What Determines the Rate Performance of Sodium-Ion Battery Cathode Materials

SEP 25, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Sodium-Ion Battery Cathode Evolution and Performance Targets

Sodium-ion battery (SIB) technology has evolved significantly since its conceptualization in the 1980s. The initial cathode materials were primarily layered transition metal oxides, inspired by lithium-ion battery chemistry. By the early 2000s, research focus shifted toward polyanionic compounds and Prussian blue analogs, offering improved structural stability during sodium insertion/extraction processes. The past decade has witnessed remarkable advancements in cathode material design, with particular emphasis on layered oxides (NaxMO2, where M represents transition metals), polyanionic compounds (Na3V2(PO4)3), and Prussian blue analogs (Na2MFe(CN)6).

Current performance targets for sodium-ion battery cathodes are increasingly stringent as the technology approaches commercial viability. Industry benchmarks now demand specific capacities exceeding 150 mAh/g, energy densities above 500 Wh/kg, and rate capabilities supporting 80% capacity retention at 5C rates. Additionally, cycle life expectations have risen to 2000+ cycles with less than 20% capacity degradation, while operating voltage windows are targeted at 2.5-4.2V to maximize energy density while maintaining electrolyte compatibility.

The evolution trajectory suggests several critical performance milestones that must be achieved for widespread commercial adoption. Near-term targets (1-3 years) focus on achieving stable cathodes with specific capacities of 160-180 mAh/g and improved rate performance at moderate temperatures. Mid-term goals (3-5 years) emphasize pushing energy densities toward 600 Wh/kg while maintaining structural integrity during extended cycling.

Long-term aspirations (5-10 years) include developing cathode materials capable of ultra-fast charging (10C rates with minimal capacity loss) and operating effectively across wider temperature ranges (-20°C to 60°C). These targets are driven by emerging applications in grid storage, electric vehicles, and portable electronics, each imposing unique performance requirements on cathode materials.

The rate performance of cathode materials has emerged as a particularly critical parameter, with research indicating that sodium diffusion kinetics within the crystal structure fundamentally limits high-rate capabilities. Consequently, future development pathways are increasingly focused on novel crystal engineering approaches, including controlled defect introduction, particle size optimization, and surface modification strategies to enhance sodium-ion transport properties.

Achieving these ambitious performance targets will require interdisciplinary approaches combining computational modeling, advanced characterization techniques, and innovative synthesis methods to design cathode materials with optimized sodium storage mechanisms and transport pathways.

Current performance targets for sodium-ion battery cathodes are increasingly stringent as the technology approaches commercial viability. Industry benchmarks now demand specific capacities exceeding 150 mAh/g, energy densities above 500 Wh/kg, and rate capabilities supporting 80% capacity retention at 5C rates. Additionally, cycle life expectations have risen to 2000+ cycles with less than 20% capacity degradation, while operating voltage windows are targeted at 2.5-4.2V to maximize energy density while maintaining electrolyte compatibility.

The evolution trajectory suggests several critical performance milestones that must be achieved for widespread commercial adoption. Near-term targets (1-3 years) focus on achieving stable cathodes with specific capacities of 160-180 mAh/g and improved rate performance at moderate temperatures. Mid-term goals (3-5 years) emphasize pushing energy densities toward 600 Wh/kg while maintaining structural integrity during extended cycling.

Long-term aspirations (5-10 years) include developing cathode materials capable of ultra-fast charging (10C rates with minimal capacity loss) and operating effectively across wider temperature ranges (-20°C to 60°C). These targets are driven by emerging applications in grid storage, electric vehicles, and portable electronics, each imposing unique performance requirements on cathode materials.

The rate performance of cathode materials has emerged as a particularly critical parameter, with research indicating that sodium diffusion kinetics within the crystal structure fundamentally limits high-rate capabilities. Consequently, future development pathways are increasingly focused on novel crystal engineering approaches, including controlled defect introduction, particle size optimization, and surface modification strategies to enhance sodium-ion transport properties.

