Silicon carbide vs neuromorphic materials in power electronics

SEP 19, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

SiC and Neuromorphic Materials Evolution

Silicon carbide (SiC) has undergone remarkable evolution since its first synthesis in the early 19th century. Initially considered merely a laboratory curiosity, SiC's exceptional properties—wide bandgap, high thermal conductivity, and excellent chemical stability—remained largely unexploited until the late 20th century. The 1990s marked a turning point when researchers at Cree (now Wolfspeed) developed commercially viable SiC wafer production techniques, catalyzing its adoption in power electronics.

The evolution accelerated in the 2000s with significant improvements in crystal growth methods, particularly through modified Lely processes and seeded sublimation techniques. These advancements enabled larger wafer diameters and reduced defect densities, making SiC increasingly viable for commercial applications. By 2010, 4-inch SiC wafers became standard, with 6-inch wafers emerging by 2015, and 8-inch wafers now entering production—a trajectory mirroring silicon's historical scaling but at an accelerated pace.

Neuromorphic materials, by contrast, represent a more recent technological development. While conceptual foundations were laid in the 1980s with Carver Mead's pioneering work on neuromorphic engineering, material-specific implementations gained momentum only in the early 2000s. The evolution began with simple memristive devices based on metal oxides like TiO2, demonstrating rudimentary synaptic behaviors.

A significant evolutionary leap occurred around 2010 with the development of phase-change materials and complex oxide heterostructures that could more faithfully emulate biological synaptic functions. These materials exhibited critical properties like spike-timing-dependent plasticity (STDP) and short-term/long-term potentiation, essential for neuromorphic computing. Recent years have witnessed the emergence of 2D materials and organic semiconductors as promising neuromorphic platforms, offering unprecedented flexibility and biocompatibility.

The convergence of these seemingly disparate materials began around 2018, when researchers started exploring neuromorphic approaches to power management. This intersection represents a fascinating evolutionary branch where SiC provides the robust power handling capabilities while neuromorphic elements contribute adaptive control and energy optimization. Materials like SiC-integrated memristive oxides and neuromorphic sensors on SiC substrates exemplify this convergence.

Looking forward, both material systems continue to evolve along complementary trajectories. SiC evolution focuses on defect reduction, larger wafers, and epitaxial growth optimization, while neuromorphic materials advance toward greater stability, reproducibility, and integration density. Their combined evolution promises transformative capabilities in adaptive power electronics that can dynamically respond to changing conditions while maintaining the robustness required for high-power applications.

The evolution accelerated in the 2000s with significant improvements in crystal growth methods, particularly through modified Lely processes and seeded sublimation techniques. These advancements enabled larger wafer diameters and reduced defect densities, making SiC increasingly viable for commercial applications. By 2010, 4-inch SiC wafers became standard, with 6-inch wafers emerging by 2015, and 8-inch wafers now entering production—a trajectory mirroring silicon's historical scaling but at an accelerated pace.

Neuromorphic materials, by contrast, represent a more recent technological development. While conceptual foundations were laid in the 1980s with Carver Mead's pioneering work on neuromorphic engineering, material-specific implementations gained momentum only in the early 2000s. The evolution began with simple memristive devices based on metal oxides like TiO2, demonstrating rudimentary synaptic behaviors.

A significant evolutionary leap occurred around 2010 with the development of phase-change materials and complex oxide heterostructures that could more faithfully emulate biological synaptic functions. These materials exhibited critical properties like spike-timing-dependent plasticity (STDP) and short-term/long-term potentiation, essential for neuromorphic computing. Recent years have witnessed the emergence of 2D materials and organic semiconductors as promising neuromorphic platforms, offering unprecedented flexibility and biocompatibility.

The convergence of these seemingly disparate materials began around 2018, when researchers started exploring neuromorphic approaches to power management. This intersection represents a fascinating evolutionary branch where SiC provides the robust power handling capabilities while neuromorphic elements contribute adaptive control and energy optimization. Materials like SiC-integrated memristive oxides and neuromorphic sensors on SiC substrates exemplify this convergence.

Looking forward, both material systems continue to evolve along complementary trajectories. SiC evolution focuses on defect reduction, larger wafers, and epitaxial growth optimization, while neuromorphic materials advance toward greater stability, reproducibility, and integration density. Their combined evolution promises transformative capabilities in adaptive power electronics that can dynamically respond to changing conditions while maintaining the robustness required for high-power applications.

