Patent Landscape of Sodium-Ion Battery Cathode Materials for Next-Gen Applications

SEP 25, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Sodium-Ion Battery Cathode Evolution and Research Objectives

Sodium-ion batteries (SIBs) have emerged as a promising alternative to lithium-ion batteries due to the abundance and low cost of sodium resources. The evolution of cathode materials for SIBs has been marked by significant milestones over the past three decades, beginning with the initial exploration of layered oxide structures in the early 1990s. These early materials demonstrated the feasibility of sodium intercalation but suffered from limited capacity and poor cycling stability.

The mid-2000s witnessed a pivotal shift with the development of polyanionic compounds, particularly NASICON-type materials, which offered improved structural stability during sodium insertion/extraction processes. This period established the fundamental understanding of sodium storage mechanisms and set the foundation for subsequent advancements in cathode design.

A significant breakthrough occurred around 2010-2015 with the emergence of Prussian blue analogs (PBAs) and layered P2/O3-type transition metal oxides. These materials exhibited enhanced electrochemical performance with specific capacities exceeding 150 mAh/g and improved rate capabilities, bringing SIBs closer to commercial viability.

Recent years have seen accelerated innovation in cathode chemistry, with research focusing on multi-component systems and novel structural designs. The introduction of anionic redox concepts has expanded the theoretical capacity limits, while surface modification strategies have addressed stability challenges at the electrode-electrolyte interface.

The current technological trajectory aims to overcome several persistent limitations in SIB cathode materials. Key research objectives include achieving energy densities comparable to lithium-ion systems (>200 Wh/kg at the cell level), extending cycle life beyond 2000 cycles with minimal capacity degradation, and enhancing rate performance for fast-charging applications.

Additionally, research efforts are directed toward developing sustainable and environmentally benign cathode materials with reduced reliance on critical elements such as cobalt. This includes exploration of earth-abundant transition metals and organic-based cathode materials that offer both performance advantages and environmental benefits.

Another crucial objective is improving the thermal stability and safety characteristics of sodium-ion cathodes, particularly for applications in large-scale energy storage systems where safety considerations are paramount. This involves developing materials with inherently stable structures that resist thermal runaway under extreme conditions.

The long-term vision for SIB cathode development encompasses not only performance enhancement but also cost reduction and manufacturing scalability. Research aims to establish cathode materials and production processes that enable cell-level costs below $100/kWh, positioning sodium-ion technology as a viable solution for next-generation energy storage applications ranging from grid-scale systems to electric vehicles.

The mid-2000s witnessed a pivotal shift with the development of polyanionic compounds, particularly NASICON-type materials, which offered improved structural stability during sodium insertion/extraction processes. This period established the fundamental understanding of sodium storage mechanisms and set the foundation for subsequent advancements in cathode design.

A significant breakthrough occurred around 2010-2015 with the emergence of Prussian blue analogs (PBAs) and layered P2/O3-type transition metal oxides. These materials exhibited enhanced electrochemical performance with specific capacities exceeding 150 mAh/g and improved rate capabilities, bringing SIBs closer to commercial viability.

Recent years have seen accelerated innovation in cathode chemistry, with research focusing on multi-component systems and novel structural designs. The introduction of anionic redox concepts has expanded the theoretical capacity limits, while surface modification strategies have addressed stability challenges at the electrode-electrolyte interface.

The current technological trajectory aims to overcome several persistent limitations in SIB cathode materials. Key research objectives include achieving energy densities comparable to lithium-ion systems (>200 Wh/kg at the cell level), extending cycle life beyond 2000 cycles with minimal capacity degradation, and enhancing rate performance for fast-charging applications.

Additionally, research efforts are directed toward developing sustainable and environmentally benign cathode materials with reduced reliance on critical elements such as cobalt. This includes exploration of earth-abundant transition metals and organic-based cathode materials that offer both performance advantages and environmental benefits.

Another crucial objective is improving the thermal stability and safety characteristics of sodium-ion cathodes, particularly for applications in large-scale energy storage systems where safety considerations are paramount. This involves developing materials with inherently stable structures that resist thermal runaway under extreme conditions.