Achieving these ambitious performance targets will require interdisciplinary approaches combining computational modeling, advanced characterization techniques, and innovative synthesis methods to design cathode materials with optimized sodium storage mechanisms and transport pathways.

Market Analysis for Sodium-Ion Battery Technologies

The global sodium-ion battery market is experiencing significant growth, driven by increasing demand for sustainable energy storage solutions. Current market valuations indicate a compound annual growth rate (CAGR) of approximately 18% between 2023 and 2030, with the market expected to reach substantial commercial scale by mid-decade. This accelerated growth trajectory is primarily fueled by the inherent advantages of sodium-ion technology over traditional lithium-ion batteries, particularly in terms of resource availability and cost-effectiveness.

Sodium-ion batteries are positioned to capture specific market segments where their performance characteristics align with application requirements. The grid energy storage sector represents the most promising immediate market opportunity, where cost considerations often outweigh energy density limitations. This sector is projected to grow at over 20% annually through 2030, creating a substantial addressable market for sodium-ion technologies.

The electric vehicle (EV) segment presents a more nuanced opportunity. While sodium-ion batteries currently face challenges in competing with lithium-ion technologies for premium passenger vehicles due to energy density limitations, they show considerable promise for commercial vehicles, two-wheelers, and entry-level EVs in emerging markets. Market analysis suggests that by 2028, sodium-ion batteries could capture up to 10% of the electric two-wheeler market in Asia, representing a significant commercial opportunity.

Consumer electronics represents another potential market, particularly for applications where cost sensitivity outweighs performance requirements. The technology is especially well-positioned for stationary applications like backup power systems and off-grid solutions in developing regions.

Regional market dynamics show China leading sodium-ion battery development and commercialization, with substantial investments from both government and private sectors. European markets are increasingly focused on sodium-ion technology as part of broader sustainability initiatives, while North American adoption remains more cautious but is expected to accelerate as the technology matures.

Key market drivers include raw material considerations, with sodium resources being approximately 1,000 times more abundant than lithium globally. This abundance translates to potentially 30-40% lower material costs compared to lithium-ion batteries. Additionally, growing concerns about lithium supply chain vulnerabilities and geopolitical factors are accelerating interest in sodium-ion alternatives.

Market barriers include the technology's current performance limitations, particularly regarding energy density, and the established manufacturing infrastructure for lithium-ion batteries. However, the compatibility of sodium-ion production with existing lithium-ion manufacturing processes represents a significant advantage for market entry and scaling.

Sodium-ion batteries are positioned to capture specific market segments where their performance characteristics align with application requirements. The grid energy storage sector represents the most promising immediate market opportunity, where cost considerations often outweigh energy density limitations. This sector is projected to grow at over 20% annually through 2030, creating a substantial addressable market for sodium-ion technologies.

The electric vehicle (EV) segment presents a more nuanced opportunity. While sodium-ion batteries currently face challenges in competing with lithium-ion technologies for premium passenger vehicles due to energy density limitations, they show considerable promise for commercial vehicles, two-wheelers, and entry-level EVs in emerging markets. Market analysis suggests that by 2028, sodium-ion batteries could capture up to 10% of the electric two-wheeler market in Asia, representing a significant commercial opportunity.

Consumer electronics represents another potential market, particularly for applications where cost sensitivity outweighs performance requirements. The technology is especially well-positioned for stationary applications like backup power systems and off-grid solutions in developing regions.

Regional market dynamics show China leading sodium-ion battery development and commercialization, with substantial investments from both government and private sectors. European markets are increasingly focused on sodium-ion technology as part of broader sustainability initiatives, while North American adoption remains more cautious but is expected to accelerate as the technology matures.

Key market drivers include raw material considerations, with sodium resources being approximately 1,000 times more abundant than lithium globally. This abundance translates to potentially 30-40% lower material costs compared to lithium-ion batteries. Additionally, growing concerns about lithium supply chain vulnerabilities and geopolitical factors are accelerating interest in sodium-ion alternatives.