Power Electronics Market Demand Analysis

The global power electronics market is experiencing robust growth, projected to reach $49.3 billion by 2027, with a compound annual growth rate (CAGR) of 5.7%. This expansion is primarily driven by increasing electrification across multiple sectors, particularly automotive, renewable energy, industrial automation, and consumer electronics. The shift toward electric vehicles (EVs) represents one of the most significant market drivers, with global EV sales exceeding 10 million units in 2022 and expected to reach 30 million by 2030.

Within this expanding market, the demand for more efficient power conversion and management solutions has intensified the competition between traditional and emerging semiconductor materials. Silicon carbide (SiC) has established a growing presence in the market, with its segment valued at $1.1 billion in 2022 and projected to reach $6.3 billion by 2028. This growth reflects the material's superior properties for high-power, high-temperature, and high-frequency applications compared to conventional silicon.

The renewable energy sector constitutes another major demand driver, with global installed capacity of solar and wind power increasing by 13% annually. Power electronics based on advanced materials like SiC are essential for efficient energy conversion in these applications, reducing energy losses by up to 50% compared to traditional silicon-based solutions. This efficiency translates directly to improved return on investment for renewable energy installations.

Industrial applications represent the largest current market segment for power electronics at 35% of total demand, with requirements for motor drives, uninterruptible power supplies, and industrial automation systems. The industrial Internet of Things (IIoT) trend is further accelerating demand for intelligent power management solutions that can operate reliably in harsh environments.

Emerging neuromorphic materials represent a potentially disruptive technology in this landscape, though currently at a nascent market stage. Industry analysts estimate the potential market for neuromorphic computing hardware, including power management components, could reach $2.5 billion by 2035. These materials offer the promise of ultra-low power consumption through brain-inspired computing architectures, potentially reducing energy requirements by orders of magnitude compared to conventional approaches.

Regional analysis reveals Asia-Pacific as the dominant market for power electronics with 45% market share, followed by North America (25%) and Europe (20%). China leads manufacturing capacity for both traditional and advanced power electronics, though significant investments in SiC production are occurring in the United States, Europe, and Japan as part of strategic initiatives to secure supply chains for critical technologies.

Within this expanding market, the demand for more efficient power conversion and management solutions has intensified the competition between traditional and emerging semiconductor materials. Silicon carbide (SiC) has established a growing presence in the market, with its segment valued at $1.1 billion in 2022 and projected to reach $6.3 billion by 2028. This growth reflects the material's superior properties for high-power, high-temperature, and high-frequency applications compared to conventional silicon.

The renewable energy sector constitutes another major demand driver, with global installed capacity of solar and wind power increasing by 13% annually. Power electronics based on advanced materials like SiC are essential for efficient energy conversion in these applications, reducing energy losses by up to 50% compared to traditional silicon-based solutions. This efficiency translates directly to improved return on investment for renewable energy installations.

Industrial applications represent the largest current market segment for power electronics at 35% of total demand, with requirements for motor drives, uninterruptible power supplies, and industrial automation systems. The industrial Internet of Things (IIoT) trend is further accelerating demand for intelligent power management solutions that can operate reliably in harsh environments.

Emerging neuromorphic materials represent a potentially disruptive technology in this landscape, though currently at a nascent market stage. Industry analysts estimate the potential market for neuromorphic computing hardware, including power management components, could reach $2.5 billion by 2035. These materials offer the promise of ultra-low power consumption through brain-inspired computing architectures, potentially reducing energy requirements by orders of magnitude compared to conventional approaches.

Regional analysis reveals Asia-Pacific as the dominant market for power electronics with 45% market share, followed by North America (25%) and Europe (20%). China leads manufacturing capacity for both traditional and advanced power electronics, though significant investments in SiC production are occurring in the United States, Europe, and Japan as part of strategic initiatives to secure supply chains for critical technologies.

Technical Challenges in Advanced Semiconductor Materials

The semiconductor industry faces significant technical challenges in developing advanced materials for power electronics applications. Silicon carbide (SiC) has emerged as a leading wide bandgap semiconductor material, offering superior properties compared to traditional silicon, including higher breakdown voltage, thermal conductivity, and electron saturation velocity. However, SiC manufacturing presents considerable difficulties, particularly in crystal growth processes where defects like micropipes, dislocations, and stacking faults compromise device performance and reliability.