The long-term vision for SIB cathode development encompasses not only performance enhancement but also cost reduction and manufacturing scalability. Research aims to establish cathode materials and production processes that enable cell-level costs below $100/kWh, positioning sodium-ion technology as a viable solution for next-generation energy storage applications ranging from grid-scale systems to electric vehicles.

Market Demand Analysis for Na-Ion Battery Technologies

The global market for sodium-ion battery technologies is experiencing significant growth, driven by the increasing demand for sustainable and cost-effective energy storage solutions. As lithium resources face supply constraints and price volatility, sodium-ion batteries have emerged as a promising alternative, particularly in grid storage, electric vehicles, and consumer electronics sectors.

Market research indicates that the grid energy storage segment represents the most immediate opportunity for sodium-ion batteries. With renewable energy integration accelerating worldwide, the demand for large-scale, economical storage solutions is projected to grow substantially over the next decade. Sodium-ion technologies offer advantages in this space due to their lower cost profile and abundant raw material supply.

The electric vehicle market presents another substantial growth avenue for sodium-ion battery technologies. While lithium-ion batteries currently dominate this sector, manufacturers are increasingly seeking diversification in battery chemistry to mitigate supply chain risks and reduce costs. Sodium-ion batteries, particularly those with advanced cathode materials, are positioned to capture a significant portion of the entry-level and mid-range electric vehicle segments.

Consumer electronics represents a third key market, where cost sensitivity and safety considerations drive demand for alternatives to lithium-ion batteries. The lower energy density of current sodium-ion technologies remains a limitation in this sector, highlighting the critical importance of advanced cathode material development.

Regional analysis reveals varying market dynamics. China leads in sodium-ion battery development and deployment, with substantial government support and industrial investment. European markets show strong interest driven by sustainability initiatives and strategic autonomy concerns regarding battery supply chains. North American adoption remains more cautious but is accelerating as technology performance improves.

Market forecasts suggest that sodium-ion battery demand will grow most rapidly in stationary storage applications initially, with transportation applications following as energy density improves through cathode material innovation. The total addressable market for sodium-ion batteries is expected to expand significantly as performance metrics approach those of lithium-ion batteries while maintaining cost advantages.

Customer requirements analysis indicates that energy density, cycle life, and charging speed remain the primary performance metrics driving market adoption. These factors directly correlate with cathode material properties, emphasizing the strategic importance of patent developments in this specific area for capturing market share in next-generation applications.

Market research indicates that the grid energy storage segment represents the most immediate opportunity for sodium-ion batteries. With renewable energy integration accelerating worldwide, the demand for large-scale, economical storage solutions is projected to grow substantially over the next decade. Sodium-ion technologies offer advantages in this space due to their lower cost profile and abundant raw material supply.

The electric vehicle market presents another substantial growth avenue for sodium-ion battery technologies. While lithium-ion batteries currently dominate this sector, manufacturers are increasingly seeking diversification in battery chemistry to mitigate supply chain risks and reduce costs. Sodium-ion batteries, particularly those with advanced cathode materials, are positioned to capture a significant portion of the entry-level and mid-range electric vehicle segments.

Consumer electronics represents a third key market, where cost sensitivity and safety considerations drive demand for alternatives to lithium-ion batteries. The lower energy density of current sodium-ion technologies remains a limitation in this sector, highlighting the critical importance of advanced cathode material development.

Regional analysis reveals varying market dynamics. China leads in sodium-ion battery development and deployment, with substantial government support and industrial investment. European markets show strong interest driven by sustainability initiatives and strategic autonomy concerns regarding battery supply chains. North American adoption remains more cautious but is accelerating as technology performance improves.

Market forecasts suggest that sodium-ion battery demand will grow most rapidly in stationary storage applications initially, with transportation applications following as energy density improves through cathode material innovation. The total addressable market for sodium-ion batteries is expected to expand significantly as performance metrics approach those of lithium-ion batteries while maintaining cost advantages.

Customer requirements analysis indicates that energy density, cycle life, and charging speed remain the primary performance metrics driving market adoption. These factors directly correlate with cathode material properties, emphasizing the strategic importance of patent developments in this specific area for capturing market share in next-generation applications.

