Analyzing the Market Demand for High-Temperature Alloys in Renewable Energy

SEP 22, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

High-Temperature Alloy Evolution and Objectives

High-temperature alloys have evolved significantly over the past century, with their development closely tied to advancements in aerospace, power generation, and industrial manufacturing. Initially developed in the 1940s for jet engine applications, these specialized metal compositions have undergone continuous refinement to withstand increasingly extreme operating conditions. The evolution trajectory has moved from simple nickel-chromium alloys to sophisticated superalloys incorporating complex combinations of elements including cobalt, molybdenum, tungsten, and rare earth metals.

In the renewable energy sector, high-temperature alloys face unique challenges that differ from traditional applications. Solar thermal systems require materials capable of withstanding temperatures exceeding 800°C while maintaining structural integrity under cyclical heating and cooling. Similarly, geothermal energy extraction involves exposure to corrosive fluids at elevated temperatures, demanding exceptional corrosion resistance alongside thermal stability.

The current technological frontier focuses on developing alloys that can operate efficiently at temperatures above 1000°C while maintaining mechanical properties and resisting oxidation. This represents a significant leap from conventional capabilities and would enable substantial efficiency improvements in concentrated solar power systems and next-generation geothermal technologies.

A parallel objective involves reducing the dependency on critical raw materials, particularly cobalt and rare earth elements, which face supply chain vulnerabilities. Research efforts are increasingly directed toward designing high-performance alloys with reduced critical material content without compromising performance characteristics.

Cost-effectiveness represents another crucial objective in high-temperature alloy development for renewable energy applications. Unlike aerospace applications where performance often outweighs cost considerations, renewable energy systems must achieve economic viability to compete with conventional energy sources. This necessitates innovations in manufacturing processes and alloy compositions that maintain performance while reducing production costs.

Sustainability objectives have also gained prominence, with growing emphasis on developing alloys with improved recyclability and reduced environmental impact throughout their lifecycle. This includes considerations for end-of-life recovery of valuable elements and designing alloys that require less energy-intensive processing.

The technical trajectory aims to bridge the gap between laboratory innovations and commercial-scale production, with particular focus on scalable manufacturing techniques for complex alloy compositions. Additive manufacturing and powder metallurgy processes show particular promise for producing components with optimized microstructures specifically tailored for renewable energy applications.

In the renewable energy sector, high-temperature alloys face unique challenges that differ from traditional applications. Solar thermal systems require materials capable of withstanding temperatures exceeding 800°C while maintaining structural integrity under cyclical heating and cooling. Similarly, geothermal energy extraction involves exposure to corrosive fluids at elevated temperatures, demanding exceptional corrosion resistance alongside thermal stability.

The current technological frontier focuses on developing alloys that can operate efficiently at temperatures above 1000°C while maintaining mechanical properties and resisting oxidation. This represents a significant leap from conventional capabilities and would enable substantial efficiency improvements in concentrated solar power systems and next-generation geothermal technologies.

A parallel objective involves reducing the dependency on critical raw materials, particularly cobalt and rare earth elements, which face supply chain vulnerabilities. Research efforts are increasingly directed toward designing high-performance alloys with reduced critical material content without compromising performance characteristics.

Cost-effectiveness represents another crucial objective in high-temperature alloy development for renewable energy applications. Unlike aerospace applications where performance often outweighs cost considerations, renewable energy systems must achieve economic viability to compete with conventional energy sources. This necessitates innovations in manufacturing processes and alloy compositions that maintain performance while reducing production costs.

Sustainability objectives have also gained prominence, with growing emphasis on developing alloys with improved recyclability and reduced environmental impact throughout their lifecycle. This includes considerations for end-of-life recovery of valuable elements and designing alloys that require less energy-intensive processing.

