Manufacturing Readiness And Scale-Up Pathways For AEM Electrolyzers

AUG 22, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

AEM Electrolyzer Technology Background and Objectives

Anion Exchange Membrane (AEM) electrolyzers represent a promising technology in the hydrogen production landscape, emerging as a potential bridge between the established alkaline electrolyzers and the more advanced but costly Proton Exchange Membrane (PEM) systems. The development of AEM technology dates back to the early 2000s, with significant acceleration in research and development efforts occurring over the past decade as global interest in hydrogen economies has intensified.

The evolution of AEM technology has been driven by the need to overcome limitations in traditional water electrolysis methods. Alkaline electrolyzers, while cost-effective and durable, suffer from lower efficiency and operational flexibility. PEM systems offer higher performance but at substantially increased costs due to precious metal catalysts and specialized materials. AEM technology aims to combine the advantages of both approaches, utilizing non-noble metal catalysts in an alkaline environment while maintaining membrane-based architecture for improved efficiency.

Recent technological breakthroughs in membrane materials, particularly the development of hydrocarbon-based polymers with quaternary ammonium functional groups, have significantly enhanced the stability and conductivity of AEM systems. These advances have extended membrane lifetimes from mere hundreds of hours to several thousand hours under operating conditions, marking a critical step toward commercial viability.

The primary technical objectives for AEM electrolyzer development center around four key areas: durability enhancement, performance optimization, cost reduction, and manufacturing scalability. Current research aims to achieve membrane and catalyst stability exceeding 40,000 operating hours, system efficiencies above 70% (LHV), capital costs below $500/kW, and manufacturing processes suitable for gigawatt-scale production.

Global research initiatives have established performance targets that align with broader hydrogen production goals. The U.S. Department of Energy's Hydrogen and Fuel Cell Technologies Office has set specific technical targets for 2025, including system costs of $2/kg H₂, electrolyzer efficiency of 44 kWh/kg H₂, and stack durability of at least 50,000 hours. The European Hydrogen Strategy similarly emphasizes the need for cost-effective electrolysis technologies to achieve their 40 GW electrolyzer capacity target by 2030.

The technological trajectory suggests AEM electrolyzers could reach commercial maturity within the next 5-7 years, potentially capturing a significant market share in the medium-power range applications (100 kW to 10 MW) where they offer the most compelling advantages over competing technologies. This timeline aligns with projected hydrogen demand growth in industrial decarbonization, energy storage, and transportation sectors.

The evolution of AEM technology has been driven by the need to overcome limitations in traditional water electrolysis methods. Alkaline electrolyzers, while cost-effective and durable, suffer from lower efficiency and operational flexibility. PEM systems offer higher performance but at substantially increased costs due to precious metal catalysts and specialized materials. AEM technology aims to combine the advantages of both approaches, utilizing non-noble metal catalysts in an alkaline environment while maintaining membrane-based architecture for improved efficiency.

Recent technological breakthroughs in membrane materials, particularly the development of hydrocarbon-based polymers with quaternary ammonium functional groups, have significantly enhanced the stability and conductivity of AEM systems. These advances have extended membrane lifetimes from mere hundreds of hours to several thousand hours under operating conditions, marking a critical step toward commercial viability.

The primary technical objectives for AEM electrolyzer development center around four key areas: durability enhancement, performance optimization, cost reduction, and manufacturing scalability. Current research aims to achieve membrane and catalyst stability exceeding 40,000 operating hours, system efficiencies above 70% (LHV), capital costs below $500/kW, and manufacturing processes suitable for gigawatt-scale production.

Global research initiatives have established performance targets that align with broader hydrogen production goals. The U.S. Department of Energy's Hydrogen and Fuel Cell Technologies Office has set specific technical targets for 2025, including system costs of $2/kg H₂, electrolyzer efficiency of 44 kWh/kg H₂, and stack durability of at least 50,000 hours. The European Hydrogen Strategy similarly emphasizes the need for cost-effective electrolysis technologies to achieve their 40 GW electrolyzer capacity target by 2030.

The technological trajectory suggests AEM electrolyzers could reach commercial maturity within the next 5-7 years, potentially capturing a significant market share in the medium-power range applications (100 kW to 10 MW) where they offer the most compelling advantages over competing technologies. This timeline aligns with projected hydrogen demand growth in industrial decarbonization, energy storage, and transportation sectors.