SiC wafer production struggles with scalability issues, with current technology limited primarily to 6-inch wafers compared to silicon's 12-inch standard. This size limitation increases production costs and restricts widespread adoption. Additionally, SiC device fabrication requires extremely high processing temperatures (1600-1700°C), necessitating specialized equipment and increasing manufacturing complexity.

Meanwhile, neuromorphic materials represent an emerging alternative approach for power electronics. These materials, designed to mimic neural network structures, offer potential advantages in energy efficiency and adaptive functionality. However, they face even more substantial technical barriers than SiC, including immature fabrication techniques, inconsistent electrical properties, and limited stability under high-voltage conditions.

The interface engineering between different semiconductor layers presents another critical challenge for both material systems. For SiC, the SiC/SiO2 interface quality significantly impacts device performance, with interface states causing threshold voltage instability and reduced channel mobility. Neuromorphic materials face even greater interface challenges due to their complex compositions and structures.

Packaging technologies for high-temperature operation constitute another major hurdle. While SiC can theoretically operate at temperatures exceeding 300°C, conventional packaging materials and interconnects typically fail at such temperatures. This limitation prevents full utilization of SiC's thermal capabilities. Neuromorphic materials require entirely new packaging paradigms to accommodate their unique operational characteristics.

Reliability testing methodologies need substantial development for both material systems. SiC devices exhibit different failure mechanisms compared to silicon, requiring new accelerated life testing protocols. For neuromorphic materials, reliability standards are virtually non-existent, creating significant barriers to commercial adoption.

Cost remains perhaps the most significant challenge. Current SiC wafers cost approximately 5-10 times more than silicon wafers of comparable size, while neuromorphic materials face even higher cost premiums due to their experimental nature and complex processing requirements. Until manufacturing economies of scale can be achieved, these advanced materials will remain confined to high-value applications where their performance benefits justify the premium cost.

SiC wafer production struggles with scalability issues, with current technology limited primarily to 6-inch wafers compared to silicon's 12-inch standard. This size limitation increases production costs and restricts widespread adoption. Additionally, SiC device fabrication requires extremely high processing temperatures (1600-1700°C), necessitating specialized equipment and increasing manufacturing complexity.

Meanwhile, neuromorphic materials represent an emerging alternative approach for power electronics. These materials, designed to mimic neural network structures, offer potential advantages in energy efficiency and adaptive functionality. However, they face even more substantial technical barriers than SiC, including immature fabrication techniques, inconsistent electrical properties, and limited stability under high-voltage conditions.

The interface engineering between different semiconductor layers presents another critical challenge for both material systems. For SiC, the SiC/SiO2 interface quality significantly impacts device performance, with interface states causing threshold voltage instability and reduced channel mobility. Neuromorphic materials face even greater interface challenges due to their complex compositions and structures.

Packaging technologies for high-temperature operation constitute another major hurdle. While SiC can theoretically operate at temperatures exceeding 300°C, conventional packaging materials and interconnects typically fail at such temperatures. This limitation prevents full utilization of SiC's thermal capabilities. Neuromorphic materials require entirely new packaging paradigms to accommodate their unique operational characteristics.

Reliability testing methodologies need substantial development for both material systems. SiC devices exhibit different failure mechanisms compared to silicon, requiring new accelerated life testing protocols. For neuromorphic materials, reliability standards are virtually non-existent, creating significant barriers to commercial adoption.

Cost remains perhaps the most significant challenge. Current SiC wafers cost approximately 5-10 times more than silicon wafers of comparable size, while neuromorphic materials face even higher cost premiums due to their experimental nature and complex processing requirements. Until manufacturing economies of scale can be achieved, these advanced materials will remain confined to high-value applications where their performance benefits justify the premium cost.

Current SiC and Neuromorphic Implementation Solutions

01 Silicon carbide for neuromorphic computing devices

Silicon carbide (SiC) is being utilized in the development of neuromorphic computing devices that mimic the functionality of the human brain. These materials offer advantages such as high thermal conductivity, wide bandgap, and excellent chemical stability, making them suitable for creating artificial neural networks. The integration of SiC in neuromorphic architectures enables efficient signal processing and memory capabilities while withstanding harsh operating conditions.- Silicon carbide for neuromorphic computing devices: Silicon carbide materials are being utilized in the development of neuromorphic computing devices that mimic the functionality of the human brain. These materials offer advantages such as high thermal conductivity, wide bandgap, and excellent electrical properties, making them suitable for creating artificial neural networks and brain-inspired computing architectures. The integration of silicon carbide in neuromorphic systems enables more efficient processing of complex information patterns while consuming less power than traditional computing methods.

