The Role of Conductive Polymer Inks in Modern Electronics

SEP 29, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Conductive Polymer Inks Background and Objectives

Conductive polymer inks represent a revolutionary advancement in the field of electronics, marking a significant departure from traditional metallic conductors. Since their discovery in the late 1970s, these materials have evolved from laboratory curiosities to commercially viable alternatives for numerous electronic applications. The development trajectory has been characterized by continuous improvements in conductivity, stability, and processability, with major breakthroughs occurring in the 1990s and early 2000s as researchers overcame initial limitations in electrical performance and environmental stability.

The fundamental innovation of conductive polymer inks lies in their unique combination of electrical conductivity—traditionally associated with metals—and the processing advantages of polymers, including flexibility, solution processability, and potential for low-cost manufacturing. This hybrid nature has positioned them at the intersection of multiple technological trends, including flexible electronics, printed electronics, wearable devices, and sustainable manufacturing.

Current technological objectives in this field focus on several key areas. First, enhancing electrical conductivity to approach that of metallic conductors while maintaining the inherent advantages of polymers. Second, improving long-term stability under various environmental conditions, particularly humidity and temperature fluctuations. Third, developing formulations compatible with mass-production techniques such as roll-to-roll printing, inkjet printing, and screen printing to enable cost-effective scaling.

The evolution of conductive polymer inks has been closely tied to broader technological shifts in electronics manufacturing, particularly the move toward additive manufacturing processes and the growing demand for flexible, conformable electronic components. This trend is expected to accelerate as industries increasingly adopt Internet of Things (IoT) technologies, requiring distributed, low-cost sensing and communication capabilities.

Looking forward, the field is trending toward multi-functional conductive polymer systems that combine electrical conductivity with additional properties such as thermoelectric effects, optical transparency, or biocompatibility. These developments are opening new application spaces in energy harvesting, transparent electrodes, and bioelectronics. Additionally, there is growing interest in environmentally sustainable formulations that reduce or eliminate toxic components while maintaining performance characteristics.

The ultimate goal for conductive polymer ink technology is to establish a versatile platform that enables the fabrication of complex electronic systems on diverse substrates using simple, scalable printing processes—effectively democratizing electronics manufacturing and enabling new device architectures that are impossible with conventional fabrication techniques.

The fundamental innovation of conductive polymer inks lies in their unique combination of electrical conductivity—traditionally associated with metals—and the processing advantages of polymers, including flexibility, solution processability, and potential for low-cost manufacturing. This hybrid nature has positioned them at the intersection of multiple technological trends, including flexible electronics, printed electronics, wearable devices, and sustainable manufacturing.

Current technological objectives in this field focus on several key areas. First, enhancing electrical conductivity to approach that of metallic conductors while maintaining the inherent advantages of polymers. Second, improving long-term stability under various environmental conditions, particularly humidity and temperature fluctuations. Third, developing formulations compatible with mass-production techniques such as roll-to-roll printing, inkjet printing, and screen printing to enable cost-effective scaling.

The evolution of conductive polymer inks has been closely tied to broader technological shifts in electronics manufacturing, particularly the move toward additive manufacturing processes and the growing demand for flexible, conformable electronic components. This trend is expected to accelerate as industries increasingly adopt Internet of Things (IoT) technologies, requiring distributed, low-cost sensing and communication capabilities.

Looking forward, the field is trending toward multi-functional conductive polymer systems that combine electrical conductivity with additional properties such as thermoelectric effects, optical transparency, or biocompatibility. These developments are opening new application spaces in energy harvesting, transparent electrodes, and bioelectronics. Additionally, there is growing interest in environmentally sustainable formulations that reduce or eliminate toxic components while maintaining performance characteristics.

The ultimate goal for conductive polymer ink technology is to establish a versatile platform that enables the fabrication of complex electronic systems on diverse substrates using simple, scalable printing processes—effectively democratizing electronics manufacturing and enabling new device architectures that are impossible with conventional fabrication techniques.

