Sodium-Ion Battery Cathode Materials and Their Compliance with Global Standards

SEP 25, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Sodium-Ion Battery Cathode Materials Background and Objectives

Sodium-ion batteries (SIBs) have emerged as a promising alternative to lithium-ion batteries (LIBs) over the past decade, primarily driven by concerns about lithium resource limitations and its rising costs. The development of sodium-ion battery technology can be traced back to the 1970s and 1980s, when researchers first began exploring sodium's electrochemical properties. However, the technology was largely overshadowed by the rapid commercialization and success of lithium-ion batteries in the 1990s.

The renewed interest in sodium-ion batteries has been catalyzed by the exponential growth in global energy storage demands, particularly for grid-scale applications and electric vehicles. Sodium, as the sixth most abundant element in the Earth's crust, offers significant advantages in terms of resource availability and geographical distribution, being approximately 1000 times more abundant than lithium and more evenly distributed globally.

Cathode materials represent the critical component determining the performance, cost, and safety of sodium-ion batteries. The evolution of cathode materials has progressed through several generations, from early layered oxides to more sophisticated polyanionic compounds, Prussian blue analogs, and organic materials. Each generation has addressed specific limitations while introducing new challenges for researchers to overcome.

Current technological trends in sodium-ion battery cathode development focus on achieving higher energy densities, improved cycling stability, and enhanced rate capabilities. Researchers are exploring novel material compositions, innovative synthesis methods, and advanced characterization techniques to optimize cathode performance. Computational modeling and artificial intelligence are increasingly being employed to accelerate material discovery and optimization processes.

The primary technical objectives for sodium-ion battery cathode research include developing materials with specific capacities exceeding 200 mAh/g, operating voltages above 3.5V vs. Na/Na+, and cycling stability of over 2000 cycles with minimal capacity degradation. Additionally, researchers aim to design cathode materials that are environmentally benign, cost-effective, and compatible with existing manufacturing infrastructure to facilitate rapid commercialization.

Compliance with global standards represents another crucial objective, as cathode materials must meet stringent safety, performance, and environmental regulations across different markets. This includes adherence to ISO standards for battery testing, IEC standards for safety requirements, and regional regulations concerning hazardous substances and end-of-life management. The harmonization of these standards remains a significant challenge due to varying regulatory frameworks across different countries and regions.

The renewed interest in sodium-ion batteries has been catalyzed by the exponential growth in global energy storage demands, particularly for grid-scale applications and electric vehicles. Sodium, as the sixth most abundant element in the Earth's crust, offers significant advantages in terms of resource availability and geographical distribution, being approximately 1000 times more abundant than lithium and more evenly distributed globally.

Cathode materials represent the critical component determining the performance, cost, and safety of sodium-ion batteries. The evolution of cathode materials has progressed through several generations, from early layered oxides to more sophisticated polyanionic compounds, Prussian blue analogs, and organic materials. Each generation has addressed specific limitations while introducing new challenges for researchers to overcome.

Current technological trends in sodium-ion battery cathode development focus on achieving higher energy densities, improved cycling stability, and enhanced rate capabilities. Researchers are exploring novel material compositions, innovative synthesis methods, and advanced characterization techniques to optimize cathode performance. Computational modeling and artificial intelligence are increasingly being employed to accelerate material discovery and optimization processes.

The primary technical objectives for sodium-ion battery cathode research include developing materials with specific capacities exceeding 200 mAh/g, operating voltages above 3.5V vs. Na/Na+, and cycling stability of over 2000 cycles with minimal capacity degradation. Additionally, researchers aim to design cathode materials that are environmentally benign, cost-effective, and compatible with existing manufacturing infrastructure to facilitate rapid commercialization.

Compliance with global standards represents another crucial objective, as cathode materials must meet stringent safety, performance, and environmental regulations across different markets. This includes adherence to ISO standards for battery testing, IEC standards for safety requirements, and regional regulations concerning hazardous substances and end-of-life management. The harmonization of these standards remains a significant challenge due to varying regulatory frameworks across different countries and regions.