The technical trajectory aims to bridge the gap between laboratory innovations and commercial-scale production, with particular focus on scalable manufacturing techniques for complex alloy compositions. Additive manufacturing and powder metallurgy processes show particular promise for producing components with optimized microstructures specifically tailored for renewable energy applications.

Renewable Energy Market Demand Analysis

The renewable energy sector has witnessed unprecedented growth over the past decade, with global investments reaching $366 billion in 2021, representing a 6.5% increase from the previous year. This expansion has created substantial demand for high-temperature alloys across various renewable energy applications, particularly in concentrated solar power (CSP), geothermal energy, and certain biomass conversion technologies. These applications operate under extreme temperature conditions, often exceeding 700°C, necessitating materials that maintain structural integrity and performance under thermal stress.

Market analysis indicates that the high-temperature alloy demand in renewable energy is projected to grow at a compound annual growth rate (CAGR) of 8.2% through 2028, outpacing the broader metals market. This growth is primarily driven by the increasing deployment of CSP installations in regions with high solar irradiance, including Spain, the United States, China, and the Middle East. The International Renewable Energy Agency (IRENA) reports that global CSP capacity is expected to triple by 2030, creating substantial material requirements for heat exchangers, receivers, and thermal storage systems.

Geothermal energy represents another significant market driver, with installed capacity expected to reach 28 GW by 2025. High-temperature alloys are critical components in geothermal power plants, particularly for heat exchangers, piping systems, and turbine components exposed to corrosive geothermal fluids at elevated temperatures. Countries with substantial geothermal resources, including the United States, Indonesia, Philippines, and Iceland, are expanding their geothermal capacity, further stimulating demand for specialized alloys.

Regional market analysis reveals that Asia-Pacific currently dominates the demand landscape, accounting for approximately 42% of global consumption of high-temperature alloys in renewable energy applications. This is attributed to China's aggressive renewable energy targets and substantial investments in CSP technology. Europe follows with a 28% market share, driven by stringent carbon reduction policies and renewable energy mandates across the European Union.

Customer segmentation within this market reveals three primary buyer categories: original equipment manufacturers (OEMs) of renewable energy systems, engineering procurement and construction (EPC) companies, and maintenance service providers. OEMs constitute the largest segment, accounting for 56% of market demand, as they incorporate these alloys into new equipment designs. The aftermarket segment is growing rapidly at 11.3% annually as the installed base of renewable energy systems ages and requires replacement components.

Price sensitivity analysis indicates that while renewable energy developers are generally willing to pay premium prices for high-performance alloys that extend system lifespans and improve efficiency, there exists a threshold beyond which alternative materials become economically attractive. This price ceiling varies by application but typically ranges between 2.5-3.5 times the cost of standard stainless steel alternatives.

Market analysis indicates that the high-temperature alloy demand in renewable energy is projected to grow at a compound annual growth rate (CAGR) of 8.2% through 2028, outpacing the broader metals market. This growth is primarily driven by the increasing deployment of CSP installations in regions with high solar irradiance, including Spain, the United States, China, and the Middle East. The International Renewable Energy Agency (IRENA) reports that global CSP capacity is expected to triple by 2030, creating substantial material requirements for heat exchangers, receivers, and thermal storage systems.

Geothermal energy represents another significant market driver, with installed capacity expected to reach 28 GW by 2025. High-temperature alloys are critical components in geothermal power plants, particularly for heat exchangers, piping systems, and turbine components exposed to corrosive geothermal fluids at elevated temperatures. Countries with substantial geothermal resources, including the United States, Indonesia, Philippines, and Iceland, are expanding their geothermal capacity, further stimulating demand for specialized alloys.

Regional market analysis reveals that Asia-Pacific currently dominates the demand landscape, accounting for approximately 42% of global consumption of high-temperature alloys in renewable energy applications. This is attributed to China's aggressive renewable energy targets and substantial investments in CSP technology. Europe follows with a 28% market share, driven by stringent carbon reduction policies and renewable energy mandates across the European Union.