Market Analysis for Green Hydrogen Production

The global green hydrogen market is experiencing unprecedented growth, driven by the urgent need for decarbonization across multiple sectors. Current market valuations place green hydrogen at approximately $2.5 billion in 2022, with projections indicating a compound annual growth rate (CAGR) of 39.5% through 2030, potentially reaching a market size of $58.5 billion. This remarkable growth trajectory is supported by substantial government investments worldwide, with over $70 billion committed to hydrogen development initiatives.

AEM (Anion Exchange Membrane) electrolyzers represent a significant segment within this expanding market. Positioned between alkaline and PEM technologies, AEM electrolyzers are gaining traction due to their balance of cost-effectiveness and performance characteristics. Market analysis indicates that while AEM technology currently holds less than 5% of the electrolyzer market share, it is expected to grow to 15-20% by 2030 as manufacturing capabilities mature.

Demand drivers for green hydrogen production are diversifying rapidly. Traditional industrial applications in ammonia production and petroleum refining remain strong, accounting for approximately 60% of current hydrogen consumption. However, emerging applications in steel manufacturing, transportation, and energy storage are expanding the market potential significantly. The steel industry alone could represent a 20 million ton annual hydrogen demand by 2050 as decarbonization efforts accelerate.

Regional market dynamics show considerable variation. Europe leads in policy support and deployment targets, with Germany, Netherlands, and Spain establishing clear hydrogen strategies backed by substantial funding. The Asia-Pacific region, particularly China, Japan, and South Korea, is rapidly scaling manufacturing capabilities for electrolyzer components. North America has recently accelerated its market position through the Inflation Reduction Act, which provides production tax credits of up to $3 per kilogram for clean hydrogen.

Cost considerations remain central to market adoption. Current green hydrogen production costs range from $4-6 per kilogram, with AEM technology positioned to potentially reduce costs to $2-3 per kilogram by 2030 through manufacturing scale-up and efficiency improvements. This cost trajectory is critical as price parity with gray hydrogen (currently $1-2 per kilogram) represents a key market inflection point.

Customer segments are evolving beyond traditional industrial users to include utilities, transportation companies, and energy storage developers. This diversification creates new market opportunities but also demands varied product specifications and deployment models, challenging manufacturers to develop flexible, scalable production capabilities.

AEM (Anion Exchange Membrane) electrolyzers represent a significant segment within this expanding market. Positioned between alkaline and PEM technologies, AEM electrolyzers are gaining traction due to their balance of cost-effectiveness and performance characteristics. Market analysis indicates that while AEM technology currently holds less than 5% of the electrolyzer market share, it is expected to grow to 15-20% by 2030 as manufacturing capabilities mature.

Demand drivers for green hydrogen production are diversifying rapidly. Traditional industrial applications in ammonia production and petroleum refining remain strong, accounting for approximately 60% of current hydrogen consumption. However, emerging applications in steel manufacturing, transportation, and energy storage are expanding the market potential significantly. The steel industry alone could represent a 20 million ton annual hydrogen demand by 2050 as decarbonization efforts accelerate.

Regional market dynamics show considerable variation. Europe leads in policy support and deployment targets, with Germany, Netherlands, and Spain establishing clear hydrogen strategies backed by substantial funding. The Asia-Pacific region, particularly China, Japan, and South Korea, is rapidly scaling manufacturing capabilities for electrolyzer components. North America has recently accelerated its market position through the Inflation Reduction Act, which provides production tax credits of up to $3 per kilogram for clean hydrogen.

Cost considerations remain central to market adoption. Current green hydrogen production costs range from $4-6 per kilogram, with AEM technology positioned to potentially reduce costs to $2-3 per kilogram by 2030 through manufacturing scale-up and efficiency improvements. This cost trajectory is critical as price parity with gray hydrogen (currently $1-2 per kilogram) represents a key market inflection point.

Customer segments are evolving beyond traditional industrial users to include utilities, transportation companies, and energy storage developers. This diversification creates new market opportunities but also demands varied product specifications and deployment models, challenging manufacturers to develop flexible, scalable production capabilities.

AEM Technology Status and Manufacturing Barriers

Anion Exchange Membrane (AEM) electrolyzers represent a promising middle-ground technology between alkaline and PEM electrolyzers, potentially offering cost advantages without sacrificing performance. However, the current manufacturing readiness level remains significantly behind more established technologies, presenting substantial barriers to commercialization and scale-up.

