Montmorillonite vs Calcium Carbonate: Cost Benefit in Filler Use

AUG 27, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Filler Technology Background and Objectives

Fillers have been integral components in various industries for decades, evolving from simple extenders to sophisticated functional additives. The historical trajectory of filler technology began in the early 20th century with basic materials like clay and chalk, primarily used to reduce costs in paper and rubber manufacturing. By mid-century, the focus shifted toward enhancing specific properties of host materials, leading to more deliberate selection and modification of fillers based on their inherent characteristics.

In recent years, the filler technology landscape has witnessed significant advancements, particularly in the development of mineral-based fillers with specialized properties. Among these, montmorillonite and calcium carbonate have emerged as prominent options across multiple industries including plastics, paper, coatings, and adhesives. The evolution of these materials has been driven by increasing demands for cost-effective solutions that simultaneously deliver performance benefits.

The technical evolution trend clearly indicates a shift from volume-based to value-based filler selection. Modern fillers are expected not only to reduce material costs but also to contribute functional properties such as improved mechanical strength, thermal stability, barrier properties, and flame retardance. This transition has been accelerated by advancements in surface modification techniques, allowing for better compatibility between fillers and matrix materials.

Montmorillonite, a layered silicate mineral with nanoscale dimensions when properly exfoliated, represents the cutting edge of this evolution. Its high aspect ratio and intercalation capabilities offer exceptional reinforcement potential at low loading levels. Conversely, calcium carbonate, available in various particle sizes and morphologies, has maintained its position as the most widely used mineral filler globally due to its abundance, low cost, and versatility.

The primary technical objective of this investigation is to conduct a comprehensive cost-benefit analysis comparing montmorillonite and calcium carbonate as industrial fillers. This includes evaluating their relative performance across multiple parameters including reinforcement efficiency, processing implications, compatibility with different polymer systems, and overall economic impact throughout the product lifecycle.

Secondary objectives include identifying optimal loading levels for each filler type in various applications, assessing the environmental footprint of both options, and exploring potential synergistic effects when used in combination. Additionally, this research aims to establish clear decision frameworks for material engineers to select the most appropriate filler based on specific application requirements and cost constraints.

The findings from this technical assessment will serve as a foundation for strategic material selection decisions, potentially leading to significant cost savings while maintaining or enhancing product performance across multiple industrial sectors.

In recent years, the filler technology landscape has witnessed significant advancements, particularly in the development of mineral-based fillers with specialized properties. Among these, montmorillonite and calcium carbonate have emerged as prominent options across multiple industries including plastics, paper, coatings, and adhesives. The evolution of these materials has been driven by increasing demands for cost-effective solutions that simultaneously deliver performance benefits.

The technical evolution trend clearly indicates a shift from volume-based to value-based filler selection. Modern fillers are expected not only to reduce material costs but also to contribute functional properties such as improved mechanical strength, thermal stability, barrier properties, and flame retardance. This transition has been accelerated by advancements in surface modification techniques, allowing for better compatibility between fillers and matrix materials.

Montmorillonite, a layered silicate mineral with nanoscale dimensions when properly exfoliated, represents the cutting edge of this evolution. Its high aspect ratio and intercalation capabilities offer exceptional reinforcement potential at low loading levels. Conversely, calcium carbonate, available in various particle sizes and morphologies, has maintained its position as the most widely used mineral filler globally due to its abundance, low cost, and versatility.

The primary technical objective of this investigation is to conduct a comprehensive cost-benefit analysis comparing montmorillonite and calcium carbonate as industrial fillers. This includes evaluating their relative performance across multiple parameters including reinforcement efficiency, processing implications, compatibility with different polymer systems, and overall economic impact throughout the product lifecycle.

Secondary objectives include identifying optimal loading levels for each filler type in various applications, assessing the environmental footprint of both options, and exploring potential synergistic effects when used in combination. Additionally, this research aims to establish clear decision frameworks for material engineers to select the most appropriate filler based on specific application requirements and cost constraints.

The findings from this technical assessment will serve as a foundation for strategic material selection decisions, potentially leading to significant cost savings while maintaining or enhancing product performance across multiple industrial sectors.