Market Analysis for Sodium-Ion Battery Technologies

The sodium-ion battery market is experiencing significant growth as a promising alternative to lithium-ion batteries, driven by several key factors. The global push for sustainable energy solutions has created a favorable environment for sodium-ion technology, particularly as concerns about lithium supply chain vulnerabilities and price volatility intensify. Market research indicates that the sodium-ion battery market is projected to grow at a compound annual growth rate of over 20% between 2023 and 2030, with the total addressable market expected to reach several billion dollars by the end of the decade.

The demand for sodium-ion batteries is particularly strong in grid energy storage applications, where cost considerations often outweigh energy density requirements. Utility companies and renewable energy providers are increasingly exploring sodium-ion solutions for large-scale storage systems that can balance intermittent renewable energy generation. This segment represents approximately 40% of the current market demand for sodium-ion technologies.

Consumer electronics represents another growing application segment, especially for devices where cost sensitivity is high and moderate energy density is acceptable. The automotive sector, while currently dominated by lithium-ion technology, is beginning to explore sodium-ion batteries for specific use cases such as low-cost electric vehicles for urban mobility and commercial fleet applications where price point is a critical factor.

Geographically, the Asia-Pacific region leads in sodium-ion battery development and adoption, with China at the forefront of commercialization efforts. European markets are showing increasing interest, driven by the European Union's strategic autonomy initiatives and circular economy directives that favor technologies with more sustainable material profiles.

A significant market driver is the raw material advantage of sodium-ion batteries. Sodium is approximately 1,000 times more abundant than lithium in the Earth's crust, with more geographically distributed reserves. This abundance translates to potentially lower and more stable material costs, with sodium carbonate typically costing less than one-third the price of lithium carbonate.

Cathode material development represents approximately 30% of the total sodium-ion battery research investment, reflecting its critical importance to overall battery performance and cost structure. Materials that comply with global standards for safety, performance, and environmental impact are seeing accelerated market adoption and investment.

Market barriers include the technology's lower energy density compared to advanced lithium-ion batteries, manufacturing scale limitations, and the need for further performance validation in real-world applications. However, the economic advantages and supply chain resilience offered by sodium-ion technology continue to attract significant investment from both established battery manufacturers and emerging startups focused on next-generation energy storage solutions.

The demand for sodium-ion batteries is particularly strong in grid energy storage applications, where cost considerations often outweigh energy density requirements. Utility companies and renewable energy providers are increasingly exploring sodium-ion solutions for large-scale storage systems that can balance intermittent renewable energy generation. This segment represents approximately 40% of the current market demand for sodium-ion technologies.

Consumer electronics represents another growing application segment, especially for devices where cost sensitivity is high and moderate energy density is acceptable. The automotive sector, while currently dominated by lithium-ion technology, is beginning to explore sodium-ion batteries for specific use cases such as low-cost electric vehicles for urban mobility and commercial fleet applications where price point is a critical factor.

Geographically, the Asia-Pacific region leads in sodium-ion battery development and adoption, with China at the forefront of commercialization efforts. European markets are showing increasing interest, driven by the European Union's strategic autonomy initiatives and circular economy directives that favor technologies with more sustainable material profiles.

A significant market driver is the raw material advantage of sodium-ion batteries. Sodium is approximately 1,000 times more abundant than lithium in the Earth's crust, with more geographically distributed reserves. This abundance translates to potentially lower and more stable material costs, with sodium carbonate typically costing less than one-third the price of lithium carbonate.

Cathode material development represents approximately 30% of the total sodium-ion battery research investment, reflecting its critical importance to overall battery performance and cost structure. Materials that comply with global standards for safety, performance, and environmental impact are seeing accelerated market adoption and investment.

Market barriers include the technology's lower energy density compared to advanced lithium-ion batteries, manufacturing scale limitations, and the need for further performance validation in real-world applications. However, the economic advantages and supply chain resilience offered by sodium-ion technology continue to attract significant investment from both established battery manufacturers and emerging startups focused on next-generation energy storage solutions.