- Fabrication methods for silicon carbide-based neuromorphic materials: Various fabrication techniques are employed to create silicon carbide-based materials for neuromorphic applications. These methods include chemical vapor deposition, physical vapor deposition, and epitaxial growth processes that enable precise control over material properties. Advanced processing techniques allow for the creation of specific crystal structures and defect engineering that enhance the neuromorphic functionality. These fabrication approaches are crucial for developing materials with the desired electrical, thermal, and mechanical characteristics needed for brain-inspired computing systems.

- Memristive properties of silicon carbide for synaptic functions: Silicon carbide exhibits memristive properties that make it suitable for implementing synaptic functions in neuromorphic systems. These properties allow silicon carbide-based devices to mimic the behavior of biological synapses, including plasticity and memory retention. By controlling defects, doping levels, and interface properties, researchers can tune the memristive characteristics of silicon carbide materials to achieve desired synaptic weight changes and learning capabilities. This enables the development of artificial neural networks capable of adaptive learning and information processing similar to biological systems.

- Silicon carbide composites with other neuromorphic materials: Composite materials combining silicon carbide with other neuromorphic materials are being developed to enhance functionality and performance. These composites integrate silicon carbide with materials such as graphene, transition metal oxides, or other semiconductors to create hybrid structures with improved neuromorphic properties. The synergistic effects between silicon carbide and these complementary materials enable enhanced synaptic plasticity, lower power consumption, and improved reliability. These composite materials represent an important advancement in the development of more efficient and capable neuromorphic computing systems.

- Silicon carbide for radiation-resistant neuromorphic systems: Silicon carbide's inherent radiation resistance makes it particularly valuable for neuromorphic systems operating in harsh environments. The strong chemical bonds and stable crystal structure of silicon carbide enable neuromorphic devices to maintain functionality under conditions of high radiation, extreme temperatures, or other challenging environments. This property is especially important for applications in space exploration, nuclear facilities, or defense systems where conventional electronic materials would degrade rapidly. The development of radiation-resistant neuromorphic systems based on silicon carbide opens new possibilities for intelligent computing in extreme conditions.

02 Fabrication methods for SiC-based neuromorphic materials

Various fabrication techniques are employed to create silicon carbide-based neuromorphic materials with specific properties. These methods include chemical vapor deposition, epitaxial growth, and specialized doping processes to achieve desired electrical characteristics. Advanced manufacturing approaches enable the creation of complex structures with precise control over material composition, crystallinity, and interface properties, which are crucial for neuromorphic applications.Expand Specific Solutions03 SiC composite materials for enhanced neuromorphic performance

Silicon carbide can be combined with other materials to create composites with enhanced properties for neuromorphic applications. These composites integrate SiC with metals, ceramics, or other semiconductors to achieve specific electrical, thermal, or mechanical characteristics. The resulting hybrid materials demonstrate improved synaptic behavior, memory retention, and signal processing capabilities compared to single-material systems.Expand Specific Solutions04 Memristive and synaptic devices using SiC

Silicon carbide is being utilized to develop memristive and synaptic devices that are fundamental components of neuromorphic systems. These devices exhibit variable resistance states that can be modulated based on the history of applied voltage or current, similar to biological synapses. SiC-based memristive structures offer advantages such as non-volatility, low power consumption, and high endurance, making them promising for brain-inspired computing architectures.Expand Specific Solutions05 Integration of SiC neuromorphic materials with conventional electronics

Research focuses on integrating silicon carbide neuromorphic materials with conventional electronic systems to create hybrid computing architectures. This integration enables the combination of traditional digital processing with brain-inspired computing capabilities. Techniques for interfacing SiC-based neuromorphic components with silicon CMOS technology are being developed to leverage the advantages of both approaches, resulting in more efficient and versatile computing systems.Expand Specific Solutions

Key Industry Players and Competitive Landscape

The silicon carbide (SiC) power electronics market is currently in a growth phase, with an estimated market size exceeding $2 billion and projected to grow at 25-30% CAGR through 2030. Leading players like Wolfspeed, STMicroelectronics, and ROHM have established strong positions in SiC technology, which has reached commercial maturity for high-voltage applications. Meanwhile, neuromorphic materials for power electronics remain largely in the research phase, with academic institutions (University of Warwick, Chongqing University) and research organizations (IBM, Lawrence Livermore) leading development efforts. Companies like Renesas and Toshiba are exploring hybrid approaches that leverage both technologies' strengths. The competitive landscape shows SiC dominating near-term commercial applications while neuromorphic solutions represent promising but longer-term alternatives for next-generation power management systems.