The global manufacturing status of AEM electrolyzers is predominantly at laboratory or small pilot scale, with few companies achieving early commercial deployment. Most manufacturers are producing units below 1 MW capacity, with limited examples of larger installations. This contrasts sharply with alkaline and PEM technologies that have achieved multi-megawatt to gigawatt manufacturing capabilities.

A primary manufacturing barrier is membrane and catalyst production at scale. Current AEM membranes suffer from inconsistent quality when produced in larger batches, with variations in ion conductivity, mechanical stability, and chemical durability. The specialized polymers required for AEM membranes involve complex synthesis processes that have not been optimized for high-volume production, resulting in high costs and quality control challenges.

Catalyst layer deposition presents another significant manufacturing hurdle. Unlike PEM systems with established coating techniques, AEM catalyst layers require precise control of ionomer-to-catalyst ratios and specialized deposition methods to achieve optimal hydroxide ion transport while maintaining electrical conductivity. Current manufacturing processes show poor reproducibility at larger scales, leading to performance variations between production batches.

Stack assembly automation remains underdeveloped for AEM technology. The unique requirements of AEM stacks, including specialized gasket materials resistant to high pH environments and precise compression control to prevent membrane degradation, have not been fully integrated into automated assembly lines. Most manufacturers still rely on labor-intensive manual assembly processes, creating bottlenecks for scaling production.

Supply chain limitations further constrain manufacturing scale-up. The specialized materials required for AEM systems, particularly functionalized polymers and non-platinum group metal catalysts, have limited supplier networks. This creates vulnerabilities in material availability and quality consistency, while also maintaining higher costs due to lack of economies of scale.

Testing and quality control protocols for AEM systems are still evolving, without standardized procedures across the industry. This creates challenges in performance validation and certification, particularly for long-term durability assessment, which is critical for customer confidence and market acceptance.

Addressing these manufacturing barriers requires coordinated efforts across the value chain, from fundamental materials research to process engineering and automation development. Significant investment in manufacturing process development and specialized equipment will be necessary to bridge the gap between laboratory demonstrations and gigawatt-scale production capabilities.

The global manufacturing status of AEM electrolyzers is predominantly at laboratory or small pilot scale, with few companies achieving early commercial deployment. Most manufacturers are producing units below 1 MW capacity, with limited examples of larger installations. This contrasts sharply with alkaline and PEM technologies that have achieved multi-megawatt to gigawatt manufacturing capabilities.

A primary manufacturing barrier is membrane and catalyst production at scale. Current AEM membranes suffer from inconsistent quality when produced in larger batches, with variations in ion conductivity, mechanical stability, and chemical durability. The specialized polymers required for AEM membranes involve complex synthesis processes that have not been optimized for high-volume production, resulting in high costs and quality control challenges.

Catalyst layer deposition presents another significant manufacturing hurdle. Unlike PEM systems with established coating techniques, AEM catalyst layers require precise control of ionomer-to-catalyst ratios and specialized deposition methods to achieve optimal hydroxide ion transport while maintaining electrical conductivity. Current manufacturing processes show poor reproducibility at larger scales, leading to performance variations between production batches.

Stack assembly automation remains underdeveloped for AEM technology. The unique requirements of AEM stacks, including specialized gasket materials resistant to high pH environments and precise compression control to prevent membrane degradation, have not been fully integrated into automated assembly lines. Most manufacturers still rely on labor-intensive manual assembly processes, creating bottlenecks for scaling production.

Supply chain limitations further constrain manufacturing scale-up. The specialized materials required for AEM systems, particularly functionalized polymers and non-platinum group metal catalysts, have limited supplier networks. This creates vulnerabilities in material availability and quality consistency, while also maintaining higher costs due to lack of economies of scale.

Testing and quality control protocols for AEM systems are still evolving, without standardized procedures across the industry. This creates challenges in performance validation and certification, particularly for long-term durability assessment, which is critical for customer confidence and market acceptance.

Addressing these manufacturing barriers requires coordinated efforts across the value chain, from fundamental materials research to process engineering and automation development. Significant investment in manufacturing process development and specialized equipment will be necessary to bridge the gap between laboratory demonstrations and gigawatt-scale production capabilities.