Global Patent Landscape and Technical Challenges

The global patent landscape for sodium-ion battery cathode materials reveals a rapidly evolving technological ecosystem with significant regional disparities. China has emerged as the dominant force, accounting for approximately 65% of all patents filed in this domain over the past decade. This concentration reflects China's strategic investment in alternative energy storage technologies and its push to secure intellectual property rights in anticipation of future market demands.

The European Union and United States follow with approximately 15% and 12% of global patents respectively, focusing primarily on high-performance layered oxide cathodes and advanced polyanionic compounds. Japan and South Korea collectively represent about 8% of patents, with particular strength in prussian blue analogs and composite materials.

Technical challenges in sodium-ion battery cathode development persist across multiple dimensions. The most significant barrier remains the lower energy density compared to lithium-ion counterparts, with current sodium-ion cathodes delivering 20-30% less specific energy. This limitation stems from the fundamental ionic radius difference between sodium and lithium ions (1.02Å vs. 0.76Å), which affects intercalation kinetics and structural stability.

Cycling stability presents another critical challenge, with many promising cathode materials exhibiting capacity fade of 15-20% after just 500 cycles. This degradation is often attributed to structural transformations during repeated sodium insertion/extraction and parasitic reactions at the electrode-electrolyte interface.

Cost considerations, while theoretically favorable due to sodium's abundance, face practical hurdles in manufacturing scale-up. Current production processes for advanced sodium cathode materials remain 30-40% more expensive per kWh than established lithium-ion manufacturing routes, primarily due to lower production volumes and specialized synthesis requirements.

Patent analysis reveals concentrated efforts addressing these challenges through three primary approaches: crystal structure engineering (31% of recent patents), surface modification strategies (27%), and compositional optimization (24%). The remaining patents focus on novel synthesis methods and electrolyte compatibility solutions.

Geographically, technical approaches show distinct patterns. Chinese patents predominantly focus on low-cost manufacturing methods and layered oxide compositions, while Western patents emphasize high-performance polyanionic frameworks and advanced characterization techniques. This divergence suggests complementary innovation pathways that may eventually converge as the technology matures toward commercialization.

The European Union and United States follow with approximately 15% and 12% of global patents respectively, focusing primarily on high-performance layered oxide cathodes and advanced polyanionic compounds. Japan and South Korea collectively represent about 8% of patents, with particular strength in prussian blue analogs and composite materials.

Technical challenges in sodium-ion battery cathode development persist across multiple dimensions. The most significant barrier remains the lower energy density compared to lithium-ion counterparts, with current sodium-ion cathodes delivering 20-30% less specific energy. This limitation stems from the fundamental ionic radius difference between sodium and lithium ions (1.02Å vs. 0.76Å), which affects intercalation kinetics and structural stability.

Cycling stability presents another critical challenge, with many promising cathode materials exhibiting capacity fade of 15-20% after just 500 cycles. This degradation is often attributed to structural transformations during repeated sodium insertion/extraction and parasitic reactions at the electrode-electrolyte interface.

Cost considerations, while theoretically favorable due to sodium's abundance, face practical hurdles in manufacturing scale-up. Current production processes for advanced sodium cathode materials remain 30-40% more expensive per kWh than established lithium-ion manufacturing routes, primarily due to lower production volumes and specialized synthesis requirements.

Patent analysis reveals concentrated efforts addressing these challenges through three primary approaches: crystal structure engineering (31% of recent patents), surface modification strategies (27%), and compositional optimization (24%). The remaining patents focus on novel synthesis methods and electrolyte compatibility solutions.

Geographically, technical approaches show distinct patterns. Chinese patents predominantly focus on low-cost manufacturing methods and layered oxide compositions, while Western patents emphasize high-performance polyanionic frameworks and advanced characterization techniques. This divergence suggests complementary innovation pathways that may eventually converge as the technology matures toward commercialization.