Stmicroelectronics Srl

Technical Solution: STMicroelectronics has developed a comprehensive silicon carbide (SiC) technology platform called STPOWER SiC, which includes both MOSFETs and diodes optimized for power electronics applications. Their third-generation SiC MOSFETs feature trench gate architecture that achieves 50% reduction in RDS(on) per unit area compared to planar designs, while maintaining robust short-circuit withstand capability exceeding 5μs. ST has implemented a unique split-gate design that balances performance and reliability concerns inherent to trench structures. The company has secured long-term SiC substrate supply through strategic agreements with Wolfspeed and Cree, while simultaneously developing internal SiC wafer manufacturing capabilities. Their automotive-grade SiC devices are qualified to AEC-Q101 standards with extended temperature operation up to 200°C and demonstrate switching frequencies above 100kHz with minimal switching losses, enabling more compact power conversion systems for electric vehicles.

Strengths: Vertical integration strategy with both substrate and device manufacturing capabilities; extensive automotive qualification experience; strong system-level expertise enabling optimized reference designs. Weaknesses: Higher cost structure compared to silicon alternatives; thermal management challenges at maximum operating temperatures; limited neuromorphic material research compared to SiC development.

Wolfspeed, Inc.

Technical Solution: Wolfspeed has pioneered silicon carbide (SiC) technology for power electronics, developing advanced 150mm and 200mm SiC wafer fabrication processes. Their latest generation of SiC MOSFETs and Schottky diodes deliver significantly higher efficiency with switching losses reduced by approximately 75% compared to silicon IGBTs. Wolfspeed's vertical integration approach encompasses the entire value chain from SiC substrate production to device manufacturing, enabling tight quality control. Their SiC devices operate efficiently at junction temperatures up to 175°C, with breakdown voltages exceeding 1700V while maintaining low on-resistance (specific RDS(on) below 2.0 mΩ·cm²). The company has recently expanded manufacturing capacity with their Mohawk Valley Fab, representing a $1 billion investment to meet growing demand for SiC power devices in electric vehicles and renewable energy applications.

Strengths: Industry-leading SiC substrate quality with defect density below 1/cm²; comprehensive device portfolio spanning 650V-1700V range; proven reliability with over 10 trillion device field hours. Weaknesses: Higher initial cost compared to silicon alternatives; supply constraints due to manufacturing complexity; requires specialized packaging solutions to handle higher thermal loads.

Core Patents and Research Breakthroughs

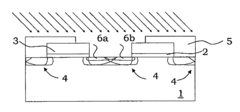

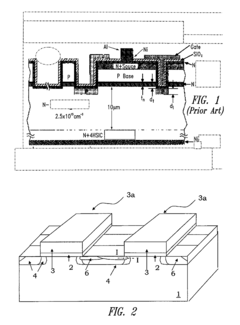

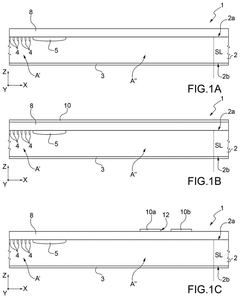

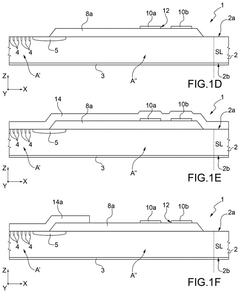

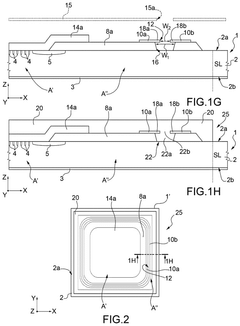

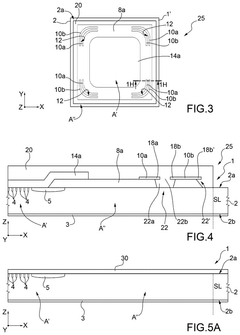

Method for manufacturing electronic devices integrated in a semiconductor substrate and corresponding devices

PatentActiveUS7713853B2

Innovation

- A method involving ion implantation of dopant species on a semiconductor substrate to create defined doped regions without thermal diffusion, using a low thermal budget activation process to form implanted regions with specific angles and energies, allowing for efficient formation of electronic devices without diffusion.

