This method is widely used due to its cost-effectiveness and ability to maintain the material's properties. The process can include steps such as contaminant removal, size reduction, and extrusion to create new LDPE products.- Chemical recycling methods for LDPE: Chemical recycling techniques are used to break down LDPE into its constituent monomers or other valuable chemical products. This process involves using solvents, catalysts, or other chemical agents to depolymerize the plastic, allowing for the creation of new materials or the regeneration of virgin-like polymers.

- Mechanical recycling processes for LDPE: Mechanical recycling involves physical processes such as sorting, grinding, washing, and re-pelletizing LDPE waste. This method preserves the polymer structure and is suitable for producing recycled LDPE products with similar properties to virgin material. Innovations in this area focus on improving the efficiency and quality of the recycled output.

- Additives and compatibilizers for LDPE recycling: The use of additives and compatibilizers in LDPE recycling enhances the properties of recycled materials and improves their compatibility with virgin polymers. These additives can help stabilize the recycled LDPE, improve its mechanical properties, and increase its resistance to degradation during reprocessing.

- Sorting and separation technologies for LDPE recycling: Advanced sorting and separation technologies are crucial for efficient LDPE recycling. These may include optical sorting, density separation, or other innovative methods to isolate LDPE from mixed plastic waste streams. Improving the purity of sorted LDPE enhances the quality of recycled products.

- Energy recovery and upcycling of LDPE waste: When direct recycling is not feasible, LDPE waste can be used for energy recovery through incineration or converted into higher-value products through upcycling processes. These methods aim to maximize the utility of LDPE waste that cannot be conventionally recycled, reducing environmental impact and creating valuable resources.

02 Chemical recycling of LDPE

Chemical recycling techniques break down LDPE into its chemical components through processes like pyrolysis or depolymerization. This method allows for the production of high-quality recycled materials and can handle mixed plastic waste streams. The resulting chemicals can be used to create new plastics or other products.Expand Specific Solutions03 Additives and compatibilizers for LDPE recycling

The use of additives and compatibilizers can improve the properties of recycled LDPE and enhance its compatibility with other materials. These additives can help maintain or improve mechanical properties, increase processability, and extend the range of applications for recycled LDPE.Expand Specific Solutions04 LDPE recycling equipment and machinery

Specialized equipment and machinery are developed for efficient LDPE recycling. This includes sorting systems, washing lines, shredders, extruders, and pelletizing machines. Innovations in recycling equipment focus on improving efficiency, reducing energy consumption, and enhancing the quality of recycled LDPE.Expand Specific Solutions05 LDPE recycling for specific applications

Recycled LDPE can be used in various applications, including packaging, construction materials, and agricultural products. Research focuses on developing specific recycling processes and formulations to meet the requirements of different end-use applications, ensuring the recycled material's performance and quality are suitable for its intended use.Expand Specific Solutions

Key Players in LDPE Recycling Industry

The integration of LDPE recycling into supply chains is in a transitional phase, with the market showing significant growth potential. The global LDPE recycling market is expanding due to increasing environmental concerns and regulatory pressures. However, the technology's maturity varies across companies. Industry leaders like ExxonMobil, SABIC, and Sinopec are investing heavily in advanced recycling technologies, while smaller players like Kingfa Sci. & Tech. and Anhui Dongjin are focusing on niche applications. The involvement of academic institutions such as Oxford University and Sichuan University indicates ongoing research to improve recycling efficiency and scalability. Overall, the competitive landscape is diverse, with both established petrochemical giants and specialized recycling firms vying for market share in this evolving sector.

SABIC Global Technologies BV

Technical Solution: SABIC has developed a closed-loop recycling process for LDPE, focusing on mechanical recycling and chemical recycling technologies. Their TruCircle™ portfolio includes recycled LDPE suitable for various applications. The company employs advanced sorting and cleaning technologies to ensure high-quality recycled materials. SABIC has also invested in chemical recycling processes that break down plastic waste into feedstock for new plastics production[1][2]. They have implemented blockchain technology to enhance traceability and transparency in their recycled materials supply chain[3].

Strengths: Global reach, advanced technologies, and a comprehensive recycling portfolio. Weaknesses: High investment costs and potential challenges in scaling up chemical recycling processes.

ExxonMobil Technology & Engineering Co.

Technical Solution: ExxonMobil has developed advanced recycling technology that can process a wide range of plastic waste, including LDPE. Their process involves breaking down plastic waste into molecular building blocks, which can then be used to create virgin-quality plastic products. The company has established partnerships with waste management companies to secure a steady supply of plastic waste for recycling. ExxonMobil's technology can process difficult-to-recycle plastics, potentially increasing the overall recycling rate of LDPE in supply chains[4][5]. They have also invested in improving the energy efficiency of their recycling processes to reduce the carbon footprint of recycled materials.

