LDPE Market Growth: Trends and Predictions

JUN 30, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

LDPE Industry Overview

Low-density polyethylene (LDPE) has been a cornerstone of the plastics industry since its commercial introduction in the 1930s. This versatile polymer, known for its flexibility, durability, and chemical resistance, has found widespread applications across various sectors, including packaging, agriculture, and consumer goods. The LDPE market has experienced steady growth over the past decades, driven by increasing demand in emerging economies and the material's adaptability to evolving consumer needs.

The global LDPE industry is characterized by a complex interplay of factors, including raw material prices, technological advancements, and environmental regulations. The primary feedstock for LDPE production is ethylene, derived from petroleum or natural gas, making the industry sensitive to fluctuations in oil and gas prices. This dependency has led to ongoing efforts to improve production efficiency and explore alternative feedstocks to maintain competitive pricing and sustainability.

Market dynamics in the LDPE sector are influenced by regional variations in demand and production capacity. While mature markets like North America and Western Europe have seen relatively stable consumption patterns, rapid industrialization and urbanization in Asia-Pacific and Latin America have fueled significant growth. China, in particular, has emerged as both a major producer and consumer of LDPE, reshaping global trade flows and competitive landscapes.

The industry structure is marked by the presence of large multinational corporations alongside regional players. Major companies have invested heavily in research and development to enhance product properties and manufacturing processes. This has led to the development of specialized LDPE grades tailored for specific applications, such as high-clarity films for packaging or long-lasting materials for agricultural use.

Environmental concerns and regulatory pressures have become increasingly important factors shaping the LDPE industry. The growing focus on plastic waste and recycling has prompted manufacturers to invest in circular economy initiatives and develop more sustainable production methods. This includes efforts to increase the use of recycled content in LDPE products and improve the recyclability of LDPE materials.

Technological innovations continue to drive the evolution of the LDPE market. Advancements in catalyst technology and process optimization have enabled manufacturers to produce LDPE with enhanced properties and greater consistency. Additionally, the integration of digital technologies and automation in production facilities has improved operational efficiency and product quality control.

As the LDPE industry moves forward, it faces both challenges and opportunities. The push towards sustainability and the need to address plastic waste concerns will likely drive further innovations in product design and recycling technologies. Meanwhile, the growing demand for flexible packaging and the expansion of e-commerce are expected to provide new avenues for LDPE application and market growth.

The global LDPE industry is characterized by a complex interplay of factors, including raw material prices, technological advancements, and environmental regulations. The primary feedstock for LDPE production is ethylene, derived from petroleum or natural gas, making the industry sensitive to fluctuations in oil and gas prices. This dependency has led to ongoing efforts to improve production efficiency and explore alternative feedstocks to maintain competitive pricing and sustainability.

Market dynamics in the LDPE sector are influenced by regional variations in demand and production capacity. While mature markets like North America and Western Europe have seen relatively stable consumption patterns, rapid industrialization and urbanization in Asia-Pacific and Latin America have fueled significant growth. China, in particular, has emerged as both a major producer and consumer of LDPE, reshaping global trade flows and competitive landscapes.

The industry structure is marked by the presence of large multinational corporations alongside regional players. Major companies have invested heavily in research and development to enhance product properties and manufacturing processes. This has led to the development of specialized LDPE grades tailored for specific applications, such as high-clarity films for packaging or long-lasting materials for agricultural use.

Environmental concerns and regulatory pressures have become increasingly important factors shaping the LDPE industry. The growing focus on plastic waste and recycling has prompted manufacturers to invest in circular economy initiatives and develop more sustainable production methods. This includes efforts to increase the use of recycled content in LDPE products and improve the recyclability of LDPE materials.

Technological innovations continue to drive the evolution of the LDPE market. Advancements in catalyst technology and process optimization have enabled manufacturers to produce LDPE with enhanced properties and greater consistency. Additionally, the integration of digital technologies and automation in production facilities has improved operational efficiency and product quality control.

As the LDPE industry moves forward, it faces both challenges and opportunities. The push towards sustainability and the need to address plastic waste concerns will likely drive further innovations in product design and recycling technologies. Meanwhile, the growing demand for flexible packaging and the expansion of e-commerce are expected to provide new avenues for LDPE application and market growth.