Current Manufacturing Approaches for AEM Electrolyzers

01 AEM electrolyzer design and components

Anion Exchange Membrane (AEM) electrolyzers require specific design considerations and components for optimal performance. These include specialized membrane materials, electrode configurations, and cell assembly techniques. The design focuses on enhancing ion conductivity, reducing electrical resistance, and ensuring proper sealing to prevent leakage. Advanced components such as catalysts and bipolar plates are critical for improving efficiency and durability of the electrolyzer systems.- AEM electrolyzer design and manufacturing techniques: Anion Exchange Membrane (AEM) electrolyzers require specific design considerations and manufacturing techniques to ensure optimal performance. These include specialized electrode structures, membrane assembly methods, and cell stack configurations that enhance efficiency and durability. Advanced manufacturing processes focus on precision assembly of components, quality control measures, and scalable production methods to achieve commercial viability.

- Materials and components for AEM electrolyzers: The selection and development of materials for AEM electrolyzers significantly impact their performance and manufacturing readiness. Key components include specialized membrane materials, catalyst formulations, electrode substrates, and bipolar plates. Advanced materials science approaches focus on developing components that offer improved ionic conductivity, chemical stability in alkaline environments, and resistance to degradation during operation.

- Manufacturing readiness assessment and scale-up strategies: Evaluating manufacturing readiness levels for AEM electrolyzers involves systematic assessment of production capabilities, supply chain readiness, and quality control systems. Scale-up strategies focus on transitioning from laboratory-scale to commercial production through process optimization, automation implementation, and manufacturing line design. These assessments help identify technical and economic barriers to mass production and develop mitigation strategies.

- Quality control and testing protocols: Ensuring consistent quality in AEM electrolyzer manufacturing requires robust testing protocols and quality control measures. These include in-line inspection techniques, performance validation methods, and accelerated durability testing. Advanced quality management systems incorporate sensor technologies, data analytics, and statistical process control to identify manufacturing defects and ensure product reliability.

- Innovation in production processes and equipment: Advancements in production processes and specialized equipment are critical for improving AEM electrolyzer manufacturing readiness. These innovations include automated assembly systems, precision coating technologies, and novel joining methods. Custom-designed manufacturing equipment addresses the unique challenges of electrolyzer production, such as maintaining clean room conditions, ensuring precise alignment of components, and implementing efficient material handling systems.

02 Manufacturing processes and scale-up techniques

Manufacturing readiness for AEM electrolyzers involves specialized production processes and scale-up techniques. This includes automated assembly lines, quality control systems, and standardized production protocols. Advanced manufacturing methods such as roll-to-roll processing for membrane electrode assemblies and precision coating technologies are employed to ensure consistent quality at scale. Process optimization focuses on reducing production costs while maintaining performance standards.Expand Specific Solutions03 Materials innovation and supply chain management

Material innovations are crucial for advancing AEM electrolyzer technology, including development of novel catalysts, membranes, and structural components. Supply chain management strategies ensure reliable access to critical raw materials and components. This involves establishing relationships with multiple suppliers, implementing inventory management systems, and developing alternative materials to mitigate supply risks. Material qualification processes ensure consistency and performance across production batches.Expand Specific Solutions04 Testing, validation and quality assurance

Comprehensive testing and validation protocols are essential for ensuring AEM electrolyzer manufacturing readiness. This includes performance testing under various operating conditions, accelerated stress tests, and durability assessments. Quality assurance systems incorporate in-line inspection, statistical process control, and traceability throughout the manufacturing process. Standardized testing methodologies help verify compliance with safety regulations and performance specifications.Expand Specific Solutions05 Production management and digital integration

Effective production management systems and digital integration are key to achieving manufacturing readiness for AEM electrolyzers. This includes implementation of manufacturing execution systems, digital twins for process optimization, and data analytics for continuous improvement. Industry 4.0 technologies enable real-time monitoring, predictive maintenance, and adaptive manufacturing processes. Enterprise resource planning systems help coordinate supply chain, inventory, and production scheduling to optimize manufacturing efficiency.Expand Specific Solutions

Key Industry Players in AEM Electrolyzer Manufacturing

The AEM electrolyzer manufacturing readiness landscape is currently in a transitional phase, moving from early commercialization to industrial scale-up, with a global market projected to reach $2.5 billion by 2030. The technology maturity varies significantly among key players. Companies like Enapter and Power to Hydrogen have demonstrated commercial-ready modular systems, while established industrial firms including Toyota, Panasonic, and DENSO are leveraging their manufacturing expertise to address scale-up challenges. Academic institutions (Georgia Tech, EPFL, University of Freiburg) are driving fundamental innovations in materials and processes. The competitive landscape is diversifying with specialized component manufacturers (Mott Corp., Promerus) addressing specific technical bottlenecks in membrane technology and porous transport layers, creating a complex ecosystem of collaborators and competitors working to establish manufacturing readiness pathways.