Market barriers include the technology's current performance limitations, particularly regarding energy density, and the established manufacturing infrastructure for lithium-ion batteries. However, the compatibility of sodium-ion production with existing lithium-ion manufacturing processes represents a significant advantage for market entry and scaling.

Current Limitations and Challenges in Cathode Rate Performance

Despite the promising potential of sodium-ion batteries (SIBs) as alternatives to lithium-ion batteries, their widespread adoption faces significant challenges, particularly regarding cathode rate performance. The larger ionic radius of Na+ (1.02 Å) compared to Li+ (0.76 Å) fundamentally limits Na+ diffusion kinetics, resulting in slower charge-discharge capabilities. This intrinsic limitation becomes especially pronounced during high-rate operations, where cathode materials struggle to maintain capacity and structural stability.

Structural degradation represents another critical challenge for SIB cathodes. During repeated Na+ insertion/extraction cycles, many cathode materials experience significant volume changes, leading to mechanical stress, particle cracking, and eventual capacity fading. This problem is exacerbated at higher cycling rates, where the rapid movement of Na+ ions creates more severe structural distortions and accelerated degradation pathways.

Interface issues further complicate cathode rate performance. The cathode-electrolyte interface (CEI) often develops high resistance layers that impede Na+ transport. Unlike their lithium counterparts, sodium-based systems frequently form less stable and more resistive interfacial films, particularly when operating at high rates. These interface phenomena significantly contribute to increased polarization and reduced rate capability.

Electronic conductivity limitations present additional barriers to high-rate performance. Many promising sodium cathode materials, particularly those based on transition metal oxides and polyanionic compounds, exhibit inherently low electronic conductivity. This characteristic restricts electron transport during electrochemical reactions, creating a bottleneck that limits overall rate performance regardless of ionic diffusion capabilities.

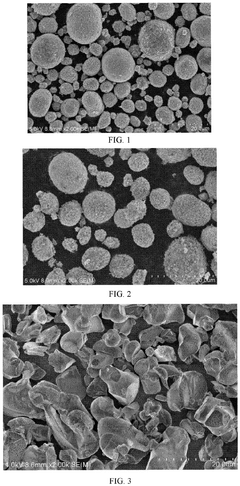

The synthesis and processing of cathode materials introduce further challenges. Current manufacturing methods often produce materials with suboptimal particle morphology, size distribution, and surface properties. These factors directly impact Na+ diffusion pathways, active material utilization, and electrode-level kinetics. Additionally, the scalability of advanced synthesis techniques remains problematic for commercial applications.

Electrolyte compatibility issues also hinder rate performance advancement. Current electrolyte formulations for SIBs frequently demonstrate limited stability at high voltages, insufficient ionic conductivity, or problematic solvation/desolvation kinetics at the cathode interface. These limitations become particularly restrictive during high-rate cycling, where efficient ion transport through the electrolyte becomes crucial for maintaining performance.

Finally, the fundamental understanding of Na+ storage mechanisms in various cathode materials remains incomplete. This knowledge gap hampers rational design approaches for high-rate cathode materials and prevents systematic optimization of existing systems. Without comprehensive mechanistic insights, addressing the multifaceted challenges affecting rate performance becomes significantly more difficult.

Structural degradation represents another critical challenge for SIB cathodes. During repeated Na+ insertion/extraction cycles, many cathode materials experience significant volume changes, leading to mechanical stress, particle cracking, and eventual capacity fading. This problem is exacerbated at higher cycling rates, where the rapid movement of Na+ ions creates more severe structural distortions and accelerated degradation pathways.

Interface issues further complicate cathode rate performance. The cathode-electrolyte interface (CEI) often develops high resistance layers that impede Na+ transport. Unlike their lithium counterparts, sodium-based systems frequently form less stable and more resistive interfacial films, particularly when operating at high rates. These interface phenomena significantly contribute to increased polarization and reduced rate capability.