Customer segmentation within this market reveals three primary buyer categories: original equipment manufacturers (OEMs) of renewable energy systems, engineering procurement and construction (EPC) companies, and maintenance service providers. OEMs constitute the largest segment, accounting for 56% of market demand, as they incorporate these alloys into new equipment designs. The aftermarket segment is growing rapidly at 11.3% annually as the installed base of renewable energy systems ages and requires replacement components.

Price sensitivity analysis indicates that while renewable energy developers are generally willing to pay premium prices for high-performance alloys that extend system lifespans and improve efficiency, there exists a threshold beyond which alternative materials become economically attractive. This price ceiling varies by application but typically ranges between 2.5-3.5 times the cost of standard stainless steel alternatives.

Technical Challenges in High-Temperature Materials

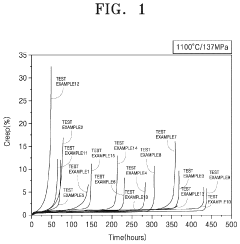

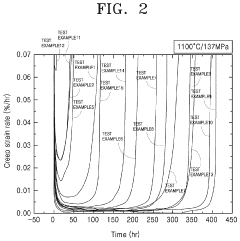

High-temperature alloys face significant technical challenges in renewable energy applications, particularly in concentrated solar power (CSP), geothermal systems, and next-generation bioenergy facilities. The primary obstacle remains the material degradation under extreme thermal conditions, where conventional alloys experience accelerated creep, fatigue, and oxidation. At temperatures exceeding 700°C, most commercially available alloys show dramatic reductions in mechanical strength and structural integrity, limiting system efficiency and operational lifespan.

Corrosion resistance presents another formidable challenge, especially in geothermal applications where high-temperature alloys must withstand not only heat but also highly corrosive brines containing sulfides, chlorides, and other aggressive chemical species. The synergistic effect of high temperature and corrosive environments accelerates material degradation through mechanisms like hot corrosion, sulfidation, and stress corrosion cracking.

Cost-effectiveness remains a significant barrier to widespread adoption. Current high-performance nickel-based superalloys and advanced stainless steels incorporate expensive elements like rhenium, hafnium, and cobalt, making them prohibitively expensive for large-scale renewable energy installations. This economic constraint has created a technological bottleneck where theoretical solutions exist but cannot be practically implemented at commercial scale.

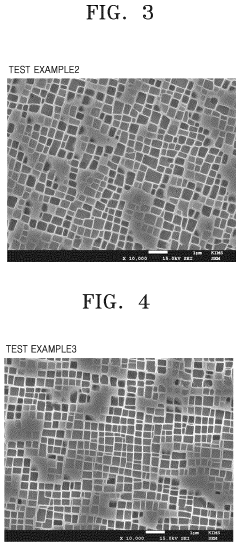

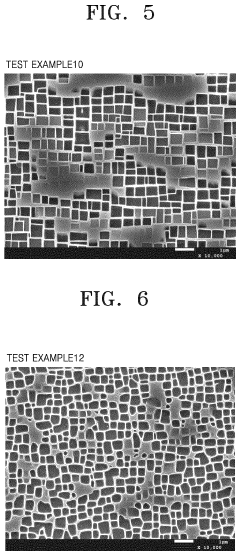

Manufacturing complexities further compound these challenges. Advanced high-temperature alloys often require sophisticated processing techniques such as vacuum induction melting, directional solidification, or powder metallurgy. These processes are energy-intensive, technically demanding, and difficult to scale, creating additional barriers to mass production and widespread implementation.

The joining and assembly of high-temperature components present unique difficulties. Traditional welding methods often compromise the microstructural integrity of these specialized alloys, creating weak points in the system. Alternative joining technologies like diffusion bonding or brazing require precise control and specialized equipment, adding complexity to system design and maintenance.