Asahi Kasei Corp.

Technical Solution: Asahi Kasei has developed advanced manufacturing processes for AEM electrolyzers leveraging their extensive expertise in membrane technology and chemical processing. Their approach focuses on high-performance ion-exchange membranes specifically engineered for alkaline environments, addressing one of the key challenges in AEM technology durability. The company has established pilot production facilities that implement continuous flow manufacturing techniques for membrane electrode assemblies, significantly reducing production time and improving consistency. Asahi Kasei's scale-up pathway incorporates automated quality control systems using machine vision and AI-based defect detection to maintain high standards during mass production. Their manufacturing process includes specialized coating techniques for catalyst application that optimize catalyst utilization and reduce material waste. The company has developed proprietary sealing technologies that enhance stack reliability while simplifying assembly procedures, making their systems more amenable to automated manufacturing.

Strengths: Extensive experience in membrane technology provides competitive advantage in addressing AEM durability issues; established manufacturing infrastructure enables rapid scaling; strong materials science expertise supports continuous improvement of key components. Weaknesses: Higher initial capital costs compared to some competitors; technology optimization still ongoing for maximum efficiency; requires specialized manufacturing equipment for certain proprietary processes.

Enapter Srl

Technical Solution: Enapter has developed a modular AEM (Anion Exchange Membrane) electrolyzer technology with a focus on mass manufacturing readiness. Their approach centers on standardized, compact electrolyzer modules (EL 4.0) that can be stacked to scale hydrogen production. Enapter's manufacturing strategy involves automated production lines with robotic assembly and quality control systems. Their AEM technology operates at lower temperatures (40-60°C) compared to traditional alkaline electrolyzers and doesn't require noble metal catalysts like PEM systems. The company has established a mass production facility called "Enapter Campus" in Germany designed for high-volume manufacturing with Industry 4.0 principles. Their electrolyzers feature patented AEM stack designs with specialized membrane electrode assemblies that enable operation with deionized water without caustic electrolytes.

Strengths: Highly modular and scalable design allows for flexible deployment across various applications; lower capital costs due to absence of platinum group metals; simplified balance-of-plant requirements compared to PEM systems. Weaknesses: Lower current density compared to PEM technology; membrane durability challenges under certain operating conditions; relatively newer technology with less long-term operational data compared to alkaline systems.

Critical Patents and Technical Innovations in AEM Technology

Device for hydrogen production

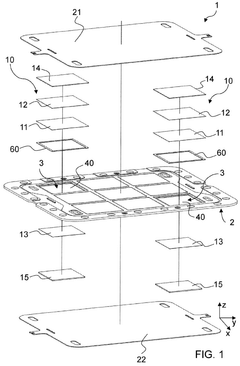

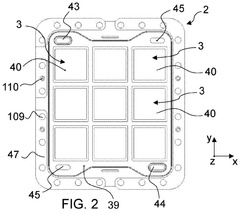

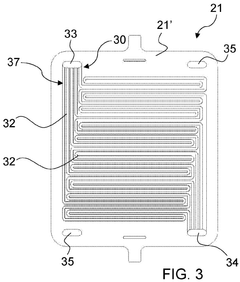

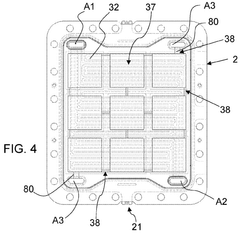

PatentWO2024261689A1

Innovation

- The design features a modular AEMWE device with a laminar support frame and non-overlapping electrochemical modules, each with an anion exchange membrane and distinct electrodes, allowing for increased hydrogen production density and scalability while maintaining mechanical robustness and low costs.