LDPE Market Dynamics

The LDPE (Low-Density Polyethylene) market has been experiencing significant growth and transformation in recent years, driven by various factors that shape its dynamics. One of the primary drivers of LDPE market growth is the increasing demand from packaging industries, particularly in the food and beverage sector. The versatility and cost-effectiveness of LDPE make it a preferred choice for flexible packaging applications, contributing to its market expansion.

The construction industry also plays a crucial role in LDPE market dynamics. As urbanization and infrastructure development continue to accelerate globally, the demand for LDPE in construction materials, such as pipes, wires, and cables, has seen a substantial uptick. This trend is particularly pronounced in emerging economies where rapid industrialization and urban development are taking place.

Another significant factor influencing LDPE market dynamics is the growing emphasis on sustainability and environmental concerns. While LDPE is a plastic material, manufacturers are increasingly focusing on developing recyclable and eco-friendly LDPE products to address environmental issues. This shift towards sustainable practices is reshaping the market landscape and influencing consumer preferences.

The automotive industry is emerging as a key player in LDPE market dynamics. The lightweight properties of LDPE make it an attractive material for automotive components, contributing to fuel efficiency and reduced emissions. As the automotive sector continues to evolve with a focus on electric and hybrid vehicles, the demand for LDPE in this industry is expected to grow further.

Geographically, Asia-Pacific has been a dominant force in the LDPE market, with China and India leading the growth. The region's robust manufacturing sector, coupled with increasing consumer spending power, has been driving the demand for LDPE across various applications. North America and Europe, while mature markets, continue to contribute significantly to the global LDPE market, particularly in high-end applications and technological innovations.

The LDPE market is also influenced by fluctuations in raw material prices, particularly ethylene. As ethylene is derived from crude oil, volatility in oil prices can have a direct impact on LDPE production costs and, consequently, market dynamics. This factor underscores the importance of efficient production processes and supply chain management in maintaining market competitiveness.

Technological advancements in LDPE production processes are shaping market dynamics as well. Innovations in catalyst technology and production methods are enabling manufacturers to produce LDPE with enhanced properties, opening up new application areas and market opportunities. These advancements are crucial in meeting the evolving demands of end-users across various industries.

The construction industry also plays a crucial role in LDPE market dynamics. As urbanization and infrastructure development continue to accelerate globally, the demand for LDPE in construction materials, such as pipes, wires, and cables, has seen a substantial uptick. This trend is particularly pronounced in emerging economies where rapid industrialization and urban development are taking place.

Another significant factor influencing LDPE market dynamics is the growing emphasis on sustainability and environmental concerns. While LDPE is a plastic material, manufacturers are increasingly focusing on developing recyclable and eco-friendly LDPE products to address environmental issues. This shift towards sustainable practices is reshaping the market landscape and influencing consumer preferences.

The automotive industry is emerging as a key player in LDPE market dynamics. The lightweight properties of LDPE make it an attractive material for automotive components, contributing to fuel efficiency and reduced emissions. As the automotive sector continues to evolve with a focus on electric and hybrid vehicles, the demand for LDPE in this industry is expected to grow further.

Geographically, Asia-Pacific has been a dominant force in the LDPE market, with China and India leading the growth. The region's robust manufacturing sector, coupled with increasing consumer spending power, has been driving the demand for LDPE across various applications. North America and Europe, while mature markets, continue to contribute significantly to the global LDPE market, particularly in high-end applications and technological innovations.

The LDPE market is also influenced by fluctuations in raw material prices, particularly ethylene. As ethylene is derived from crude oil, volatility in oil prices can have a direct impact on LDPE production costs and, consequently, market dynamics. This factor underscores the importance of efficient production processes and supply chain management in maintaining market competitiveness.

Technological advancements in LDPE production processes are shaping market dynamics as well. Innovations in catalyst technology and production methods are enabling manufacturers to produce LDPE with enhanced properties, opening up new application areas and market opportunities. These advancements are crucial in meeting the evolving demands of end-users across various industries.

Technical Challenges

The LDPE (Low-Density Polyethylene) market faces several technical challenges that impact its growth trajectory and future predictions. One of the primary hurdles is the environmental concern associated with plastic production and disposal. As global awareness of plastic pollution increases, there is mounting pressure on the LDPE industry to develop more sustainable and eco-friendly production methods.

The traditional production process of LDPE is energy-intensive and relies heavily on fossil fuels, contributing to greenhouse gas emissions. This presents a significant challenge for manufacturers to reduce their carbon footprint while maintaining production efficiency. The industry is grappling with the need to transition towards renewable energy sources and implement more energy-efficient technologies in the production process.