Market Demand Analysis for Flexible Electronics

The flexible electronics market has witnessed substantial growth in recent years, driven by increasing demand for lightweight, bendable, and portable electronic devices. The global flexible electronics market was valued at approximately $29.28 billion in 2020 and is projected to reach $73.43 billion by 2027, growing at a CAGR of 14.2% during the forecast period. Conductive polymer inks play a crucial role in this expansion as they enable the printing of electronic circuits on flexible substrates, thereby facilitating the development of innovative flexible electronic products.

Consumer electronics represents the largest application segment for flexible electronics, accounting for over 35% of the market share. The rising adoption of wearable devices, foldable smartphones, and curved displays has significantly boosted the demand for conductive polymer inks in this sector. Major smartphone manufacturers have already incorporated flexible display technologies in their premium products, creating a substantial market for materials that enable such innovations.

Healthcare is emerging as another promising application area for flexible electronics, with a projected CAGR of 16.8% through 2027. Medical devices such as smart patches, flexible sensors for patient monitoring, and electronic skin applications require conductive materials that can conform to body contours while maintaining electrical performance. Conductive polymer inks meet these requirements effectively, driving their adoption in medical technology development.

The automotive industry is increasingly integrating flexible electronics into vehicle designs, particularly for human-machine interfaces, lighting systems, and sensor networks. This sector is expected to grow at a CAGR of 15.3% in terms of flexible electronics adoption, creating significant opportunities for conductive polymer ink manufacturers. The push toward electric vehicles and autonomous driving technologies further amplifies this demand.

Geographically, Asia Pacific dominates the flexible electronics market with approximately 42% market share, primarily due to the strong presence of electronics manufacturing facilities in countries like China, Japan, South Korea, and Taiwan. North America follows with around 28% market share, driven by technological innovations and substantial R&D investments in flexible electronics.

A key market trend is the growing demand for environmentally friendly and sustainable electronic materials. This has led to increased research in bio-based conductive polymer inks that offer comparable performance to traditional materials while reducing environmental impact. Companies developing such sustainable alternatives are likely to gain competitive advantages as environmental regulations become more stringent globally.

Consumer electronics represents the largest application segment for flexible electronics, accounting for over 35% of the market share. The rising adoption of wearable devices, foldable smartphones, and curved displays has significantly boosted the demand for conductive polymer inks in this sector. Major smartphone manufacturers have already incorporated flexible display technologies in their premium products, creating a substantial market for materials that enable such innovations.

Healthcare is emerging as another promising application area for flexible electronics, with a projected CAGR of 16.8% through 2027. Medical devices such as smart patches, flexible sensors for patient monitoring, and electronic skin applications require conductive materials that can conform to body contours while maintaining electrical performance. Conductive polymer inks meet these requirements effectively, driving their adoption in medical technology development.

The automotive industry is increasingly integrating flexible electronics into vehicle designs, particularly for human-machine interfaces, lighting systems, and sensor networks. This sector is expected to grow at a CAGR of 15.3% in terms of flexible electronics adoption, creating significant opportunities for conductive polymer ink manufacturers. The push toward electric vehicles and autonomous driving technologies further amplifies this demand.

Geographically, Asia Pacific dominates the flexible electronics market with approximately 42% market share, primarily due to the strong presence of electronics manufacturing facilities in countries like China, Japan, South Korea, and Taiwan. North America follows with around 28% market share, driven by technological innovations and substantial R&D investments in flexible electronics.

A key market trend is the growing demand for environmentally friendly and sustainable electronic materials. This has led to increased research in bio-based conductive polymer inks that offer comparable performance to traditional materials while reducing environmental impact. Companies developing such sustainable alternatives are likely to gain competitive advantages as environmental regulations become more stringent globally.

Current Status and Technical Challenges in Polymer Inks

Conductive polymer inks have emerged as a transformative technology in modern electronics, with significant advancements achieved over the past decade. Currently, these materials occupy a critical position in the development of flexible electronics, printed circuit boards, and wearable technology. The global market for conductive polymer inks reached approximately $3.1 billion in 2022 and is projected to grow at a CAGR of 9.2% through 2028, indicating substantial industrial interest and investment.