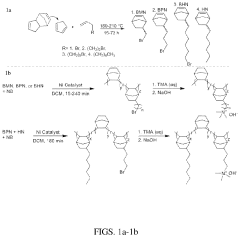

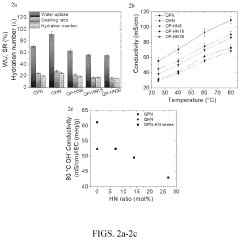

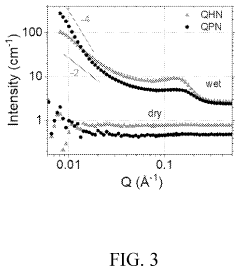

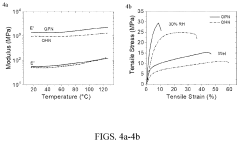

Vinyl-addition polynorbornene cationic compositions and uses thereof in anion exchange membrane fuel cells and electrolyzers

PatentPendingUS20240132647A1

Innovation

- The development of anion exchange polymeric compositions based on a polynorbornene copolymer structure with quaternary ammonium groups and optional hydrocarbon or fluorine-substituted alkyl groups, which are uncrosslinked, enhancing hydroxide conductivity and mechanical strength while maintaining low water uptake.

Supply Chain Considerations for Scale-Up

The scale-up of AEM (Anion Exchange Membrane) electrolyzers requires robust supply chain strategies to ensure sustainable manufacturing growth. Current supply chains for AEM technology components remain underdeveloped compared to traditional alkaline and PEM electrolyzers, creating potential bottlenecks in the commercialization pathway. Critical materials include specialized membrane materials, catalysts (particularly non-precious metal alternatives), porous transport layers, and bipolar plates.

Raw material availability presents significant challenges, particularly for specialized polymers used in membrane fabrication. These materials often have limited suppliers globally, creating vulnerability to supply disruptions. Similarly, catalyst materials face potential constraints, though AEM technology's advantage lies in utilizing non-precious metal catalysts, reducing dependency on scarce platinum group metals that affect competing technologies.

Component manufacturing capacity represents another critical consideration. Current production volumes for AEM-specific components remain limited, with few suppliers capable of meeting quality specifications at scale. Establishing redundant supply sources and developing standardized specifications will be essential for risk mitigation as production volumes increase.

Geographic distribution of the supply chain presents both challenges and opportunities. Currently, membrane materials and specialized components are concentrated among suppliers in North America, Europe, and East Asia. This concentration creates potential vulnerabilities to regional disruptions. Developing regional manufacturing hubs near deployment centers could optimize logistics and reduce transportation costs while enhancing supply security.

Quality control systems must evolve alongside manufacturing scale-up. As production volumes increase, maintaining consistent component quality becomes increasingly challenging. Implementing advanced in-line quality monitoring systems and establishing industry-wide quality standards will be crucial for maintaining performance reliability at scale.

Supply chain resilience strategies should include vertical integration considerations, strategic stockpiling of critical materials, and development of alternative material pathways. Companies leading AEM commercialization must balance the benefits of proprietary supply chains against the industry-wide advantages of standardization and multiple sourcing options.

Long-term sustainability considerations must also factor into supply chain development. Life-cycle assessment of materials, recycling pathways for end-of-life components, and environmental impact of manufacturing processes should be integrated into supply chain planning from early stages to ensure alignment with hydrogen's role in decarbonization efforts.

Raw material availability presents significant challenges, particularly for specialized polymers used in membrane fabrication. These materials often have limited suppliers globally, creating vulnerability to supply disruptions. Similarly, catalyst materials face potential constraints, though AEM technology's advantage lies in utilizing non-precious metal catalysts, reducing dependency on scarce platinum group metals that affect competing technologies.

Component manufacturing capacity represents another critical consideration. Current production volumes for AEM-specific components remain limited, with few suppliers capable of meeting quality specifications at scale. Establishing redundant supply sources and developing standardized specifications will be essential for risk mitigation as production volumes increase.

Geographic distribution of the supply chain presents both challenges and opportunities. Currently, membrane materials and specialized components are concentrated among suppliers in North America, Europe, and East Asia. This concentration creates potential vulnerabilities to regional disruptions. Developing regional manufacturing hubs near deployment centers could optimize logistics and reduce transportation costs while enhancing supply security.