Market Analysis of Montmorillonite and Calcium Carbonate Fillers

The global market for mineral fillers has been experiencing significant growth, with montmorillonite and calcium carbonate representing two of the most widely used materials across multiple industries. The calcium carbonate market currently dominates in terms of volume, valued at approximately $22.5 billion in 2022 with projections to reach $28.6 billion by 2027, growing at a CAGR of 4.9%. This substantial market share is primarily due to calcium carbonate's widespread availability, cost-effectiveness, and versatility across paper, plastics, paints, and construction materials.

Montmorillonite, while commanding a smaller market share valued at around $1.7 billion in 2022, is experiencing faster growth with a projected CAGR of 6.8% through 2027. This accelerated growth is driven by increasing demand in specialty applications where its superior properties justify the premium pricing.

Price comparison reveals a significant differential, with industrial-grade calcium carbonate typically priced between $80-150 per ton, while montmorillonite commands $400-800 per ton depending on purity and modification. This price gap reflects the different extraction processes, availability, and performance characteristics of each material.

Regional market dynamics show Asia-Pacific leading consumption of both fillers, accounting for over 45% of global demand, with China being the largest consumer and producer. North America and Europe represent mature markets with stable growth rates of 3-4% annually, focusing increasingly on higher-performance applications and sustainable sourcing.

Industry-specific demand patterns reveal distinct preferences. The paper industry remains the largest consumer of calcium carbonate (approximately 35% of total volume), while the polymer and plastics sector shows the fastest growth for both fillers. The automotive industry increasingly utilizes montmorillonite in lightweight composite materials, while construction materials predominantly rely on calcium carbonate for cost efficiency.

Market trends indicate growing interest in functionalized and nano-sized versions of both fillers, commanding premium prices but offering enhanced performance characteristics. Sustainability concerns are reshaping market dynamics, with manufacturers increasingly emphasizing environmentally responsible sourcing and processing methods.

Supply chain analysis reveals calcium carbonate benefits from widespread geographical availability and simpler processing requirements, resulting in lower transportation costs and more stable pricing. Montmorillonite, with more limited high-quality deposits concentrated in specific regions, faces greater supply chain vulnerabilities and price volatility.

Montmorillonite, while commanding a smaller market share valued at around $1.7 billion in 2022, is experiencing faster growth with a projected CAGR of 6.8% through 2027. This accelerated growth is driven by increasing demand in specialty applications where its superior properties justify the premium pricing.

Price comparison reveals a significant differential, with industrial-grade calcium carbonate typically priced between $80-150 per ton, while montmorillonite commands $400-800 per ton depending on purity and modification. This price gap reflects the different extraction processes, availability, and performance characteristics of each material.

Regional market dynamics show Asia-Pacific leading consumption of both fillers, accounting for over 45% of global demand, with China being the largest consumer and producer. North America and Europe represent mature markets with stable growth rates of 3-4% annually, focusing increasingly on higher-performance applications and sustainable sourcing.

Industry-specific demand patterns reveal distinct preferences. The paper industry remains the largest consumer of calcium carbonate (approximately 35% of total volume), while the polymer and plastics sector shows the fastest growth for both fillers. The automotive industry increasingly utilizes montmorillonite in lightweight composite materials, while construction materials predominantly rely on calcium carbonate for cost efficiency.

Market trends indicate growing interest in functionalized and nano-sized versions of both fillers, commanding premium prices but offering enhanced performance characteristics. Sustainability concerns are reshaping market dynamics, with manufacturers increasingly emphasizing environmentally responsible sourcing and processing methods.

Supply chain analysis reveals calcium carbonate benefits from widespread geographical availability and simpler processing requirements, resulting in lower transportation costs and more stable pricing. Montmorillonite, with more limited high-quality deposits concentrated in specific regions, faces greater supply chain vulnerabilities and price volatility.

Current Status and Technical Challenges in Filler Applications

The global filler market is currently experiencing significant growth, with calcium carbonate (CaCO₃) dominating as the most widely used mineral filler across multiple industries. Annual consumption of calcium carbonate exceeds 15 million tons, representing approximately 40% of the total filler market. Montmorillonite, while less prevalent, has been gaining attention due to its unique properties and potential cost benefits in specific applications.

In the polymer industry, calcium carbonate remains the standard filler choice due to its low cost (typically $80-150 per ton), widespread availability, and established supply chains. Montmorillonite, particularly in its organically modified form (organoclay), commands significantly higher prices ranging from $1,500-3,000 per ton, limiting its mass adoption despite superior performance characteristics in certain applications.