Electronic conductivity limitations present additional barriers to high-rate performance. Many promising sodium cathode materials, particularly those based on transition metal oxides and polyanionic compounds, exhibit inherently low electronic conductivity. This characteristic restricts electron transport during electrochemical reactions, creating a bottleneck that limits overall rate performance regardless of ionic diffusion capabilities.

The synthesis and processing of cathode materials introduce further challenges. Current manufacturing methods often produce materials with suboptimal particle morphology, size distribution, and surface properties. These factors directly impact Na+ diffusion pathways, active material utilization, and electrode-level kinetics. Additionally, the scalability of advanced synthesis techniques remains problematic for commercial applications.

Electrolyte compatibility issues also hinder rate performance advancement. Current electrolyte formulations for SIBs frequently demonstrate limited stability at high voltages, insufficient ionic conductivity, or problematic solvation/desolvation kinetics at the cathode interface. These limitations become particularly restrictive during high-rate cycling, where efficient ion transport through the electrolyte becomes crucial for maintaining performance.

Finally, the fundamental understanding of Na+ storage mechanisms in various cathode materials remains incomplete. This knowledge gap hampers rational design approaches for high-rate cathode materials and prevents systematic optimization of existing systems. Without comprehensive mechanistic insights, addressing the multifaceted challenges affecting rate performance becomes significantly more difficult.

State-of-the-Art Cathode Material Solutions for Enhanced Rate Capability

01 Transition metal-based cathode materials

Transition metal-based compounds are widely used as cathode materials in sodium-ion batteries due to their high capacity and good structural stability. These materials, including layered transition metal oxides and phosphates, provide stable frameworks for sodium ion insertion and extraction. The incorporation of specific transition metals (such as manganese, iron, and nickel) can significantly enhance the rate performance by improving electronic conductivity and facilitating faster ion diffusion pathways.- Transition metal-based cathode materials: Transition metal-based compounds are widely used as cathode materials in sodium-ion batteries due to their high capacity and good structural stability. These materials, including layered oxides and polyanionic compounds containing metals such as manganese, iron, and nickel, offer improved rate performance through optimized crystal structures that facilitate sodium ion diffusion. Various synthesis methods and doping strategies are employed to enhance their electrochemical properties and cycling stability.

- Nanostructured cathode materials: Nanostructuring of cathode materials significantly improves rate performance in sodium-ion batteries by shortening ion diffusion paths and increasing electrode-electrolyte contact area. Various morphologies such as nanoparticles, nanosheets, and 3D hierarchical structures are designed to enhance sodium ion transport kinetics. These nanostructured materials demonstrate superior high-rate capabilities and cycling stability compared to their bulk counterparts, making them promising for fast-charging applications.

- Carbon-based composite cathode materials: Carbon-based composite cathode materials combine active materials with various carbon forms (graphene, carbon nanotubes, carbon coating) to enhance electronic conductivity and rate performance. The carbon component creates conductive networks that facilitate electron transport throughout the electrode, while also buffering volume changes during cycling. These composites demonstrate significantly improved rate capability, cycling stability, and capacity retention at high current densities compared to non-carbon-containing counterparts.

- Prussian blue analogs for high-rate performance: Prussian blue analogs (PBAs) are promising cathode materials for high-rate sodium-ion batteries due to their open framework structure with large interstitial spaces that facilitate rapid sodium ion diffusion. These materials feature a cubic structure with transition metal ions connected by cyanide bridges, creating channels for fast ion transport. Modified synthesis methods and compositional tuning improve their structural stability, capacity, and rate performance, making them suitable for applications requiring rapid charging and discharging.