Another technical challenge lies in the recycling of LDPE products. While LDPE is theoretically recyclable, the process is often complicated by contamination and the presence of additives. Developing more effective sorting and cleaning technologies for recycled LDPE is crucial to improve recycling rates and quality of recycled materials.

The demand for enhanced product performance poses additional technical hurdles. Customers across various industries require LDPE with improved mechanical properties, better barrier characteristics, and increased durability. Meeting these requirements while maintaining the cost-effectiveness and processability of LDPE is a significant challenge for researchers and manufacturers.

Furthermore, the LDPE industry faces competition from alternative materials, including bio-based plastics and other polyethylene grades like LLDPE (Linear Low-Density Polyethylene). This necessitates continuous innovation in LDPE production and properties to maintain its market position and expand into new applications.

The global nature of the LDPE market introduces challenges related to supply chain management and raw material availability. Fluctuations in oil prices, which directly affect ethylene production (the primary raw material for LDPE), create uncertainties in production costs and market dynamics. Developing strategies to mitigate these supply chain risks and ensure consistent raw material supply is crucial for sustained market growth.

Regulatory pressures also present technical challenges for the LDPE industry. Stricter environmental regulations and potential bans on single-use plastics in various regions require manufacturers to adapt their production processes and develop new, compliant products. This often involves significant research and development efforts to create LDPE formulations that meet both regulatory requirements and customer needs.

The traditional production process of LDPE is energy-intensive and relies heavily on fossil fuels, contributing to greenhouse gas emissions. This presents a significant challenge for manufacturers to reduce their carbon footprint while maintaining production efficiency. The industry is grappling with the need to transition towards renewable energy sources and implement more energy-efficient technologies in the production process.

Another technical challenge lies in the recycling of LDPE products. While LDPE is theoretically recyclable, the process is often complicated by contamination and the presence of additives. Developing more effective sorting and cleaning technologies for recycled LDPE is crucial to improve recycling rates and quality of recycled materials.

The demand for enhanced product performance poses additional technical hurdles. Customers across various industries require LDPE with improved mechanical properties, better barrier characteristics, and increased durability. Meeting these requirements while maintaining the cost-effectiveness and processability of LDPE is a significant challenge for researchers and manufacturers.

Furthermore, the LDPE industry faces competition from alternative materials, including bio-based plastics and other polyethylene grades like LLDPE (Linear Low-Density Polyethylene). This necessitates continuous innovation in LDPE production and properties to maintain its market position and expand into new applications.

The global nature of the LDPE market introduces challenges related to supply chain management and raw material availability. Fluctuations in oil prices, which directly affect ethylene production (the primary raw material for LDPE), create uncertainties in production costs and market dynamics. Developing strategies to mitigate these supply chain risks and ensure consistent raw material supply is crucial for sustained market growth.

Regulatory pressures also present technical challenges for the LDPE industry. Stricter environmental regulations and potential bans on single-use plastics in various regions require manufacturers to adapt their production processes and develop new, compliant products. This often involves significant research and development efforts to create LDPE formulations that meet both regulatory requirements and customer needs.

Current LDPE Technologies

01 Market expansion and product development

The LDPE market is experiencing growth through expansion into new applications and product development. Companies are focusing on creating innovative LDPE formulations with enhanced properties to meet specific industry needs. This includes developing specialized grades for packaging, agriculture, and construction sectors.- Market expansion and product development: The LDPE market is experiencing growth through expansion into new applications and product development. Companies are focusing on creating innovative LDPE products with enhanced properties to meet diverse industry needs. This includes developing specialized grades for packaging, agriculture, and construction sectors.

- Sustainable and eco-friendly LDPE solutions: There is a growing trend towards sustainable and eco-friendly LDPE solutions. Manufacturers are investing in research and development to create biodegradable LDPE variants and improve recycling processes. This shift is driven by increasing environmental concerns and regulatory pressures.

- Technological advancements in LDPE production: Technological advancements are driving efficiency and quality improvements in LDPE production. This includes the development of new catalysts, process optimizations, and the integration of automation and digital technologies in manufacturing processes. These innovations are contributing to increased production capacity and reduced costs.

- LDPE market growth in emerging economies: The LDPE market is experiencing significant growth in emerging economies, particularly in Asia-Pacific and Latin America. This growth is driven by increasing industrialization, urbanization, and rising consumer demand for packaged goods. Manufacturers are expanding their production capacities in these regions to meet the growing demand.