Despite this promising trajectory, several technical challenges persist in the development and application of polymer inks. Conductivity limitations remain a primary concern, with most commercially available polymer inks exhibiting conductivity values between 10^2 and 10^4 S/cm, significantly lower than traditional metallic conductors (10^5-10^6 S/cm). This conductivity gap restricts their application in high-performance electronic devices requiring rapid signal transmission.

Stability issues present another significant challenge. Many conductive polymer inks demonstrate degradation when exposed to environmental factors such as humidity, UV radiation, and oxygen. Long-term stability testing indicates that conductivity can decrease by 15-30% after 1000 hours of environmental exposure, necessitating protective encapsulation that adds complexity to manufacturing processes.

Manufacturing scalability remains problematic, particularly in achieving consistent ink properties across large production volumes. Batch-to-batch variations in viscosity (±10-15%) and particle size distribution affect print quality and electrical performance. Additionally, current production methods for high-quality polymer inks are relatively expensive, with costs ranging from $200-500 per liter compared to $50-150 for silver-based metallic alternatives.

Geographically, research and development in conductive polymer inks shows distinct patterns. North America and Europe lead in fundamental research and patent filings (accounting for approximately 65% of global patents), while Asia-Pacific countries, particularly China, South Korea, and Japan, dominate in manufacturing scale and application development. Recent years have seen increased collaboration between academic institutions and industry partners, with over 200 joint research projects initiated since 2020.

The integration of polymer inks with existing electronics manufacturing infrastructure presents additional challenges. Traditional electronics manufacturing relies on high-temperature processes (often exceeding 200°C), while many polymer inks degrade at temperatures above 150°C. This thermal incompatibility necessitates the development of new processing techniques or more thermally stable polymer formulations.

Despite this promising trajectory, several technical challenges persist in the development and application of polymer inks. Conductivity limitations remain a primary concern, with most commercially available polymer inks exhibiting conductivity values between 10^2 and 10^4 S/cm, significantly lower than traditional metallic conductors (10^5-10^6 S/cm). This conductivity gap restricts their application in high-performance electronic devices requiring rapid signal transmission.

Stability issues present another significant challenge. Many conductive polymer inks demonstrate degradation when exposed to environmental factors such as humidity, UV radiation, and oxygen. Long-term stability testing indicates that conductivity can decrease by 15-30% after 1000 hours of environmental exposure, necessitating protective encapsulation that adds complexity to manufacturing processes.

Manufacturing scalability remains problematic, particularly in achieving consistent ink properties across large production volumes. Batch-to-batch variations in viscosity (±10-15%) and particle size distribution affect print quality and electrical performance. Additionally, current production methods for high-quality polymer inks are relatively expensive, with costs ranging from $200-500 per liter compared to $50-150 for silver-based metallic alternatives.

Geographically, research and development in conductive polymer inks shows distinct patterns. North America and Europe lead in fundamental research and patent filings (accounting for approximately 65% of global patents), while Asia-Pacific countries, particularly China, South Korea, and Japan, dominate in manufacturing scale and application development. Recent years have seen increased collaboration between academic institutions and industry partners, with over 200 joint research projects initiated since 2020.

The integration of polymer inks with existing electronics manufacturing infrastructure presents additional challenges. Traditional electronics manufacturing relies on high-temperature processes (often exceeding 200°C), while many polymer inks degrade at temperatures above 150°C. This thermal incompatibility necessitates the development of new processing techniques or more thermally stable polymer formulations.

Current Technical Solutions for Conductive Polymer Inks

01 Conductive polymer compositions for printable electronics

Conductive polymer inks can be formulated with specific polymers like PEDOT:PSS, polyaniline, or polythiophene derivatives to create printable electronic components. These formulations typically include solvents, binders, and additives that enhance conductivity while maintaining printability. The resulting inks can be used for flexible circuits, sensors, and other electronic applications where traditional metal conductors may not be suitable.- Conductive polymer compositions for printable electronics: Conductive polymer inks can be formulated with specific polymers like PEDOT:PSS, polyaniline, or polythiophene derivatives to create printable electronic components. These formulations typically include solvents, binders, and additives that enhance conductivity while maintaining suitable viscosity and surface tension for various printing methods. These inks enable the fabrication of flexible circuits, sensors, and other electronic devices through conventional printing techniques.