- Electrolyte optimization for improved rate performance: Electrolyte composition significantly impacts the rate performance of sodium-ion battery cathodes by affecting interfacial properties and ion transport. Advanced electrolyte formulations incorporate additives that form stable solid electrolyte interphases, reducing interfacial resistance and enhancing sodium ion diffusion. Concentrated electrolytes and ionic liquid-based systems demonstrate improved thermal stability and wider electrochemical windows, enabling better high-rate performance and cycling stability of various cathode materials.

02 Nanostructured cathode materials

Nanostructuring of cathode materials is an effective approach to enhance rate performance in sodium-ion batteries. By reducing particle size to nanoscale dimensions, the diffusion path length for sodium ions is shortened, leading to improved kinetics. Various nanostructures including nanoparticles, nanosheets, and nanofibers provide increased surface area for electrode-electrolyte contact and better accommodation of volume changes during cycling, resulting in superior rate capability and cycling stability.Expand Specific Solutions03 Carbon-based composite cathode materials

Carbon-based composite cathode materials combine active materials with various carbon forms (such as graphene, carbon nanotubes, or carbon coatings) to enhance electronic conductivity and rate performance. The carbon component creates conductive networks throughout the electrode, facilitating electron transport and improving the overall electrochemical performance. These composites also help maintain structural integrity during cycling, preventing agglomeration of active particles and ensuring consistent rate performance over extended cycles.Expand Specific Solutions04 Doping and surface modification strategies

Doping and surface modification are effective strategies to enhance the rate performance of sodium-ion battery cathode materials. Introduction of dopant elements can modify the electronic structure, increase conductivity, and stabilize the crystal structure during sodium insertion/extraction. Surface modifications, including coatings and functional groups, can reduce unwanted side reactions with the electrolyte, improve interfacial stability, and facilitate sodium ion transport across the electrode-electrolyte interface, resulting in enhanced rate capability.Expand Specific Solutions05 Prussian blue analogs and polyanionic compounds

Prussian blue analogs and polyanionic compounds represent promising cathode material classes for high-rate sodium-ion batteries. These materials feature open framework structures with large interstitial spaces that facilitate rapid sodium ion diffusion. The strong covalent bonding in polyanionic compounds provides excellent structural stability during cycling. Both material classes offer tunable compositions through substitution of metal centers or polyanion groups, allowing optimization of operating voltage, capacity, and rate performance for specific applications.Expand Specific Solutions

Leading Companies and Research Institutions in Na-Ion Battery Development

The sodium-ion battery cathode materials market is in an early growth phase, characterized by increasing commercial interest but limited large-scale deployment. The market size is expanding rapidly, with companies like Shenzhen Zhenhua New Material achieving ten-ton sales by 2022, though still significantly smaller than the lithium-ion battery market. Technical maturity varies across players, with Chinese companies leading commercialization efforts. Shenzhen Zhenhua has developed multi-element collaborative doping and crystal structure control technologies, while CATL, LG Energy Solution, and Ningde Amperex are leveraging their lithium-ion expertise to advance sodium-ion solutions. Academic institutions like Nankai University and Karlsruhe Institute of Technology are contributing fundamental research on rate performance limitations, creating a competitive landscape balanced between established battery manufacturers and specialized materials companies.

Contemporary Amperex Technology Co., Ltd.

Technical Solution: Contemporary Amperex Technology (CATL) has developed a novel layered oxide cathode material with sodium-deficient composition Na0.67Ni0.33Mn0.67O2 that demonstrates superior rate performance. Their approach focuses on optimizing crystal structure and sodium ion diffusion pathways through precise control of transition metal ordering. CATL's research shows that the rate performance is primarily determined by three key factors: (1) sodium ion diffusion kinetics within the crystal structure, (2) electronic conductivity of the material, and (3) structural stability during repeated sodium insertion/extraction. Their proprietary synthesis method involves a controlled co-precipitation process followed by carefully optimized thermal treatment to create materials with larger interlayer spacing and reduced sodium diffusion barriers. This results in cathode materials capable of delivering over 80% capacity retention at 5C rates compared to performance at 0.1C, significantly outperforming conventional materials.