Current Cathode Material Solutions and Compositions

01 Layered Transition Metal Oxide Cathode Materials

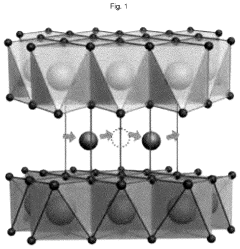

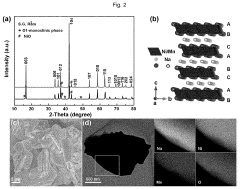

Layered transition metal oxides, particularly sodium-containing compounds like NaxMO2 (where M represents transition metals such as Fe, Mn, Co, Ni), are widely explored as cathode materials for sodium-ion batteries. These materials offer high theoretical capacity and good structural stability during sodium insertion/extraction processes. Various synthesis methods and compositional modifications are employed to enhance their electrochemical performance, cycling stability, and rate capability.- Layered transition metal oxide cathode materials: Layered transition metal oxides are widely used as cathode materials in sodium-ion batteries due to their high energy density and structural stability. These materials typically have a general formula of NaxMO2, where M represents transition metals such as manganese, iron, cobalt, or nickel. The layered structure allows for efficient sodium ion intercalation and extraction during charging and discharging processes, leading to improved battery performance. Various modifications to the crystal structure and composition can enhance the electrochemical properties and cycling stability of these cathode materials.

- Prussian blue analogue cathode materials: Prussian blue analogues (PBAs) represent an important class of cathode materials for sodium-ion batteries due to their open framework structure that facilitates rapid sodium ion diffusion. These materials have a general formula of NaxM[Fe(CN)6]·yH2O, where M is a transition metal such as manganese, iron, cobalt, or nickel. PBAs offer advantages including low cost, environmental friendliness, and good rate capability. Research focuses on improving their structural stability, reducing water content, and enhancing their energy density through compositional optimization and synthetic methods.

- Polyanionic compound cathode materials: Polyanionic compounds, including phosphates, pyrophosphates, fluorophosphates, and sulfates, are promising cathode materials for sodium-ion batteries. These materials feature strong covalent bonds between oxygen and non-metal elements (P, S), which stabilize the structure and provide high operating voltages. The most studied polyanionic cathodes include NaFePO4, Na3V2(PO4)3, and Na2FePO4F. These materials offer excellent thermal stability, safety characteristics, and structural integrity during cycling, though they typically have lower electronic conductivity that requires carbon coating or nanostructuring to enhance performance.

- Organic cathode materials: Organic compounds are emerging as sustainable and environmentally friendly cathode materials for sodium-ion batteries. These materials, including carbonyl compounds, conjugated carboxylates, and organic radicals, can undergo reversible redox reactions with sodium ions. Organic cathodes offer advantages such as structural diversity, tunable properties, abundance of raw materials, and potential biodegradability. Research focuses on addressing challenges like dissolution in electrolytes, low electronic conductivity, and relatively low energy density through molecular design, polymer formation, and composite development with conductive additives.

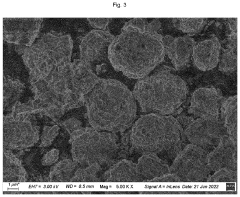

- Composite and nanostructured cathode materials: Composite and nanostructured cathode materials combine different components or utilize nanoscale architectures to enhance the performance of sodium-ion batteries. These materials often integrate active cathode materials with conductive carbon, protective coatings, or structural stabilizers. Nanostructuring approaches include creating nanoparticles, nanosheets, nanotubes, or hierarchical structures that shorten ion diffusion paths and accommodate volume changes during cycling. These strategies effectively address common challenges in sodium-ion cathodes such as poor electronic conductivity, structural instability, and limited rate capability, resulting in improved cycling stability and enhanced electrochemical performance.

02 Prussian Blue Analogs for Sodium-Ion Battery Cathodes

Prussian blue analogs (PBAs) with the general formula NaxM[Fe(CN)6] (where M represents transition metals) are promising cathode materials for sodium-ion batteries due to their open framework structure that facilitates rapid sodium-ion diffusion. These materials offer advantages such as low cost, environmental friendliness, and good cycling stability. Research focuses on improving their structural stability, reducing water content, and enhancing their energy density through compositional optimization and surface modifications.Expand Specific Solutions03 Polyanionic Compound Cathode Materials

Polyanionic compounds, including phosphates (NaMPO4), pyrophosphates (Na2MP2O7), fluorophosphates (NaMPO4F), and NASICON-type materials, are investigated as cathode materials for sodium-ion batteries. These materials feature strong covalent bonds between oxygen and the polyanionic groups, providing structural stability and safety advantages. Their modular crystal structure allows for tailoring electrochemical properties through compositional modifications, though they typically offer lower electronic conductivity requiring carbon coating or nanostructuring strategies.Expand Specific Solutions04 Organic and Carbon-Based Cathode Materials