- Carbon-based additives for enhanced conductivity: Incorporating carbon-based materials such as graphene, carbon nanotubes, or carbon black into polymer inks significantly improves their electrical conductivity. These carbon additives create conductive networks within the polymer matrix, allowing for lower resistivity and better performance in electronic applications. The dispersion quality and loading percentage of these carbon materials are critical factors in determining the final conductivity and printability of the ink formulations.

- Metal nanoparticle incorporation techniques: Metal nanoparticles, particularly silver, gold, and copper, can be incorporated into polymer inks to achieve high conductivity. These formulations typically require specific stabilizers and surface treatments to prevent agglomeration and maintain uniform dispersion. Post-deposition treatments like thermal sintering or photonic curing are often employed to remove organic components and create continuous conductive pathways between the metal particles, significantly enhancing the conductivity of the printed structures.

- Processing methods for improved performance: Various processing techniques can enhance the performance of conductive polymer inks. These include solvent selection for optimal polymer dissolution, surfactant addition for improved wetting properties, and post-processing methods such as thermal annealing or solvent vapor treatment. The processing conditions significantly impact the morphology of the conductive polymer films, affecting their electrical properties, adhesion to substrates, and long-term stability. Optimization of these parameters is essential for achieving high-performance printed electronic devices.

- Application-specific ink formulations: Conductive polymer inks can be tailored for specific applications such as transparent electrodes, electromagnetic interference (EMI) shielding, antistatic coatings, or bioelectronics. These specialized formulations may incorporate additional functional components like UV stabilizers, adhesion promoters, or biocompatible materials. The rheological properties of the inks are adjusted according to the deposition method, whether it's screen printing, inkjet printing, gravure printing, or aerosol jet printing, ensuring optimal performance for each specific application and printing technology.

02 Carbon-based additives for enhanced conductivity

Incorporating carbon-based materials such as graphene, carbon nanotubes, or carbon black into polymer inks significantly improves their electrical conductivity. These carbon additives create conductive networks within the polymer matrix, allowing for lower resistance pathways for electron transport. The dispersion quality and loading level of these carbon materials are critical factors in determining the final conductivity and printability of the ink formulations.Expand Specific Solutions03 Processing techniques for conductive polymer inks

Various processing methods can be employed to optimize the performance of conductive polymer inks, including solvent selection, curing conditions, and post-treatment processes. Techniques such as thermal annealing, UV curing, or chemical treatments can significantly enhance conductivity by improving polymer chain alignment or removing insulating components. The viscosity and surface tension of the ink must be carefully controlled to ensure compatibility with different printing methods like screen printing, inkjet printing, or flexography.Expand Specific Solutions04 Metal nanoparticle incorporation in polymer inks

The addition of metal nanoparticles (silver, gold, copper) to polymer inks creates hybrid systems with enhanced conductivity while maintaining the flexibility and processability of polymers. These metal-polymer composite inks combine the high conductivity of metals with the mechanical properties and adhesion characteristics of polymers. Particle size, distribution, and surface functionalization are key parameters that affect both the electrical performance and stability of these hybrid ink formulations.Expand Specific Solutions05 Application-specific conductive polymer ink formulations

Conductive polymer inks can be tailored for specific applications such as transparent electrodes, electromagnetic shielding, antistatic coatings, or bioelectronics. These specialized formulations may include additional components like plasticizers, crosslinking agents, or biocompatible materials depending on the intended use. For applications requiring transparency, formulations typically minimize particle size and optimize polymer selection to balance conductivity with optical clarity. Stretchable electronics applications require elastomeric components that maintain conductivity under mechanical deformation.Expand Specific Solutions