The technical landscape presents several challenges for both fillers. For calcium carbonate, the primary limitations include poor dispersion in hydrophobic polymer matrices, weak interfacial adhesion with host polymers, and limited functional benefits beyond cost reduction and volume filling. These challenges often necessitate surface treatments with stearic acid or coupling agents, adding complexity and cost to formulations.

Montmorillonite faces different technical hurdles, most notably the difficulty in achieving complete exfoliation of its layered silicate structure within polymer matrices. Without proper exfoliation, many of its potential benefits remain unrealized. Additionally, the processing conditions required for montmorillonite incorporation often demand specialized equipment or process modifications, creating barriers to adoption for manufacturers with established production lines.

Recent technological developments have focused on hybrid systems that leverage the cost advantages of calcium carbonate while incorporating small amounts of montmorillonite to enhance overall performance. This approach has shown promise in balancing cost-benefit ratios but requires precise formulation expertise and often proprietary processing techniques.

Environmental and sustainability considerations are increasingly influencing filler selection. While calcium carbonate has a lower carbon footprint in production compared to many synthetic alternatives, montmorillonite offers potential advantages in reducing overall material usage through its reinforcing capabilities at lower loading levels. This aspect is becoming more significant as industries face growing pressure to reduce environmental impact.

Regional disparities in raw material availability also impact the competitive landscape. Countries with abundant limestone deposits maintain cost advantages in calcium carbonate production, while nations with significant clay deposits may find montmorillonite more economically viable. These geographical factors create varying cost-benefit equations across different manufacturing regions.

In the polymer industry, calcium carbonate remains the standard filler choice due to its low cost (typically $80-150 per ton), widespread availability, and established supply chains. Montmorillonite, particularly in its organically modified form (organoclay), commands significantly higher prices ranging from $1,500-3,000 per ton, limiting its mass adoption despite superior performance characteristics in certain applications.

The technical landscape presents several challenges for both fillers. For calcium carbonate, the primary limitations include poor dispersion in hydrophobic polymer matrices, weak interfacial adhesion with host polymers, and limited functional benefits beyond cost reduction and volume filling. These challenges often necessitate surface treatments with stearic acid or coupling agents, adding complexity and cost to formulations.

Montmorillonite faces different technical hurdles, most notably the difficulty in achieving complete exfoliation of its layered silicate structure within polymer matrices. Without proper exfoliation, many of its potential benefits remain unrealized. Additionally, the processing conditions required for montmorillonite incorporation often demand specialized equipment or process modifications, creating barriers to adoption for manufacturers with established production lines.

Recent technological developments have focused on hybrid systems that leverage the cost advantages of calcium carbonate while incorporating small amounts of montmorillonite to enhance overall performance. This approach has shown promise in balancing cost-benefit ratios but requires precise formulation expertise and often proprietary processing techniques.

Environmental and sustainability considerations are increasingly influencing filler selection. While calcium carbonate has a lower carbon footprint in production compared to many synthetic alternatives, montmorillonite offers potential advantages in reducing overall material usage through its reinforcing capabilities at lower loading levels. This aspect is becoming more significant as industries face growing pressure to reduce environmental impact.

Regional disparities in raw material availability also impact the competitive landscape. Countries with abundant limestone deposits maintain cost advantages in calcium carbonate production, while nations with significant clay deposits may find montmorillonite more economically viable. These geographical factors create varying cost-benefit equations across different manufacturing regions.

Comparative Analysis of Current Filler Solutions

01 Cost-effectiveness of montmorillonite and calcium carbonate as fillers

Montmorillonite and calcium carbonate are cost-effective fillers used in various industrial applications. These materials provide significant economic benefits due to their natural abundance, low extraction costs, and minimal processing requirements. When compared to synthetic alternatives, these natural mineral fillers offer substantial cost savings while maintaining acceptable performance characteristics in end products. The cost-benefit ratio is particularly favorable in high-volume applications where material costs represent a significant portion of overall production expenses.- Cost-effectiveness of montmorillonite and calcium carbonate as fillers: Montmorillonite and calcium carbonate are cost-effective fillers used in various applications. These materials provide significant economic benefits compared to other fillers due to their natural abundance and relatively simple processing requirements. The combination of these fillers can optimize cost while maintaining desired performance characteristics in products such as plastics, papers, and construction materials.