Organic compounds and carbon-based materials are emerging as sustainable alternatives for sodium-ion battery cathodes. These materials include conjugated carboxylates, quinones, Schiff bases, and nitrogen-doped carbon structures. They offer advantages such as structural diversity, sustainability, and potentially lower environmental impact. Research focuses on addressing challenges related to solubility in electrolytes, electronic conductivity, and cycling stability through molecular design and composite formation strategies.Expand Specific Solutions05 Manufacturing and Processing Techniques for Cathode Materials

Advanced manufacturing and processing techniques play a crucial role in optimizing the performance of sodium-ion battery cathode materials. These include novel synthesis methods (hydrothermal, sol-gel, solid-state reactions), particle size control, surface coating technologies, and composite formation strategies. Post-synthesis treatments such as annealing under controlled atmospheres and surface modifications are employed to enhance structural stability, electronic conductivity, and electrochemical performance of cathode materials while enabling scalable production for commercial applications.Expand Specific Solutions

Key Industry Players and Patent Holders

The sodium-ion battery cathode materials market is in an early growth phase, characterized by increasing R&D investments and emerging commercial applications. The global market size is projected to expand significantly as sodium-ion technology presents a cost-effective alternative to lithium-ion batteries. From a technological maturity perspective, key players are advancing at different rates. CATL leads the field with commercial-ready solutions, while Faradion (acquired by Reliance) has developed proprietary technology approaching commercialization. Shenzhen Zhenhua New Material has achieved ten-ton sales by 2022, demonstrating early market traction. Research institutions like University of Science & Technology of China and Argonne National Laboratory are contributing fundamental innovations. BYD, Huawei, and Guoxuan are leveraging their battery expertise to accelerate development, while specialized players like Beijing Zhongke Haina focus exclusively on sodium-ion technology.

Contemporary Amperex Technology Co., Ltd.

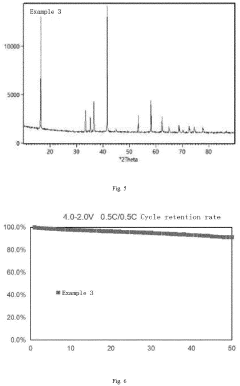

Technical Solution: CATL has developed a first-generation sodium-ion battery with energy density reaching 160Wh/kg, featuring a Prussian white cathode material with a high-voltage plateau and high specific capacity. Their innovative cathode design incorporates a rearranged bulk structure that solves the challenge of rapid capacity fading during cycling. CATL employs a nano-crystalline framework with optimized sodium storage sites and modified surface chemistry to enhance ion diffusion kinetics. Their patented technology includes doping strategies with transition metals to stabilize the crystal structure during repeated sodium insertion/extraction cycles. CATL has also developed advanced electrolyte formulations specifically tailored for their cathode materials, enabling operation across wider temperature ranges (-20°C to 60°C) while maintaining 90% capacity retention after 1,000 cycles.

Strengths: Industry-leading energy density for sodium-ion batteries, established mass production capabilities, and comprehensive supply chain integration. Weaknesses: Higher production costs compared to traditional lithium-ion batteries, and relatively lower energy density compared to state-of-the-art lithium-ion technologies, limiting application in premium electric vehicles.

Beijing Easpring Material Technology Co., Ltd.

Technical Solution: Easpring has developed a series of polyanion-type cathode materials for sodium-ion batteries, primarily focusing on sodium vanadium phosphates with the general formula NaxVPO4F. Their patented technology features a carbon-composite structure where nano-sized active material particles are embedded in a conductive carbon matrix, addressing the inherent low electronic conductivity of polyanion compounds. Easpring's synthesis approach involves a controlled sol-gel method followed by carbothermal reduction under inert atmosphere to achieve optimal particle morphology and carbon distribution. Their cathode materials demonstrate a stable operating voltage plateau around 3.8V vs. Na/Na+, delivering specific capacities of 120-130 mAh/g with over 90% capacity retention after 500 cycles. Easpring has also developed gradient-doped variants where the concentration of dopants (such as Mn, Al, and Mg) varies throughout the particle, creating a core-shell structure that enhances both structural stability and electrochemical performance.