Strengths: Advanced chemical recycling technology and strong industry partnerships. Weaknesses: High energy requirements for the recycling process and potential scalability challenges.

Innovative LDPE Recycling Technologies

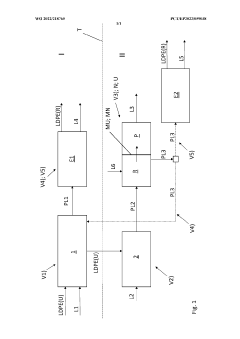

Method and apparatus for the recycling of low-density polyethylene (LDPE)

PatentWO2022218765A1

Innovation

- A method involving selective dissolution of LDPE in an organic solvent at a temperature where HDPE and PP do not dissolve, followed by ultrafiltration or nanofiltration to concentrate LDPE, allowing for its efficient recovery through evaporation, eliminating the need for additional separation steps and reducing energy consumption.

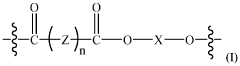

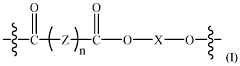

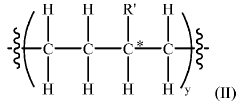

Repeatedly recyclable polymer mimics (RR-pm) of low-density polyethylene (LDPE) polymers

PatentWO2024133401A2

Innovation

- Development of repeatedly recyclable polymer mimics (RR-PM) of LDPE, which are created from a reaction product of difunctional oligomers and linkers obtained through depolymerization of used articles, allowing for repeated recycling with minimal loss of properties and reduced need for virgin materials.

Environmental Regulations Impact

Environmental regulations play a crucial role in shaping the integration of LDPE recycling into supply chains. These regulations, which vary across different regions and countries, significantly impact the feasibility and implementation of recycling initiatives. In recent years, there has been a global trend towards stricter environmental policies, particularly concerning plastic waste management and recycling.

Many countries have introduced extended producer responsibility (EPR) schemes, which require manufacturers to take responsibility for the entire lifecycle of their products, including disposal and recycling. These regulations often mandate specific recycling targets for plastic packaging, including LDPE. As a result, companies are increasingly compelled to incorporate recycling processes into their supply chains to comply with these requirements.

The European Union, for instance, has set ambitious targets through its Circular Economy Action Plan, aiming to make all plastic packaging recyclable or reusable by 2030. This has led to the development of more advanced recycling technologies and infrastructure within the EU, creating opportunities for LDPE recycling integration. Similarly, China's National Sword policy, which banned the import of certain types of plastic waste, has forced many countries to develop domestic recycling capabilities, including for LDPE.

In the United States, regulations vary by state, but there is a growing trend towards more stringent recycling requirements. California, for example, has implemented progressive recycling laws that mandate increased recycling rates for various materials, including plastics. These regulations have spurred innovation in recycling technologies and encouraged businesses to redesign their supply chains to accommodate recycling processes.

The impact of these regulations extends beyond compliance requirements. They also create market incentives for recycled LDPE, as companies seek to meet recycled content targets in their products. This has led to increased investment in recycling infrastructure and technologies, making it more economically viable to integrate LDPE recycling into supply chains.

However, the regulatory landscape also presents challenges. Inconsistencies in regulations across different regions can complicate supply chain integration for multinational companies. Additionally, rapidly evolving regulations require businesses to remain agile and adaptable in their recycling strategies. Despite these challenges, the overall trend towards stricter environmental regulations is driving innovation and investment in LDPE recycling, ultimately facilitating its integration into global supply chains.

Many countries have introduced extended producer responsibility (EPR) schemes, which require manufacturers to take responsibility for the entire lifecycle of their products, including disposal and recycling. These regulations often mandate specific recycling targets for plastic packaging, including LDPE. As a result, companies are increasingly compelled to incorporate recycling processes into their supply chains to comply with these requirements.

The European Union, for instance, has set ambitious targets through its Circular Economy Action Plan, aiming to make all plastic packaging recyclable or reusable by 2030. This has led to the development of more advanced recycling technologies and infrastructure within the EU, creating opportunities for LDPE recycling integration. Similarly, China's National Sword policy, which banned the import of certain types of plastic waste, has forced many countries to develop domestic recycling capabilities, including for LDPE.

In the United States, regulations vary by state, but there is a growing trend towards more stringent recycling requirements. California, for example, has implemented progressive recycling laws that mandate increased recycling rates for various materials, including plastics. These regulations have spurred innovation in recycling technologies and encouraged businesses to redesign their supply chains to accommodate recycling processes.