- Performance enhancement in polymer composites: When incorporated into polymer matrices, montmorillonite and calcium carbonate fillers provide enhanced mechanical properties and improved performance characteristics. These fillers can increase tensile strength, impact resistance, and dimensional stability while reducing material costs. The synergistic effect of combining both fillers results in superior performance compared to using either filler alone, offering manufacturers a cost-benefit advantage in producing high-performance composite materials.

- Environmental and sustainability benefits: The use of montmorillonite and calcium carbonate as fillers provides significant environmental benefits alongside cost advantages. These naturally occurring minerals reduce the carbon footprint of end products by decreasing the amount of synthetic materials required. Their biodegradability and non-toxic nature contribute to more sustainable manufacturing processes and products, aligning with green initiatives while maintaining economic viability.

- Processing efficiency and manufacturing advantages: Montmorillonite and calcium carbonate fillers offer manufacturing advantages that translate to cost benefits. These materials improve processing efficiency by enhancing flow properties, reducing cycle times, and decreasing energy consumption during production. Their compatibility with various manufacturing methods allows for seamless integration into existing production lines without significant capital investment, resulting in overall cost savings.

- Application-specific cost-benefit analysis: The cost-benefit ratio of montmorillonite and calcium carbonate fillers varies across different applications. In construction materials, these fillers reduce material costs while maintaining structural integrity. In paper production, they improve opacity and printability while lowering raw material expenses. In plastics and polymers, they serve as effective extenders that reduce the amount of more expensive base materials required. This versatility across industries contributes to their favorable economic profile.

02 Performance enhancement in polymer composites

The incorporation of montmorillonite and calcium carbonate fillers in polymer composites leads to enhanced mechanical properties and improved performance-to-cost ratios. These fillers can increase tensile strength, impact resistance, and dimensional stability while reducing the overall cost of the composite material. The surface modification of these fillers can further improve their compatibility with polymer matrices, resulting in better dispersion and enhanced mechanical properties. This combination of performance enhancement and cost reduction makes these fillers particularly valuable in industries such as automotive, construction, and consumer goods manufacturing.Expand Specific Solutions03 Environmental and sustainability benefits

The use of montmorillonite and calcium carbonate as fillers offers significant environmental and sustainability advantages that translate into economic benefits. These natural minerals are abundant, renewable resources with lower carbon footprints compared to synthetic alternatives. Their incorporation can reduce the amount of petroleum-based polymers needed in formulations, leading to cost savings and reduced environmental impact. Additionally, products containing these natural fillers may qualify for green certifications or eco-labels, potentially commanding premium prices in environmentally conscious markets while maintaining lower production costs.Expand Specific Solutions04 Processing efficiency and manufacturing cost reduction

Montmorillonite and calcium carbonate fillers can improve processing efficiency and reduce manufacturing costs in various applications. These fillers can enhance flow properties, reduce cycle times, and lower energy consumption during processing. The proper selection and treatment of these fillers can minimize equipment wear and maintenance costs. Furthermore, their incorporation can reduce shrinkage and warpage in molded products, decreasing rejection rates and improving overall production efficiency. These processing advantages contribute significantly to the overall cost-benefit profile of these mineral fillers.Expand Specific Solutions05 Application-specific cost-benefit analysis

The cost-benefit ratio of montmorillonite and calcium carbonate fillers varies significantly depending on the specific application. In construction materials, these fillers can reduce material costs while maintaining or improving structural integrity and durability. In paper production, they can enhance opacity and printability while reducing fiber costs. In coatings and adhesives, they can improve rheological properties and reduce the need for expensive synthetic additives. The optimal filler selection, concentration, and treatment method must be determined through application-specific testing to maximize the cost-benefit ratio for each particular use case.Expand Specific Solutions

Key Industry Players and Supplier Landscape

The montmorillonite vs calcium carbonate filler market is in a growth phase, with increasing demand driven by cost-efficiency requirements across multiple industries. The global market for mineral fillers is expanding at approximately 6-7% annually, with these materials representing significant segments. Technologically, calcium carbonate enjoys greater maturity and widespread adoption, while montmorillonite applications are evolving rapidly, particularly in advanced composites and barrier materials. Leading companies like BASF, Henkel, and DuPont are investing in research to optimize cost-benefit ratios of both fillers, while academic institutions including South China University of Technology and Tianjin University are advancing fundamental understanding of their properties. Specialized players such as Tianjin Yongxu New Materials and XG Sciences are developing innovative applications combining these fillers with other materials for enhanced performance-to-cost ratios.