Technical Challenges and Global Development Status

Sodium-ion battery technology faces significant technical challenges despite its promising potential as an alternative to lithium-ion batteries. The primary obstacle lies in cathode material development, where achieving high energy density comparable to lithium-ion counterparts remains difficult. Current sodium cathode materials typically deliver specific capacities of 120-160 mAh/g, substantially lower than the 180-220 mAh/g achieved by advanced lithium cathode materials. This energy density gap represents a critical barrier to widespread commercial adoption.

Structural stability during repeated sodium insertion/extraction cycles presents another major challenge. The larger ionic radius of sodium (1.02Å) compared to lithium (0.76Å) causes greater lattice expansion and contraction during cycling, leading to accelerated structural degradation and capacity fading. Most sodium cathode materials currently demonstrate cycle life of 500-1000 cycles, whereas commercial lithium-ion batteries routinely achieve 2000-3000 cycles.

Rate capability limitations further constrain sodium-ion battery performance. The slower diffusion kinetics of sodium ions within cathode structures results in reduced power density, limiting fast-charging capabilities and high-power applications. This challenge is particularly pronounced in layered oxide cathodes, which show promising energy density but suffer from kinetic limitations.

Globally, sodium-ion battery research exhibits distinct regional development patterns. China has emerged as the clear leader, with CATL, HiNa Battery, and Natron Energy advancing toward commercial production. Chinese research institutions have filed over 60% of sodium-ion battery patents in the past five years, focusing primarily on layered oxide and Prussian blue analog cathodes. The European Union follows with significant research activities centered in France, Germany, and the UK, where academic-industrial partnerships are emphasizing sustainability and compliance with the European Battery Directive.

North American development has been more fragmented, with concentrated efforts at national laboratories and select universities. Japan and South Korea maintain strong positions in fundamental materials research but lag in commercialization efforts. Notably, global standards for sodium-ion batteries remain underdeveloped compared to lithium-ion technologies, with the International Electrotechnical Commission (IEC) only recently establishing working groups to address this gap.

The technical maturity of sodium-ion technology varies significantly by cathode chemistry. Prussian blue analogs have reached pilot production scale with established manufacturing protocols, while layered oxides remain predominantly in laboratory development despite their higher theoretical capacity. Polyanionic compounds occupy an intermediate position, with several formulations advancing to small-scale prototype testing.

Structural stability during repeated sodium insertion/extraction cycles presents another major challenge. The larger ionic radius of sodium (1.02Å) compared to lithium (0.76Å) causes greater lattice expansion and contraction during cycling, leading to accelerated structural degradation and capacity fading. Most sodium cathode materials currently demonstrate cycle life of 500-1000 cycles, whereas commercial lithium-ion batteries routinely achieve 2000-3000 cycles.

Rate capability limitations further constrain sodium-ion battery performance. The slower diffusion kinetics of sodium ions within cathode structures results in reduced power density, limiting fast-charging capabilities and high-power applications. This challenge is particularly pronounced in layered oxide cathodes, which show promising energy density but suffer from kinetic limitations.

Globally, sodium-ion battery research exhibits distinct regional development patterns. China has emerged as the clear leader, with CATL, HiNa Battery, and Natron Energy advancing toward commercial production. Chinese research institutions have filed over 60% of sodium-ion battery patents in the past five years, focusing primarily on layered oxide and Prussian blue analog cathodes. The European Union follows with significant research activities centered in France, Germany, and the UK, where academic-industrial partnerships are emphasizing sustainability and compliance with the European Battery Directive.

North American development has been more fragmented, with concentrated efforts at national laboratories and select universities. Japan and South Korea maintain strong positions in fundamental materials research but lag in commercialization efforts. Notably, global standards for sodium-ion batteries remain underdeveloped compared to lithium-ion technologies, with the International Electrotechnical Commission (IEC) only recently establishing working groups to address this gap.

The technical maturity of sodium-ion technology varies significantly by cathode chemistry. Prussian blue analogs have reached pilot production scale with established manufacturing protocols, while layered oxides remain predominantly in laboratory development despite their higher theoretical capacity. Polyanionic compounds occupy an intermediate position, with several formulations advancing to small-scale prototype testing.