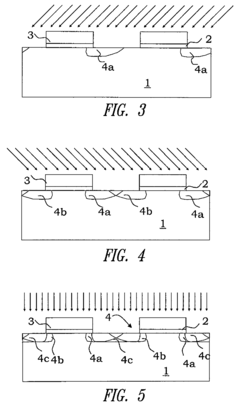

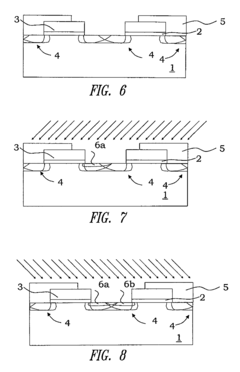

Silicon carbide power device with improved robustness and corresponding manufacturing process

PatentActiveUS12125762B2

Innovation

- A silicon carbide power device manufacturing process that includes forming a dielectric region and a passivation layer with an anchorage region extending through the dielectric layer, providing mechanical anchorage to prevent delamination and ensure robustness against thermomechanical stresses.

Energy Efficiency and Sustainability Impact

The energy efficiency advantages of silicon carbide (SiC) in power electronics are substantial, with devices demonstrating up to 40% reduction in energy losses compared to traditional silicon-based components. This efficiency gain stems from SiC's wider bandgap (3.26 eV versus Si's 1.12 eV) and higher thermal conductivity (3-4 times that of silicon), enabling operation at higher temperatures and switching frequencies with minimal losses. These properties translate directly into reduced cooling requirements and smaller passive components, resulting in more compact and lightweight power systems.

From a sustainability perspective, SiC-based power electronics contribute significantly to carbon footprint reduction across multiple applications. In electric vehicles, SiC inverters extend driving range by 5-10% through improved power conversion efficiency, while in renewable energy systems, SiC-based converters increase energy harvest from solar panels by 1-2% and improve wind turbine power conversion by similar margins. The cumulative environmental impact is substantial when scaled across global energy infrastructure.

Neuromorphic materials, while still emerging in power electronics applications, show promising sustainability characteristics through fundamentally different operational principles. These materials mimic biological neural systems, potentially enabling adaptive power management that responds dynamically to changing conditions. Early research indicates that neuromorphic-based power controllers could reduce energy consumption by 15-30% in specific applications through intelligent load prediction and management.

The lifecycle assessment comparison reveals important sustainability considerations. SiC devices require higher energy input during manufacturing (approximately 30% more than silicon), but this initial carbon debt is typically recovered within 1-3 years of operation through efficiency gains. Neuromorphic materials present a mixed picture, with some requiring rare elements raising resource scarcity concerns, while others utilize abundant materials with potentially lower environmental impact.

Water usage represents another critical sustainability metric. SiC manufacturing processes currently consume 1.5-2 times more water than conventional silicon fabrication, though industry initiatives are reducing this gap. Neuromorphic material production varies widely in water requirements depending on the specific compounds and fabrication methods employed.

The recyclability profile favors conventional SiC, with established recovery methods capturing up to 85% of materials from end-of-life devices. Neuromorphic components often incorporate complex material combinations that present recycling challenges, though this remains an active area of research as these technologies mature toward commercial deployment.

From a sustainability perspective, SiC-based power electronics contribute significantly to carbon footprint reduction across multiple applications. In electric vehicles, SiC inverters extend driving range by 5-10% through improved power conversion efficiency, while in renewable energy systems, SiC-based converters increase energy harvest from solar panels by 1-2% and improve wind turbine power conversion by similar margins. The cumulative environmental impact is substantial when scaled across global energy infrastructure.

Neuromorphic materials, while still emerging in power electronics applications, show promising sustainability characteristics through fundamentally different operational principles. These materials mimic biological neural systems, potentially enabling adaptive power management that responds dynamically to changing conditions. Early research indicates that neuromorphic-based power controllers could reduce energy consumption by 15-30% in specific applications through intelligent load prediction and management.