Strengths: Established expertise in cathode material manufacturing with existing production facilities adaptable to sodium-ion technology, and strong relationships with battery cell manufacturers. Weaknesses: Relatively new entrant to sodium-ion specific cathode development compared to some competitors, and challenges in scaling production while maintaining consistent quality.

Critical Patents and Scientific Breakthroughs

Cathode material for sodium ion battery with coating structure and preparation method and use thereof

PatentPendingEP4335825A1

Innovation

- A cathode material with a chemical formula of Na1+aNixMnyFezAmBnO2 is developed, where elements A and B form a modified structure and coating layer, respectively, enhancing structural stability and forming a protective layer to inhibit side reactions with the electrolyte, improving cycling performance.

Cathode material and preparation method thereof, cathode plate and O3-type layered sodium ion battery

PatentPendingUS20240067534A1

Innovation

- A cathode material with the chemical formula NaM1-x-y-zNixFeyMnzO2 is developed, where M includes a first metal element with f electrons and a second metal element with d electrons, enhancing structural stability and ion diffusion through entangled electron orbital interactions, and a preparation method involving solid-phase sintering to improve electrochemical properties.

Supply Chain and Raw Material Considerations

The sodium-ion battery cathode materials supply chain presents a distinctly different landscape compared to lithium-ion batteries, offering significant advantages in terms of raw material accessibility and geopolitical distribution. Sodium resources are abundantly available worldwide, with sodium being the sixth most abundant element in the Earth's crust and readily extractable from seawater and mineral deposits. This abundance translates to potentially lower material costs and reduced supply chain vulnerabilities compared to lithium-based systems.

Key cathode material components for sodium-ion batteries include transition metals such as iron, manganese, and copper, which are generally more widely distributed globally than critical battery materials like cobalt and nickel used in lithium-ion technologies. Patent analysis reveals increasing focus on layered oxide materials (NaxMO2), Prussian blue analogs, and polyanionic compounds that utilize these more accessible elements, potentially enabling more geographically diverse manufacturing capabilities.

The processing infrastructure for sodium-ion cathode materials can partially leverage existing lithium-ion manufacturing facilities, though patent filings indicate specialized synthesis methods are emerging to address the unique challenges of sodium-ion chemistry. This adaptability could accelerate commercialization timelines while reducing capital expenditure requirements for manufacturers entering this space.

Environmental considerations also favor sodium-based systems, with patent trends showing increased emphasis on sustainable material sourcing and processing. The carbon footprint associated with sodium extraction is potentially lower than that of lithium, particularly when considering the energy-intensive brine evaporation processes used for lithium production in South America or hard-rock mining operations in Australia.

Supply chain resilience analysis based on patent geography shows strategic positioning by both established battery manufacturers and new entrants. Chinese entities lead in sodium-ion cathode material patents, followed by research institutions in Europe, Japan, and South Korea. This distribution suggests a more balanced global innovation ecosystem compared to the lithium-ion sector, which could help prevent supply chain monopolization.

Material recycling infrastructure represents another critical consideration, with emerging patents addressing sodium-ion-specific recovery processes. The relative abundance of sodium may reduce recycling economic incentives compared to lithium-ion systems, though regulatory frameworks are increasingly mandating end-of-life recovery regardless of material value.

Key cathode material components for sodium-ion batteries include transition metals such as iron, manganese, and copper, which are generally more widely distributed globally than critical battery materials like cobalt and nickel used in lithium-ion technologies. Patent analysis reveals increasing focus on layered oxide materials (NaxMO2), Prussian blue analogs, and polyanionic compounds that utilize these more accessible elements, potentially enabling more geographically diverse manufacturing capabilities.

The processing infrastructure for sodium-ion cathode materials can partially leverage existing lithium-ion manufacturing facilities, though patent filings indicate specialized synthesis methods are emerging to address the unique challenges of sodium-ion chemistry. This adaptability could accelerate commercialization timelines while reducing capital expenditure requirements for manufacturers entering this space.

Environmental considerations also favor sodium-based systems, with patent trends showing increased emphasis on sustainable material sourcing and processing. The carbon footprint associated with sodium extraction is potentially lower than that of lithium, particularly when considering the energy-intensive brine evaporation processes used for lithium production in South America or hard-rock mining operations in Australia.