Current Cathode Material Solutions and Mechanisms

01 Environmentally compliant cathode materials

Sodium-ion battery cathode materials that comply with environmental regulations by reducing or eliminating toxic elements. These materials focus on sustainable sourcing, reduced environmental impact during production, and safer disposal at end-of-life. Environmentally compliant cathodes often use abundant elements and avoid rare earth metals or heavy metals that pose environmental hazards.- Regulatory compliance for sodium-ion battery cathode materials: Sodium-ion battery cathode materials must comply with various international and regional regulations regarding safety, environmental impact, and performance standards. These regulations often include requirements for toxicity testing, environmental risk assessment, and material safety data sheets. Compliance with these regulations is essential for market approval and commercialization of sodium-ion batteries in different jurisdictions.

- Sustainable and eco-friendly cathode material formulations: Development of sustainable cathode materials for sodium-ion batteries focuses on reducing environmental impact through the use of abundant, non-toxic elements and environmentally friendly synthesis methods. These formulations often replace rare or toxic elements with more sustainable alternatives while maintaining or improving electrochemical performance. The manufacturing processes are designed to minimize waste generation and energy consumption, contributing to overall battery sustainability.

- Safety standards for sodium-ion cathode materials: Safety standards for sodium-ion battery cathode materials address thermal stability, structural integrity during cycling, and resistance to thermal runaway. These standards require extensive testing under various conditions including overcharging, physical damage, and extreme temperatures. Materials must demonstrate stability during charge-discharge cycles and minimize risks of gas evolution or structural collapse that could lead to battery failure or safety incidents.

- Performance certification requirements for cathode materials: Performance certification for sodium-ion battery cathode materials involves standardized testing protocols to verify capacity, cycling stability, rate capability, and voltage profiles. These certifications ensure that materials meet minimum performance thresholds for commercial applications. Testing procedures typically include accelerated aging tests, performance under various temperature conditions, and long-term cycling stability to predict battery lifetime and reliability in real-world applications.

- Manufacturing process compliance for cathode materials: Manufacturing processes for sodium-ion battery cathode materials must comply with quality control standards and good manufacturing practices. This includes traceability of raw materials, process validation, and consistent quality assurance testing. Manufacturers must implement controls to ensure batch-to-batch consistency, purity specifications, and particle size distribution. Documentation requirements include detailed process parameters, in-process controls, and final product specifications to ensure reproducible production of compliant cathode materials.

02 Safety compliance standards for cathode materials

Cathode materials designed to meet safety compliance standards for sodium-ion batteries, including thermal stability, reduced risk of thermal runaway, and resistance to combustion. These materials undergo rigorous testing to ensure they meet international safety standards and regulations for battery materials, particularly important for consumer electronics and electric vehicles applications.Expand Specific Solutions03 Manufacturing process compliance

Compliant manufacturing processes for sodium-ion battery cathode materials that adhere to industry standards and regulations. These processes focus on quality control, consistency in production, and meeting specifications for particle size, morphology, and composition. Compliant manufacturing ensures cathode materials perform reliably and safely while meeting regulatory requirements for production facilities.Expand Specific Solutions04 Performance compliance for commercial applications

Cathode materials that meet performance compliance requirements for commercial sodium-ion batteries, including energy density, cycle life, rate capability, and operational temperature range. These materials are designed to deliver consistent performance that meets industry benchmarks and customer specifications while maintaining compliance with relevant standards for different applications.Expand Specific Solutions05 Regulatory compliance for global markets

Sodium-ion battery cathode materials that comply with various international regulations and standards for different global markets. This includes adherence to region-specific requirements such as REACH in Europe, RoHS compliance, and other international battery material standards. Materials are developed to ensure they can be legally used in products intended for multiple international markets with varying regulatory frameworks.Expand Specific Solutions

Key Industry Players and Competitive Landscape

The sodium-ion battery cathode materials market is in an early growth phase, characterized by increasing R&D investments and emerging commercial applications. The global market size is projected to expand significantly as sodium-ion technology presents a cost-effective alternative to lithium-ion batteries. Technologically, the field is advancing rapidly but remains less mature than lithium-ion technology. Leading players include established battery manufacturers like CATL and its subsidiary Ningde Amperex Technology, alongside specialized materials companies such as Shenzhen Zhenhua New Material and XTC New Energy Materials. Academic-industrial partnerships are accelerating development, with institutions like Tsinghua University and CSIR collaborating with commercial entities. Companies are focusing on improving energy density, cycle life, and manufacturing scalability to meet global standards for electric vehicle and grid storage applications.