The lifecycle assessment comparison reveals important sustainability considerations. SiC devices require higher energy input during manufacturing (approximately 30% more than silicon), but this initial carbon debt is typically recovered within 1-3 years of operation through efficiency gains. Neuromorphic materials present a mixed picture, with some requiring rare elements raising resource scarcity concerns, while others utilize abundant materials with potentially lower environmental impact.

Water usage represents another critical sustainability metric. SiC manufacturing processes currently consume 1.5-2 times more water than conventional silicon fabrication, though industry initiatives are reducing this gap. Neuromorphic material production varies widely in water requirements depending on the specific compounds and fabrication methods employed.

The recyclability profile favors conventional SiC, with established recovery methods capturing up to 85% of materials from end-of-life devices. Neuromorphic components often incorporate complex material combinations that present recycling challenges, though this remains an active area of research as these technologies mature toward commercial deployment.

Supply Chain and Manufacturing Considerations

The supply chain for silicon carbide (SiC) power electronics has matured significantly over the past decade, with established manufacturing processes and growing production capacity. Major suppliers like Wolfspeed, ROHM, and STMicroelectronics have invested heavily in SiC wafer production facilities, creating a relatively stable supply ecosystem. However, the SiC supply chain still faces challenges including limited raw material sources, complex processing requirements, and high production costs. The manufacturing process demands specialized equipment for crystal growth, wafer cutting, and device fabrication, contributing to the premium pricing of SiC components compared to traditional silicon alternatives.

In contrast, neuromorphic materials for power electronics represent an emerging technology with a nascent and fragmented supply chain. These materials, which mimic neural processing capabilities while potentially offering energy efficiency advantages, currently lack standardized manufacturing processes and face significant scaling challenges. Production typically occurs in limited research or pilot facilities rather than high-volume manufacturing environments. The specialized nature of these materials often requires custom fabrication techniques that have not yet benefited from economies of scale.

Quality control presents another critical distinction between these technologies. SiC manufacturing has developed robust quality assurance protocols over years of industrial implementation, with established testing methodologies and reliability standards. Neuromorphic materials lack this manufacturing maturity, with quality consistency remaining a significant hurdle to widespread adoption in power electronics applications.

From a geographical perspective, SiC production has concentrated primarily in the United States, Japan, and Europe, creating potential supply vulnerabilities. Recent geopolitical tensions have highlighted the strategic importance of diversifying manufacturing locations for critical power electronic components. Neuromorphic materials research and production capabilities are similarly concentrated in advanced technology hubs, though the early stage of development means supply chains have not yet solidified.

Cost considerations heavily favor established SiC technology in the near term. While SiC components command premium prices compared to silicon, manufacturing scale has steadily reduced costs. Neuromorphic materials face substantially higher production expenses due to specialized processing requirements and low production volumes. However, as research advances and applications expand, neuromorphic solutions may eventually achieve more competitive cost structures, particularly if their potential for energy efficiency translates to system-level savings in power electronic applications.

In contrast, neuromorphic materials for power electronics represent an emerging technology with a nascent and fragmented supply chain. These materials, which mimic neural processing capabilities while potentially offering energy efficiency advantages, currently lack standardized manufacturing processes and face significant scaling challenges. Production typically occurs in limited research or pilot facilities rather than high-volume manufacturing environments. The specialized nature of these materials often requires custom fabrication techniques that have not yet benefited from economies of scale.

Quality control presents another critical distinction between these technologies. SiC manufacturing has developed robust quality assurance protocols over years of industrial implementation, with established testing methodologies and reliability standards. Neuromorphic materials lack this manufacturing maturity, with quality consistency remaining a significant hurdle to widespread adoption in power electronics applications.

From a geographical perspective, SiC production has concentrated primarily in the United States, Japan, and Europe, creating potential supply vulnerabilities. Recent geopolitical tensions have highlighted the strategic importance of diversifying manufacturing locations for critical power electronic components. Neuromorphic materials research and production capabilities are similarly concentrated in advanced technology hubs, though the early stage of development means supply chains have not yet solidified.

Cost considerations heavily favor established SiC technology in the near term. While SiC components command premium prices compared to silicon, manufacturing scale has steadily reduced costs. Neuromorphic materials face substantially higher production expenses due to specialized processing requirements and low production volumes. However, as research advances and applications expand, neuromorphic solutions may eventually achieve more competitive cost structures, particularly if their potential for energy efficiency translates to system-level savings in power electronic applications.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!