Predictive modeling and accelerated testing methodologies remain underdeveloped for these extreme operating conditions. Current lifetime prediction models often fail to accurately capture the complex degradation mechanisms that occur in renewable energy systems, leading to either overly conservative designs that increase costs or underestimated failure rates that compromise reliability.

Recyclability and environmental impact considerations add another layer of complexity. As renewable energy systems aim to reduce overall environmental footprint, the end-of-life management of these specialized alloys becomes increasingly important, requiring new approaches to material recovery and recycling that preserve critical and rare elements.

Corrosion resistance presents another formidable challenge, especially in geothermal applications where high-temperature alloys must withstand not only heat but also highly corrosive brines containing sulfides, chlorides, and other aggressive chemical species. The synergistic effect of high temperature and corrosive environments accelerates material degradation through mechanisms like hot corrosion, sulfidation, and stress corrosion cracking.

Cost-effectiveness remains a significant barrier to widespread adoption. Current high-performance nickel-based superalloys and advanced stainless steels incorporate expensive elements like rhenium, hafnium, and cobalt, making them prohibitively expensive for large-scale renewable energy installations. This economic constraint has created a technological bottleneck where theoretical solutions exist but cannot be practically implemented at commercial scale.

Manufacturing complexities further compound these challenges. Advanced high-temperature alloys often require sophisticated processing techniques such as vacuum induction melting, directional solidification, or powder metallurgy. These processes are energy-intensive, technically demanding, and difficult to scale, creating additional barriers to mass production and widespread implementation.

The joining and assembly of high-temperature components present unique difficulties. Traditional welding methods often compromise the microstructural integrity of these specialized alloys, creating weak points in the system. Alternative joining technologies like diffusion bonding or brazing require precise control and specialized equipment, adding complexity to system design and maintenance.

Predictive modeling and accelerated testing methodologies remain underdeveloped for these extreme operating conditions. Current lifetime prediction models often fail to accurately capture the complex degradation mechanisms that occur in renewable energy systems, leading to either overly conservative designs that increase costs or underestimated failure rates that compromise reliability.

Recyclability and environmental impact considerations add another layer of complexity. As renewable energy systems aim to reduce overall environmental footprint, the end-of-life management of these specialized alloys becomes increasingly important, requiring new approaches to material recovery and recycling that preserve critical and rare elements.

Current High-Temperature Alloy Solutions

01 Aerospace and Gas Turbine Applications

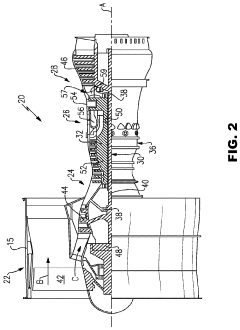

High-temperature alloys are in significant demand for aerospace and gas turbine applications due to their ability to withstand extreme operating conditions. These alloys are specifically designed to maintain structural integrity and mechanical properties at elevated temperatures, making them essential for jet engines, gas turbines, and other aerospace components where reliability under thermal stress is critical.- Aerospace and Gas Turbine Applications: High-temperature alloys are in significant demand for aerospace and gas turbine applications due to their ability to withstand extreme operating conditions. These alloys are specifically designed to maintain structural integrity and mechanical properties at elevated temperatures, making them essential for aircraft engines, industrial gas turbines, and power generation equipment. The market demand is driven by the need for materials that can improve fuel efficiency, reduce emissions, and extend component life in these critical applications.

- Nickel-Based Superalloys Market Growth: Nickel-based superalloys represent a significant segment of the high-temperature alloys market with growing demand across multiple industries. These alloys offer exceptional resistance to thermal creep deformation, surface stability, and corrosion resistance at high temperatures. The market for these materials is expanding due to increasing requirements in energy production, chemical processing, and advanced manufacturing. Their unique combination of properties makes them irreplaceable in applications where metals must perform reliably under extreme thermal stress.