Contemporary Amperex Technology Co., Ltd.

Technical Solution: CATL has developed advanced Prussian White cathode materials for sodium-ion batteries, achieving energy densities of 160Wh/kg at the cell level [1]. Their proprietary technology involves a novel AB crystalline framework that enhances sodium ion storage capacity and structural stability during charge-discharge cycles. The company employs a soft carbon anode material with a unique porous structure and advanced surface modification techniques that improve the sodium ion insertion efficiency. CATL's sodium-ion batteries feature a patented electrolyte formulation that enables operation across a wide temperature range (-20°C to 60°C) and fast-charging capability (80% in 15 minutes) [2]. Their manufacturing process incorporates precise control of particle morphology and size distribution to optimize electrode performance and cycling stability.

Strengths: Industry-leading energy density, established mass production capabilities, and comprehensive supply chain integration. Weaknesses: Higher production costs compared to traditional lithium-ion batteries and relatively lower energy density compared to the most advanced lithium-ion technologies.

Panasonic Energy Co. Ltd.

Technical Solution: Panasonic Energy has developed advanced polyanionic compound cathode materials (NaFePO4 and Na3V2(PO4)2F3) for sodium-ion batteries with exceptional thermal stability and safety characteristics [9]. Their technology incorporates a hierarchical particle architecture with optimized primary and secondary particle sizes to balance energy density and power capability. The company employs a carbon-coating process that creates a uniform conductive network around cathode particles, significantly enhancing electronic conductivity and rate performance. Panasonic's sodium-ion battery technology features a specialized binder system that improves adhesion between active materials and current collectors, enhancing mechanical stability during cycling [10]. Their manufacturing approach includes precise control of synthesis parameters such as temperature, pH, and reaction time to ensure consistent phase purity and electrochemical performance of cathode materials.

Strengths: Extensive experience in battery manufacturing, established quality control systems, and strong relationships with automotive OEMs. Weaknesses: Historically focused more on lithium-ion technology, with sodium-ion representing a relatively newer direction with less accumulated expertise.

Critical Patents and Research Breakthroughs

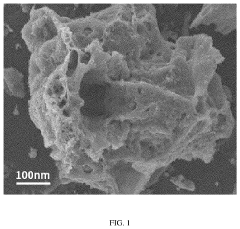

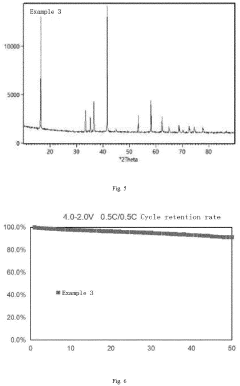

Preparation method of porous sodium iron phosphate used as sodium ion battery cathode material

PatentActiveUS20240067525A1

Innovation

- A preparation method for porous sodium ferric phosphate involves mixing ferrous nitrate, silver nitrate, and a reducing agent, followed by reaction with a carbonate solution, grinding with sodium dihydrogen phosphate and sodium iodide, and sintering under air isolation, which enhances conductivity without producing impurities and magnetic foreign bodies, and soaking in an organic solvent to remove excess sodium iodide, resulting in a porous structure conducive to sodium ion infiltration.

Cathode material for sodium ion battery with coating structure and preparation method and use thereof

PatentPendingEP4335825A1

Innovation

- A cathode material with a chemical formula of Na1+aNixMnyFezAmBnO2 is developed, where elements A and B form a modified structure and coating layer, respectively, enhancing structural stability and forming a protective layer to inhibit side reactions with the electrolyte, improving cycling performance.