Key Industry Players and Competitive Landscape

The conductive polymer inks market in modern electronics is in a growth phase, with increasing adoption across flexible electronics, printed circuit boards, and wearable technology applications. The market is projected to expand significantly due to rising demand for miniaturized electronic components and sustainable manufacturing processes. Technologically, the field shows varying maturity levels, with established players like Henkel AG & Co. KGaA and DuPont de Nemours offering commercial solutions, while innovative companies such as Vorbeck Materials and Nanotech Energy are advancing graphene-based formulations. Academic institutions including Xiamen University and Clemson University are contributing fundamental research, while Asian manufacturers like BYD and LG Chem are integrating these materials into next-generation electronic products, creating a competitive landscape balanced between established chemical companies and emerging materials science innovators.

Sun Chemical Corp. (New Jersey)

Technical Solution: Sun Chemical has developed a comprehensive portfolio of conductive polymer ink technologies under their SunTronic product line. Their approach combines conductive polymers with metallic nanoparticles to create hybrid systems that balance conductivity, flexibility, and cost-effectiveness. The company's flagship products include the SunTronic CRSN series, which utilizes silver nanoparticles dispersed in specialized polymer matrices to achieve sheet resistances as low as 10 mΩ/sq. Sun Chemical has pioneered solvent engineering techniques that enable their inks to be compatible with various printing processes including screen, flexo, and inkjet printing. Their proprietary polymer binding systems create strong adhesion to substrates while maintaining flexibility after curing. Recent innovations include their temperature-sensitive formulations that undergo conductivity changes at specific thresholds, enabling applications in smart packaging and temperature monitoring systems. Sun Chemical has also developed UV-curable conductive polymer inks that eliminate the need for thermal processing, expanding compatibility with heat-sensitive substrates.

Strengths: Extensive distribution network and technical support infrastructure; broad compatibility across multiple printing platforms; excellent balance between cost and performance; strong adhesion to difficult substrates like PET and polyimide. Weaknesses: Some formulations require specialized storage conditions; certain high-performance variants have limited shelf life; higher viscosity formulations can present challenges in fine-feature printing applications.

DIC Corp.

Technical Solution: DIC Corporation has developed sophisticated conductive polymer ink technologies through their Electronic Materials Division. Their approach centers on PEDOT:PSS (poly(3,4-ethylenedioxythiophene) polystyrene sulfonate) formulations with proprietary additives that enhance conductivity while maintaining processability. DIC's flagship products include the DICNEX™ series of conductive polymer inks, which feature carefully engineered particle morphology to create efficient conduction pathways while maintaining flexibility. The company has pioneered post-treatment methods that significantly enhance conductivity through selective removal of insulating components in the polymer matrix. Their technology incorporates specialized surfactants and dispersing agents that enable long-term stability in various environmental conditions. DIC has also developed hybrid systems that combine conductive polymers with carbon nanomaterials like graphene and carbon nanotubes, achieving synergistic effects that enhance both mechanical and electrical properties. Their recent innovations include stretchable formulations that maintain conductivity even at elongations exceeding 100%, enabling applications in wearable electronics and soft robotics.

Strengths: Superior environmental stability compared to many competitors; excellent adhesion to challenging substrates; proprietary additives that enhance conductivity without compromising flexibility; strong compatibility with high-speed printing processes. Weaknesses: Higher cost for specialized high-performance formulations; some variants require controlled environmental conditions during processing; certain formulations have compatibility limitations with common solvents used in electronics manufacturing.

Core Patents and Innovations in Polymer Conductivity

Conducting polymer ink

PatentActiveUS20110048772A1

Innovation

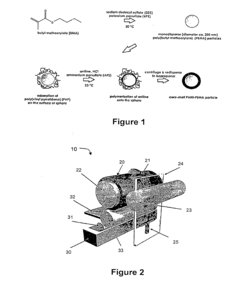

- Development of conductive polymer inks with a dispersion of core/shell polymeric particles, where the core is insulative and has a low glass transition temperature, and the shell is conductive, allowing for formulation with environmentally friendly carrier liquids and additives to control viscosity and electrical characteristics, enabling high-speed printing and high conductivity.