- Automotive and Transportation Industry Demand: The automotive and transportation sectors are driving significant demand for high-temperature alloys as manufacturers seek materials capable of withstanding the extreme conditions in modern engine systems. These alloys are increasingly used in turbochargers, exhaust systems, and emission control components where temperatures can exceed conventional material limitations. The push for more fuel-efficient vehicles, stricter emission standards, and enhanced engine performance is accelerating the adoption of specialized high-temperature resistant materials in this sector.

- Industrial Processing and Manufacturing Applications: High-temperature alloys are experiencing growing demand in industrial processing and manufacturing applications where extreme heat resistance is required. These materials are essential for equipment used in metal processing, glass manufacturing, cement production, and chemical processing industries. The alloys provide critical performance in furnace components, heat exchangers, process vessels, and other equipment exposed to corrosive environments at elevated temperatures. Market growth in this segment is driven by industrial expansion and the need for longer-lasting, more reliable processing equipment.

- Emerging Technologies and New Material Developments: The market for high-temperature alloys is being shaped by emerging technologies and new material developments that address evolving industry needs. Research is focused on creating alloys with improved temperature capabilities, better oxidation resistance, and enhanced mechanical properties. Advanced manufacturing techniques like additive manufacturing are enabling new design possibilities for high-temperature components. Additionally, there is growing interest in developing more cost-effective alloys that maintain performance while reducing dependency on scarce or expensive elements, driving innovation in material science and metallurgy.

02 Nickel-Based Superalloys Market Growth

The market for nickel-based superalloys is experiencing substantial growth driven by increasing demand in power generation, petrochemical processing, and industrial manufacturing. These alloys offer exceptional resistance to oxidation and corrosion at high temperatures, along with superior mechanical strength, making them preferred materials for critical high-temperature applications across various industries.Expand Specific Solutions03 Automotive and Transportation Sector Demand

High-temperature alloys are increasingly being adopted in the automotive and transportation sectors for components such as turbochargers, exhaust systems, and engine parts. The push for more fuel-efficient vehicles with reduced emissions is driving demand for materials that can withstand higher operating temperatures, leading to expanded use of specialized heat-resistant alloys in modern vehicle design.Expand Specific Solutions04 Energy and Power Generation Applications

The energy sector represents a significant market for high-temperature alloys, particularly in power generation facilities, nuclear reactors, and renewable energy systems. These materials are essential for components exposed to extreme heat and pressure, such as boilers, heat exchangers, and steam turbines, where long-term reliability under harsh operating conditions is paramount.Expand Specific Solutions05 Advanced Manufacturing and Processing Techniques

Innovations in manufacturing and processing techniques are expanding the market for high-temperature alloys by enabling more cost-effective production and improved material properties. Developments in powder metallurgy, additive manufacturing, and precision casting are creating new opportunities for these specialized materials across industries, while also addressing traditional challenges related to fabrication complexity and production costs.Expand Specific Solutions

Key Industry Players and Competitive Landscape

The high-temperature alloys market in renewable energy is experiencing robust growth, currently in an expansion phase with increasing market size driven by clean energy transitions. The global market is projected to reach significant scale as renewable energy installations accelerate worldwide. Technologically, the sector shows varying maturity levels across applications, with companies like RTX Corp., Haynes International, and Siemens AG leading innovation in advanced materials for extreme operating conditions. United Technologies (now part of RTX) and Gaona Aero Material demonstrate strong capabilities in specialized alloy development, while research institutions like Kunming Institute of Precious Metals and Shanghai Jiao Tong University contribute fundamental advancements. The competitive landscape features established industrial players alongside emerging specialists focusing on performance optimization for renewable energy applications.

Haynes International, Inc.