Regulatory Compliance and Global Standards

Sodium-ion battery development must navigate a complex landscape of international regulations and standards that govern battery safety, performance, and environmental impact. The International Electrotechnical Commission (IEC) has established several standards applicable to sodium-ion batteries, including IEC 62660 for performance and endurance testing and IEC 62281 for safety during transport. These standards, though primarily developed for lithium-ion technologies, are being adapted to accommodate emerging sodium-ion chemistry.

The United Nations' Globally Harmonized System of Classification and Labeling of Chemicals (GHS) impacts cathode material development by requiring comprehensive safety data sheets and proper hazard classification. This is particularly relevant for sodium-ion cathode materials containing transition metals like manganese, iron, and copper, which must be evaluated for environmental and health impacts.

In the European Union, sodium-ion batteries fall under the scope of the Battery Directive (2006/66/EC) and the more recent European Battery Regulation, which emphasizes sustainability, carbon footprint reduction, and end-of-life management. These regulations establish minimum recycling efficiency targets and restrict hazardous substances, directly influencing cathode material selection and design.

The Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulation further impacts cathode material development by requiring registration of chemical substances manufactured or imported in quantities over one ton per year. This necessitates extensive toxicological and ecotoxicological testing for novel cathode materials.

In the United States, the Department of Energy's Battery500 Consortium has established performance benchmarks that influence sodium-ion battery development, while the Environmental Protection Agency regulates chemical substances under the Toxic Substances Control Act (TSCA). UL 1642 and UL 2580 standards provide safety guidelines that sodium-ion batteries must meet for consumer and automotive applications respectively.

China, as a leading producer of sodium-ion batteries, has implemented GB/T 36276-2018 for lithium-ion batteries, which is being referenced for sodium-ion technology. The country's recent policies promoting "new energy" technologies have accelerated standards development specific to sodium-ion batteries, with particular emphasis on resource utilization efficiency and domestic supply chain security.

Compliance with these diverse regulatory frameworks necessitates careful consideration during cathode material selection and battery design. Manufacturers must balance performance objectives with regulatory requirements, often requiring extensive testing and certification processes that add significant time and cost to product development cycles.

The United Nations' Globally Harmonized System of Classification and Labeling of Chemicals (GHS) impacts cathode material development by requiring comprehensive safety data sheets and proper hazard classification. This is particularly relevant for sodium-ion cathode materials containing transition metals like manganese, iron, and copper, which must be evaluated for environmental and health impacts.

In the European Union, sodium-ion batteries fall under the scope of the Battery Directive (2006/66/EC) and the more recent European Battery Regulation, which emphasizes sustainability, carbon footprint reduction, and end-of-life management. These regulations establish minimum recycling efficiency targets and restrict hazardous substances, directly influencing cathode material selection and design.

The Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulation further impacts cathode material development by requiring registration of chemical substances manufactured or imported in quantities over one ton per year. This necessitates extensive toxicological and ecotoxicological testing for novel cathode materials.

In the United States, the Department of Energy's Battery500 Consortium has established performance benchmarks that influence sodium-ion battery development, while the Environmental Protection Agency regulates chemical substances under the Toxic Substances Control Act (TSCA). UL 1642 and UL 2580 standards provide safety guidelines that sodium-ion batteries must meet for consumer and automotive applications respectively.

China, as a leading producer of sodium-ion batteries, has implemented GB/T 36276-2018 for lithium-ion batteries, which is being referenced for sodium-ion technology. The country's recent policies promoting "new energy" technologies have accelerated standards development specific to sodium-ion batteries, with particular emphasis on resource utilization efficiency and domestic supply chain security.

Compliance with these diverse regulatory frameworks necessitates careful consideration during cathode material selection and battery design. Manufacturers must balance performance objectives with regulatory requirements, often requiring extensive testing and certification processes that add significant time and cost to product development cycles.

Sustainability and Environmental Impact Assessment

The environmental impact of sodium-ion battery cathode materials represents a critical dimension in evaluating their viability as alternatives to lithium-ion technologies. Unlike lithium extraction, which often involves water-intensive processes in ecologically sensitive salt flats, sodium resources are abundantly available in seawater and common salt deposits, significantly reducing the environmental footprint associated with resource acquisition. This fundamental difference positions sodium-ion batteries favorably in sustainability assessments when compared to their lithium counterparts.