Electrically conductive ink jet ink

PatentInactiveEP1614725A1

Innovation

- Incorporating electrically conductive polymers as solids in the inkjet ink, allowing for high concentrations without viscosity increases, using polymers like polyacetylenes and polyanilines dispersed to less than 2 μm in size, with solvents and surfactants to ensure stable printability.

Environmental Impact and Sustainability Considerations

The environmental impact of conductive polymer inks represents a critical consideration in their growing adoption within modern electronics. Traditional electronic manufacturing processes often rely on heavy metals and toxic chemicals that pose significant environmental hazards throughout their lifecycle. Conductive polymer inks offer a promising alternative with potentially lower environmental footprints, particularly when derived from sustainable sources or designed with biodegradability in mind.

Manufacturing processes for conductive polymer inks typically consume less energy compared to conventional metal-based conductors, which require energy-intensive mining and refining operations. This reduced energy requirement translates to lower carbon emissions across the production chain. Additionally, many polymer ink formulations utilize water-based systems rather than volatile organic compounds (VOCs), further reducing air pollution and workplace hazards during manufacturing and application processes.

End-of-life considerations present both challenges and opportunities for conductive polymer electronics. While conventional electronics contribute significantly to e-waste problems, certain conductive polymers can be designed for easier recycling or even biodegradation under specific conditions. Research into bio-based conductive polymers derived from renewable resources rather than petroleum-based feedstocks shows particular promise for reducing the overall environmental impact of electronic components.

Resource efficiency represents another sustainability advantage of conductive polymer ink technologies. The additive manufacturing processes commonly used with these materials, such as inkjet printing, inherently minimize material waste compared to traditional subtractive manufacturing methods. This efficiency extends to reduced water usage and fewer chemical inputs throughout the production process.

Regulatory frameworks worldwide are increasingly emphasizing environmental considerations in electronics manufacturing. The European Union's Restriction of Hazardous Substances (RoHS) and Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulations have accelerated the transition toward more environmentally benign materials in electronics. Conductive polymer inks that eliminate or reduce regulated substances provide manufacturers with compliance advantages while reducing environmental liabilities.

Despite these advantages, challenges remain in fully realizing the sustainability potential of conductive polymer inks. Life cycle assessment studies indicate that some polymer formulations may introduce new environmental concerns, particularly regarding persistence in the environment and potential toxicity of certain additives. Additionally, the durability and longevity of polymer-based electronics compared to traditional counterparts remains an important consideration in overall sustainability calculations.

Manufacturing processes for conductive polymer inks typically consume less energy compared to conventional metal-based conductors, which require energy-intensive mining and refining operations. This reduced energy requirement translates to lower carbon emissions across the production chain. Additionally, many polymer ink formulations utilize water-based systems rather than volatile organic compounds (VOCs), further reducing air pollution and workplace hazards during manufacturing and application processes.

End-of-life considerations present both challenges and opportunities for conductive polymer electronics. While conventional electronics contribute significantly to e-waste problems, certain conductive polymers can be designed for easier recycling or even biodegradation under specific conditions. Research into bio-based conductive polymers derived from renewable resources rather than petroleum-based feedstocks shows particular promise for reducing the overall environmental impact of electronic components.

Resource efficiency represents another sustainability advantage of conductive polymer ink technologies. The additive manufacturing processes commonly used with these materials, such as inkjet printing, inherently minimize material waste compared to traditional subtractive manufacturing methods. This efficiency extends to reduced water usage and fewer chemical inputs throughout the production process.

Regulatory frameworks worldwide are increasingly emphasizing environmental considerations in electronics manufacturing. The European Union's Restriction of Hazardous Substances (RoHS) and Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulations have accelerated the transition toward more environmentally benign materials in electronics. Conductive polymer inks that eliminate or reduce regulated substances provide manufacturers with compliance advantages while reducing environmental liabilities.