Strengths: Industry-leading sodium ion diffusion kinetics through optimized crystal structure; excellent structural stability during cycling; established mass production capabilities. Weaknesses: Higher production costs compared to iron-based alternatives; potential resource constraints for nickel-based formulations; thermal management challenges at ultra-fast charging rates.

BASF Corp.

Technical Solution: BASF has developed a comprehensive materials science approach to sodium-ion battery cathodes focusing on layered oxide materials with the general formula NaxMO2 (where M represents various transition metals). Their research identifies that rate performance is determined by a complex interplay of factors including: crystal structure defects, particle morphology, surface chemistry, and conductive additive integration. BASF's innovation centers on their "core-shell gradient" technology where particle composition transitions from a manganese-rich core for stability to a nickel-rich surface for enhanced electronic conductivity. Their materials feature precisely controlled oxygen vacancies that create "fast lanes" for sodium ion diffusion without compromising structural integrity. BASF's synthesis approach employs a proprietary co-precipitation method with molecular-level mixing followed by carefully controlled calcination under specific atmosphere conditions. This results in materials delivering up to 135 mAh/g at 0.1C with 78% retention at 5C rates. Additionally, BASF has developed specialized carbon-coating techniques using biomass-derived precursors that create a conductive network while minimizing interfacial resistance.

Strengths: Advanced material design with gradient composition; excellent balance of energy density and power capability; scalable manufacturing processes. Weaknesses: Complex synthesis requirements increasing production costs; performance sensitivity to processing parameters; moderate first-cycle efficiency requiring additional formation protocols.

Critical Patents and Research Breakthroughs in Na-Ion Cathode Design

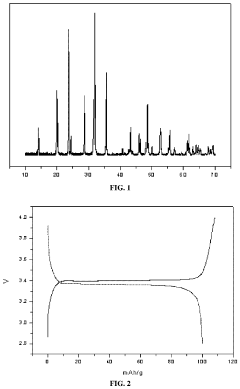

Sodium ion battery cathode material and preparation method thereof and sodium ion battery

PatentActiveEP4516744A1

Innovation

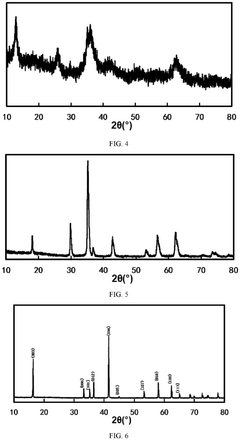

- A sodium ion battery cathode material with improved air and structural stability is developed, characterized by specific XRD peak arrangements and ratios, an O3-type monocrystal structure, and a controlled composition and particle size distribution, achieved through a precise pre-sintering and calcination process.

Sodium ion battery positive electrode material, preparation method therefor and application thereof

PatentActiveUS20210151767A1

Innovation

- A method involving the preparation of sulfur-nitrogen doped carbon cathode materials using a sol-gel process with zwitterionic polymers, where methyl allyl polyoxyethylene ether, N,N-dimethyl (methacryloxyethyl) ammonium propanesulfonate, and acrylic acid are reacted to form a zwitterionic polymer solution, mixed with sodium vanadium phosphate, and then sintered to enhance conductivity and stability.

Material Supply Chain and Sustainability Considerations

The supply chain for sodium-ion battery cathode materials presents significant advantages over lithium-ion batteries, particularly regarding resource availability and geographical distribution. Sodium is approximately 1,000 times more abundant than lithium in the Earth's crust, with virtually unlimited reserves in seawater. This abundance translates to lower material costs and reduced supply chain risks, which are critical factors for large-scale energy storage applications where rate performance must be balanced with economic viability.

The extraction and processing of sodium compounds generally require less energy and water compared to lithium, resulting in a smaller environmental footprint. This aspect becomes increasingly important as battery production scales up to meet growing global demand. Furthermore, the geographical distribution of sodium resources is more evenly spread globally, reducing geopolitical dependencies that currently characterize the lithium supply chain, which is concentrated in countries like Chile, Australia, and China.