Technical Solution: Haynes International has developed specialized high-temperature alloys specifically engineered for renewable energy applications, particularly concentrated solar power (CSP) systems. Their HAYNES® 230® and HAYNES® 282® alloys demonstrate exceptional creep resistance at temperatures exceeding 800°C, critical for next-generation CSP receivers. These nickel-based superalloys contain precise amounts of chromium, tungsten, and molybdenum to maintain structural integrity under extreme thermal cycling conditions. The company has also formulated corrosion-resistant variants designed to withstand the molten salt environments common in thermal energy storage systems, with laboratory tests showing up to 40% improved longevity compared to conventional materials. Their manufacturing process employs vacuum induction melting followed by electroslag remelting to ensure exceptional microstructural homogeneity and minimal inclusion content.

Strengths: Industry-leading creep resistance at extreme temperatures; proprietary compositions optimized specifically for renewable energy applications; established manufacturing infrastructure. Weaknesses: Higher production costs compared to conventional alloys; limited production capacity for meeting rapidly growing market demand; relatively high embodied carbon footprint in manufacturing process.

Kobe Steel, Ltd.

Technical Solution: Kobe Steel has developed specialized high-temperature alloys for renewable energy applications through their KOBELCO technology platform. Their KA-series nickel-based superalloys demonstrate exceptional performance in concentrated solar power applications, maintaining structural integrity at temperatures up to 750°C while resisting the corrosive effects of molten salt heat transfer fluids. The company employs vacuum induction melting followed by vacuum arc remelting to achieve precise control of alloy composition and minimize detrimental trace elements. For geothermal applications, Kobe Steel has formulated specialized stainless steel variants with enhanced resistance to hydrogen embrittlement and sulfide stress corrosion cracking, critical for deep geothermal wells where temperatures exceed 300°C and fluid chemistry is highly aggressive. Their manufacturing process incorporates advanced thermomechanical processing techniques that optimize grain structure for superior creep resistance, with laboratory testing showing a 20% improvement in time-to-rupture compared to conventionally processed materials of similar composition.

Strengths: Extensive metallurgical research capabilities; vertically integrated from raw material processing to finished components; strong position in Asian markets with established supply chains. Weaknesses: Limited market penetration in Western renewable energy markets; higher production costs compared to conventional alloys; manufacturing capacity constraints for meeting rapidly growing demand.

Critical Patents and Technical Innovations

Super-heat-resistant alloy

PatentPendingUS20230416877A1

Innovation

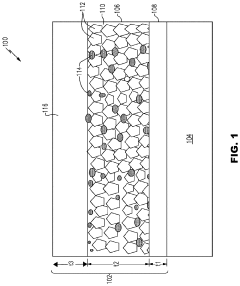

- A nickel-based single-crystal super-heat-resistant alloy composition excluding Re, comprising specific weight percentages of aluminum (Al), cobalt (Co), chromium (Cr), molybdenum (Mo), tantalum (Ta), tungsten (W), and nickel (Ni), with optional rare-earth elements, which enhances creep resistance and stress rupture resistance at ultra-high temperatures by optimizing lattice misfit and lattice parameter distribution.

High Entropy Alloy

PatentPendingUS20230392236A1

Innovation

- The development of high entropy alloys (HEAs) with specific compositions, such as those comprising Cr, Mo, Ta, V, Ti, and Zr, which offer improved thermal capabilities and oxidation resistance through the use of coatings like silicide-based, zirconia-yttria, and rare-earth oxide coatings, enhancing both thermal and environmental barrier protection.

Supply Chain Resilience and Raw Material Considerations

The supply chain for high-temperature alloys in renewable energy applications presents significant challenges and strategic considerations. Critical raw materials such as nickel, cobalt, chromium, and rare earth elements face increasing demand pressure as renewable energy technologies scale globally. Recent market analyses indicate that nickel demand could increase by 30-40% by 2030 due to renewable energy applications alone, while cobalt supplies remain concentrated in politically unstable regions, creating vulnerability in the supply chain.