Despite these advantages, challenges remain in fully realizing the sustainability potential of conductive polymer inks. Life cycle assessment studies indicate that some polymer formulations may introduce new environmental concerns, particularly regarding persistence in the environment and potential toxicity of certain additives. Additionally, the durability and longevity of polymer-based electronics compared to traditional counterparts remains an important consideration in overall sustainability calculations.

Manufacturing Scalability and Cost Analysis

The scalability of conductive polymer ink manufacturing represents a critical factor in determining their widespread adoption in modern electronics. Current production methods range from small-batch laboratory synthesis to industrial-scale manufacturing, with significant variations in cost efficiency across these scales. Large-scale production typically employs continuous flow reactors and automated mixing systems that substantially reduce per-unit costs compared to small-batch processes, potentially decreasing production expenses by 40-60% when annual production volumes exceed 1,000 kg.

Material costs constitute approximately 50-70% of total production expenses for conductive polymer inks, with specialized monomers and dopants being the most significant cost drivers. Silver-based conductive inks currently cost between $200-500 per kilogram, while emerging carbon-based alternatives can be produced for $50-150 per kilogram, representing a substantial cost advantage despite typically lower conductivity performance.

Equipment investment presents another major cost consideration, with industrial-scale production facilities requiring capital expenditures of $2-5 million for comprehensive manufacturing lines. However, these investments enable economies of scale that become increasingly advantageous as production volumes rise, with break-even points typically occurring at 3-5 years of operation under current market conditions.

Quality control processes add approximately 15-20% to manufacturing costs but are essential for ensuring consistent electrical performance in electronic applications. Advanced inline monitoring systems, while initially expensive, can reduce long-term quality control costs by minimizing waste and rework requirements. The implementation of Six Sigma methodologies in leading manufacturing facilities has demonstrated potential cost reductions of 12-18% through process optimization.

Environmental regulations increasingly impact manufacturing economics, with solvent recovery systems and emission control technologies adding 5-10% to production costs. However, water-based formulations are gaining traction as they reduce both regulatory compliance costs and environmental impact, potentially offering 15-25% cost savings in regions with stringent environmental regulations.

Recent innovations in high-throughput screening and process intensification technologies suggest potential for additional 20-30% cost reductions within the next 3-5 years. These advancements, coupled with increasing production volumes as market adoption grows, indicate a favorable trajectory for conductive polymer ink manufacturing economics that will likely accelerate their integration into mainstream electronic manufacturing processes.

Material costs constitute approximately 50-70% of total production expenses for conductive polymer inks, with specialized monomers and dopants being the most significant cost drivers. Silver-based conductive inks currently cost between $200-500 per kilogram, while emerging carbon-based alternatives can be produced for $50-150 per kilogram, representing a substantial cost advantage despite typically lower conductivity performance.

Equipment investment presents another major cost consideration, with industrial-scale production facilities requiring capital expenditures of $2-5 million for comprehensive manufacturing lines. However, these investments enable economies of scale that become increasingly advantageous as production volumes rise, with break-even points typically occurring at 3-5 years of operation under current market conditions.

Quality control processes add approximately 15-20% to manufacturing costs but are essential for ensuring consistent electrical performance in electronic applications. Advanced inline monitoring systems, while initially expensive, can reduce long-term quality control costs by minimizing waste and rework requirements. The implementation of Six Sigma methodologies in leading manufacturing facilities has demonstrated potential cost reductions of 12-18% through process optimization.

Environmental regulations increasingly impact manufacturing economics, with solvent recovery systems and emission control technologies adding 5-10% to production costs. However, water-based formulations are gaining traction as they reduce both regulatory compliance costs and environmental impact, potentially offering 15-25% cost savings in regions with stringent environmental regulations.

Recent innovations in high-throughput screening and process intensification technologies suggest potential for additional 20-30% cost reductions within the next 3-5 years. These advancements, coupled with increasing production volumes as market adoption grows, indicate a favorable trajectory for conductive polymer ink manufacturing economics that will likely accelerate their integration into mainstream electronic manufacturing processes.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!