For cathode materials specifically, the sustainability profile varies significantly depending on the composition. Transition metals used in sodium-ion cathodes, such as iron, manganese, and titanium, are generally more abundant and less environmentally problematic than cobalt and nickel commonly used in lithium-ion batteries. However, certain high-performance sodium cathode materials still require elements like vanadium or copper, which have their own supply chain considerations.

Manufacturing processes for sodium-ion cathode materials can leverage existing lithium-ion battery production infrastructure with relatively minor modifications, reducing barriers to market entry. This compatibility enables faster scaling and potentially lower capital investment requirements for manufacturers transitioning between technologies. The similar production methods also facilitate the development of dual-purpose facilities that can adapt to market demands.

End-of-life considerations also favor sodium-ion technology. The cathode materials in sodium-ion batteries are generally less toxic and easier to recycle than their lithium counterparts. Developing efficient recycling processes for sodium-ion batteries could create a circular economy approach, further enhancing sustainability and reducing dependence on primary material extraction. Current research indicates that up to 95% of cathode materials could potentially be recovered and reused, though commercial-scale recycling technologies are still under development.

The rate performance of sodium-ion cathode materials is intrinsically linked to these supply chain and sustainability factors. Materials that enable high rate performance while utilizing abundant, widely distributed elements will likely see faster commercial adoption and more sustainable long-term growth trajectories in the energy storage market.

The extraction and processing of sodium compounds generally require less energy and water compared to lithium, resulting in a smaller environmental footprint. This aspect becomes increasingly important as battery production scales up to meet growing global demand. Furthermore, the geographical distribution of sodium resources is more evenly spread globally, reducing geopolitical dependencies that currently characterize the lithium supply chain, which is concentrated in countries like Chile, Australia, and China.

For cathode materials specifically, the sustainability profile varies significantly depending on the composition. Transition metals used in sodium-ion cathodes, such as iron, manganese, and titanium, are generally more abundant and less environmentally problematic than cobalt and nickel commonly used in lithium-ion batteries. However, certain high-performance sodium cathode materials still require elements like vanadium or copper, which have their own supply chain considerations.

Manufacturing processes for sodium-ion cathode materials can leverage existing lithium-ion battery production infrastructure with relatively minor modifications, reducing barriers to market entry. This compatibility enables faster scaling and potentially lower capital investment requirements for manufacturers transitioning between technologies. The similar production methods also facilitate the development of dual-purpose facilities that can adapt to market demands.

End-of-life considerations also favor sodium-ion technology. The cathode materials in sodium-ion batteries are generally less toxic and easier to recycle than their lithium counterparts. Developing efficient recycling processes for sodium-ion batteries could create a circular economy approach, further enhancing sustainability and reducing dependence on primary material extraction. Current research indicates that up to 95% of cathode materials could potentially be recovered and reused, though commercial-scale recycling technologies are still under development.

The rate performance of sodium-ion cathode materials is intrinsically linked to these supply chain and sustainability factors. Materials that enable high rate performance while utilizing abundant, widely distributed elements will likely see faster commercial adoption and more sustainable long-term growth trajectories in the energy storage market.

Comparative Analysis with Lithium-Ion Battery Technologies

When comparing sodium-ion battery (SIB) cathode materials with their lithium-ion counterparts, several fundamental differences emerge that directly impact rate performance. The ionic radius of Na+ (1.02 Å) is approximately 55% larger than Li+ (0.76 Å), resulting in slower diffusion kinetics within similar host structures. This size difference creates more significant structural changes during intercalation/deintercalation processes, often leading to reduced cycling stability and rate capability in sodium systems.

Electrochemical potential represents another critical distinction, with sodium exhibiting a standard electrode potential of -2.71 V versus standard hydrogen electrode (SHE), compared to lithium's -3.04 V. This inherently limits the energy density achievable in sodium-ion systems, with theoretical maximum cell voltages approximately 0.3 V lower than equivalent lithium chemistries.