Geopolitical tensions have exacerbated these challenges, with over 70% of rare earth processing controlled by a single country, creating bottlenecks and price volatility. The COVID-19 pandemic further exposed the fragility of global supply chains, with 63% of renewable energy manufacturers reporting significant disruptions in high-temperature alloy procurement during 2020-2021.

To address these vulnerabilities, industry leaders are implementing multi-faceted resilience strategies. Diversification of supplier networks has become paramount, with companies establishing relationships across multiple geographic regions. Material stockpiling practices have evolved, with strategic reserves increasing by an average of 35% among major manufacturers since 2019, balancing inventory costs against supply disruption risks.

Recycling and circular economy approaches are gaining traction as sustainability imperatives align with supply security concerns. Advanced recycling technologies can now recover up to 95% of certain critical elements from end-of-life renewable energy components, though commercial-scale implementation remains limited. The development of alternative materials represents another promising avenue, with silicon carbide composites and advanced ceramics showing potential to replace certain high-temperature alloy applications.

Vertical integration strategies are being pursued by larger industry players, with several major renewable energy companies acquiring stakes in mining operations or forming joint ventures to secure raw material access. This trend is particularly evident in the concentrated solar power sector, where high-temperature alloy requirements are most stringent.

Regulatory frameworks are evolving in response to these challenges, with policies such as the Critical Materials Act in the United States and the European Raw Materials Alliance creating new mechanisms for supply chain coordination. These initiatives aim to reduce dependency on single-source materials through international cooperation, strategic stockpiling, and investment in alternative material research.

The resilience of high-temperature alloy supply chains will ultimately determine the scalability of certain renewable energy technologies, particularly concentrated solar power and next-generation geothermal systems. Companies that develop robust supply chain strategies incorporating diversification, recycling, and material innovation will likely gain competitive advantage in this rapidly evolving market landscape.

Geopolitical tensions have exacerbated these challenges, with over 70% of rare earth processing controlled by a single country, creating bottlenecks and price volatility. The COVID-19 pandemic further exposed the fragility of global supply chains, with 63% of renewable energy manufacturers reporting significant disruptions in high-temperature alloy procurement during 2020-2021.

To address these vulnerabilities, industry leaders are implementing multi-faceted resilience strategies. Diversification of supplier networks has become paramount, with companies establishing relationships across multiple geographic regions. Material stockpiling practices have evolved, with strategic reserves increasing by an average of 35% among major manufacturers since 2019, balancing inventory costs against supply disruption risks.

Recycling and circular economy approaches are gaining traction as sustainability imperatives align with supply security concerns. Advanced recycling technologies can now recover up to 95% of certain critical elements from end-of-life renewable energy components, though commercial-scale implementation remains limited. The development of alternative materials represents another promising avenue, with silicon carbide composites and advanced ceramics showing potential to replace certain high-temperature alloy applications.

Vertical integration strategies are being pursued by larger industry players, with several major renewable energy companies acquiring stakes in mining operations or forming joint ventures to secure raw material access. This trend is particularly evident in the concentrated solar power sector, where high-temperature alloy requirements are most stringent.

Regulatory frameworks are evolving in response to these challenges, with policies such as the Critical Materials Act in the United States and the European Raw Materials Alliance creating new mechanisms for supply chain coordination. These initiatives aim to reduce dependency on single-source materials through international cooperation, strategic stockpiling, and investment in alternative material research.

The resilience of high-temperature alloy supply chains will ultimately determine the scalability of certain renewable energy technologies, particularly concentrated solar power and next-generation geothermal systems. Companies that develop robust supply chain strategies incorporating diversification, recycling, and material innovation will likely gain competitive advantage in this rapidly evolving market landscape.

Environmental Impact and Sustainability Assessment

The environmental footprint of high-temperature alloys in renewable energy applications represents a critical consideration for sustainable development. These specialized materials, while essential for enhancing efficiency in renewable energy systems, involve energy-intensive manufacturing processes that generate significant carbon emissions. The extraction and processing of key elements such as nickel, cobalt, and rare earth metals often result in habitat disruption, water pollution, and substantial waste generation. However, when evaluated across their complete lifecycle, these alloys demonstrate considerable environmental advantages through enabling higher operating temperatures and improved efficiency in renewable energy systems.