Quality control systems must evolve alongside manufacturing scale-up. As production volumes increase, maintaining consistent component quality becomes increasingly challenging. Implementing advanced in-line quality monitoring systems and establishing industry-wide quality standards will be crucial for maintaining performance reliability at scale.

Supply chain resilience strategies should include vertical integration considerations, strategic stockpiling of critical materials, and development of alternative material pathways. Companies leading AEM commercialization must balance the benefits of proprietary supply chains against the industry-wide advantages of standardization and multiple sourcing options.

Long-term sustainability considerations must also factor into supply chain development. Life-cycle assessment of materials, recycling pathways for end-of-life components, and environmental impact of manufacturing processes should be integrated into supply chain planning from early stages to ensure alignment with hydrogen's role in decarbonization efforts.

Cost Reduction Strategies for Commercial Viability

The economic viability of AEM electrolyzers hinges critically on implementing strategic cost reduction measures across the value chain. Material optimization represents a primary pathway, with research indicating that substituting platinum group metals (PGMs) with earth-abundant catalysts could reduce catalyst costs by 60-70%. Innovative manufacturing techniques such as roll-to-roll processing for membrane electrode assemblies show potential to decrease production costs by 35-45% compared to traditional batch manufacturing methods. These advancements must be coupled with standardization of components and modular designs to enable economies of scale.

Supply chain optimization presents another significant opportunity, particularly through vertical integration strategies. Companies that control multiple stages of production have demonstrated cost reductions of 15-25% through elimination of markup margins between suppliers. Establishing regional manufacturing hubs near renewable energy sources can further reduce logistics costs by 10-15% while decreasing carbon footprint. Strategic partnerships with raw material suppliers through long-term agreements can stabilize input costs and reduce price volatility risks.

Process automation and digitalization offer substantial efficiency gains in AEM electrolyzer manufacturing. Implementation of Industry 4.0 technologies including AI-driven quality control systems has shown to reduce defect rates by 30-40% in pilot facilities. Digital twins for production line optimization can increase throughput by 20-25% without additional capital investment. These technologies require initial investment but typically demonstrate ROI within 18-24 months through reduced labor costs and improved yield rates.

Scale-up strategies must be carefully planned to balance capital expenditure with market development. Phased capacity expansion models indicate optimal efficiency when production capacity increases in 50-100 MW increments, allowing for learning curve benefits while minimizing overcapacity risks. Financial modeling suggests that achieving price parity with conventional hydrogen production methods requires manufacturing scales of at least 1 GW annually, highlighting the importance of policy support during market development phases.

Research into alternative business models reveals that equipment leasing and hydrogen-as-a-service offerings can reduce adoption barriers by converting customer capital expenditures to operational expenses. These models can accelerate market penetration by 30-40% compared to traditional equipment sales approaches, creating a virtuous cycle of increased production volumes leading to further cost reductions through economies of scale and learning effects.

Supply chain optimization presents another significant opportunity, particularly through vertical integration strategies. Companies that control multiple stages of production have demonstrated cost reductions of 15-25% through elimination of markup margins between suppliers. Establishing regional manufacturing hubs near renewable energy sources can further reduce logistics costs by 10-15% while decreasing carbon footprint. Strategic partnerships with raw material suppliers through long-term agreements can stabilize input costs and reduce price volatility risks.

Process automation and digitalization offer substantial efficiency gains in AEM electrolyzer manufacturing. Implementation of Industry 4.0 technologies including AI-driven quality control systems has shown to reduce defect rates by 30-40% in pilot facilities. Digital twins for production line optimization can increase throughput by 20-25% without additional capital investment. These technologies require initial investment but typically demonstrate ROI within 18-24 months through reduced labor costs and improved yield rates.

Scale-up strategies must be carefully planned to balance capital expenditure with market development. Phased capacity expansion models indicate optimal efficiency when production capacity increases in 50-100 MW increments, allowing for learning curve benefits while minimizing overcapacity risks. Financial modeling suggests that achieving price parity with conventional hydrogen production methods requires manufacturing scales of at least 1 GW annually, highlighting the importance of policy support during market development phases.

Research into alternative business models reveals that equipment leasing and hydrogen-as-a-service offerings can reduce adoption barriers by converting customer capital expenditures to operational expenses. These models can accelerate market penetration by 30-40% compared to traditional equipment sales approaches, creating a virtuous cycle of increased production volumes leading to further cost reductions through economies of scale and learning effects.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!