Henkel AG & Co. KGaA

Technical Solution: Henkel has developed a sophisticated dual-filler approach comparing montmorillonite and calcium carbonate for adhesives and sealants applications. Their technology involves selective use of organically-modified montmorillonite (at 1-3% loading) for high-performance requirements and precipitated calcium carbonate (at 10-30% loading) for cost-sensitive applications. Henkel's research demonstrates that montmorillonite provides superior reinforcement with significant improvements in tensile strength (up to 40% increase) and heat resistance, while requiring substantially lower loading levels. Their calcium carbonate formulations utilize surface-treated grades to improve dispersion and polymer-filler interactions, offering cost advantages with loading levels up to 40% without significant property degradation. Henkel has implemented a proprietary cost-benefit analysis framework that evaluates performance metrics against raw material costs, processing requirements, and end-use specifications. This approach has been successfully applied in their construction adhesives, automotive assembly solutions, and consumer product lines, with documented case studies showing optimal filler selection based on application requirements and cost constraints.

Strengths: Balanced approach optimizing performance and cost; extensive formulation expertise with both filler types; proprietary surface treatment technologies enhancing compatibility with various polymer systems. Weaknesses: Higher-performance montmorillonite formulations require more complex processing conditions and quality control measures; some applications face limitations in achieving uniform dispersion at higher loading levels.

BASF Corp.

Technical Solution: BASF has developed advanced filler technologies comparing montmorillonite and calcium carbonate for various applications. Their approach involves surface modification of montmorillonite clay to enhance compatibility with polymer matrices, resulting in nanocomposites with superior barrier properties and mechanical strength at lower loading levels (2-5%) compared to conventional calcium carbonate fillers (typically requiring 15-40%). BASF's proprietary treatment processes for montmorillonite include organic modification with quaternary ammonium compounds to improve dispersion and compatibility with hydrophobic polymers. For calcium carbonate, they've developed precipitation techniques yielding ultra-fine particles with controlled morphology and surface characteristics. Their comparative analysis shows montmorillonite providing better reinforcement and barrier properties, while calcium carbonate offers cost advantages and processing benefits. BASF has implemented these technologies in packaging, automotive, and construction applications, with documented performance improvements and cost-benefit analyses for specific end-use scenarios.

Strengths: Comprehensive expertise in both filler types with proprietary surface modification technologies; extensive application knowledge across multiple industries; ability to customize solutions based on specific performance/cost requirements. Weaknesses: Higher-performance montmorillonite solutions often come with increased processing complexity and higher raw material costs compared to calcium carbonate alternatives.

Technical Properties and Performance Characteristics

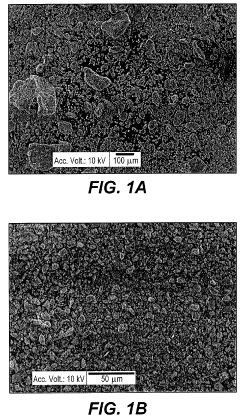

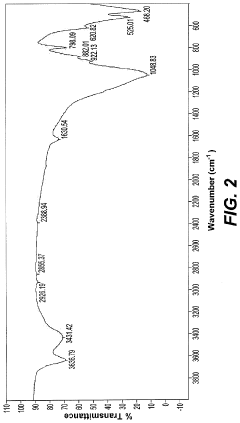

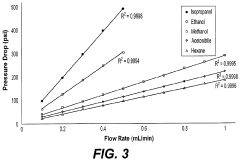

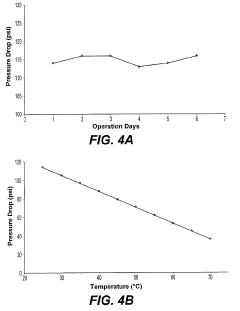

Montmorillonite-based liquid chromatography column

PatentInactiveUS20200246777A1

Innovation

- A montmorillonite-based liquid chromatography column is developed by sieving montmorillonite to achieve a desired particle size range of 5-10 μm, drying the particles, and packing them into a column under pressure, which can be used for both normal-phase and reversed-phase HPLC modes by functionalization or incorporation into organic porous polymers.