- LDPE applications in medical and healthcare sectors: The LDPE market is expanding in the medical and healthcare sectors, driven by the material's versatility and safety properties. LDPE is being increasingly used in medical packaging, disposable medical devices, and pharmaceutical applications. This trend has been further accelerated by the global health crisis, leading to increased demand for LDPE in healthcare-related products.

02 Sustainable and eco-friendly LDPE solutions

There is a growing trend towards sustainable and eco-friendly LDPE solutions. Manufacturers are investing in research and development to create biodegradable LDPE variants and improve recycling processes. This shift is driven by increasing environmental concerns and regulatory pressures.Expand Specific Solutions03 Technological advancements in LDPE production

Technological advancements are driving efficiency and quality improvements in LDPE production. This includes the development of new catalysts, process optimizations, and the integration of automation and digital technologies in manufacturing processes. These innovations are contributing to increased production capacity and reduced costs.Expand Specific Solutions04 LDPE applications in emerging markets

The LDPE market is experiencing growth in emerging markets, particularly in Asia-Pacific and Latin America. Increasing industrialization, urbanization, and consumer demand for packaged goods are driving this expansion. Manufacturers are establishing production facilities and distribution networks to capitalize on these opportunities.Expand Specific Solutions05 LDPE blends and composites

The development of LDPE blends and composites is opening up new market opportunities. By combining LDPE with other materials or polymers, manufacturers are creating products with enhanced properties such as improved strength, barrier properties, or thermal resistance. This is expanding the range of applications for LDPE-based materials.Expand Specific Solutions

Key LDPE Manufacturers

The LDPE market is experiencing growth driven by increasing demand across various industries. The market is in a mature stage but continues to expand due to technological advancements and new applications. Key players like Dow Global Technologies, ExxonMobil Chemical, and PetroChina are investing in research and development to improve product quality and production efficiency. The market's technological maturity is evident from the involvement of established companies such as Borealis AG and Formosa Plastics Corp., which are focusing on innovative solutions and sustainable practices. Emerging players and research institutions are also contributing to the market's evolution, indicating a competitive and dynamic landscape with potential for further growth and innovation.

Dow Global Technologies LLC

Technical Solution: Dow has developed advanced LDPE production technologies, including high-pressure tubular reactors and innovative catalyst systems. Their ELITE™ Enhanced Polyethylene technology enables the production of LDPE with improved physical properties and processing characteristics[1]. Dow's AGILITY™ LDPE resins offer enhanced optical properties and excellent processability for flexible packaging applications[2]. The company has also invested in sustainable LDPE solutions, such as bio-based and recycled content polyethylene, to address growing environmental concerns in the market[3].

Strengths: Strong R&D capabilities, wide product portfolio, and focus on sustainability. Weaknesses: High production costs associated with advanced technologies and potential regulatory challenges related to plastic waste.

ExxonMobil Chemical Patents, Inc.

Technical Solution: ExxonMobil has developed proprietary technologies for LDPE production, including advanced tubular reactor designs and process control systems. Their Exceed™ XP performance polymers offer enhanced toughness and optical properties for flexible packaging applications[4]. ExxonMobil's LDPE grades feature improved melt strength and processability, catering to various end-use markets such as food packaging and agricultural films[5]. The company has also invested in circular economy initiatives, developing technologies to chemically recycle plastic waste into feedstock for new LDPE production[6].

Strengths: Extensive global production capacity, strong brand recognition, and focus on high-performance LDPE grades. Weaknesses: Potential vulnerability to fluctuations in oil prices and increasing pressure to reduce plastic waste.

LDPE Innovation Analysis

Lldpe-LDPE blown film blend

PatentInactiveUS20130245201A1

Innovation

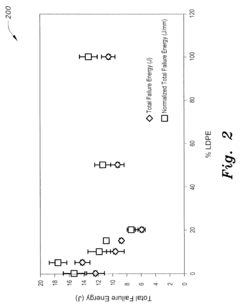

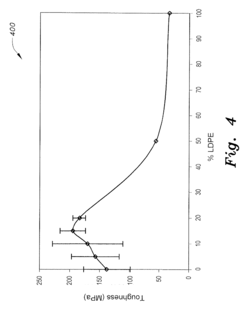

- A blown film blend of unimodal hexene-LLDPE and LDPE with a blend ratio of 2%-10% LDPE to 98%-90% h-LLDPE, which increases transverse direction tear resistance by 100%, impact failure energy by 20%, and toughness and yield strength in the machine direction, while reducing energy consumption in film production.