The impact of these regulations extends beyond compliance requirements. They also create market incentives for recycled LDPE, as companies seek to meet recycled content targets in their products. This has led to increased investment in recycling infrastructure and technologies, making it more economically viable to integrate LDPE recycling into supply chains.

However, the regulatory landscape also presents challenges. Inconsistencies in regulations across different regions can complicate supply chain integration for multinational companies. Additionally, rapidly evolving regulations require businesses to remain agile and adaptable in their recycling strategies. Despite these challenges, the overall trend towards stricter environmental regulations is driving innovation and investment in LDPE recycling, ultimately facilitating its integration into global supply chains.

Economic Feasibility Assessment

The economic feasibility of integrating LDPE recycling into supply chains is a critical consideration for businesses and policymakers alike. This assessment must take into account various factors that influence the financial viability and long-term sustainability of such integration.

One of the primary considerations is the cost-benefit analysis of implementing LDPE recycling processes within existing supply chains. Initial capital investments for recycling equipment and infrastructure can be substantial, potentially creating a barrier to entry for smaller businesses. However, these costs must be weighed against the potential long-term savings from reduced raw material purchases and waste disposal fees.

The market dynamics for recycled LDPE play a crucial role in determining economic feasibility. The demand for recycled LDPE products and the price differential between virgin and recycled LDPE significantly impact the profitability of recycling operations. As consumer awareness and regulatory pressures increase, the market for recycled LDPE is expected to grow, potentially improving the economic outlook for recycling initiatives.

Operational costs associated with LDPE recycling, including collection, sorting, and processing, must be carefully evaluated. Efficiency improvements in these areas can substantially impact the overall economic viability. Technological advancements in recycling processes, such as improved sorting technologies and more efficient washing and extrusion systems, can help reduce operational costs and increase the quality of recycled LDPE.

Government policies and incentives also play a significant role in the economic feasibility of LDPE recycling integration. Tax incentives, grants, or subsidies for recycling initiatives can offset initial costs and improve the financial attractiveness of such projects. Additionally, regulations mandating the use of recycled content in products can create a more stable market for recycled LDPE, enhancing economic viability.

The potential for value creation through LDPE recycling should not be overlooked. Companies that successfully integrate recycling into their supply chains may benefit from improved brand image, increased customer loyalty, and potential premium pricing for eco-friendly products. These intangible benefits can contribute significantly to the overall economic feasibility of LDPE recycling initiatives.

Lastly, the scalability of LDPE recycling operations is a crucial factor in economic feasibility. As recycling operations scale up, economies of scale can be achieved, potentially reducing per-unit costs and improving overall profitability. However, this must be balanced against the availability of consistent LDPE waste streams and the capacity of the market to absorb increased volumes of recycled material.

One of the primary considerations is the cost-benefit analysis of implementing LDPE recycling processes within existing supply chains. Initial capital investments for recycling equipment and infrastructure can be substantial, potentially creating a barrier to entry for smaller businesses. However, these costs must be weighed against the potential long-term savings from reduced raw material purchases and waste disposal fees.

The market dynamics for recycled LDPE play a crucial role in determining economic feasibility. The demand for recycled LDPE products and the price differential between virgin and recycled LDPE significantly impact the profitability of recycling operations. As consumer awareness and regulatory pressures increase, the market for recycled LDPE is expected to grow, potentially improving the economic outlook for recycling initiatives.

Operational costs associated with LDPE recycling, including collection, sorting, and processing, must be carefully evaluated. Efficiency improvements in these areas can substantially impact the overall economic viability. Technological advancements in recycling processes, such as improved sorting technologies and more efficient washing and extrusion systems, can help reduce operational costs and increase the quality of recycled LDPE.

Government policies and incentives also play a significant role in the economic feasibility of LDPE recycling integration. Tax incentives, grants, or subsidies for recycling initiatives can offset initial costs and improve the financial attractiveness of such projects. Additionally, regulations mandating the use of recycled content in products can create a more stable market for recycled LDPE, enhancing economic viability.

The potential for value creation through LDPE recycling should not be overlooked. Companies that successfully integrate recycling into their supply chains may benefit from improved brand image, increased customer loyalty, and potential premium pricing for eco-friendly products. These intangible benefits can contribute significantly to the overall economic feasibility of LDPE recycling initiatives.

Lastly, the scalability of LDPE recycling operations is a crucial factor in economic feasibility. As recycling operations scale up, economies of scale can be achieved, potentially reducing per-unit costs and improving overall profitability. However, this must be balanced against the availability of consistent LDPE waste streams and the capacity of the market to absorb increased volumes of recycled material.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!