The interaction between sodium ions and host materials differs substantially from lithium systems. Sodium's larger size and different electronic configuration create distinct coordination preferences and binding energies within cathode structures. These differences manifest in altered charge transfer kinetics at electrode-electrolyte interfaces, generally resulting in higher activation barriers for sodium insertion/extraction compared to lithium systems.

Structurally, cathode materials optimized for lithium often perform poorly with sodium due to inadequate interstitial spaces. While layered oxides function effectively in both systems, sodium cathodes typically require larger interlayer spacing and more open frameworks to accommodate the larger ions. This structural requirement often comes at the cost of volumetric energy density.

From a materials perspective, lithium-ion batteries predominantly utilize LiCoO₂, LiNiMnCoO₂ (NMC), and LiFePO₄ cathodes, achieving practical capacities of 140-180 mAh/g with rate capabilities supporting 1-5C operation in commercial cells. Comparable sodium cathodes like Na₀.₆₇Mn₀.₆₇Ni₀.₃₃O₂ and Na₃V₂(PO₄)₃ typically deliver lower practical capacities (80-140 mAh/g) with more limited rate performance, rarely exceeding 2C in optimized systems.

Electrolyte compatibility also differs significantly between the two systems. The larger sodium ions require careful electrolyte engineering to facilitate efficient transport at interfaces. The solid electrolyte interphase (SEI) formation dynamics vary considerably, with sodium systems often forming less stable interfaces that continue to evolve during cycling, negatively impacting long-term rate performance.

Despite these challenges, sodium systems offer compelling advantages in specific applications where cost sensitivity outweighs performance requirements. The abundance and geographical distribution of sodium resources present significant economic and supply chain advantages over lithium, particularly as battery demand continues to escalate globally.

Electrochemical potential represents another critical distinction, with sodium exhibiting a standard electrode potential of -2.71 V versus standard hydrogen electrode (SHE), compared to lithium's -3.04 V. This inherently limits the energy density achievable in sodium-ion systems, with theoretical maximum cell voltages approximately 0.3 V lower than equivalent lithium chemistries.

The interaction between sodium ions and host materials differs substantially from lithium systems. Sodium's larger size and different electronic configuration create distinct coordination preferences and binding energies within cathode structures. These differences manifest in altered charge transfer kinetics at electrode-electrolyte interfaces, generally resulting in higher activation barriers for sodium insertion/extraction compared to lithium systems.

Structurally, cathode materials optimized for lithium often perform poorly with sodium due to inadequate interstitial spaces. While layered oxides function effectively in both systems, sodium cathodes typically require larger interlayer spacing and more open frameworks to accommodate the larger ions. This structural requirement often comes at the cost of volumetric energy density.

From a materials perspective, lithium-ion batteries predominantly utilize LiCoO₂, LiNiMnCoO₂ (NMC), and LiFePO₄ cathodes, achieving practical capacities of 140-180 mAh/g with rate capabilities supporting 1-5C operation in commercial cells. Comparable sodium cathodes like Na₀.₆₇Mn₀.₆₇Ni₀.₃₃O₂ and Na₃V₂(PO₄)₃ typically deliver lower practical capacities (80-140 mAh/g) with more limited rate performance, rarely exceeding 2C in optimized systems.

Electrolyte compatibility also differs significantly between the two systems. The larger sodium ions require careful electrolyte engineering to facilitate efficient transport at interfaces. The solid electrolyte interphase (SEI) formation dynamics vary considerably, with sodium systems often forming less stable interfaces that continue to evolve during cycling, negatively impacting long-term rate performance.

Despite these challenges, sodium systems offer compelling advantages in specific applications where cost sensitivity outweighs performance requirements. The abundance and geographical distribution of sodium resources present significant economic and supply chain advantages over lithium, particularly as battery demand continues to escalate globally.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!