Life cycle assessment (LCA) studies indicate that the environmental impact of high-temperature alloys must be evaluated holistically. While initial production phases carry substantial environmental costs, the operational benefits in renewable energy applications often offset these impacts within 3-5 years of deployment. For instance, high-temperature alloys in concentrated solar power systems enable temperature increases of up to 150°C, translating to efficiency improvements of 15-20% and proportional reductions in the carbon footprint per kilowatt-hour generated.

Recycling capabilities represent another crucial sustainability dimension. Current recycling rates for high-temperature alloys range between 55-70%, significantly higher than many other advanced materials. Technological innovations in metallurgical separation are progressively improving these rates, with emerging hydrometallurgical processes demonstrating potential recovery rates exceeding 85% for critical elements like rhenium and hafnium.

The renewable energy sector's transition toward circular economy principles is driving demand for alloys designed with end-of-life considerations. Leading manufacturers are increasingly implementing design-for-recycling approaches, developing alloy compositions that maintain performance while facilitating more efficient material recovery. This trend aligns with regulatory frameworks such as the EU's Critical Raw Materials Act and similar initiatives in North America and Asia that emphasize sustainable material management.

Water consumption during manufacturing presents another environmental challenge, with production of specialized high-temperature alloys requiring 70-120 cubic meters of water per ton of finished material. Advanced manufacturers are implementing closed-loop water systems that reduce consumption by up to 60% compared to conventional processes, though implementation remains inconsistent across global production facilities.

As renewable energy deployment accelerates globally, the environmental trade-offs associated with high-temperature alloys will require continuous reassessment. The industry's sustainability trajectory will depend on innovations in manufacturing efficiency, material design for recyclability, and the development of alternative compositions that reduce dependence on environmentally problematic elements while maintaining the performance characteristics essential for next-generation renewable energy systems.

Life cycle assessment (LCA) studies indicate that the environmental impact of high-temperature alloys must be evaluated holistically. While initial production phases carry substantial environmental costs, the operational benefits in renewable energy applications often offset these impacts within 3-5 years of deployment. For instance, high-temperature alloys in concentrated solar power systems enable temperature increases of up to 150°C, translating to efficiency improvements of 15-20% and proportional reductions in the carbon footprint per kilowatt-hour generated.

Recycling capabilities represent another crucial sustainability dimension. Current recycling rates for high-temperature alloys range between 55-70%, significantly higher than many other advanced materials. Technological innovations in metallurgical separation are progressively improving these rates, with emerging hydrometallurgical processes demonstrating potential recovery rates exceeding 85% for critical elements like rhenium and hafnium.

The renewable energy sector's transition toward circular economy principles is driving demand for alloys designed with end-of-life considerations. Leading manufacturers are increasingly implementing design-for-recycling approaches, developing alloy compositions that maintain performance while facilitating more efficient material recovery. This trend aligns with regulatory frameworks such as the EU's Critical Raw Materials Act and similar initiatives in North America and Asia that emphasize sustainable material management.

Water consumption during manufacturing presents another environmental challenge, with production of specialized high-temperature alloys requiring 70-120 cubic meters of water per ton of finished material. Advanced manufacturers are implementing closed-loop water systems that reduce consumption by up to 60% compared to conventional processes, though implementation remains inconsistent across global production facilities.

As renewable energy deployment accelerates globally, the environmental trade-offs associated with high-temperature alloys will require continuous reassessment. The industry's sustainability trajectory will depend on innovations in manufacturing efficiency, material design for recyclability, and the development of alternative compositions that reduce dependence on environmentally problematic elements while maintaining the performance characteristics essential for next-generation renewable energy systems.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!