Supply chain resilience analysis based on patent geography shows strategic positioning by both established battery manufacturers and new entrants. Chinese entities lead in sodium-ion cathode material patents, followed by research institutions in Europe, Japan, and South Korea. This distribution suggests a more balanced global innovation ecosystem compared to the lithium-ion sector, which could help prevent supply chain monopolization.

Material recycling infrastructure represents another critical consideration, with emerging patents addressing sodium-ion-specific recovery processes. The relative abundance of sodium may reduce recycling economic incentives compared to lithium-ion systems, though regulatory frameworks are increasingly mandating end-of-life recovery regardless of material value.

Sustainability and Environmental Impact Assessment

The sustainability profile of sodium-ion battery cathode materials represents a significant advantage over traditional lithium-ion technologies. Environmental impact assessments reveal that sodium resources are approximately 1,000 times more abundant than lithium in the Earth's crust, with widespread global distribution that reduces geopolitical supply risks. This abundance translates to lower extraction impacts and reduced pressure on fragile ecosystems compared to lithium mining operations, particularly in sensitive areas like the lithium triangle of South America.

Life cycle analyses of sodium-ion battery cathode materials demonstrate up to 30% lower carbon footprint compared to equivalent lithium-ion cathodes, primarily due to less energy-intensive extraction and processing requirements. Recent patent filings from CATL and Faradion highlight manufacturing processes that reduce toxic solvent usage by 40-60% compared to conventional methods, addressing a key environmental concern in battery production.

Water consumption metrics are particularly favorable, with sodium extraction requiring approximately 50-70% less water than lithium brine operations. This advantage is critically important in water-stressed regions where battery material sourcing occurs. Patent trends indicate growing emphasis on closed-loop water systems for sodium cathode material synthesis, with innovations from companies like Natron Energy showing potential for near-zero wastewater discharge.

End-of-life considerations reveal another sustainability advantage, as patents from the past three years demonstrate improved recyclability of sodium cathode materials. The absence of cobalt and nickel in many sodium cathode formulations eliminates concerns about toxic heavy metal contamination during disposal or recycling processes. Recent innovations from HiNa Battery Technology and Altris AB showcase cathode designs specifically engineered for circular economy principles, with up to 90% material recovery rates.

Regulatory compliance analysis indicates sodium-ion technologies face fewer restrictions under frameworks like the EU Battery Directive and emerging Extended Producer Responsibility regulations. This regulatory advantage may accelerate commercial adoption as environmental compliance costs for lithium technologies continue to increase. The patent landscape shows growing attention to sodium cathode materials that eliminate regulated substances, positioning these technologies favorably for future sustainability-focused markets.

Life cycle analyses of sodium-ion battery cathode materials demonstrate up to 30% lower carbon footprint compared to equivalent lithium-ion cathodes, primarily due to less energy-intensive extraction and processing requirements. Recent patent filings from CATL and Faradion highlight manufacturing processes that reduce toxic solvent usage by 40-60% compared to conventional methods, addressing a key environmental concern in battery production.

Water consumption metrics are particularly favorable, with sodium extraction requiring approximately 50-70% less water than lithium brine operations. This advantage is critically important in water-stressed regions where battery material sourcing occurs. Patent trends indicate growing emphasis on closed-loop water systems for sodium cathode material synthesis, with innovations from companies like Natron Energy showing potential for near-zero wastewater discharge.

End-of-life considerations reveal another sustainability advantage, as patents from the past three years demonstrate improved recyclability of sodium cathode materials. The absence of cobalt and nickel in many sodium cathode formulations eliminates concerns about toxic heavy metal contamination during disposal or recycling processes. Recent innovations from HiNa Battery Technology and Altris AB showcase cathode designs specifically engineered for circular economy principles, with up to 90% material recovery rates.

Regulatory compliance analysis indicates sodium-ion technologies face fewer restrictions under frameworks like the EU Battery Directive and emerging Extended Producer Responsibility regulations. This regulatory advantage may accelerate commercial adoption as environmental compliance costs for lithium technologies continue to increase. The patent landscape shows growing attention to sodium cathode materials that eliminate regulated substances, positioning these technologies favorably for future sustainability-focused markets.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!