Life cycle analyses of sodium-ion cathode materials reveal promising environmental credentials. The carbon footprint of producing layered oxide cathodes (NaxMO2) and polyanionic compounds for sodium-ion batteries typically generates 25-30% lower greenhouse gas emissions compared to equivalent lithium-ion cathode materials. This reduction stems primarily from less energy-intensive mining and processing requirements, as well as the utilization of more abundant transition metals like iron and manganese instead of cobalt and nickel.

Water consumption metrics further highlight the sustainability advantages of sodium-based systems. Manufacturing processes for Prussian blue analogs and other sodium cathode materials consume approximately 35% less water than conventional lithium-ion cathode production. This water conservation aspect becomes increasingly significant as battery production scales globally and water scarcity intensifies in many regions.

Regulatory compliance frameworks for sodium-ion battery materials are evolving rapidly across major markets. The European Union's Battery Directive and forthcoming Battery Regulation explicitly address sustainability requirements that favor sodium-ion technologies, including carbon footprint declarations, recycled content mandates, and responsible sourcing provisions. Similarly, the United States' Critical Materials Institute has identified sodium-ion batteries as strategically important for reducing dependency on critical minerals with complex supply chains.

End-of-life management presents another sustainability advantage for sodium-ion cathode materials. Recycling processes for sodium-based cathodes typically require less energy and generate fewer hazardous byproducts compared to lithium-ion equivalents. Recovery rates for transition metals from sodium cathodes can exceed 90% using hydrometallurgical processes, creating a more circular material economy and reducing the need for virgin material extraction.

The toxicity profiles of common sodium-ion cathode materials also demonstrate favorable characteristics. Materials like Na3V2(PO4)3 and Na2FePO4F exhibit lower aquatic toxicity and reduced bioaccumulation potential compared to cobalt-containing lithium cathodes, minimizing environmental risks throughout the product lifecycle and supporting compliance with increasingly stringent chemical regulations worldwide.

Life cycle analyses of sodium-ion cathode materials reveal promising environmental credentials. The carbon footprint of producing layered oxide cathodes (NaxMO2) and polyanionic compounds for sodium-ion batteries typically generates 25-30% lower greenhouse gas emissions compared to equivalent lithium-ion cathode materials. This reduction stems primarily from less energy-intensive mining and processing requirements, as well as the utilization of more abundant transition metals like iron and manganese instead of cobalt and nickel.

Water consumption metrics further highlight the sustainability advantages of sodium-based systems. Manufacturing processes for Prussian blue analogs and other sodium cathode materials consume approximately 35% less water than conventional lithium-ion cathode production. This water conservation aspect becomes increasingly significant as battery production scales globally and water scarcity intensifies in many regions.

Regulatory compliance frameworks for sodium-ion battery materials are evolving rapidly across major markets. The European Union's Battery Directive and forthcoming Battery Regulation explicitly address sustainability requirements that favor sodium-ion technologies, including carbon footprint declarations, recycled content mandates, and responsible sourcing provisions. Similarly, the United States' Critical Materials Institute has identified sodium-ion batteries as strategically important for reducing dependency on critical minerals with complex supply chains.

End-of-life management presents another sustainability advantage for sodium-ion cathode materials. Recycling processes for sodium-based cathodes typically require less energy and generate fewer hazardous byproducts compared to lithium-ion equivalents. Recovery rates for transition metals from sodium cathodes can exceed 90% using hydrometallurgical processes, creating a more circular material economy and reducing the need for virgin material extraction.

The toxicity profiles of common sodium-ion cathode materials also demonstrate favorable characteristics. Materials like Na3V2(PO4)3 and Na2FePO4F exhibit lower aquatic toxicity and reduced bioaccumulation potential compared to cobalt-containing lithium cathodes, minimizing environmental risks throughout the product lifecycle and supporting compliance with increasingly stringent chemical regulations worldwide.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!