Composition for Odor Suppression

PatentActiveUS20220169839A1

Innovation

- A composition comprising an olefin-based polymer with 0.15 wt % to 15 wt % of an odor suppressant, including 0.05 wt % to 2 wt % of a metal oxide with a band gap greater than 5.0 eV and 0.1 wt % to 13 wt % of an acid copolymer, which synergistically reduces volatile hetero-carbonyl species without compromising processability or film properties.

Sustainability in LDPE

Sustainability has become a crucial factor in the LDPE (Low-Density Polyethylene) market growth, influencing trends and predictions for the industry. As environmental concerns continue to rise, manufacturers and consumers alike are increasingly focusing on sustainable practices in LDPE production and usage.

One of the primary sustainability trends in the LDPE market is the shift towards recycled and bio-based materials. Companies are investing in advanced recycling technologies to convert post-consumer plastic waste into high-quality LDPE resins. This circular economy approach not only reduces the environmental impact but also addresses the growing demand for eco-friendly packaging solutions.

The development of biodegradable LDPE alternatives is another significant trend shaping the market. Researchers are exploring various bio-based polymers that can mimic the properties of traditional LDPE while offering improved end-of-life options. These innovations are expected to gain traction in sectors such as agriculture and single-use packaging.

Energy efficiency in LDPE production processes is becoming a key focus area for manufacturers. Implementation of advanced process control systems, heat recovery technologies, and more efficient catalysts are helping to reduce energy consumption and greenhouse gas emissions. This not only improves the sustainability profile of LDPE but also contributes to cost savings for producers.

The push for sustainability is also driving changes in LDPE product design. Manufacturers are developing thinner, lighter-weight LDPE films that maintain the required performance characteristics while using less material. This trend aligns with the broader industry goal of resource conservation and waste reduction.

Regulatory pressures and consumer demands are expected to further accelerate sustainability initiatives in the LDPE market. Many countries are implementing stricter regulations on plastic usage and disposal, prompting LDPE producers to adapt their strategies. Additionally, brands and retailers are increasingly setting ambitious sustainability targets, creating a ripple effect throughout the LDPE supply chain.

Looking ahead, the LDPE market is predicted to see continued growth in sustainable solutions. Investments in recycling infrastructure, bio-based feedstocks, and eco-friendly additives are likely to increase. The industry may also witness collaborations between LDPE producers, waste management companies, and technology providers to develop more integrated and efficient recycling systems.

As sustainability becomes a key differentiator in the market, companies that successfully integrate environmentally friendly practices into their LDPE offerings are expected to gain a competitive edge. This shift towards sustainability is not just a trend but a fundamental transformation that will shape the future of the LDPE industry, influencing market growth patterns and technological advancements in the coming years.

One of the primary sustainability trends in the LDPE market is the shift towards recycled and bio-based materials. Companies are investing in advanced recycling technologies to convert post-consumer plastic waste into high-quality LDPE resins. This circular economy approach not only reduces the environmental impact but also addresses the growing demand for eco-friendly packaging solutions.

The development of biodegradable LDPE alternatives is another significant trend shaping the market. Researchers are exploring various bio-based polymers that can mimic the properties of traditional LDPE while offering improved end-of-life options. These innovations are expected to gain traction in sectors such as agriculture and single-use packaging.

Energy efficiency in LDPE production processes is becoming a key focus area for manufacturers. Implementation of advanced process control systems, heat recovery technologies, and more efficient catalysts are helping to reduce energy consumption and greenhouse gas emissions. This not only improves the sustainability profile of LDPE but also contributes to cost savings for producers.

The push for sustainability is also driving changes in LDPE product design. Manufacturers are developing thinner, lighter-weight LDPE films that maintain the required performance characteristics while using less material. This trend aligns with the broader industry goal of resource conservation and waste reduction.

Regulatory pressures and consumer demands are expected to further accelerate sustainability initiatives in the LDPE market. Many countries are implementing stricter regulations on plastic usage and disposal, prompting LDPE producers to adapt their strategies. Additionally, brands and retailers are increasingly setting ambitious sustainability targets, creating a ripple effect throughout the LDPE supply chain.