Layered film and packaging material

PatentInactiveUS6727001B2

Innovation

- A laminated film comprising a resin substrate and a coated film with montmorillonite containing a cation exchanger other than sodium ions, specifically potassium ions, and a water-soluble polymer, which maintains an excellent oxygen-permeability barrier and firm bonding even at high humidity.

Environmental Impact and Sustainability Considerations

The environmental impact of filler materials has become increasingly significant in industrial decision-making processes, particularly when comparing montmorillonite and calcium carbonate. Calcium carbonate mining operations typically involve open-pit extraction methods that can lead to habitat disruption, landscape alteration, and potential water quality issues in surrounding areas. However, the material's abundance and widespread geographical distribution mean that transportation-related carbon emissions can be minimized through localized sourcing.

Montmorillonite extraction, primarily from bentonite clay deposits, generally creates a smaller initial environmental footprint due to the concentrated nature of deposits and lower volume requirements for equivalent applications. Nevertheless, the processing of montmorillonite often requires more intensive chemical treatments and energy inputs, potentially offsetting some of its environmental advantages at the extraction phase.

From a lifecycle perspective, calcium carbonate demonstrates notable sustainability benefits through its carbon sequestration properties. When exposed to atmospheric conditions over time, calcium carbonate can absorb CO2, effectively acting as a carbon sink in certain applications. This characteristic has led to increased interest in calcium carbonate as a component in carbon-neutral or carbon-negative material formulations.

Montmorillonite offers distinct environmental advantages through its functional properties. Its high adsorption capacity makes it effective in removing environmental contaminants, and its reinforcing capabilities in composites can lead to materials with extended service lives. Additionally, the lower quantities required for equivalent performance can translate to reduced material consumption across supply chains.

Water usage presents another critical environmental consideration. Calcium carbonate processing typically requires significant water volumes for washing and purification, while montmorillonite processing often involves less water but may introduce more complex wastewater treatment challenges due to the presence of exchangeable ions and colloidal particles.

Regulatory frameworks increasingly influence filler selection decisions. Many jurisdictions have implemented stricter environmental compliance requirements for mining operations, waste management, and emissions control. Montmorillonite often faces fewer extraction-related regulations due to its smaller mining footprint, while calcium carbonate operations must navigate more comprehensive environmental impact assessment processes in many regions.

End-of-life considerations reveal that calcium carbonate-filled products generally present fewer disposal challenges, as the material is chemically inert and naturally abundant. Montmorillonite can potentially complicate recycling processes due to its interaction with polymer matrices, though its biodegradability in certain applications represents a sustainability advantage in appropriate contexts.

Montmorillonite extraction, primarily from bentonite clay deposits, generally creates a smaller initial environmental footprint due to the concentrated nature of deposits and lower volume requirements for equivalent applications. Nevertheless, the processing of montmorillonite often requires more intensive chemical treatments and energy inputs, potentially offsetting some of its environmental advantages at the extraction phase.

From a lifecycle perspective, calcium carbonate demonstrates notable sustainability benefits through its carbon sequestration properties. When exposed to atmospheric conditions over time, calcium carbonate can absorb CO2, effectively acting as a carbon sink in certain applications. This characteristic has led to increased interest in calcium carbonate as a component in carbon-neutral or carbon-negative material formulations.

Montmorillonite offers distinct environmental advantages through its functional properties. Its high adsorption capacity makes it effective in removing environmental contaminants, and its reinforcing capabilities in composites can lead to materials with extended service lives. Additionally, the lower quantities required for equivalent performance can translate to reduced material consumption across supply chains.

Water usage presents another critical environmental consideration. Calcium carbonate processing typically requires significant water volumes for washing and purification, while montmorillonite processing often involves less water but may introduce more complex wastewater treatment challenges due to the presence of exchangeable ions and colloidal particles.

Regulatory frameworks increasingly influence filler selection decisions. Many jurisdictions have implemented stricter environmental compliance requirements for mining operations, waste management, and emissions control. Montmorillonite often faces fewer extraction-related regulations due to its smaller mining footprint, while calcium carbonate operations must navigate more comprehensive environmental impact assessment processes in many regions.

End-of-life considerations reveal that calcium carbonate-filled products generally present fewer disposal challenges, as the material is chemically inert and naturally abundant. Montmorillonite can potentially complicate recycling processes due to its interaction with polymer matrices, though its biodegradability in certain applications represents a sustainability advantage in appropriate contexts.

Regulatory Framework for Industrial Mineral Fillers

The regulatory landscape governing industrial mineral fillers like montmorillonite and calcium carbonate is complex and multifaceted, varying significantly across regions and applications. In the United States, the Environmental Protection Agency (EPA) regulates these materials under the Toxic Substances Control Act (TSCA), which requires manufacturers to report chemical substances that may pose environmental or health risks. For food contact applications, calcium carbonate enjoys Generally Recognized as Safe (GRAS) status from the FDA, while montmorillonite applications face more stringent scrutiny.

European regulations are typically more comprehensive, with the REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) framework requiring extensive safety data for both minerals when used in quantities exceeding one ton annually. The European Food Safety Authority (EFSA) has established specific migration limits for calcium carbonate in food packaging, whereas montmorillonite applications often require additional safety assessments due to potential nanoparticle concerns.

Occupational safety regulations present another critical dimension, with OSHA in the US and equivalent bodies in other regions establishing permissible exposure limits for airborne mineral dust. Calcium carbonate typically has higher allowable exposure thresholds compared to montmorillonite, which may contain respirable silica requiring additional workplace controls and monitoring.

Environmental regulations increasingly impact filler selection decisions. Calcium carbonate mining operations must comply with land reclamation requirements and water discharge permits. Montmorillonite extraction faces similar constraints, though its processing typically involves fewer chemical treatments, potentially simplifying compliance with chemical discharge regulations.

Product-specific regulations create additional compliance considerations. In pharmaceuticals, both fillers must meet pharmacopeia standards, with calcium carbonate having more established monographs. In plastics intended for children's products, regulations limiting heavy metals favor highly purified grades of both minerals, though calcium carbonate's naturally lower trace metal content often simplifies compliance.

Emerging regulatory trends suggest increasing scrutiny of nanomaterials, potentially affecting montmorillonite applications where exfoliation creates nano-scale particles. Simultaneously, carbon footprint disclosure requirements are becoming more common, potentially favoring calcium carbonate due to its abundance and simpler processing requirements in many regions.

Companies must therefore consider not only current compliance costs but also regulatory trajectory when evaluating the total cost-benefit equation of these mineral fillers across their product lifecycle and target markets.

European regulations are typically more comprehensive, with the REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) framework requiring extensive safety data for both minerals when used in quantities exceeding one ton annually. The European Food Safety Authority (EFSA) has established specific migration limits for calcium carbonate in food packaging, whereas montmorillonite applications often require additional safety assessments due to potential nanoparticle concerns.

Occupational safety regulations present another critical dimension, with OSHA in the US and equivalent bodies in other regions establishing permissible exposure limits for airborne mineral dust. Calcium carbonate typically has higher allowable exposure thresholds compared to montmorillonite, which may contain respirable silica requiring additional workplace controls and monitoring.

Environmental regulations increasingly impact filler selection decisions. Calcium carbonate mining operations must comply with land reclamation requirements and water discharge permits. Montmorillonite extraction faces similar constraints, though its processing typically involves fewer chemical treatments, potentially simplifying compliance with chemical discharge regulations.

Product-specific regulations create additional compliance considerations. In pharmaceuticals, both fillers must meet pharmacopeia standards, with calcium carbonate having more established monographs. In plastics intended for children's products, regulations limiting heavy metals favor highly purified grades of both minerals, though calcium carbonate's naturally lower trace metal content often simplifies compliance.

Emerging regulatory trends suggest increasing scrutiny of nanomaterials, potentially affecting montmorillonite applications where exfoliation creates nano-scale particles. Simultaneously, carbon footprint disclosure requirements are becoming more common, potentially favoring calcium carbonate due to its abundance and simpler processing requirements in many regions.

Companies must therefore consider not only current compliance costs but also regulatory trajectory when evaluating the total cost-benefit equation of these mineral fillers across their product lifecycle and target markets.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!