Looking ahead, the LDPE market is predicted to see continued growth in sustainable solutions. Investments in recycling infrastructure, bio-based feedstocks, and eco-friendly additives are likely to increase. The industry may also witness collaborations between LDPE producers, waste management companies, and technology providers to develop more integrated and efficient recycling systems.

As sustainability becomes a key differentiator in the market, companies that successfully integrate environmentally friendly practices into their LDPE offerings are expected to gain a competitive edge. This shift towards sustainability is not just a trend but a fundamental transformation that will shape the future of the LDPE industry, influencing market growth patterns and technological advancements in the coming years.

LDPE Trade Regulations

The global Low-Density Polyethylene (LDPE) market is subject to various trade regulations that significantly impact its growth trends and future predictions. These regulations are designed to ensure fair trade practices, environmental protection, and product quality standards across different regions.

In the United States, the import and export of LDPE are regulated by the U.S. International Trade Commission and the Department of Commerce. These agencies enforce anti-dumping and countervailing duty laws to protect domestic producers from unfair foreign competition. Additionally, the U.S. Environmental Protection Agency (EPA) imposes regulations on the production and use of LDPE to minimize environmental impact.

The European Union has implemented stringent regulations on plastic materials, including LDPE, through the Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH) regulation. This comprehensive framework aims to protect human health and the environment from the risks posed by chemicals. LDPE manufacturers and importers must comply with REACH requirements, which include registration of substances and adherence to specific safety standards.

In Asia, China has introduced new policies to reduce plastic waste and promote sustainable development. These regulations have led to increased scrutiny of LDPE imports and stricter quality control measures. Similarly, Japan and South Korea have implemented their own sets of regulations governing the import, export, and use of LDPE in various applications.

The implementation of these trade regulations has led to the emergence of new market dynamics in the LDPE industry. Companies are increasingly focusing on developing eco-friendly LDPE variants to comply with environmental regulations and meet consumer demands for sustainable products. This trend is expected to drive innovation and create new opportunities for market growth.

Trade agreements also play a crucial role in shaping the LDPE market landscape. Free trade agreements between countries or regions can facilitate easier movement of LDPE products across borders, potentially leading to increased market competition and lower prices for consumers. Conversely, trade disputes or tariffs can create barriers to market entry and impact the global supply chain of LDPE.

As sustainability becomes a key focus for governments worldwide, regulations around recycling and circular economy principles are likely to become more prevalent. This shift may lead to increased demand for recycled LDPE and put pressure on manufacturers to incorporate more recycled content in their products. Such regulatory changes could significantly influence future market trends and predictions for the LDPE industry.

In the United States, the import and export of LDPE are regulated by the U.S. International Trade Commission and the Department of Commerce. These agencies enforce anti-dumping and countervailing duty laws to protect domestic producers from unfair foreign competition. Additionally, the U.S. Environmental Protection Agency (EPA) imposes regulations on the production and use of LDPE to minimize environmental impact.

The European Union has implemented stringent regulations on plastic materials, including LDPE, through the Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH) regulation. This comprehensive framework aims to protect human health and the environment from the risks posed by chemicals. LDPE manufacturers and importers must comply with REACH requirements, which include registration of substances and adherence to specific safety standards.

In Asia, China has introduced new policies to reduce plastic waste and promote sustainable development. These regulations have led to increased scrutiny of LDPE imports and stricter quality control measures. Similarly, Japan and South Korea have implemented their own sets of regulations governing the import, export, and use of LDPE in various applications.

The implementation of these trade regulations has led to the emergence of new market dynamics in the LDPE industry. Companies are increasingly focusing on developing eco-friendly LDPE variants to comply with environmental regulations and meet consumer demands for sustainable products. This trend is expected to drive innovation and create new opportunities for market growth.

Trade agreements also play a crucial role in shaping the LDPE market landscape. Free trade agreements between countries or regions can facilitate easier movement of LDPE products across borders, potentially leading to increased market competition and lower prices for consumers. Conversely, trade disputes or tariffs can create barriers to market entry and impact the global supply chain of LDPE.

As sustainability becomes a key focus for governments worldwide, regulations around recycling and circular economy principles are likely to become more prevalent. This shift may lead to increased demand for recycled LDPE and put pressure on manufacturers to incorporate more recycled content in their products. Such regulatory changes could significantly influence future market trends and predictions for the LDPE industry.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!